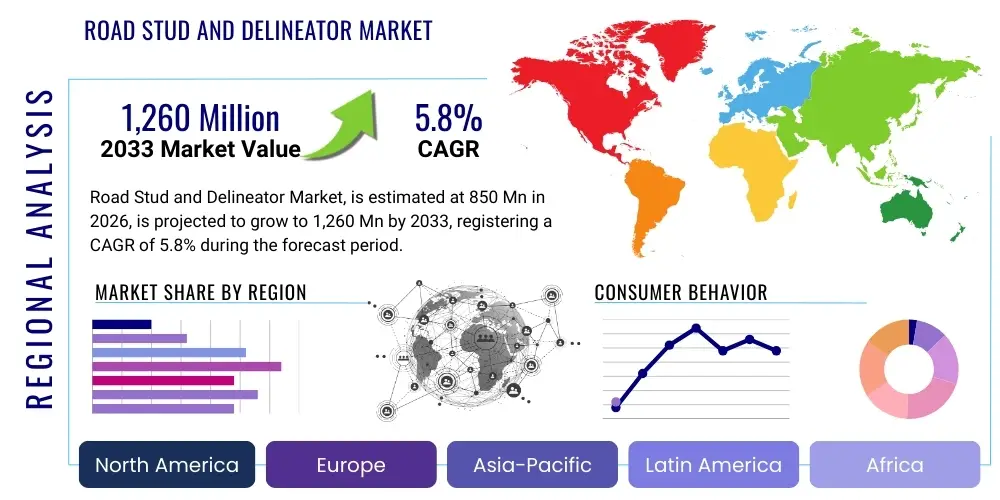

Road Stud and Delineator Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441179 | Date : Feb, 2026 | Pages : 255 | Region : Global | Publisher : MRU

Road Stud and Delineator Market Size

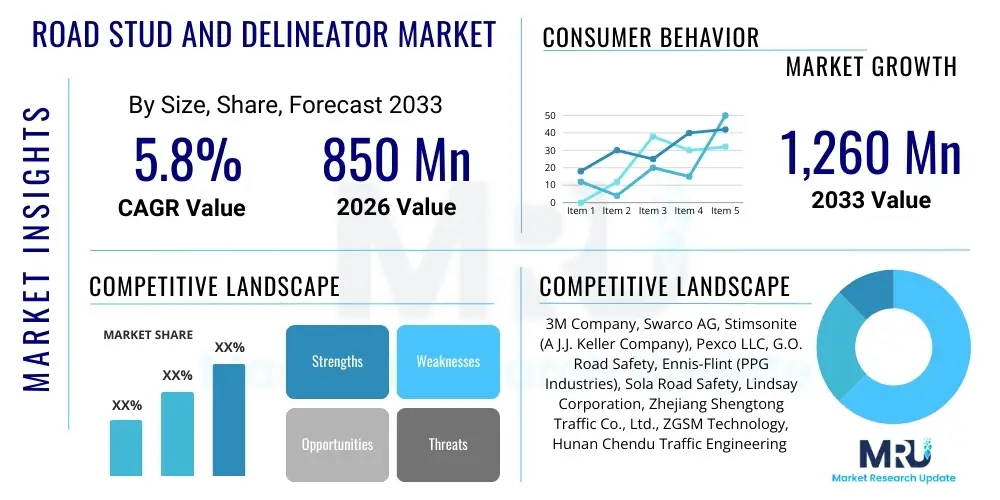

The Road Stud and Delineator Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $850 Million in 2026 and is projected to reach $1,260 Million by the end of the forecast period in 2033.

Road Stud and Delineator Market introduction

The Road Stud and Delineator Market encompasses the manufacturing, distribution, and installation of various road marking devices designed to enhance visibility, delineate traffic lanes, and improve overall road safety, particularly under adverse weather conditions or at night. Road studs, also known as raised pavement markers, are embedded or adhered to the road surface, utilizing reflective materials or integrated light sources (solar/LED) to guide drivers. Delineators, conversely, are vertical or semi-vertical posts placed along road edges or construction zones to provide visual warning and separation. These passive and active safety devices are crucial components of intelligent transportation systems (ITS) infrastructure, providing critical navigational feedback that standard paint markings often fail to deliver effectively due to wear or poor visibility.

The primary application of road studs and delineators is centered around infrastructural safety enhancements across national highways, urban thoroughfares, bridges, and tunnels. Key products include conventional retro-reflective studs made of plastic, aluminum, or ceramic, and increasingly, solar-powered LED studs which offer prolonged illumination and high visibility without external power sources. Delineators are often deployed in areas requiring temporary traffic control, such as road construction sites, or permanently installed along hazardous curves and mountain passes. The rapid pace of global infrastructure development, coupled with stringent government mandates focused on reducing road fatalities, serves as the fundamental driving force for market expansion, particularly in emerging economies where road quality and safety standards are undergoing rapid modernization.

The benefits derived from the deployment of these safety products are multi-faceted, ranging from substantial reductions in night-time accidents and minimizing driver fatigue to improving traffic flow efficiency and demarcation reliability. Driving factors include increasing regulatory pressure from international bodies and national transportation agencies (such as the FHWA in the U.S. and relevant bodies in the EU) mandating the use of high-visibility aids, especially for lane separation and curve warnings. Furthermore, technological advancements leading to durable, cost-effective, and smart solutions, such as self-cleaning or sensor-integrated markers, are broadening the adoption scope beyond standard reflective models, thereby sustaining the market’s steady growth trajectory throughout the forecast period.

Road Stud and Delineator Market Executive Summary

The Road Stud and Delineator Market is characterized by robust growth, primarily driven by escalating global concerns regarding road safety and increased investment in modern infrastructure projects. Business trends indicate a significant shift toward active safety solutions, specifically solar-powered LED road studs, which provide superior performance and energy independence compared to passive reflective markers. Key market players are focusing on materials science innovations to enhance product durability against heavy traffic wear and extreme environmental conditions, leading to the deployment of advanced polycarbonates, ceramics, and resilient metals. Strategic partnerships between manufacturers and government highway authorities through long-term maintenance contracts are becoming vital for securing market share, shifting the focus from initial product sale to lifecycle management services.

Regional trends highlight the Asia Pacific (APAC) as the fastest-growing market, propelled by massive governmental investments in building extensive highway networks and modernizing existing road infrastructure in countries like China, India, and Southeast Asia. North America and Europe, while mature, maintain high demand due to mandatory replacement cycles and the integration of these devices into Smart City initiatives, requiring markers that can communicate or collect data. The Middle East and Africa (MEA) region show high potential driven by large-scale infrastructure projects related to urbanization and preparation for major international events, necessitating rapid adoption of high-standard safety solutions across desert and coastal road environments.

Segmentation trends show that the solar/LED segment is gaining dominance over traditional reflective technology due to its superior visibility and decreasing manufacturing costs. By material, specialized plastics (such as high-impact polycarbonate) and durable aluminum alloys remain prominent, balancing cost-effectiveness with necessary longevity. The application segment continues to be dominated by intercity and national highways, although urban road applications are rapidly increasing as city planners integrate road delineation into complex intersection management systems. The demand for integrated delineators used in temporary traffic control (TTC) zones, driven by continuous infrastructure repair and expansion, also forms a critical sub-segment fueling consistent market stability and revenue generation.

AI Impact Analysis on Road Stud and Delineator Market

User queries regarding AI's influence on the Road Stud and Delineator Market typically center on whether autonomous vehicle technologies and advanced mapping will render physical markers obsolete, or conversely, if AI can enhance their utility. Key user concerns revolve around the integration of physical infrastructure with digital intelligence. They frequently ask about the role of AI in predictive maintenance for road studs, optimizing deployment patterns based on accident data, and integrating marker visibility data into Vehicle-to-Infrastructure (V2I) communication systems. The overarching expectation is that AI will transform these traditionally passive safety tools into active, data-generating components of the smart road ecosystem, focusing on optimization, longevity, and communication rather than outright replacement.

The transition toward Intelligent Transportation Systems (ITS) leverages AI and Machine Learning (ML) to significantly enhance the operational effectiveness and life cycle management of road studs and delineators. AI-driven vision systems in maintenance vehicles can rapidly assess the reflectivity degradation or physical damage of installed markers, scheduling targeted repairs before safety standards drop below acceptable thresholds. This predictive maintenance capability dramatically reduces manual inspection costs and ensures consistent compliance with safety regulations. Furthermore, ML algorithms can analyze traffic flow patterns, accident hotspots, and environmental data to recommend optimal placement density and type (reflective vs. active) of markers for new or reconstructed road sections, maximizing safety impact per dollar invested.

While autonomous vehicles rely heavily on Lidar and high-definition cameras, physical delineation remains a critical redundancy layer, especially in low-visibility situations (heavy rain, snow, fog) where digital sensors can struggle. AI integration ensures that these physical markers are "smart." For instance, solar road studs can be equipped with basic edge computing capabilities to monitor local road conditions (temperature, wetness) and communicate this information via low-power wide-area networks (LPWAN) to municipal databases or directly to passing vehicles. This transition from basic reflectors to active, data-transmitting nodes cements the long-term relevance of these devices in the evolving landscape of connected and autonomous mobility, driven by AI-optimized decision-making systems.

- AI drives predictive maintenance scheduling for optimizing marker replacement cycles, improving cost efficiency.

- Machine Learning algorithms determine optimal placement and density of studs based on geospatial accident data and risk modeling.

- Integrated sensors in advanced studs utilize edge AI processing to monitor and report localized road conditions (e.g., ice presence, high-water levels).

- AI-enhanced vision systems in autonomous vehicles rely on highly reflective and visibly stable physical markers as essential physical benchmarks for sensor calibration.

- Generative modeling helps in designing more durable and highly visible marker geometries tailored for specific regional traffic stress and weather patterns.

DRO & Impact Forces Of Road Stud and Delineator Market

The Road Stud and Delineator Market is primarily shaped by a confluence of legislative requirements (Drivers), initial capital outlay and maintenance complexity (Restraints), and the emergence of smart infrastructure technologies (Opportunities). The overarching driver remains the non-negotiable imperative for enhanced road safety mandated by governmental and international bodies, which pushes for greater penetration of highly visible, durable delineation systems across all classes of roads. However, the high initial cost of solar LED markers compared to traditional paint or reflective models, coupled with the susceptibility of active systems to physical damage and battery degradation, imposes significant financial restraints on budget-conscious regional authorities. The market is propelled forward by the opportunity to integrate these devices into burgeoning Smart City frameworks, allowing for data collection and real-time communication, which elevates their value proposition beyond mere physical guidance.

Key impact forces influencing this market include rapid urbanization, leading to increased traffic complexity and demanding clearer urban lane delineation, and fluctuating raw material prices (especially for aluminum and high-grade plastics) which affect manufacturing costs and subsequent tender pricing. Another significant force is the technological standardization pushed by major economic blocs (like ISO and CE standards), which often accelerates the adoption of premium, certified products. Socio-economic factors, particularly public pressure for reduced road fatalities, also exert strong pressure on governments to prioritize investment in proven safety technologies like road studs and delineators over less effective or outdated measures.

Specific market dynamics show that Drivers related to the aging infrastructure replacement cycle in developed nations provide consistent demand, while the Restraint of proprietary technology lock-in restricts competition and standardization in certain active marker segments. Furthermore, environmental regulations promoting sustainability create an Opportunity for manufacturers focusing on recycled materials or markers with minimal ecological impact. The interaction of these forces suggests a future where high-performance, active marking systems dominate new infrastructure projects, while traditional reflective markers remain foundational in cost-sensitive replacement markets, contingent on manufacturers successfully addressing durability and battery life issues.

Segmentation Analysis

The Road Stud and Delineator Market is comprehensively segmented based on technology type, the material utilized for manufacturing, and the specific application environment. This multi-dimensional segmentation allows for a precise understanding of demand patterns, showing clear preference shifts from passive reflective technologies toward technologically advanced, active illumination systems. The material segment reflects a crucial balance between cost, longevity, and resistance to environmental stress, where composites and high-grade engineered plastics increasingly challenge traditional metal and ceramic options. The application segment reveals differential requirements for national highways versus complex urban settings, influencing the required impact resistance and illumination intensity needed for compliance and optimal safety performance.

From a technological standpoint, the market is broadly divided between passive and active systems. Passive markers, utilizing retro-reflectivity, are cost-effective but depend entirely on vehicle headlights. Active systems, predominantly solar-powered LED studs, offer independent, prolonged illumination, drastically improving visibility distance and reaction time for drivers. The increasing reliability and lowering cost of photovoltaic cells are strong factors favoring the rapid adoption of active markers, especially on high-risk, unlit roadways. This technological evolution dictates capital expenditure priorities for municipal bodies and transportation authorities globally.

Further analysis of the material segment highlights the trade-offs involved in product selection. Aluminum studs offer superior durability and are often used in high-traffic areas, while plastic/polycarbonate studs are lighter, easier to install, and more cost-effective for deployment across vast road networks. Ceramic and glass beads are critical components in retro-reflective surfaces, and specialized plastics are used in delineators for flexibility and impact resistance. The choice of material is highly dependent on regional climatic conditions, ranging from frost heave resistance in temperate zones to UV and heat resistance in equatorial and desert environments, ensuring that the market remains diverse and requires highly localized product offerings.

- By Technology:

- Passive (Retro-Reflective)

- Active (Solar/LED Powered)

- By Material:

- Aluminum

- Plastic (Polycarbonate, ABS)

- Ceramic

- Glass

- By Product Type:

- Road Studs (Raised Pavement Markers)

- Delineators (Vertical Markers, Guide Posts)

- By Application:

- Highways and Intercity Roads

- Urban Roads and Municipalities

- Tunnels and Bridges

- Construction Zones (Temporary Traffic Control)

- By Installation Method:

- Surface Mounted (Adhesive)

- Embedded/Recessed

Value Chain Analysis For Road Stud and Delineator Market

The Road Stud and Delineator Market value chain begins with the upstream sourcing of raw materials, which includes specialized high-grade plastics (polycarbonate, polymer resins), metals (aluminum alloys), reflective elements (glass beads, microprisms), and for active systems, electronic components (solar panels, LEDs, batteries, microcontrollers). Critical upstream activities involve R&D focused on material resilience, energy efficiency, and photometrics. Manufacturers must secure consistent supply chains for these components, often negotiating long-term contracts to stabilize input costs, particularly for petroleum-derived plastics and rare earth minerals used in specialized LEDs. Quality control at the raw material stage is paramount, as the final product must withstand extreme environmental conditions and high levels of physical impact from traffic.

Manufacturing and processing constitute the core of the value chain, where raw materials are transformed into finished road safety products through processes like injection molding, casting, and assembly. This stage includes meticulous testing to ensure products meet stringent international standards (e.g., durability, reflectivity, luminosity, and ingress protection ratings). The downstream segment involves complex logistics, where finished goods are distributed. Direct channels often involve manufacturers bidding on large government tenders, supplying directly to national or regional Departments of Transportation (DOTs). This requires specialized sales teams and the ability to manage large, multi-year contracts that include installation and post-sales service.

Indirect distribution involves a network of construction material distributors, specialized traffic safety contractors, and retail suppliers for smaller municipal or private development projects. These intermediaries provide crucial regional inventory management and often handle smaller volume, immediate needs. The end-user, predominantly governmental agencies, significantly influences the distribution dynamics through specified procurement methods and requirements for certified installation partners. The increasing demand for solar-powered studs has introduced a technical layer to the distribution, requiring channels capable of providing technical support and ensuring correct electrical installation and system commissioning, thereby adding complexity and value downstream.

Road Stud and Delineator Market Potential Customers

The primary customer base for the Road Stud and Delineator Market consists overwhelmingly of governmental and quasi-governmental bodies responsible for public infrastructure maintenance and development. These include national departments of transportation (e.g., FHWA, UK Highways Agency), regional state highway authorities, and local municipal corporations. These entities are the largest volume buyers, driven by mandatory safety regulations, infrastructure upgrade programs, and cyclical replacement schedules for existing road markings. Their purchasing decisions are highly influenced by product lifespan, compliance with technical specifications, and total cost of ownership over a typical five-to-seven-year service life, making durability and long-term warranties critical factors.

A secondary, yet rapidly growing, customer segment includes private sector actors involved in large-scale infrastructure projects. This encompasses civil engineering firms, private road concession operators (for toll roads and expressways), and real estate developers responsible for constructing large industrial parks or residential communities where internal road networks require clear demarcation. These customers often prioritize installation speed and adherence to project timelines, showing a preference for high-quality, long-lasting products that minimize future maintenance liabilities. The demand from private developers often follows urban expansion trends and global economic investment cycles.

Furthermore, specialized safety and construction rental companies act as crucial buyers, particularly for delineators and temporary road studs used in temporary traffic control (TTC) zones. These customers require products that are highly visible, easy to install and remove, and exceptionally robust to withstand frequent handling and re-deployment. The stability of demand from this segment is tied directly to ongoing repair, maintenance, and expansion activities across all road networks. As government outsourcing of maintenance increases, the influence of specialized infrastructure management and construction companies as direct end-users grows, demanding comprehensive solutions rather than just raw products.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $850 Million |

| Market Forecast in 2033 | $1,260 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | 3M Company, Swarco AG, Stimsonite (A J.J. Keller Company), Pexco LLC, G.O. Road Safety, Ennis-Flint (PPG Industries), Sola Road Safety, Lindsay Corporation, Zhejiang Shengtong Traffic Co., Ltd., ZGSM Technology, Hunan Chendu Traffic Engineering Co., Liming Road Industry, Ruian Xinguang Traffic Safety, Solar Marker, Europalite Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Road Stud and Delineator Market Key Technology Landscape

The technology landscape of the Road Stud and Delineator Market is rapidly evolving from simple retro-reflectivity to sophisticated integrated systems, focusing on power independence, communication capability, and superior durability. The most critical technological advancement is the maturation of Active Road Stud technology, primarily utilizing solar energy harvesting coupled with high-efficiency Light Emitting Diodes (LEDs). These systems employ advanced photovoltaic cells capable of charging internal batteries even under low-light conditions, ensuring prolonged operational life and consistent visibility at night or during extreme weather. Modern solar studs utilize durable encapsulation techniques (often IP68 rated) and advanced micro-controllers for optimized power management, extending battery life beyond five years, addressing a key historical restraint related to maintenance frequency.

Material science innovation is equally crucial, focusing on developing highly durable and impact-resistant materials to prolong product life in high-stress environments. This includes the use of advanced polymers, specialized resins, and high-strength aluminum alloys designed to resist abrasion from snowplows and repeated heavy traffic loading. Furthermore, the development of self-cleaning surface treatments for reflective faces helps maintain optimal retro-reflectivity over the product lifespan, mitigating the common issue of surface dirt accumulation that diminishes performance. For delineators, the technology centers on highly flexible polymers that can bend significantly upon impact and return to their original position, minimizing the need for replacement after minor traffic incidents.

The integration of smart road infrastructure marks the future technological direction. This involves embedding communication modules (such as LoRaWAN, cellular IoT, or short-range radio) into road studs, transforming them into data points. These "smart markers" can potentially communicate critical information, such as real-time lane closure status, hazardous conditions (e.g., black ice), or accident alerts, directly to connected vehicles (V2I communication). While currently in the pilot phase, this technology signifies a shift towards integrated safety systems where the physical markers interact dynamically with the digital infrastructure, requiring expertise in both traffic engineering and telecommunications within the manufacturing process.

Regional Highlights

Regional variations in infrastructure spending, regulatory environments, and climate influence the market dynamics significantly. Each major region demonstrates unique demand patterns and technological preferences driven by local road safety priorities and economic development stages. The commitment to Intelligent Transportation Systems (ITS) and the enforcement of specific standards for road geometry and visibility are primary determinants of market size and growth rate across geographies.

- North America (U.S. and Canada): This market is mature but highly focused on quality and advanced safety features. Demand is steady, driven by strict regulatory standards (e.g., Manual on Uniform Traffic Control Devices - MUTCD) and the necessity for snowplow-resistant markers, favoring recessed or specialized aluminum studs. The region is a significant adopter of advanced LED solar studs due to large budgets for safety enhancements and high labor costs, making low-maintenance solutions economically attractive. Smart infrastructure integration trials are prominent here, boosting demand for V2I-capable delineators and studs.

- Europe: The European market emphasizes standardization and sustainability, driven by directives from the European Union (EU) regarding road safety targets. Countries like Germany, France, and the UK prioritize highly reliable, certified products. There is a strong uptake of robust, environmentally friendly materials and an increasing trend toward solar-powered markers on rural and unlit roads. Infrastructure spending is stable, focused on maintenance and upgrades of existing dense road networks, ensuring consistent replacement demand and favoring long-life products to minimize disruption.

- Asia Pacific (APAC): APAC is the engine of global growth, characterized by massive infrastructure expansion projects in countries like China, India, and Indonesia. Demand is high for both cost-effective reflective markers for rural roads and high-performance solar studs for newly built national highways and expressways. The market is competitive, often driven by large government tenders focused on volume and initial cost, though quality requirements are rapidly escalating as safety standards align with international norms. Urbanization in Southeast Asia drives demand for complex urban delineation systems.

- Latin America (LATAM): The market is characterized by moderate growth, heavily influenced by government spending cycles and commodity prices. Investment in road safety infrastructure is often focused on high-risk areas and major commercial corridors. Reflective plastic markers are widely used due to cost sensitivity. However, there is growing recognition of the need for active solar studs in remote or mountainous regions where consistent electrical infrastructure is lacking, providing a niche opportunity for premium product suppliers.

- Middle East and Africa (MEA): Growth is robust in the GCC states (UAE, Saudi Arabia) due to large-scale urbanization and mega-project development (e.g., NEOM). Demand centers on products resistant to extreme heat, sand abrasion, and high UV exposure. The requirement for high-visibility delineation on desert highways drives premium pricing for specialized aluminum and high-lumen solar studs. In parts of Africa, infrastructure development projects funded by international aid and domestic government programs are opening new markets, focusing primarily on basic, durable reflective solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Road Stud and Delineator Market.- 3M Company

- Swarco AG

- Stimsonite (A J.J. Keller Company)

- Pexco LLC

- G.O. Road Safety

- Ennis-Flint (PPG Industries)

- Sola Road Safety

- Lindsay Corporation

- Zhejiang Shengtong Traffic Co., Ltd.

- ZGSM Technology

- Hunan Chendu Traffic Engineering Co.

- Liming Road Industry

- Ruian Xinguang Traffic Safety

- Solar Marker

- Europalite Ltd.

- Guangzhou Flash Road Safety Technology Co., Ltd.

- RPS Industries

- Mega Signal Technologies

- Roadway Safety Service Inc.

- Solar LED Systems Inc.

Frequently Asked Questions

Analyze common user questions about the Road Stud and Delineator market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Road Stud and Delineator Market?

The primary factor driving market growth is increasing global regulatory pressure and government mandates focused on enhanced road safety, particularly reducing night-time accident rates through superior visual guidance and lane demarcation. Infrastructure modernization programs globally also necessitate the replacement of older, less effective marking systems.

How do solar LED road studs compare economically to traditional reflective markers?

Solar LED studs have a significantly higher initial purchase and installation cost compared to traditional reflective markers. However, they offer dramatically enhanced visibility, reduce reliance on vehicle headlights, and often have a superior lifespan with lower long-term maintenance needs, resulting in a favorable total cost of ownership (TCO) in high-risk zones.

Which material type holds the largest share in the road stud market and why?

While durable materials like aluminum hold strong share in high-traffic, snowplow-prone areas, high-impact specialized plastics (such as polycarbonate) collectively account for a large volume share due to their cost-effectiveness, ease of installation (surface mounting), and adequate durability for moderate traffic volumes and urban applications across diverse global regions.

Is the integration of AI or V2I technology making physical road studs obsolete?

No, AI and V2I technologies are enhancing, not replacing, physical road studs. Advanced systems use AI for optimizing marker placement and maintenance. Physical markers serve as critical, redundant visual benchmarks for autonomous vehicle sensors, especially in adverse weather conditions, ensuring safety continuity when digital systems might struggle.

Which geographical region is expected to show the fastest market growth through 2033?

The Asia Pacific (APAC) region is projected to exhibit the fastest growth, primarily fueled by extensive, large-scale infrastructure development projects, including the construction of new national highways and expressways, combined with rapidly improving regulatory compliance concerning road safety standards in major economies like China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager