Robot Vacuums and Mops Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441265 | Date : Feb, 2026 | Pages : 251 | Region : Global | Publisher : MRU

Robot Vacuums and Mops Market Size

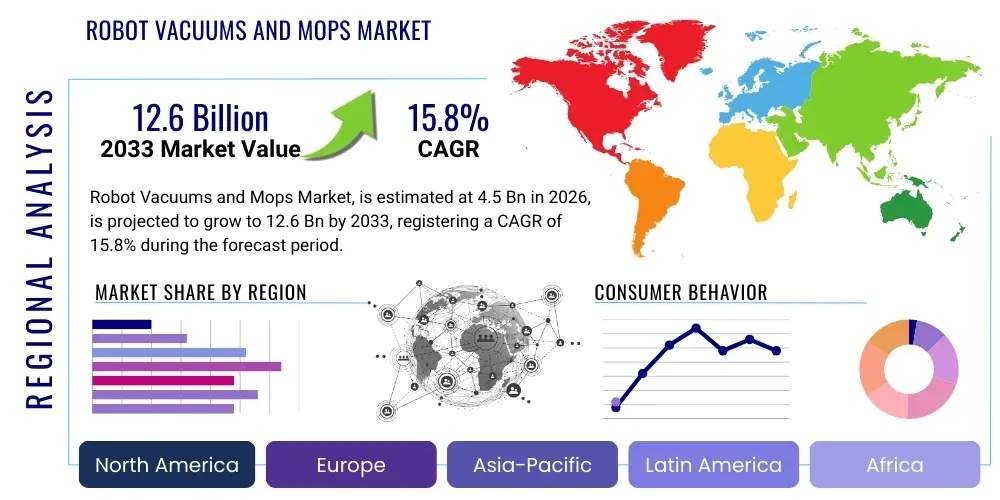

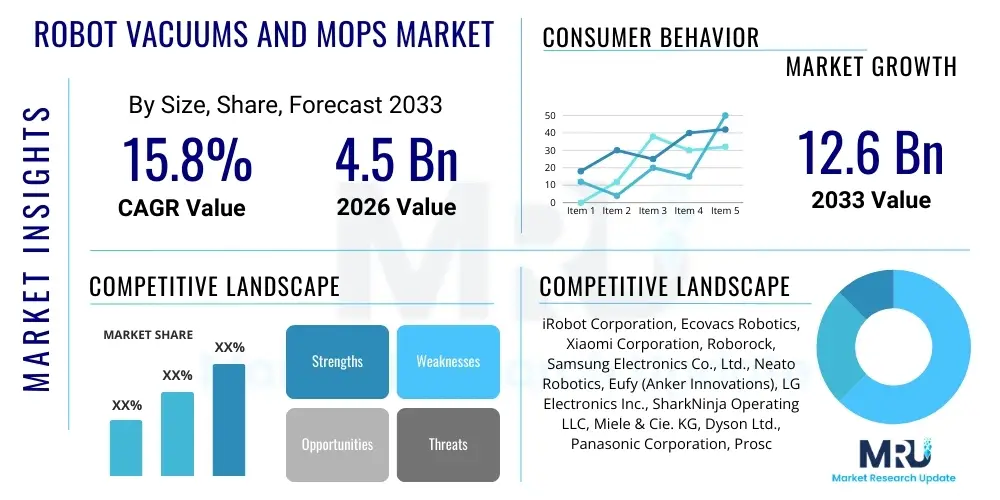

The Robot Vacuums and Mops Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 12.6 Billion by the end of the forecast period in 2033. This robust expansion is primarily fueled by increasing consumer disposable income, rapid advancements in artificial intelligence (AI) and sensor technology allowing for superior navigation, and the growing demand for automated cleaning solutions in both residential and commercial sectors globally. The market transition from basic vacuum functionalities to integrated, multi-functional cleaning robots capable of both dry vacuuming and wet mopping is a key factor driving up average selling prices and overall market valuation. Furthermore, the rising proliferation of smart homes and connected ecosystems necessitates seamless integration of these cleaning devices, further boosting market momentum.

The market valuation reflects significant investment in research and development aimed at improving battery life, decreasing charging times, and enhancing the durability and effectiveness of cleaning mechanisms. Manufacturers are focusing heavily on developing sophisticated mapping technologies, such as simultaneous localization and mapping (SLAM) and advanced LiDAR systems, which enable robots to efficiently navigate complex environments, recognize obstacles, and optimize cleaning paths. This technological leap is critical for overcoming historical consumer skepticism regarding coverage and efficiency, thereby expanding the potential customer base. The trend towards specialized robots for hard floors versus carpets, alongside modular designs that allow for easy repair and upgrades, also contributes substantially to the market’s projected growth trajectory, ensuring long-term product viability and consumer loyalty.

Robot Vacuums and Mops Market introduction

The Robot Vacuums and Mops Market encompasses autonomous floor-cleaning devices designed to perform cleaning tasks with minimal human intervention. These smart appliances integrate sophisticated sensors, navigation algorithms, and connectivity features (Wi-Fi, app control) to map environments, avoid obstacles, and execute scheduled cleaning routines. The primary product offerings range from dedicated vacuuming units and mopping units to increasingly popular hybrid models that combine both functions, providing comprehensive floor care. Major applications span residential settings, where convenience and time-saving are paramount, and commercial environments, including small offices, hotels, and retail spaces, seeking efficient maintenance solutions. The core benefits include enhanced cleaning consistency, significant time savings for users, reduced physical labor, and integration into existing smart home ecosystems, contributing to an elevated quality of life.

Key driving factors accelerating market penetration include the sustained global urbanization trend leading to smaller, high-density living spaces where automation is valued, coupled with rising labor costs making manual cleaning less desirable. Technological advancements in solid-state sensors, AI-driven dirt detection, and self-cleaning/self-emptying base stations have significantly improved robot reliability and user experience. Moreover, competitive pricing strategies by established and emerging Asian manufacturers are making these devices accessible to a broader consumer demographic. The convergence of IoT (Internet of Things) and home automation further solidifies the robot vacuum and mop as a necessary component of a modern, connected household, pushing innovation in seamless connectivity and remote management capabilities.

Robot Vacuums and Mops Market Executive Summary

The Robot Vacuums and Mops Market is experiencing robust expansion driven by continuous technological integration, notably in AI-powered navigation and enhanced multi-functional capabilities. Business trends highlight a strong shift towards hybrid models that offer combined vacuuming and mopping, reducing the need for multiple devices and maximizing efficiency. Key manufacturers are focusing on subscription models for consumables and specialized services, creating recurring revenue streams and improving customer retention. Strategic partnerships between robot manufacturers and smart home platform providers (like Google and Amazon) are crucial for market success, ensuring seamless device interoperability and expanding the ecosystem footprint. Furthermore, intense competition is spurring innovation in design, battery life, and noise reduction, catering to discerning consumers demanding premium features.

Regional trends indicate that North America and Europe remain mature markets characterized by high adoption rates of premium, feature-rich models incorporating advanced mapping and self-cleaning technologies. Conversely, the Asia Pacific (APAC) region is poised for the highest growth, fueled by rapid urbanization, increasing disposable incomes in countries like China and India, and a strong cultural affinity for technological gadgets. The APAC market is highly price-sensitive but shows increasing demand for mid-range hybrid devices. Latin America and MEA are emerging markets, currently dominated by entry-level and mid-range vacuum-only models, with growth expected to accelerate as internet penetration and purchasing power increase, supported by localized marketing efforts addressing regional housing specifications.

Segment trends demonstrate the residential segment's dominant market share, although the commercial segment, particularly for large-scale floor maintenance in hospitality and healthcare, is exhibiting accelerated growth due to the implementation of larger, industrial-grade autonomous cleaning machines. In terms of navigation technology, visual simultaneous localization and mapping (VSLAM) and LiDAR are rapidly replacing older, less efficient infrared-based systems. The hybrid (vacuum and mop) product type segment is projected to maintain the fastest growth rate, reflecting consumer preference for all-in-one solutions. Battery technology improvements, particularly the move towards higher energy density lithium-ion variants, also constitute a significant trend across all product categories, directly addressing primary consumer pain points related to coverage capacity.

AI Impact Analysis on Robot Vacuums and Mops Market

User queries regarding AI's role in the Robot Vacuums and Mops Market predominantly center on practical efficiency gains, privacy concerns, and future capabilities. Common questions include: "How does AI improve cleaning effectiveness?" "Are AI robots better at avoiding specific objects like cords or pet waste?" and "What data do these robots collect and how is it secured?" This collective analysis reveals a core expectation that AI should transition the robots from simple automated sweepers to genuinely intelligent cleaning assistants. Users seek assurance that AI algorithms optimize path planning (reducing cleaning time), enhance object recognition accuracy (preventing entanglement or damage), and enable personalized cleaning schedules based on learned behavioral patterns within the home. The integration of sophisticated neural networks for environmental sensing and adaptive cleaning modes is crucial for meeting these high consumer expectations, particularly in complex, multi-level homes.

The impact of AI is transforming the fundamental utility of robotic cleaners, moving beyond basic navigation to predictive maintenance and hyper-personalized operation. AI models are trained on vast datasets of household layouts and debris types, allowing the robot to dynamically adjust suction power, brush speed, and mopping pressure based on surface type (carpet vs. hardwood) and the concentration of dirt detected. This adaptive cleaning maximizes battery efficiency and cleaning quality simultaneously. Furthermore, advanced AI facilitates improved communication interfaces, allowing robots to understand complex voice commands and integrate seamlessly with other smart home devices, elevating the user experience from merely functional to truly intuitive. The ability of AI to learn a home’s idiosyncrasies—such as recognizing high-traffic areas requiring deeper cleaning—is a primary differentiator in the premium segment, validating higher price points and fostering market growth through enhanced utility.

However, the reliance on AI also introduces significant ethical and logistical challenges. Consumer concerns about data privacy surrounding home mapping data (often stored in the cloud) require manufacturers to invest heavily in robust encryption and clear data handling policies, a key factor influencing purchasing decisions. Furthermore, the complexity of AI algorithms necessitates substantial computing power onboard the device, influencing hardware costs and battery design. Companies that successfully navigate the balance between leveraging complex AI for superior performance and maintaining transparent, secure data practices will achieve market leadership. Future AI developments are expected to focus on contextual understanding—for example, automatically cleaning spills as they happen, or distinguishing between temporary obstacles and permanent furniture—further embedding these robots as indispensable household managers.

- AI-driven Simultaneous Localization and Mapping (SLAM) enhances real-time navigation and optimized path planning efficiency.

- Advanced object recognition via neural networks improves the avoidance of small household items, cords, and challenging debris like pet waste.

- Machine learning algorithms enable personalized cleaning routines based on environmental history and user habits.

- Predictive cleaning adjustments allow robots to automatically modulate suction and mopping intensity based on detected floor material and dirt level.

- AI facilitates enhanced integration with voice assistants (Alexa, Google Assistant) for intuitive, conversational control.

- Improved battery management systems use AI to calculate optimal charging intervals and reduce energy wastage during cleaning cycles.

- Self-diagnosis and predictive maintenance features leverage AI to alert users to potential malfunctions before they occur.

- Cloud-based AI processing enables continuous software updates and performance improvements without hardware modification.

DRO & Impact Forces Of Robot Vacuums and Mops Market

The Robot Vacuums and Mops Market is governed by a dynamic interplay of Drivers, Restraints, and Opportunities (DRO), which collectively constitute the critical Impact Forces shaping its trajectory. The primary drivers include increasing adoption of smart home technology, rising consumer demand for convenience and automation due to busy lifestyles, and continuous technological breakthroughs in sensor integration (LiDAR, VSLAM) and AI processing. These factors substantially accelerate market penetration, particularly in developed economies. Restraints, however, pose significant barriers, notably the high initial cost of premium, feature-rich models, limiting adoption among lower-income demographics. Additionally, consumer skepticism concerning cleaning efficiency on challenging surfaces (like deep carpets or uneven grout lines) and persistent concerns regarding data privacy and security of internal home maps act as deterrents. Addressing these restraints requires strategic price point adjustments and rigorous data protection compliance. The core opportunity lies in the burgeoning commercial segment (hotels, schools, small businesses) seeking professional, autonomous cleaning solutions, and the development of specialized robots (e.g., dedicated pet hair removal units or outdoor cleaning bots), expanding the market beyond traditional residential floor care. Furthermore, geographical expansion into emerging markets offers substantial untapped potential.

Impact forces stemming from these DRO elements exert strong pressure on manufacturers. The push for automation is an accelerating force, necessitating faster product cycles and greater investment in R&D to maintain competitive parity. Conversely, the high cost constraint acts as a limiting force, pushing companies to develop more economical versions without significantly compromising performance—a critical balancing act. The opportunity for specialization drives innovation towards differentiated products, focusing on niche needs such as air purification integration or deep-mopping functionality. Regulatory pressures related to IoT device security and battery disposal (environmental sustainability) also increasingly influence design and manufacturing processes. The overall impact results in a highly competitive landscape where technological superiority, operational simplicity, and strategic pricing are paramount for achieving long-term market dominance. Companies must prioritize continuous software optimization and firmware updates to ensure long-term value delivery, countering the restraint of initial high investment.

Segmentation Analysis

The Robot Vacuums and Mops Market is segmented across several critical dimensions, including product type, connectivity, distribution channel, application, and navigation technology, providing a granular view of market dynamics and consumer preferences. Product type segmentation distinguishes between standalone vacuum robots, dedicated mopping robots, and the highly popular hybrid 2-in-1 models, which integrate both dry and wet cleaning capabilities, simplifying the cleaning routine for consumers. Connectivity segmentation includes Wi-Fi enabled robots, which dominate the market due to their integration capabilities with smartphone apps and smart home ecosystems, and non-connected basic models, which cater to the entry-level segment seeking simple operation. This granular segmentation allows manufacturers to tailor marketing strategies and product development efforts toward specific consumer needs and technological adoption rates across different regions. Understanding these segments is crucial for accurate forecasting and strategic resource allocation.

Segmentation by application clarifies the primary usage environments, differentiating between the dominant residential sector, where convenience and lifestyle enhancement are drivers, and the rapidly growing commercial sector, which demands greater durability, larger capacity dustbins, and centralized fleet management capabilities for efficient large-area coverage. Furthermore, navigation technology is a critical segment, distinguishing devices utilizing sophisticated methodologies like LiDAR, VSLAM (Visual SLAM), and advanced sensor fusion from those relying on basic gyroscope or infrared sensors. The distribution channel segmentation, encompassing online retail, specialized electronic stores, and hypermarkets, dictates product accessibility and pricing strategies. The ongoing shift toward online channels, driven by detailed product reviews and comparative shopping ease, is influencing how manufacturers structure their sales networks and digital marketing campaigns to reach tech-savvy consumers globally.

- By Product Type:

- Vacuum Robots

- Mopping Robots

- Hybrid (Vacuum and Mopping) Robots

- By Connectivity:

- Wi-Fi Enabled

- Non-Connected (Basic Models)

- By Navigation Technology:

- LiDAR (Laser Distance Sensor)

- VSLAM (Visual Simultaneous Localization and Mapping)

- Gyroscope and Infrared Sensors

- By Application:

- Residential

- Commercial (Hospitality, Healthcare, Office Space)

- By Distribution Channel:

- Online Retail (E-commerce Platforms)

- Offline Retail (Specialty Stores, Hypermarkets)

Value Chain Analysis For Robot Vacuums and Mops Market

The value chain for the Robot Vacuums and Mops Market begins with upstream activities focused on the procurement and manufacturing of highly specialized components. This includes the sourcing of advanced sensors (LiDAR modules, ultrasonic sensors, infrared arrays), high-density Lithium-Ion battery cells, proprietary microprocessors for SLAM and AI processing, and durable, injection-molded plastic chassis materials. Key suppliers for these sophisticated electronic and power components often originate from established technology hubs in Asia, creating complex global supply chain dependencies. R&D and design—where software development for navigation algorithms and connectivity features occurs—represent the highest value-addition stage in the upstream segment, demanding continuous investment to maintain a competitive edge. Efficient inventory management and component quality control are critical at this stage, directly impacting final product performance and reliability, which are core determinants of consumer satisfaction.

Downstream activities center on assembly, branding, marketing, and, crucially, distribution. Final assembly operations are increasingly automated, often located near major logistical hubs to reduce transportation costs. Branding and digital marketing play a vital role, emphasizing product features like noise reduction, battery longevity, and specific AI capabilities. Distribution channels are bifurcated into direct and indirect routes. Direct distribution involves manufacturer-owned online stores, offering full control over pricing and customer data, but demanding significant logistical infrastructure. Indirect channels, which dominate the market, rely heavily on large-scale e-commerce platforms (Amazon, Taobao) and major physical retailers (Best Buy, Walmart). The choice of distribution partner significantly affects market reach and speed of inventory turnover, particularly during peak holiday sales periods, requiring nuanced channel management strategies.

After-sales service and support constitute the final, crucial stage of the value chain. Given the complexity and cost of these devices, effective customer support, easy access to replacement parts (brushes, filters, batteries), and efficient warranty handling are paramount for enhancing customer loyalty and generating positive reviews, which fuel subsequent sales. Direct sales channels often facilitate stronger long-term customer relationships, enabling manufacturers to gather direct feedback for product improvement. The entire chain is highly sensitive to geopolitical factors and global tariff policies, which influence raw material and component costs, demanding resilient supply chain strategies to mitigate risks and maintain profitability in this fiercely competitive consumer electronics segment.

Robot Vacuums and Mops Market Potential Customers

The primary segment of potential customers for Robot Vacuums and Mops falls within the residential demographic, specifically targeting busy professionals, dual-income households, and older adults who prioritize convenience, time savings, and automation in household chores. Tech-savvy millennials and Generation Z, who are early adopters of smart home technology and integrated IoT devices, represent a substantial and growing customer base willing to invest in premium models offering the latest features, such as personalized app control and sophisticated mapping. Furthermore, households with pets are a highly lucrative niche, requiring devices with specialized features like enhanced suction power, anti-tangle brush designs, and self-emptying capabilities to manage constant shedding, thus driving demand for specialized, high-performance units that overcome common pain points associated with pet ownership.

A rapidly expanding secondary customer base resides within the commercial and light industrial sector. Small to medium-sized enterprises (SMEs), including boutique hotels, local restaurants, clinics, and small corporate offices, are increasingly adopting professional-grade robot cleaners. These businesses seek solutions that minimize recurring human cleaning labor costs while maintaining a consistently high level of cleanliness, especially in customer-facing areas. These commercial buyers typically require robust devices with larger dust capacities, longer operational cycles, and centralized management software for coordinating multiple units across different floor plans. The institutional segment, including schools and small healthcare facilities, also presents significant potential, driven by stringent hygiene standards and the need for discreet, scheduled cleaning outside of operational hours.

Geographically, customers in developed nations, characterized by higher disposable incomes and established smart home infrastructure, represent the core market for advanced and high-priced models. However, emerging markets are crucial for volume growth, primarily targeting consumers who are upgrading from traditional cleaning methods. These emerging market buyers often prioritize value and reliability, driving demand for entry-level and mid-range hybrid robots that offer essential functionalities at an accessible price point, often relying on localized marketing and warranty support provided through trusted regional distributors.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 12.6 Billion |

| Growth Rate | 15.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | iRobot Corporation, Ecovacs Robotics, Xiaomi Corporation, Roborock, Samsung Electronics Co., Ltd., Neato Robotics, Eufy (Anker Innovations), LG Electronics Inc., SharkNinja Operating LLC, Miele & Cie. KG, Dyson Ltd., Panasonic Corporation, Proscenic, Bissell Inc., Tesvor, 360 Smart Life, Dreametech, Narwal Robotics, SwitchBot, Coredy. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Robot Vacuums and Mops Market Key Technology Landscape

The technological landscape of the Robot Vacuums and Mops Market is rapidly evolving, defined primarily by advancements in three core areas: navigation and mapping, cleaning mechanics, and connectivity/power management. Navigation technology has transitioned from random bumper-based movement to highly precise, algorithmic mapping systems. LiDAR (Light Detection and Ranging) sensors offer millimeter-level accuracy for creating detailed 3D maps of the environment, enabling efficient, systematic cleaning paths even in low-light conditions. VSLAM (Visual Simultaneous Localization and Mapping), which uses cameras and computer vision combined with inertial sensors, provides contextual awareness, allowing the robot to identify and categorize obstacles (e.g., distinguishing a sock from a chair leg). The integration of sensor fusion—combining LiDAR, VSLAM, cliff sensors, and ultrasonic detectors—ensures robust, failure-proof operation across varied home environments and floor surfaces, fundamentally improving market acceptance regarding coverage reliability.

In terms of cleaning mechanics, innovation focuses on maximizing debris pickup and optimizing mopping functionality. High-efficiency particulate air (HEPA) filtration is standard, addressing allergen concerns. The latest models employ multi-surface main brushes (often rubberized or composite materials) designed to prevent hair tangling, a major historical complaint. Mopping technology has moved beyond simple drag-and-wet pads to sophisticated systems incorporating high-frequency sonic vibration or rotating pressurized pads, simulating manual scrubbing action for effective stain removal. Self-cleaning stations, which automatically empty the dustbin and wash/dry the mopping pads, represent a significant technological leap in convenience, transforming the robot from a device requiring daily maintenance to one needing only periodic attention, thereby strengthening the product's value proposition and reducing user burden.

Power management and connectivity are foundational technologies enabling the modern smart robot. Lithium-ion batteries with optimized energy density allow for longer run times and faster recharging cycles, essential for covering larger homes. AI-driven battery management systems predict the optimal time to return to the base station mid-cycle for recharging and resuming cleaning, ensuring maximum coverage efficiency. Connectivity is maintained via Wi-Fi, supporting complex integration with proprietary smartphone applications and broader smart home platforms (Matter, Zigbee). This connectivity facilitates firmware Over-The-Air (OTA) updates, ensuring robots continuously improve their mapping and navigation capabilities post-purchase, offering long-term value and sustained relevance in a dynamically changing home technology ecosystem.

Regional Highlights

- North America: The North American market is characterized by high consumer spending power and rapid adoption of premium, high-end robot vacuums and mops, often incorporating features like automatic self-emptying docks, advanced AI obstacle recognition, and superior LiDAR mapping. The US and Canada are mature markets where brand loyalty and comprehensive smart home integration capabilities drive purchasing decisions. Demand is strongest for hybrid models that offer exceptional performance on mixed surfaces, including heavy carpeting. Competitive pricing strategies among leading brands and robust e-commerce penetration further fuel market growth in this region.

- Europe: Europe represents a technologically sophisticated market with high segmentation across varying national preferences. Western European countries (Germany, UK, France) emphasize quality, durability, and energy efficiency, often favoring established brands compliant with stringent environmental and data protection regulations (e.g., GDPR). Central and Eastern Europe are emerging as high-growth areas, with increasing penetration of mid-range hybrid models due to rising disposable incomes. Noise level reduction is a significant buying criterion across the region due to dense urban living arrangements.

- Asia Pacific (APAC): APAC is the fastest-growing region globally, driven by massive urbanization, a strong consumer affinity for gadgets, and manufacturing dominance in countries like China and South Korea. China, in particular, is a hyper-competitive market with localized brands offering highly sophisticated technology at competitive price points. Demand here favors slim, compact designs suitable for smaller apartments and models optimized for hard floors prevalent in many Asian housing structures. India and Southeast Asia present enormous untapped growth potential as the middle-class population expands and affordability improves.

- Latin America (LATAM): The LATAM market is nascent but accelerating, primarily driven by large urban centers in Brazil and Mexico. Consumers are generally more price-sensitive, leading to higher demand for entry-level and mid-range vacuum-only robots. Growth is constrained by fluctuating currency values and infrastructure challenges, but increasing internet connectivity and local assembly initiatives are poised to boost adoption rates in the forecast period. Marketing often focuses on the utility of automation against the backdrop of rising domestic labor costs.

- Middle East and Africa (MEA): The MEA market is still highly fragmented, with strong demand localized in the Gulf Cooperation Council (GCC) states (UAE, Saudi Arabia) due to high per capita income and luxurious residential segments demanding advanced smart home technology. Market penetration is lower in Africa, constrained by economic variability, though adoption is starting in affluent urban hubs like Johannesburg and Cape Town. The region requires durable devices capable of managing fine desert dust and high ambient temperatures.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Robot Vacuums and Mops Market.- iRobot Corporation

- Ecovacs Robotics

- Xiaomi Corporation

- Roborock

- Samsung Electronics Co., Ltd.

- Neato Robotics

- Eufy (Anker Innovations)

- LG Electronics Inc.

- SharkNinja Operating LLC

- Miele & Cie. KG

- Dyson Ltd.

- Panasonic Corporation

- Proscenic

- Bissell Inc.

- Tesvor

- 360 Smart Life

- Dreametech

- Narwal Robotics

- SwitchBot

- Coredy

Frequently Asked Questions

Analyze common user questions about the Robot Vacuums and Mops market and generate a concise list of summarized FAQs reflecting key topics and concerns.What technological factors are primarily driving the market growth for robot vacuums and mops?

The primary drivers are advancements in AI-powered navigation, specifically the adoption of LiDAR and VSLAM technologies for highly efficient mapping and path optimization. Furthermore, the development of sophisticated sensor fusion and self-cleaning/self-emptying base stations significantly enhances user convenience, bolstering market demand for premium models and enabling a more autonomous user experience that minimizes interaction frequency.

What is the competitive advantage of hybrid (2-in-1) robot models over dedicated vacuum units?

Hybrid robot models offer a significant competitive advantage by providing combined dry vacuuming and wet mopping functionality within a single device. This integration saves space, reduces the total cost of ownership compared to purchasing two separate machines, and streamlines the automated cleaning process, making them increasingly popular among consumers seeking comprehensive, time-efficient floor care solutions for mixed-surface homes, thus dominating sales.

How significant is the impact of smart home integration on consumer purchasing decisions?

Smart home integration is a critical factor, particularly for high-end market segments. Consumers prioritize robots that seamlessly connect via Wi-Fi, respond to voice commands through platforms like Alexa or Google Assistant, and integrate with personalized routines (e.g., automatically cleaning when the house is empty). This connectivity ensures convenience, remote control, and future-proofing via over-the-air firmware updates, making integration capabilities a key non-negotiable feature for tech-savvy buyers.

Which geographical region is expected to exhibit the highest growth rate during the forecast period?

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR). This acceleration is driven by rapid urbanization, substantial increases in disposable income across emerging economies like China and India, and a strong cultural affinity for household automation technology, despite intense regional price competition among manufacturers offering localized, high-value products.

What are the main restraints impacting the broader market adoption of robot cleaners?

The primary restraints include the high initial purchase price of premium models, which limits penetration in lower-income demographics. Furthermore, consumer concerns regarding the long-term effectiveness on specific challenging surfaces (like very thick carpets) and significant anxiety surrounding data privacy and the security of home mapping information stored in the cloud continue to act as barriers to mass market acceptance and require manufacturers to ensure clear security protocols.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager