Robotic Injection Molding Machines Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442641 | Date : Feb, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Robotic Injection Molding Machines Market Size

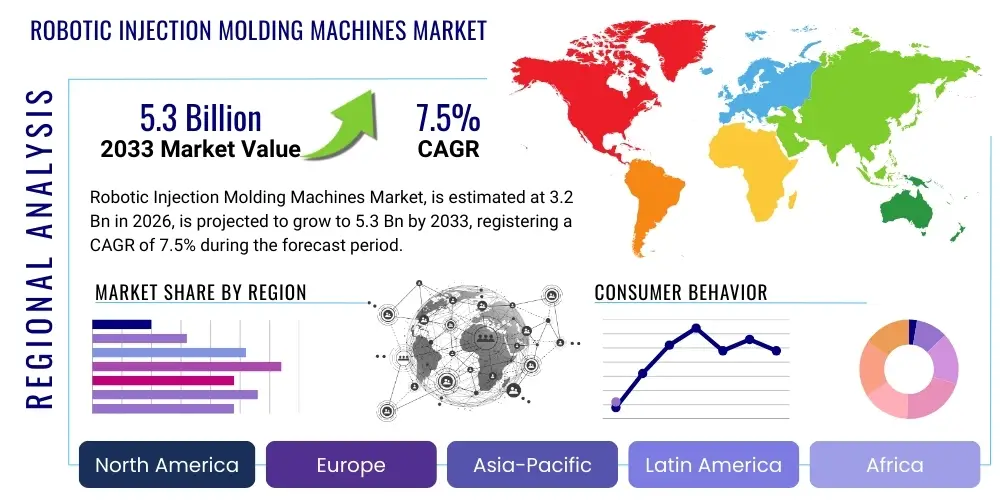

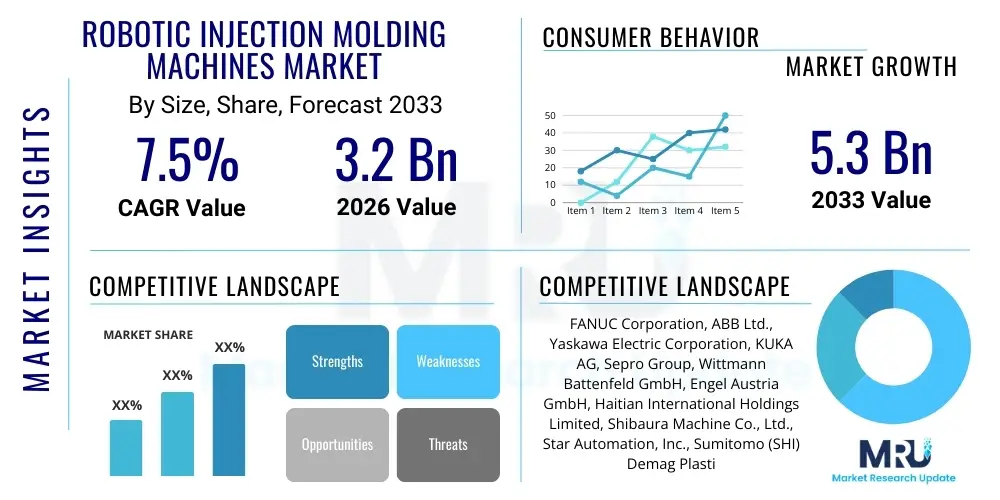

The Robotic Injection Molding Machines Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 3.2 Billion in 2026 and is projected to reach USD 5.3 Billion by the end of the forecast period in 2033.

Robotic Injection Molding Machines Market introduction

The Robotic Injection Molding Machines Market encompasses the integration of advanced robotic systems, including Cartesian, SCARA, and 6-Axis articulated robots, into the plastic injection molding process. These systems are predominantly utilized for automating critical, repetitive, and high-precision tasks such as high-speed part removal, insert placement, overmolding, packaging, and quality inspection. The core product definition centers on specialized automation equipment designed to interface seamlessly with standard injection molding machinery, enhancing efficiency, reducing cycle times, and ensuring consistent product quality across various production volumes. Modern systems feature sophisticated control interfaces and often incorporate advanced sensing technologies and machine vision for enhanced operational accuracy and flexibility in handling complex geometries.

Major applications of robotic injection molding machines span highly regulated and high-volume sectors, including the automotive industry for producing intricate components like interior trim and engine parts, and the medical device sector, where precision and cleanroom compatibility are paramount for manufacturing syringes, diagnostic kits, and surgical components. Furthermore, the consumer goods and electronics industries heavily rely on these robots for producing casings, connectors, and packaged items quickly and accurately. The adoption of these machines is fundamentally driven by their capacity to mitigate challenges associated with manual labor, such as high labor costs, inconsistency, and safety risks in handling hot or sharp components, thereby ensuring a competitive edge in global manufacturing landscapes.

The primary benefits realized by adopting these robotic solutions include significant improvements in operational throughput, remarkable reduction in scrap rates due to precise handling, and enhanced safety compliance by removing human operators from hazardous environments. Key driving factors underpinning market expansion include the global push toward Industry 4.0 adoption, increasing demand for miniaturized and highly precise plastic components, and persistent skilled labor shortages in industrialized regions. These dynamics compel manufacturers to invest in automation that offers long-term operational resilience and superior cost efficiency compared to traditional manual or semi-automated processes.

Robotic Injection Molding Machines Market Executive Summary

The Robotic Injection Molding Machines Market is experiencing robust growth fueled by pervasive business trends focusing on operational optimization, customization capabilities, and sustainability in manufacturing. Businesses are increasingly prioritizing investments in collaborative robots (cobots) and advanced vision-guided systems that offer faster deployment and greater adaptability to diverse production runs, moving away from large, rigid automation setups. The convergence of IoT and robotics is central to current business strategies, enabling comprehensive data collection and predictive maintenance, thereby maximizing uptime and overall equipment effectiveness (OEE). This strategic shift is largely mandated by global supply chain volatility, which necessitates manufacturing flexibility and reduced reliance on external labor markets, accelerating the adoption of turnkey robotic solutions integrated directly into existing production lines across SMEs and large enterprises alike.

Regionally, Asia Pacific (APAC) dominates the market, driven by massive expansions in the automotive and electronics manufacturing sectors, particularly in China, Japan, and South Korea, which serve as global hubs for high-volume plastic component production. North America and Europe demonstrate mature market adoption, characterized by a strong focus on high-payload, high-speed applications, and stringent quality control standards, particularly within the medical and aerospace sectors. These developed regions exhibit a rapid technological transition towards advanced 6-axis articulated robots capable of complex manipulation and secondary operations like assembly and packaging, reflecting a regional trend toward high-value, niche manufacturing processes utilizing sophisticated automation to offset high internal labor costs and maintain quality leadership.

Segmentation trends indicate a significant shift towards 6-Axis Articulated Robots due to their superior flexibility and reach, making them suitable for complex tasks beyond simple pick-and-place, such such as placing inserts and performing post-molding trimming. While Cartesian robots maintain their dominance in high-speed, dedicated part removal due to their simplicity and cost-effectiveness, the fastest growth is observed in the lower payload category (up to 10 kg), driven by the proliferation of collaborative robot solutions suitable for smaller molding machines and constrained factory floors. Furthermore, the medical devices segment is projected to exhibit the highest CAGR, primarily because of the non-negotiable requirement for zero-defect production and sterile handling, where human intervention is systematically minimized through robotic automation to ensure regulatory compliance and product purity.

AI Impact Analysis on Robotic Injection Molding Machines Market

User inquiries regarding the impact of AI on the Robotic Injection Molding Machines Market frequently center on predictive quality control, autonomous decision-making in cycle optimization, and the potential for robots to learn and adapt to material variability. Key themes include the implementation of machine learning (ML) algorithms for real-time defect detection using high-speed vision systems, moving beyond simple programmed parameters to dynamic process adjustments. Users are highly concerned about how AI can handle complex, real-world variations in polymer rheology and ambient conditions that typically necessitate manual intervention. Expectations are focused on AI-driven self-optimization capabilities that can automatically fine-tune parameters like injection speed, melt temperature, and cooling time to achieve energy savings and maintain precise tolerances across millions of cycles without human oversight, fundamentally transforming the role of the machine operator into a supervisory function.

- AI-Enhanced Quality Control: Utilizing deep learning models for classifying micro-defects invisible to traditional systems, ensuring near-zero defect rates in critical applications (e.g., medical, automotive safety components).

- Predictive Maintenance Integration: AI algorithms analyze sensor data from robots and IMMs (Injection Molding Machines) to predict component failure, scheduling maintenance proactively and minimizing unplanned downtime.

- Autonomous Cycle Optimization: Machine Learning adjusts molding parameters in real-time based on material flow and environmental changes, optimizing cycle time and reducing energy consumption automatically.

- Robotic Path Planning Efficiency: AI optimizes robot trajectories for faster part removal and safer movement within the cell, particularly important for complex multi-cavity molds.

- Simplified Programming and Deployment: AI tools reduce the complexity of teaching new tasks to robots, enabling faster setup for short production runs and customization.

DRO & Impact Forces Of Robotic Injection Molding Machines Market

The market is primarily driven by the imperative for operational efficiency, propelled by rising global labor costs and the increasing complexity and miniaturization of molded components, necessitating high-precision handling capabilities that only robots can reliably provide. However, significant restraints exist, notably the high initial capital investment required for sophisticated robotic cells, which can deter smaller manufacturers (SMEs), coupled with the requirement for highly specialized programming expertise and seamless integration with legacy injection molding machinery. Opportunities abound through the development of collaborative robotics (cobots) which lower the barriers to entry by offering safer, more flexible integration, alongside the expansion into emerging economies where rapid industrialization demands scalable automation solutions. These forces collectively shape the competitive landscape, pushing manufacturers towards continuous innovation in flexibility and affordability to capture market share across diverse industrial spectra.

Impact forces currently exerting the strongest influence include technological acceleration and stringent regulatory standards. The impact of Industry 4.0 paradigms mandates robust connectivity and data exchange capabilities for robotic systems, effectively turning robots into smart nodes within the manufacturing ecosystem, which increases system complexity but exponentially boosts data-driven decision-making. Simultaneously, stringent quality and validation requirements, particularly in sectors such as medical and pharmaceutical, necessitate advanced robotics capable of verifiable, repeatable, and documented precision processes. These regulatory pressures force market players to invest heavily in integrated vision systems and validation software, positioning these advanced features not as optional upgrades but as essential components for market entry in high-value application areas.

The balance between high initial cost (Restraint) and massive long-term labor savings (Driver) is the central tension defining adoption rates. The ability of manufacturers to offer leasing models or highly standardized, easily deployable cells (Opportunity) directly mitigates the financial barrier. Furthermore, the persistent and worsening skilled labor shortage globally acts as a powerful, non-cyclical driver, ensuring sustained demand regardless of immediate economic fluctuations. Conversely, the market remains vulnerable to economic downturns, which can cause significant delays or cancellations of large capital expenditure projects, although the long-term strategic necessity of automation often buffers the market against severe protracted declines.

Segmentation Analysis

The Robotic Injection Molding Machines market is comprehensively segmented based on the type of robot utilized, the payload capacity it can handle, the specific application area, and the primary end-use industry served. This multi-dimensional segmentation allows for granular analysis of market demand drivers, technological preferences, and regional adoption patterns. For instance, Cartesian robots dominate volume due to their cost efficiency and suitability for simple linear movement, while articulated robots command higher revenues due to their complex task capabilities. The distinction between low and high payload systems directly correlates with the size of the injection molding machine and the molded part weight, whereas end-use industry segmentation dictates the necessary compliance standards and speed requirements, with medical demanding cleanliness and precision, and automotive requiring high throughput and large part handling. Understanding these segments is crucial for strategic product development and targeted market penetration strategies.

- By Robot Type:

- Cartesian (Linear) Robots

- SCARA Robots

- 6-Axis Articulated Robots

- Collaborative Robots (Cobots)

- By Payload Capacity:

- Up to 10 kg

- 10 kg to 50 kg

- Above 50 kg

- By Application:

- Part Removal and Handling

- Insert Placement

- Overmolding and Degating

- Packaging and Palletizing

- Secondary Operations (Assembly, Inspection)

- By End-Use Industry:

- Automotive

- Electronics and Electrical

- Medical and Healthcare

- Consumer Goods and Packaging

- Others (Aerospace, Construction)

Value Chain Analysis For Robotic Injection Molding Machines Market

The value chain for robotic injection molding machines begins with upstream analysis, which involves key component suppliers providing high-precision hardware such as servomotors, advanced controllers, sensors, and specialized end-of-arm tooling (EOAT), often tailored to specific polymer materials or mold designs. Critical upstream activities also include the development of proprietary software platforms and algorithms that manage robot movement, vision systems, and the interface with the Injection Molding Machine (IMM) controller. Integration expertise in this stage is paramount, as the efficiency and reliability of the final system heavily rely on the seamless interoperability of diverse hardware and software components sourced from specialist technology providers globally. Major robotic manufacturers focus on achieving vertical integration or securing strategic partnerships with these critical component suppliers to ensure supply chain robustness and technological superiority.

The mid-stream encompasses the core activities of robot manufacturing, system integration, and configuration. Robot manufacturers design and produce the kinematic structures, while system integrators play a crucial role in customizing the standard robotic arm into a functional injection molding cell. This involves designing bespoke EOATs (e.g., vacuum grippers, mechanical grippers), programming specific movement sequences optimized for cycle time, and conducting rigorous acceptance testing to meet the end-user’s specific production metrics (e.g., cycle time guarantees, defect tolerance). Distribution channels are bifurcated into direct sales channels, where major global robot suppliers directly service large, multinational automotive and medical clients, and indirect channels, utilizing specialized distributors, value-added resellers (VARs), and dedicated machine tool dealers who often focus on serving regional or SME markets requiring localized support and complex, tailored solutions.

Downstream analysis centers on installation, commissioning, maintenance, and aftermarket services. Post-sale support, including spare parts supply, remote diagnostics, and operator training, constitutes a significant portion of the total value generated, particularly as robotic systems require continuous software updates and occasional hardware recalibration. Direct distribution channels are typically favored for high-complexity installations and ongoing service contracts, ensuring direct technical expertise from the OEM. Indirect channels, relying on local partners, excel in providing rapid local support and integration services, particularly crucial for minimizing production disruption. The effectiveness of the downstream service network often becomes a competitive differentiator, particularly in highly automated industries where uptime is the primary measure of efficiency and profitability.

Robotic Injection Molding Machines Market Potential Customers

Potential customers for Robotic Injection Molding Machines span across multiple industrial sectors, primarily focusing on entities engaged in high-volume, precision manufacturing of plastic components where consistency, speed, and safety are critical performance indicators. The largest buyers include Tier 1 and Tier 2 suppliers in the automotive industry, which require large 6-axis articulated robots for handling heavy, complex vehicle parts, or high-speed Cartesian robots for rapid production of small electrical connectors and interior clips. Another significant segment is the medical device manufacturing industry, including producers of disposable medical consumables, implants, and diagnostic equipment, where the non-negotiable requirement for sterile, validated processes drives the immediate adoption of dedicated, cleanroom-compatible robotic solutions to eliminate contamination risks associated with human handling.

Beyond the core sectors, consumer electronics manufacturers are major customers, leveraging robots for the high-speed removal and delicate placement of components like smartphone casings, wearable device parts, and intricate connectors, often demanding integrated vision systems for aesthetic quality checks. Packaging manufacturers, especially those involved in food and beverage containers, also form a substantial customer base, utilizing automated systems for high-speed stacking, boxing, and palletizing after molding. The defining characteristic across all these customer groups is the need to replace highly repetitive, ergonomically stressful tasks that pose safety risks or result in quality variations when performed manually, thereby justifying the substantial capital investment required for robotic integration as a strategic operational necessity.

Furthermore, small and medium-sized enterprises (SMEs) are increasingly becoming potential customers, particularly those operating in regions facing acute labor shortages or those looking to expand their production capacity without significant infrastructural expansion. This segment is highly receptive to the newer generation of collaborative robots (cobots), which offer faster ROI, require less stringent safety guarding, and are easier to redeploy between different molding machines. These smaller organizations often prioritize ease of use, local support from integrators, and flexible financing options when evaluating robotic solutions, signifying a democratization of access to advanced automation beyond the traditionally large, well-capitalized corporations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.2 Billion |

| Market Forecast in 2033 | USD 5.3 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | FANUC Corporation, ABB Ltd., Yaskawa Electric Corporation, KUKA AG, Sepro Group, Wittmann Battenfeld GmbH, Engel Austria GmbH, Haitian International Holdings Limited, Shibaura Machine Co., Ltd., Star Automation, Inc., Sumitomo (SHI) Demag Plastics Machinery GmbH, Arburg GmbH + Co KG, Universal Robots A/S, Stäubli International AG, Dai-ichi Robotics, Inc., Dr. Boy GmbH & Co. KG, Kawaguchi Ltd., Shini USA, Conair Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Robotic Injection Molding Machines Market Key Technology Landscape

The technology landscape of the Robotic Injection Molding Machines Market is rapidly evolving, driven by the shift towards fully integrated, intelligent manufacturing environments. Key technological advances center around enhanced control systems that allow for simultaneous communication between the robot, the injection molding machine, and peripheral equipment (such as conveyors and quality inspection stations) via standardized protocols like OPC UA. This convergence supports true closed-loop manufacturing, where data collected by the robot during part handling is instantly fed back to the IMM controller to adjust parameters, optimizing the overall cycle. Furthermore, the development of lightweight, highly efficient servo motors and composite materials allows modern robots to achieve greater speeds and acceleration without compromising precision or energy efficiency, which is crucial for reducing the critical 'parts out' time in high-volume production cycles.

A second major technological cornerstone is the exponential improvement in end-of-arm tooling (EOAT) and quick-change systems. Modern EOATs are often 3D-printed using lightweight, application-specific materials to perfectly match the contour of complex parts, ensuring secure gripping without marring the surface finish, a requirement particularly important in consumer electronics and high-gloss automotive components. Advanced tooling incorporates integrated sensors for force feedback and thermal monitoring, providing robots with a sense of touch to handle delicate inserts or verify successful part removal. Furthermore, the emergence of standardized modular EOAT platforms significantly reduces downtime associated with mold changeovers, allowing manufacturers to switch between producing different parts in a matter of minutes, thus enhancing manufacturing flexibility and enabling efficient low-volume, high-mix production.

The integration of advanced machine vision and artificial intelligence (AI) forms the frontier of technological development. High-resolution 2D and 3D vision systems are now routine for tasks such as locating randomly placed inserts, verifying complex gating removal, and conducting comprehensive, non-contact quality inspection immediately after ejection. AI algorithms process this visual data faster and more accurately than human inspectors, identifying subtle flaws and geometric deviations in real-time. This capability not only improves product quality but also reduces reliance on costly, post-molding inspection setups. Collaborative robotics also represent a major technological shift, moving towards safer, human-friendly designs that eliminate the need for large physical safety cages, enabling closer interaction with human operators and facilitating flexible, cost-effective automation, especially appealing to SMEs in industrialized nations seeking rapid automation deployment.

Regional Highlights

- Asia Pacific (APAC): Dominating the global market in terms of production volume and market share, APAC is driven by massive investment in manufacturing infrastructure, particularly in China, India, and Southeast Asian countries. The region serves as the global manufacturing hub for electronics, automotive, and consumer goods, necessitating high-speed, cost-effective automation solutions. China, in particular, exhibits rapid adoption rates driven by government initiatives promoting smart manufacturing and a significant push to replace rising manual labor costs with automated systems. The robust growth in local robot manufacturers also contributes to competitive pricing and tailored regional solutions.

- North America: Characterized by mature industrial processes and a strong emphasis on high-value, quality-critical manufacturing, North America focuses heavily on automating highly complex tasks, particularly in the medical, aerospace, and high-end automotive sectors. The adoption here is driven less by labor cost arbitrage and more by the need for superior precision, traceability, and managing acute shortages of skilled manufacturing labor. This region sees higher penetration of advanced technologies like collaborative robots and AI-integrated vision systems, reflecting a preference for sophisticated, high-ROI solutions.

- Europe: Europe is a highly advanced market, with Germany, Italy, and France leading adoption, emphasizing energy efficiency, sustainability, and high precision engineering. The market is defined by stringent safety regulations and strong technological competence, fostering innovation in areas like standardized communication protocols and seamless integration between robots and injection molding machines (IMM). European manufacturers favor robust, customizable solutions and are leaders in implementing Industry 4.0 standards across their production facilities, focusing on minimizing cycle times while maintaining high ecological standards.

- Latin America (LATAM) and Middle East & Africa (MEA): These regions represent emerging markets characterized by accelerating industrialization and growing foreign direct investment (FDI) in manufacturing, particularly in automotive assembly (Mexico, Brazil) and packaging (UAE, Saudi Arabia). While adoption rates are lower than in established regions, they are expanding rapidly as global manufacturers establish local production bases. The initial focus is often on high-speed Cartesian systems for basic part removal, but increasing local expertise is beginning to drive demand for more flexible 6-axis and collaborative solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Robotic Injection Molding Machines Market.- FANUC Corporation

- ABB Ltd.

- Yaskawa Electric Corporation

- KUKA AG

- Sepro Group

- Wittmann Battenfeld GmbH

- Engel Austria GmbH

- Haitian International Holdings Limited

- Shibaura Machine Co., Ltd.

- Star Automation, Inc.

- Sumitomo (SHI) Demag Plastics Machinery GmbH

- Arburg GmbH + Co KG

- Universal Robots A/S

- Stäubli International AG

- Dai-ichi Robotics, Inc.

- Dr. Boy GmbH & Co. KG

- Kawaguchi Ltd.

- Shini USA

- Conair Group

Frequently Asked Questions

Analyze common user questions about the Robotic Injection Molding Machines market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the typical Return on Investment (ROI) period for a robotic injection molding system?

The ROI period typically ranges from 18 to 36 months, heavily depending on the application complexity, the level of replaced manual labor, and the robot's utilization rate. High-volume, 24/7 operations often achieve faster returns due to significant savings in labor costs and reduced scrap rates.

Which type of robot is most suitable for high-speed part removal in basic injection molding?

Cartesian (linear) robots are generally the most suitable for high-speed, direct part removal. They offer superior speed along their linear axes, are mechanically simpler, and are highly effective for repetitive, non-complex pick-and-place tasks within the mold area.

How are collaborative robots (cobots) changing the injection molding automation landscape?

Cobots are lowering the barrier to entry for automation, especially for SMEs, by offering easy programming, flexibility, and enhanced safety without requiring extensive safety guarding. They are ideal for lower-payload applications and tasks involving human interaction, such as placing inserts or performing secondary checks near the molding machine.

What are the primary integration challenges when adopting robotic systems?

Key challenges include ensuring seamless communication and synchronization between the robot controller and the injection molding machine (IMM), designing custom End-of-Arm Tooling (EOAT) for unique parts, and overcoming the initial investment cost, especially when upgrading legacy equipment.

What role does Industry 4.0 play in the future of robotic injection molding?

Industry 4.0 enables smart factories through data connectivity. Robots become integral nodes, utilizing IoT sensors and cloud analytics to facilitate real-time performance monitoring, predictive maintenance, and autonomous self-optimization of the entire molding cycle, leading to unparalleled efficiency and traceability.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager