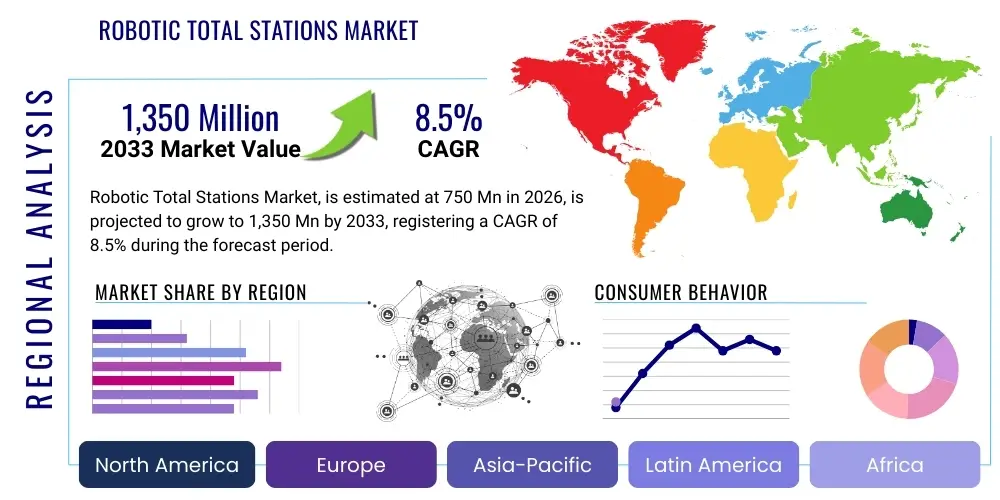

Robotic Total Stations Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441772 | Date : Feb, 2026 | Pages : 241 | Region : Global | Publisher : MRU

Robotic Total Stations Market Size

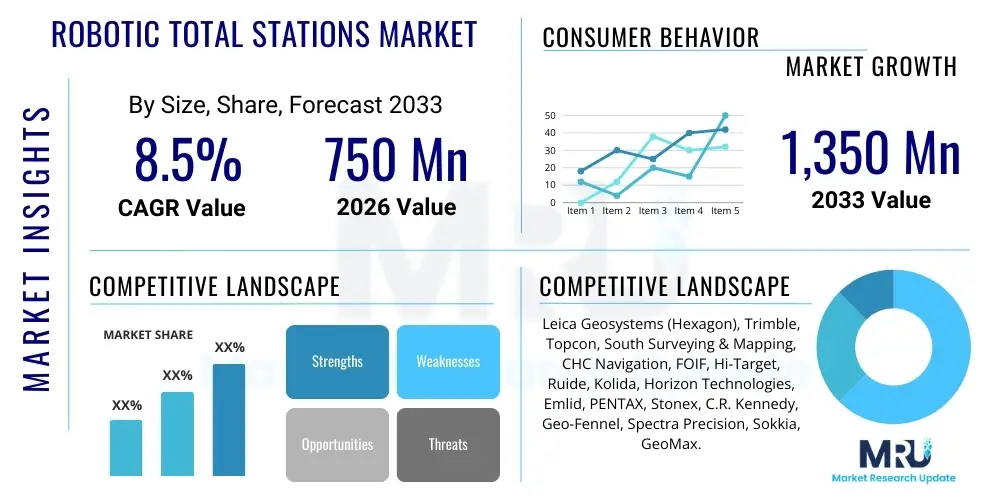

The Robotic Total Stations Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 750 Million in 2026 and is projected to reach USD 1,350 Million by the end of the forecast period in 2033.

Robotic Total Stations Market introduction

The Robotic Total Stations (RTS) Market encompasses advanced electronic/optical instruments used predominantly in surveying, civil engineering, and construction, integrating distance measurement, angle measurement, and data processing capabilities. These devices are distinguished by their motorization and remote operation functionality, allowing them to automatically track prisms, measure points, and record data without requiring an operator behind the instrument, thus significantly enhancing workflow efficiency and accuracy. The technology combines high-precision optical sensors, sophisticated servo motors, and advanced software algorithms, often incorporating features like automatic target recognition (ATR) and reflectorless measurement, making them indispensable tools for complex fieldwork.

Major applications of RTS span across infrastructure development, large-scale construction projects, topographical surveys, and volume calculations in mining and quarrying operations. In construction, RTS are critical for setting out control points, structural monitoring, and ensuring precise alignment of building elements. Their ability to deliver rapid, high-density point measurements streamlines processes that were traditionally time-consuming and labor-intensive using conventional total stations. The adoption of RTS is particularly strong in environments requiring millimeter-level precision and repeatability, driven by the increasing complexity of modern architectural and engineering designs.

Key market driving factors include the escalating global investment in infrastructure projects, the rapid pace of urbanization, and the pervasive industry demand for automated, high-efficiency surveying instruments to mitigate skilled labor shortages. The benefits derived from using RTS—such as reduced time on site, lower operational costs due to requiring fewer personnel, improved data quality, and enhanced worker safety—strongly motivate their adoption across various sectors. Furthermore, the integration of RTS with Building Information Modeling (BIM) workflows and drone photogrammetry is cementing their role as foundational elements of smart construction and digital twin initiatives globally.

Robotic Total Stations Market Executive Summary

The Robotic Total Stations (RTS) market is currently undergoing robust expansion, characterized by significant technological convergence, focusing on improved automation and seamless integration with digital construction ecosystems. Business trends indicate a strong shift toward subscription-based models for software accompanying the hardware, offering clients enhanced flexibility and ensuring access to continuous updates in firmware and analytics tools. Strategic mergers and acquisitions among leading industry players, alongside collaborative ventures focusing on developing integrated solutions (e.g., combining RTS with mobile mapping systems and reality capture technologies), are reshaping the competitive landscape and accelerating market maturity. The increasing focus on user-friendly interfaces and ruggedized designs suitable for harsh construction environments is also a major trend influencing product development.

Regional trends highlight that North America and Europe remain the primary revenue contributors, driven by stringent regulatory requirements for construction precision and high levels of investment in smart infrastructure and digitalization initiatives. However, the Asia Pacific (APAC) region is poised for the highest growth rate, fueled by massive government spending on infrastructure, particularly in developing economies like China, India, and Southeast Asian nations. This regional growth is directly linked to rapid urbanization necessitating new transportation networks, commercial complexes, and utilities. Latin America and the Middle East and Africa (MEA) are also exhibiting rising adoption rates, often driven by large-scale oil and gas infrastructure projects and new city development blueprints, demanding efficient surveying solutions.

Segmentation analysis reveals that the Fully Robotic segment dominates the market due to its superior efficiency and minimum need for human interaction during operation. By application, the Construction sector holds the largest market share, leveraging RTS for layout, quality control, and monitoring tasks critical for timely project completion. The emergence of smaller, lighter, and more affordable RTS models is simultaneously opening up opportunities in specialized fields like precision agriculture and archaeological mapping. Continuous advancements in sensor technology and algorithms, particularly in improving automatic target recognition reliability under challenging atmospheric conditions, are critical segment trends driving future demand and penetration into niche markets.

AI Impact Analysis on Robotic Total Stations Market

Common user questions regarding AI’s impact on Robotic Total Stations frequently revolve around how artificial intelligence can further automate fieldwork, enhance measurement accuracy, and integrate disparate data sources. Users often ask if AI can enable predictive maintenance for the hardware, optimize scanning paths autonomously, or automatically classify and interpret surveyed data points (e.g., distinguishing between natural terrain, existing structures, and construction elements). Concerns typically focus on the reliability of AI-driven decision-making in high-stakes environments like large infrastructure projects and the computational demands required to run sophisticated AI algorithms directly on site equipment. Expectations are high regarding AI's ability to transition RTS usage from mere data collection tools to intelligent analytical platforms capable of real-time site assessment and deviation detection.

The direct integration of AI and Machine Learning (ML) within Robotic Total Stations is fundamentally transforming their operational capabilities, shifting them from programmable instruments to semi-autonomous systems. AI algorithms are being deployed to significantly improve Automatic Target Recognition (ATR) systems, enabling faster and more reliable locking onto prisms even amidst visual obstructions or heavy traffic on site. ML is also critical for enhancing the efficiency of remote operations by predicting optimal measurement sequences and minimizing downtime caused by target loss or environmental interference. This increased intelligence allows a single operator to manage multiple RTS units simultaneously, further boosting labor productivity and reducing project timelines.

Furthermore, AI facilitates advanced data processing and quality assurance immediately following data capture. By analyzing point cloud data generated by RTS, AI models can automatically detect outliers, identify potential errors in setup or measurement, and classify geometric features. This capability significantly reduces the need for extensive post-processing in the office and ensures that highly accurate, clean data is fed directly into BIM models or digital twin environments. The use of neural networks for pattern recognition in monitoring applications—such as tracking structural deformation or ground movement—provides predictive insights, enabling proactive interventions and mitigating potential risks on major civil engineering projects.

- AI optimizes ATR reliability and speed under varying site conditions.

- Machine Learning algorithms predict optimal measurement paths and sequences.

- AI enables real-time, automated data classification and outlier detection in point clouds.

- Integration of AI supports advanced structural health monitoring and predictive analytics.

- AI facilitates automated error checking and enhances data quality assurance on site.

- ML models assist in providing proactive maintenance alerts for RTS hardware components.

DRO & Impact Forces Of Robotic Total Stations Market

The Robotic Total Stations Market is substantially propelled by key drivers, primarily the global boom in civil engineering and infrastructure development, coupled with the increasing integration of digital workflows such as BIM in construction. Restraints include the high initial capital investment required for these advanced instruments, posing a barrier to entry for smaller surveying firms, alongside the necessity for specialized training and technical proficiency for effective operation and maintenance. Opportunities are rapidly expanding through the development of hybrid surveying solutions, integration with UAVs (drones), and the adoption of more affordable, lightweight components. The impact forces are predominantly shaped by technological innovation in sensor accuracy and automation levels, governmental policies promoting smart construction practices, and competitive pressures driving down manufacturing costs while demanding higher performance standards.

Segmentation Analysis

The Robotic Total Stations market is segmented based on the level of robotic functionality, the associated measurement technology, the end-user application, and the geographical region. Analyzing these segments provides a clear understanding of market dynamics, growth potential, and areas of high demand penetration. The key segmentation dimensions reflect the diverse requirements of the construction, surveying, and engineering sectors, ranging from high-precision infrastructure monitoring to rapid topographical mapping. This structural analysis helps identify niche markets, such as reflectorless applications and specialized high-accuracy models, which drive premium pricing and specialized feature development.

- By Product Type:

- Fully Robotic Total Stations

- Semi-Robotic Total Stations

- By Technology:

- Prism-based Measurement

- Reflectorless Measurement

- By Application:

- Construction (Layout, Quality Control)

- Surveying and Land Mapping (Topographical Surveys, Cadastral Surveys)

- Mining and Quarrying (Volume Calculation, Blast Monitoring)

- Civil Engineering and Infrastructure (Tunneling, Bridge Construction)

- Others (Archaeology, Precision Agriculture)

- By End-User:

- Engineering and Construction Firms

- Government Agencies and Public Works

- Mining Companies

- Surveying Services Providers

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Robotic Total Stations Market

The value chain for Robotic Total Stations begins with upstream activities focused on the sourcing and manufacturing of high-precision components, including advanced optical lenses, electro-mechanical servo systems, and sophisticated microprocessors and sensors. Key suppliers in the upstream segment specialize in optics (lenses, prisms), electronics (circuit boards, chips), and precision mechanics (motors, gimbals). Strategic relationships with high-quality component manufacturers are crucial for maintaining the accuracy and reliability of the final product, which is a major competitive differentiator. Research and Development (R&D) activities focused on miniaturization, improved battery life, and enhanced software algorithms are central to value creation at this stage.

The midstream involves the core manufacturing, assembly, integration, and calibration of the robotic total station units. Leading original equipment manufacturers (OEMs) invest heavily in clean-room assembly processes and automated calibration facilities to ensure the specified angular and distance measurement accuracies are consistently met. This stage also includes the development and integration of proprietary operating systems and application software that manage the robotic functions (such as automatic tracking and data logging). Quality control and testing are rigorous, as market reputation relies heavily on the long-term field performance of the instruments in demanding environments.

The downstream segment includes distribution, sales, technical support, and post-sales services. Distribution channels are typically a mix of direct sales channels for large, institutional clients (such as government bodies or Tier 1 construction firms) and a vast network of authorized third-party distributors and specialized surveying equipment dealers who offer localized support and training. Aftermarket services, including calibration, maintenance contracts, and firmware updates, are a significant revenue source and a critical factor in customer retention. The increasing shift towards digital licensing for accompanying software introduces recurring revenue streams and strengthens the direct link between the manufacturer and the end-user base.

Robotic Total Stations Market Potential Customers

The primary end-users and buyers of Robotic Total Stations are multifaceted professional entities deeply involved in the planning, execution, and monitoring phases of civil and private infrastructure projects. These customers prioritize efficiency, precision, and the ability to integrate collected data seamlessly into existing digital workflows such as Building Information Modeling (BIM) platforms. They are generally characterized by high operational scales, complex project requirements, and an acute sensitivity to project timelines and construction accuracy standards. Their purchasing decisions are heavily influenced by factors such as instrument reliability, the scope of after-sales service, the ease of integration with other surveying technologies (e.g., GPS/GNSS, scanners), and the total cost of ownership over the equipment's lifespan.

Key segments of potential customers include large global and regional engineering and construction (E&C) firms that manage multi-billion dollar projects like high-speed rail, massive commercial complexes, or utility pipelines. These firms often maintain large fleets of surveying equipment and require sophisticated data management tools integrated with their RTS units. Another crucial customer base consists of independent professional surveying service providers, ranging from small local firms offering land boundary surveys to specialized consultants focusing on high-accuracy industrial measurement or deformation monitoring for existing infrastructure.

Furthermore, governmental departments responsible for public works, transportation, and natural resource management constitute a steady demand source. These bodies utilize RTS for infrastructure inventory mapping, monitoring environmental changes, managing land cadastral records, and overseeing contractor compliance on public projects. The mining and quarrying sector represents another high-value customer group, utilizing RTS for precise volume calculation, geological mapping, and monitoring ground stability around extraction zones, where automated and remote operation capabilities significantly enhance safety protocols.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 750 Million |

| Market Forecast in 2033 | USD 1,350 Million |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Leica Geosystems (Hexagon), Trimble, Topcon, South Surveying & Mapping, CHC Navigation, FOIF, Hi-Target, Ruide, Kolida, Horizon Technologies, Emlid, PENTAX, Stonex, C.R. Kennedy, Geo-Fennel, Spectra Precision, Sokkia, GeoMax. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Robotic Total Stations Market Key Technology Landscape

The core technology powering the Robotic Total Stations market revolves around the convergence of ultra-precise measurement mechanics, sophisticated electronics, and advanced software intelligence. Central to these systems are high-accuracy Electronic Distance Measurement (EDM) units, capable of measuring distances with sub-millimeter precision, often utilizing phase shift or pulsed laser technologies. Integrated servo drives and motors provide the necessary mechanical control for automated horizontal and vertical angle turning, enabling the instrument to track moving targets dynamically and execute complex scanning patterns without manual intervention. The reliability and speed of these motor systems directly influence the overall efficiency of the RTS in field applications.

A critical differentiating technology is the Automatic Target Recognition (ATR) and tracking system. ATR relies on sophisticated algorithms, often utilizing image processing and pattern recognition (increasingly supported by AI), to automatically locate and lock onto the prism target. Modern RTS incorporate highly sensitive imaging sensors (cameras) that capture visual data alongside the traditional measurement data, providing photographic evidence of the point measured and aiding in setup verification. The integration of GNSS (Global Navigation Satellite System) capabilities is also increasingly common, creating hybrid instruments that leverage both highly accurate terrestrial measurements and global coordinates for quick setup and orientation, optimizing fieldwork in vast geographical areas.

Furthermore, the shift towards reflectorless measurement technology, which uses laser pulses to measure distances to surfaces without a prism, is expanding the application scope of RTS in hard-to-reach or hazardous areas. Data connectivity, utilizing fast communication protocols like Bluetooth, Wi-Fi, and integrated cellular modems, is essential for real-time data transfer to remote control units and cloud-based processing platforms. Software innovations are focused on creating seamless interoperability with BIM software, generating 3D point clouds, and offering remote monitoring capabilities, transforming the data collected into actionable insights almost instantaneously.

Regional Highlights

- North America: This region holds a significant market share, driven by rapid technological adoption, high labor costs necessitating automation, and substantial investment in smart city infrastructure and transportation networks. The U.S. and Canada are early adopters of integrated surveying technologies, heavily leveraging BIM and GIS integration, leading to high demand for advanced, fully robotic models. Strict quality and safety regulations in construction further cement the reliance on high-precision RTS equipment.

- Europe: Characterized by stringent environmental standards and a historical focus on preservation and detailed urban planning, Europe exhibits strong demand for RTS, particularly in structural monitoring and tunneling applications. Western European countries, including Germany, the UK, and France, are major markets due to ongoing refurbishments of aging infrastructure and advanced R&D activities in geospatial technologies. Digitalization initiatives across the construction sector are accelerating RTS deployment.

- Asia Pacific (APAC): Expected to register the highest growth rate during the forecast period. This surge is attributed to massive infrastructure investments in emerging economies (China, India, Southeast Asia) and rapid urbanization. While price sensitivity remains a factor, the sheer volume of large-scale construction projects, coupled with increasing awareness of efficiency gains provided by robotics, is driving mass market adoption, particularly for domestic and semi-robotic models.

- Latin America (LATAM): Market growth is steady, fueled primarily by major mining activities, energy sector infrastructure projects, and large civil works in Brazil, Mexico, and Chile. Adoption is gradually increasing as regional firms seek to match international project standards, although economic volatility in certain countries can occasionally restrain large capital investments in surveying equipment.

- Middle East and Africa (MEA): Growth is primarily concentrated in the Gulf Cooperation Council (GCC) nations, driven by large-scale megaprojects (e.g., NEOM in Saudi Arabia, smart city developments in UAE) that require the most advanced, high-efficiency surveying instruments. The challenging desert environments also necessitate robust, reliable robotic total stations capable of operating under extreme conditions, favoring premium product offerings.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Robotic Total Stations Market.- Leica Geosystems (Hexagon AB)

- Trimble Inc.

- Topcon Corporation

- South Surveying & Mapping Technology Co., Ltd.

- CHC Navigation Technology Co., Ltd.

- FOIF (Suzhou Focusearth Instrument Co., Ltd.)

- Hi-Target International Group Limited

- Ruide Surveying Instrument

- Kolida Instrument

- Horizon Technologies

- Emlid Ltd.

- PENTAX (TI Asahi Co., Ltd.)

- Stonex S.p.A.

- C.R. Kennedy

- Geo-Fennel GmbH

- Spectra Precision (Trimble Brand)

- Sokkia (Topcon Brand)

- GeoMax (Hexagon Brand)

Frequently Asked Questions

Analyze common user questions about the Robotic Total Stations market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary benefit of using a fully robotic total station over a conventional one?

The primary benefit of a fully robotic total station (RTS) is enhanced labor efficiency and automation. RTS allows a single operator to manage all measurement tasks remotely, automatically tracking the target prism and recording data, significantly reducing the personnel required on site and minimizing measurement errors due to manual handling, thereby accelerating project timelines.

How does AI technology specifically improve the performance of Robotic Total Stations?

AI technology enhances RTS performance by optimizing Automatic Target Recognition (ATR) systems, ensuring faster and more reliable locking onto targets, especially in complex environments. Additionally, AI supports real-time data quality checks, automated feature classification, and predictive maintenance alerts, transforming raw data into immediate actionable insights for construction management and BIM integration.

Which geographical region is expected to demonstrate the fastest growth in the Robotic Total Stations Market?

The Asia Pacific (APAC) region is projected to experience the fastest growth in the RTS market, primarily driven by massive government investments in infrastructure development, rapid urbanization, and increased adoption of modern construction techniques in large economies like China, India, and Southeast Asia, leading to high-volume demand for efficient surveying equipment.

What are the main applications of reflectorless measurement technology in Robotic Total Stations?

Reflectorless measurement allows RTS to accurately measure distances to surfaces and points without requiring a prism. Its main applications include measuring inaccessible or dangerous points (e.g., facades, tunnels, high structures), performing rapid topographical scanning, and volume calculations in areas like quarries or construction stockpiles where placing a prism is impractical or unsafe.

What is the current trend regarding the integration of Robotic Total Stations with other technologies?

The predominant trend is seamless integration with other reality capture technologies and digital workflows. This includes connecting RTS data directly into BIM software, combining RTS measurements with point clouds from 3D laser scanners and UAV photogrammetry for comprehensive site models, and utilizing GNSS integration for faster setup and georeferencing on large projects.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager