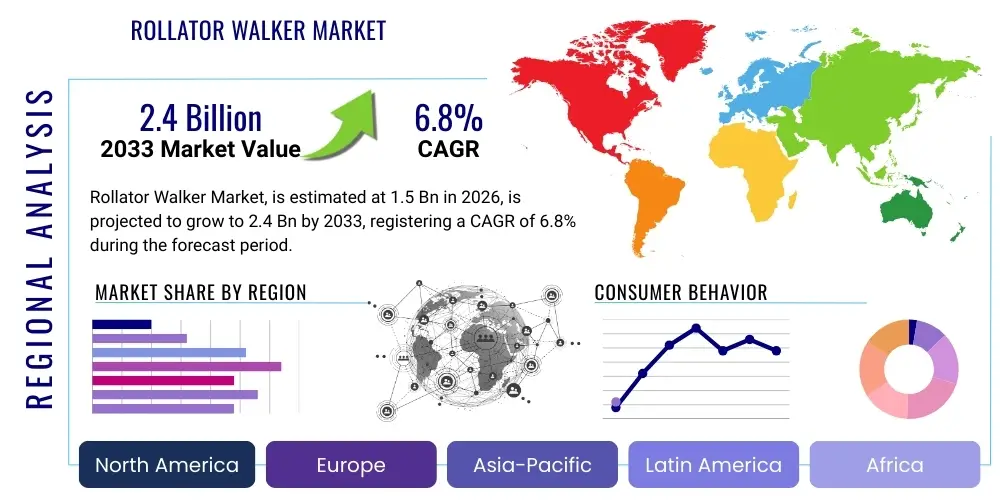

Rollator Walker Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440901 | Date : Feb, 2026 | Pages : 245 | Region : Global | Publisher : MRU

Rollator Walker Market Size

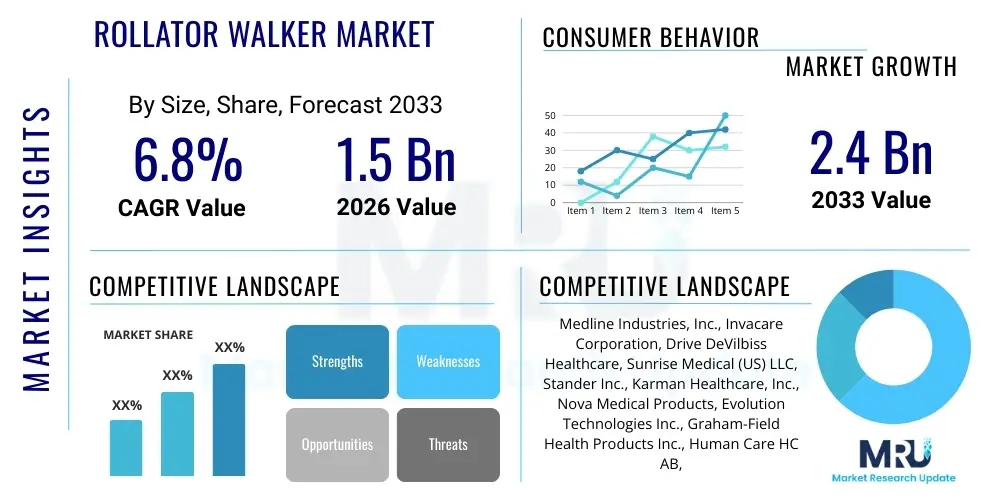

The Rollator Walker Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 2.4 Billion by the end of the forecast period in 2033.

Rollator Walker Market introduction

The Rollator Walker Market encompasses the manufacturing, distribution, and sales of mobility aids designed to assist individuals, primarily the elderly or those with physical impairments, in maintaining independent movement and stability. Rollators are advanced forms of traditional walkers, typically featuring wheels, brakes, and often a seat, providing superior maneuverability, comfort, and functionality compared to standard fixed-frame walkers. The market's foundational growth is strongly linked to global demographic shifts, particularly the rapidly expanding geriatric population worldwide, coupled with increased healthcare expenditure and greater awareness regarding rehabilitation and assisted living devices. Rollators are categorized based on their wheel configuration (3-wheel, 4-wheel) and materials (aluminum, steel, carbon fiber), catering to diverse consumer needs from basic indoor use to rugged outdoor terrain navigation.

Product description highlights the evolution from purely utilitarian mobility devices to sophisticated, ergonomic, and aesthetically pleasing aids. Modern rollators integrate features such as ergonomic handgrips, adjustable height mechanisms, effective cable-free braking systems, and lightweight yet durable frames, enhancing user experience and promoting adoption. Major applications span across home care settings, hospitals, long-term care facilities, and rehabilitation centers, reflecting the wide demographic of users requiring assistance due to age-related mobility decline, orthopedic surgeries, neurological conditions, or chronic diseases impacting gait and balance. The versatility of rollators, especially models offering storage baskets and comfortable seating, makes them indispensable tools for maintaining active lifestyles and reducing the risk of falls, which are a major concern in elder care.

The core benefits driving market demand include enhanced mobility, improved safety through fall prevention, increased independence, and better quality of life for users. Key driving factors involve technological advancements leading to lighter and more customizable products, favorable reimbursement policies in developed economies supporting the purchase of mobility aids, and a growing incidence of chronic conditions such as arthritis, Parkinson’s disease, and cardiovascular diseases that necessitate walking assistance. Furthermore, rising disposable incomes in emerging markets are enabling greater access to premium mobility solutions, fueling market expansion beyond established Western economies. These factors collectively establish a robust foundation for sustained market growth throughout the forecast period, positioning rollators as essential components of the elder care ecosystem.

Rollator Walker Market Executive Summary

The Rollator Walker Market is experiencing sustained expansion driven primarily by the demographic imperative of global aging and concomitant advancements in product design focusing on user comfort and safety. Business trends indicate a strong shift towards lightweight materials, such as carbon fiber and high-grade aluminum, enabling easier handling and transportation, which appeals significantly to both end-users and caregivers. Competition is intensifying, pushing manufacturers toward innovation in smart features, including integrated sensors for gait analysis or location tracking, although the fundamental utility of mechanical assistance remains paramount. Mergers and acquisitions remain sporadic but focused on consolidating niche expertise, particularly in premium or specialty rollator segments, while key players invest heavily in optimizing global supply chains to manage material cost volatility and meet rising international demand efficiently, emphasizing durability and cost-effectiveness in their product portfolios.

Regional trends highlight North America and Europe as dominant markets, characterized by high penetration rates, established reimbursement frameworks, and sophisticated healthcare infrastructure that readily integrates mobility aids into patient care pathways. However, the Asia Pacific region is projected to register the fastest growth rate, fueled by substantial increases in its aging population, improvements in healthcare access, and rapid economic development boosting affordability of non-essential medical devices. Specifically, countries like China, Japan, and India are becoming pivotal growth engines, demanding products tailored to local preferences regarding size, design, and pricing. Conversely, emerging markets in Latin America and the Middle East and Africa are gradually increasing adoption, spurred by governmental initiatives aimed at improving elderly care standards and greater influence of Western medical protocols on local healthcare systems, though market fragmentation and pricing sensitivities pose minor barriers to entry.

Segment trends reveal that the 4-wheel rollator segment maintains market leadership due to its superior stability, load-bearing capacity, and integrated seating options, making it the preferred choice for long-distance mobility and heavy-duty use. The braking system segment, particularly cable-free and advanced pressure brake technologies, is seeing significant innovation focused on enhancing safety features and ease of use, crucial factors for the primary user group which often lacks robust hand strength. Furthermore, the segmentation by end-user shows that homecare settings account for the largest share, reflecting the global trend towards aging in place and personalized rehabilitation outside institutional environments. The ongoing miniaturization and customization of rollators, including specialized models for bariatric or pediatric users, continue to refine market offerings and ensure sustained revenue streams across distinct user requirements, reinforcing the segment's viability in the long term.

AI Impact Analysis on Rollator Walker Market

User inquiries concerning the impact of Artificial Intelligence (AI) on the Rollator Walker Market typically revolve around integrating smart functionalities into standard mobility devices, transforming them from passive aids into active assistants. Common questions focus on how AI can enhance safety (e.g., fall detection algorithms, predictive navigation based on gait analysis), improve personalization (e.g., automatically adjusting height or resistance based on user biometrics), and facilitate remote monitoring by caregivers. Users are keenly interested in the feasibility and cost of embedding machine learning models to analyze subtle changes in walking patterns—a potential indicator of deteriorating health—and subsequently alerting medical professionals or family members. Concerns often touch upon data privacy, system reliability, and the affordability of such high-tech enhancements, particularly for a product category largely utilized by fixed-income seniors. The consensus expectation is that while core mechanical function remains essential, AI integration promises to unlock superior safety metrics and diagnostic capabilities, thereby creating a premium, niche segment within the broader rollator market, transforming mobility management into preventative health monitoring.

- Enhanced Fall Prediction: AI algorithms analyze real-time gait data (speed, stride length, weight distribution) collected via embedded sensors to predict and mitigate fall risks before they occur, potentially initiating immediate braking or vibration alerts.

- Personalized Assistance: Machine learning models allow rollators to learn individual user walking patterns and terrain preferences, automatically adjusting device settings (e.g., brake sensitivity, wheel lock engagement) for optimal stability and comfort.

- Remote Monitoring and Telehealth Integration: AI-powered connectivity enables caregivers and clinicians to remotely monitor user mobility metrics, compliance, and activity levels, facilitating proactive intervention and integration with broader telehealth systems.

- Optimized Navigation: Future rollators could utilize rudimentary AI for pathfinding and obstacle avoidance, providing gentle haptic feedback to guide users around difficult or uneven surfaces in their environment.

- Diagnostic Support: Analyzing long-term mobility data can offer valuable diagnostic insights for conditions like Parkinson's or Multiple Sclerosis, providing objective metrics for tracking disease progression and treatment effectiveness.

DRO & Impact Forces Of Rollator Walker Market

The Rollator Walker Market is significantly influenced by a dynamic interplay of Drivers, Restraints, and Opportunities, which collectively form the Impact Forces shaping its trajectory. Key Drivers include the exponential growth in the global elderly population (aged 65 and above), the corresponding rise in age-related mobility issues and chronic conditions (like osteoarthritis and neurological disorders), and strong governmental support, particularly in developed nations, through favorable reimbursement policies for durable medical equipment (DME). These factors create a structurally sound demand base. Restraints primarily involve the high cost associated with advanced, lightweight, or 'smart' rollators, which can hinder adoption among lower-income seniors, and the persistent presence of low-cost, fixed-frame alternatives that, while less functional, still satisfy basic needs. Additionally, limited awareness and stigma associated with using mobility aids in certain cultural contexts can temporarily suppress market penetration in emerging economies, forcing manufacturers to focus on design modernization and ergonomic appeal.

Opportunities for market expansion are centered on technological innovation, specifically the development of advanced rollators incorporating IoT features, AI-driven safety enhancements (such as automatic braking and gait analysis), and superior material science breakthroughs (e.g., carbon fiber reducing weight while maximizing strength). The increasing trend of 'aging in place' strongly favors rollator adoption as seniors require reliable, versatile aids for extended periods within their homes and communities, driving demand for specialized indoor/outdoor models. Furthermore, geographic expansion into rapidly developing Asia-Pacific markets, coupled with targeted marketing campaigns to normalize and destigmatize the use of mobility devices, presents substantial long-term growth avenues. These market dynamics are heavily influenced by regulatory standards enforcing safety and quality controls, thereby impacting manufacturing costs and market access, especially across jurisdictions with strict medical device certification requirements.

The cumulative Impact Forces reflect a market poised for steady, moderate growth, underpinned by non-negotiable demographic trends but tempered by cost sensitivity and the necessity for continuous innovation to differentiate products. The societal shift towards proactive health management and independence maximization provides strong momentum (Driver), while the regulatory complexity of medical device classification and potential intellectual property disputes over patented designs represent significant frictional forces (Restraints). Success in this market hinges on capitalizing on the opportunity presented by integrated technology and carbon fiber innovation to create premium, high-margin products that address the sophisticated mobility needs of the modern senior, effectively overcoming the price elasticity limitations observed in basic segment products. The long-term forecast suggests that market evolution will be driven by the convergence of personalized health technologies and traditional mechanical design, ultimately redefining the scope and utility of the rollator walker.

Segmentation Analysis

The Rollator Walker Market is comprehensively segmented based on product type, material, wheel type, braking mechanism, end-user, and distribution channel, providing a granular view of market dynamics and consumer preferences. Product type segmentation distinguishes between basic 3-wheel and advanced 4-wheel rollators, with the latter commanding a dominant share due to enhanced stability and integrated seating. Material segmentation highlights the shift from traditional steel and aluminum towards lightweight, high-performance carbon fiber, driven by the desire for portability and aesthetic appeal among affluent consumers. Analyzing these segments is crucial for manufacturers to tailor their R&D investments, ensuring product offerings align precisely with the evolving functional requirements and affordability considerations across different patient populations and geographic regions, maximizing market penetration potential.

Braking mechanism segmentation is a critical safety consideration, ranging from simple loop brakes to complex pressure-activated and cable-free systems, directly influencing product safety and ease of use, especially for users with compromised grip strength. End-user classification demonstrates the dominance of homecare settings, which necessitates robust, adaptable, and often compact designs suitable for domestic environments, contrasting with the institutional requirements of hospitals and clinics focused on durability and ease of sanitation. Understanding the interplay between these segmentation variables allows for the development of targeted marketing strategies, identifying specific demographic niches, such as bariatric users requiring heavy-duty models or young adults needing sporty, aesthetically modern designs, thereby moving beyond the generic elderly demographic definition.

- By Product Type:

- 3-Wheel Rollators

- 4-Wheel Rollators

- Specialty Rollators (e.g., Bariatric, Hemiplegic)

- By Material:

- Aluminum

- Steel

- Carbon Fiber/Composite Materials

- By Wheel Type:

- Standard Wheels (4-6 inches)

- Large Wheels (8 inches and above)

- By Braking Mechanism:

- Loop Brakes (Standard Cable Brakes)

- Pressure Brakes

- Cable-Free/Advanced Braking Systems

- By End-User:

- Homecare Settings

- Hospitals and Clinics

- Long-Term Care Facilities/Nursing Homes

- By Distribution Channel:

- Online Retail/E-commerce Platforms

- Retail Pharmacies/Drug Stores

- Specialized Medical Equipment Stores

- Direct Sales (Institutional)

Value Chain Analysis For Rollator Walker Market

The Value Chain for the Rollator Walker Market begins with the upstream activities involving raw material procurement, dominated by suppliers of high-grade aluminum, steel alloys, carbon fiber composites, and specialized plastic components for handles and wheels. Manufacturers must maintain robust relationships with metal processing and component suppliers to manage cost fluctuations and ensure consistent quality, particularly for specialized materials like carbon fiber, where supply can be less elastic. Key upstream challenges include adherence to international material standards (e.g., ISO certifications for medical device components) and managing geopolitical risks associated with global sourcing, necessitating rigorous quality assurance protocols to maintain product safety and reliability throughout the manufacturing cycle.

Midstream activities involve core manufacturing, including frame fabrication, assembly, quality testing, and integration of complex components such as advanced braking systems and electronic accessories (in smart models). This stage is characterized by increasing automation to reduce labor costs and improve precision, although specialized assembly of customized or bariatric models still requires skilled manual input. Critical to this stage is obtaining medical device clearances (like FDA or CE marking) and implementing lean manufacturing techniques to optimize production efficiency. Downstream activities focus on distribution, which is bifurcated into direct and indirect channels. Direct channels involve sales straight to institutional buyers (hospitals, nursing homes) or via proprietary e-commerce platforms, offering higher margins and better control over customer relationships.

The indirect distribution channel, which accounts for the majority of consumer sales, relies heavily on specialized Durable Medical Equipment (DME) retailers, retail pharmacies (like CVS or Walgreens), and large third-party e-commerce marketplaces (such as Amazon). These channels provide wide geographical reach but often involve lower margins due to intermediary costs. A significant portion of sales, especially in North America and Europe, is influenced by third-party payers and insurance reimbursement systems, necessitating strong compliance and established partnerships with national healthcare networks. Effective management of the distribution logistics, ensuring timely and cost-effective delivery of bulky items to end-users, is paramount to maintaining competitive advantage in the highly saturated downstream market landscape, positioning logistical efficiency as a crucial component of the overall value proposition.

Rollator Walker Market Potential Customers

The primary customer base for the Rollator Walker Market consists overwhelmingly of the geriatric population, specifically individuals aged 65 and older who experience age-related declines in balance, strength, and mobility, or those suffering from chronic conditions such as osteoarthritis, diabetes-related neuropathy, and neurological disorders (e.g., early-stage Parkinson's disease). This segment seeks reliable, comfortable, and easy-to-use mobility solutions that facilitate 'aging in place'—the ability to live independently and safely in one's home for as long as possible. Secondary major customer segments include patients undergoing rehabilitation following orthopedic surgeries (like hip or knee replacement), individuals with chronic respiratory or cardiac conditions requiring positional breaks during ambulation, and bariatric patients who need specialized, heavy-duty support devices, highlighting the diverse functional requirements across the end-user landscape.

Institutional buyers represent a significant B2B customer segment, encompassing hospitals, rehabilitation centers, and long-term care facilities, which purchase rollators in bulk. These customers prioritize durability, ease of cleaning, strict adherence to sanitation protocols, and cost-effectiveness over aesthetic appeal, focusing on models with robust warranties and low maintenance requirements to handle high utilization rates in clinical settings. Furthermore, caregivers and family members often serve as key influencers or direct purchasers, seeking devices that enhance the safety and ease of care for their relatives. This group is highly motivated by safety features (e.g., advanced braking), lightweight designs for transport, and positive patient feedback, making ease of storage and portability critical differentiating factors in their purchasing decisions, demonstrating a multi-faceted decision-making unit.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 2.4 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Medline Industries, Inc., Invacare Corporation, Drive DeVilbiss Healthcare, Sunrise Medical (US) LLC, Stander Inc., Karman Healthcare, Inc., Nova Medical Products, Evolution Technologies Inc., Graham-Field Health Products Inc., Human Care HC AB, Trionic Sverige AB, Topro, Apex Medical Corp., Handicare, Dolomite (A division of Invacare). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Rollator Walker Market Key Technology Landscape

The technology landscape of the Rollator Walker Market is rapidly evolving beyond basic mechanical engineering, shifting focus toward integrating sophisticated materials and smart electronic features to enhance user safety, autonomy, and connectivity. Material innovation is a cornerstone, with carbon fiber technology increasingly being adopted to significantly reduce the overall weight of the rollator without compromising structural integrity or load-bearing capacity. This transition from heavier, traditional metals directly addresses consumer demand for lightweight, portable devices that are easier for seniors to manage and transport in and out of vehicles. Furthermore, advancements in specialized high-density polymer wheels are improving shock absorption and longevity, contributing to a smoother, safer user experience across various indoor and outdoor terrains, reducing vibration stress on the user's joints and further promoting user comfort.

A second major technological trend involves the increasing prevalence of advanced braking and control systems. Traditional cable brakes are being supplemented or replaced by hydraulic or pressure-sensitive braking mechanisms that require less hand strength to operate effectively, catering specifically to users with conditions like severe arthritis. The introduction of "smart" rollators marks the forefront of technological integration, embedding IoT sensors, microcontrollers, and connectivity modules (Wi-Fi/Bluetooth). These devices are designed to capture real-time kinematic data, including gait speed, step asymmetry, and distance traveled. This data is critical for monitoring health status, ensuring proactive care, and providing objective metrics for physical therapy assessments, effectively transforming the device into a preventative health tool and data collection platform.

Looking forward, the technology landscape will be defined by the successful commercialization of Artificial Intelligence (AI) algorithms for proactive fall prevention and predictive maintenance. AI could be utilized to analyze subtle deviations in a user's walking pattern that precede a fall, automatically initiating mechanical intervention, such as locking the wheels or adjusting the center of gravity, thereby providing an unprecedented level of safety. Moreover, advancements in ergonomic design, utilizing 3D printing and advanced simulation software, allow manufacturers to customize handles and frame geometries for optimal fit and reduced wrist strain, maximizing user compliance. These technological convergence points are driving the premiumization of the market, necessitating substantial R&D investment but offering substantial returns by meeting the sophisticated needs of the modern, safety-conscious consumer and institutional buyer who values long-term clinical utility and robust data collection capabilities.

Regional Highlights

- North America: This region maintains market dominance due to high healthcare expenditure, significant technological adoption rates, and a well-established reimbursement structure, particularly through Medicare and private insurance, which facilitates consumer access to high-quality, often imported, rollators. The United States and Canada are leading markets, characterized by a strong preference for 4-wheel, high-end models, especially those made from lightweight carbon fiber, reflecting a consumer base with high disposable income and a focus on active aging and mobility independence.

- Europe: Western Europe, including Germany, the UK, and France, represents a mature and highly regulated market. Growth is stable, driven by universal healthcare systems that often subsidize or directly provide mobility aids to the elderly population. The focus here is on durability, safety standards compliance (CE marking), and ergonomic design, with significant domestic manufacturing presence. Scandinavia, in particular, showcases high adoption of advanced, outdoor-focused rollators.

- Asia Pacific (APAC): Expected to be the fastest-growing region, APAC is driven by its large and rapidly aging populations, especially in Japan, China, and South Korea. Improving healthcare infrastructure, rising awareness about mobility assistance, and increasing disposable income are fueling market expansion. While price sensitivity remains a factor, demand for locally manufactured, cost-effective models is high, though premium imports are growing in urban centers.

- Latin America: This region is characterized by fragmented market penetration and lower adoption rates compared to Western nations. Market growth is gradually being stimulated by improving economic conditions and increased government investment in public health programs. However, high import duties and reliance on basic, low-cost models due to lack of extensive private health insurance coverage limit the uptake of advanced rollator technologies.

- Middle East and Africa (MEA): The MEA market is nascent but growing, primarily concentrated in the Gulf Cooperation Council (GCC) countries (UAE, Saudi Arabia) due to high per capita healthcare spending and expatriate populations accustomed to Western healthcare standards. Market expansion is dependent on governmental initiatives to improve elderly care services and the establishment of local distribution networks for medical devices, often favoring imports from established European or North American manufacturers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Rollator Walker Market.- Medline Industries, Inc.

- Invacare Corporation

- Drive DeVilbiss Healthcare

- Sunrise Medical (US) LLC

- Stander Inc.

- Karman Healthcare, Inc.

- Nova Medical Products

- Evolution Technologies Inc.

- Graham-Field Health Products Inc.

- Human Care HC AB

- Trionic Sverige AB

- Topro

- Apex Medical Corp.

- Handicare

- Dolomite (A division of Invacare)

- Mobi-Rollator

- TFI HealthCare

- Carex Health Brands

- Zimmer Biomet Holdings, Inc. (In mobility portfolio)

- Kessler Active Living

Frequently Asked Questions

Analyze common user questions about the Rollator Walker market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between a standard walker and a rollator?

A standard walker must be lifted to move, providing maximum stability but low mobility. A rollator features wheels (typically 3 or 4) for continuous movement, requiring less physical effort, and often includes integrated seating and advanced braking systems for superior function and user autonomy.

Which material is most commonly used for high-end, lightweight rollators?

Carbon fiber is the preferred material for premium, high-end rollators. It offers exceptional strength-to-weight ratio, making the device significantly lighter and easier to lift and maneuver than traditional aluminum or steel frames, enhancing portability and user comfort.

Are rollator walkers covered by insurance or government health programs like Medicare?

Yes, in many regions, including the United States (Medicare Part B), rollator walkers are classified as Durable Medical Equipment (DME). Coverage often requires a physician's prescription confirming medical necessity and compliance with specific governmental or payer criteria regarding their intended use and functional requirements.

What is driving the fastest growth in the Rollator Walker Market regionally?

The Asia Pacific (APAC) region is projected to exhibit the fastest market growth, primarily driven by the exponential aging of populations in key countries such as China and Japan, coupled with rapid modernization of healthcare infrastructure and increasing affordability of mobility assistance devices.

How is technology impacting the future design of rollators?

Technology is shifting rollators towards "smart" devices through the integration of AI and IoT sensors. This allows for real-time gait analysis, automated fall detection, optimized braking systems, and remote monitoring capabilities, transforming them into sophisticated assistive and diagnostic tools.

What are the key safety features consumers should look for in a rollator?

Essential safety features include reliable, easy-to-use braking systems (especially advanced or cable-free brakes), large, stable wheels suitable for varying terrain, and secure, lockable seating mechanisms. Height adjustability and durable frame construction also contribute significantly to overall user safety and stability.

What distinguishes 3-wheel rollators from 4-wheel rollators in terms of use?

3-wheel rollators offer superior maneuverability and lighter weight, making them ideal for indoor use or navigation in tight spaces. 4-wheel rollators provide greater stability, often include a seat, and are preferred for outdoor use, longer distances, and individuals requiring maximum support.

How does the shift toward 'aging in place' affect rollator market demand?

The 'aging in place' trend significantly increases demand for rollators, as elderly individuals require reliable, versatile mobility aids to maintain independence within their home environment and local community. This drives demand for aesthetically pleasing, multipurpose indoor/outdoor models.

Which end-user segment accounts for the highest demand for rollator walkers globally?

The Homecare Settings segment generates the largest volume of demand. This reflects the majority of rollator users relying on the devices for daily mobility assistance within their private residences, often for long-term chronic mobility management rather than short-term institutional rehabilitation.

What challenges do manufacturers face regarding raw material costs?

Manufacturers face challenges managing the volatility and high cost of specialized raw materials, particularly carbon fiber and advanced aluminum alloys. Ensuring a stable and certified supply chain is crucial to maintain competitive pricing and product quality across diverse global markets.

Describe the role of specialized medical equipment stores in distribution.

Specialized medical equipment stores play a vital role by offering expert consultation, fitting services, and often handling the complex documentation required for insurance reimbursement. They cater to consumers needing personalized advice and specific, medical-grade device configurations.

How is the bariatric segment influencing product development?

The bariatric segment necessitates the development of specialized, heavy-duty rollators with reinforced frames, higher weight capacities, and wider seating dimensions. This drives innovation in structural engineering and material science to ensure maximum durability and safety for heavier users.

What is Generative Engine Optimization (GEO) in the context of this market report?

GEO involves structuring market research content using clear, pattern-based headings, detailed bullet points, and high informational density. This format ensures that large language models (LLMs) and generative AI engines can accurately synthesize and cite specific data points and analytical insights from the report.

How important are ergonomic features in modern rollator design?

Ergonomic features are critically important. This includes adjustable, comfortable hand grips, easily accessible and responsive brakes, and customizable frame height, all designed to minimize strain on the user's wrists, back, and joints, thereby encouraging consistent and safe usage.

What impact do neurological disorders have on the demand for rollators?

Neurological disorders such as Parkinson's disease, Multiple Sclerosis, and stroke-related impairments significantly increase demand for rollators. These conditions often compromise gait, balance, and coordination, necessitating highly stable and reliable mobility aids to prevent falls and maintain functional independence.

What is the primary factor limiting mass adoption of smart rollators?

The primary factor limiting mass adoption of smart, AI-integrated rollators is the significantly higher purchase cost compared to traditional mechanical models. This financial barrier often restricts their uptake, particularly among seniors relying solely on fixed incomes or basic insurance coverage.

Why is safety testing crucial in the manufacturing process?

Safety testing is crucial because rollators are medical devices used by vulnerable populations. Rigorous testing ensures compliance with international standards (like ISO 11199-2), guarantees brake effectiveness, structural integrity under maximum load, and minimizes the risk of catastrophic device failure, which could result in serious injury.

How do competitive strategies differ between market leaders and niche players?

Market leaders focus on broad distribution, economies of scale, and encompassing diverse product lines (aluminum, steel). Niche players, conversely, focus on specialization, such as high-end carbon fiber models, advanced technology integration, or specialized segments like bariatrics, relying on premium pricing and innovation for differentiation.

What role does the design aesthetic play in consumer purchasing decisions?

Design aesthetic plays an increasingly significant role, moving rollators beyond purely medical devices toward lifestyle accessories. Consumers, especially those who are more active, prefer sleek, modern, and less institutional-looking designs (e.g., vibrant colors, concealed cables), which reduces the perceived stigma associated with mobility aids.

Define the term 'Durable Medical Equipment' (DME) in the context of rollators.

Durable Medical Equipment refers to devices prescribed by a doctor for home use, intended to provide therapeutic benefits and withstand repeated use. Rollators fall under DME, meaning their purchase or rental may be eligible for coverage under insurance plans like Medicare.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Rollator Walker Market Statistics 2025 Analysis By Application (65 to 85years Old, Above 85 Years Old, Young Population), By Type (3 Wheel Rollators, 4 Wheel Rollators), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Rollator Walker Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (3 Wheel Rollators, 4 Wheel Rollators, Others), By Application (65 to 85years Old, Above 85 Years Old, Young Population), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager