Roller Hockey Skates Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441752 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Roller Hockey Skates Market Size

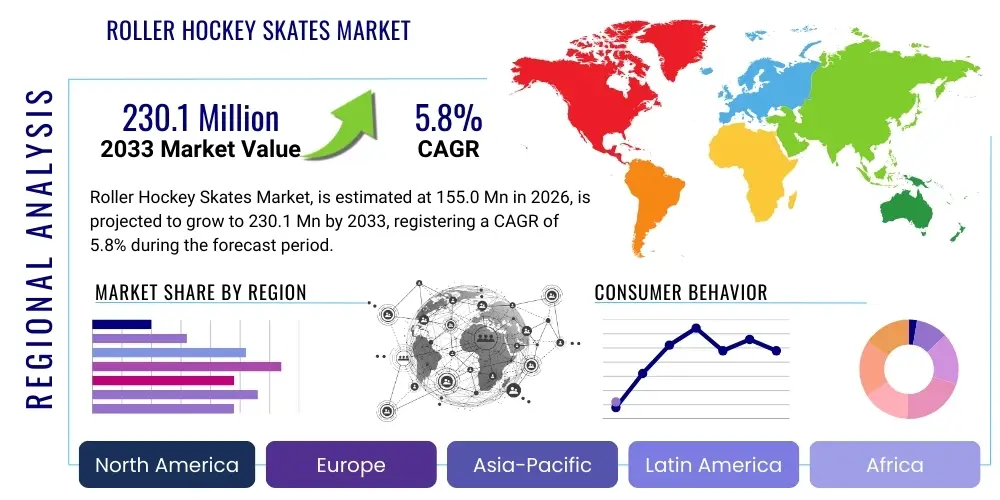

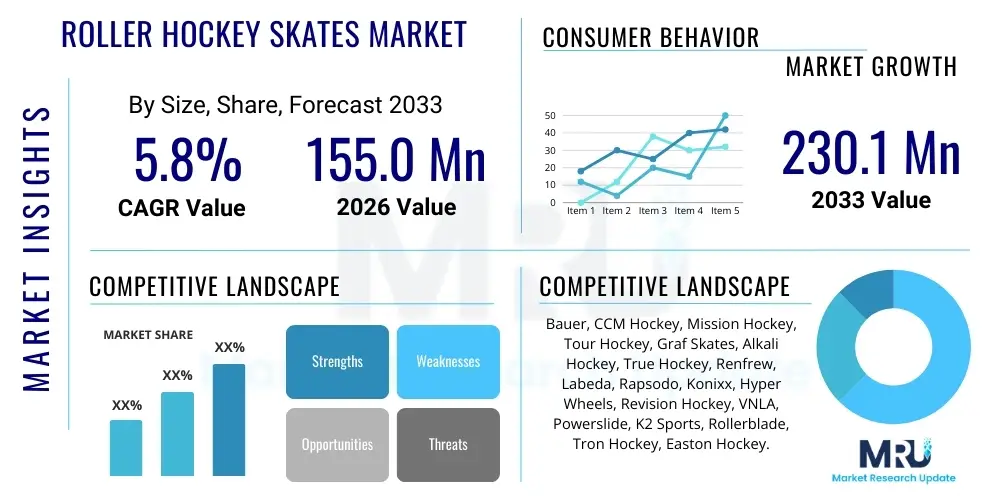

The Roller Hockey Skates Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 155.0 Million in 2026 and is projected to reach USD 230.1 Million by the end of the forecast period in 2033.

Roller Hockey Skates Market introduction

The Roller Hockey Skates Market encompasses the manufacturing, distribution, and sale of specialized footwear designed for the sport of inline hockey (often referred to as roller hockey). These skates are structurally distinct from traditional ice hockey skates, utilizing durable chassis frames, typically four to five inline polyurethane wheels, and specialized bearings tailored for maximizing speed and maneuverability on non-ice surfaces such as sport court, asphalt, or specialized tile systems. The core product provides essential components including the boot (often thermoformable for custom fit), the chassis (usually aluminum or composite materials), the wheels (varying in hardness and size based on playing surface), and high-precision bearings.

Major applications for roller hockey skates span professional competitive leagues, amateur recreational leagues, fitness training, and general recreational skating. The increasing global acceptance of inline sports, driven by their lower entry barriers compared to ice hockey in warmer climates, significantly boosts demand. Furthermore, the skates are crucial equipment in multi-sport facilities that host roller hockey tournaments, ensuring year-round usage and sustained demand from committed athletes. The evolution of materials science, particularly in lightweight carbon composites and advanced wheel formulations, contributes directly to enhanced product performance and player safety, further stabilizing market growth.

Key benefits driving market adoption include the accessibility of the sport, the improved energy transfer provided by advanced chassis designs, and the comfort offered by customized boot fitting technologies. Driving factors fueling the market expansion are the rising disposable incomes in emerging economies, aggressive marketing strategies by key equipment manufacturers, and the resurgence of fitness trends emphasizing high-intensity, low-impact sports. Moreover, the cross-training benefits that roller hockey provides for ice hockey athletes ensure a constant demographic of high-spending, performance-focused consumers.

Roller Hockey Skates Market Executive Summary

The Roller Hockey Skates Market demonstrates robust growth, primarily propelled by favorable business trends such as innovation in boot construction and chassis weight reduction, alongside aggressive expansion into digital retail channels. Manufacturers are heavily investing in proprietary materials to enhance stiffness-to-weight ratios, targeting professional and high-level amateur segments willing to pay a premium for performance advantages. The market currently exhibits intense competition characterized by frequent product refresh cycles and strategic partnerships between equipment providers and major roller hockey leagues to secure brand visibility and drive product adoption among developing players. Sustainability initiatives regarding manufacturing processes and materials sourcing are also beginning to influence purchasing decisions, positioning eco-friendly brands advantageously.

From a regional perspective, North America, particularly the United States and Canada, retains market dominance due to the deeply embedded culture of hockey and highly structured league systems, providing a stable, high-value consumer base. However, Asia Pacific is emerging as the fastest-growing region, fueled by increasing investment in sports infrastructure, rising awareness of inline sports, and rapid urbanization that promotes recreational activities. Europe shows steady, mature growth, with countries like Germany, Czechia, and Italy maintaining strong participation rates in inline hockey, driven by local governmental support for sports programs. Manufacturers are focusing on tailored regional distribution strategies, addressing specific climate and playing surface preferences (e.g., prioritizing harder wheels in regions where street hockey is prevalent).

Segment trends indicate that the High-end Skates segment (priced over $500) will capture a disproportionately high share of revenue growth, reflecting the professionalization of the sport and consumer desire for elite technology. Concurrently, the Online Retail segment is rapidly accelerating its market penetration, offering convenience, broader product selection, and competitive pricing, which challenges traditional brick-and-mortar specialty stores. Key strategic moves involve leveraging Artificial Intelligence (AI) for predictive sizing and personalized customer recommendations to mitigate the sizing challenges inherent in online footwear purchases. Furthermore, there is a clear trend toward specialized wheel configurations (e.g., Hi-Lo setups) optimized for agility and speed, replacing older, uniform wheel configurations across performance segments.

AI Impact Analysis on Roller Hockey Skates Market

Common user questions regarding AI’s impact on the Roller Hockey Skates Market center primarily on how AI can personalize equipment, optimize performance, and improve manufacturing efficiency. Users frequently inquire about "smart skates" that track performance metrics, AI-driven fitting systems to replace traditional thermoforming, and the use of machine learning in designing lightweight, structurally superior boot shells and chassis frames. Concerns often revolve around data privacy related to smart equipment and the potential increased cost of AI-enabled products. The consensus expectation is that AI will revolutionize customization, moving beyond standard sizing charts to offer truly bespoke equipment solutions tailored precisely to individual player biomechanics and playing style, thereby reducing injury risk and maximizing on-rink performance.

- AI-driven predictive analytics for identifying optimal material compositions (e.g., carbon fiber layup density) to enhance structural integrity and reduce weight.

- Implementation of sophisticated 3D scanning and machine learning algorithms for customized boot molding, ensuring perfect anatomical fit and improved energy transfer efficiency.

- Integration of embedded sensors and AI processors in skates to track real-time performance metrics such as stride length, push-off force, velocity, and lateral acceleration.

- Optimization of supply chain and inventory management using AI to forecast demand accurately across different regional and seasonal segments, minimizing waste and warehousing costs.

- AI-powered virtual try-on and recommendation engines in e-commerce platforms, significantly reducing return rates associated with incorrect sizing and fit issues.

- Automated quality control systems utilizing computer vision to detect microscopic flaws in chassis welding or boot construction during the manufacturing process.

- Development of personalized training recommendations based on performance data gathered from AI-enabled skates, providing actionable insights for athletes.

DRO & Impact Forces Of Roller Hockey Skates Market

The dynamics of the Roller Hockey Skates Market are primarily shaped by a trifecta of drivers, restraints, and opportunities, collectively influenced by powerful external impact forces. Key drivers include the ongoing surge in health consciousness globally, encouraging participation in active sports, and the technological advancements leading to lighter, more durable, and performance-enhancing materials (such as aerospace-grade aluminum and injection-molded carbon composites). The expansion of dedicated indoor and outdoor roller hockey facilities, especially in densely populated urban centers, further removes infrastructural barriers, supporting sustained market momentum. Moreover, aggressive branding and athlete endorsement strategies by market leaders significantly influence consumer purchasing behavior, particularly among aspiring young players seeking equipment mirroring professional standards.

Conversely, significant restraints hinder optimal market growth. The relatively high initial cost of premium roller hockey skates often acts as a deterrent for entry-level and recreational users, especially when compared to other non-contact recreational footwear. Furthermore, the market faces cyclical demand linked closely to the seasonality of sports participation in temperate zones, requiring complex inventory management. Counterfeit products, particularly those replicating high-end brand designs but using substandard materials, pose a safety risk and dilute legitimate brand value, forcing manufacturers to allocate substantial resources toward intellectual property protection and consumer education campaigns regarding authorized retail channels.

Opportunities for exponential growth are concentrated in untapped geographical areas, particularly Latin America and Southeast Asia, where participation is nascent but accelerating due to climate suitability. Innovation in sustainable manufacturing practices presents a significant opportunity for market differentiation, appealing to environmentally conscious Generation Z and Millennial consumers. Furthermore, the development of modular skate systems, allowing easy replacement of worn components (wheels, bearings, chassis) rather than requiring full skate replacement, improves customer lifetime value and sustainability perception. The primary impact force remains the competitive landscape, where rapid innovation cycles necessitate constant R&D investment, pressuring profit margins for smaller manufacturers, while global economic fluctuations affect discretionary spending on premium sporting goods.

Segmentation Analysis

The Roller Hockey Skates Market is rigorously segmented to understand varied consumer needs and market dynamics across different product specifications, end-user categories, and distribution mechanisms. This market structure allows companies to tailor their product lines, pricing strategies, and marketing campaigns to specific high-value cohorts. The fundamental segmentation variables encompass the type of boot material (composite vs. plastic), the wheel setup (Hi-Lo vs. standard), the target skill level (professional, intermediate, recreational), and the sales channel utilized. Analyzing these segments is critical for manufacturers aiming to optimize their global supply chains and achieve maximum market penetration by aligning product features with specific player requirements, such as focusing on lighter, stiffer boots for professionals and prioritizing comfort and durability for recreational users.

- By Product Type:

- High-end Skates (Professional/Elite performance)

- Mid-range Skates (Intermediate/Advanced amateur use)

- Entry-level Skates (Recreational/Beginner use)

- By Wheel Size/Configuration:

- Standard (Equal size wheels, e.g., 80mm all around)

- Hi-Lo Setup (Mixed wheel sizes, e.g., 76mm front, 80mm rear)

- Large Wheel Setup (Focusing on speed and distance, >84mm)

- By End-User:

- Professional Players

- Amateur League Players

- Recreational Users

- By Distribution Channel:

- Online Retail (E-commerce platforms, brand websites)

- Offline Retail

- Specialty Sports Stores

- Department and General Sporting Goods Stores

Value Chain Analysis For Roller Hockey Skates Market

The Value Chain for the Roller Hockey Skates Market begins with Upstream Analysis, which focuses on the sourcing and processing of raw materials. This includes procuring specialized plastics and resins for boot construction, high-grade carbon fibers for professional models, aerospace-grade aluminum or lightweight composites for chassis manufacturing, and high-quality polyurethane compounds for wheels. Key upstream activities involve meticulous quality control of bearing components and synthetic leather materials. Critical bottlenecks often arise from the global scarcity or price volatility of specialized petrochemicals used in urethane wheel production. Efficient management of these raw material costs and securing long-term contracts with reliable component suppliers (like bearing manufacturers) are paramount for maintaining competitive pricing and ensuring consistent product quality.

Midstream activities revolve around the manufacturing and assembly process, where design and technological expertise are most vital. This stage includes sophisticated processes such as injection molding, thermoforming of boot liners, precision CNC machining of chassis frames, and final assembly, including riveting the chassis to the boot and installing the wheels and bearings. Major manufacturers often utilize integrated manufacturing facilities to control quality tightly, while others rely on outsourced specialized Asian manufacturers, particularly for high-volume, lower-cost components. Crucial to this stage is research and development (R&D) focused on biomechanics and material science to innovate new product generations that offer superior comfort, reduced weight, and improved durability compared to previous models.

Downstream analysis covers the distribution channels, marketing, sales, and after-sales service. The distribution channel is segmented into Direct (brand-owned e-commerce sites) and Indirect (Specialty Sports Retailers, General Sporting Goods Stores, and third-party online marketplaces). Specialty stores provide high-touch service, essential for correct fitting and sizing, which remains a key consumer concern, while online channels offer convenience and price competitiveness. Effective marketing leverages professional athlete endorsements and digital campaigns targeting active sports communities. After-sales service, including warranty provisions and accessible component replacement (wheels, bearings, brakes), plays a vital role in building brand loyalty and ensuring positive long-term customer relationships.

Roller Hockey Skates Market Potential Customers

The primary potential customers and end-users of roller hockey skates are stratified across three distinct cohorts: Professional and Elite Athletes, Dedicated Amateur League Players, and General Recreational/Fitness Skaters. Professional and elite players, although a smaller volume segment, represent the highest-value customer base, prioritizing cutting-edge technology, perfect fit, and maximal performance (often selecting high-end carbon composite skates with custom thermoforming). This group exhibits low price sensitivity but high brand loyalty to manufacturers who consistently deliver performance gains and are often the first adopters of new, expensive innovations.

Dedicated Amateur League Players constitute the largest volume segment, participating in local, regional, and national roller hockey leagues. These customers seek a balance between performance, durability, and cost. They frequently require mid-range to upper mid-range skates that offer excellent value and reliability for regular, intensive use. Their purchasing decisions are highly influenced by local team recommendations, peer reviews, and the perceived durability of the chassis and wheel setup, given the wear and tear associated with prolonged competitive play on varied rink surfaces.

Recreational Users and Fitness Skaters comprise a growing segment seeking comfort, stability, and ease of use, often opting for entry-level or mid-range skates. These buyers may use the skates for general fitness, casual street hockey, or simple fun activities. Their purchasing criteria heavily emphasize comfort, ease of breaking in the boot, and an attractive price point. Marketing efforts aimed at this demographic frequently focus on the health benefits of inline skating and the skates' durability, positioning them as a viable and entertaining cross-training tool or family activity investment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 155.0 Million |

| Market Forecast in 2033 | USD 230.1 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bauer, CCM Hockey, Mission Hockey, Tour Hockey, Graf Skates, Alkali Hockey, True Hockey, Renfrew, Labeda, Rapsodo, Konixx, Hyper Wheels, Revision Hockey, VNLA, Powerslide, K2 Sports, Rollerblade, Tron Hockey, Easton Hockey. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Roller Hockey Skates Market Key Technology Landscape

The technological landscape of the Roller Hockey Skates Market is characterized by constant innovation focused on biomechanical efficiency, weight reduction, and customization. A significant technological focus is on advanced boot construction using thermoformable materials, such as specific epoxy resins and carbon composite layers, allowing the skate to be heat-molded precisely to the skater’s foot shape. This technology, borrowed largely from ice hockey skate manufacturing, maximizes energy transfer during stride, reduces 'negative space' within the boot, and enhances comfort, directly impacting elite player performance. Furthermore, manufacturers are employing sophisticated CAD/CAM technologies to design anatomically correct tendon guards and ankle support structures, minimizing potential points of friction and improving lateral stability essential for quick directional changes inherent in roller hockey.

Chassis and wheel technology represent another pivotal area of R&D. The Hi-Lo chassis configuration—utilizing smaller wheels in the front for quicker turning and larger wheels in the back for speed—is now standard in performance skates, optimizing the skater's angle of attack. Manufacturers are experimenting with magnesium and high-grade aluminum alloys for chassis construction to achieve exceptional rigidity while dramatically lowering the overall skate weight. In wheel technology, the development of dual-pour polyurethane wheels has become crucial. This patented process involves casting two different urethane durometers (hardness levels) into a single wheel structure: a softer outer ring for grip and a harder inner core for roll and speed. This ensures optimized performance across diverse playing surfaces, from slick indoor sport courts to abrasive outdoor asphalt.

Emerging technologies focus on integrating smart features and improving material durability through nanotechnology. For instance, manufacturers are exploring hydrophobic coatings for boots to minimize moisture absorption and weight gain during play, extending the product's lifespan. Bearing technology is moving toward specialized ceramic hybrids that offer superior friction reduction and corrosion resistance compared to traditional steel bearings, though at a higher cost. The integration of 3D printing (additive manufacturing) is also gaining traction, particularly in prototyping specialized components like custom footbeds, specialized toe caps, and lightweight chassis designs, allowing for quicker iteration and personalized customer solutions not feasible with traditional subtractive manufacturing methods.

Regional Highlights

- North America: This region maintains the dominant share of the global roller hockey skates market, primarily driven by the U.S. and Canada. The region benefits from a deep-rooted hockey culture, highly organized competitive leagues (such as the National Collegiate Roller Hockey Association and various adult leagues), and strong consumer affinity for premium sporting goods. Technological adoption is rapid here, with consumers willing to pay top dollar for the latest innovations in boot stiffness and chassis design. Manufacturers often use North America as the launchpad for new, high-end performance products. The market size is mature but stable, relying heavily on replacement cycles and the influx of cross-training athletes from the ice hockey community.

- Europe: Europe represents a significant, mature market, characterized by strong participation in countries like Germany, Czechia, France, and Spain, which have robust national roller hockey federations. European demand often balances performance and value, showing high interest in mid-range and durable skates. Unlike North America, roller hockey in parts of Southern Europe is often treated as a stand-alone sport rather than solely an off-season ice hockey activity, fostering a distinct consumer culture. The growth is steady, supported by investment in dedicated multi-sport facilities and active governmental support for youth sports.

- Asia Pacific (APAC): The APAC region is poised for the highest growth rate during the forecast period. This acceleration is attributed to increasing discretionary spending, improving sports infrastructure (particularly in Japan, South Korea, and Australia), and widespread marketing of inline skating as a fitness and recreational activity in urban centers. While currently smaller in market size than North America or Europe, the potential for expansion among the vast youth demographic and the suitability of the climate for year-round outdoor play makes it a crucial target for global manufacturers seeking volume growth.

- Latin America: This region exhibits high growth potential, especially in Brazil, Argentina, and Colombia, where the climate supports outdoor inline sports participation throughout the year. The market is highly price-sensitive, with strong demand for entry-level and mid-range, durable skates. Challenges include less structured competitive leagues compared to North America, but increasing urbanization and a focus on fitness are driving the recreational segment strongly.

- Middle East and Africa (MEA): The MEA market is still nascent but developing, with pockets of growth in the UAE and South Africa, often tied to expatriate communities and newly constructed modern sports facilities. Growth here is dependent on infrastructure development and cultural shifts toward Western-style team sports. Currently, the market segment is primarily catered to through imports of mid-range and recreational skates.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Roller Hockey Skates Market.- Bauer

- CCM Hockey

- Mission Hockey

- Tour Hockey

- Graf Skates

- Alkali Hockey

- True Hockey

- Renfrew

- Labeda

- Rapsodo

- Konixx

- Hyper Wheels

- Revision Hockey

- VNLA

- Powerslide

- K2 Sports

- Rollerblade

- Tron Hockey

- Easton Hockey

- Riedell Skates

Frequently Asked Questions

Analyze common user questions about the Roller Hockey Skates market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth trajectory for the Roller Hockey Skates Market?

The Roller Hockey Skates Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033, driven by increased participation in inline sports and continuous technological advancements in skate materials.

How are advancements in boot technology influencing professional skate performance?

Technological advancements, particularly the use of thermoformable carbon composites and AI-driven 3D scanning for custom fitting, significantly enhance energy transfer, stability, and comfort, which are critical performance factors for professional players.

Which geographical region holds the largest market share and why?

North America (primarily the United States and Canada) holds the largest market share due to its established hockey culture, highly structured league systems, and high consumer spending on premium, performance-oriented sports equipment.

What are the primary differences between Hi-Lo and standard wheel configurations?

The Hi-Lo setup uses smaller wheels in the front and larger wheels in the back (e.g., 76mm/80mm) to improve agility and achieve an aggressive forward stance, whereas standard configurations use wheels of uniform size for consistent speed and stability.

Which distribution channel is expected to see the fastest growth in the market?

The Online Retail distribution channel is expected to experience the fastest growth, offering consumers greater product variety, competitive pricing, and the convenience necessary for purchasing specialized sporting goods globally.

The Roller Hockey Skates Market is undergoing a rapid evolution, moving beyond basic equipment to integrated performance systems. The competitive dynamics are heavily influenced by the ability of manufacturers to successfully integrate lightweight, durable materials, such as specific carbon composite blends and specialized aerospace aluminum alloys, into their chassis designs. This integration is paramount for addressing the professional segment's demand for equipment that provides maximum stiffness-to-weight ratio, thereby ensuring efficient power transmission from the skater’s foot to the rink surface. This requires significant upfront capital investment in precision engineering and advanced manufacturing machinery, which tends to concentrate market power among a few well-capitalized global players. Furthermore, intellectual property protection related to boot ventilation systems and unique wheel compound formulations is becoming a critical competitive battlefield, ensuring that proprietary technologies yield sustainable competitive advantages.

Market penetration strategies across varying price points are essential for sustained revenue growth. High-end product lines generate prestige and anchor brand perception, allowing manufacturers to leverage these innovations across their mid-range offerings after a few product cycles. Conversely, entry-level products, often sourced via OEM agreements in lower-cost manufacturing hubs, are essential for capturing beginner athletes and expanding the consumer base in emerging markets, especially Asia Pacific, where disposable incomes are rising but value consciousness remains high. The ongoing shift toward digital retail is forcing traditional brick-and-mortar specialty stores to redefine their value proposition, primarily by focusing on providing expert fitting services and personalized maintenance advice that cannot be easily replicated by online platforms. Successful companies are those implementing robust omnichannel strategies that blend the educational aspects of physical retail with the vast inventory and logistical efficiency of e-commerce operations.

The regulatory environment, particularly surrounding safety standards for chassis integrity and wheel durability, also impacts market operations. While roller hockey is often viewed as a niche sport compared to ice hockey, adherence to international standards for protective gear and equipment certification is vital for market credibility, particularly when selling to organized leagues and youth programs. The market's resilience against economic downturns is bolstered by the dedicated nature of the athlete consumer base, who generally prioritize equipment maintenance and upgrades despite broader economic pressures. The forecasted CAGR reflects confidence in continued innovation, successful globalization of the sport, and effective utilization of digital platforms to engage the next generation of skaters, particularly through social media and influencer marketing campaigns that showcase elite performance and the lifestyle associated with inline sports.

The Roller Hockey Skates Market also faces significant challenges related to environmental sustainability and ethical sourcing. Consumer scrutiny regarding the use of petrochemical-derived plastics in wheels and boots is increasing, pushing companies toward developing bio-based or recycled materials without compromising performance specifications, which is a complex material science challenge. Successfully navigating these sustainability concerns represents a massive opportunity for brand differentiation, especially in Western European markets where green consumption trends are highly influential. Furthermore, the specialized nature of the product means that inventory management must be highly sophisticated, utilizing predictive modeling to match stock levels with highly specific regional and seasonal demand patterns, mitigating the risk of obsolescence associated with high-value, fast-changing product lines.

The impact of technological advancements extends deeply into consumer interaction and purchasing decisions. For instance, the deployment of augmented reality (AR) apps allows prospective buyers to virtually customize and view skate models, enhancing the pre-purchase experience on digital platforms and bridging the gap between online viewing and physical product evaluation. The increasing prevalence of data-driven marketing, fueled by consumer behavior tracking and purchase history analysis, enables companies to launch highly personalized campaigns, offering specific product recommendations (e.g., suggesting a specialized set of softer indoor wheels to a skater who historically buys aggressive outdoor setups). This level of micro-targeting increases conversion rates and strengthens the relationship between the brand and the highly knowledgeable roller hockey consumer base. This continuous feedback loop—from performance data captured by 'smart' equipment to R&D for the next generation of product design—ensures that market growth remains highly consumer-centric and technologically iterative.

Finally, the long-term health of the market is dependent on fostering grassroots participation. Initiatives by major skate manufacturers to sponsor youth clinics, provide discounted equipment to school programs, and invest in facility development are crucial for developing the next generation of consumers. These activities, while not immediately revenue-generating, ensure the longevity of the customer pipeline. Competitive differentiation is also achieved through superior customer service models, including quick resolution of warranty claims and accessible online tutorials for skate maintenance and component replacement. As the market moves forward, successful organizations will be those that effectively balance high-tech material science, globalized supply chains, and robust, localized customer engagement strategies, all underpinned by a commitment to quality and athlete safety.

The market for mid-range roller hockey skates (typically priced between $200 and $400) is highly fragmented and competitive, catering to the vast segment of dedicated amateur league players. This segment demands a difficult combination of advanced features, such as reinforced ankle support and effective moisture-wicking liners, coupled with long-term durability to withstand frequent use throughout a season. Manufacturers in this bracket must continuously optimize cost structures without sacrificing crucial performance elements like bearing quality or chassis alignment precision. The trend here is leaning towards modular components that allow players to easily upgrade or replace parts, maximizing the skate's usable life and driving consumer satisfaction through perceived value and customization capability. This requires standardized component interfaces across various models and price points, simplifying the aftermarket accessories supply chain.

Conversely, the entry-level segment is intensely focused on aggressive pricing and robust durability, targeting first-time buyers and recreational users. These skates usually feature simpler, non-thermoformable plastic or synthetic leather boots and standard wheel setups. The marketing emphasis is on ease of use, safety features, and comfort rather than elite performance metrics. This segment is particularly sensitive to economic fluctuations and is often dominated by large sporting goods retailers and general e-commerce platforms that prioritize volume sales. Innovation in this area centers around improving the comfort and reducing the weight of lower-cost synthetic materials, making the sport more accessible to the general population and reducing the financial barrier to entry.

Furthermore, the segmentation by wheel configuration highlights the specialization of the sport. While the Hi-Lo setup dominates competitive play for its dynamic agility, certain league rules or player preferences dictate the use of standard setups. Wheel hardness (Durometer rating) is a micro-segmentation factor, with players requiring softer wheels (lower Durometer) for excellent grip on slick indoor sport courts and harder wheels for abrasive outdoor surfaces. Manufacturers must manage a complex inventory matrix to ensure they offer the precise combination of boot performance, chassis rigidity, and wheel durometer required by specific regional markets and playing environments, demonstrating the intricate supply chain logistics required in this highly specialized equipment market.

In summary, the detailed segmentation analysis reveals a highly nuanced market where no single product specification dominates all consumer cohorts. Success requires pinpoint accuracy in aligning product design and cost management with specific user needs, whether it be the professional’s non-negotiable demand for custom fit and lightweight materials, the amateur player’s focus on durability and performance value, or the recreational user’s need for comfort and affordability. The shift towards online purchasing also necessitates optimizing product descriptions and detailed sizing charts, mitigating the fitting risks associated with buying performance footwear sight unseen, thus supporting the exponential growth observed within the e-commerce distribution channel.

The primary focus for key market players in the coming years will be on integrating digital capabilities into the physical product lifecycle. This includes leveraging cloud-based platforms to gather usage data from smart skates, which can then inform R&D departments about real-world stress points and failure modes, leading to iterative design improvements. The intellectual property landscape is becoming increasingly complex, with patents focusing on kinetic energy return systems built into the chassis and specialized bearing lubrication methods that enhance rotational efficiency while reducing maintenance requirements. Competitive rivalry is also extending into strategic acquisitions, where larger sports conglomerates absorb niche technology firms specializing in materials science or biomechanical analytics, consolidating expertise and market share.

The development of customized, flexible financing options, especially for high-end skates, is another subtle but powerful technological trend enabling greater market accessibility. By utilizing fintech solutions, manufacturers can segment payment plans based on consumer credit profiles, turning a high upfront cost into a manageable monthly expense, thereby boosting sales volumes in the premium segment. Furthermore, the adoption of advanced manufacturing execution systems (MES) is critical for maintaining the high-quality control required for carbon fiber layups and precise CNC machining of chassis parts, ensuring that every pair of high-performance skates meets rigorous quality specifications before leaving the factory floor, a non-negotiable requirement for professional users.

Overall, the technology landscape is characterized by a drive toward personalization and performance optimization, heavily utilizing digital tools and advanced material engineering. The interplay between physical product innovation (e.g., boot shell stiffness) and digital augmentation (e.g., performance tracking apps) defines the competitive edge, dictating which companies can command premium pricing and secure long-term brand loyalty among the discerning consumer base of competitive roller hockey players globally. The move toward lighter, stronger, and smarter skates will continue to be the main technological growth engine through the forecast period.

The current market dynamics necessitate that competitive strategies pivot towards customer engagement and loyalty programs, recognizing that the lifespan of a premium skate is substantial, requiring manufacturers to maintain relationships between purchase cycles. This involves offering specialized maintenance kits, replacement parts readily available through authorized service centers, and subscription services for performance monitoring apps linked to smart skate technologies. Brand reputation is heavily weighted on product longevity and accessible customer support, especially given the intense physical demands placed on the equipment during competitive play. Ethical manufacturing practices are also gaining commercial importance; companies able to transparently document their reduced carbon footprint or use of ethically sourced materials are positioning themselves favorably with environmentally conscious consumers in developed markets.

Furthermore, global market fragmentation, while offering diverse growth opportunities, mandates a highly decentralized approach to product distribution and sizing. Sizing conventions can vary significantly between regions, and climate differences necessitate different wheel and bearing specifications. For example, a skate optimized for an air-conditioned indoor rink in North America may perform sub-optimally in a humid, non-climate-controlled environment in Southeast Asia. Successful multinational corporations are therefore investing in hyper-localized inventory management systems and regional customization centers to address these highly specific environmental and cultural needs, thereby minimizing logistical costs and maximizing regional market relevance and penetration effectiveness.

The sustained success of the Roller Hockey Skates Market through 2033 is fundamentally tied to the industry’s capacity for iterative, athlete-centric innovation and effective cost management within the complex global supply chain. The convergence of material science breakthroughs (e.g., lighter carbon fiber composites), digital technologies (AI fitting and performance tracking), and evolving consumer expectations (sustainability and customization) will define the market leaders and shape the competitive landscape for the next decade, ensuring continued robust growth in both volume and value segments across all major geographic regions.

The primary drivers for market acceleration include the infrastructural shift toward multi-sport venues, which often incorporate roller hockey rinks, broadening the sport's accessibility beyond ice-centric regions. Coupled with this is the robust influencer culture within the sports world, where endorsements from professional athletes and successful YouTube personalities drive significant consumer interest, particularly among younger demographics who emulate high-performance gear choices. Technological push from the manufacturing side, particularly advancements in polyurethane chemistry leading to longer-lasting and higher-grip wheels, further fuels the replacement cycle among dedicated players seeking marginal performance gains. These compounding factors solidify the market’s steady growth trajectory, providing a resilient foundation against minor economic headwinds.

Restraints, beyond cost and seasonality, involve the inherent safety risks associated with high-speed inline sports. Regulatory bodies and consumer safety groups continuously demand higher standards for protective equipment and skate durability to mitigate common injuries, such as ankle fractures and abrasions. Manufacturers must continuously invest in stress testing and quality control beyond minimum regulatory compliance to maintain consumer trust and avoid costly product recalls, adding a necessary burden to the production cost structure. Additionally, the limited global media visibility of roller hockey compared to major sports like soccer or basketball slightly restricts the pace of global awareness and subsequent consumer recruitment, making targeted, niche marketing essential but also expensive relative to the overall market size.

However, significant opportunities exist in developing highly modular and customizable skates. A shift towards a platform-based design where boots, chassis, and wheels are interchangeable through quick-release mechanisms allows consumers to easily adapt their equipment to various playing conditions without purchasing multiple full skate setups. This approach enhances perceived value and stimulates sales within the aftermarket components segment. Furthermore, the burgeoning sports tourism sector, with major international roller hockey tournaments attracting global participants, offers manufacturers unique high-visibility platforms to showcase and launch new performance equipment, providing immediate exposure to the most influential consumers—the dedicated, frequent players and competitive athletes.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager