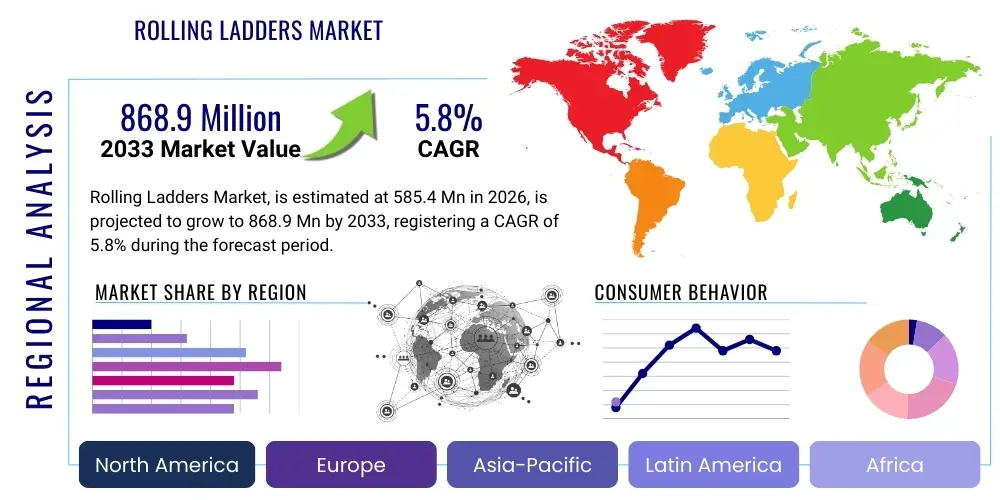

Rolling Ladders Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443460 | Date : Feb, 2026 | Pages : 241 | Region : Global | Publisher : MRU

Rolling Ladders Market Size

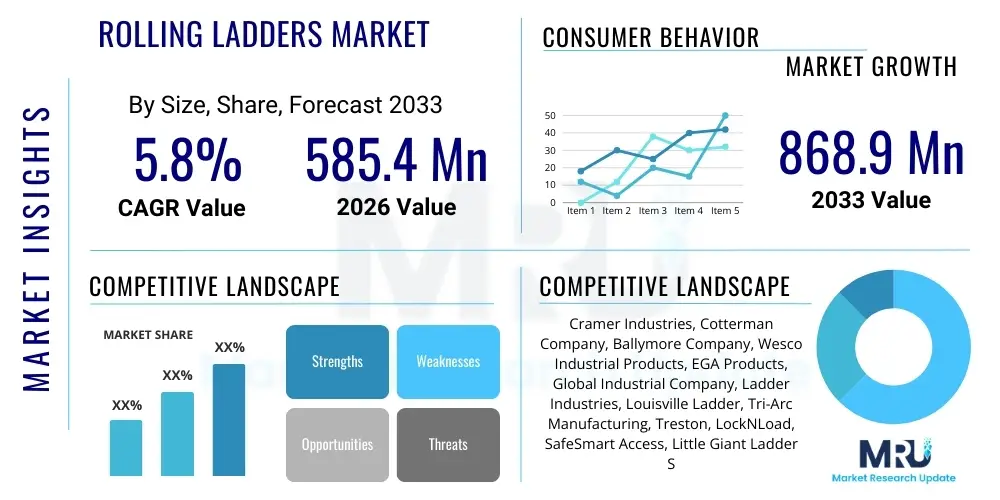

The Rolling Ladders Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 585.4 Million in 2026 and is projected to reach USD 868.9 Million by the end of the forecast period in 2033.

Rolling Ladders Market introduction

Rolling ladders, also known as mobile safety ladders or warehouse ladders, are essential material handling and access equipment designed for industrial, retail, and institutional environments. These ladders are characterized by their integrated casters, which allow for easy movement and repositioning, coupled with robust safety features such as spring-loaded steps or auto-locking mechanisms that ensure stability when weight is applied. The product spectrum spans various materials, including durable steel for heavy-duty applications, lightweight aluminum for portability, and non-conductive fiberglass for specific industrial settings.

Major applications for rolling ladders are predominantly found in high-density storage facilities, particularly within the logistics and e-commerce sectors, where vertical space utilization is critical. They provide safe, ergonomic access to elevated shelves and inventory locations that standard stepladders cannot reliably reach. Beyond warehousing, rolling ladders are indispensable in large retail environments for stocking and display maintenance, in archives and libraries for accessing book stacks, and in maintenance facilities where temporary elevated platforms are required.

The primary benefits driving the market adoption include enhanced workplace safety—reducing fall risks associated with improvised access solutions—and significant operational efficiency gained through rapid and safe movement across large floor areas. Driving factors underpinning current market growth are the global surge in e-commerce necessitating optimized warehouse operations, increasing strictness of occupational safety standards (OSHA/ANSI compliance), and continuous innovation in material science leading to lighter yet more durable and feature-rich ladder designs.

Rolling Ladders Market Executive Summary

The Rolling Ladders Market is undergoing steady expansion driven by pivotal business trends centered on automation synergy and safety compliance mandates. The relentless growth of global e-commerce has propelled investment in advanced fulfillment centers and automated storage and retrieval systems (AS/RS), where rolling ladders serve as critical supplementary equipment for tasks requiring human intervention, such as order exception handling and system maintenance. Key manufacturers are focusing heavily on integrating advanced safety mechanisms, such as enhanced braking systems and sensor-based engagement locks, transforming these traditionally simple tools into smarter components of the overall material handling ecosystem. Furthermore, the rising cost of labor and the emphasis on worker ergonomics are pushing demand for customized, easily maneuverable ladders that minimize strain and maximize operational throughput in dynamic environments.

Regionally, the market exhibits strong growth momentum in the Asia Pacific (APAC), primarily fueled by rapid industrialization, massive infrastructure development, and the explosive adoption of online retail in economies like China, India, and Southeast Asian nations. North America remains a dominant market, characterized by stringent safety regulations and high adoption rates of advanced, often customized, high-end rolling ladders in sophisticated logistics networks. European markets prioritize compliance with strict EU safety directives, leading to demand for certified, high-quality, ergonomic models, often featuring specialized coatings or construction materials suited for specific sector needs, such as food processing or pharmaceutical storage.

Segmentation trends indicate a strong preference for steel rolling ladders due to their durability and load-bearing capacity, particularly in heavy industrial settings, although aluminum and fiberglass segments are gaining traction due to lightweight properties and specialized application suitability (e.g., electrical safety). In terms of application, the Warehouse and Logistics segment maintains the largest market share and is expected to exhibit the highest CAGR, reflective of ongoing global supply chain expansion. The trend towards higher vertical storage solutions mandates the increased adoption of rolling ladders with elevated platform heights and enhanced stability features, further differentiating product offerings based on application-specific requirements like aisle width compatibility and shelf depth access.

AI Impact Analysis on Rolling Ladders Market

User inquiries regarding AI's influence on the Rolling Ladders Market typically revolve around three core themes: obsolescence, integration, and safety enhancement. Users frequently question whether the increasing deployment of fully autonomous mobile robots (AMRs) and automated guided vehicles (AGVs) in warehouses will render rolling ladders obsolete. A second major theme centers on how traditional, non-powered equipment can interface with sophisticated warehouse management systems (WMS) utilizing AI for inventory tracking and optimization. Finally, a significant portion of user concern focuses on leveraging AI to enhance the safety profile of human operations, specifically through predictive maintenance alerts and real-time operator monitoring systems integrated into the ladders or the immediate operational environment.

While AI-driven automation significantly reduces the reliance on manual human access for routine tasks like picking and fetching, rolling ladders maintain their indispensable role in exception handling, maintenance, repair, facility audits, and non-standard tasks where dexterity and human decision-making are paramount. The impact of AI is therefore less about replacement and more about optimization and enhanced human-machine collaboration. AI algorithms optimize the operational routes for human workers using rolling ladders, identifying the most efficient pathways and reducing travel time. Furthermore, AI contributes to safety by analyzing usage patterns, detecting potential mechanical failures in casters or locking mechanisms before they occur, and flagging operational deviations that might lead to accidents.

The next generation of high-end rolling ladders is expected to incorporate elements of "smart assistance." This includes sensor integration that relays real-time telemetry—such as load weight, brake status, and tilt angle—back to a central AI safety monitoring system. This allows facility managers to enforce dynamic safety protocols, limit ladder usage in high-risk zones based on current inventory configuration, or generate immediate alerts if a ladder is misused. The AI layer effectively serves as a comprehensive risk management tool, transforming the physical asset into a data-generating endpoint that contributes to overall warehouse efficiency and compliance reporting, thereby prolonging the relevance and functionality of human-operated access equipment in automated facilities.

- AI optimizes human task routing using real-time inventory location data.

- Predictive maintenance analytics for casters, steps, and braking systems increase uptime.

- Computer vision and AI monitoring systems detect unsafe ladder usage (e.g., standing on non-designated steps).

- Integration with WMS allows workers using ladders to update inventory status via connected devices.

- Enhanced facility layout optimization driven by AI ensures clear pathways for mobile ladders.

- AI-enabled training simulations improve operator proficiency and reinforce safety protocols.

DRO & Impact Forces Of Rolling Ladders Market

The Rolling Ladders Market dynamics are dictated by a balanced interplay of accelerating factors, structural constraints, and nascent opportunities, all influenced by the overarching regulatory environment and global economic trends. The primary driver is the exponential expansion of the global logistics and warehousing sector, primarily fueled by the sustained growth of the e-commerce giants and third-party logistics providers (3PLs) who continuously build and expand high-bay facilities requiring vertical access solutions. Safety regulations mandated by bodies like OSHA and ANSI act as a crucial impact force, demanding specialized, certified equipment, thereby phasing out makeshift or substandard access tools and ensuring market growth is focused on quality, high-value products. Additionally, demographic shifts, including an aging workforce, necessitate ergonomic solutions, driving demand for ladders with features that reduce physical strain, such as easy-roll casters and optimized step depths.

Restraints on market growth include the substantial initial capital investment required for high-quality, customized rolling ladder systems, particularly those with advanced safety features or non-standard materials. Furthermore, the inherent competition from specialized, often highly automated, alternatives like personnel lifts, scissor lifts, and advanced robotic pickers in very high-bay applications limits the upper end of the rolling ladder market. Economic volatility and disruptions in the supply chain for raw materials, specifically aluminum and steel, can also lead to unpredictable production costs, subsequently impacting the final consumer price and potentially delaying purchasing decisions by smaller enterprises.

Opportunities for market players are concentrated in product specialization, geographic expansion, and technology integration. Customization based on specialized industrial needs—such as corrosion-resistant coatings for cold storage or specialized non-marking wheels for sensitive floor areas—presents a high-margin opportunity. Moreover, underserved emerging markets in APAC and Latin America, where safety standards are rapidly catching up to Western norms, offer significant scope for new market entry and volume growth. The long-term opportunity lies in developing ‘smart’ rolling ladders that integrate seamlessly with IoT platforms and facility management software, providing competitive differentiation beyond mere physical access.

Segmentation Analysis

The Rolling Ladders Market segmentation provides a granular view of product performance, adoption patterns, and target end-user needs. The market is primarily segmented based on the type of material used in construction (Steel, Aluminum, Fiberglass), the height capacity and platform configuration (Low-level, Medium-level, High-level), the braking mechanism employed (Spring-loaded, Foot-operated, Gravity-actuated), and the specific application sector (Warehouse & Logistics, Retail & Supermarkets, Industrial Maintenance, Archives & Libraries, Others). This structured differentiation allows manufacturers to tailor features such as load capacity, mobility, resistance to environmental factors (e.g., moisture, chemicals), and compliance certifications to specific customer requirements, optimizing product fit and enhancing market penetration across various sectors.

- Material:

- Steel Rolling Ladders

- Aluminum Rolling Ladders

- Fiberglass Rolling Ladders

- Height/Platform:

- Below 10 Feet

- 10 to 16 Feet

- Above 16 Feet (High-Level Access)

- Braking Mechanism:

- Spring-Loaded Casters

- Foot-Lever Lock Mechanisms

- Gravity-Actuated Brakes

- End-Use Application:

- Warehouse and Logistics Centers

- Retail and Supermarkets

- Industrial Facilities and Manufacturing

- Archives and Libraries

- Maintenance and Utility Services

Value Chain Analysis For Rolling Ladders Market

The value chain for the Rolling Ladders Market begins with the upstream sourcing of primary raw materials, predominantly high-grade industrial steel, specialized aluminum alloys, and reinforced fiberglass composites, alongside components such as casters, braking systems, and safety tread materials. Efficiency in this phase is critical, as volatile commodity prices directly influence manufacturing margins. Key upstream activities include material preparation, cutting, welding, and anti-corrosion treatment processes. Strategic partnerships with reliable, globally compliant metal suppliers are essential to ensure material quality, structural integrity, and adherence to load-bearing specifications mandated by regulatory bodies like ANSI and European standards, forming the foundation of the product’s safety profile.

The midstream activities focus on precision manufacturing, assembly, and quality assurance. This phase includes the integration of advanced safety features like ergonomic handrails, auto-locking mechanisms, and specialized platform surfaces. Manufacturing capabilities, particularly relating to modular design and customization for varying heights and load requirements, determine competitive advantage. Distribution channels are varied: direct sales are common for highly specialized, custom industrial orders, while indirect channels leverage a network of industrial supply distributors, material handling equipment wholesalers, and, increasingly, specialized e-commerce platforms focused on industrial safety and storage solutions. The selection of the distribution channel is often dictated by the size of the end-user and the complexity of the required product.

Downstream activities center around deployment, installation (for very large, fixed-base rolling ladder systems), after-sales service, and periodic safety inspections required by industrial clients. Direct distribution allows manufacturers to maintain higher margins and direct customer relationships, facilitating rapid feedback loops for product improvement. Indirect distribution, leveraging major industrial retailers and regional resellers, offers broader market access and reduced logistics costs for standard, high-volume products. The overall value chain is highly focused on quality control and certification throughout, as product failure directly results in significant legal and operational liabilities for the end-user, emphasizing the importance of robust supplier qualification and rigorous final product testing.

Rolling Ladders Market Potential Customers

The primary end-users and potential buyers of rolling ladders are organizations requiring safe, frequent, and mobile access to elevated inventory or resources within large commercial or industrial structures. The largest demand segment originates from the rapidly expanding supply chain ecosystem, encompassing massive e-commerce fulfillment centers, regional distribution hubs, and 3PL warehousing providers, where vertical storage density is maximized, necessitating ladders capable of reaching heights up to 20 feet. These customers prioritize mobility, durability, and strict compliance with national safety standards to minimize operational risks and insurance liabilities associated with working at heights.

Secondary high-volume purchasers include large format retail establishments and supermarkets, where rolling ladders are constantly utilized for stocking high shelves, managing seasonal displays, and conducting general store maintenance. In these environments, aesthetic appeal, lightweight design (often aluminum), and non-marking casters are key purchasing criteria. Furthermore, institutional sectors, such as university libraries, corporate archives, government record centers, and museum storage facilities, represent consistent, albeit specialized, customers demanding narrow-aisle compatibility and features designed to protect sensitive materials, sometimes opting for non-metal constructions like fiberglass.

Industrial maintenance, repair, and overhaul (MRO) departments across various manufacturing sectors—from automotive assembly to pharmaceutical production—also constitute significant end-users. These customers often require ladders with specialized features, such as chemical resistance, non-conductivity (fiberglass models), or ultra-heavy-duty steel construction for access to machinery or elevated platforms during routine maintenance tasks. The purchasing decision for these entities is heavily influenced by the ladder’s load rating, stability under dynamic conditions, and the ease of mobility across diverse industrial flooring types.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 585.4 Million |

| Market Forecast in 2033 | USD 868.9 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Cramer Industries, Cotterman Company, Ballymore Company, Wesco Industrial Products, EGA Products, Global Industrial Company, Ladder Industries, Louisville Ladder, Tri-Arc Manufacturing, Treston, LockNLoad, SafeSmart Access, Little Giant Ladder Systems, Penca-Se, Factory Cat, RiveLite, Metaltech, Alum-A-Pole, Platform Ladder Company, Telesteps |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Rolling Ladders Market Key Technology Landscape

The technology landscape within the Rolling Ladders Market, while fundamentally rooted in mechanical engineering, is progressively advancing through material innovation and enhanced safety mechanism integration. Modern rolling ladders utilize high-strength, low-weight materials, such as specific grades of aluminum and composites, which drastically improve mobility without sacrificing structural integrity or load capacity. A core technology advancement is the perfection of the braking system. The industry standard has shifted towards highly reliable, force-actuated mechanisms—such as the spring-loaded casters that retract when weight is applied, firmly planting the ladder feet—and advanced foot-lever locks that provide secure, manual engagement, ensuring maximum stability during use. Continuous research is focused on optimizing these mechanisms for maintenance-free operation and extreme durability under constant, repetitive industrial use.

A significant area of development involves ergonomic design and modularity, addressing the safety and fatigue issues associated with manual handling and prolonged use. This includes wider, non-slip step surfaces, optimized step depths and angles, and strategically placed handrails that meet or exceed updated ANSI and OSHA standards for fall protection. Modular designs allow end-users to easily adjust platform heights, add safety cages, or change wheel types (e.g., from standard rubber to non-marking polyurethane or specialized conductive casters for static-sensitive environments), maximizing the utility and lifespan of a single unit across diverse operational needs, thereby improving the return on investment.

In line with broader industrial IoT trends, the nascent technological frontier involves integrating sensor packages. While not yet standard across the entire market, high-end, specialized rolling platforms are beginning to incorporate load sensors that alert operators or supervisory systems if the ladder is overloaded or if weight distribution is uneven. Furthermore, RFID or Bluetooth Low Energy (BLE) tags are being affixed to track asset location, usage frequency, and maintenance history, enabling facility managers to integrate rolling ladder management into overall WMS platforms. This data-driven approach supports compliance tracking, preemptive maintenance scheduling, and optimization of resource allocation within the facility, representing the leading edge of technology adoption in this sector.

Regional Highlights

- North America (U.S. and Canada): This region is characterized by mature logistics infrastructure, large-scale retail chains, and some of the world's most stringent workplace safety regulations (OSHA). The market demands high-quality, durable rolling ladders, often customized for wide aisles and extreme heights prevalent in modern mega-warehouses. Adoption rates for technologically advanced braking systems and ergonomic features are highest here. The U.S. remains the largest individual market, driven by constant investment in e-commerce fulfillment capabilities and a strong commitment to maintaining regulatory compliance, often necessitating equipment replacement or upgrades.

- Europe (Germany, UK, France): European demand is fundamentally driven by compliance with CE marking requirements and strict European Union directives regarding health and safety equipment. The market favors ergonomic, environmentally certified, and highly specified products, often requiring specialized coatings or materials suitable for diverse industrial environments (e.g., ATEX-rated zones). Germany, as a major manufacturing and logistics hub, is a key consumer, prioritizing durability and seamless integration of access equipment into existing operational layouts, including narrow-aisle designs common in older facilities.

- Asia Pacific (China, India, Japan, South Korea): APAC is projected to be the fastest-growing region, fueled by unprecedented infrastructure development, the rapid urbanization of industrial processes, and the explosive growth of regional e-commerce markets, particularly in China and India. While price sensitivity exists, there is a clear shift towards higher quality and safer ladders as local safety regulations become more formalized and enforced. China dominates regional demand volume, whereas Japan and South Korea lead in adopting premium, specialized models, reflecting their high-tech manufacturing and logistics sectors.

- Latin America (Brazil, Mexico): Market growth in Latin America is tied to foreign investment in manufacturing and the modernization of retail and warehousing facilities. Demand is often concentrated around major urban and industrial corridors in Brazil and Mexico. The market generally seeks a balance between cost-effectiveness and adherence to international safety standards, with a growing appetite for standard steel rolling ladders for industrial and logistics applications.

- Middle East and Africa (MEA): Growth is primarily concentrated in the Gulf Cooperation Council (GCC) nations due to massive investments in logistics hubs (e.g., Dubai, Saudi Arabia) and expansion of retail infrastructure. Climatic conditions drive demand for materials resistant to high heat and dust. In Africa, market adoption is nascent but accelerating, driven by the expansion of international retailers and the formalization of industrial storage solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Rolling Ladders Market.- Cotterman Company

- Ballymore Company

- Cramer Industries

- Wesco Industrial Products

- EGA Products

- Global Industrial Company

- Tri-Arc Manufacturing

- Ladder Industries

- Louisville Ladder

- Penca-Se

- Treston

- SafeSmart Access

- LockNLoad

- Little Giant Ladder Systems

- Custom Equipment LLC

- RiveLite

- Metaltech

- Alum-A-Pole

- Platform Ladder Company

- Telesteps

Frequently Asked Questions

Analyze common user questions about the Rolling Ladders market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand for rolling ladders in the logistics sector?

The primary driver is the explosive growth of e-commerce, which necessitates vertical storage optimization in fulfillment centers. Rolling ladders provide safe, mobile access for inventory management, exception handling, and maintenance in high-bay, high-density storage environments.

How do safety regulations, such as OSHA, impact the Rolling Ladders Market?

Strict safety regulations mandate the use of certified, tested equipment featuring specific safety enhancements (e.g., automatic brakes, secure railings). This compliance requirement elevates the quality floor of the market, driving investment in ergonomic and sophisticated braking technologies.

Which material segment (Steel, Aluminum, Fiberglass) is expected to grow fastest?

While steel maintains volume dominance, the Aluminum segment is projected for rapid growth due to increasing demand for lightweight, highly maneuverable ladders in retail and light-duty warehouse environments, balancing durability with reduced physical effort for operators.

Can rolling ladders be integrated with modern Warehouse Management Systems (WMS)?

Yes, higher-end industrial rolling ladders can be integrated indirectly via attached mobile devices, or directly through integrated IoT sensors (RFID/BLE) that track asset location, usage metrics, and maintenance status, contributing to WMS data for efficiency and safety compliance.

What is the typical lifespan and required maintenance for an industrial rolling ladder?

An industrial rolling ladder, particularly steel models, can have a lifespan exceeding 15 years. Maintenance is low but critical, primarily involving periodic inspection of caster integrity, brake mechanism functionality, and checking for structural damage or weld fatigue, usually mandated by facility safety protocols.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager