Roofing Insulation Adhesives Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441781 | Date : Feb, 2026 | Pages : 257 | Region : Global | Publisher : MRU

Roofing Insulation Adhesives Market Size

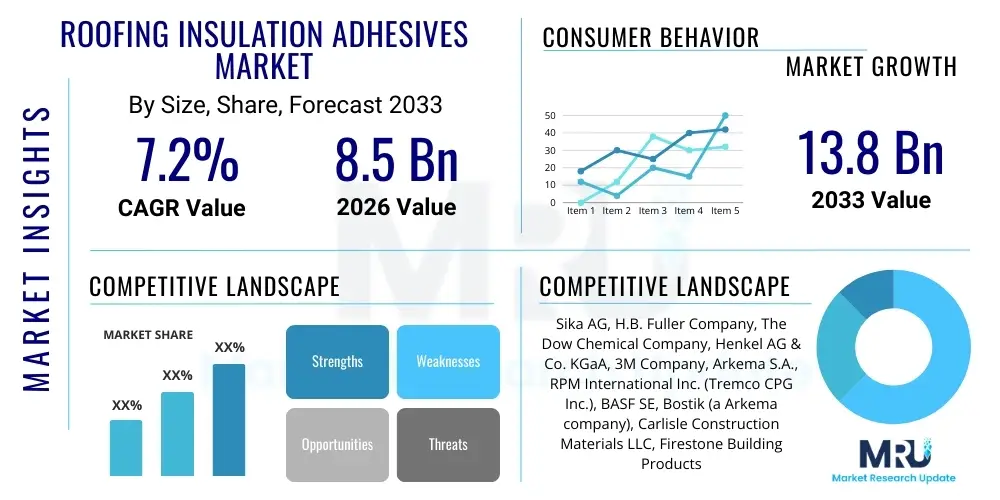

The Roofing Insulation Adhesives Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 1.9 Billion in 2026 and is projected to reach USD 2.8 Billion by the end of the forecast period in 2033.

Roofing Insulation Adhesives Market introduction

The Roofing Insulation Adhesives Market encompasses specialized chemical compounds designed for bonding various types of rigid and semi-rigid insulation materials—such as polyisocyanurate (polyiso), expanded polystyrene (EPS), and extruded polystyrene (XPS)—to roofing substrates like concrete, wood, and metal decks. These adhesives are critical components in modern, high-performance roofing systems, offering superior wind uplift resistance, thermal stability, and enhanced longevity compared to traditional mechanical fastening methods or hot asphalt applications. The primary shift driving this market involves increased regulatory mandates focused on energy efficiency in buildings, necessitating the use of thicker and more effective insulation layers, which in turn require reliable adhesive solutions to maintain structural integrity and thermal performance over the structure's lifespan.

Major applications of these adhesives span across low-slope (commercial and industrial) and steep-slope (residential) roofing segments, though the commercial sector remains the dominant consumer due to stringent building codes for large flat roofs. Benefits derived from using advanced roofing adhesives include reduced thermal bridging, which significantly improves the U-value of the roofing assembly; faster installation times, particularly for large projects; and reduced penetration of the vapor barrier, mitigating the risk of moisture ingress. Furthermore, the use of solvent-free and low Volatile Organic Compound (VOC) formulations is becoming a major product development theme, aligning with sustainability goals and improving worker safety during installation, thereby contributing to broader environmental, social, and governance (ESG) compliance within the construction industry.

The market growth is primarily driven by the robust expansion of the commercial construction sector globally, especially in emerging economies, coupled with significant refurbishment and re-roofing activities in mature markets seeking to upgrade existing structures to meet contemporary energy codes. Technological innovations, such as the development of two-component polyurethane foam adhesives and specialized single-component adhesives, are continuously enhancing product performance metrics like cure speed, adhesion strength across diverse substrates, and tolerance to varying environmental conditions. These factors collectively position the roofing insulation adhesives sector as a vital, high-growth component within the broader specialty chemicals and construction materials industries, essential for sustainable infrastructure development.

Roofing Insulation Adhesives Market Executive Summary

The Roofing Insulation Adhesives Market is characterized by accelerating demand fueled by global imperatives toward energy conservation and sustainable building practices. Business trends indicate a strong move away from traditional mechanical fastening methods towards sophisticated adhesive systems, driven by performance advantages, including superior wind load resistance and elimination of thermal short circuits. Key industry participants are focusing heavily on research and development (RD) to introduce high-solids, low-VOC formulations, particularly in the polyurethane and solvent-based elastomer categories, to comply with increasingly stringent environmental regulations across North America and Europe. Strategic mergers, acquisitions, and partnerships are also prevalent, allowing major chemical producers to integrate vertically and secure robust supply chains for critical raw materials such as isocyanates and polyols, ensuring market resilience against commodity price volatility.

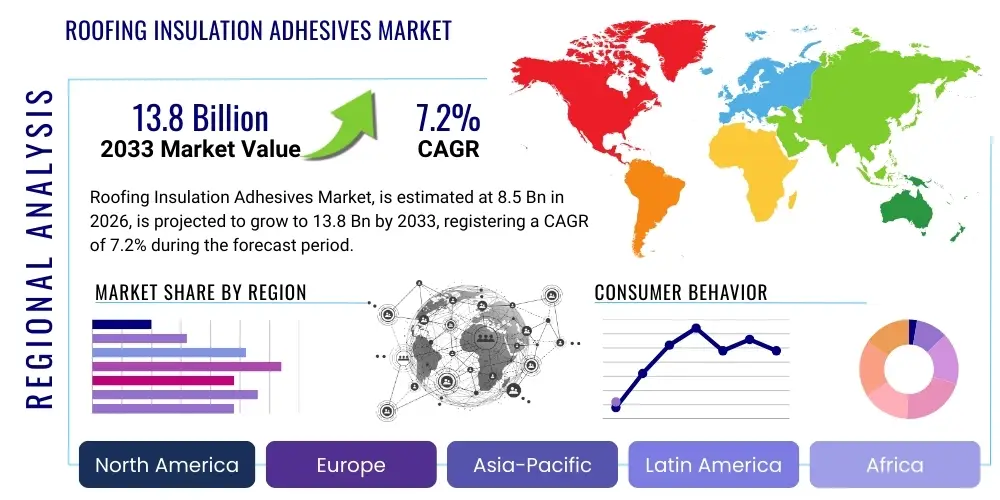

Regionally, Asia Pacific is emerging as the fastest-growing market, largely due to rapid urbanization, immense infrastructure spending, and the introduction of new energy-efficient building codes in countries like China and India. While North America and Europe remain mature and highly regulated markets, growth is sustained by mandatory retrofitting projects aimed at maximizing the energy performance of aging commercial and institutional buildings. Latin America and the Middle East and Africa (MEA) are also experiencing significant adoption, catalyzed by large-scale commercial and industrial construction projects, including logistics centers and manufacturing facilities, requiring durable and high-specification roofing assemblies to withstand harsh climatic conditions, ranging from extreme heat to high humidity.

Segmentation trends highlight the dominance of Polyurethane (PU) adhesives due to their versatility, rapid cure speed, and excellent bond strength across multiple insulation types and substrates. Within applications, the low-slope commercial roofing segment accounts for the largest market share, directly correlating with the proliferation of large flat-roof structures globally. However, the steep-slope residential segment is expected to show steady growth, primarily driven by the increasing adoption of synthetic slate and metal roofing systems that benefit significantly from adhesive application techniques. Furthermore, the shift towards spray foam applications for installation efficiency is also marking a crucial sub-segment trend, offering applicators speed and comprehensive coverage.

AI Impact Analysis on Roofing Insulation Adhesives Market

Common user questions regarding AI's impact on the Roofing Insulation Adhesives Market often revolve around predictive modeling for raw material price volatility, optimization of adhesive formulation based on real-time weather data, and the role of autonomous robotics in adhesive application on construction sites. Users are particularly keen on understanding how AI can enhance supply chain resilience by forecasting demand fluctuations and identifying optimal stock levels for geographically dispersed construction projects. Furthermore, there is significant interest in using machine learning (ML) algorithms to analyze data from installed roofing systems—such as temperature variances, moisture readings, and wind stress—to predict potential adhesive failure points and optimize maintenance schedules, thereby extending the service life of the roof assembly and providing data-backed warranties. The overarching theme is leveraging AI to transition from reactive product performance assessment to proactive, predictive maintenance and dynamic formulation adjustments.

AI’s influence is moving beyond simple data crunching into complex operational areas. For example, AI-driven process control systems are being implemented in adhesive manufacturing plants to fine-tune reaction parameters, ensuring consistent batch quality and reducing waste, which is vital given the highly specialized chemical nature of these products. Moreover, in the realm of application, advanced computer vision systems integrated into drone technology are beginning to assess roof substrate readiness and ensure uniform adhesive coverage, drastically improving installation quality and reducing labor dependency. This integration of smart technology is redefining quality assurance protocols and minimizing potential application errors that traditionally lead to premature system failure, thereby justifying a premium pricing strategy for technologically enhanced adhesive products.

Overall, AI is expected to significantly improve efficiency, quality control, and predictive maintenance within the roofing insulation adhesives ecosystem. While AI is not directly involved in the chemical reaction of the adhesive itself, its ability to analyze massive datasets related to performance, logistics, and climate will lead to smarter, more resilient, and customizable product offerings. This translates into a competitive edge for companies that successfully integrate these analytical tools into their product development and service delivery models, ultimately lowering long-term costs for end-users by minimizing structural failures and maximizing thermal performance.

- AI-driven supply chain optimization (forecasting raw material volatility, logistics planning).

- Machine learning algorithms enhancing quality control in adhesive manufacturing processes.

- Predictive maintenance modeling based on installed roof sensor data (temperature, moisture, stress).

- Autonomous robotic systems utilizing computer vision for precise adhesive application and substrate analysis.

- Dynamic formulation adjustments based on localized climate and installation conditions (Smart Adhesives).

- Optimized inventory management and waste reduction through demand forecasting accuracy.

- Enhanced warranty offerings backed by AI-validated performance data over time.

DRO & Impact Forces Of Roofing Insulation Adhesives Market

The Roofing Insulation Adhesives Market is powerfully shaped by a dynamic interplay of Drivers, Restraints, and Opportunities, collectively forming the core Impact Forces. The primary Driver is the increasing global focus on energy efficiency, mandated by international agreements and domestic building codes (e.g., Net-Zero Energy goals), which necessitates superior insulation systems where adhesives offer better thermal continuity than mechanical fasteners. Coupled with this is the robust growth in the commercial refurbishment sector, particularly the trend of "re-roofing over existing roofs," which favors lightweight, easy-to-apply adhesive solutions over heavy, disruptive traditional methods. These drivers are amplified by advancements in adhesive chemistry, providing faster curing times and stronger bonds, thus boosting installer productivity and reducing overall project timelines, which is a significant economic incentive for contractors.

However, the market faces notable Restraints. The most prominent is the volatility and dependency on petrochemical raw material prices, particularly for polyurethane precursors like MDI and TDI, which directly influence the final cost and profitability of adhesive products. Secondly, the market faces resistance from long-standing traditional construction practices, where mechanical fasteners and hot asphalt are deeply entrenched, requiring sustained technical education and proven performance data to convince long-term users of the superiority of adhesive systems. Regulatory hurdles regarding VOC content and flammability standards (FM approvals) also add complexity and cost to the research and development pipeline, forcing continuous, expensive reformulation efforts.

Opportunities in this sector are vast, driven primarily by the shift towards green building materials and sustainable construction. The expansion of insulated metal panel (IMP) systems and specialized roofing applications like green roofs and solar panel integration require customized, high-performance adhesive solutions that traditional fasteners cannot adequately provide. Moreover, untapped potential exists in developing highly specialized adhesives for extreme weather zones—products capable of maintaining integrity under high seismic stress, severe wind uplift, or extreme temperature cycling. The rapid growth of the cold storage and temperature-controlled logistics industries also presents a niche opportunity requiring insulation adhered with highly resilient, low-temperature resistant bonding agents. These forces collectively dictate the market trajectory, rewarding innovation in performance and sustainability.

The Impact Forces are heavily weighted towards the Drivers and Opportunities segments, suggesting a strong growth outlook despite raw material volatility. Regulatory frameworks and climate goals are acting as catalysts, forcing the adoption of high-performance materials. The shift from manual labor towards automated application methods in developed economies also favors adhesive systems that can be efficiently dispensed via robotics or automated spraying equipment, further strengthening the long-term viability of the adhesive over the mechanical fastening approach in specialized construction.

Segmentation Analysis

The Roofing Insulation Adhesives Market is segmented based on critical technical and application parameters, including Chemistry Type, Application Method, Application, and End-Use Sector. This structure allows for a detailed analysis of specialized needs within the construction industry, where product requirements vary significantly based on substrate, insulation type, and environmental exposure. The complexity of modern roofing systems, incorporating multiple layers of vapor barriers, thermal insulation, and membranes, necessitates a diverse portfolio of adhesive products tailored for specific bonding challenges, driving distinct segmentation strategies among key market players. The Chemistry Type segmentation is perhaps the most crucial, as it dictates performance characteristics such as curing time, bond strength, flexibility, and resistance to environmental factors like UV radiation and temperature extremes, directly impacting the product’s suitability for commercial or residential use.

Application Method segmentation reflects the increasing industry demand for installation efficiency and safety. The shift from traditional bucket-and-trowel methods to automated spray and bead application systems has profoundly influenced market preferences, favoring cartridge-based and two-component systems that offer quicker cure times and greater consistency of coverage. Conversely, the Application segmentation differentiates between the vast low-slope commercial sector, requiring large volumes of high-strength adhesives, and the smaller, but steadily growing, steep-slope residential sector, often requiring specialized, smaller-format products. Analyzing these segments helps manufacturers align their production capabilities and marketing efforts with the specific demands of installers and building owners across different project scales and complexities.

- By Chemistry Type:

- Polyurethane (PU) Adhesives (Single and Two-Component)

- Epoxy Adhesives

- Solvent-Based Adhesives (e.g., Synthetic Rubber/Elastomers)

- Water-Based Adhesives (Acrylic, Vinyl Acetate)

- Asphalt/Bituminous Adhesives (Diminishing Share)

- By Application Method:

- Spray Application (Low- and High-Pressure Systems)

- Bead/Extrusion Application (Manual and Automated)

- Roller/Trowel Application

- Aerosol Canisters/Cartridges

- By Application:

- Low-Slope Roofing (Commercial, Industrial, Institutional)

- Steep-Slope Roofing (Residential, Multifamily)

- By End-Use Sector:

- Commercial Construction (New and Re-roofing)

- Residential Construction (New and Re-roofing)

- Industrial Facilities (Warehouses, Manufacturing)

- Institutional Buildings (Schools, Hospitals)

Value Chain Analysis For Roofing Insulation Adhesives Market

The Value Chain for the Roofing Insulation Adhesives Market begins with the upstream procurement of essential petrochemical raw materials, primarily MDI (Methylene diphenyl diisocyanate), TDI (Toluene diisocyanate), polyols, solvents, and various specialized additives such as catalysts, fillers, and stabilizers. Raw material producers, often large global chemical conglomerates, exert significant influence over the cost structure of the final product due to price volatility and supply concentration. Specialty chemical manufacturers then transform these raw materials through complex polymerization and mixing processes into formulated adhesive products, focusing on R&D to optimize cure speed, viscosity, and environmental compliance, adding substantial intellectual value at this stage. This manufacturing phase is critical for achieving necessary industry certifications and performance metrics, such as Factory Mutual (FM) approval or local building code compliance.

The distribution channel plays a vital intermediary role, bridging the gap between sophisticated manufacturers and geographically dispersed construction sites. The distribution network typically involves both direct and indirect channels. Direct distribution is favored for large-volume, highly technical commercial projects, where manufacturers supply bulk adhesives directly to major roofing contractors, often accompanied by extensive technical support and training. This allows for tighter quality control and direct feedback loops. Conversely, the majority of the market utilizes indirect distribution through specialized construction material distributors, building supply wholesalers, and dedicated roofing material suppliers. These entities manage inventory, logistics, and sales to smaller and medium-sized contractors and residential builders, providing necessary convenience and accessibility, particularly for cartridge and canister formats.

The downstream segment of the value chain involves the final application and the end-users. Roofing contractors are the primary immediate customers, whose purchasing decisions are influenced by product performance, ease of application, compliance with project specifications, and installer familiarity. End-users, including commercial building owners, facility managers, and residential homeowners, are the ultimate beneficiaries, driving demand based on their requirements for thermal efficiency, durability, and long-term cost of ownership. The efficiency and success of the application determine the product’s reputation, creating a strong feedback loop that links end-user satisfaction directly back to manufacturer formulation and distribution quality. Successful value chain management requires robust raw material sourcing, efficient formulation, and a highly responsive, technically proficient distribution network.

Roofing Insulation Adhesives Market Potential Customers

The primary consumers and end-users of roofing insulation adhesives are diverse entities within the construction and infrastructure maintenance ecosystem, categorized mainly by the scale and nature of their roofing projects. Large Commercial Roofing Contractors represent the most significant potential customer segment globally. These firms execute massive, low-slope projects for commercial, industrial, and institutional buildings, demanding high volumes of two-component polyurethane adhesives and single-ply membrane bonding agents. Their decision-making criteria revolve around application speed, documented wind-uplift ratings, and seamless integration with specific membrane types (TPO, PVC, EPDM), often purchasing directly or through large regional distributors with established service agreements.

Secondly, Building Owners and Facility Managers of large institutional and industrial complexes (such as hospitals, universities, manufacturing plants, and data centers) are critical indirect customers. While they do not purchase the adhesive directly, they set the technical specifications and standards for refurbishment and new construction projects, often mandating the use of advanced, durable, and highly insulative systems that necessitate high-performance adhesives. Their primary concern is minimizing operational disruption, maximizing energy efficiency, and ensuring the longevity of the roof asset, driving demand for premium, warrantied adhesive systems with proven long-term performance data and low lifecycle costs. This segment is characterized by long planning cycles and a focus on total value rather than initial material cost.

Lastly, Residential and Small-to-Mid-Sized General Contractors constitute a substantial customer base, particularly in the steep-slope segment and smaller commercial re-roofing jobs. These contractors frequently utilize easily manageable products such as aerosol canisters or cartridges, prioritizing ease of handling, rapid setup, and versatility for bonding various materials like plywood, rigid foam boards, and vapor barriers. As the residential sector increasingly adopts energy-efficient building standards and specialized roofing materials (e.g., metal roofing or synthetic underlayments), the demand for contractor-friendly, fast-curing adhesives in smaller formats continues to grow, emphasizing the need for robust retail and specialized builder supply distribution channels targeting this fragmented customer base.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.9 Billion |

| Market Forecast in 2033 | USD 2.8 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sika AG, H.B. Fuller, Carlisle Companies Inc., GCP Applied Technologies, Henry Company, Arkema (Bostik), The Dow Chemical Company, Kemper System, Johns Manville, Accella Polyurethane Systems, Tremco Incorporated, GAF Materials Corporation, Firestone Building Products, Polyglass USA, ITW Polymers Sealants North America, ICP Group, Momentive Performance Materials, Huntsman Corporation, Henkel AG Co. KGaA, USG Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Roofing Insulation Adhesives Market Key Technology Landscape

The technology landscape for roofing insulation adhesives is characterized by continuous innovation aimed at enhancing performance, improving application efficiency, and ensuring environmental compliance. A dominant technological trend is the proliferation of high-performance, two-component polyurethane (2K PU) foam adhesives. These systems react rapidly upon mixing, providing immediate, high-strength bonds that can withstand severe wind uplift forces, a critical requirement for modern commercial structures. The 2K PU technology allows for solvent-free formulations, drastically reducing VOC emissions and addressing safety concerns. Furthermore, advancements in specialized nozzle and dispensing equipment technology are crucial, ensuring precise mixing ratios and uniform application coverage, which is vital for maintaining the structural integrity of the roof assembly and optimizing material usage on site.

Another significant technological focus is the development of moisture-cured single-component polyurethane (1K PU) and advanced moisture-reactive polyether-based hybrid adhesives. These products offer versatility and ease of use, as they cure utilizing ambient humidity, simplifying the installation process, particularly in remote or smaller-scale projects. Manufacturers are also heavily investing in micro-encapsulation technologies and phase-change materials (PCMs) integrated into the adhesive matrix. While still nascent, this innovation aims to create "smart adhesives" that can dynamically react to temperature changes, enhancing the thermal stability of the bond line over extreme temperature cycles, thereby extending the life of the insulation system and improving overall roof energy performance in harsh climates.

Furthermore, technology is playing a vital role in the environmental sustainability profile of these products. The shift from solvent-based systems to water-based acrylic or specialized high-solids adhesive chemistries is a major technological evolution driven by strict regulatory pressures in developed markets. Research is concentrating on formulating products with bio-based or recycled content without compromising adhesive strength or durability. The integration of QR codes and RFID tags on adhesive packaging is also part of the technology landscape, enabling contractors and inspectors to instantly access detailed technical data, safety sheets, and application instructions, streamlining quality assurance and traceability across large, complex construction projects. This technology integration is critical for maintaining high standards in a highly competitive and regulated environment.

Regional Highlights

Regional dynamics play a crucial role in shaping the demand for roofing insulation adhesives, influenced by varying climate conditions, energy regulations, and construction activity levels. North America (comprising the US and Canada) represents a dominant and mature market segment, characterized by rigorous building codes, widespread adoption of high-performance rigid insulation (Polyiso), and high labor costs that favor high-speed application systems like spray-foam or bead adhesives. The growth here is primarily driven by extensive re-roofing and retrofitting activities in the large commercial and industrial sectors, alongside the need for materials that comply with stringent FM and UL fire and wind uplift standards, fueling demand for premium, warranted adhesive systems.

Europe stands as another major market, defined by some of the world's most aggressive energy efficiency mandates (e.g., European Performance of Buildings Directive). This region exhibits high demand for low-VOC and sustainable adhesive solutions, often preferring water-based or advanced solvent-free PU chemistries. Germany, the UK, and France are leaders in adopting specialized flat roofing solutions and require adhesives that complement specific membrane types common in the European construction market. Regulatory alignment across the EU drives standardization in product development, emphasizing compliance with REACH and other environmental standards.

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR) during the forecast period. This rapid expansion is primarily attributable to massive urbanization, burgeoning infrastructure investment (commercial real estate, logistics hubs, and manufacturing facilities), particularly in China, India, and Southeast Asian nations. While price sensitivity remains a factor, the gradual introduction of stricter building and energy codes is compelling developers to utilize higher-quality insulation and adhesive systems. This region presents significant growth opportunities for international manufacturers willing to localize production and distribution strategies to address the varying construction practices and climatic extremes found across the sub-continent.

Latin America (LATAM) and the Middle East and Africa (MEA) are emerging markets experiencing substantial growth in commercial construction, fueled by economic diversification and major public infrastructure projects (e.g., Saudi Arabia’s Vision 2030 and UAE infrastructure developments). Demand in the MEA region is driven by the necessity for adhesives capable of performing reliably under extreme high temperatures and intense solar radiation, requiring formulations with enhanced UV stability and heat resistance. LATAM growth is more fragmented but is increasing with rising foreign investment in manufacturing and logistics, particularly in countries like Brazil and Mexico, creating a need for modern, durable roofing systems.

- North America: Market leader in high-performance PU and spray foam systems; driven by strict building codes and re-roofing projects.

- Europe: Focus on sustainability, low-VOC formulations, and adherence to aggressive energy efficiency mandates.

- Asia Pacific (APAC): Fastest-growing market driven by urbanization, commercial infrastructure development, and increasing energy regulation enforcement in key economies.

- Latin America (LATAM): Emerging market growth linked to industrial expansion and modernization of existing building stock.

- Middle East and Africa (MEA): Demand focused on high-temperature and UV-resistant adhesive technologies for new commercial and governmental construction.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Roofing Insulation Adhesives Market.- Sika AG

- H.B. Fuller

- Carlisle Companies Inc.

- GCP Applied Technologies

- Henry Company

- Arkema (Bostik)

- The Dow Chemical Company

- Kemper System

- Johns Manville

- Accella Polyurethane Systems

- Tremco Incorporated

- GAF Materials Corporation

- Firestone Building Products (part of Holcim)

- Polyglass USA, Inc.

- ITW Polymers Sealants North America

- ICP Group

- Momentive Performance Materials

- Huntsman Corporation

- Henkel AG Co. KGaA

- W. R. Meadows, Inc.

Frequently Asked Questions

Analyze common user questions about the Roofing Insulation Adhesives market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the key drivers for the increased adoption of roofing insulation adhesives over mechanical fasteners?

The key drivers include stringent energy efficiency regulations mandating continuous insulation layers, the ability of adhesives to eliminate thermal bridging caused by fasteners, superior performance in high wind uplift zones, and increased installation speed, particularly in large commercial, low-slope applications.

Which chemistry type dominates the roofing insulation adhesives market and why?

Polyurethane (PU) adhesives, particularly two-component foam systems, dominate the market due to their excellent bond strength across diverse substrates (concrete, steel, wood), rapid curing time, and solvent-free, low-VOC formulations which meet stringent performance and environmental standards in commercial roofing.

How is AI impacting the production and application of these adhesives?

AI is primarily impacting the sector through supply chain optimization, predicting raw material cost volatility, enhancing manufacturing quality control through machine learning, and aiding in predictive maintenance by analyzing installed roof performance data, leading to smarter, more resilient products.

What is the primary restraint affecting market growth and profitability?

The most significant restraint is the high volatility in the pricing and supply of key petrochemical raw materials, specifically diisocyanates (MDI/TDI) and polyols, which directly influences the manufacturing cost of polyurethane-based adhesive systems and introduces uncertainty into long-term contract pricing.

Which regional market is exhibiting the fastest growth rate for roofing adhesives?

The Asia Pacific (APAC) region is exhibiting the fastest growth rate, driven by accelerated commercial and industrial construction projects, rapid urbanization, and the gradual adoption and enforcement of modern energy-saving building codes across major economies like China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager