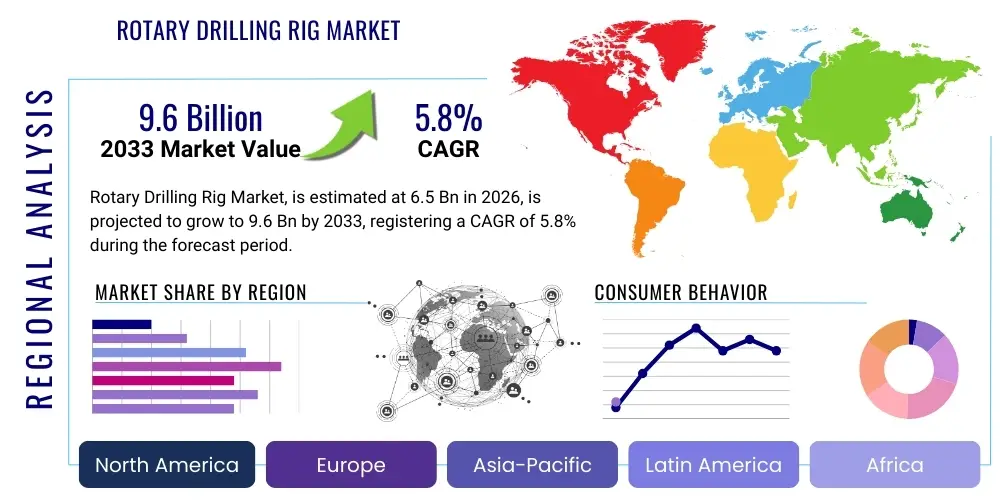

Rotary Drilling Rig Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443243 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Rotary Drilling Rig Market Size

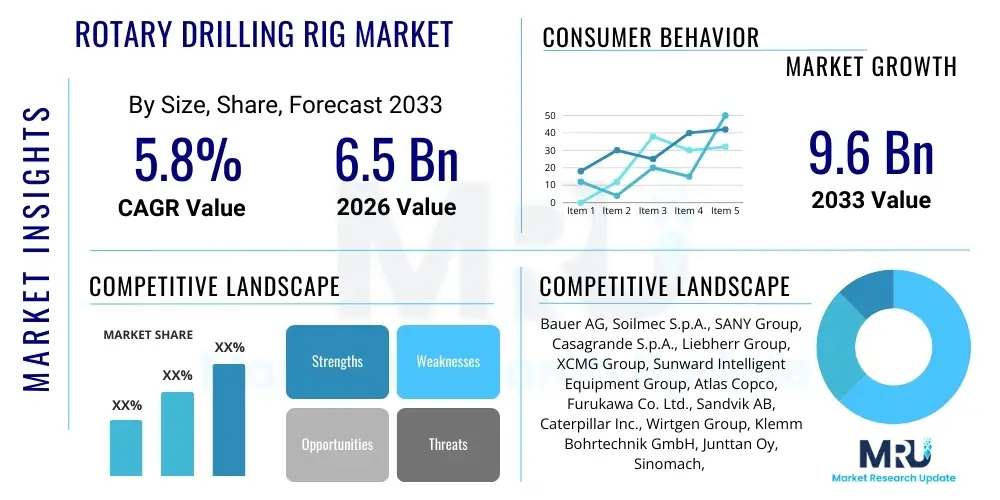

The Rotary Drilling Rig Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 6.5 Billion in 2026 and is projected to reach USD 9.6 Billion by the end of the forecast period in 2033. This robust expansion is primarily driven by significant global investments in civil infrastructure, deep foundation projects for high-rise construction, and the sustained demand from the mining and geotechnical engineering sectors. The specialized nature of rotary drilling rigs, offering high precision and efficiency in diverse geological conditions, positions them as indispensable assets across various capital-intensive industries.

Rotary Drilling Rig Market introduction

The Rotary Drilling Rig Market encompasses the manufacturing, distribution, and utilization of heavy-duty machinery designed to bore vertical or angled holes into the earth's surface using a rotating cutting tool, typically for geotechnical investigation, foundation construction, mining exploration, or shallow oil and gas exploration. These powerful machines employ advanced hydraulic and electrical systems to deliver high torque and downforce, enabling penetration through hard rock formations and complex subsurface layers. The primary product categories include hydraulic rotary rigs, truck-mounted rigs, and crawler-mounted rigs, catering to different mobility and depth requirements across diverse project scales.

Major applications of rotary drilling rigs span several critical industries, notably in urban development for constructing deep foundations, pilings, and retaining walls necessary for bridges, skyscrapers, and tunnels. They are also crucial in the mining sector for exploration drilling and geotechnical sampling, ensuring safe and efficient resource extraction planning. Furthermore, the market benefits from increasing global energy demand, where these rigs are essential for geothermal well drilling and specific shallow conventional oil and gas operations. The intrinsic benefits of using modern rotary drilling rigs include significantly reduced drilling time, improved hole quality, enhanced safety features through automation, and higher operational efficiency compared to older percussion or cable tool methods.

The core driving factors fueling the market expansion are the exponential growth in urbanization across developing economies, necessitating massive infrastructure investments, particularly in Asia Pacific and the Middle East. Government initiatives supporting renewable energy projects, such as geothermal energy, also contribute substantially to demand. Additionally, technological advancements focused on integrating GPS positioning, real-time monitoring, and modular design are improving rig utilization rates and reducing environmental impact, making sophisticated rotary drilling rigs an attractive investment for contracting and exploration companies worldwide.

Rotary Drilling Rig Market Executive Summary

The global Rotary Drilling Rig Market is experiencing a substantial uplift, characterized by robust business trends focusing on digitalization and operational efficiency. Contractors are increasingly favoring automated and semi-automated hydraulic rotary rigs that offer enhanced precision and reduced labor costs. Key business trends include the adoption of 'Drilling as a Service' models and strong merger and acquisition activities aimed at consolidating market share and achieving greater operational scale. The shift toward sustainable practices is also notable, pushing manufacturers to develop rigs with lower fuel consumption and reduced noise emissions, aligning with stringent environmental regulations being implemented globally. These technological and operational shifts are crucial for maintaining competitiveness in a capital-intensive industry.

Regionally, Asia Pacific maintains its dominance due to unprecedented infrastructure spending and rapid urbanization in countries like China, India, and Southeast Asian nations, generating consistent high demand for foundation and geotechnical drilling. North America and Europe demonstrate mature market characteristics, focusing on technological upgrades, replacing older fleet models, and investing heavily in specialized rigs for complex urban drilling and environmental remediation projects. Meanwhile, the Middle East and Africa are witnessing renewed investment in oil and gas infrastructure and mining exploration, providing significant opportunities for heavy-duty rotary rigs, although geopolitical risks remain a factor influencing the pace of growth in certain sub-regions.

Segment trends indicate a strong preference for large-diameter rotary drilling rigs, reflecting the increasing depth and size requirements of modern infrastructure projects, particularly deep foundations for high-speed rail and large commercial buildings. The crawler-mounted segment dominates due to superior stability and mobility on varied terrain common in construction and mining sites. Application-wise, the infrastructure and construction sector remains the largest end-user, but the mining and quarrying sector is projected to exhibit the highest CAGR as resource exploration intensifies globally. Furthermore, the rising adoption of rental fleets over outright purchase is transforming procurement models, especially among small to medium-sized enterprises seeking flexibility and reduced capital expenditure.

AI Impact Analysis on Rotary Drilling Rig Market

Users frequently inquire about how Artificial Intelligence (AI) and Machine Learning (ML) are transforming traditional rotary drilling processes, focusing intensely on efficiency gains, predictive maintenance capabilities, and enhanced safety protocols. Common questions revolve around the practical integration of AI-driven drilling parameters optimization, the role of digital twins in simulating complex geological formations, and the financial return on investment (ROI) associated with implementing such sophisticated systems. Users are seeking clarity on the transition from manual rig operation to fully automated or robotic drilling systems, and the subsequent impact on labor skills and workforce structure. The overriding theme is the expectation that AI will deliver superior operational precision, minimize costly downtime, and fundamentally alter project timelines and overall risk assessment in geotechnical and exploration activities.

The integration of AI into the Rotary Drilling Rig Market marks a paradigm shift towards intelligent drilling operations, moving beyond simple automation to predictive control and real-time decision making. AI algorithms are now routinely analyzing vast streams of telemetry data—including torque, pressure, rotational speed, and vibration signatures—to dynamically optimize drilling parameters as geological conditions change. This immediate, data-driven adjustment not only accelerates the drilling process but also significantly reduces wear and tear on expensive components like drill bits and motors, maximizing the lifespan of the equipment. Furthermore, sophisticated ML models are being trained on historical project data to improve the accuracy of geotechnical site investigations, providing contractors with clearer foresight into potential subsurface obstacles before drilling commences.

Crucially, AI applications are fundamentally enhancing safety and reliability. Predictive maintenance systems utilizing AI monitor subtle anomalies in machine performance, accurately forecasting potential equipment failures days or even weeks in advance. This allows maintenance teams to schedule interventions proactively, eliminating the high costs and safety risks associated with sudden breakdowns during operation. Moreover, AI-powered vision systems are being deployed on drilling sites to monitor site safety, detect proximity hazards, and ensure strict adherence to operational procedures, minimizing human error and providing an additional layer of protection for site personnel. The commercial imperative driving this adoption is clear: AI translates directly into fewer operational stops, lower operational expenditure, and demonstrably safer working environments.

- Enhanced Predictive Maintenance: AI algorithms analyze sensor data to forecast component failure, minimizing unplanned downtime.

- Automated Drilling Parameter Optimization: Real-time adjustment of feed rate, rotation speed, and pressure based on immediate subsurface feedback.

- Improved Geological Modeling: Machine Learning processes seismic and logging data to create highly accurate 3D models of strata, reducing exploration risk.

- Robotics and Autonomous Control: Development of fully automated drilling cycles, reducing reliance on human intervention in hazardous environments.

- Digital Twin Technology: Creation of virtual rig models for simulating drilling scenarios, operator training, and performance benchmarking.

- Increased Fuel Efficiency: AI-driven power management systems optimize engine load, resulting in measurable reduction in fuel consumption and carbon footprint.

DRO & Impact Forces Of Rotary Drilling Rig Market

The Rotary Drilling Rig Market is significantly shaped by a dynamic interplay of Drivers, Restraints, and Opportunities (DRO), which collectively dictate its growth trajectory and competitive landscape. The primary Drivers stem from global urbanization trends, which necessitate extensive infrastructure development, including deep foundations for high-rise buildings and major transport networks. Simultaneously, the persistent worldwide demand for mineral resources and energy, specifically in developing regions, ensures a constant need for efficient rotary rigs in mining exploration and shallow oil/gas activities. Technological innovations, such particularly in hydraulic efficiency and digital integration, serve as internal market drivers, enhancing the performance and attractiveness of new machinery. These forces exert substantial positive pressure on market growth, encouraging fleet expansion and modernization across all major operational segments.

However, the market faces significant Restraints that temper this expansion. High initial capital expenditure required for purchasing and maintaining advanced rotary drilling rigs poses a barrier to entry, especially for smaller contractors. Furthermore, the volatility of commodity prices, particularly in the oil and gas and mining sectors, can lead to sudden pauses or cancellations of large-scale projects, directly impacting equipment procurement cycles. Strict environmental regulations regarding noise, emissions, and soil disturbance, though necessary, impose additional compliance costs on operators and manufacturers, requiring continuous investment in more eco-friendly equipment. The shortage of highly skilled operators capable of utilizing sophisticated, digitally-enabled rigs represents another crucial operational bottleneck, restricting the full utilization of modern machinery.

Opportunities for growth are predominantly centered around the rising adoption of geothermal energy infrastructure globally, which relies heavily on specialized rotary drilling technology for deep borehole creation. The burgeoning trend of equipment rental and leasing offers financial flexibility, broadening the customer base by making advanced equipment accessible without heavy capital outlay. Furthermore, focused efforts on developing smart drilling technology—including IoT sensors, real-time telemetry, and integrated diagnostics—promise to redefine operational standards, reduce operational expenditure (OPEX), and open new avenues for service-based revenue streams. The collective impact forces highlight a market driven by necessity (infrastructure/energy) but moderated by high investment costs and operational complexities, pushing stakeholders toward efficiency-focused technological solutions to unlock sustainable growth.

Segmentation Analysis

The Rotary Drilling Rig Market is systematically segmented based on rig type, application, sales channel, and maximum drilling depth, providing a granular view of demand patterns and specific technological requirements across different user groups. This segmentation is crucial for market participants to tailor their product offerings, marketing strategies, and distribution networks efficiently. The categorization by rig type differentiates between hydraulic rotary rigs, which dominate construction foundation applications due to their precision and maneuverability, and larger conventional rigs used in heavy mining or deep geotechnical investigation. Understanding these segment dynamics helps manufacturers prioritize R&D investment toward features that offer the greatest competitive advantage within their target end-use sector.

Application-based segmentation clearly delineates the market landscape, highlighting the differing needs of the construction/infrastructure sector versus the mining/quarrying and oil/gas exploration segments. For instance, foundation drilling requires high torque and stability for large-diameter holes, while mineral exploration often necessitates portability and versatility for remote site operations. Geographic segmentation, detailed elsewhere, provides critical insights into regional regulatory environments and predominant project types. Overall, the market's structure reflects a strong correlation between segment specifications (e.g., maximum torque, depth capacity) and the end-user's primary operational goals, ensuring that highly specialized equipment meets precise industry needs. The consistent trend is toward modular and highly adaptable rigs capable of servicing multiple segments effectively.

- By Rig Type:

- Hydraulic Rotary Drilling Rigs

- Conventional Rotary Drilling Rigs (Truck-Mounted and Crawler-Mounted)

- Micro-Piling Rigs

- CFA (Continuous Flight Auger) Rigs

- By Application:

- Construction and Infrastructure (Foundations, Bridges, Tunnels)

- Mining and Quarrying (Exploration, Blasting Holes)

- Oil and Gas (Shallow Drilling, Geothermal Wells)

- Geotechnical and Environmental Projects

- By Maximum Drilling Depth:

- Shallow Depth Rigs (Up to 50 meters)

- Medium Depth Rigs (50 meters to 300 meters)

- Deep Depth Rigs (Above 300 meters)

- By Sales Channel:

- OEM (Original Equipment Manufacturer) Sales

- Aftermarket Sales (Parts and Service)

- Rental and Leasing Services

Value Chain Analysis For Rotary Drilling Rig Market

The Value Chain for the Rotary Drilling Rig Market begins with upstream activities involving the sourcing and processing of core raw materials, predominantly high-grade steel alloys, specialized hydraulic components, and advanced electronic controls. Key upstream suppliers include steel mills, forging companies, and specialized hydraulic cylinder manufacturers. Rig manufacturers rely heavily on these suppliers for high-quality, durable components that can withstand extreme operational stresses and harsh environments. Efficiency and quality control at this stage are paramount, as the integrity of the final product—the drilling rig—depends entirely on the foundational quality of its constituent parts. Manufacturers often engage in strategic, long-term partnerships with critical upstream suppliers to ensure stable pricing and supply chain resilience, especially given the current volatility in global commodity markets.

The midstream section is dominated by the Original Equipment Manufacturers (OEMs) responsible for the design, assembly, and testing of the final rotary drilling rigs. This stage involves significant R&D investment focused on integrating advanced technologies such as telemetry, automation software, and improved engine efficiency. Manufacturing processes are complex, requiring specialized fabrication capabilities and adherence to stringent safety and quality certifications (e.g., ISO standards, CE marking). Distribution channels then manage the flow of finished equipment to the end-users. Direct sales are common for large, customized orders, allowing manufacturers to maintain close relationships and offer tailored support. However, indirect channels, involving authorized dealers and specialized equipment rental companies, play a crucial role in reaching geographically dispersed or smaller contractors who prefer leasing options, providing necessary local inventory and after-sales support.

Downstream activities center around the end-use applications in construction, mining, and energy sectors, followed by comprehensive after-sales support, maintenance, and service provision. The quality of aftermarket services—including the supply of genuine spare parts, rapid repair services, and technical training—is a major differentiator and a significant revenue stream for OEMs. The lifecycle management of these highly valuable assets is critical, extending their operational life through refurbishments and major overhauls. This comprehensive value chain is characterized by high capital intensity and a critical dependency on specialized technical expertise at every stage, from material specification to on-site operational support and eventual decommissioning, emphasizing the importance of integrated service offerings to optimize machine uptime.

Rotary Drilling Rig Market Potential Customers

The primary customers for the Rotary Drilling Rig Market are characterized by large capital expenditure budgets and a consistent need for high-performance subsurface penetration capabilities. Geotechnical engineering firms and specialized foundation contractors represent a core customer base, relying on these rigs for critical infrastructure support, including piling for bridges, ports, and high-rise developments. These customers prioritize precision, reliability, and the ability to operate efficiently in densely populated urban environments, often demanding rigs with lower noise profiles and advanced vibration control systems. Their purchasing decisions are heavily influenced by project complexity, regulatory requirements, and the need for equipment that minimizes project risk and adheres strictly to demanding deadlines.

Another significant segment comprises major mining corporations and mineral exploration companies globally. These entities utilize rotary drilling rigs extensively for defining resource boundaries, exploratory drilling, and creating blast holes in both surface and underground mining operations. For this customer group, key purchasing criteria include rugged durability, ease of transportability to remote locations, and the capability to drill deep holes quickly under variable geological conditions. The global resurgence in demand for critical minerals, such as copper, lithium, and rare earths, is driving substantial procurement activity within this segment. These companies require robust, often crawler-mounted rigs that can withstand continuous, demanding operation far from maintenance hubs, making reliability a non-negotiable factor.

Furthermore, state-owned and private energy companies focused on developing geothermal resources and conducting shallow conventional oil and gas drilling also constitute essential customers. As governments worldwide push for decarbonization, investment in geothermal energy projects is increasing, thereby boosting demand for deep-drilling rotary rigs capable of handling high temperatures and pressures. Additionally, heavy equipment rental companies are emerging as crucial intermediaries, purchasing large fleets of standardized and versatile rigs to cater to the fluctuating needs of smaller contractors and niche projects. These rental firms prioritize equipment with high resale value, ease of maintenance, and broad applicability across different foundation and drilling tasks, effectively democratizing access to expensive machinery for the wider construction ecosystem.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 6.5 Billion |

| Market Forecast in 2033 | USD 9.6 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bauer AG, Soilmec S.p.A., SANY Group, Casagrande S.p.A., Liebherr Group, XCMG Group, Sunward Intelligent Equipment Group, Atlas Copco, Furukawa Co. Ltd., Sandvik AB, Caterpillar Inc., Wirtgen Group, Klemm Bohrtechnik GmbH, Junttan Oy, Sinomach, Tamrock, Epiroc AB, Aichi Corporation, Tescar S.r.l., Changsha Zoomlion Heavy Industry Science and Technology Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Rotary Drilling Rig Market Key Technology Landscape

The technological landscape of the Rotary Drilling Rig Market is evolving rapidly, centered on achieving higher efficiency, enhanced safety, and reduced environmental impact. Modern rigs are increasingly integrating sophisticated hydraulic systems that allow for precise control over drilling parameters, maximizing penetration rates while minimizing energy loss. Crucially, the shift from traditional mechanical drives to advanced electro-hydraulic systems facilitates smoother operation, requires less maintenance, and provides the foundation necessary for complete operational automation. Engine technology is also seeing significant upgrades, with manufacturers adopting Tier 4 Final/Stage V compliant engines to meet stringent global emission standards, often coupled with smart power management software to optimize fuel consumption based on real-time load demands. This focus on efficiency not only cuts operating costs but also addresses the industry's commitment to sustainability.

Digitalization forms the cornerstone of contemporary rig technology, moving beyond basic GPS tracking to encompass comprehensive telemetry and remote diagnostics capabilities. Advanced data acquisition systems continuously log parameters such as drilling depth, inclination, tool wear, and formation resistance, transmitting this data instantly to centralized operational hubs. This connectivity enables remote monitoring by experts, facilitating proactive troubleshooting and optimization of drilling programs without requiring on-site supervision. Furthermore, the development of sophisticated HMI (Human-Machine Interface) systems within the operator cabin provides intuitive, touch-screen control panels that simplify complex operations and improve operator awareness, significantly contributing to both safety and productivity gains. The underlying philosophy is to make high-performance rigs accessible and manageable through intelligent, user-friendly digital interfaces.

The most transformative technologies involve the application of sensors and automation for precise execution. Integrated tilt sensors and angle monitoring systems ensure that piles and boreholes are drilled to exact specifications, a non-negotiable requirement for critical infrastructure projects. Automation software is now capable of executing repetitive tasks, such as pipe handling and tool changes, autonomously, freeing the operator to focus on geological challenges and site safety. The development and deployment of specialized drilling tools utilizing high-strength, wear-resistant materials, often incorporating tungsten carbide composites, further extend the life of drilling components, allowing for more aggressive penetration rates in hard rock formations. These combined technological advances—from materials science to deep learning algorithms—are fundamentally redefining the performance envelope and economic viability of modern rotary drilling operations.

Regional Highlights

The regional dynamics of the Rotary Drilling Rig Market illustrate a diverse landscape driven by varying levels of infrastructure maturity, geological resource dependence, and government spending priorities. Asia Pacific (APAC) stands out as the largest and fastest-growing market, largely fueled by aggressive urbanization and massive state-sponsored infrastructure projects, particularly in India, China, and Southeast Asian economies like Indonesia and Vietnam. The demand here is overwhelming for large and medium-sized crawler-mounted hydraulic rigs suitable for deep foundation work in rapidly expanding metropolitan areas. Governments in this region continue to allocate substantial funds to high-speed rail, port expansions, and industrial zone development, ensuring sustained demand throughout the forecast period, making it a critical region for global manufacturers.

North America and Europe represent mature markets characterized by replacement demand, technological sophistication, and a high focus on specialized applications. In North America, demand is stable, driven by the replacement of aging equipment fleets, significant investment in civil remediation projects, and continued—albeit fluctuating—activity in unconventional resource exploration requiring specialized drilling techniques. European demand is bolstered by stringent environmental standards, pushing operators towards low-emission, highly automated rigs used in complex urban foundation projects and growing geothermal energy installation. These regions prioritize quality, efficiency, and adherence to environmental regulations, rewarding manufacturers who offer advanced automation and sustainability features.

The Middle East and Africa (MEA) region presents significant growth potential, underpinned by substantial capital investments in new oil and gas infrastructure, diversification into mining, and ambitious mega-projects in countries such as Saudi Arabia, UAE, and Qatar. While the region’s oil and gas sector remains a key consumer for drilling rigs, the increasing focus on developing foundation structures for smart cities and extensive transportation corridors is generating secondary demand. Latin America, meanwhile, is recovering, with mining exploration in countries like Chile and Peru being a primary driver, alongside necessary infrastructure upgrades. However, political instability and economic uncertainties in some nations temper the overall growth rate in this sub-continent, requiring careful strategic investment by market players.

- Asia Pacific (APAC): Dominates the market due to colossal government infrastructure spending, rapid urbanization, and high demand for deep foundation work in construction sectors across China, India, and Southeast Asia.

- North America: Focuses on fleet replacement, sophisticated deep foundation projects, and niche drilling for geothermal and environmental remediation, prioritizing advanced automation and digital integration.

- Europe: Characterized by stringent environmental mandates, driving demand for low-emission, highly efficient rigs used in challenging urban construction and renewal projects, particularly in Germany and the Nordic countries.

- Middle East & Africa (MEA): Growth driven by large-scale commercial and infrastructure mega-projects (e.g., smart city development) and ongoing investment in the energy and mining sectors across Gulf Cooperation Council (GCC) countries and parts of Africa.

- Latin America: Market growth primarily supported by stable mining operations (copper, iron ore) and gradual investment in public infrastructure modernization, though vulnerable to economic volatility.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Rotary Drilling Rig Market.- Bauer AG

- Soilmec S.p.A.

- SANY Group

- Casagrande S.p.A.

- Liebherr Group

- XCMG Group

- Sunward Intelligent Equipment Group

- Atlas Copco

- Furukawa Co. Ltd.

- Sandvik AB

- Caterpillar Inc.

- Wirtgen Group

- Klemm Bohrtechnik GmbH

- Junttan Oy

- Sinomach

- Tamrock

- Epiroc AB

- Aichi Corporation

- Tescar S.r.l.

- Changsha Zoomlion Heavy Industry Science and Technology Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Rotary Drilling Rig market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Rotary Drilling Rig Market?

The Rotary Drilling Rig Market is anticipated to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033, driven largely by global infrastructure development and increased investments in foundation drilling projects.

Which application segment holds the largest share in the market?

The Construction and Infrastructure segment currently accounts for the largest market share, due to persistent global urbanization trends and the corresponding demand for deep foundations for high-rise buildings, bridges, and transport networks.

How is technological advancement impacting rotary drilling rig operations?

Technology is significantly impacting operations through the integration of AI for predictive maintenance, advanced hydraulic systems for better precision, and telemetry for real-time remote monitoring, resulting in reduced downtime and enhanced safety.

Which region is expected to dominate market growth and why?

Asia Pacific (APAC) is projected to dominate market growth, primarily due to large-scale infrastructure investments, massive government spending on urbanization projects, and high demand from rapidly developing economies like China and India.

What are the main restraints affecting the adoption of new rotary drilling rigs?

Key restraints include the extremely high initial capital cost of advanced rotary drilling equipment, the volatility of commodity prices influencing project lifecycles, and a critical shortage of skilled operators and maintenance personnel capable of managing complex, automated rigs.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager