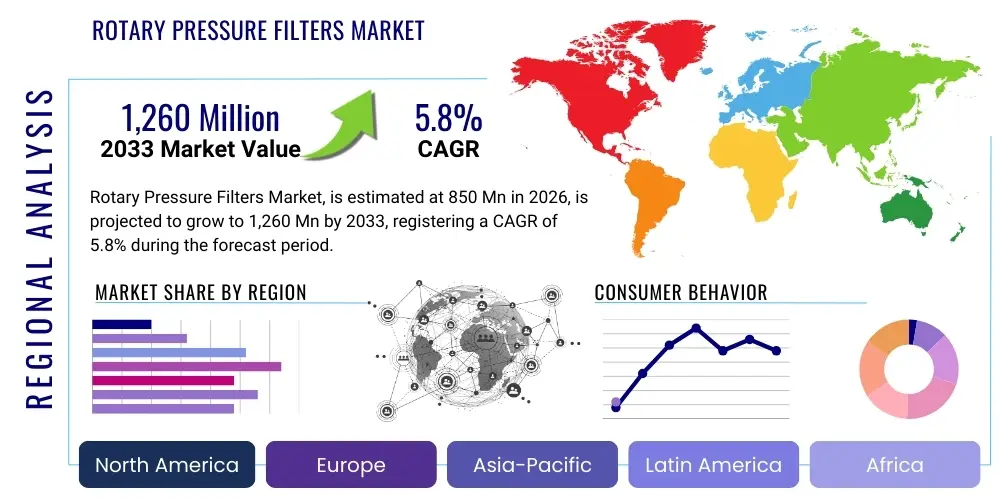

Rotary Pressure Filters Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442696 | Date : Feb, 2026 | Pages : 242 | Region : Global | Publisher : MRU

Rotary Pressure Filters Market Size

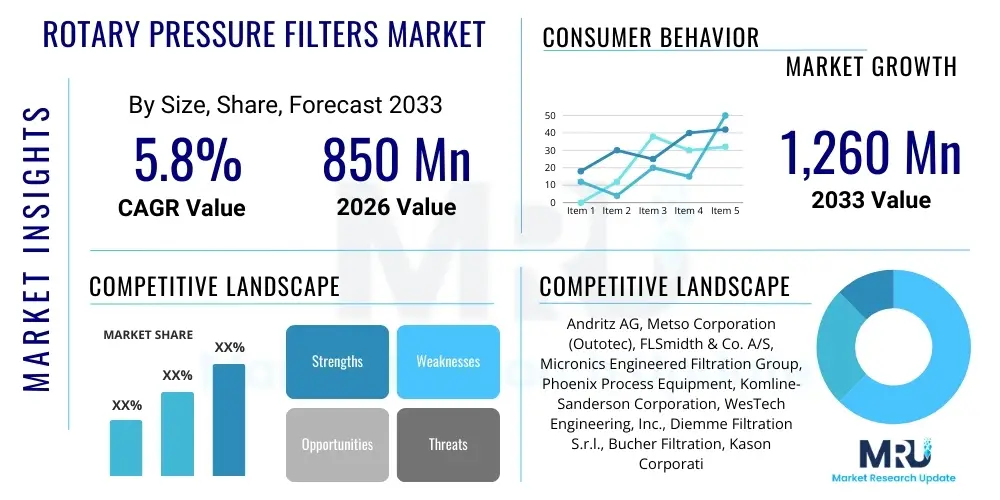

The Rotary Pressure Filters Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. This robust growth trajectory is underpinned by increasing industrial demands for efficient solid-liquid separation processes, particularly within the mining, chemical, and pharmaceutical sectors. The market expansion is further fueled by stringent environmental regulations necessitating higher filtration efficiency and minimal residual moisture content in waste streams.

The market is estimated at USD 850 Million in 2026, driven primarily by investments in mineral processing plants across Asia Pacific and modernization initiatives in established industrial economies. Rotary pressure filters offer superior performance compared to conventional vacuum filters, leading to higher throughput and reduced energy consumption, making them a preferred choice for large-scale operations.

By the end of the forecast period in 2033, the market is projected to reach USD 1,260 Million. This valuation reflects anticipated technological advancements, including automation integration and the development of filters capable of handling highly abrasive or corrosive slurries. Sustained demand from the hydrometallurgy sector, coupled with expansion in municipal wastewater treatment facilities utilizing advanced dewatering techniques, will be critical contributors to achieving this forecasted market size.

Rotary Pressure Filters Market introduction

The Rotary Pressure Filters Market encompasses specialized industrial machinery designed for highly efficient solid-liquid separation, particularly where high driving forces are required to achieve low residual moisture content in the filter cake. These systems operate under elevated pressure differentials, significantly enhancing the filtration rate and the degree of dewatering compared to standard vacuum or gravity filtration methods. Rotary pressure filters are pivotal in continuous processes requiring consistent and high-quality product output, ensuring optimal resource recovery and minimizing environmental discharge volumes. The core mechanism involves a rotary body, such as a drum or disc, where filtration takes place under controlled pressure within an enclosed casing.

Major applications of rotary pressure filters span across several heavy industries, including mineral and metallurgy (e.g., copper concentrate, iron ore fines), chemical processing (e.g., pigments, specialty chemicals), and life sciences (e.g., bulk pharmaceuticals, fermentation broth separation). Their capability to handle fine particles and achieve extremely dry filter cakes makes them indispensable in operations focused on minimizing subsequent thermal drying costs or meeting strict regulatory standards for material purity and waste disposal. Benefits driving their adoption include reduced energy consumption per unit of dry solid produced, enhanced throughput rates, and the ability to process difficult-to-filter materials that would clog conventional filters.

The primary driving factors for the Rotary Pressure Filters Market include the global emphasis on resource efficiency and sustainability, which mandates minimal moisture content in mineral concentrates to reduce transportation costs and energy required for smelting. Furthermore, rapid industrialization, particularly in emerging economies, is boosting the demand for high-performance filtration equipment in new infrastructure projects and process upgrades. Technological innovations, such as advanced instrumentation for process control and the use of corrosion-resistant materials for construction, are also contributing significantly to market growth by expanding the operational envelope of these filters into more challenging applications.

Rotary Pressure Filters Market Executive Summary

The Rotary Pressure Filters Market is characterized by robust business trends centered on technological specialization and automation integration. Key market participants are focusing intensely on developing modular and scalable filtration systems that offer superior flexibility and reduced maintenance downtime. There is a discernible shift towards solutions tailored for specific high-value materials, such as ultrafine mineral concentrates and high-purity chemical compounds, driving up the average selling price of advanced units. Strategic partnerships between equipment manufacturers and engineering, procurement, and construction (EPC) firms are becoming crucial for accessing large-scale mining and chemical plant expansion projects globally, underpinning sustained revenue growth throughout the forecast period.

Regionally, the Asia Pacific (APAC) continues to dominate the market growth trajectory, fueled by extensive investments in mining activities (e.g., Indonesia, Australia) and the rapid expansion of the chemical and pharmaceutical manufacturing bases in China and India. North America and Europe, while mature markets, exhibit strong demand for replacement and upgrade cycles, driven primarily by stringent environmental protection standards that necessitate highly efficient dewatering technologies. Latin America, rich in mineral resources, presents significant opportunities, particularly in Chile and Peru, where major copper and lithium mining projects are adopting pressure filtration to optimize operational costs and water management.

Segment trends reveal that the mining and metallurgy application segment remains the largest revenue contributor, owing to the volume of materials processed and the need for high-quality concentrates. By filter type, the Rotary Disc Pressure Filter segment is expected to show accelerated growth due to its high filtration area-to-footprint ratio, making it ideal for large-capacity applications where floor space is limited. Furthermore, the trend toward continuous operation filters is increasingly replacing batch systems across many industries, driving the demand for high-reliability, automated rotary pressure filter systems that minimize human intervention and maximize operational uptime, thereby optimizing labor costs and process consistency.

AI Impact Analysis on Rotary Pressure Filters Market

User inquiries regarding AI's impact on Rotary Pressure Filters primarily revolve around optimizing filtration cycles, predictive maintenance, and enhancing slurry characteristics sensing. Common concerns focus on how AI can autonomously adjust parameters like pressure differential, rotation speed, and washing cycles in real-time to maintain peak efficiency despite variations in feed material composition (e.g., particle size distribution, solid concentration). Users are keenly interested in reducing filter cloth consumption and minimizing unscheduled downtime through AI-driven diagnostics. Expectations are high that AI will transition rotary pressure filters from reactive maintenance schedules to highly predictive and prescriptive operational models, maximizing throughput and reducing operational expenditure (OPEX).

AI and Machine Learning (ML) are set to revolutionize the efficiency and reliability of rotary pressure filtration systems. By integrating sensor data—such as torque measurements, cake resistance, moisture probes, and flow rates—AI algorithms can construct complex operational models that predict performance degradation far in advance. This capability allows operators to schedule maintenance precisely when needed, rather than relying on fixed time intervals or post-failure diagnostics. Moreover, sophisticated ML models can dynamically manage the filtration process, adjusting the dewatering time based on real-time slurry analysis to achieve consistent residual moisture levels, which is crucial for subsequent processing steps like drying or pelletization.

The implementation of AI also extends to optimizing energy consumption. Rotary pressure filters, being high-energy systems, benefit significantly from AI control systems that minimize energy expenditure by optimizing pump and motor operation based on current filtration load rather than fixed maximum settings. Furthermore, AI-driven digital twins of the filtration unit can simulate various operational scenarios, allowing engineers to test process changes virtually before deployment, leading to safer, more efficient process scale-ups and reduced commissioning times for new installations, thereby offering a significant competitive advantage to manufacturers adopting these technologies.

- AI-driven Predictive Maintenance: Forecast component failures (e.g., seals, bearings, filter cloth) reducing unplanned downtime by up to 30%.

- Real-time Process Optimization: Automated adjustment of pressure, speed, and wash cycles based on dynamic slurry input characteristics, ensuring consistent cake quality.

- Energy Consumption Reduction: Optimization of pump and motor usage based on instantaneous filtration resistance, minimizing OPEX.

- Digital Twin Simulation: Creation of virtual models for risk-free testing of new process parameters and operator training.

- Enhanced Data Analytics: Converting operational data into actionable insights regarding long-term equipment health and process bottlenecks.

- Slurry Characterization: Using AI to analyze sensor data for rapid identification of changes in feed material properties, ensuring optimal filter performance.

DRO & Impact Forces Of Rotary Pressure Filters Market

The Rotary Pressure Filters Market is powerfully influenced by a combination of drivers and opportunities stemming from global industrial growth and environmental mandates, balanced against significant operational restraints. Key drivers include stringent environmental regulations demanding lower moisture content in industrial waste and concentrate streams, directly increasing the utility and necessity of pressure filters over less efficient vacuum systems. Opportunities arise from technological integration, such as the adoption of Industry 4.0 principles, allowing manufacturers to offer smart, highly efficient, and networked filtration units. However, high initial capital expenditure and the complexity of maintenance requirements act as significant restraints, particularly for small and medium-sized enterprises (SMEs). The interplay of these forces dictates market trajectory, pushing innovation while necessitating robust lifecycle support from key vendors.

Impact forces in this market are significant and multifaceted. On the demand side, the rapid growth of the electric vehicle (EV) sector drives the need for critical minerals like nickel, cobalt, and lithium, where pressure filtration is essential for high-purity concentrate production. This sustained demand provides a strong positive impact. Conversely, fluctuating commodity prices, particularly in the mining sector, can lead to deferred capital investment decisions, creating a cyclical impact on equipment sales. The regulatory environment exerts a structural impact; for instance, European Union directives on industrial emissions and water quality mandate best available technologies (BAT), which often point towards pressure filtration solutions, solidifying their market position.

Further analysis reveals that the continuous innovation in filter media technology represents a powerful opportunity. Development of durable, high-permeability cloths that resist blinding and chemical attack broadens the application scope of rotary pressure filters into niche markets such as highly corrosive chemical processes or difficult biological slurries. The most impactful restraint remains the highly technical expertise required for system operation and troubleshooting, creating a barrier to entry for widespread adoption in regions lacking specialized labor. Mitigating this restraint through advanced human-machine interfaces (HMIs) and remote diagnostic capabilities is critical for unlocking future market potential.

Segmentation Analysis

The Rotary Pressure Filters Market is systematically segmented based on Type, Operation, Application, and Region, providing a detailed view of demand patterns and growth pockets across the industrial landscape. Segmentation by type differentiates between rotary disc filters, which offer high capacity in a small footprint, and rotary drum filters, known for their robustness and versatility across various slurry types. The operational segmentation distinguishes between continuous systems, preferred for large-volume, consistent processes, and batch systems, typically used for smaller-scale or specialized, low-volume productions. The application segmentation highlights the critical reliance of sectors like mining and chemicals on these high-performance dewatering solutions.

The structure of the segmentation reflects the heterogeneity of industrial needs. The dominant application area, Mining & Metallurgy, drives the demand for high-throughput, rugged units, whereas the Pharmaceuticals segment requires ultra-hygienic and specialized materials of construction, often leading to higher unit costs. Understanding these segments is crucial for manufacturers to tailor their R&D efforts and marketing strategies, focusing on features like corrosion resistance for chemical applications or maximum dry solids content for mineral processing. Regional segmentation emphasizes the geographical distribution of industrial activity and resource extraction, with APAC currently showing the most dynamic expansion due to ongoing infrastructure development.

- By Type:

- Rotary Drum Pressure Filters

- Rotary Disc Pressure Filters

- Rotary Table Pressure Filters

- Other Types (e.g., Belt Pressure Filters)

- By Operation:

- Continuous Filters

- Batch Filters

- By Application:

- Mining & Metallurgy (e.g., Concentrate Dewatering, Tailings Management)

- Chemical Processing (e.g., Pigments, Fertilizers, Chlor-Alkali)

- Pharmaceuticals & Biotechnology

- Food & Beverage (e.g., Starch, Sugar Refining)

- Wastewater and Sludge Treatment

- Pulp and Paper

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Rotary Pressure Filters Market

The value chain for the Rotary Pressure Filters Market begins with upstream activities involving the sourcing of highly specialized raw materials, primarily high-grade stainless steel, corrosion-resistant alloys, and advanced polymer filter media. Key upstream players include specialized metal fabricators and filter cloth manufacturers who supply components that must withstand high pressures, abrasive slurries, and chemical attack. The complexity and precision required in manufacturing the pressure vessel and internal components, such as the rotary manifold and sealing elements, necessitate stringent quality control and specialized engineering expertise, differentiating top-tier original equipment manufacturers (OEMs) from smaller competitors.

The midstream stage is dominated by the OEMs themselves, who undertake design, assembly, and integration of the complex mechanical, hydraulic, and control systems. This stage adds the most significant value through proprietary intellectual property related to filter design, efficiency optimization algorithms, and automation features. Distribution channels are typically hybrid; direct sales are predominant for large, custom-engineered projects in the mining and high-end chemical sectors, where technical consultation and ongoing field service are mandatory. Indirect channels, involving authorized distributors, agents, or system integrators, are often used for standard units or geographic regions where the OEM lacks a direct physical presence, helping to manage inventory and streamline regional service provision.

Downstream analysis focuses on installation, commissioning, operation, and extensive aftermarket services. End-users require comprehensive training and ongoing technical support, including the supply of high-wear spare parts like filter cloths, seals, and hydraulic components. Aftermarket services, including maintenance contracts and system upgrades (retrofitting automation features), represent a critical and high-margin revenue stream for OEMs, ensuring the long-term operational viability and efficiency of installed units. The longevity and continuous nature of industrial processes mean that the quality of downstream support often heavily influences the initial procurement decision by potential customers.

Rotary Pressure Filters Market Potential Customers

Potential customers for rotary pressure filters are primarily large industrial entities operating continuous process plants where solid-liquid separation is a bottleneck or where extremely dry products are mandated. The primary buyers are large-scale mining corporations engaged in the extraction and processing of base metals (copper, zinc, nickel) and precious metals, where these filters are used to dewater high-value concentrates prior to shipment or further refinement. Similarly, companies in the bulk chemical sector, including manufacturers of inorganic chemicals, pigments, and fertilizers, represent significant buyers due to the necessity of minimizing moisture content in their final products to reduce drying costs and ensure product specifications are met.

In addition to the heavy industrial users, the pharmaceutical and biotechnology sectors constitute a specialized, high-value customer base. These buyers require rotary pressure filters designed to meet strict Good Manufacturing Practice (GMP) standards, often involving stainless steel construction with specific surface finishes, ensuring ease of cleaning and sterilization. Though the volume throughput might be smaller than in mining, the critical nature of the product purity and the high unit cost of specialized hygienic filters make this segment vital. Furthermore, municipal and industrial wastewater treatment plants are increasingly adopting advanced pressure filtration systems for sludge dewatering to reduce disposal volumes and costs, representing a growing utility customer segment.

Other emerging potential buyers include specialized manufacturers in the food processing industry, such as starch and sugar producers, who utilize pressure filtration for efficient separation and purification processes. Essentially, any industry where high-volume, continuous separation is required, coupled with the need for maximal solid recovery or minimal residual moisture, falls into the target customer profile. Procurement decisions in these sectors are typically driven by total cost of ownership (TCO), system reliability, and proven performance metrics such as throughput capacity and residual moisture percentage.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850 Million |

| Market Forecast in 2033 | USD 1,260 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Andritz AG, Metso Corporation (Outotec), FLSmidth & Co. A/S, Micronics Engineered Filtration Group, Phoenix Process Equipment, Komline-Sanderson Corporation, WesTech Engineering, Inc., Diemme Filtration S.r.l., Bucher Filtration, Kason Corporation, Sepco Process Inc., Filtra Systems, Met-Chem, Multotec Group, McLanahan Corporation, Filtermax, BHS-Sonthofen GmbH, Shaanxi Tiande Filter Equipment Co., Ltd., Shanghai Jixing Filter Equipment Co., Ltd., Schenck Process. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Rotary Pressure Filters Market Key Technology Landscape

The technological landscape of the Rotary Pressure Filters Market is defined by continuous advancements focused on maximizing efficiency, extending filter media life, and enhancing process control. A primary focus is on optimizing the pressure application mechanism and slurry feeding systems to ensure uniform cake formation and reduce heel formation, thereby maximizing filtration surface utilization. Modern units incorporate advanced sealing technologies, often using inflatable elastomer seals, to maintain high internal pressure integrity while accommodating the rotary motion, which is crucial for achieving extremely low residual moisture levels. Furthermore, the development of specialized high-tensile filter cloths made from materials like polypropylene or polyester, engineered for specific particle size distributions and chemical compatibility, is pivotal to reducing blinding and extending operational cycles between washings.

Automation and instrumentation represent the forefront of technological innovation. Contemporary rotary pressure filters are equipped with sophisticated PLC-based control systems integrated with various sensors, including cake thickness measurement, residual moisture probes (e.g., microwave or infrared), and hydraulic pressure monitors. These systems enable closed-loop control, allowing the filter to dynamically adjust rotation speed, wash water volume, and blowing time based on instantaneous process conditions, moving away from manually set parameters. This high level of automation facilitates remote monitoring, predictive diagnostics, and seamless integration into plant-wide distributed control systems (DCS), aligning with Industry 4.0 standards and enabling lights-out operation in many facilities.

Sustainability driven technology is another significant trend. Manufacturers are investing heavily in technologies that minimize water consumption, particularly in the cake washing phase, and optimize air consumption during the blow-off stage. Energy-efficient drive systems, such as variable frequency drives (VFDs) for pump and rotation motors, are standard components aimed at reducing the overall power footprint. Furthermore, modular design is gaining traction, allowing for easier maintenance, faster assembly on site, and scalability. The ability to quickly swap out filter elements and access internal components through enhanced design features minimizes maintenance windows, thus improving overall equipment effectiveness (OEE) and operational reliability across demanding industrial applications.

Regional Highlights

The global market for Rotary Pressure Filters exhibits distinct growth characteristics influenced by regional industrial maturity, regulatory frameworks, and resource endowment. Asia Pacific (APAC) leads the market in terms of new installation growth, largely propelled by massive infrastructure investment in mineral processing in countries like China, Australia, and Indonesia. The need to process complex, lower-grade ores and adhere to evolving environmental standards regarding tailings management necessitates the adoption of high-performance pressure filtration technologies in this region. This high demand volume makes APAC the fastest-growing region during the forecast period.

Europe and North America represent established markets characterized by stability and high value. Growth in these regions is driven primarily by replacement demand, modernization projects, and a focus on high-purity applications within the pharmaceutical and specialty chemical sectors. Stringent environmental regulations in the EU and EPA mandates in the US ensure continued investment in the most efficient dewatering technologies to minimize water usage and reduce landfill volume for waste sludge. European manufacturers also lead in technological innovation, particularly concerning energy efficiency and adherence to strict safety standards, maintaining a strong position in high-specification market niches.

Latin America (LATAM) and the Middle East & Africa (MEA) hold immense potential tied to commodity cycles. LATAM, abundant in copper, iron ore, and lithium resources (especially in Chile, Peru, and Brazil), is a critical market for large-scale mining filter installations. Market volatility is a factor, but sustained global demand for EV battery minerals ensures long-term commitment to highly efficient dewatering solutions. The MEA region, particularly South Africa for mining and the GCC states for chemical and water treatment projects, is showing increasing investment in advanced filtration infrastructure to support economic diversification and water security initiatives, creating steady, project-based growth opportunities.

- Asia Pacific (APAC): Dominates market growth due to expansive mining operations (e.g., copper, nickel, coal) and rapid industrialization in China and India. High investment in new chemical and pharmaceutical manufacturing capacity drives demand for advanced dewatering solutions.

- North America: Stable market focusing on system modernization, regulatory compliance (especially EPA water quality standards), and high-specification filters for high-value chemical and life science applications.

- Europe: Driven by strict environmental policies (EU directives), emphasizing high energy efficiency, low emissions, and reliable dewatering in wastewater treatment and specialized chemical production. Key center for R&D in filter media and automation.

- Latin America (LATAM): Significant demand linked to large-scale copper, iron ore, and lithium mining projects. Focus is on robust, high-throughput systems to maximize commodity extraction efficiency.

- Middle East & Africa (MEA): Emerging market growth spurred by infrastructure development, municipal water treatment projects, and mineral processing expansion in key resource-rich nations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Rotary Pressure Filters Market.- Andritz AG

- Metso Corporation (Outotec)

- FLSmidth & Co. A/S

- Micronics Engineered Filtration Group

- Phoenix Process Equipment

- Komline-Sanderson Corporation

- WesTech Engineering, Inc.

- Diemme Filtration S.r.l.

- Bucher Filtration

- Kason Corporation

- Sepco Process Inc.

- Filtra Systems

- Met-Chem

- Multotec Group

- McLanahan Corporation

- BHS-Sonthofen GmbH

- Shandong Tianli Renewable Energy Co., Ltd.

- Shandong Jinyuan Mining Machinery Co., Ltd.

- Shandong Tairui Machinery Manufacturing Co., Ltd.

- Schenck Process

Frequently Asked Questions

Analyze common user questions about the Rotary Pressure Filters market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of a Rotary Pressure Filter?

The primary function of a rotary pressure filter is to achieve highly efficient solid-liquid separation by utilizing a pressure differential significantly higher than atmospheric pressure. This process minimizes residual moisture content in the resulting filter cake, crucial for reducing subsequent drying costs and meeting product purity specifications in industries like mining and chemical processing.

Which application segment drives the largest demand for Rotary Pressure Filters?

The Mining and Metallurgy segment drives the largest global demand for Rotary Pressure Filters. This is due to the enormous volume of concentrates (e.g., copper, iron ore) that must be dewatered efficiently to achieve high throughput, lower transportation costs, and meet increasingly stringent environmental regulations regarding moisture levels in tailings.

How does AI technology impact the operational efficiency of these filters?

AI technology significantly enhances operational efficiency through predictive maintenance and real-time process optimization. AI algorithms analyze sensor data to forecast component failures and dynamically adjust filtration parameters (pressure, speed, washing cycles) to maintain peak performance and achieve consistent filter cake dryness regardless of variability in the feed slurry.

What is the main advantage of Rotary Disc Pressure Filters over Rotary Drum types?

The main advantage of Rotary Disc Pressure Filters is their superior filtration area-to-footprint ratio. This design allows for higher capacity filtration within a smaller physical space compared to rotary drum filters, making them highly suitable for large-scale operations where plant floor space is a premium constraint.

What restraints are limiting the widespread adoption of Rotary Pressure Filters?

The most significant restraints limiting widespread adoption are the high initial capital investment required for these complex, high-pressure systems and the need for specialized technical expertise for installation, operation, and maintenance. These factors often deter smaller enterprises or those with tighter capital budgets from immediate adoption.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Rotary Pressure Filters Market Statistics 2025 Analysis By Application (Food Processing, Pharmaceutical, Chemicals), By Type (Small Filter Area, Medium Filter Area, Large Filter Area), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Rotary Pressure Filters Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Large Filter Area, Medium Filter Area, Small Filter Area), By Application (Chemicals, Pharmaceutical, Food Processing, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager