Rotary Seals Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440855 | Date : Feb, 2026 | Pages : 257 | Region : Global | Publisher : MRU

Rotary Seals Market Size

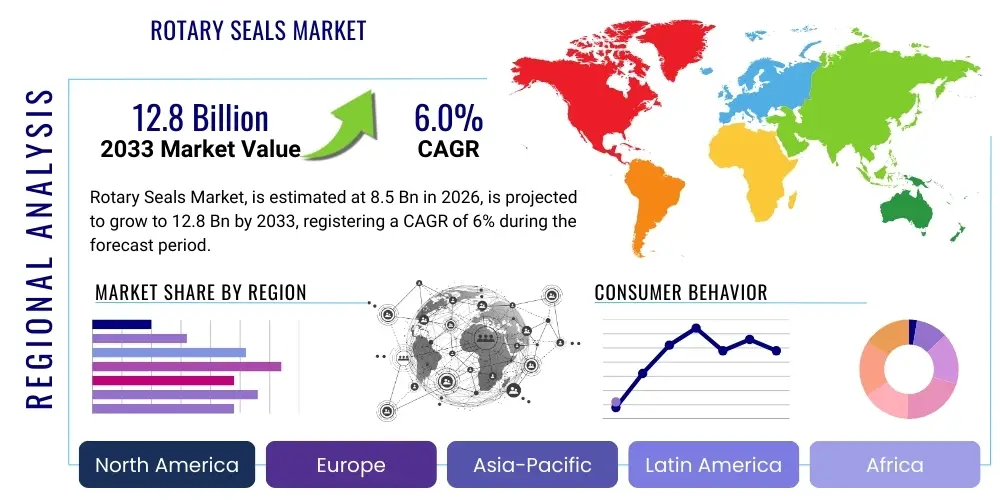

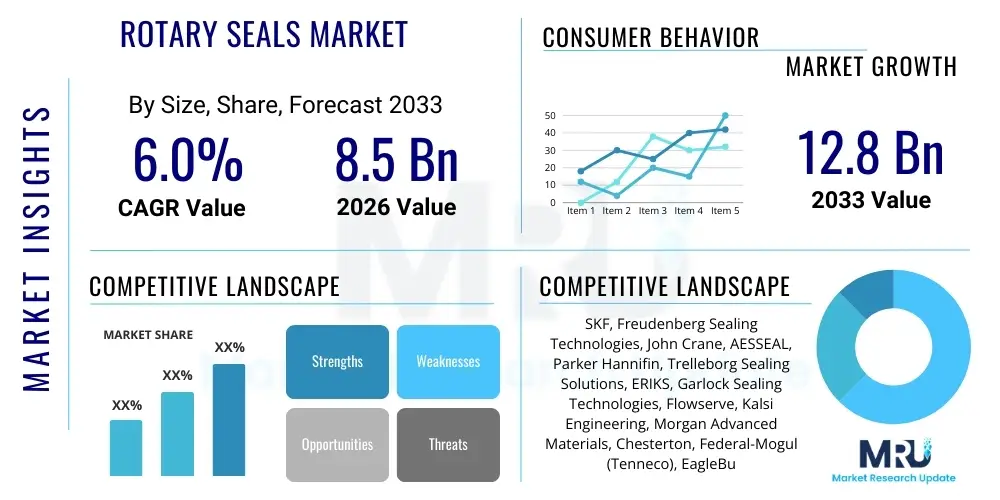

The Rotary Seals Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.0% between 2026 and 2033. The market is estimated at USD 8.5 Billion in 2026 and is projected to reach USD 12.8 Billion by the end of the forecast period in 2033.

Rotary Seals Market introduction

The rotary seals market is a critical segment within the broader industrial components landscape, providing essential sealing solutions for applications involving rotating shafts. These seals are designed to prevent the leakage of fluids (liquids or gases) and ingress of contaminants (dust, dirt, moisture) into machinery, thereby ensuring the optimal performance, longevity, and efficiency of various industrial equipment. The core function of a rotary seal is to maintain a barrier between a stationary and a rotating part, operating under dynamic conditions that demand robust material properties and precision engineering. This market encompasses a wide array of products, including radial shaft seals (often referred to as oil seals), mechanical seals, labyrinth seals, and magnetic fluid seals, each tailored for specific operational environments and fluid types, ranging from high-speed, high-pressure applications to corrosive or abrasive conditions.

The primary applications of rotary seals span across a multitude of industries, highlighting their indispensable nature in modern manufacturing and infrastructure. Key sectors include automotive, where they are vital for engines, transmissions, and axles; industrial machinery, encompassing pumps, compressors, gearboxes, and electric motors; aerospace, for aircraft engines and hydraulic systems; and the energy sector, particularly in oil and gas exploration, power generation turbines, and renewable energy equipment like wind turbines. Beyond these, the food and beverage industry relies on hygienic rotary seals, while the medical sector utilizes specialized seals for high-precision devices. The extensive and diverse application base underscores the continuous demand for advanced sealing solutions that can withstand increasingly demanding operational parameters and comply with stringent regulatory standards.

The benefits derived from high-performance rotary seals are multifaceted, contributing significantly to operational reliability and cost efficiency. These include enhanced equipment lifespan by protecting internal components from wear and contamination, reduced maintenance costs through prolonged seal life and fewer breakdowns, improved energy efficiency by minimizing friction and fluid loss, and adherence to environmental regulations by preventing hazardous fluid leaks. Driving factors for market growth are primarily linked to the ongoing industrialization in emerging economies, the expansion of the automotive and manufacturing sectors, the increasing demand for automation and high-performance machinery, and continuous technological advancements in material science and seal design. Furthermore, the growing focus on predictive maintenance and the adoption of Industry 4.0 principles necessitate more durable and intelligent sealing solutions, further propelling market innovation and demand.

Rotary Seals Market Executive Summary

The Rotary Seals Market is experiencing dynamic shifts driven by global industrial expansion, technological advancements, and evolving regulatory landscapes. Key business trends indicate a strong emphasis on developing high-performance seals capable of operating under extreme conditions, including high temperatures, pressures, and corrosive environments, aligning with the increasingly stringent demands of modern industrial applications. There is a discernible trend towards custom-engineered solutions, where manufacturers are collaborating closely with end-users to design seals that precisely meet unique application requirements, moving away from a one-size-fits-all approach. Furthermore, sustainability initiatives are influencing product development, with a growing focus on seals made from eco-friendly materials, designed for extended operational life, and contributing to reduced energy consumption and environmental impact. Mergers and acquisitions remain a strategic tool for market players to expand their product portfolios, geographic reach, and technological capabilities, fostering consolidation and intense competition.

Regionally, the market exhibits varied growth trajectories and demand patterns. Asia Pacific stands out as the dominant and fastest-growing region, fueled by rapid industrialization, burgeoning automotive production, and massive infrastructure development in countries like China, India, and Southeast Asian nations. North America and Europe, while mature markets, continue to demonstrate steady demand, largely driven by the adoption of advanced manufacturing technologies, replacement demand in aging industrial infrastructure, and a strong focus on innovation in aerospace, medical, and high-tech industries. Latin America, the Middle East, and Africa are showing promising growth, particularly in the oil and gas, mining, and agricultural sectors, as these regions enhance their industrial capabilities and invest in new projects, leading to increased adoption of rotary seals in various machinery and equipment.

From a segmentation perspective, material innovation is a crucial trend, with fluoropolymers (PTFE), elastomers (FKM, NBR), and advanced composites gaining traction due to their superior chemical resistance, thermal stability, and mechanical properties. The demand for mechanical seals is particularly robust, driven by their enhanced reliability and ability to handle critical applications in process industries, while radial shaft seals continue to see widespread use in general industrial and automotive contexts. End-use industry trends highlight strong growth in the automotive sector due to increasing vehicle production and the shift towards electric vehicles requiring specialized sealing solutions. The industrial machinery and oil and gas sectors also remain significant consumers, driven by new investments and maintenance requirements for heavy equipment. Overall, the market is characterized by a drive towards specialized, durable, and efficient sealing technologies that support the performance and reliability of critical rotating equipment across diverse global industries.

AI Impact Analysis on Rotary Seals Market

The integration of Artificial Intelligence (AI) across industrial sectors is prompting significant discussion and interest regarding its potential to revolutionize the Rotary Seals Market. Users frequently inquire about how AI can enhance the design, manufacturing, and operational efficiency of rotary seals, often focusing on capabilities such as predictive maintenance, material optimization, and automated quality control. There is a keen interest in understanding how AI can contribute to extending seal lifespan, reducing unplanned downtime in critical machinery, and facilitating the development of smarter, more responsive sealing solutions. Concerns also emerge regarding the data infrastructure required for AI implementation, the cybersecurity implications of connected systems, and the potential for job displacement as automation increases. Overall, the prevailing expectation is that AI will drive a paradigm shift towards more intelligent, data-driven approaches in the rotary seals industry, promising improved performance, cost savings, and a competitive edge for early adopters.

- AI-driven predictive maintenance can forecast seal failure based on operational data, minimizing unplanned downtime and optimizing maintenance schedules.

- AI algorithms can analyze vast datasets of material properties and performance under various conditions, enabling optimized material selection for specific rotary seal applications, enhancing durability and efficiency.

- Generative design techniques powered by AI can accelerate the development of novel seal geometries, leading to more efficient and robust designs tailored for complex operating environments.

- Automated quality inspection systems utilizing AI and machine vision can detect minute defects in rotary seals during manufacturing, ensuring higher product quality and reducing waste.

- AI can optimize manufacturing processes for rotary seals by analyzing production data, identifying bottlenecks, and suggesting improvements for efficiency and consistency.

- Supply chain management for rotary seals can be enhanced through AI, which predicts demand fluctuations, optimizes inventory levels, and streamlines logistics, improving delivery reliability and reducing costs.

- Real-time monitoring and anomaly detection using AI can provide immediate insights into seal performance, allowing for prompt intervention and preventing catastrophic equipment failures.

- AI can facilitate the creation of digital twins for rotary seals, simulating their performance under various stress conditions to refine design and predict operational behavior more accurately.

- Enhanced customer support and troubleshooting through AI-powered chatbots and expert systems can quickly address queries related to seal selection, installation, and maintenance.

- AI can enable personalized product offerings by analyzing customer requirements and operational data to recommend highly customized rotary seal solutions.

DRO & Impact Forces Of Rotary Seals Market

The Rotary Seals Market is profoundly shaped by a confluence of drivers, restraints, and opportunities that collectively determine its growth trajectory and competitive landscape. A primary driver is the relentless growth of industrialization and urbanization globally, particularly in emerging economies, which necessitates an increasing volume of machinery and equipment across manufacturing, construction, and processing sectors. This organic expansion directly translates to a higher demand for rotary seals for both original equipment manufacturing (OEM) and aftermarket maintenance. Furthermore, the burgeoning automotive industry, encompassing both internal combustion engine (ICE) vehicles and the rapidly expanding electric vehicle (EV) segment, remains a critical demand generator, as rotary seals are indispensable components in various vehicle systems. The continuous drive for enhanced operational efficiency, reduced energy consumption, and extended equipment lifespan across all industries compels manufacturers to invest in advanced, high-performance sealing solutions, further stimulating market growth.

Despite these robust drivers, the market faces significant restraints that temper its growth potential. Volatility in raw material prices, especially for high-performance elastomers and fluoropolymers, can impact production costs and profit margins, forcing manufacturers to absorb costs or pass them on to customers, potentially affecting demand. Stringent environmental regulations, particularly concerning emissions and fluid leakage, while creating demand for better seals, also impose significant compliance costs and design complexities. The market is also subject to intense competition, with numerous global and regional players vying for market share, leading to pricing pressures and reducing profitability. Moreover, the technical complexity involved in designing and manufacturing seals for specialized, high-performance applications requires substantial investment in research and development, which can be a barrier for smaller players and slow down innovation for others.

Opportunities within the Rotary Seals Market are primarily found in technological innovation and the penetration of new application areas. The development of advanced materials, such as perfluoroelastomers (FFKM) and custom-engineered plastics, offering superior chemical resistance, temperature stability, and wear resistance, presents significant growth avenues, especially for critical applications in aerospace, chemical processing, and semiconductors. The increasing adoption of Industry 4.0 and smart manufacturing initiatives creates opportunities for "smart seals" integrated with sensors for real-time monitoring and predictive maintenance, adding value beyond traditional sealing functions. Furthermore, the growing focus on renewable energy sectors, including wind turbines, solar trackers, and hydro power, which require specialized, long-life seals capable of withstanding harsh environmental conditions, opens new lucrative markets. The aftermarket segment also offers substantial opportunities, driven by the need for maintenance, repair, and overhaul (MRO) services for existing industrial machinery, providing a steady revenue stream independent of new equipment sales.

Segmentation Analysis

The Rotary Seals Market is comprehensively segmented by various parameters to provide a granular understanding of its dynamics and target specific opportunities. These segmentation criteria typically include material type, seal type, end-use industry, and geographic region, each offering distinct insights into market trends and consumer preferences. Understanding these segments is crucial for market participants to tailor their product offerings, marketing strategies, and R&D efforts effectively. The material segmentation reflects the constant innovation in polymer science and material engineering to meet diverse operational challenges, while the seal type segmentation differentiates between various mechanical and design principles employed for sealing rotating components. End-use industry analysis highlights the diverse applications and the varying demands from sectors like automotive, industrial machinery, and aerospace, underscoring the broad utility of rotary seals across the global economy.

- By Material Type:

- Elastomers (NBR, FKM, EPDM, HNBR, VMQ, ACM)

- Thermoplastics (PTFE, PEEK, Polyurethane)

- Metal (Stainless Steel, Bronze, Carbon Steel)

- Composites (Fiber-reinforced polymers, Carbon-based materials)

- Other Advanced Materials (Ceramics, Graphite, Silicon Carbide)

- By Seal Type:

- Radial Shaft Seals (Oil Seals)

- Mechanical Seals (Pusher, Non-Pusher, Cartridge, Component)

- Labyrinth Seals

- Magnetic Fluid Seals

- Brush Seals

- Diaphragm Seals

- Lip Seals

- V-Rings

- By End-Use Industry:

- Automotive (Passenger Cars, Commercial Vehicles, Electric Vehicles)

- Industrial Machinery (Pumps, Compressors, Gearboxes, Motors, Machine Tools)

- Oil and Gas (Upstream, Midstream, Downstream)

- Aerospace and Defense

- Food and Beverage

- Pharmaceutical and Medical

- Energy (Power Generation, Renewable Energy - Wind, Hydro)

- Mining and Construction

- Agriculture

- Chemical Processing

- Marine

- By Region:

- North America (U.S., Canada, Mexico)

- Europe (Germany, UK, France, Italy, Spain, Rest of Europe)

- Asia Pacific (China, India, Japan, South Korea, ASEAN, Rest of Asia Pacific)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East and Africa (UAE, Saudi Arabia, South Africa, Rest of MEA)

Value Chain Analysis For Rotary Seals Market

A comprehensive value chain analysis for the Rotary Seals Market reveals a complex interplay of activities that transform raw materials into finished sealing solutions delivered to end-users, highlighting critical stages of value creation and potential areas for optimization. The upstream segment of the value chain is dominated by raw material suppliers, including producers of specialized elastomers, thermoplastics, metals, and advanced composite materials. These suppliers play a crucial role in providing the foundational components with precise chemical and physical properties necessary for high-performance seals. Key activities at this stage involve sourcing high-quality raw materials, processing them into forms suitable for manufacturing, and adhering to strict quality control standards. Relationships with these suppliers are often strategic, as the availability and cost of these specialized materials significantly impact the overall production efficiency and competitiveness of seal manufacturers.

The core manufacturing stage involves the conversion of raw materials into finished rotary seals through various processes such as molding, machining, vulcanization, and assembly. This midstream segment is characterized by significant investment in advanced manufacturing technologies, precision engineering, and quality assurance systems. Manufacturers focus on product design and development, leveraging R&D to innovate new seal geometries, material combinations, and surface treatments to enhance performance characteristics like friction reduction, wear resistance, and sealing efficiency. Quality control and testing are paramount at this stage to ensure seals meet stringent industry standards and application-specific requirements. The competitive landscape in this segment is shaped by economies of scale, technological expertise, intellectual property, and the ability to offer customized solutions, catering to the diverse needs of various end-use industries.

Downstream activities involve the distribution, sales, and aftermarket services for rotary seals, connecting manufacturers with a broad base of customers. Distribution channels typically include direct sales to large original equipment manufacturers (OEMs), who integrate seals into their machinery, and indirect channels through a network of distributors and wholesalers serving the aftermarket and smaller industrial clients. Direct distribution allows for closer customer relationships and customized solutions, while indirect channels provide broader market reach and efficient logistics for standardized products. Aftermarket services, including technical support, installation guidance, and replacement parts, are crucial for customer retention and long-term revenue generation. The efficiency of the distribution network, the effectiveness of sales teams, and the reliability of customer support collectively determine the accessibility of products to the market and the overall customer satisfaction, forming a vital link in the value delivery process for the rotary seals industry.

Rotary Seals Market Potential Customers

The potential customers for rotary seals represent a vast and diverse ecosystem of industries and enterprises, fundamentally comprising any entity that operates machinery or equipment with rotating shafts requiring fluid containment or contaminant exclusion. These end-users can be broadly categorized into original equipment manufacturers (OEMs) and aftermarket clients. OEMs, such as automotive manufacturers, industrial pump and compressor makers, gearbox producers, and aerospace component suppliers, integrate rotary seals directly into their new products during the initial assembly phase. For these customers, the primary drivers are consistent supply, high-performance characteristics, competitive pricing, and the ability to custom-engineer seals that meet their specific design parameters, durability requirements, and regulatory compliance, ensuring their end products operate optimally from the outset.

Beyond OEMs, a substantial segment of potential customers resides within the aftermarket, encompassing maintenance, repair, and overhaul (MRO) operations across virtually every industrial sector. This includes heavy industries like oil and gas refineries, chemical processing plants, power generation facilities, and mining operations, where machinery experiences continuous wear and tear, necessitating regular replacement of seals to prevent costly downtime and operational failures. Commercial and industrial facilities, ranging from food and beverage processing plants to pharmaceutical manufacturing and general manufacturing units, also represent significant aftermarket demand. For these customers, critical factors include immediate availability of replacement parts, ease of installation, compatibility with existing equipment, and technical support to ensure effective sealing solutions that minimize production interruptions and extend asset life.

Moreover, specialized niche markets present unique potential customer bases with very specific needs. For instance, the renewable energy sector, particularly wind turbine manufacturers and operators, requires seals capable of extremely long service life and resistance to harsh environmental conditions. The marine industry demands robust seals for propulsion systems and deck machinery that can withstand saltwater corrosion. The medical and pharmaceutical sectors require ultra-hygienic and biocompatible seals for sterile environments and precision instruments. Agricultural machinery manufacturers and operators, construction equipment producers, and even domestic appliance manufacturers also rely on various types of rotary seals. Each of these diverse customer groups, driven by distinct operational demands and regulatory landscapes, contributes to the expansive and dynamic potential customer base for rotary seals, emphasizing the need for manufacturers to offer a broad portfolio of specialized and standardized products.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 8.5 Billion |

| Market Forecast in 2033 | USD 12.8 Billion |

| Growth Rate | 6.0% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SKF, Freudenberg Sealing Technologies, John Crane, AESSEAL, Parker Hannifin, Trelleborg Sealing Solutions, ERIKS, Garlock Sealing Technologies, Flowserve, Kalsi Engineering, Morgan Advanced Materials, Chesterton, Federal-Mogul (Tenneco), EagleBurgmann, NOK Corporation, W. L. Gore & Associates, Greene, Tweed & Co., Technetics Group, Pioneer West-ECO. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Rotary Seals Market Key Technology Landscape

The Rotary Seals Market is continually evolving, driven by advancements in material science, manufacturing processes, and smart integration, resulting in a sophisticated technology landscape. One of the most critical technological areas involves the development and application of advanced materials. This includes high-performance elastomers such as perfluoroelastomers (FFKM) and fluorocarbon rubbers (FKM) that offer exceptional chemical resistance and thermal stability, enabling seals to operate reliably in aggressive chemical environments and extreme temperatures. Similarly, engineered thermoplastics like Polyetheretherketone (PEEK) and Polytetrafluoroethylene (PTFE) are increasingly utilized for their superior wear resistance, low friction, and broad temperature capabilities, often enhanced with fillers (e.g., carbon fiber, glass fiber, bronze) to further optimize mechanical properties and reduce cold flow under pressure. The continuous innovation in these material compositions allows manufacturers to push the boundaries of seal performance, addressing the increasingly demanding operational parameters of modern industrial machinery.

Beyond material composition, advancements in seal design and manufacturing processes are pivotal. Computer-Aided Design (CAD) and Finite Element Analysis (FEA) software are indispensable tools for simulating seal behavior under various operating conditions, optimizing seal geometry for reduced friction, enhanced sealing efficiency, and extended lifespan before physical prototyping. Precision molding techniques, such as injection molding and compression molding, along with advanced machining capabilities, ensure the tight tolerances and surface finishes required for effective sealing in dynamic applications. Furthermore, surface treatment technologies, including plasma treatments, laser texturing, and specialized coatings, are employed to modify the tribological properties of seal surfaces, reducing wear, friction, and improving chemical resistance. These manufacturing innovations contribute significantly to producing highly consistent and reliable rotary seals capable of meeting the rigorous performance standards demanded by critical industries.

The emerging technological frontier for rotary seals lies in their integration with smart technologies and the Internet of Things (IoT). This involves the development of "smart seals" equipped with embedded sensors that can monitor critical operational parameters such as temperature, pressure, rotational speed, and even early signs of wear or leakage. These sensors transmit real-time data to control systems, enabling predictive maintenance strategies, alerting operators to potential failures before they occur, and optimizing maintenance schedules to minimize downtime. The data collected from these smart seals can also feed into AI and machine learning algorithms to further refine seal design, material selection, and operational parameters for enhanced efficiency and longevity. This convergence of traditional mechanical engineering with digital intelligence represents a significant leap, transforming rotary seals from passive components into active contributors to the overall health monitoring and operational intelligence of industrial equipment, offering substantial value propositions in terms of reliability and cost savings.

Regional Highlights

- North America: This mature market is characterized by a strong emphasis on technological innovation and high-performance applications, particularly in the aerospace, automotive (especially electric vehicle components), and industrial machinery sectors. The U.S. and Canada lead in adopting advanced sealing solutions, driven by rigorous safety standards and the demand for efficiency in manufacturing and energy industries. Significant investments in infrastructure and the push towards automation further sustain market growth.

- Europe: A highly developed market with Germany, the UK, and France at its forefront. Europe benefits from a robust automotive sector, advanced manufacturing base, and a strong focus on renewable energy. Environmental regulations are particularly stringent, driving demand for leak-proof and energy-efficient seals. The region is a hub for R&D in materials science and precision engineering, leading to continuous innovation in rotary seal technologies.

- Asia Pacific (APAC): The fastest-growing region globally, APAC's expansion is fueled by rapid industrialization, burgeoning automotive production (particularly in China and India), and massive infrastructure projects across the region. Lower manufacturing costs and increasing foreign direct investment contribute to the region's dominance. The demand for rotary seals is broad, spanning from heavy industries and construction to consumer electronics and electric vehicles, reflecting the region's diverse economic growth.

- Latin America: This region exhibits steady growth, primarily driven by investments in the oil and gas, mining, and agricultural sectors. Countries like Brazil and Mexico are key players due to their natural resources and growing manufacturing capabilities. While the market is price-sensitive, there is an increasing demand for durable and reliable seals that can withstand harsh operational environments common in these industries.

- Middle East and Africa (MEA): Growth in MEA is largely attributed to significant investments in the oil and gas industry, as well as developing infrastructure and industrial diversification efforts. Saudi Arabia and the UAE are prominent markets, focusing on energy production and processing. The demand here is primarily for heavy-duty, corrosion-resistant seals that can endure extreme temperatures and abrasive conditions typical of oil exploration and refining.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Rotary Seals Market.- SKF

- Freudenberg Sealing Technologies

- John Crane

- AESSEAL

- Parker Hannifin

- Trelleborg Sealing Solutions

- ERIKS

- Garlock Sealing Technologies

- Flowserve

- Kalsi Engineering

- Morgan Advanced Materials

- Chesterton

- Federal-Mogul (Tenneco)

- EagleBurgmann

- NOK Corporation

- W. L. Gore & Associates

- Greene, Tweed & Co.

- Technetics Group

- Pioneer West-ECO

Frequently Asked Questions

Analyze common user questions about the Rotary Seals market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Rotary Seals Market?

The Rotary Seals Market is primarily driven by global industrialization and urbanization, leading to increased demand for machinery and equipment across various sectors. The burgeoning automotive industry, including both traditional and electric vehicles, significantly contributes to market expansion. Additionally, the constant pursuit of enhanced operational efficiency, reduced energy consumption, and extended equipment lifespan across all industries necessitates the adoption of high-performance sealing solutions, further stimulating market growth. Technological advancements in material science and seal design also play a crucial role, allowing seals to operate in more demanding environments and applications.

Furthermore, the growth of critical end-use industries such as oil and gas, energy generation (including renewables), and industrial machinery, which rely heavily on rotating equipment, continuously fuels demand. The increasing focus on predictive maintenance and the adoption of Industry 4.0 principles globally also create opportunities for innovative, smart sealing solutions that offer real-time monitoring capabilities, thereby propelling market development and diversification into new product categories.

How do material advancements impact the performance and application of rotary seals?

Material advancements are foundational to enhancing the performance and expanding the application range of rotary seals. Innovations in high-performance elastomers like FFKM and FKM provide superior chemical resistance and thermal stability, enabling seals to operate reliably in aggressive chemical environments, extreme temperatures, and high-pressure conditions that conventional materials cannot withstand. Engineered thermoplastics such as PEEK and PTFE offer excellent wear resistance, low friction coefficients, and broad temperature capabilities, often tailored with fillers to improve mechanical properties and mitigate issues like cold flow, crucial for dynamic sealing applications where minimal friction and maximum durability are paramount.

These material innovations directly translate to increased seal lifespan, reduced maintenance frequency, and improved overall equipment reliability. For instance, seals made from advanced composites can offer lighter weight solutions for aerospace applications, while specialized ceramic or graphite materials enhance performance in highly abrasive or high-speed rotary contexts. Such advancements allow rotary seals to meet the increasingly stringent demands of modern industrial processes, supporting higher operational parameters, ensuring greater safety, and enabling more efficient energy utilization across diverse sectors from automotive and aerospace to chemical processing and renewable energy.

What role does the automotive industry, particularly electric vehicles, play in the Rotary Seals Market?

The automotive industry is a significant consumer of rotary seals, and its evolving landscape, particularly the rapid growth of electric vehicles (EVs), plays a transformative role in the market. In traditional internal combustion engine (ICE) vehicles, rotary seals are essential components in engines, transmissions, axles, and various ancillary systems, requiring robust sealing against oil, fuel, and exhaust gases. The sustained production of ICE vehicles worldwide continues to drive substantial demand for a wide array of standard and specialized rotary seals, maintaining a consistent baseline for market volume.

The advent of electric vehicles, while eliminating the need for some seals found in ICE powertrains, introduces new and distinct sealing challenges. EVs require specialized seals for e-motors, battery cooling systems, gearboxes (often integrated into electric drive units), and charging ports. These seals must often withstand different fluid chemistries (e.g., specialized coolants, dielectric fluids), wider temperature ranges, higher rotational speeds in some motor applications, and increasingly stringent electromagnetic compatibility requirements. Furthermore, the push for lighter components and extended service intervals in EVs drives demand for extremely durable, low-friction, and high-efficiency sealing solutions. This shift necessitates innovation in materials and design tailored specifically for EV applications, opening new growth avenues for rotary seal manufacturers and reshaping product development priorities within the industry.

How is the Rotary Seals Market impacted by Industry 4.0 and smart manufacturing trends?

Industry 4.0 and smart manufacturing trends are profoundly impacting the Rotary Seals Market by driving demand for more intelligent, interconnected, and predictive sealing solutions. The integration of sensors into rotary seals, creating "smart seals," allows for real-time monitoring of critical parameters such as temperature, pressure, rotational speed, and vibration. This data can be transmitted wirelessly to central control systems, enabling advanced analytics and predictive maintenance algorithms. Instead of reactive or time-based maintenance, operators can now foresee potential seal failures, schedule maintenance proactively, and minimize unplanned downtime, significantly reducing operational costs and maximizing equipment availability.

Moreover, smart manufacturing principles are optimizing the production processes of rotary seals themselves. Automation, robotics, and advanced quality control systems leveraging machine vision and AI enhance precision, consistency, and efficiency in seal manufacturing. This leads to higher quality products, reduced waste, and faster production cycles. The ability to collect and analyze manufacturing data helps in continuous process improvement and customized production runs. This shift towards data-driven manufacturing and intelligent product integration ultimately transforms rotary seals from passive components into active elements within a connected industrial ecosystem, contributing directly to the overall efficiency, reliability, and intelligence of industrial machinery.

What are the key challenges faced by manufacturers in the Rotary Seals Market?

Manufacturers in the Rotary Seals Market face several significant challenges that require strategic navigation. One primary challenge is the volatility and rising costs of raw materials, particularly for high-performance elastomers, thermoplastics, and metals. These fluctuations directly impact production costs and profit margins, making it difficult to maintain competitive pricing while ensuring product quality. Another key challenge stems from increasingly stringent environmental regulations regarding emissions, fluid leakage, and material composition. Compliance requires substantial investment in R&D for eco-friendly materials and advanced seal designs that meet strict performance and sustainability standards, adding complexity to product development and manufacturing processes.

Furthermore, the market is highly competitive, characterized by numerous global and regional players. This intense competition often leads to pricing pressures, eroding profitability and necessitating continuous innovation to differentiate products. The demand for highly specialized, custom-engineered solutions for critical applications also presents a challenge, as it requires significant R&D investment, specialized expertise, and flexible manufacturing capabilities. Lastly, managing complex global supply chains, especially in the face of geopolitical instability and logistics disruptions, poses considerable operational hurdles, affecting lead times and the timely delivery of products to a diverse customer base worldwide.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager