Rubber Antioxidant Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442139 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Rubber Antioxidant Market Size

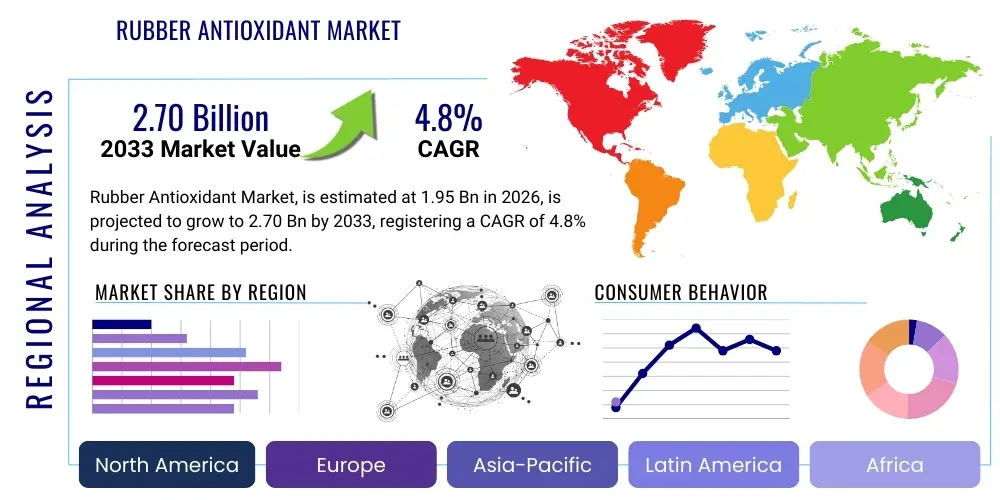

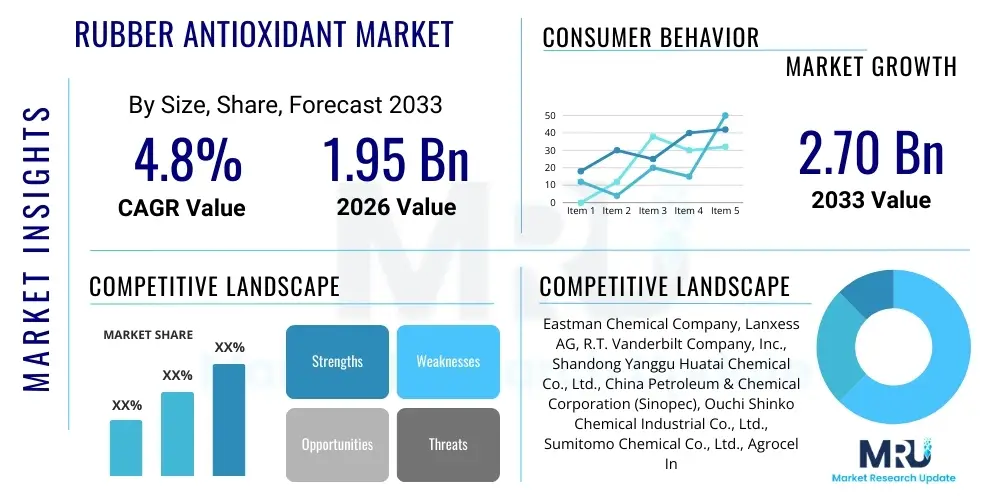

The Rubber Antioxidant Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 1.95 Billion in 2026 and is projected to reach USD 2.70 Billion by the end of the forecast period in 2033.

Rubber Antioxidant Market introduction

Rubber antioxidants are specialized chemical additives integrated into rubber formulations to inhibit the degradation processes caused by environmental factors such as oxygen, ozone, heat, and fatigue stress. This degradation, commonly known as aging, leads to irreversible changes in the physical properties of rubber, including cracking, reduced elasticity, and diminished tensile strength, ultimately shortening the service life of rubber products. The primary function of these antioxidants is to interrupt the free-radical chain reactions initiated during exposure to these elements, ensuring the longevity and structural integrity of materials used across critical sectors like automotive and infrastructure. Historically, the demand for high-performance elastomers in demanding applications has been the cornerstone driving the need for sophisticated stabilization systems.

The product portfolio encompasses various chemical classes, predominantly paraphenylenediamines (PPDs), amines (like polymerized trimethyldihydroquinoline - TMQ), and phenolics. PPDs, such as IPPD and 6PPD, are highly effective against ozone and flex fatigue and are predominantly utilized in tire manufacturing due to their superior performance under dynamic stress. Amines and phenolics offer good heat aging resistance and are more commonly deployed in non-tire rubber products, including hoses, belts, gaskets, and seals. These compounds are essential not only for synthetic rubbers (SBR, BR, NBR) but also for natural rubber (NR) applications, where protection against oxidation and heat exposure is crucial for maintaining operational safety and efficiency.

Major applications of rubber antioxidants are overwhelmingly concentrated in the tire industry, where they constitute a critical component for enhancing tire durability, fuel efficiency, and overall performance, especially under high-stress driving conditions. Beyond tires, the benefits extend to automotive components such as engine mounts and vibration dampeners, industrial rubber goods like conveyor belts and seals, and consumer products including footwear and gloves. Driving factors for market growth include the robust expansion of the global automotive sector, particularly in emerging economies, the stringent regulatory requirements mandating longer-lasting and safer vehicular components, and the increasing demand for high-performance elastomers capable of withstanding extreme thermal and mechanical stresses in industrial settings.

Rubber Antioxidant Market Executive Summary

The Rubber Antioxidant Market demonstrates resilient growth, underpinned by the indispensable nature of these chemicals in prolonging the operational lifespan of elastomers, particularly within the automotive and infrastructure sectors. Business trends highlight a strong shift toward environmentally friendlier, non-staining, and low-volatility antioxidant solutions, driven by evolving health, safety, and environmental (HSE) regulations, especially concerning the use of certain amine derivatives. Key players are investing heavily in research and development to synthesize novel, cost-effective antioxidant formulations that meet stringent compliance standards while maintaining superior performance characteristics against ozone and heat aging. Mergers, acquisitions, and strategic partnerships focusing on securing raw material supply chains and expanding geographical presence in high-growth regions like Asia Pacific characterize the competitive landscape.

Regional trends indicate that Asia Pacific remains the dominant market, propelled by its massive production base for tires and automotive components, particularly in China, India, and Southeast Asia, coupled with rapid urbanization and infrastructure development necessitating increased consumption of industrial rubber products. North America and Europe, while mature, exhibit strong demand driven by the stringent quality requirements for specialized and high-performance rubber applications, alongside a regulatory push favoring sustainable and non-toxic antioxidants. Segment trends underscore the continued dominance of the PPDs type segment due to its unparalleled efficacy in tire manufacturing, though the phenolic segment is experiencing significant growth in non-tire and specialty applications where discoloration must be avoided.

The market faces concurrent challenges and opportunities. Restraints include the volatility in petrochemical raw material prices and the strict regulatory scrutiny on several established antioxidant chemistries, particularly PPDs due to health and safety concerns, pushing manufacturers toward alternatives. Conversely, the opportunity lies in the burgeoning electric vehicle (EV) market, which demands specialized rubber components capable of handling high torque and specific thermal management challenges, creating new avenues for advanced antioxidant formulations. Furthermore, the increasing service life expectation for machinery and vehicles globally necessitates higher incorporation rates of premium protective additives, securing the market's long-term growth trajectory and justifying continuous innovation in compounding technology.

AI Impact Analysis on Rubber Antioxidant Market

User inquiries regarding AI's influence in the Rubber Antioxidant Market frequently center on themes such as how computational chemistry can accelerate the discovery of new, safer PPD alternatives, the role of machine learning in optimizing rubber compounding processes for efficiency, and AI's potential in predicting material degradation under varying environmental conditions. Key concerns revolve around the cost of implementing AI-driven simulation tools and whether AI can effectively handle the complex, multi-variable interactions inherent in elastomer aging phenomena. Users generally expect AI to revolutionize R&D by dramatically cutting down experimental cycles and improving predictive maintenance for rubber assets globally. This widespread interest underscores the industry's need for faster, more sustainable, and precisely tailored antioxidant solutions, achievable through advanced algorithmic modeling and data-driven material informatics.

- AI-driven molecular modeling accelerates the design and screening of novel, non-toxic antioxidant molecules, reducing dependence on traditional, high-risk chemistries.

- Predictive analytics and machine learning optimize the blending ratios and incorporation levels of antioxidants in rubber compounds, ensuring peak performance and minimizing material waste.

- AI enhances quality control in manufacturing by monitoring complex polymerization and mixing processes, identifying defects related to poor antioxidant dispersion in real-time.

- Generative AI tools assist material scientists in simulating long-term material aging under specific service conditions (e.g., high heat, extreme ozone exposure), aiding in product lifetime prediction.

- Supply chain optimization using AI improves raw material procurement efficiency for antioxidant production, mitigating risks associated with petrochemical price volatility.

DRO & Impact Forces Of Rubber Antioxidant Market

The Rubber Antioxidant Market is fundamentally driven by the relentless expansion of the global tire and automotive sectors, coupled with the increasing necessity for durability in industrial rubber products subjected to severe operating conditions. Stringent governmental regulations globally, particularly in developed regions, mandating improved vehicular safety and reduced component failure rates act as a significant driver, forcing manufacturers to incorporate higher-quality protective additives. However, this growth trajectory is restrained by two primary factors: the significant volatility in the prices of key petrochemical feedstocks required for antioxidant synthesis, which compresses profit margins, and the escalating environmental and health scrutiny over established PPD-based chemistries, leading to mandatory phase-outs or severe usage limitations in certain applications and regions. This regulatory pressure simultaneously creates an opportunity for specialized chemical manufacturers to innovate and introduce high-performance, safer, and ecologically responsible alternatives, commanding premium pricing and expanding market share in niche applications.

A key opportunity is presented by the surging investment in sustainable and green rubber products, where non-staining, non-discoloring, and bio-based antioxidants are sought after for consumer-facing goods and medical applications. Furthermore, the robust growth in specialized elastomers for high-performance end-uses, such as aerospace seals, deep-sea exploration equipment, and advanced machinery, requires customized stabilization packages that traditional antioxidants often cannot fully provide, necessitating development of synergistic blends and polymer-bound antioxidants. Conversely, the emergence of advanced tire technologies, aimed at reducing rolling resistance for improved fuel economy in traditional vehicles and extending range in electric vehicles, challenges the existing material formulation approaches, requiring antioxidants that do not negatively interfere with these new material properties.

The impact forces influencing the market equilibrium are multifaceted, involving substitution risk from alternative polymer stabilizers, technological shifts in compounding methodologies, and geopolitical stability affecting chemical supply chains. Regulatory impact forces, particularly the European Union's REACH framework and similar directives in Asia, significantly dictate product viability and market access for specific chemical types. Economic impact forces, such as fluctuating global automotive production levels and consumer spending on replacement tires, directly translate to demand fluctuations for rubber antioxidants. The synergistic interplay between stringent performance demands (e.g., higher mileage tires) and increasingly strict environmental standards forms a powerful dual impact force, compelling sustained innovation in material science and driving the market toward complex, multi-functional additive systems that offer comprehensive protection against multiple degradation vectors simultaneously.

Segmentation Analysis

The Rubber Antioxidant Market is comprehensively segmented based on the chemical type of the additive, the physical form in which it is supplied, and the specific end-use application where the stabilized rubber is utilized. Understanding these segment dynamics is crucial as performance requirements vary drastically between, for instance, a high-stress tire application and a non-staining medical rubber component. Type segmentation is paramount, differentiating between highly effective, but potentially controversial PPDs, traditional and cost-effective amine antioxidants (TMQ), and specialty phenolic antioxidants. This structure allows for precise market sizing based on regulatory suitability and technical performance requirements across diverse industrial landscapes. The application segmentation clearly demonstrates the market's dependency on the automotive sector, distinguishing between the massive volume consumed by tire manufacturing and the specialized demand from non-tire automotive components, followed by other significant industrial and consumer applications.

- By Type:

- Paraphenylenediamines (PPDs)

- Amine-based Antioxidants (e.g., TMQ)

- Phenolic Antioxidants (e.g., BHT)

- Others (Phosphites, Thioesters)

- By Form:

- Powder/Granule

- Liquid/Emulsion

- Waxes and Pellets

- By Application:

- Tire Manufacturing

- Non-Tire Automotive (Belts, Hoses, Seals, Gaskets)

- Industrial Rubber Goods (Conveyor Belts, Mining Equipment)

- Footwear and Consumer Goods

- Medical and Specialty Applications

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Rubber Antioxidant Market

The value chain for the Rubber Antioxidant Market begins with the upstream segment, dominated by the procurement and processing of petrochemical feedstocks, primarily aniline, acetone, and petroleum-derived aromatic hydrocarbons like p-phenylenediamine precursors. This segment is characterized by high capital intensity and vulnerability to crude oil price fluctuations, directly influencing the manufacturing cost of the final antioxidant products. Key chemical intermediate producers often have backward integration into these raw materials to ensure supply stability and cost control. The transformation of these intermediates into technical grade rubber antioxidants, involving complex chemical synthesis, purification, and formulation (e.g., granulation or emulsification), represents the core manufacturing stage where intellectual property related to synthesis routes and specialized stabilization technologies is critical. Efficiency and adherence to stringent quality control standards are paramount here, particularly regarding impurity levels which can negatively affect rubber performance or regulatory compliance.

Downstream, the market is characterized by distribution channels that are crucial for reaching a highly fragmented end-user base. Direct distribution is often favored for large-volume customers, specifically major global tire manufacturers, where supply contracts are long-term, and technical support is integrated. These direct sales ensure customized product delivery and formulation consultation. Conversely, indirect distribution, utilizing specialized chemical distributors and agents, serves smaller non-tire rubber component manufacturers and regional producers. These distributors provide inventory management, regional access, and aggregation services, which are vital for servicing the diverse industrial rubber goods market across various geographies. The technical sales aspect of distribution is significant, as rubber compounders require detailed material safety data and performance specifications to correctly integrate antioxidants into complex rubber matrices.

The final consumption stage involves the integration of these antioxidants into rubber compounding lines. End-users evaluate suppliers not only on price but crucially on product efficacy, dispersion characteristics, regulatory status (especially PPDs), and technical support responsiveness. The move towards highly specialized, pre-dispersed forms (such as polymer-bound granules) aims to improve safety during handling, enhance dispersion uniformity in the rubber mix, and reduce processing time for the end-user. This optimization of delivery form is a critical factor driving value addition in the downstream segment. The entire chain is heavily regulated, meaning compliance costs are borne across the upstream manufacturing and downstream distribution segments, emphasizing the necessity for meticulous supply chain auditing and product traceability from raw material to finished rubber component.

Rubber Antioxidant Market Potential Customers

The primary consumers of rubber antioxidants are large-scale manufacturers operating within the elastomeric products sector, focused on producing durable goods where resistance to environmental degradation is non-negotiable for safety and longevity. Dominantly, multinational tire manufacturers, including those producing both passenger vehicle and heavy-duty commercial vehicle tires, represent the single largest customer segment due to the inherent stress and exposure tires face, necessitating maximum protection against ozone and flex fatigue using chemicals like 6PPD. The non-tire automotive sector forms the second major customer cluster, comprising companies that specialize in high-performance engine components, automotive fluid transfer systems (hoses), and vibration isolation parts (bushings and mounts), where thermal stability and oil resistance are critical requirements demanding specialized antioxidant types, such as TMQ and certain phenolics.

Beyond the automotive sphere, potential customers include manufacturers of industrial rubber goods, such as conveyor belt producers used in mining and logistics, heavy-duty seal and gasket manufacturers for oil and gas or chemical processing industries, and specialized producers of waterproof roofing membranes. These industrial applications demand robust antioxidants capable of withstanding prolonged exposure to extreme temperatures, chemical agents, and high mechanical abrasion. Furthermore, the consumer goods and medical industries are emerging customer bases, particularly seeking non-staining, low-migration phenolic antioxidants for applications like footwear soles, food-grade seals, medical tubing, and gloves, where product appearance, safety, and regulatory approval are paramount purchasing criteria. The purchasing decision for these customers is driven by a complex balance of cost-in-use, documented long-term performance data, regulatory compliance documentation, and the supplier's capacity for consistent, high-volume delivery.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.95 Billion |

| Market Forecast in 2033 | USD 2.70 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Eastman Chemical Company, Lanxess AG, R.T. Vanderbilt Company, Inc., Shandong Yanggu Huatai Chemical Co., Ltd., China Petroleum & Chemical Corporation (Sinopec), Ouchi Shinko Chemical Industrial Co., Ltd., Sumitomo Chemical Co., Ltd., Agrocel Industries Pvt. Ltd., Kumho Petrochemical Co., Ltd., Addivant (now part of SK Capital Partners), King Industries, Inc., Solvay S.A., Arkema S.A., Dow Inc., Flexsys. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Rubber Antioxidant Market Key Technology Landscape

The technological landscape in the Rubber Antioxidant Market is evolving rapidly, driven by the need to balance high efficacy with improved environmental and handling safety. A significant technological shift involves the development and wider adoption of polymer-bound antioxidants (PBA). PBAs are chemically linked to an inert polymer matrix, which prevents migration, leaching, and surface blooming (crystallization) of the antioxidant in the finished rubber product. This technology not only enhances the physical safety of workers during compounding by reducing airborne dust and volatile organic compound (VOC) emissions but also ensures the antioxidant remains active within the rubber matrix for the entire service life, offering superior long-term performance compared to traditional powder forms. Furthermore, PBAs enable precise metering during the mixing process, contributing to more consistent and higher quality rubber compounds, particularly critical in advanced tire formulations where precise compound uniformity is paramount for safety and efficiency.

Another crucial technological focus is the synthesis of synergistic antioxidant packages. Instead of relying on a single large-dose antioxidant, modern formulations combine primary antioxidants (free radical scavengers like PPDs) with secondary antioxidants (peroxide decomposers like phosphites or thioesters). This synergy maximizes protection against multiple degradation pathways simultaneously (e.g., thermal oxidation and ozone attack) at lower total additive loadings. Research is actively exploring novel sterically hindered phenolic structures and specialized substituted diarylamines designed to offer the performance characteristics of PPDs but with a lower toxicological profile and reduced staining propensity. This innovation is directly addressing the regulatory pressures facing legacy chemical types and unlocking opportunities in non-tire, color-sensitive applications.

Process technologies are also witnessing innovation, particularly in reaction control and purification processes. Manufacturers are deploying advanced process analytical technologies (PAT) to monitor the synthesis of complex antioxidant molecules in real-time, ensuring high purity and consistent batch quality, which is essential for end-use performance. Furthermore, micro-encapsulation techniques are being refined to deliver liquid antioxidants, which are highly effective but difficult to handle, in a dry, easy-to-disperse format. This technology enhances the shelf stability and incorporation efficiency of these specialized additives, streamlining the compounding operations for rubber manufacturers. The focus on high throughput screening and computational chemistry (as discussed in the AI section) is forming the bedrock for next-generation material discovery, accelerating the shift toward bio-based or nature-identical structures that promise superior sustainability profiles without compromising the mechanical integrity of rubber products.

Regional Highlights

- Asia Pacific (APAC): APAC is the unequivocally largest and fastest-growing market, primarily due to the concentration of global tire manufacturing capacity in countries like China, India, Thailand, and Indonesia. Robust expansion in automotive production (both traditional internal combustion engines and electric vehicles) and massive infrastructural projects fuel the region's immense demand for both tire and industrial rubber antioxidants. Furthermore, favorable manufacturing economics and supportive governmental policies contribute to sustained, high-volume consumption.

- North America: Characterized by stringent quality requirements and a strong focus on high-performance elastomers for premium automotive, aerospace, and specialty industrial applications. The market is mature but drives demand for advanced, polymer-bound, and non-staining antioxidants. Regulatory compliance, especially related to VOC emissions and chemical safety, dictates product selection, promoting innovation toward safer alternatives.

- Europe: The European market is highly regulated, dominated by the strict enforcement of REACH regulations, which significantly influences the types of antioxidants utilized. This region is a leader in adopting sustainable and low-migration chemistries, driving market growth in specialized phenolic and environmentally friendly amine derivatives. The focus is on lightweighting in vehicles and extending the service life of industrial machinery.

- Latin America (LATAM) & Middle East and Africa (MEA): These regions are characterized by growing automotive assembly plants and expanding mining and energy sectors, driving moderate but consistent demand for rubber antioxidants, particularly for industrial equipment and heavy vehicle tires. Infrastructure development projects, especially in the MEA region, necessitate durable rubber products that can withstand harsh climatic conditions, requiring robust thermal and UV protection chemistries.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Rubber Antioxidant Market.- Eastman Chemical Company

- Lanxess AG

- R.T. Vanderbilt Company, Inc.

- Shandong Yanggu Huatai Chemical Co., Ltd.

- China Petroleum & Chemical Corporation (Sinopec)

- Ouchi Shinko Chemical Industrial Co., Ltd.

- Sumitomo Chemical Co., Ltd.

- Agrocel Industries Pvt. Ltd.

- Kumho Petrochemical Co., Ltd.

- Addivant (now part of SK Capital Partners)

- King Industries, Inc.

- Solvay S.A.

- Arkema S.A.

- Dow Inc.

- Flexsys

- JSR Corporation

- Songwon Industrial Co., Ltd.

- Wacker Chemie AG

- Nantong Shizong Chemical Co., Ltd.

- Kawaguchi Chemical Industry Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Rubber Antioxidant market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary chemical types of rubber antioxidants and their main applications?

The primary types are Paraphenylenediamines (PPDs), predominantly used in tires for superior ozone and flex fatigue protection; Amine-based antioxidants (like TMQ) effective against heat aging; and Phenolic antioxidants, utilized in non-staining, non-discoloring applications like footwear and medical rubber goods.

How do global regulations, such as REACH, affect the consumption patterns of rubber antioxidants?

Regulations like REACH enforce strict testing and authorization requirements for chemical use, particularly scrutinizing certain PPDs due to health concerns. This drives manufacturers to invest in and adopt safer, low-migration, and less hazardous alternatives, shifting market preference towards specialized phenolic and polymer-bound chemistries, especially in Europe.

Why is the Asia Pacific region the dominant market for rubber antioxidants?

The Asia Pacific region dominates due to its massive scale of tire and automotive component production, particularly in China and India, coupled with rapid industrialization and infrastructure development that fuels continuous high-volume demand for elastomers and their protective chemical additives.

What is the key technological innovation transforming the rubber antioxidant industry?

The development and increasing adoption of Polymer-Bound Antioxidants (PBAs) is the key transformation. PBAs prevent the antioxidant from migrating or blooming out of the rubber matrix, enhancing long-term performance, improving worker safety by reducing dust exposure, and ensuring consistent quality in the final rubber product.

How does the growth of the Electric Vehicle (EV) segment influence the demand for rubber antioxidants?

The EV segment increases demand for specialized, high-performance rubber components requiring superior thermal management and durability to handle high torque and battery-related thermal challenges. This necessitates new, high-specification antioxidant packages that can maintain rubber integrity under these unique, demanding operating conditions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager