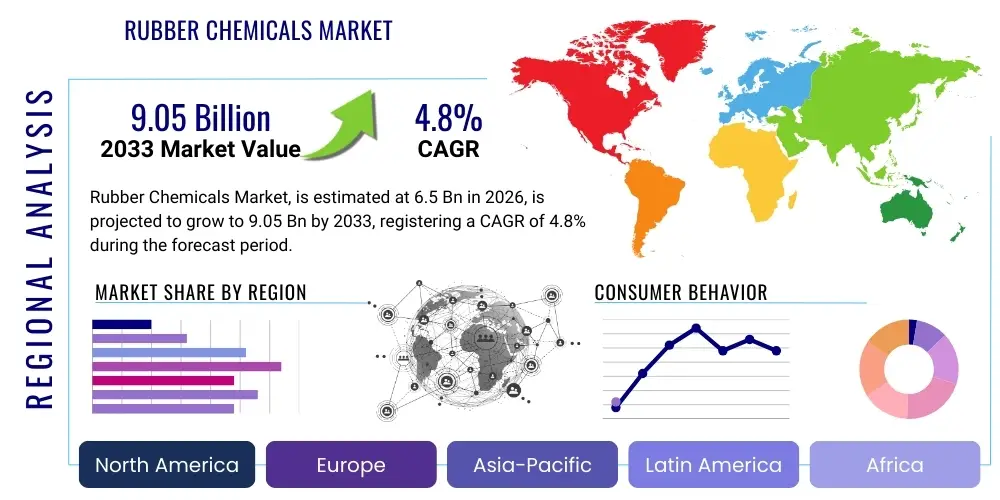

Rubber Chemicals Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443248 | Date : Feb, 2026 | Pages : 242 | Region : Global | Publisher : MRU

Rubber Chemicals Market Size

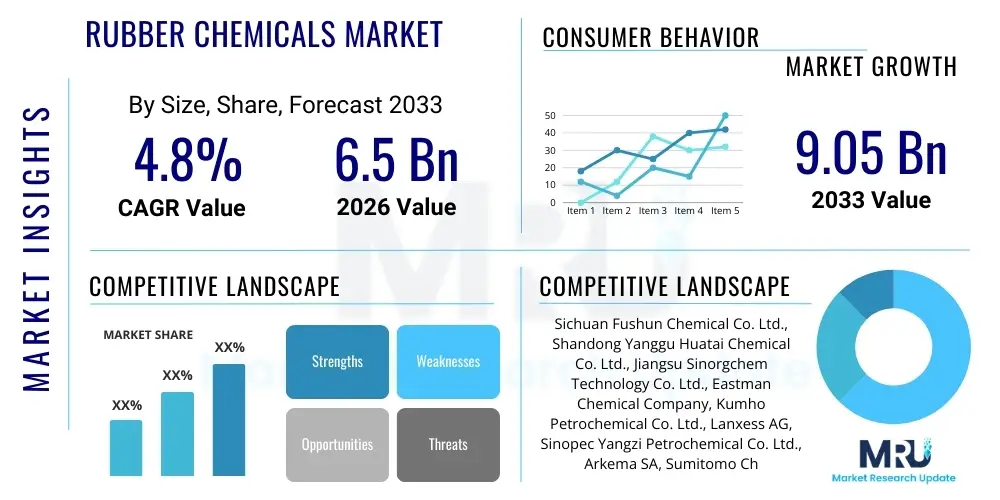

The Rubber Chemicals Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 6.5 Billion in 2026 and is projected to reach USD 9.05 Billion by the end of the forecast period in 2033.

Rubber Chemicals Market introduction

The Rubber Chemicals Market encompasses a vital segment of the specialty chemicals industry, providing essential additives necessary for processing, curing, and protecting raw rubber materials, both natural and synthetic. These chemicals are critical components that determine the final properties, durability, and performance characteristics of rubber products, ensuring they meet rigorous industrial specifications, particularly in high-stress applications such as automotive tires and industrial belts. The primary function of rubber chemicals involves acting as accelerators, antioxidants, antiozonants, processing aids, and vulcanizing agents, which collectively optimize the cross-linking process (vulcanization) and prevent degradation from heat, oxygen, and fatigue, thereby extending the lifespan and enhancing the utility of finished rubber goods. The market dynamics are intricately linked to global manufacturing output, infrastructural development, and, most prominently, the production volumes within the automotive sector.

Product descriptions within this market include specialized classes such as thiazoles, sulfenamides, dithiocarbamates, and paraphenylenediamines (PPDs). Accelerators, like MBT and CBS, significantly reduce curing time and temperature, enhancing manufacturing efficiency. Antioxidants and antiozonants (e.g., 6PPD) are indispensable for protecting tires and other outdoor rubber items from premature failure caused by environmental exposure and dynamic stress cracking. Major applications span across the manufacturing of automotive tires, which account for the largest consumption share, followed by the production of industrial rubber goods, footwear, construction materials (such as seals and gaskets), and medical devices. The intrinsic benefits provided by these chemicals—including improved tensile strength, abrasion resistance, enhanced elasticity, and superior thermal stability—make them non-negotiable inputs for modern rubber processing.

Driving factors fueling market expansion include the consistent recovery and expansion of the global automotive industry, particularly in developing economies, which necessitates high volumes of performance tires and specialized non-tire components. Furthermore, stringent regulatory standards pertaining to vehicular safety and fuel efficiency are spurring demand for advanced rubber compounds that offer low rolling resistance and extended wear life, thereby driving innovation and consumption of specialized chemical additives. The rise in infrastructure projects globally also boosts demand for high-performance rubber applications, such as conveyor belts and anti-vibration mounts, while the growing focus on sustainable and eco-friendly rubber chemistry introduces new market opportunities for bio-based and low-nitrosamine-forming accelerators, catering to shifting environmental mandates.

Rubber Chemicals Market Executive Summary

The global Rubber Chemicals Market trajectory is defined by robust business trends centered on sustainability, supply chain resilience, and technological advancements aimed at improving efficiency and environmental compliance. Key business trends involve the strategic shift by major producers towards localized manufacturing to mitigate geopolitical risks and freight volatility, coupled with intense research and development efforts focused on creating safer alternatives to traditional nitrosamine-generating accelerators, aligning with stricter REACH regulations in Europe and similar mandates worldwide. Furthermore, mergers and acquisitions remain a consistent feature, consolidating market share among key players and facilitating vertical integration to secure stable raw material supply, particularly aniline and sulfur derivatives, which are essential precursors for many rubber additives. The competitive landscape is characterized by a high degree of product differentiation based on performance and purity, forcing manufacturers to invest heavily in specialized production facilities and quality assurance protocols to meet the stringent requirements of tier-one tire manufacturers.

Regional trends indicate that the Asia Pacific (APAC) region maintains its dominance, primarily driven by China and India, which are the world's largest hubs for tire manufacturing and automotive production, benefiting from rapid urbanization and increasing per capita vehicle ownership. This region not only serves as a major consumption center but also houses significant production capacity for basic and intermediate chemicals, influencing global pricing dynamics. Conversely, North America and Europe demonstrate mature markets, characterized by stable demand for high-performance specialty chemicals used in premium and regulatory-compliant rubber products. These developed regions are the primary innovators in sustainable rubber chemistry, leading the adoption of non-staining antioxidants and halogen-free compounds, driven by stringent environmental protection and workplace safety standards, thus commanding a higher premium for advanced chemical grades.

Segmentation trends highlight the continued supremacy of accelerators and antidegradants (antioxidants and antiozonants) as the largest product segments by value and volume, essential for the high-volume tire sector. Within accelerators, sulfenamides remain crucial due to their versatility and delayed action characteristics, critical for complex molding processes. The end-user segment is heavily tilted towards the tire industry, but the non-tire sector, encompassing industrial rubber products (e.g., hoses, seals, gaskets) and footwear, is demonstrating faster growth, propelled by expansion in construction, mining, and general manufacturing activities globally. This segmentation shift emphasizes the need for tailored chemical solutions designed for specific material properties beyond conventional tire requirements, such as improved oil resistance and lower compression set, driving demand for specialized processing aids and protective waxes.

AI Impact Analysis on Rubber Chemicals Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Rubber Chemicals Market frequently revolve around optimizing complex manufacturing processes, ensuring quality control in high-throughput environments, and accelerating the discovery of novel chemical formulations. Users express concerns about integrating legacy systems with new AI platforms, the potential cost of deployment, and how AI can specifically address the industry's need for sustainability, particularly in reducing energy consumption during the vulcanization process and minimizing waste. Key expectations focus on AI's ability to model molecular interactions to predict performance characteristics of new additives (in-silico R&D), automate dynamic process parameter adjustments during mixing and curing, and enhance predictive maintenance for chemical reactors, thereby increasing operational uptime and consistency in highly critical chemical synthesis stages.

- AI-driven optimization of batch processing parameters (temperature, pressure, mixing time) in rubber compounding, minimizing energy usage and material scrap.

- Predictive modeling using machine learning to forecast the performance characteristics (e.g., abrasion resistance, tensile strength) of new chemical formulations before physical synthesis, accelerating R&D cycles.

- Enhanced quality control through computer vision systems and AI algorithms analyzing chemical purity and particulate distribution during manufacturing, ensuring consistency in high-performance grades.

- Supply chain risk management enabled by AI, predicting fluctuations in raw material costs (e.g., aniline, sulfur) and optimizing logistics for time-sensitive chemical delivery.

- Development of digital twins for chemical reactors to simulate vulcanization processes and test new accelerator systems under virtual conditions, reducing reliance on expensive physical prototypes.

- AI supporting regulatory compliance by monitoring and tracing chemicals throughout the value chain, ensuring adherence to environmental and toxicity standards (e.g., nitrosamine formation limits).

DRO & Impact Forces Of Rubber Chemicals Market

The Rubber Chemicals Market is significantly influenced by a confluence of accelerating drivers, structural restraints, and compelling opportunities, creating a dynamic impact landscape. Key drivers include the robust global demand from the automotive sector, particularly the surging production of passenger vehicles and heavy-duty trucks in emerging economies, alongside the persistent regulatory pressure towards higher performance and fuel-efficient tires requiring advanced chemical formulations. Restraints encompass the volatile pricing and supply chain unpredictability of key petrochemical raw materials, stringent environmental regulations forcing expensive shifts away from conventional but effective chemicals (like certain PPDs and high-nitrosamine accelerators), and the considerable capital expenditure required for compliance upgrades and specialized manufacturing processes. Opportunities emerge from the accelerating shift towards sustainable mobility, generating demand for specialty chemicals tailored for electric vehicle (EV) tires (which require high wear resistance and low rolling resistance), the untapped potential in bio-based and non-toxic additives, and the growing application of advanced rubber compounds in construction and infrastructure development, particularly seismic isolation components and durable sealing systems. These forces collectively dictate the market growth trajectory, rewarding innovation in sustainable chemistry and efficiency while penalizing reliance on outdated, non-compliant production methods.

Segmentation Analysis

The Rubber Chemicals Market is comprehensively segmented based on product type, application, and end-use, providing a granular view of consumption patterns and technological specialization across various industries. Product type segmentation distinguishes between chemicals based on their functional role in the rubber matrix, such as improving curing speed, enhancing longevity, or modifying processing ease. Application segmentation specifically details where these chemicals are utilized, primarily differentiating between tire manufacturing and non-tire uses. End-use segmentation further categorizes the ultimate consumer industries, offering insights into demand derived from construction, automotive components, and consumer goods, reflecting the diverse industrial requirements for tailored rubber properties, ranging from high elasticity in medical applications to extreme heat resistance in automotive gaskets.

- Product Type: Accelerators (Thiazoles, Sulfenamides, Thiurams, Dithiocarbamates), Antioxidants and Antiozonants (Paraphenylenediamines (PPDs), Phenolics, Amines), Processing Aids, Retarders, Vulcanizing Agents (Sulfur and its derivatives), and Specialty Chemicals.

- Application: Tire Manufacturing (Passenger Car Tires, Commercial Vehicle Tires, Off-the-Road (OTR) Tires), Non-Tire Manufacturing (Industrial Rubber Products, Footwear, Consumer Goods, Construction and Infrastructure, Medical and Healthcare).

- End-Use Industry: Automotive, Construction, Manufacturing, Footwear, Medical, and Others.

Value Chain Analysis For Rubber Chemicals Market

The Value Chain for the Rubber Chemicals Market begins with the upstream procurement of fundamental petrochemical raw materials, primarily sourced from oil refining and chemical synthesis sectors. Key precursors include aniline, acetone, sulfur, and various amines, whose price and availability are dictated by global crude oil prices and the operational capacity of large petrochemical complexes. Manufacturers of rubber chemicals then convert these basic building blocks into specialized additives through complex chemical reactions, often requiring high-pressure and high-temperature environments. This conversion phase is characterized by stringent quality control and high energy input. The midstream involves compounding and formulation, where these chemicals are often mixed into masterbatches or specialized blends to ease handling and incorporation by rubber processors, particularly tire manufacturers.

Downstream analysis highlights the crucial role of specialized distribution channels, which handle the transportation and inventory of these potentially hazardous chemicals, requiring compliance with stringent safety and storage regulations. Distribution channels are typically a mix of direct sales to large, integrated tire manufacturers and indirect sales through specialty chemical distributors serving smaller non-tire rubber processors. Direct sales ensure tight quality control and long-term contracts, fostering collaborative R&D efforts between chemical suppliers and major tire producers (Tier 1 relationships). Indirect channels offer greater market penetration across fragmented non-tire segments, providing technical support and localized inventory management to diverse end-users who require smaller, varied quantities of chemicals tailored for specific product lines such as automotive belts, weatherstrips, or industrial hoses.

The final consumption stage occurs within the rubber fabrication plants where the chemicals are incorporated into the rubber mix during the compounding and vulcanization steps. Efficiency and optimization in this final stage are highly dependent on the quality and purity of the chemicals supplied. The profitability across the value chain is highest in the specialized chemical manufacturing segment, particularly for patented or high-performance antidegradants, owing to the high technical barriers to entry and the critical performance role these chemicals play in the finished rubber product. Disruptions in the upstream supply of raw materials, particularly aniline (a key precursor for PPDs and accelerators), pose the greatest threat to overall market stability, underscoring the importance of vertical integration or strategic long-term supply agreements.

Rubber Chemicals Market Potential Customers

The primary end-users and buyers of rubber chemicals are manufacturers engaged in the compounding and processing of natural and synthetic rubber materials into finished goods. The automotive industry represents the largest and most concentrated customer base, dominated by global tire manufacturers who demand massive quantities of accelerators, antioxidants, and vulcanizing agents to produce passenger car, truck, and specialized off-the-road (OTR) tires. These tire giants—such as Bridgestone, Michelin, Goodyear, and Continental—require chemicals that meet extremely high specifications regarding safety, sustainability, and performance characteristics, including low rolling resistance and extended tread life. Consequently, they often engage in long-term supply contracts, seeking secure supply and consistency in product quality to maintain their competitive edge in high-stakes markets.

Beyond the tire sector, a highly diverse group of non-tire manufacturers constitutes a growing segment of potential customers. These include producers of industrial rubber goods, such as conveyor belts used in mining and logistics, hydraulic hoses for construction and agriculture, and sealing systems (O-rings, gaskets, weatherstripping) vital for general manufacturing and aerospace applications. Furthermore, the footwear industry, particularly manufacturers of high-performance sports and specialized industrial safety shoes, relies on rubber chemicals for durability, elasticity, and molding characteristics. The demand from these non-tire customers is often more fragmented and requires a broader portfolio of specialty chemicals, including processing aids and retarders, customized for unique physical property requirements such as resistance to heat, oil, or specific chemicals, driving the need for sophisticated formulation support from the chemical suppliers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 6.5 Billion |

| Market Forecast in 2033 | USD 9.05 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sichuan Fushun Chemical Co. Ltd., Shandong Yanggu Huatai Chemical Co. Ltd., Jiangsu Sinorgchem Technology Co. Ltd., Eastman Chemical Company, Kumho Petrochemical Co. Ltd., Lanxess AG, Sinopec Yangzi Petrochemical Co. Ltd., Arkema SA, Sumitomo Chemical Co. Ltd., Qingdao Doublestar, Roberto, Ouchi Shinko Chemical Industrial Co. Ltd., Agrocel Industries Pvt. Ltd., R.T. Vanderbilt Holding Company Inc., China Sunsine Chemical Holdings Ltd., Nocil Limited, Kemai Chemical Co. Ltd., Pukhraj Additives LLP, WRC Rubber Chemicals, Performance Additives. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Rubber Chemicals Market Key Technology Landscape

The technology landscape within the Rubber Chemicals Market is undergoing a fundamental shift, moving away from conventional synthesis methods towards highly efficient, sustainable, and safer chemical production techniques. A key area of technological advancement is the development and commercialization of pre-dispersed chemicals and masterbatches. This technology encapsulates the powdered chemicals in a polymer binder, greatly improving dispersion uniformity within the rubber compound, reducing processing time, eliminating dust hazards, and ensuring precise dosage, which is crucial for achieving consistent vulcanization characteristics in high-performance tires. The adoption of pre-dispersed forms minimizes health and safety risks associated with handling fine chemical powders, aligning with increasingly strict workplace safety regulations in North America and Europe.

Another significant technological focus is Green Chemistry, specifically directed towards replacing traditional accelerators, such as certain thiurams and dithiocarbamates, that can generate harmful N-nitrosamines during or after the vulcanization process. Research is concentrating on developing low- or non-nitrosamine forming sulfenamide and guanidine derivatives that maintain or even surpass the performance metrics of their predecessors regarding cure speed and final physical properties. Furthermore, innovations in antidegradant chemistry are crucial, focusing on developing high-performance, non-staining antioxidants and antiozonants (e.g., advanced PPD variants and novel phenolic compounds) that provide superior protection against weathering and fatigue, especially required for modern radial tires and critical industrial seals exposed to severe environmental conditions, without discoloring light-colored rubber products.

Processing technology also involves advanced polymerization techniques, particularly in the synthesis of specialized high-purity chemical intermediates. Continuous process improvements, often supported by AI and advanced process control (APC) systems, aim to maximize yield, reduce side-product formation, and lower the overall carbon footprint of chemical manufacturing. The integration of continuous flow chemistry techniques is being explored to replace traditional batch processing, promising enhanced scalability, tighter control over exothermic reactions, and improved product consistency, particularly for high-volume intermediates like MBT and CBS. This technological push is essential for manufacturers to maintain competitiveness while adhering to global environmental mandates and meeting the increasing demand for high-quality, high-performance rubber products required by the evolving automotive and industrial sectors.

Regional Highlights

- Asia Pacific (APAC): APAC is the global epicenter for rubber chemical consumption and production, driven primarily by China and India, which house the world's largest tire manufacturing base and rapidly expanding automotive industries. The region benefits from lower operating costs and governmental support for chemical manufacturing, though it faces increasing pressure to adopt cleaner production technologies and adhere to stringent emission controls. High demand for accelerators and antidegradants in the volume tire segment solidifies its dominance.

- North America: This region represents a mature market characterized by demand for high-value specialty chemicals, particularly those designed for rigorous performance standards and environmental compliance. North America leads in the adoption of non-nitrosamine accelerators and advanced antiozonants required for premium tires, especially those catering to the replacement market and electric vehicle segment, focusing heavily on sustainability and low rolling resistance.

- Europe: Europe is defined by the strictest regulatory framework, notably REACH, driving innovation towards bio-based and non-toxic rubber additives. Demand is stable, centered around specialty and high-performance non-tire applications, alongside premium tire manufacturing. The region often sets the global benchmark for chemical safety and environmental responsibility, compelling producers to invest heavily in clean manufacturing processes.

- Latin America (LATAM): Growth in LATAM is closely linked to the automotive production output in Brazil and Mexico, coupled with expanding agricultural and mining sectors that require industrial rubber goods like conveyor belts and heavy-duty tires. The market is moderately fragmented, with increasing reliance on imports of high-performance chemicals, though local manufacturing capacity is gradually increasing.

- Middle East and Africa (MEA): This region is an emerging market, driven by infrastructural projects, oil and gas exploration (requiring specialized seals and hoses), and gradually increasing domestic automotive assembly. Demand growth is robust, albeit from a lower base, largely dependent on imported specialty chemicals to meet demanding industrial specifications, particularly in the harsh operating environments characteristic of the region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Rubber Chemicals Market.- Sichuan Fushun Chemical Co. Ltd.

- Shandong Yanggu Huatai Chemical Co. Ltd.

- Jiangsu Sinorgchem Technology Co. Ltd.

- Eastman Chemical Company

- Kumho Petrochemical Co. Ltd.

- Lanxess AG

- Sinopec Yangzi Petrochemical Co. Ltd.

- Arkema SA

- Sumitomo Chemical Co. Ltd.

- Qingdao Doublestar

- Roberto

- Ouchi Shinko Chemical Industrial Co. Ltd.

- Agrocel Industries Pvt. Ltd.

- R.T. Vanderbilt Holding Company Inc.

- China Sunsine Chemical Holdings Ltd.

- Nocil Limited

- Kemai Chemical Co. Ltd.

- Pukhraj Additives LLP

- WRC Rubber Chemicals

- Performance Additives

Frequently Asked Questions

What are the primary drivers of growth in the Rubber Chemicals Market?

The key growth drivers are the robust recovery and expansion of the global automotive industry, particularly in Asia Pacific; the mandatory adoption of high-performance tires for electric vehicles (EVs); and increasing regulatory requirements demanding safer, more durable, and fuel-efficient rubber products globally, thereby boosting demand for specialized accelerators and antidegradants.

How is the adoption of electric vehicles (EVs) impacting the demand for rubber chemicals?

EV adoption significantly increases demand for specialized rubber chemicals because EV tires require compounds offering higher load bearing capacity, significantly reduced rolling resistance for extended battery range, and enhanced abrasion resistance due to the higher torque and instant acceleration characteristics of electric powertrains. This favors high-purity, advanced accelerator and antioxidant systems.

What is the role of accelerators in rubber processing and which types dominate the market?

Accelerators significantly reduce the time and temperature required for the vulcanization (curing) process, optimizing manufacturing efficiency and improving the final physical properties of the rubber, such as strength and elasticity. Sulfenamides (e.g., CBS and TBBS) and Thiazoles (e.g., MBT and MBTS) are the most dominant types, known for their versatility and controlled vulcanization kinetics.

Which geographical region holds the largest market share for rubber chemicals and why?

The Asia Pacific (APAC) region holds the largest market share, predominantly due to the massive scale of the automotive and tire manufacturing industries in countries like China and India. The region benefits from substantial production capacity for petrochemical raw materials and a highly competitive manufacturing base, leading to high consumption volumes.

What regulatory challenges are chemical manufacturers facing in this market?

Manufacturers face significant regulatory challenges, primarily driven by stringent environmental regulations like the European Union's REACH framework, which mandates the phase-out of chemicals that generate harmful N-nitrosamines. This requires substantial investment in R&D to formulate safer, compliant alternatives and upgrade existing production facilities, increasing operational costs.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager