Rubber Latex Thread Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442681 | Date : Feb, 2026 | Pages : 257 | Region : Global | Publisher : MRU

Rubber Latex Thread Market Size

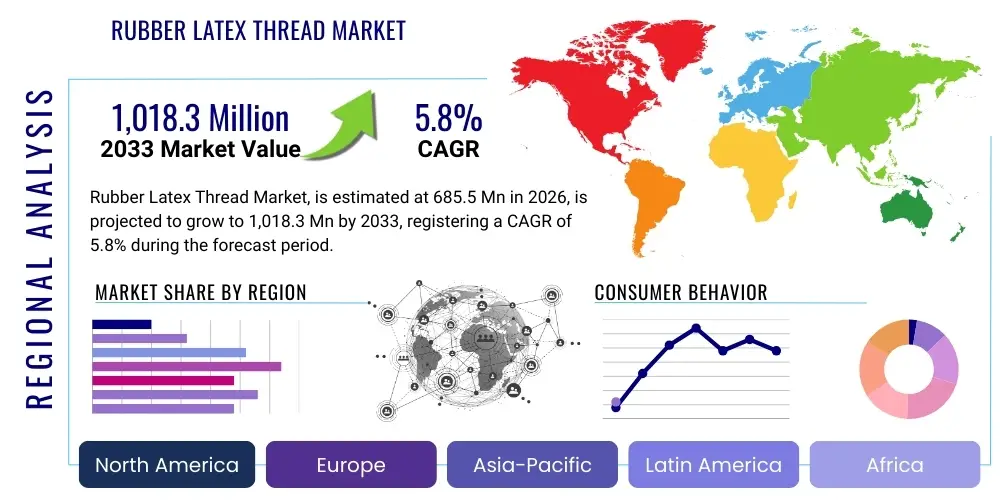

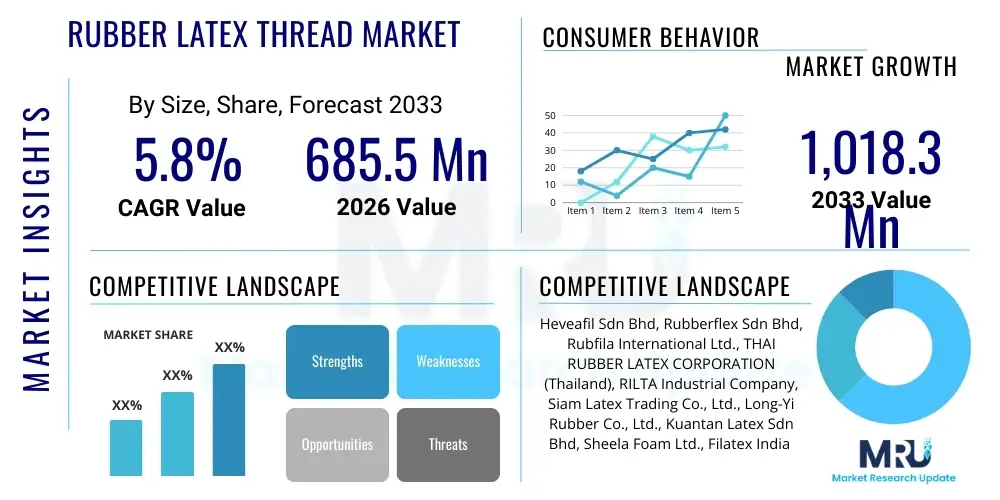

The Rubber Latex Thread Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 685.5 Million in 2026 and is projected to reach USD 1,018.3 Million by the end of the forecast period in 2033.

Rubber Latex Thread Market introduction

The Rubber Latex Thread Market encompasses the manufacturing, distribution, and utilization of threads derived primarily from natural rubber latex, known for their exceptional elasticity and recovery properties. These threads are foundational components in the textile industry, providing stretch capabilities vital for modern apparel and specialized industrial applications. Natural rubber latex threads offer superior elongation and tensile strength compared to many synthetic alternatives, making them indispensable in applications requiring reliable, long-lasting stretch.

Rubber latex thread is manufactured through complex processes involving compounding, coagulation, and vulcanization of concentrated liquid natural rubber latex. The final product is used across various sectors, most notably in the production of elastic bands, hosiery, compression garments, and surgical stockings. The major applications span functional textiles, including sportswear, intimate wear (lingerie), and critical medical textiles where precise compression is required. The inherent softness and breathability of natural latex also contribute to its sustained demand in comfort-focused applications.

The market growth is fundamentally driven by the expanding global apparel industry, particularly the rising consumer preference for comfortable, flexible, and athleisure wear that heavily relies on high-quality elastic components. Additionally, the aging population and increased prevalence of vascular diseases fuel the demand for medical compression therapy, where latex threads are paramount. Key benefits include high rebound resilience, excellent durability, and cost-effectiveness compared to premium synthetic fibers, sustaining its competitive edge despite environmental and raw material volatility concerns.

Rubber Latex Thread Market Executive Summary

The global Rubber Latex Thread Market is experiencing steady growth, propelled by robust demand from the apparel and healthcare sectors. Business trends indicate a strong focus on manufacturing efficiency, aiming to mitigate the impact of fluctuating natural rubber commodity prices and labor costs. Strategic collaborations between thread manufacturers and textile mills are becoming common, emphasizing tailored product development, such as specialized latex threads for seamless garment technology and enhanced durability in industrial applications. Investment in automated processing lines and quality control systems remains a priority for market leaders seeking to optimize production yield and maintain consistent thread characteristics, which is crucial for high-speed weaving and knitting operations.

Regionally, the Asia Pacific (APAC) dominates the market, primarily due to the concentration of natural rubber plantations and the massive presence of textile and apparel manufacturing hubs, particularly in countries like Thailand, India, and China. This region not only serves as the largest producer but also the largest consumer, driven by rapid urbanization and rising disposable incomes leading to increased consumer spending on garments. North America and Europe, while slower growth regions, maintain high demand for premium, specialized latex threads used in advanced medical applications and high-end branded sportswear, focusing heavily on sustainability certifications and compliance with strict regulatory standards regarding material safety and processing traceability.

Segment-wise, Powdered Latex Thread currently holds a significant share, although there is an increasing shift towards Talc Coated and Non-Powdered variants due to rising health consciousness and safety regulations related to airborne powder particles in manufacturing environments and end-use products. Application-wise, the Apparel segment remains the largest consumer, but the Medical segment is projected to exhibit the highest CAGR, spurred by technological advancements in compression wear and surgical materials that require high-precision elastic characteristics. Manufacturers are continuously exploring innovations in dyeing capabilities and bonding characteristics to enhance integration with synthetic cover yarns like polyester and nylon.

AI Impact Analysis on Rubber Latex Thread Market

User queries regarding AI's impact on the Rubber Latex Thread market primarily center on operational efficiency, predictive maintenance, and supply chain transparency, rather than direct product innovation, as latex thread production is fundamentally material-science based. Common themes include how AI can forecast natural rubber price volatility, optimize blending ratios for consistent quality control, and improve throughput in high-volume spinning operations. Concerns often relate to the cost of implementing AI infrastructure in traditional manufacturing setups and the required workforce retraining. Expectations are high regarding AI’s ability to minimize material waste, predict equipment failure in vulcanization units, and enhance end-to-end supply chain visibility from plantation to finished textile product, ensuring timely delivery and responsive inventory management.

- AI-driven Predictive Maintenance: Reduces downtime in complex manufacturing machinery (extruders, vulcanizers) by analyzing sensor data for potential failures.

- Optimized Quality Control (QC): Computer vision systems and machine learning algorithms automatically detect minuscule defects in thread uniformity and thickness, ensuring higher product consistency.

- Supply Chain & Pricing Forecasting: Advanced analytics predict fluctuations in natural rubber commodity prices, enabling proactive procurement strategies and hedging against volatility.

- Process Parameter Optimization: AI models fine-tune curing times and chemical additive amounts in compounding, minimizing batch-to-batch variations and improving thread elasticity profiles.

- Enhanced Inventory Management: Machine learning forecasts demand based on seasonal textile trends, optimizing raw material (liquid latex) inventory levels and reducing storage costs.

DRO & Impact Forces Of Rubber Latex Thread Market

The market dynamics for rubber latex thread are shaped by a complex interplay of internal material superiority and external economic and environmental pressures. Key drivers predominantly stem from the intrinsic properties of natural latex, such as its unmatched elasticity, high heat resistance, and superior recovery, which provide a competitive advantage over most synthetic elastomers in functional applications. Furthermore, the persistent global expansion of consumer markets for specialized textiles, including advanced compression wear and high-performance athletic apparel, continually strengthens demand. This sustained market pull necessitates consistent supply and incentivizes manufacturers to improve processing efficiency and scale production volumes.

However, the market faces significant restraints, primarily revolving around the economic volatility of the core raw material. Natural rubber prices are susceptible to geopolitical shifts, weather patterns, and agricultural output cycles, leading to unpredictable manufacturing costs and impacting profitability margins. Additionally, the growing popularity and perceived convenience of synthetic alternatives, notably spandex (elastane) and synthetic polyisoprene, pose a competitive threat, especially in applications where extreme chemical resistance or specific color retention is prioritized over natural feel and high rebound. Regulatory scrutiny regarding latex allergies, though affecting a small portion of the population, also mandates manufacturers to implement strict labeling and sometimes transition to low-protein or specialized variants, incurring higher production costs.

Significant opportunities for growth lie in the development of sustainable and certified rubber sourcing practices, addressing rising consumer and regulatory demands for environmentally responsible products. Innovations in low-ammonia or TMTD-free (tetramethylthiuram disulfide) processing are opening doors to niche markets focused on hypoallergenic and eco-friendly textiles. The rapidly developing economies in Southeast Asia and Africa present untapped market potential, offering new manufacturing bases closer to raw material sources and expanding local demand for affordable, high-quality textiles. The increasing penetration of e-commerce platforms also enables specialized thread manufacturers to reach global niche customers, driving customized small-batch orders and product diversification.

These internal and external forces have a profound impact on strategic decision-making within the industry. High raw material dependence necessitates forward integration into plantation management or implementing sophisticated price hedging mechanisms (Impact Force). The need for specialized, high-performance threads pushes capital investment towards advanced R&D for material science innovation (Impact Force). Lastly, global regulatory trends regarding worker safety and environmental governance compel manufacturers to adopt cleaner processing technologies, influencing capital expenditure and operational costs (Impact Force).

Segmentation Analysis

The Rubber Latex Thread Market is categorized based on product type, application, and geography, allowing for a detailed understanding of consumer preferences and regional market characteristics. Segmentation by type differentiates between how the thread is treated post-processing, primarily focusing on minimizing tackiness and improving usability in textile machines. Segmentation by application highlights the vast end-use industries, with apparel and medical dominating demand due to the essential requirement for elasticity and stretch in these products. Analyzing these segments is critical for manufacturers to tailor their production capabilities and marketing strategies effectively.

- By Type:

- Powdered Latex Thread

- Non-Powdered Latex Thread

- Talc Coated Latex Thread

- By Application:

- Apparel (Elastic Bands, Hosiery, Lingerie, Athleisure)

- Medical (Bandages, Compression Stockings, Surgical Drapes)

- Industrial (Automotive Covers, Furniture Upholstery, Protective Equipment)

- Others (Toys, Stationery, Sports Equipment)

- By Geography:

- North America (U.S., Canada, Mexico)

- Europe (Germany, U.K., France, Italy, Spain)

- Asia Pacific (China, India, Japan, South Korea, Thailand, Indonesia)

- Latin America (Brazil, Argentina)

- Middle East & Africa (UAE, Saudi Arabia, South Africa)

Value Chain Analysis For Rubber Latex Thread Market

The rubber latex thread value chain begins upstream with the cultivation and harvesting of rubber trees (Hevea brasiliensis) to extract field latex. This raw material is then concentrated at processing facilities, involving steps like centrifugation to increase the Dry Rubber Content (DRC) to commercial grade, typically 60%. The quality and cost of raw liquid latex significantly dictate the final product’s profitability. Key stakeholders in this upstream segment include plantation owners, agricultural cooperatives, and large integrated rubber producers who manage tapping, collection, and primary processing. Efficiency in this stage, particularly minimizing contamination and ensuring rapid transport to concentration plants, is paramount to maintaining the inherent properties of the natural polymer.

The middle segment involves the core manufacturing process: compounding, extrusion, coagulation, washing, drying, and spooling of the rubber latex thread. Manufacturers add vulcanizing agents, antioxidants, and stabilizers during compounding to achieve desired elasticity, durability, and resistance to heat and aging. Investment in precise extrusion technology is crucial here to maintain consistent denier (thickness) and uniformity, which are non-negotiable requirements for high-speed textile machinery downstream. Major manufacturing units are predominantly located in proximity to raw material sources in Southeast Asia, leveraging lower operational costs and established infrastructure.

Downstream analysis focuses on the distribution channels and end-user consumption. Distribution is handled through a mix of direct sales to large textile conglomerates and indirect routes via specialized industrial distributors and agents who cater to smaller weaving and knitting mills. These distributors often provide warehousing and logistics services, breaking down bulk shipments. The end-users are largely textile manufacturers specializing in elastic fabrics for apparel (hosiery, elastic webbing) and medical textile producers (compression garments, bandages). Success in the downstream segment relies heavily on maintaining strong relationships with key textile manufacturers and providing certified, high-quality products that comply with textile standards such as Oeko-Tex and REACH. Direct sales are prevalent for high-volume, standard products, while complex or niche threads often utilize indirect specialty channels.

Rubber Latex Thread Market Potential Customers

The primary customers for rubber latex thread are large-scale textile manufacturers requiring elastic components for their product lines. These manufacturers range from specialized narrow-fabric weavers who produce elastic bands for waistlines and cuffs, to major hosiery and intimate wear producers who integrate the thread into knitted fabrics for stretch and shape retention. The demand is particularly high among producers of performance wear and athleisure clothing, where elasticity, breathability, and durability are key selling points for the final consumer. These customers require threads with specific tensile strengths, elongation percentages, and resistance to washing and chlorine.

Another critical set of potential buyers resides within the medical devices and healthcare textiles sector. This includes companies specializing in manufacturing compression wear, such as anti-embolism stockings, compression bandages for wound care, and supportive therapeutic garments. For these customers, consistency, hypoallergenic properties (low protein content), and compliance with strict medical device regulations (e.g., FDA, CE marking) are mandatory. The thread must maintain precise, graded compression over extended use, making material quality and manufacturing consistency paramount in the selection process. These buyers often demand direct supplier agreements with comprehensive quality assurance documentation.

Industrial applications represent a secondary but highly specialized customer base. These include manufacturers of furniture upholstery (requiring durable elastic webbing), automotive component suppliers (elastic ties and covers), and producers of specialized protective equipment and sports gear. For industrial customers, the primary purchasing criteria often revolve around resistance to harsh environments (UV light, abrasion, chemical exposure) and high mechanical strength, sometimes requiring specialty coated latex threads. The diversity of application means manufacturers must maintain a versatile product portfolio to serve these varied end-user requirements effectively.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 685.5 Million |

| Market Forecast in 2033 | USD 1,018.3 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Heveafil Sdn Bhd, Rubberflex Sdn Bhd, Rubfila International Ltd., THAI RUBBER LATEX CORPORATION (Thailand), RILTA Industrial Company, Siam Latex Trading Co., Ltd., Long-Yi Rubber Co., Ltd., Kuantan Latex Sdn Bhd, Sheela Foam Ltd., Filatex India Ltd., Jiangyin Xinhao Rubber & Plastic Co., Ltd., Guangzhou Chunshun Rubber Products Co., Ltd., D&R Latex, Vamshi Rubber Ltd., Nam Kook Rubber Industrial Co., Ltd., L.K. Rubber Industry Co., Ltd., Sri Trang Agro-Industry Public Co., Ltd., Von Bundit Co., Ltd., T. K. Rubber Products Co., Ltd., Thai Hua Rubber Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Rubber Latex Thread Market Key Technology Landscape

The manufacturing of high-quality rubber latex thread relies on a mature but constantly refined set of technologies centered around extrusion, vulcanization, and surface treatment. The core technological advancement involves continuous process control systems that ensure uniformity of the thread denier (size) and optimize the drying and curing stages. Modern extrusion techniques, often utilizing spinnerets with precise geometry, are crucial for producing ultra-fine gauge threads required for delicate hosiery and lightweight stretch fabrics, minimizing waste and maximizing throughput. Innovations in compounding technology focus on developing advanced stabilizing agents and accelerators that improve the thread’s resistance to heat, washing cycles, and chlorine degradation, thus extending the lifespan of the end textile product.

A significant technological focus area is the transition toward non-powdered and low-protein latex processing to address health and safety concerns, including latex allergies and worker exposure to dusting agents. This involves refining the washing and leaching processes to remove water-soluble proteins efficiently, alongside developing specialized surface treatments, such as silicone coating or advanced talc alternatives, that prevent the thread from sticking during spooling and knitting without introducing harmful particulates. Manufacturers are increasingly adopting closed-loop washing systems, which also contribute to environmental sustainability by reducing water consumption and managing effluent discharge more effectively, aligning with global green manufacturing standards.

Furthermore, the integration of automation and digitalization, while still nascent compared to other industries, is key to enhancing competitiveness. This includes implementing high-speed winding machines with automatic tension control and utilizing sensors throughout the manufacturing line to capture real-time data on thread tension, diameter, and chemical parameters. Such data-driven approaches enable rapid identification and correction of manufacturing defects, moving towards a zero-defect production environment. Future technological improvements are anticipated in developing hybrid threads that combine the superior elasticity of natural latex with the chemical resilience and color stability of synthetic core fibers, broadening application possibilities.

Regional Highlights

- Asia Pacific (APAC) Dominance: APAC holds the dominant share in the Rubber Latex Thread Market, driven by its dual role as the global manufacturing hub for natural rubber and a primary center for textile production. Countries like Thailand, Indonesia, and Malaysia are major raw latex producers, ensuring lower procurement costs and robust supply chain integration for thread manufacturers. China and India represent massive consumption markets, fueled by rapid expansion in the domestic apparel sector, increasing demand for affordable elastic materials in garments, and significant investments in medical infrastructure requiring sterile elastic supplies. The region’s competitive manufacturing environment and established textile supply chain infrastructure solidify its leadership.

- North America: The North American market is characterized by high demand for specialized, high-performance, and high-quality latex threads, particularly in the premium athleisure wear and advanced medical device segments. While the region is not a major thread manufacturer, it dictates global quality standards, focusing heavily on sustainability certifications, low-protein content (hypoallergenic), and strict adherence to material safety data sheets. Growth is moderate but stable, driven by continuous innovation in technical textiles and replacement demand in established consumer markets.

- Europe: Europe represents a mature market with a strong emphasis on regulatory compliance (e.g., REACH regulations concerning chemical safety) and environmental responsibility. Demand is concentrated in Western European countries (Germany, Italy, UK) for high-end fashion, intimate apparel, and sophisticated compression garments. Manufacturers supplying this region must demonstrate traceability and ethical sourcing, often leading to a preference for sustainable or certified natural rubber products. The regional trend leans towards premiumization and technical textiles rather than mass-market volume growth.

- Latin America (LATAM): The LATAM region exhibits moderate growth, driven by an expanding domestic textile industry, particularly in Brazil and Mexico. Demand is sensitive to global commodity prices and internal economic conditions. The market serves both local apparel needs and provides competitive manufacturing capabilities for exports. Investment in thread production technology is growing, aiming to modernize existing facilities and reduce reliance on imported elastic components.

- Middle East & Africa (MEA): The MEA region is currently the smallest market but shows promise, largely due to infrastructure development, rising healthcare spending, and expanding local textile manufacturing initiatives (especially in Turkey and South Africa). Demand for surgical and medical textile applications is accelerating, spurred by governmental efforts to improve healthcare access and build local manufacturing capacity, minimizing dependence on global imports for essential goods.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Rubber Latex Thread Market.- Heveafil Sdn Bhd

- Rubberflex Sdn Bhd

- Rubfila International Ltd.

- THAI RUBBER LATEX CORPORATION

- RILTA Industrial Company

- Siam Latex Trading Co., Ltd.

- Long-Yi Rubber Co., Ltd.

- Kuantan Latex Sdn Bhd

- Sheela Foam Ltd.

- Filatex India Ltd.

- Jiangyin Xinhao Rubber & Plastic Co., Ltd.

- Guangzhou Chunshun Rubber Products Co., Ltd.

- D&R Latex

- Vamshi Rubber Ltd.

- Nam Kook Rubber Industrial Co., Ltd.

- L.K. Rubber Industry Co., Ltd.

- Sri Trang Agro-Industry Public Co., Ltd.

- Von Bundit Co., Ltd.

- T. K. Rubber Products Co., Ltd.

- Thai Hua Rubber Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Rubber Latex Thread market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Rubber Latex Thread Market?

The key growth driver is the continuous and expanding global demand for elastic textiles, particularly within the apparel sector (athleisure, intimate wear) and the healthcare sector, which relies heavily on high-quality rubber latex threads for compression garments due to their superior stretch and recovery properties.

How does the volatility of natural rubber prices affect thread manufacturers?

Raw natural rubber is a commodity, and its price volatility directly impacts the manufacturing cost of latex thread, leading to fluctuating profit margins and necessitating sophisticated supply chain management, hedging strategies, or long-term procurement contracts to stabilize input costs.

Which application segment holds the largest share in the Rubber Latex Thread Market?

The Apparel segment, encompassing elastic bands for clothing, hosiery, and lingerie, currently holds the largest market share due to the widespread need for reliable stretch components in almost all forms of modern functional and everyday clothing globally.

Are synthetic alternatives like spandex a major threat to the rubber latex thread industry?

Synthetic alternatives, primarily spandex (elastane), pose a significant competitive restraint, especially in textiles requiring high chemical resistance or specific color retention, though natural latex maintains an advantage in elasticity, comfort, and cost-effectiveness for many high-rebound applications.

Which geographical region is the most significant producer and consumer of rubber latex thread?

Asia Pacific (APAC), particularly Southeast Asian countries like Thailand and Malaysia (as raw material sources) and China and India (as manufacturing hubs), dominates the market, serving as both the largest production base and the leading consumption center globally.

In-Depth Strategic Analysis of Market Dynamics and Competitive Landscape

The strategic positioning within the Rubber Latex Thread Market requires manufacturers to navigate a complex matrix of commodity pricing, regulatory compliance, and rapid textile innovation. Companies focused solely on high-volume, standard powdered thread face intense price competition, primarily from Asian producers who benefit from lower raw material and labor costs. Consequently, differentiation is increasingly achieved through specialization—focusing on niche threads such as ultra-fine denier for high-end sheer hosiery, or specialized low-protein variants required by the medical sector. Strategic capital expenditure is directed toward advanced compounding facilities that can precisely control chemical inputs, thereby optimizing durability and resistance characteristics, critical for threads used in industrial or performance sportswear environments.

Competitive strategy is heavily influenced by vertical integration. Manufacturers who own or have strong, long-term contractual ties with rubber plantations gain a considerable cost advantage and enhanced control over raw latex quality and supply stability. This integration minimizes exposure to the spot market volatility of natural rubber. Furthermore, successful market penetration in developed regions, such as North America and Europe, necessitates compliance with demanding textile standards like OEKO-TEX and rigorous environmental, social, and governance (ESG) criteria. This pushes leading players to invest in traceability systems and third-party certifications, transforming sustainability from a compliance requirement into a competitive differentiator and a value-added service for their textile manufacturing customers.

In terms of future outlook, the competitive landscape is shifting towards technological partnerships. Thread manufacturers are collaborating with synthetic fiber producers (like those making nylon and polyester) to develop highly durable, blended core-spun threads. These hybrid products combine the superior stretch recovery of latex with the enhanced chemical stability and dye affinity of synthetic wraps, catering to the growing demand for highly functional and durable stretch fabrics in high-performance sportswear. This emphasis on material science innovation, coupled with the implementation of AI-driven manufacturing analytics for consistent quality control, will define market leadership over the forecast period, favoring entities capable of high capital investment in R&D and automated processing lines.

Impact of COVID-19 on Rubber Latex Thread Market

The COVID-19 pandemic introduced substantial volatility into the Rubber Latex Thread Market, characterized by initial massive supply chain disruptions followed by a complex shift in demand patterns. During the initial phase in 2020, manufacturing shutdowns across key textile hubs in Asia led to severe production bottlenecks and delayed shipments, impacting global inventory levels. Concurrently, restrictions on movement and labor shortages in rubber-producing regions temporarily constrained the supply of raw liquid latex, contributing to short-term price spikes and operational uncertainty for thread producers globally. The temporary closure of many textile factories focused on fashion and formal wear caused a sharp decline in demand from traditional apparel segments.

However, the pandemic simultaneously created a surge in demand from the medical and protective equipment sectors. Rubber latex thread is a critical component in the production of disposable medical gloves, certain types of respiratory masks (elastic bands), and, crucially, specialized compression stockings needed for treating patients confined to beds or suffering from pandemic-related circulatory issues. This acute, immediate demand from the healthcare sector partially offset losses from the fashion industry, particularly benefiting manufacturers with specialized or certified medical-grade production capabilities. Furthermore, the global shift towards working from home spurred an unexpected boom in demand for comfortable casual wear and athleisure garments, products that rely heavily on elastic fabrics, providing a mid-to-long-term compensatory demand driver for the market.

The long-term impact analysis suggests that the pandemic accelerated trends toward supply chain regionalization and digitalization. Companies recognized the risks of overly concentrated manufacturing bases and began exploring diversification strategies, seeking secondary production sites outside traditional Asian centers or increasing inventory buffers. Moreover, the enhanced focus on hygiene and health awareness has permanently bolstered the medical application segment's share. Manufacturers are now prioritizing flexibility, redundant sourcing strategies, and integrating predictive analytics tools to better forecast demand spikes and manage unexpected supply chain shocks, making the industry more resilient to future global crises.

Emerging Market Trends and Future Outlook

A primary emerging trend reshaping the Rubber Latex Thread Market is the increasing integration of circular economy principles and sustainability metrics throughout the value chain. Consumers and corporate buyers are placing greater emphasis on ethically sourced natural rubber, leading to a rising market share for threads certified by organizations like the Forest Stewardship Council (FSC) or other sustainable rubber initiatives. Manufacturers are investing in infrastructure to process bio-based chemicals and reduce the environmental footprint associated with vulcanization and wastewater management. This shift is particularly pronounced in developed economies, where stringent regulations and strong consumer advocacy necessitate a move away from conventional, chemically intensive processing methods toward cleaner, TMTD-free alternatives.

Another significant trend is the accelerating demand for specialized and customized thread characteristics. Generic, standard-size latex threads are increasingly being commoditized, forcing suppliers to innovate in niche areas. This includes developing threads optimized for specific performance criteria, such as superior chlorine resistance for swimwear, enhanced UV stability for outdoor industrial textiles, or unique dyeing capabilities for specialized fashion needs. The market is moving away from a one-size-fits-all approach toward tailored solutions, requiring manufacturers to maintain smaller, more flexible batch production capabilities and closer technical collaboration with textile producers during their fabric development phase to ensure optimal integration of the thread.

Looking forward, the global health and wellness movement will continue to drive the high-growth trajectory of the medical and compression textile segments. As global populations age and awareness of circulatory health increases, the demand for precise, effective compression garments utilizing high-quality latex thread is projected to expand significantly. Furthermore, technological advances in textile manufacturing, such as 3D knitting and seamless garment construction, rely heavily on extremely uniform and reliable elastic components, thereby creating new market opportunities for thread manufacturers who can consistently supply specialized fine-gauge products compatible with these advanced machinery types. This confluence of sustainability focus, customization, and health-driven demand ensures continued, though complex, market expansion.

Regulatory Landscape and Compliance Standards

The Rubber Latex Thread Market operates under a fragmented but increasingly stringent regulatory framework that primarily governs raw material sourcing, chemical usage, and product safety. In the European Union, regulations such as REACH (Registration, Evaluation, Authorisation, and Restriction of Chemicals) heavily influence the acceptable chemical additives (accelerators, antioxidants) used in the vulcanization process. Manufacturers exporting to Europe must ensure their products are free from restricted substances and provide exhaustive documentation regarding chemical composition. This regulatory pressure encourages the use of non-toxic, eco-friendly compounding ingredients, pushing innovation toward safer alternatives like zinc oxide and specific non-nitrosamine-forming accelerators, which raises production complexity and cost.

For threads destined for the medical sector, compliance is even more demanding, particularly in major markets like the U.S. (FDA) and EU (MDR). These standards mandate strict control over protein levels in natural rubber latex to mitigate the risk of Type I hypersensitivity (latex allergy). This has spurred the development and market adoption of low-protein or ‘deproteinized’ latex threads, requiring specialized leaching and washing protocols during manufacturing. Compliance involves rigorous testing, batch traceability, and facility certification (e.g., ISO 13485 for medical device components), adding significant overhead but ensuring access to the high-value medical textile market.

Beyond product safety, ethical and environmental regulations are gaining prominence. The increasing focus on deforestation, labor practices in plantation management, and overall supply chain transparency drives adherence to international certification standards, such as those promoted by the Global Platform for Sustainable Natural Rubber (GPSNR). While often voluntary, these standards are frequently required by major multinational textile brands concerned with their corporate social responsibility profile. Manufacturers must demonstrate robust traceability mechanisms from the source plantation to the final thread product, affecting sourcing decisions and potentially increasing raw material costs for certified latex, but securing essential business with large, sustainability-conscious buyers.

Critical Market Challenges and Risk Mitigation

One of the most profound challenges facing the Rubber Latex Thread Market is the inherent volatility and lack of control over the raw material supply—natural rubber latex. Global rubber production is highly susceptible to climate change impacts (drought, flooding), tree diseases (like the Pestalotiopsis leaf fall disease), and geopolitical instability in major producing regions. This unpredictability creates significant cost management hurdles for thread manufacturers, who must procure large volumes of liquid latex months in advance. Risk mitigation strategies include diversifying sourcing across multiple geographical regions, hedging commodity price exposure through futures markets, and building strategic raw material inventory reserves when prices are favorable, although this ties up substantial working capital.

A second critical challenge involves the growing competitive pressure from synthetic elastic fibers, mainly spandex (elastane) and other polyurethanes. While rubber latex thread offers superior elongation and comfort in certain heavy-duty applications, synthetic fibers often outperform latex in areas such as chemical resistance (especially to chlorine in swimwear), UV stability, and ease of dyeing, allowing for a broader color palette and long-lasting color retention. To counter this, latex thread manufacturers must focus their R&D efforts on enhancing these specific weak points through advanced compounding techniques, specialized surface coatings, and developing core-spun or covered threads that leverage the best of both materials while maintaining a competitive cost structure.

Finally, operational challenges related to energy consumption and labor costs remain substantial, particularly in high-volume, low-margin segments. The manufacturing process, especially the drying and vulcanization stages, is energy-intensive. Rising global energy costs put pressure on operational expenditure. Furthermore, maintaining consistent quality requires specialized labor for monitoring and calibration. Addressing these risks involves ongoing investment in energy-efficient machinery (e.g., modern thermal energy recovery systems in dryers), optimizing factory layouts for continuous flow, and implementing automation where feasible to reduce reliance on highly skilled, yet costly, manual labor, thus ensuring consistent product quality and cost competitiveness in the global market.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager