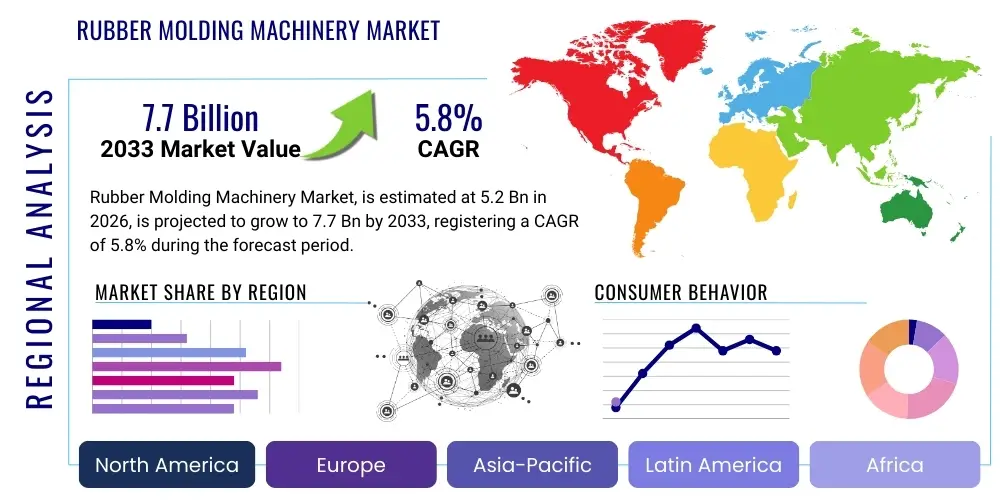

Rubber Molding Machinery Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442502 | Date : Feb, 2026 | Pages : 257 | Region : Global | Publisher : MRU

Rubber Molding Machinery Market Size

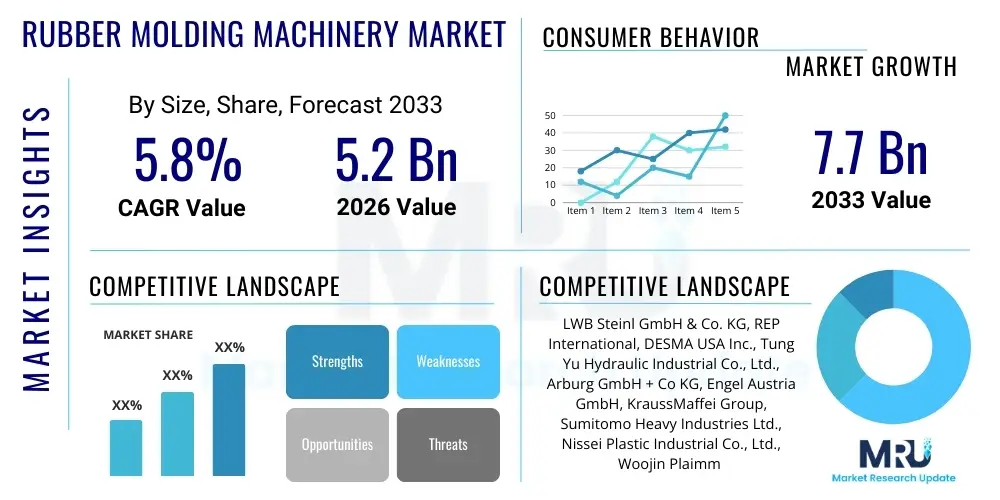

The Rubber Molding Machinery Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $5.2 Billion in 2026 and is projected to reach $7.7 Billion by the end of the forecast period in 2033.

The robust expansion of the global automotive sector, coupled with escalating demand for high-precision rubber components in the medical and consumer electronics industries, is fundamentally fueling the valuation increase. Modern rubber molding machinery integrates advanced automation and control systems, enabling manufacturers to achieve tighter tolerances and higher production efficiency, which are critical requirements in safety-critical applications like seals, gaskets, and specialized medical stoppers. Furthermore, the shift towards electric vehicles (EVs) is generating new opportunities for rubber components optimized for high-voltage and thermal management systems, necessitating continuous investment in specialized molding equipment capable of handling complex elastomers and multi-component molding processes. This technological evolution assures sustained market buoyancy throughout the forecast period.

Rubber Molding Machinery Market introduction

The Rubber Molding Machinery Market encompasses equipment designed for shaping uncured rubber compounds into final functional parts through processes such as injection, compression, and transfer molding. These specialized machines are indispensable for producing a vast range of products, including tires, sealing devices (gaskets, O-rings), vibration dampeners, medical components, and footwear soles. Major applications span the automotive, healthcare, construction, and consumer goods sectors, driven by the inherent benefits of rubber, such such as elasticity, chemical resistance, and excellent sealing capabilities. Key driving factors include increasing global vehicle production, stringent regulatory standards mandating high-quality elastomeric seals, rapid industrialization in developing economies, and the continuous need for lightweight, durable components in high-performance applications. The market's dynamism is rooted in technological integration, focusing on enhancing precision, reducing cycle times, and minimizing material waste through advanced automation and precise temperature control mechanisms, thereby assuring product consistency and operational efficiency for high-volume manufacturing environments globally.

Rubber Molding Machinery Market Executive Summary

The market exhibits strong business trends characterized by digitalization and the adoption of Industry 4.0 principles, primarily manifesting as integrated IoT sensors, real-time quality control, and predictive maintenance schedules, leading to significant operational improvements. Regionally, the Asia Pacific (APAC) dominates the market, leveraging its status as a global hub for automotive and consumer electronics manufacturing, driving substantial installation capacity, while Europe and North America focus on high-value, specialized machinery for medical and aerospace applications. Segment trends indicate a rising preference for rubber injection molding machines due to their high throughput and ability to handle complex geometries, displacing older compression molding techniques in many high-volume applications, though compression remains vital for large-scale, low-complexity parts like heavy-duty vehicle mounts and certain architectural components. Sustainability mandates are also shaping demand, with manufacturers prioritizing energy-efficient machines and those capable of processing recycled or bio-based elastomers, further segmenting the technological landscape and pushing innovation in material compatibility and processing parameters.

AI Impact Analysis on Rubber Molding Machinery Market

Users frequently inquire about how Artificial Intelligence (AI) and Machine Learning (ML) are being integrated into the traditional manufacturing processes of rubber molding. Common questions revolve around AI’s efficacy in optimizing cure times, predicting equipment failure (predictive maintenance), enhancing quality control (defect detection via machine vision), and fine-tuning material mixing and injection parameters for novel elastomer formulations. The consensus expectation is that AI will dramatically reduce scrap rates, optimize energy consumption by precisely managing heating and cooling cycles, and ultimately lead to fully autonomous operation of molding cells. Key themes emerging from user concerns include the cost of retrofitting older machinery, the need for specialized data infrastructure, and the complexity of training models for highly viscoelastic materials. Overall, users anticipate that AI integration will shift competitive dynamics toward those firms capable of leveraging data-driven insights to maximize component consistency and throughput.

- AI-driven predictive maintenance optimizes machinery uptime by forecasting component failure, significantly reducing unplanned downtime.

- Machine Learning algorithms refine process parameters (temperature, pressure, injection rate) in real-time, reducing material waste and improving dimensional stability of parts.

- Integrated machine vision systems utilizing AI algorithms provide automated, high-speed defect detection, ensuring 100% quality assurance for critical components.

- AI facilitates mold design optimization through simulation, accelerating product development cycles and reducing the need for extensive physical prototyping.

- Energy consumption is optimized by AI systems dynamically adjusting heating elements and chilling units based on current production load and ambient conditions.

DRO & Impact Forces Of Rubber Molding Machinery Market

The market is primarily driven by the escalating demand from the automotive industry, particularly for specialized rubber parts used in sealing and NVH (Noise, Vibration, and Harshness) applications, alongside rapid growth in medical device manufacturing requiring sterile, precise rubber components. Key restraints include the high initial capital investment required for modern, high-tonnage machinery and the volatility of raw material (synthetic and natural rubber) prices, which impacts manufacturing cost structures and end-product pricing stability. Opportunities are abundant in the expansion of advanced molding techniques, such as liquid silicone rubber (LSR) molding and multi-component molding, especially within the electric vehicle and high-end consumer electronics markets. The primary impact forces include stringent regulatory standards (e.g., medical device certifications, automotive safety requirements) demanding superior component quality, and intense global competition that forces manufacturers toward continuous technological adoption, specifically in automation and smart manufacturing capabilities, compelling investment cycles in highly efficient and precise equipment to maintain competitive edge and meet tightening market demands for consistency.

Segmentation Analysis

The Rubber Molding Machinery Market is comprehensively segmented based on the type of machinery utilized, the processing technology employed, the tonnage capacity of the equipment, and the diverse applications across various end-use industries globally. This structural classification allows for a detailed understanding of technological adoption patterns and expenditure trends. The machinery type segment is critical, dividing the market based on fundamental operation methods, where injection molding leads due to its high speed and precision, while compression and transfer molding machines maintain strong niches in specialized and traditional manufacturing. Analysis by end-use industry highlights sectors that are major spenders, with the automotive sector consistently dominating due to its high-volume, standardized requirements, followed by the demanding specifications of the healthcare and aerospace segments, each requiring machinery optimized for different elastomers and production scales.

Further segmentation by machine tonnage provides insights into the scale of operations, differentiating between low-tonnage equipment used for small, intricate parts (like O-rings or medical diaphragms) and high-tonnage machines essential for large structural components, such as vehicle tires or heavy-duty seals. The regional segmentation is vital, reflecting differing levels of automation maturity and manufacturing concentration worldwide, pointing toward APAC as the dominant growth region driven by mass production capabilities. Understanding these complex segment interdependencies is crucial for identifying targeted investment areas, forecasting technological trajectories, and developing customized market strategies that address specific customer needs across the production spectrum, from high-volume standardized output to low-volume, high-specification component manufacturing.

- By Machinery Type:

- Rubber Injection Molding Machines

- Rubber Compression Molding Machines

- Rubber Transfer Molding Machines

- Liquid Silicone Rubber (LSR) Molding Machines

- By Tonnage:

- Up to 200 Ton

- 201 Ton to 500 Ton

- Above 500 Ton

- By Operating Technology:

- Hydraulic

- Hybrid

- All-Electric

- By End-Use Industry:

- Automotive & Transportation

- Healthcare & Medical Devices

- Consumer Goods

- Industrial & Construction

- Aerospace & Defense

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East & Africa (MEA)

Value Chain Analysis For Rubber Molding Machinery Market

The value chain for the Rubber Molding Machinery Market initiates with the upstream supply of fundamental raw materials and complex components, primarily high-grade steel, advanced hydraulic and electric drive systems, precision control units (PLCs), and sophisticated heating elements. Key upstream activities involve the specialized manufacturing of these robust mechanical and electronic sub-assemblies, which must meet stringent durability and precision standards required for high-pressure, high-temperature molding environments. Machinery manufacturers then engage in complex design, assembly, and rigorous testing phases, focusing on integrating software for control, monitoring, and automation capabilities, distinguishing them based on technological innovation, machine speed, and energy efficiency, offering both standard and highly customized solutions to meet specific end-user needs. This intricate manufacturing process dictates a high barrier to entry due to the technical complexity and safety requirements inherent in high-pressure industrial equipment fabrication.

Downstream distribution channels typically involve a mixture of direct sales, particularly for large, customized machinery purchases by major Tier 1 automotive suppliers or global medical device companies, and indirect distribution through specialized regional dealers and system integrators. These intermediaries provide essential value-added services, including localized installation, technical training, ongoing maintenance support, and critical spare parts supply, especially crucial in regions with diverse technical standards and logistical complexities. The efficiency of this downstream network is vital, as end-users require immediate support to minimize costly production line downtime. Furthermore, the after-sales segment, including maintenance contracts and software upgrades, constitutes a significant revenue stream and competitive differentiator, ensuring the long-term operational lifespan and performance optimization of the sophisticated machinery in the field, thus solidifying manufacturer-customer relationships and securing repeat business.

Rubber Molding Machinery Market Potential Customers

The primary consumers and end-users of rubber molding machinery are high-volume manufacturers requiring precision elastomeric components across several strategic industries. These potential customers include Tier 1 and Tier 2 automotive suppliers who specialize in producing critical components such as engine mounts, chassis bushings, various seals, hoses, and weatherstripping, demanding high throughput and rigorous quality control for safety-critical parts. Another significant customer base lies within the healthcare sector, encompassing manufacturers of medical devices like syringe stoppers, respiratory masks, surgical equipment grips, and catheter components, where the focus is overwhelmingly on utilizing liquid silicone rubber (LSR) machinery for ultra-precise, sterile production environments and material traceability. Furthermore, manufacturers of consumer electronics and household appliances utilize this equipment for producing durable, aesthetic rubberized elements like seals, gaskets, and protective casings, seeking machinery that balances cost-efficiency with increasingly complex design requirements and the ability to handle colored or specialized composite materials, driving demand for multi-shot and advanced injection systems to consolidate manufacturing steps and achieve superior product integration and aesthetic quality.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $5.2 Billion |

| Market Forecast in 2033 | $7.7 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | LWB Steinl GmbH & Co. KG, REP International, DESMA USA Inc., Tung Yu Hydraulic Industrial Co., Ltd., Arburg GmbH + Co KG, Engel Austria GmbH, KraussMaffei Group, Sumitomo Heavy Industries Ltd., Nissei Plastic Industrial Co., Ltd., Woojin Plaimm Co., Ltd., Maplan International GmbH, Tiangong Machinery, Multitech Industries, Italmatic S.r.l., Wuhan Sifang, Rubber Machinery Co., Ltd., Pan Stone Hydraulic Industries Co., Ltd., Bosch Rexroth AG, Ningbo Wellmei Machinery Co., Ltd., Dalian Rubber & Plastics Machinery Co., Ltd., Yizumi Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Rubber Molding Machinery Market Key Technology Landscape

The technological landscape of the rubber molding machinery market is rapidly transforming, moving away from conventional hydraulic systems toward sophisticated hybrid and all-electric architectures. All-electric machines are gaining significant traction, particularly in applications demanding high precision, energy efficiency, and quiet operation, such as the production of medical components and high-tolerance seals. These machines offer superior repeatability and speed compared to their hydraulic predecessors, minimizing operational variability and ensuring consistent part quality across extensive production runs, which is a major draw for industries with zero-defect tolerance policies. Furthermore, advances in screw design and injection unit technology are enhancing material handling capabilities, allowing machines to effectively process a wider range of high-viscosity and specialty elastomers, including high-temperature fluorocarbon rubbers and chemically inert liquid silicone rubber (LSR), essential for expanding into challenging application domains like aerospace and advanced thermal management systems within electric vehicles.

A second critical dimension of the technological shift is the pervasive integration of smart manufacturing capabilities, aligning the sector with global Industry 4.0 standards. Modern rubber molding machines are now equipped with highly advanced proprietary control systems featuring HMI (Human-Machine Interface) touch screens, comprehensive data logging, and connectivity protocols (e.g., OPC UA). This connectivity enables seamless integration with central Manufacturing Execution Systems (MES) and Enterprise Resource Planning (ERP) systems, facilitating real-time process monitoring, remote diagnostics, and detailed analysis of production metrics, such as cycle time variations and energy consumption per part. The incorporation of IoT sensors allows for continuous monitoring of critical parameters like mold temperature uniformity, injection pressure profiles, and curing profiles, providing operators with actionable insights to maintain optimal processing conditions, which is essential for maximizing machine utilization rates and achieving substantial gains in overall equipment effectiveness (OEE).

The increasing complexity of molded parts is driving the adoption of specialized technologies like multi-component molding (2K/3K technology) and vacuum technology. Multi-component molding allows manufacturers to combine different materials or colors in a single process step, often bonding rubber directly onto plastic or metal substrates, which is crucial for complex automotive seals and integrated consumer product components. Vacuum technology, used primarily in compression and injection molding, is employed to extract gases and air trapped within the mold cavity and rubber compound before curing. This prevents blistering, porosity, and short-shots, dramatically enhancing the structural integrity and surface finish of the final product, especially vital for thick-walled or highly detailed parts. These technological advancements collectively reduce post-processing requirements, minimize manufacturing waste, and enable the production of functionally superior rubber components previously considered impossible or economically unviable using older machinery, thereby solidifying the market's long-term reliance on cutting-edge equipment investment.

Regional Highlights

- Asia Pacific (APAC): Dominance and High Growth Potential

The Asia Pacific region currently holds the largest share of the rubber molding machinery market and is projected to exhibit the highest CAGR during the forecast period. This dominance is intrinsically linked to the immense scale of manufacturing activities across key economies like China, India, and Japan, which serve as global production centers for the automotive, consumer electronics, and general industrial sectors. China, in particular, drives significant demand due to its massive domestic automotive market and its status as a primary exporter of manufactured goods, necessitating continuous investment in high-volume, automated molding equipment. Furthermore, the rising disposable incomes and expanding healthcare infrastructure in emerging economies like India and Southeast Asian nations are fueling localized demand for precision-molded medical components and higher-quality consumer products, encouraging both domestic and international machinery suppliers to expand their sales and support networks in the region, often focusing on hybrid and cost-effective high-output solutions tailored to local investment capacities.

The regional growth is further propelled by supportive governmental policies aimed at boosting domestic manufacturing capabilities and attracting foreign direct investment (FDI) into high-tech production. Local manufacturers are increasingly shifting from traditional, labor-intensive molding techniques to fully automated injection and compression molding cells to improve efficiency and maintain competitiveness against established global players. This rapid technological absorption, coupled with a vast and accessible supply chain for raw rubber materials and specialized tooling, ensures that APAC remains the epicenter of both demand for and production of rubber molding machinery, establishing strong foundational growth based on both volume output and progressive technological sophistication in rubber processing techniques.

- North America: Focus on Specialty and Automation

North America commands a significant market share, characterized by a mature manufacturing base that prioritizes quality, precision, and high levels of automation rather than sheer volume. The demand here is heavily concentrated in sophisticated applications, notably aerospace, medical device manufacturing (especially LSR technology), and high-specification automotive components related to electric vehicles and advanced driver-assistance systems (ADAS). Companies in this region typically opt for premium, all-electric or advanced hybrid machinery, focusing on minimizing defects, achieving stringent material traceability, and optimizing energy usage to comply with rigorous environmental and regulatory standards, which often surpass those found in other regions globally. The market growth is less about capacity expansion and more about upgrading existing machinery to incorporate advanced AI and IoT functionalities for improved process control and predictive maintenance.

The competitive landscape in North America is marked by intense focus on superior after-sales service, customized solutions, and rapid integration of new material processing capabilities (e.g., handling bio-based elastomers or specialized composites). Regulatory frameworks, such as those imposed by the FDA for medical components, compel manufacturers to invest in the highest quality, most reliable machinery capable of providing comprehensive validation documentation. This emphasis on technical excellence and high capital expenditure per machine ensures that while the volume of machinery installations might be lower than in APAC, the average value and technological sophistication of the equipment sold are exceptionally high, maintaining the region's importance in the global market value structure and acting as an early adopter of cutting-edge molding technology.

- Europe: Innovation and Sustainability Drive

The European market is defined by a strong emphasis on technological innovation, stringent energy efficiency standards, and a robust focus on sustainability and circular economy principles. Key countries such as Germany, Italy, and Austria are home to major global machinery manufacturers and sophisticated end-users in the premium automotive, industrial machinery, and precision engineering sectors. Demand is heavily skewed towards highly specialized, energy-efficient all-electric and hybrid machines that offer maximum precision and minimal environmental impact. European regulations, particularly those concerning emissions and energy use (e.g., EU energy efficiency directives), force manufacturers to continually innovate their machinery to meet higher operational efficiency benchmarks, often resulting in complex, highly customized equipment built for specific, niche applications.

Furthermore, the European medical and pharmaceutical sectors are major consumers, driving demand for specialized cleanroom-compatible LSR molding machines. The region also exhibits strong research and development collaboration between machinery manufacturers and academic institutions, leading to early commercialization of advanced technologies such as micro-molding and automated quality control systems integrated directly into the press. This commitment to sustainability and high-quality output, coupled with a push toward factory automation and reduced dependence on manual labor, solidifies Europe’s position as a critical, albeit mature, market for high-value rubber molding machinery, setting global standards for technological implementation and process efficiency in precision manufacturing.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Rubber Molding Machinery Market.- LWB Steinl GmbH & Co. KG

- REP International

- DESMA USA Inc.

- Tung Yu Hydraulic Industrial Co., Ltd.

- Arburg GmbH + Co KG

- Engel Austria GmbH

- KraussMaffei Group

- Sumitomo Heavy Industries Ltd.

- Nissei Plastic Industrial Co., Ltd.

- Woojin Plaimm Co., Ltd.

- Maplan International GmbH

- Tiangong Machinery

- Multitech Industries

- Italmatic S.r.l.

- Wuhan Sifang Rubber Machinery Co., Ltd.

- Pan Stone Hydraulic Industries Co., Ltd.

- Bosch Rexroth AG (Control Systems Provider)

- Ningbo Wellmei Machinery Co., Ltd.

- Dalian Rubber & Plastics Machinery Co., Ltd.

- Yizumi Group

Frequently Asked Questions

Analyze common user questions about the Rubber Molding Machinery market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Rubber Molding Machinery Market?

The market is projected to experience a Compound Annual Growth Rate (CAGR) of 5.8% between the forecast years of 2026 and 2033, driven primarily by demand from the automotive and healthcare sectors for precision elastomeric components and the global adoption of automation technologies to enhance production efficiency and product consistency.

Which machinery type currently dominates the market in terms of technological adoption and why?

Rubber Injection Molding Machines are currently dominant due to their superior capability to deliver high-volume, repeatable precision parts with minimal cycle times. The increasing adoption of all-electric and hybrid injection technology further enhances energy efficiency and process control, making it ideal for complex elastomer processing, particularly in critical applications like automotive sealing and medical device components.

How is Industry 4.0 influencing the competitive dynamics of rubber molding machinery manufacturing?

Industry 4.0 integration, through IoT sensors and AI-driven control systems, is raising the competitive bar by enabling real-time monitoring, predictive maintenance, and automatic process optimization. This integration allows manufacturers to achieve higher Overall Equipment Effectiveness (OEE) and significantly reduce material scrap, favoring vendors who offer advanced automation and data connectivity solutions.

What are the primary restraints affecting the growth of the rubber molding machinery sector?

The primary restraints include the substantial initial capital investment required for purchasing modern, highly automated machinery, which poses a barrier for smaller manufacturers. Additionally, the global volatility and supply chain instability of key raw materials, namely synthetic and natural rubber, directly impact operational costs and profitability across the value chain.

Which geographical region is expected to lead the market expansion through 2033?

The Asia Pacific (APAC) region is forecasted to lead market expansion, retaining the largest share and demonstrating the highest growth rate. This is fueled by continued rapid expansion of automotive production and general industrialization across major economies such as China and India, alongside sustained investment in high-volume, automated manufacturing capacity to meet global export demand.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager