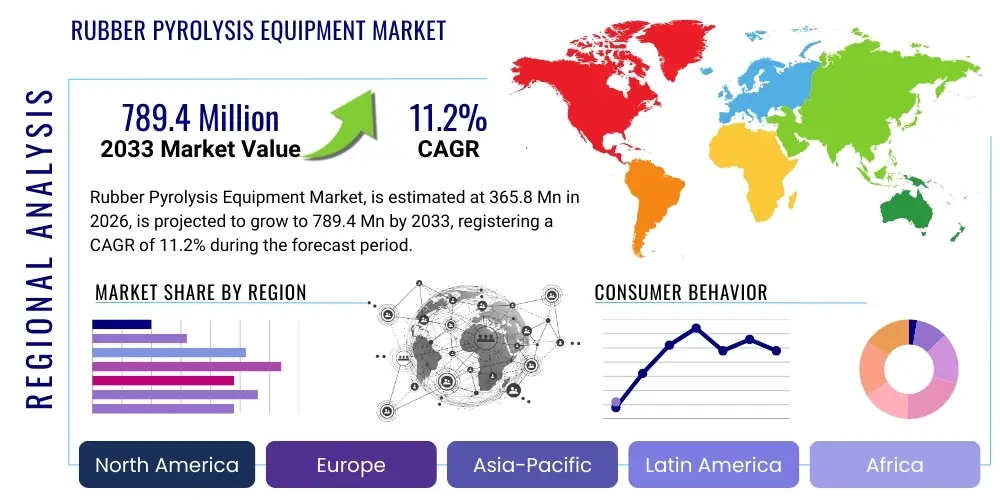

Rubber Pyrolysis Equipment Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442654 | Date : Feb, 2026 | Pages : 242 | Region : Global | Publisher : MRU

Rubber Pyrolysis Equipment Market Size

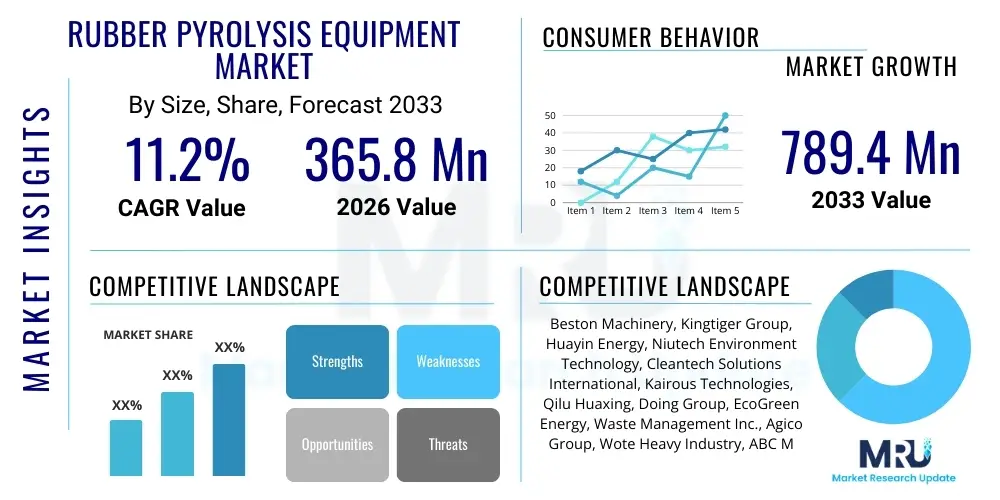

The Rubber Pyrolysis Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.2% between 2026 and 2033. The market is estimated at $365.8 Million USD in 2026 and is projected to reach $789.4 Million USD by the end of the forecast period in 2033.

Rubber Pyrolysis Equipment Market introduction

The Rubber Pyrolysis Equipment Market encompasses machinery and systems designed to thermally decompose waste rubber materials, primarily end-of-life tires (ELT), in an oxygen-depleted environment. This sophisticated recycling technology addresses the critical global issue of rubber waste accumulation by converting complex polymeric structures into valuable recovered resources: pyrolysis oil (TPO), carbon black (rCB), steel wire, and combustible gases. The process utilizes high temperatures, typically ranging from 350°C to 650°C, ensuring that the chemical bonds within the rubber are broken down safely and efficiently, thereby minimizing environmental pollution associated with traditional disposal methods like landfilling or incineration. The resultant products hold significant economic value, driving industrial interest and regulatory support for these recycling technologies globally.

Key applications of this equipment span several industrial sectors, notably in environmental protection, energy generation, and materials recovery. The pyrolysis oil derived often serves as an industrial fuel or feedstock for further refining, while recovered carbon black (rCB) finds use as a filler material in new rubber products, plastics, and coatings, promoting a circular economy. The steel wire component is high-grade scrap metal readily recyclable. The primary benefit of adopting pyrolysis technology is the dramatic reduction in landfill burden and the mitigation of greenhouse gas emissions compared to traditional waste management, coupled with the creation of sustainable, value-added products, making it a pivotal solution in sustainable waste management infrastructure.

Driving factors for market expansion are multifaceted, including stringent governmental regulations across North America and Europe mandating responsible tire disposal and establishing recycled content targets. Furthermore, the rising prices and supply volatility of virgin carbon black and crude oil incentivize industries to seek out cheaper, domestically sourced alternatives like rCB and TPO. Technological advancements, particularly in continuous pyrolysis reactors and efficient exhaust gas treatment systems, have enhanced the economic viability and environmental performance of these units, further solidifying their position as essential infrastructure for achieving global sustainability goals and resource efficiency in the plastics and rubber industries.

Rubber Pyrolysis Equipment Market Executive Summary

The Rubber Pyrolysis Equipment Market is experiencing robust growth driven by accelerating global sustainability mandates and the economic imperative to transition waste streams into viable resource inputs. Business trends indicate a significant shift towards fully automated, continuous pyrolysis systems, which offer superior throughput, reduced operational costs, and higher quality output products compared to traditional batch systems. Investment capital is increasingly flowing into projects that integrate pyrolysis units with post-processing facilities, such as carbon black upgrading plants, to maximize product value and market competitiveness. Strategic partnerships between equipment manufacturers and large-scale waste management operators are becoming commonplace, focusing on turnkey solutions that address the complex logistics of feedstock supply and product distribution, defining the competitive landscape.

Regionally, Asia Pacific, spearheaded by China and India, dominates the market share due to the enormous volume of discarded tires generated annually and comparatively lower operating costs, although North America and Europe exhibit the highest adoption rates of advanced, highly compliant systems driven by strict environmental protocols. The European market, particularly, benefits from supportive EU directives and robust investment in circular economy initiatives, focusing on achieving zero waste to landfill targets. Conversely, emerging economies in Latin America and MEA are seeing initial market penetration, characterized by small-to-medium scale batch plants catering to localized waste streams, gradually transitioning towards more sophisticated setups as regulatory frameworks mature and financial incentives become available.

Segmentation analysis highlights the continuous pyrolysis type as the fastest-growing segment, primarily due to its operational efficiency and scalability, making it attractive for large industrial operators seeking consistent production volumes. Based on the end-product, pyrolysis oil and recovered carbon black (rCB) remain the core revenue generators, with increasing focus on producing specialized, high-performance grades of rCB suitable for demanding applications in the automotive and construction sectors. The tire pyrolysis application segment maintains the largest market share, reflecting the sheer volume and standardized composition of tire waste globally, requiring dedicated, high-capacity equipment designs optimized for this specific feedstock.

AI Impact Analysis on Rubber Pyrolysis Equipment Market

Common user questions regarding AI's impact on the Rubber Pyrolysis Equipment Market often revolve around predictive maintenance, optimization of reactor conditions, and feedstock analysis. Users are keenly interested in how Artificial Intelligence can enhance the efficiency and profitability of inherently complex thermal processes. Key themes include the use of machine learning algorithms to predict equipment failure before it occurs, minimizing expensive downtime; optimizing temperature and pressure profiles in real-time based on fluctuating feedstock quality (e.g., moisture content or rubber type); and leveraging computer vision for automated sorting and quality control of incoming waste rubber. Expectations are high regarding AI’s ability to standardize output quality, particularly the recovered carbon black (rCB), by maintaining extremely tight control over process variables, leading to higher market acceptance for recycled materials and transforming operational management from reactive to predictive across the industry.

- AI-driven Predictive Maintenance: Utilizing sensor data to forecast component failure in high-wear parts (e.g., seals, bearings, refractory linings), drastically reducing unscheduled downtime and optimizing maintenance schedules.

- Real-Time Process Optimization: Machine learning models adjust reactor temperature, pressure, and residence time dynamically based on sensor feedback to maximize the yield of high-value products (pyrolysis oil and high-grade rCB).

- Feedstock Quality Calibration: AI algorithms analyze variations in incoming waste rubber characteristics (e.g., impurities, composition) and automatically recalibrate operating parameters to ensure consistent end-product quality.

- Automated Quality Control (rCB): Computer vision systems and analytical AI assess the particle size, surface area, and ash content of recovered carbon black immediately post-processing, ensuring adherence to stringent industry specifications.

- Enhanced Energy Management: AI optimizes the utilization of generated pyrolysis gas within the plant, managing burners and heat recovery systems to minimize reliance on external fuel sources and improve overall energy self-sufficiency.

- Supply Chain and Logistics Optimization: Predictive analytics forecasts feedstock availability and manages inventory levels for both input waste and output products, streamlining logistics for large-scale continuous operations.

DRO & Impact Forces Of Rubber Pyrolysis Equipment Market

The market dynamics are defined by a strong synergistic relationship between increasing environmental regulatory pressure (a primary Driver) and the inherent complexity and capital requirements of the technology (a major Restraint), tempered by the growing necessity for sustainable material sources (a key Opportunity). The primary Driver is the global mandate to manage increasing volumes of waste tires, coupled with supportive government subsidies and extended producer responsibility (EPR) schemes that incentivize pyrolysis adoption. However, a significant Restraint involves the initial high capital expenditure required for continuous, compliant pyrolysis plants and the technical challenges associated with achieving consistent, high-quality recovered carbon black that meets industrial specifications, which often deters smaller investors. The Opportunity lies in the high demand for sustainable materials, where rCB can directly displace virgin carbon black, offering compelling economic and environmental value propositions as industries commit to decarbonization and circular sourcing, defining the Impact Forces that propel moderate yet sustained market expansion over the forecast period.

Detailed Analysis of Drivers: Increasing regulatory scrutiny on waste management practices, especially concerning the landfilling and uncontrolled burning of end-of-life tires (ELT), is the foundational driver. Governments worldwide are implementing stricter waste disposal laws and setting ambitious recycling targets, making processes like pyrolysis economically necessary. Furthermore, the rising cost and geopolitical sensitivity associated with virgin carbon black production, which relies heavily on crude oil derivatives, drive manufacturers towards seeking stable, recycled alternatives. The proven viability of modern pyrolysis units, which offer near-zero emissions and high energy efficiency, particularly in continuous mode, further encourages industrial adoption, supported by various green energy tariffs and carbon credit incentives in developed economies.

Detailed Analysis of Restraints: Despite technological advances, significant hurdles persist, most notably the high initial investment cost, which can run into millions of dollars for a high-capacity continuous plant, presenting a formidable barrier to entry. Another critical restraint is the market acceptance and technical specification requirements for recovered carbon black (rCB). Users in the tire manufacturing and high-performance polymer industries demand specific characteristics (e.g., iodine absorption, DBP oil absorption, particle size) that are difficult to consistently achieve compared to virgin product, often necessitating expensive post-processing upgrades. Additionally, logistical challenges in securing a stable, quality-controlled supply of waste rubber feedstock across vast geographical areas can constrain operational efficiency.

Detailed Analysis of Opportunities: The greatest opportunity is the vast, untapped potential for substituting virgin materials with pyrolysis end-products. As major automotive and consumer goods companies globally announce commitments to use 100% sustainable or recycled content, the demand for certified rCB and TPO feedstock will skyrocket. Market expansion into non-tire rubber waste pyrolysis, such as conveyor belts, seals, and other industrial rubber products, presents a significant diversification opportunity. Moreover, technological advancements focusing on modular and skid-mounted pyrolysis units are lowering the entry barrier, allowing smaller regional waste processors to participate and capture niche markets, further widening the application base of this technology across diverse industrial landscapes.

Segmentation Analysis

The Rubber Pyrolysis Equipment Market is comprehensively segmented based on the operational technology type, the resulting end-products, the specific application of the waste rubber, and the operational capacity of the machinery. This structured segmentation provides granular insights into market dynamics, revealing that equipment type related to continuous processing systems is experiencing the fastest rate of growth due to industrial scaling and efficiency demands. The primary revenue streams are derived from equipment optimized for maximizing the yield and quality of pyrolysis oil and recovered carbon black (rCB). Understanding these segments is crucial for manufacturers to align their product development strategies with emerging industrial requirements, particularly the increasing demand for high-capacity, automated solutions that can handle diverse feedstock characteristics while meeting strict emissions standards globally.

The segmentation by application distinctly highlights the dominant role of End-of-Life (ELT) tire pyrolysis, which requires specific reactor designs and internal mechanisms to handle the steel wire component and thick rubber structure effectively. However, the non-tire waste rubber segment is expected to show accelerated growth as industries seek solutions for disposing of challenging industrial rubber waste. Furthermore, capacity segmentation is critical for tailoring equipment sales, ranging from small batch units suitable for regional waste aggregators and remote areas to massive, multi-reactor continuous systems serving centralized industrial recycling hubs. These specialized requirements necessitate equipment customization, driving innovation in material handling and thermal engineering across all defined categories within the pyrolysis equipment market.

- By Type:

- Batch Pyrolysis Equipment

- Semi-Continuous Pyrolysis Equipment

- Continuous Pyrolysis Equipment

- By End-Product:

- Pyrolysis Oil Production Equipment (TPO)

- Recovered Carbon Black (rCB) Processing Systems

- Steel Wire Recovery Systems

- Pyrolysis Gas Utilization Systems

- By Application:

- End-of-Life Tire (ELT) Pyrolysis

- Waste Rubber Pyrolysis (Non-Tire Industrial Waste)

- Medical Rubber Waste Pyrolysis

- By Capacity:

- Small Scale (<10 Tons/Day)

- Medium Scale (10-30 Tons/Day)

- Large Scale (>30 Tons/Day)

Value Chain Analysis For Rubber Pyrolysis Equipment Market

The value chain for the Rubber Pyrolysis Equipment Market begins upstream with raw material suppliers—primarily manufacturers of specialized high-temperature alloys, industrial steel, and control instrumentation necessary for constructing the robust pyrolysis reactors. Component manufacturers, including specialized vendors for air pollution control systems (scrubbers, bag filters), heat exchangers, and automation components (PLCs, sensors), form the next critical layer. Innovation and material sourcing efficiency at this upstream level are vital for ensuring the longevity and compliance of the final pyrolysis unit. Equipment manufacturers then procure these components, undertake advanced engineering design, fabrication, and integration, creating bespoke or standardized pyrolysis plants tailored to specific capacity and end-product quality requirements.

The distribution channel involves a mix of direct sales by large, integrated manufacturers to major industrial end-users (e.g., large waste management firms, petrochemical companies) and indirect sales through specialized regional distributors or engineering procurement and construction (EPC) contractors, who manage the installation and commissioning process. Direct channels are preferred for highly customized, large-scale continuous systems, ensuring closer technical collaboration between the manufacturer and the client. Indirect channels leverage local market knowledge and service networks, particularly beneficial in fragmented markets or for smaller batch units targeting municipal solid waste processors.

Downstream, the chain extends significantly to the market for the recovered outputs. Pyrolysis oil (TPO) is sold to industrial burners, refineries, or cement kilns as fuel, while recovered carbon black (rCB) requires a robust secondary market, including post-processing vendors who refine the rCB to meet specific industrial grades for use in new tire manufacturing, conveyor belts, plastics, and building materials. The successful operation of the pyrolysis equipment heavily relies on the liquidity and acceptance of these downstream markets, meaning the overall profitability is inextricably linked not just to the reactor efficiency but also to the successful market integration of the recycled products, solidifying the circular nature of this specific industrial value chain.

Rubber Pyrolysis Equipment Market Potential Customers

Potential customers for Rubber Pyrolysis Equipment are diverse, ranging from large-scale industrial recyclers and environmental service providers to manufacturers seeking to integrate waste management into their production cycles. The primary end-users are specialized waste tire processing companies that focus exclusively on transforming vast stockpiles of end-of-life tires (ELT) into tradable commodities, requiring high-capacity, continuous systems to handle millions of tires annually. These large industrial buyers are motivated by economies of scale and reliable output quality necessary to compete in the global rCB and fuel oil markets. They often require complete turnkey solutions, including pre-treatment (shredding, debeading) and post-treatment (rCB refining) infrastructure.

Municipal solid waste (MSW) management entities and regional governmental waste authorities also represent a growing customer base, particularly in regions where landfill space is scarce or prohibited for rubber waste. These customers seek pyrolysis solutions to achieve regulatory compliance and generate local revenue from resource recovery. Furthermore, cement kiln operators and energy companies are increasingly interested in these systems, not just for processing waste but for utilizing the high-calorific value pyrolysis oil and gas directly as supplemental energy sources for their primary operations, reducing dependence on fossil fuels and lowering operational costs, making them significant strategic buyers who integrate the technology into existing heavy industrial facilities.

Finally, rubber product manufacturers, particularly those involved in producing conveyor belts, seals, or non-tire rubber goods, are emerging as potential customers. They look to purchase smaller to medium-scale batch or semi-continuous units to manage their internal production scrap waste, ensuring a closed-loop system and securing a consistent supply of recycled materials for their own products. This shift towards localized, self-sufficient recycling infrastructure within manufacturing facilities reflects a broader trend toward internalizing sustainability responsibilities and reducing reliance on external waste disposal services, marking them as important niche buyers for modular equipment designs.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $365.8 Million USD |

| Market Forecast in 2033 | $789.4 Million USD |

| Growth Rate | 11.2% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Beston Machinery, Kingtiger Group, Huayin Energy, Niutech Environment Technology, Cleantech Solutions International, Kairous Technologies, Qilu Huaxing, Doing Group, EcoGreen Energy, Waste Management Inc., Agico Group, Wote Heavy Industry, ABC Machinery, Newtek Environment, Henan Barui Environmental Protection, Henan Forrun Machinery, Jiangsu Xutai, GreenBeston, Allance Machinery, Sino-Enzyme. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Rubber Pyrolysis Equipment Market Key Technology Landscape

The Rubber Pyrolysis Equipment market is defined by several evolving technological advancements aimed at maximizing conversion efficiency, improving product purity, and ensuring environmental compliance. The dominant technology remains the rotary kiln reactor, especially in continuous systems, favored for its ability to ensure uniform heat distribution and efficient handling of large volumes of shredded rubber. However, there is a distinct technological migration towards advanced reactor designs, such as fluidizing beds and vacuum pyrolysis systems. Fluidizing beds offer superior heat transfer rates, leading to faster processing times and higher oil yields, while vacuum pyrolysis operates at lower temperatures, which is beneficial for minimizing the formation of undesirable byproducts and enhancing the quality of the recovered carbon black (rCB).

A crucial area of technological focus is the integration of sophisticated post-processing units. Equipment now routinely includes high-efficiency condensation systems for fractionating the pyrolysis oil into lighter and heavier components, increasing its commercial value. Furthermore, the recovery and upgrading of carbon black represent a significant engineering challenge. Modern systems incorporate magnetic separators for steel removal, specialized grinding and milling equipment to control particle size, and, increasingly, chemical or thermal activation units to modify the rCB surface area, making it functionally equivalent to certain grades of virgin carbon black required by tire manufacturers, thus boosting market acceptance of the recycled product substantially.

Environmental control technology is mandatory and non-negotiable in the latest equipment generation. Advanced emission control systems—including multi-stage scrubbing towers, activated carbon filtration, and thermal oxidation units for non-condensable gases—ensure that all effluent gases meet stringent local and international standards. Furthermore, integration with IoT and advanced automation (as mentioned in the AI section) allows for precise control over the entire process, including internal energy loop management where the non-condensable pyrolysis gas is automatically recycled and combusted to supply the necessary heat for the reactor, significantly improving the self-sufficiency and overall energy footprint of the entire rubber pyrolysis system.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest and fastest-growing regional market, driven by the immense generation of end-of-life tires (ELT) in rapidly industrializing nations like China, India, and Southeast Asian countries. While the region initially relied on small, localized batch systems, stringent governmental environmental crackdowns, particularly in China, are accelerating the shift toward large-scale, continuous, and environmentally compliant equipment. Favorable policy measures, lower labor costs, and robust demand for industrial fuels and materials contribute significantly to its market dominance, establishing it as a primary manufacturing and consumption hub for pyrolysis systems globally.

- North America: North America represents a mature market characterized by high regulatory standards and a strong focus on maximizing product quality, especially rCB. The U.S. and Canada prioritize investment in advanced, highly automated continuous systems integrated with rigorous post-processing technology to ensure recycled materials can meet high specifications for use in automotive and construction sectors. Market growth is sustained by supportive government funding for circular economy initiatives and corporate commitments towards utilizing sustainable material inputs, emphasizing high operational compliance and low emission technologies.

- Europe: The European market is defined by the rigorous implementation of the Circular Economy Package and ambitious targets for zero waste to landfill. Europe, particularly Western Europe (Germany, UK, France), exhibits high adoption rates of sophisticated pyrolysis technology, often leveraging subsidies and research grants to pioneer innovative reactor designs and rCB upgrading techniques. The demand here is less focused on capacity volume and more on environmental performance and achieving the highest possible value from the recovered products, driving innovation in areas like modularization and localized decentralized waste processing units.

- Latin America (LATAM): LATAM is an emerging market characterized by localized demand and reliance on smaller batch pyrolysis systems. Growth is projected to accelerate as major economies like Brazil and Mexico develop more formal regulatory frameworks for ELT management. Investment is often stimulated by international environmental aid and public-private partnerships aimed at reducing environmental pollution caused by tire stockpiles, suggesting high potential for medium-scale equipment sales in the near future.

- Middle East and Africa (MEA): The MEA region is at an nascent stage, with market penetration concentrated in industrial hubs like Saudi Arabia and the UAE, primarily driven by large industrial waste management contracts and the need to manage waste generated by mining and construction activities. While adoption is currently low, the region offers significant long-term opportunities due to large land areas requiring immediate, centralized waste disposal solutions and a high reliance on hydrocarbon fuels, making the utilization of pyrolysis oil particularly economically attractive.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Rubber Pyrolysis Equipment Market.- Beston Machinery

- Kingtiger Group

- Huayin Energy

- Niutech Environment Technology

- Cleantech Solutions International

- Kairous Technologies

- Qilu Huaxing

- Doing Group

- EcoGreen Energy

- Waste Management Inc.

- Agico Group

- Wote Heavy Industry

- ABC Machinery

- Newtek Environment

- Henan Barui Environmental Protection

- Henan Forrun Machinery

- Jiangsu Xutai

- GreenBeston

- Allance Machinery

- Sino-Enzyme

Frequently Asked Questions

Analyze common user questions about the Rubber Pyrolysis Equipment market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function and economic output of rubber pyrolysis equipment?

The primary function is the thermal decomposition of waste rubber (e.g., end-of-life tires) in the absence of oxygen. The main economic outputs are pyrolysis oil (a fuel source), recovered carbon black (rCB, used as filler), and recyclable steel wire, transforming waste into valuable commodities.

What are the key differences between batch, semi-continuous, and continuous pyrolysis systems?

Batch systems process fixed material volumes and require cooling before reloading; they are suitable for smaller scale. Continuous systems offer uninterrupted operation, higher throughput, better energy efficiency, and more consistent product quality, making them ideal for large industrial applications and achieving optimal economies of scale.

Is recovered carbon black (rCB) suitable for manufacturing new tires?

Yes, rCB is increasingly suitable for new tire manufacturing, though often used in non-tread components. Advanced post-processing techniques (such as chemical activation and milling) are required to upgrade rCB to meet the specific technical specifications demanded by high-performance tire and rubber product manufacturers, driving its market acceptance.

What are the main environmental concerns associated with rubber pyrolysis technology?

The main concerns relate to potential emissions (sulfur compounds, volatile organic compounds) and residue disposal. Modern, compliant pyrolysis equipment mitigates these risks through multi-stage scrubbing, advanced gas treatment, and mandatory utilization of pyrolysis gas for internal heating, ensuring near-zero emissions when properly operated.

Which geographical region holds the largest market share for rubber pyrolysis equipment?

The Asia Pacific (APAC) region currently holds the largest market share, driven primarily by the massive volume of tire waste generated in countries like China and India, coupled with increasing governmental push for structured recycling solutions and favorable cost structures for large-scale industrial operations.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager