Running Belts and Armbands Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442276 | Date : Feb, 2026 | Pages : 251 | Region : Global | Publisher : MRU

Running Belts and Armbands Market Size

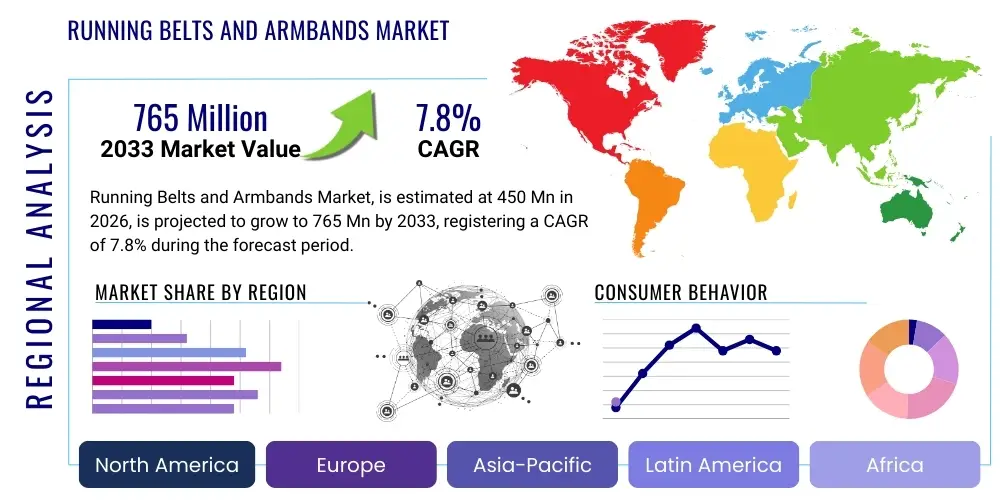

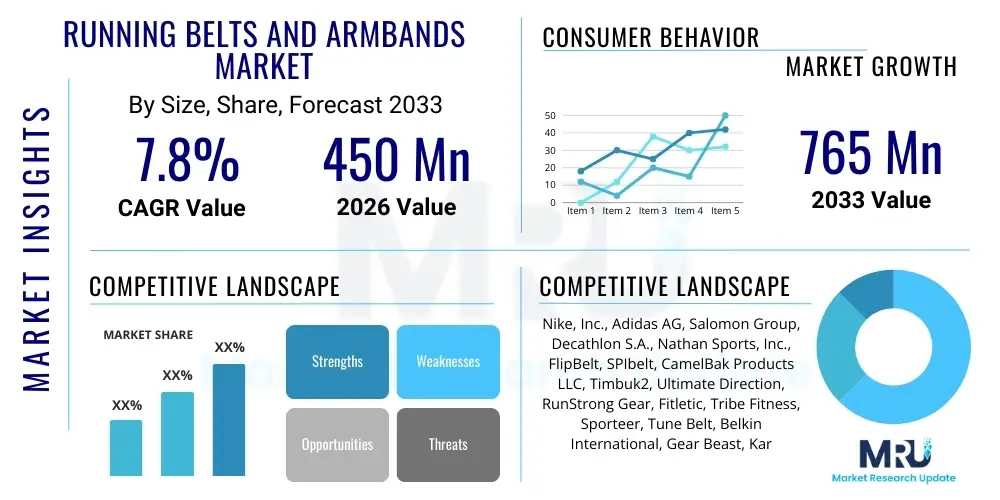

The Running Belts and Armbands Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 765 Million by the end of the forecast period in 2033.

Running Belts and Armbands Market introduction

The Running Belts and Armbands Market encompasses the production, distribution, and sale of wearable accessories designed primarily for athletes, runners, and fitness enthusiasts to securely carry essential items such as smartphones, keys, identification, water bottles, and energy gels during physical activity. These products are engineered for comfort, minimal bounce, and weather resistance, ensuring that performance is not compromised by the need to carry personal belongings. The primary product categories include waist-worn belts, typically featuring multiple pockets or elastic sleeves, and armbands designed to strap securely around the bicep. The evolution of these accessories is intrinsically linked to advancements in material science, particularly the use of lightweight, moisture-wicking, and reflective fabrics, enhancing both utility and safety for the user.

The core application for running belts and armbands is centered around convenience and safety during outdoor and indoor running, cycling, hiking, and gym workouts. The necessity for these items has been amplified by the pervasive integration of smartphones into fitness tracking ecosystems, where devices are required for music playback, GPS tracking, and communication. Consequently, the market growth is being propelled by the global increase in health consciousness, participation in marathon events, and the rise of personalized fitness routines utilizing mobile applications. Furthermore, the development of specialized designs catering to diverse needs, such as hydration belts for long-distance runners and minimal profile armbands for casual joggers, contributes significantly to market segmentation and overall revenue generation.

Key benefits derived from utilizing running belts and armbands include enhanced operational security for expensive personal devices, improved focus during exercise due to hands-free convenience, and critical accessibility to necessary hydration or nutrition during extended physical exertion. Driving factors for market expansion include robust growth in global disposable incomes, aggressive marketing strategies focusing on athlete endorsement and lifestyle branding, and continuous product innovation centered on integrating smart features. For instance, some premium belts now incorporate hidden tracking technology or specialized material compounds that regulate core body temperature, providing compelling reasons for consumers to invest in high-quality, specialized running accessories, thereby sustaining the forecasted market trajectory.

Running Belts and Armbands Market Executive Summary

The global Running Belts and Armbands market is experiencing sustained expansion, fundamentally driven by the increasing global emphasis on preventative healthcare and participatory sports. Current business trends indicate a significant shift toward premiumization, where consumers prioritize advanced features such as enhanced water resistance, greater storage capacity optimized for larger smartphone models, and ergonomic designs that eliminate chafing. Strategic competitive activity focuses heavily on collaborations with wearable technology firms and direct-to-consumer digital marketing, capitalizing on social media fitness trends. Manufacturers are also increasingly adopting sustainable materials, appealing to the environmentally conscious consumer base, positioning ecological impact as a critical differentiator in a crowded accessory landscape, thereby influencing procurement decisions across various segments.

Regional dynamics play a vital role in market segmentation and growth profiles. North America and Europe currently represent the most substantial revenue contributors, characterized by high adoption rates of fitness tracking technology and established running communities. However, the Asia Pacific (APAC) region is projected to exhibit the fastest growth over the forecast period, fueled by rapid urbanization, rising middle-class disposable incomes, and widespread governmental initiatives promoting physical activity in populous countries like China and India. This regional expansion necessitates tailored product offerings, such as designs optimized for warmer, humid climates prevalent in Southeast Asia, ensuring local market relevance and maximizing penetration potential.

Segment trends reveal that the running belts segment, particularly those designed for utility and capacity (e.g., hydration belts), is demonstrating stronger revenue performance compared to traditional armbands, primarily due to the versatility offered in carrying essentials for longer activities. Furthermore, the market for accessories made from specialized, high-performance fabrics, such as neoprene or proprietary spandex blends, continues to outperform commodity-grade materials. In terms of end-users, competitive runners and marathon participants represent a high-value segment due to their frequent replacement cycles and preference for professional-grade gear, contrasting with the much larger, but less intensive, casual fitness enthusiast segment.

AI Impact Analysis on Running Belts and Armbands Market

Common user inquiries regarding AI's impact on running accessories center on two primary themes: the integration of enhanced predictive performance metrics and the personalization of gear selection. Users frequently question if AI could lead to 'smart' belts that automatically adjust tension or humidity based on biometric data collected in real-time. A second key area of interest involves supply chain optimization, with users seeking transparency on how AI-driven inventory management and demand forecasting will lead to faster product availability and competitive pricing. The overriding expectation is that AI will move the market beyond simple storage solutions toward genuinely intelligent, integrated fitness support systems. This shift suggests a future where accessory selection and performance tracking are seamlessly intertwined, driven by advanced computational analysis of user habits and physiological responses.

- AI-driven personalized gear recommendations based on running gait, duration, and climate profiles.

- Integration of AI algorithms for real-time biometric analysis via sensors embedded in belts/armbands (e.g., sweat analysis for hydration monitoring).

- Optimization of manufacturing processes using AI for defect detection and material usage, reducing production costs.

- Enhancement of supply chain efficiency through predictive analytics for inventory management and faster distribution logistics.

- Development of AI-powered virtual fitting tools, improving online purchasing accuracy and reducing return rates.

- Creation of adaptive accessories that dynamically adjust fit or temperature through miniature motorized or thermal components managed by onboard AI chips.

DRO & Impact Forces Of Running Belts and Armbands Market

The dynamics of the Running Belts and Armbands market are dictated by a sophisticated interplay of growth drivers, structural constraints, and emerging strategic opportunities. A primary driver is the accelerating trend of digital fitness adoption, where the reliance on smartphones and specialized tracking devices for performance logging necessitates secure and comfortable carrying solutions, making these accessories indispensable. Concurrently, the proliferation of global running events, including marathons, ultra-marathons, and triathlon circuits, creates a sustained demand for professional-grade, specialized gear like hydration belts and utility packs. This demand is further amplified by social media influence, which rapidly disseminates fitness trends and promotes specific accessory brands, contributing significantly to consumer purchase intent and market momentum.

Restraints, however, pose significant challenges to the market's otherwise upward trajectory. A key constraint is the market saturation resulting from a low barrier to entry for generic, low-cost manufacturers, primarily based in Asia. This influx of non-branded products leads to intense price competition, potentially eroding profit margins for premium brands relying on innovation and quality. Furthermore, the continuous miniaturization and integration of electronics into smart apparel (e.g., smart shirts or shorts with embedded pockets) could eventually reduce the necessity for external accessories like armbands. Consumer preference for multi-functional accessories that integrate hydration and storage simultaneously also represents a restraint on single-purpose product lines, requiring constant product diversification and innovation to maintain relevance and competitive edge.

Opportunities for expansion are abundant, particularly in emerging markets where fitness culture is rapidly taking root, offering untapped potential for market penetration. Technological innovation provides a major avenue for growth, specifically through the integration of near-field communication (NFC) capabilities for contactless payment and enhanced biometric monitoring sensors directly into the accessory structure. Furthermore, specializing in niche demographics, such as highly durable gear for extreme sports or medically compliant accessories for runners with specific health requirements, offers high-margin potential. The strongest impact forces shaping the market include consumer spending confidence, technological integration standards (especially relating to smartphone size and charging ports), and global public health policies promoting active lifestyles, all coalescing to shape future demand profiles and strategic market positioning.

Segmentation Analysis

The Running Belts and Armbands Market is fundamentally segmented based on product type, material composition, distribution channel, and primary end-user application, providing a granular view of consumer preferences and market dynamics. Understanding these segments is crucial for manufacturers to tailor their marketing strategies and product development pipelines effectively. The dominant segmentation based on product type differentiates between running belts, which offer superior storage capacity and stability for heavier items or multiple gear pieces, and armbands, which prioritize lightweight design and quick access to mobile devices. The rising popularity of endurance sports is skewing the preference towards hydration-enabled running belts, suggesting that capacity and utility are increasingly valuable features for the core running demographic.

Further analysis of material segmentation highlights the shift towards high-performance textiles. While basic armbands often use nylon or PVC, premium running belts heavily utilize moisture-wicking materials such as neoprene, spandex blends, and specialized proprietary fabrics designed for optimal breathability and minimal bounce. This material focus drives the premium pricing segment and targets professional or committed amateur athletes who require maximum comfort and durability during prolonged exercise sessions. Distribution channel segmentation confirms the growing dominance of e-commerce platforms, which offer consumers unparalleled choice, detailed product specifications, and competitive pricing, significantly surpassing traditional sporting goods retail stores in terms of transaction volume and reach.

The most lucrative segments are typically tied to functional specialization. For instance, high-visibility, reflective running gear, which caters to runners exercising during low-light conditions, commands a significant price premium due to the safety features embedded. Similarly, products specifically marketed towards female athletes, focusing on unique ergonomic fits and aesthetic considerations, constitute a rapidly expanding sub-segment. Strategic market penetration relies on identifying these niche segments—where performance, safety, and specialized design intersect—to capture loyal consumer bases who are willing to pay for perceived superior functionality and brand alignment with their specific athletic identity and routine.

- By Product Type:

- Running Belts (Waist Packs, Hydration Belts, Utility Belts)

- Armbands (Smartphone Armbands, Minimalist Armbands)

- By Material:

- Neoprene

- Spandex/Lycra Blends

- Nylon

- Other Performance Fabrics

- By Application/End-User:

- Casual/Recreational Runners

- Professional/Marathon Runners

- Cyclists and Hikers

- Fitness Enthusiasts

- By Distribution Channel:

- Online Retail (E-commerce Platforms, Brand Websites)

- Offline Retail (Sporting Goods Stores, Department Stores, Specialty Retailers)

Value Chain Analysis For Running Belts and Armbands Market

The value chain for the Running Belts and Armbands Market commences with upstream activities involving the sourcing and processing of raw materials, primarily specialized performance textiles such as neoprene, proprietary moisture-wicking synthetic fibers, elastic blends, and various components like zippers, buckles, and reflective strips. Key players in this phase include specialized chemical companies and textile manufacturers focused on technical fabric production that meets rigorous standards for durability, lightness, and comfort. Cost management at this stage is critical, as fluctuations in polymer prices or textile manufacturing efficiency directly impact the final product cost. Manufacturers often seek long-term contracts with specialized fabric suppliers to ensure quality consistency and cost stability, particularly for high-end product lines that rely on advanced material science for competitive differentiation.

The midstream stage involves design, manufacturing, and assembly. This is where intellectual property related to ergonomic design, anti-bounce technology, and integrated smart features is developed. Manufacturing facilities, often located in regions with competitive labor costs such as Southeast Asia, undertake cutting, sewing, and final assembly. Quality control is paramount during this phase to prevent defects like stitching failures or component malfunction, which are frequent user complaints. Direct distribution and indirect distribution channels define the subsequent downstream activities. Direct distribution involves sales through brand-owned e-commerce platforms, offering manufacturers maximum control over pricing and customer data. This channel allows for personalized marketing campaigns and faster product feedback loops, crucial for agile product iteration and enhancing brand loyalty.

Indirect distribution relies on established retail networks, encompassing large e-commerce giants (like Amazon or Alibaba), major sporting goods chains, and independent specialty fitness stores. While indirect channels offer broader geographical reach and visibility, they introduce additional layers of margin leakage due to retailer markups. Successful market penetration depends on balancing these channels; premium, high-tech products often benefit from direct channels to convey complex features, while volume sales are typically driven through mass-market indirect distribution partners. Efficient logistics, warehousing, and inventory management are essential throughout the downstream phase to ensure product availability meets seasonal demand spikes, such as those occurring around major running seasons or holiday periods.

Running Belts and Armbands Market Potential Customers

The primary segment of potential customers for running belts and armbands consists of individuals engaged in routine physical activity who require a secure, comfortable method to carry personal essentials, primarily smartphones, credit cards, and keys. This segment spans from casual joggers who participate in fitness for general health maintenance to semi-professional athletes preparing for local races. The increasing size and value of modern smartphones make protective and stabilizing accessories a necessity rather than a luxury, driving continuous replacement cycles as users upgrade their mobile devices. Manufacturers target this broad base through mass-market online channels, emphasizing convenience, affordability, and basic protective features tailored for general fitness routines.

A second, highly valuable segment includes competitive endurance athletes, such as marathon runners, ultra-runners, and triathletes. These consumers demand specialized, high-performance gear, including sophisticated hydration belts with minimal slosh characteristics, complex compartmentalization for nutrition packets, and extreme durability against adverse weather conditions. This demographic is less price-sensitive and highly loyal to brands that can demonstrate superior performance and ergonomic engineering, presenting a prime opportunity for premium product lines. Marketing strategies targeting this group often involve athlete sponsorship, technical performance demonstrations, and sales through specialty running stores where expert advice and product trials are available.

The third critical segment encompasses niche users focused on safety and specific outdoor activities. This includes hikers, cyclists, and fitness walkers who require high-visibility, reflective accessories for safety during low-light conditions, or specialized belts designed for integrating medical alert devices or water purification tablets during extended outdoor excursions. Furthermore, gym-goers who utilize armbands solely for listening to music while keeping their hands free constitute a consistent consumer base. Identifying the distinct functional requirements of these diverse end-users—ranging from urban commuters jogging to work to remote trail runners—allows for the creation of differentiated products and focused promotional campaigns that highlight the most relevant utility and safety benefits of the running accessory.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 765 Million |

| Growth Rate | CAGR 7.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Nike, Inc., Adidas AG, Salomon Group, Decathlon S.A., Nathan Sports, Inc., FlipBelt, SPIbelt, CamelBak Products LLC, Timbuk2, Ultimate Direction, RunStrong Gear, Fitletic, Tribe Fitness, Sporteer, Tune Belt, Belkin International, Gear Beast, Karrimor, AquaQuest, Aonijie |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Running Belts and Armbands Market Key Technology Landscape

The technological evolution within the Running Belts and Armbands market focuses less on revolutionary breakthroughs and more on incremental material science and integration technologies designed to enhance user experience and functionality. The primary technology driving product development is advanced textile engineering, specifically the use of proprietary blends of synthetic fabrics that offer exceptional elasticity, compression, and moisture management. Technologies such as four-way stretch fabrics ensure a snug fit that minimizes bounce and eliminates chafing, a critical performance factor for long-distance runners. Furthermore, sonic welding and heat-sealed seams are being utilized instead of traditional stitching to improve water resistance and durability, effectively making the accessories more robust and capable of handling sweat and adverse weather conditions during intense activity periods.

Integration technology forms the second pillar of innovation. As smartphones become larger and more essential for fitness tracking, manufacturers are focusing on designing transparent, touch-sensitive screen covers for armbands that maintain device functionality while offering full weather protection. For running belts, the incorporation of highly specialized, low-profile magnetic closures or self-locking zippers ensures security without the bulk of traditional hardware. Crucially, the embedding of RFID or NFC technology for quick, contactless payments is becoming a sought-after feature, transforming the accessory from a mere carrying device into a transactional tool, which is particularly appealing to urban runners who want to travel light without wallets or physical keys.

The future technology landscape is heavily skewed towards smart integration. This involves embedding miniature, non-obtrusive sensors within the fabric of belts to monitor biometric data, such as core body temperature or sweat electrolyte levels, transmitting this data wirelessly to a connected fitness application. The development of flexible, small-scale power sources is key to enabling these smart features without compromising the accessory's flexibility or comfort. Additionally, advancements in sustainable material technologies, including recycled polyester and bio-based polymers that maintain high performance characteristics, are technological imperatives driven by global corporate social responsibility standards and increasingly environmentally conscious consumer purchasing habits, ensuring that innovation addresses both performance and ethical concerns.

Regional Highlights

North America maintains its position as a dominant force in the Running Belts and Armbands Market, primarily due to the deeply entrenched fitness culture, high disposable incomes, and the early adoption of smart wearable technologies. The United States, in particular, showcases a robust market driven by frequent participation in high-profile running events and a strong consumer preference for branded, high-performance gear. The competitive landscape here is mature, compelling manufacturers to continually innovate in areas such as specialized hydration systems and integration with mainstream fitness apps. Marketing efforts are sophisticated, leveraging digital platforms and influencer partnerships to target specific demographics, ensuring consistent demand for premium, technologically enhanced running accessories.

Europe represents another high-value market, with key contributions coming from Germany, the UK, and Scandinavia. These regions are characterized by a significant population of outdoor sports enthusiasts and a strong emphasis on product quality, safety, and sustainability. European consumers tend to favor products that offer longevity and ethical sourcing transparency. Regulatory environments in the EU, often demanding higher standards for material safety and reflective properties, influence product development, pushing brands to invest in superior materials and robust design certifications. The growth across Europe is steady, supported by strong institutional promotion of physical wellness and a well-developed retail infrastructure specializing in sporting goods.

The Asia Pacific (APAC) region is forecasted to be the fastest-growing market segment, poised for exponential expansion throughout the forecast period. This growth is underpinned by rising urbanization, the increasing prevalence of Western fitness standards, and a burgeoning middle class in economic powerhouses like China, Japan, and India. While price sensitivity remains a factor, there is a rapidly growing demand for mid-range and premium products, particularly those that offer efficient solutions for navigating dense urban environments (e.g., secure payment integration). Manufacturers are strategically establishing production facilities and localized distribution networks within APAC to capitalize on lower operational costs and meet the rapidly increasing regional consumer base seeking affordable yet reliable fitness accessories.

- North America: High penetration of premium brands, strong demand for smart integration, dominant market share.

- Europe: Focus on sustainable materials, high quality standards, robust outdoor running participation.

- Asia Pacific (APAC): Fastest growth trajectory, driven by urbanization and rising disposable income, increasing adoption of running culture.

- Latin America: Emerging market, increasing health consciousness, potential for mass-market product adoption.

- Middle East and Africa (MEA): Growth linked to government investments in sports infrastructure and fitness programs, specific demand for heat-resistant materials.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Running Belts and Armbands Market.- Nike, Inc.

- Adidas AG

- Salomon Group

- Decathlon S.A.

- Nathan Sports, Inc.

- FlipBelt

- SPIbelt

- CamelBak Products LLC

- Timbuk2

- Ultimate Direction

- RunStrong Gear

- Fitletic

- Tribe Fitness

- Sporteer

- Tune Belt

- Belkin International

- Gear Beast

- Karrimor

- AquaQuest

- Aonijie

Frequently Asked Questions

What is driving the current demand for high-performance running belts?

Current demand is primarily driven by the increasing size and dependency on smartphones for GPS tracking and music during exercise. High-performance belts are sought after because they minimize bounce, offer superior moisture resistance, and provide specialized capacity for larger phones, hydration reservoirs, and energy gels essential for long-distance running without compromising comfort or stability.

How is e-commerce affecting the distribution of running armbands and belts?

E-commerce platforms are fundamentally restructuring distribution by offering vast selection, detailed user reviews, and comparative pricing, making them the preferred purchasing channel. This digital shift compels brands to enhance their online marketing, invest in detailed product visualizations, and optimize supply chain logistics for direct-to-consumer fulfillment, accelerating market penetration globally.

Which regions show the highest growth potential for running accessories?

The Asia Pacific (APAC) region, including emerging economies like China and India, exhibits the highest growth potential. This is attributed to rapid urbanization, increasing middle-class disposable income, and the adoption of fitness-focused lifestyles, creating a massive, untapped consumer base seeking modern fitness accessories and gear.

What key material innovations are shaping the future of running accessories?

Key material innovations center on proprietary blends of elastic fabrics (like advanced spandex/neoprene composites) engineered for zero-chafing and maximum breathability. Additionally, the integration of reflective polymers for enhanced visibility and the adoption of sustainable, recycled materials are critical technological focuses to meet performance and environmental standards.

Are running belts or armbands preferred by professional athletes?

Professional athletes and long-distance runners generally prefer high-capacity running belts, particularly hydration belts, over armbands. Belts offer greater stability and storage capacity for essential items like water, electrolytes, and nutrition packs, which are crucial for maintaining performance and safety during extended competitive events like marathons and ultra-runs.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager