Rutile Tio2 Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442332 | Date : Feb, 2026 | Pages : 251 | Region : Global | Publisher : MRU

Rutile Tio2 Market Size

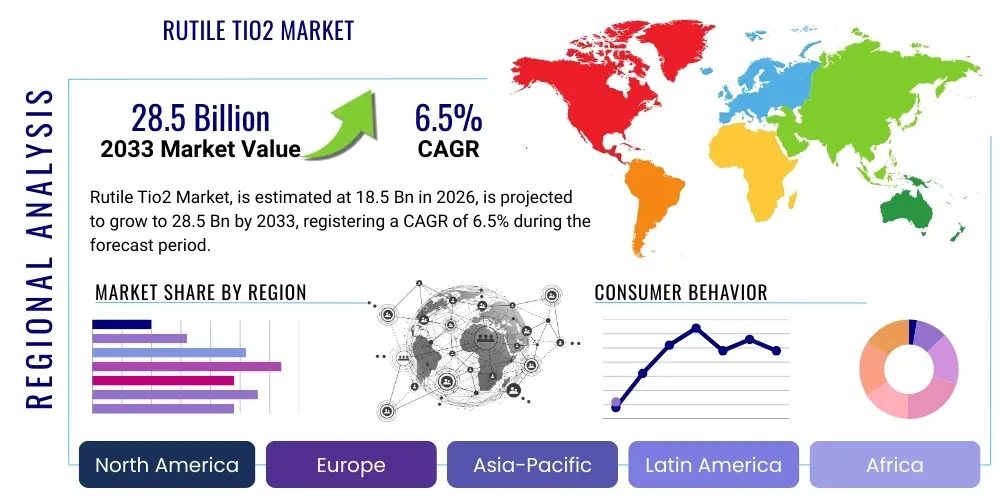

The Rutile Tio2 Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at $18.5 Billion in 2026 and is projected to reach $28.5 Billion by the end of the forecast period in 2033.

Rutile Tio2 Market introduction

Rutile Titanium Dioxide (TiO2) is the most thermodynamically stable and primary commercial crystalline form of TiO2, renowned for its superior optical properties, including high refractive index, excellent opacity, brightness, and UV resistance. This crucial inorganic pigment serves as a white pigment across various industrial applications, fundamentally improving the durability and aesthetic appeal of final products. The market growth is inherently tied to global construction output, automotive production, and the manufacturing activities of the plastics and coatings sectors. Its unparalleled efficiency in scattering light makes rutile TiO2 indispensable, particularly compared to the less opaque anatase form.

The primary applications driving the demand for rutile TiO2 encompass the paint and coatings industry, which consumes the largest share, followed by plastics, paper, and inks. In coatings, rutile provides the necessary hiding power and protects substrates from degradation due to weathering and UV exposure, critical for exterior architectural and industrial applications. Furthermore, in the plastics sector, especially for PVC and polyethylene products, rutile TiO2 ensures dimensional stability and color fastness, making it a foundational element in high-performance polymer compounding. The high demand is sustained by urbanization trends, increasing disposable incomes in emerging economies, and the necessity for durable, high-quality finishes in modern infrastructure projects.

Key driving factors influencing the robust expansion of the rutile TiO2 market include technological advancements in processing, particularly the refinement of the chloride process which offers higher purity and better cost efficiency compared to the traditional sulfate process. The benefits of using rutile TiO2, such as its exceptional chemical inertness, non-toxicity, and capability to function as a photocatalyst in certain environmental applications, further solidify its market position. Regulatory shifts, such as stricter standards regarding volatile organic compounds (VOCs) in paints, necessitate high-solids, low-VOC formulations, where high-performance rutile pigments are crucial to maintaining opacity and tint strength.

Rutile Tio2 Market Executive Summary

The Rutile TiO2 market is characterized by moderate consolidation among large multinational producers, experiencing growth primarily driven by expanding end-use sectors, particularly in Asia Pacific (APAC). Business trends indicate a strong move toward sustainable and specialty grades of rutile TiO2, including nano-grade pigments utilized in sunscreens and advanced photocatalytic coatings. Manufacturers are focused on optimizing production costs through feedstock diversification, primarily utilizing high-grade ilmenite and synthetic rutile, and increasing capacity via the highly efficient chloride route. Pricing stability remains a key concern, fluctuating based on energy costs, titanium ore availability, and environmental compliance expenditures, compelling strategic vertical integration across the value chain to mitigate supply risk.

Regionally, the market exhibits a clear skew toward APAC, which acts as both the largest consumer and producer base, fueled by rapid industrialization, extensive infrastructural development, and escalating consumer demand for durable goods and housing. North America and Europe, while mature markets, emphasize innovation in specialized applications like high-performance automotive coatings and aerospace paints, alongside rigorous adherence to environmental standards, which often favor premium, sustainably produced rutile grades. Emerging economies in Latin America and the Middle East & Africa (MEA) present significant growth opportunities, spurred by government investments in construction and expanding manufacturing capabilities, progressively shifting consumption patterns globally.

Segment trends reveal that the coatings segment maintains its dominance, but the plastics segment is demonstrating the fastest growth rate, fueled by the rising adoption of engineering plastics and lightweight materials in the automotive and packaging industries. Within process technology, the chloride process is expected to gain further market share due to its environmental advantages, higher product purity, and better scalability, challenging the dominance of the sulfate process in specific regional markets. Furthermore, surface treatment modifications, such as alumina or silica coating applied to the rutile pigment, are becoming standard practice to enhance dispersibility, weather resistance, and light stability across various demanding applications.

AI Impact Analysis on Rutile Tio2 Market

Common user inquiries regarding the impact of Artificial Intelligence (AI) on the Rutile TiO2 market center around optimizing complex production processes, predicting volatile raw material pricing, and accelerating the discovery of novel pigment functionalizations. Users are concerned with how AI can enhance the efficiency of the energy-intensive chloride and sulfate routes, specifically focusing on predictive maintenance for large-scale reactors and optimizing reaction parameters to reduce waste and improve yield. Furthermore, there is significant interest in utilizing machine learning algorithms to analyze global supply chain logistics, helping producers anticipate bottlenecks related to titanium ore sourcing and manage the high capital costs associated with new plant construction or expansion, ensuring stable supply amidst fluctuating demand signals.

- Enhanced Process Optimization: AI algorithms are employed to analyze real-time sensor data from reactors, optimizing temperature, pressure, and chemical stoichiometry in both the chloride and sulfate processes, leading to reduced energy consumption and improved pigment quality consistency.

- Predictive Maintenance: Machine learning models forecast equipment failure in critical, high-temperature units (e.g., fluid bed reactors, chlorinators), minimizing unplanned downtime which is extremely costly in continuous chemical production facilities.

- Supply Chain Resilience: AI-driven analytics provide sophisticated demand forecasting and inventory management, linking global economic indicators and end-user consumption trends (e.g., housing starts) directly to raw material procurement schedules.

- R&D Acceleration: AI simulates the interaction of various surface treatment chemicals (e.g., alumina, silica) with the TiO2 core particle, accelerating the development of specialized grades required for new applications like self-cleaning or anti-fouling coatings.

- Quality Control Automation: Computer vision systems powered by AI are utilized for automated, real-time particle size distribution and crystal morphology analysis, ensuring batches consistently meet stringent industry specifications.

- Market Pricing Prediction: Sophisticated time-series analysis powered by AI predicts future pricing trends for key inputs (e.g., chlorine, energy, titanium slag), aiding procurement professionals in hedging and strategic contract negotiation.

DRO & Impact Forces Of Rutile Tio2 Market

The Rutile TiO2 market dynamics are shaped by a complex interplay of robust demand from emerging economies (Drivers), coupled with strict environmental regulations and fluctuating raw material costs (Restraints), opening up substantial opportunities in specialty and sustainable applications. The primary driving force remains the growth in the global construction sector, necessitating durable architectural coatings and plastics. However, the high energy intensity of both the chloride and sulfate processes, coupled with waste management challenges, exerts significant downward pressure on profitability and limits easy market entry. The overall impact forces suggest a moderate to high influence on market expansion, pushing manufacturers toward efficiency and innovation.

Drivers: Significant global infrastructure projects, especially in APAC and MEA, necessitate large volumes of protective and decorative coatings, forming the foundational demand for rutile TiO2. The trend toward lightweighting in the automotive and aerospace industries mandates high-performance, opaque plastics and composite materials, increasing the specific demand for high-concentration pigment masterbatches. Furthermore, rising consumer demand for high-quality, long-lasting consumer goods, including furniture, appliances, and high-definition electronic displays, where bright white finishes are preferred, continuously reinforces market growth.

Restraints: The market faces considerable restraints due to the volatile pricing and supply chain unpredictability of titanium feedstock (ilmenite, rutile ore, slag). Environmental regulations concerning the safe disposal of process waste, particularly acid effluent generated by the sulfate process, impose high operational and capital expenditure costs on producers. Additionally, the emergence of viable substitute white pigments, such as precipitated barium sulfate or calcined clay, albeit offering lower performance characteristics, poses a potential threat, especially in cost-sensitive, low-end applications.

Opportunities: Major opportunities reside in the development and commercialization of nano-sized rutile TiO2 for applications such as UV filters in cosmetics, photocatalytic air purification systems, and advanced transparent conductive oxides (TCOs). The global push towards green building standards and sustainable manufacturing practices creates an avenue for bio-based or ultra-low-carbon footprint rutile pigments. Investment in enhanced processing technologies, such as advanced purification methods, allows for the use of lower-grade, more abundant titanium ores, thereby stabilizing feedstock costs and ensuring long-term supply resilience.

Impact Forces: The combined effect of strong demand drivers offset partially by regulatory and cost restraints results in a dynamic market environment where strategic pricing and vertical integration are paramount. The long-term impact is highly positive, driven by the indispensability of rutile TiO2 in achieving opacity and durability in key sectors. However, short-term volatility is high due to macroeconomic cycles affecting construction and energy prices. The industry’s focus on R&D for enhanced sustainability measures and cost reduction technologies will be the determining factor in mitigating the negative impacts of regulatory tightening.

Segmentation Analysis

The Rutile TiO2 market is comprehensively segmented based on its manufacturing process, primary end-use application, and grade type, reflecting the specialized requirements of diverse industrial consumers. The segmentation by process—chloride versus sulfate—highlights the technological preferences and environmental compliance levels of different regions and producers, with the chloride route generally dominating new capacity additions due to its superior efficiency and environmental profile. Application segmentation reveals the foundational reliance of the paint and coatings sector, necessitating large volume production, contrasted with high-value segments like cosmetics and food contact materials, which demand ultra-high-purity, specialty-treated grades.

Analysis of these segments indicates that while the sulfate process remains crucial in markets with abundant lower-grade ore and established legacy plants, the chloride process is setting the standard for quality and cost leadership globally. Furthermore, the segmentation by grade—pigmentary versus ultra-fine (nano)—shows a diversification of market focus. Pigmentary grades capture the bulk of the volume and revenue, serving commodity sectors, whereas nano grades, despite lower volumes, command significant price premiums due to their advanced functionality in UV absorption, catalytic activity, and specific electronic applications. Understanding these segment dynamics is critical for market players to tailor production investments and sales strategies effectively.

- By Process Type:

- Chloride Process

- Sulfate Process

- By Application:

- Paints and Coatings (Architectural, Industrial, Automotive, Marine)

- Plastics (Polymer compounding, Masterbatches, PVC, Engineering Plastics)

- Paper (Laminates, Fillers, Coating Pigments)

- Inks (Printing Inks, Digital Inks)

- Cosmetics and Personal Care (Sunscreen, Pigments)

- Others (Fibers, Ceramics, Catalysts, Rubber)

- By Grade:

- Pigmentary Grade TiO2

- Ultra-fine (Nano) Grade TiO2

Value Chain Analysis For Rutile Tio2 Market

The Rutile TiO2 value chain begins with the complex upstream extraction and beneficiation of titanium-bearing ores, primarily ilmenite and rutile, followed by their processing into intermediate feedstocks like synthetic rutile or titanium slag. This upstream phase is highly capital-intensive and geographically concentrated, often dictating production economics. Midstream operations involve the core manufacturing processes—either the high-temperature chlorination and oxidation (chloride route) or the digestion and calcination (sulfate route)—which convert the feedstock into crude TiO2. Efficiency and environmental compliance are critical differentiators at this stage, with vertical integration often favored by major players to secure stable, high-quality feedstock supply and manage cost volatility.

The downstream segment focuses on post-treatment, formulation, and distribution. Crude rutile TiO2 undergoes extensive surface treatments (e.g., coating with silica, alumina, or organic compounds) to enhance its performance characteristics, such as dispersibility, weather resistance, and compatibility with specific polymer systems or paint bases. Distribution channels are highly varied: high-volume commodity grades move through bulk distributors and large contractual agreements, while specialized, high-purity grades often utilize direct sales models supported by technical service teams. The distribution landscape is characterized by both direct sales to large, strategic end-users (e.g., major paint manufacturers) and reliance on specialized chemical distributors serving smaller or geographically diverse clients, ensuring global market reach.

Direct channels are preferred for highly technical or custom-grade sales, where deep technical expertise is required to integrate the pigment into the customer’s formulation process, such as in advanced automotive coatings or specialized plastics. Indirect channels, utilizing regional distributors and agents, are crucial for commodity grades and penetrate localized construction or consumer goods markets efficiently. The effectiveness of the value chain is increasingly measured by sustainability metrics, with end-users demanding transparency regarding the sourcing of raw materials and the environmental impact of the production process, driving innovation toward greener methodologies throughout the chain.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $18.5 Billion |

| Market Forecast in 2033 | $28.5 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Chemours, Tronox, Venator Materials, Lomon Billions, CRISTAL (acquired by Tronox), KRONOS Worldwide, TAYCA Corporation, Ishihara Sangyo Kaisha (ISK), Cinkarna Celje, Precheza, The Kish Company, Kilburn Chemicals, Evonik Industries AG, Merck KGaA, Shanghai Eko Industries, Panax, Anhui Annada Titanium Industry Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Rutile Tio2 Market Key Technology Landscape

The core technology landscape for the Rutile TiO2 market is dominated by the two established production routes: the Sulfate Process and the Chloride Process. The Sulfate Process, older and more flexible in utilizing lower-grade ilmenite ore, involves dissolving the ore in sulfuric acid followed by hydrolysis and calcination to produce the pigment. However, this method is environmentally challenging due to the large quantities of low-value acid waste generated. Consequently, modern technological focus is heavily skewed toward refining and expanding the Chloride Process, which utilizes purer rutile or titanium slag feedstock and involves high-temperature chlorination to form titanium tetrachloride (TiCl4), followed by oxidation to produce high-purity rutile TiO2 pigment, characterized by better control over particle size distribution and crystal uniformity.

Beyond the core synthesis, significant technological innovation centers on the surface treatment of the rutile particles, which dictates the pigment’s performance in end-use applications. Advanced coating technologies, involving deposition of inorganic materials like dense silica, alumina, or zirconia, enhance durability, weather resistance, and photochemical stability, particularly vital for exterior coatings and UV-exposed plastics. Furthermore, dispersion technology advancements, including specialized milling and grinding techniques, are crucial for achieving optimal tinting strength and gloss retention when the pigment is integrated into complex resin systems. These treatments allow standard rutile pigments to function effectively across water-borne, solvent-borne, and powder coating systems, driving product differentiation.

Emerging technologies also include the development of advanced photocatalytic TiO2 materials, often in the nano-grade category, which leverage the semiconductor properties of rutile for self-cleaning surfaces, environmental remediation (NOx reduction), and energy applications. Research efforts are also targeting the utilization of plasma technology and novel chemical routes to reduce the massive energy consumption inherent in traditional calcination and oxidation stages. Sustainability-focused technology developments aim to recycle and neutralize acid waste from the sulfate process and improve chlorine recovery efficiency in the chloride process, responding directly to stringent global environmental regulatory pressures.

Regional Highlights

- Asia Pacific (APAC): APAC represents the largest and fastest-growing regional market, driven by massive investments in residential and commercial infrastructure, rapid industrial expansion in China and India, and the burgeoning automotive manufacturing sector across Southeast Asia. The region is a net consumer and producer, relying significantly on both the sulfate and increasingly the chloride process capacities established locally to meet insatiable domestic demand for coatings and plastics.

- North America: A mature market characterized by high consumption of specialty and premium rutile grades for high-performance applications (aerospace, high-end automotive, industrial coatings). Growth is moderate but stable, heavily influenced by strict environmental regulations (e.g., EPA mandates) that favor high-quality, sustainably produced pigments and necessitate the adoption of waterborne and low-VOC coating technologies.

- Europe: The European market demonstrates stringent regulatory compliance, particularly under REACH, which influences both production methods and product specifications. Demand is steady, focused on architectural coatings and engineered plastics, with a strong trend toward bio-based and highly specialized nano-grade rutile for cosmetic and advanced materials applications, often favoring chloride-route producers.

- Latin America (LATAM): Growth in LATAM is promising, spurred by infrastructural development projects and recovering economies, particularly in Brazil and Mexico. The market typically imports high-quality chloride-based pigments but sees localized production (often sulfate-based) catering to domestic coating and commodity plastic needs. Market volatility is often tied to macroeconomic stability and currency fluctuations.

- Middle East and Africa (MEA): This region exhibits high growth potential, fueled by massive construction projects (residential, commercial, and energy infrastructure) in the Gulf Cooperation Council (GCC) countries. Consumption is primarily focused on durable coatings required to withstand harsh desert climates, creating specific demand for highly weather-resistant, surface-treated rutile pigments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Rutile Tio2 Market.- The Chemours Company

- Tronox Holdings plc

- Venator Materials PLC

- Lomon Billions Group Co., Ltd.

- KRONOS Worldwide, Inc.

- CRISTAL (now part of Tronox)

- Ishihara Sangyo Kaisha, Ltd. (ISK)

- TAYCA Corporation

- Cinkarna Celje d.d.

- Precheza a.s.

- Evonik Industries AG

- Ti-Cons Technology Co., Ltd.

- Shanghai Eko Industries Co., Ltd.

- Panax Titanium Co., Ltd.

- Anhui Annada Titanium Industry Co., Ltd.

- Pangang Group Vanadium & Titanium Resources Co., Ltd.

- Xianning Shunfa Group

- Huntsman Corporation (divested business)

- Qingdao Dongjia Chemical Co., Ltd.

- Kilburn Chemicals Ltd.

Frequently Asked Questions

Analyze common user questions about the Rutile Tio2 market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the fundamental difference between rutile and anatase titanium dioxide?

Rutile is the preferred commercial form of TiO2 due to its higher refractive index and superior density, providing maximum opacity, hiding power, and UV resistance, making it ideal for paints and durable plastics. Anatase has a lower refractive index, offering less opacity, but is favored in specific applications requiring photocatalytic activity or softness, such as fibers and certain cosmetic formulations.

Which production process, chloride or sulfate, dominates the current rutile TiO2 market, and why?

The Chloride Process is gaining dominance, especially for new capacity additions, as it yields a higher purity rutile product with precise particle size control and is generally considered more environmentally favorable due to producing less solid waste compared to the Sulfate Process. However, the Sulfate Process still accounts for a significant portion of global output, particularly utilizing lower-cost feedstock.

How do volatile titanium ore prices impact the profitability of rutile TiO2 manufacturers?

Fluctuations in the price of titanium feedstock (ilmenite, rutile ore, slag) directly impact the cost of goods sold, as raw materials represent a major component of production expenses. Manufacturers mitigate this by pursuing vertical integration, securing long-term supply contracts, and investing in technologies that allow for the flexible use of varying grades of feedstock.

What are the primary applications driving the strongest demand growth for rutile TiO2?

The strongest demand growth is driven by the coatings industry, particularly architectural and industrial protective coatings in Asia Pacific, coupled with the rapidly expanding use of rutile in specialized plastic masterbatches for automotive, packaging, and construction materials, where durability and color consistency are essential.

What specialized grades of rutile TiO2 are emerging as high-value market opportunities?

High-value market opportunities center around ultra-fine (nano) rutile TiO2 for applications requiring advanced UV protection in sunscreens and specialized coatings, and heavily surface-treated pigmentary grades designed for high-performance, low-VOC paint systems and engineered plastics requiring extreme weatherability and dispersibility.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager