Rx Intravenous Aspirin Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441284 | Date : Feb, 2026 | Pages : 242 | Region : Global | Publisher : MRU

Rx Intravenous Aspirin Market Size

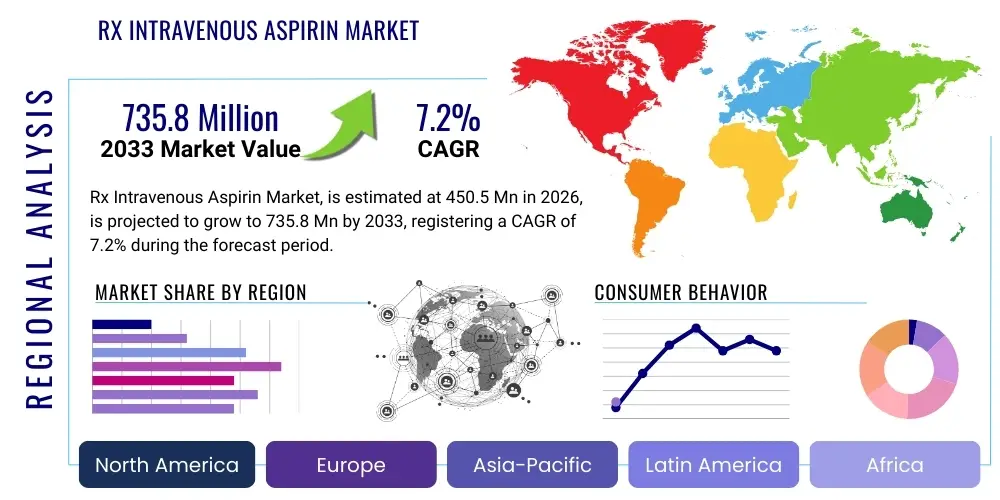

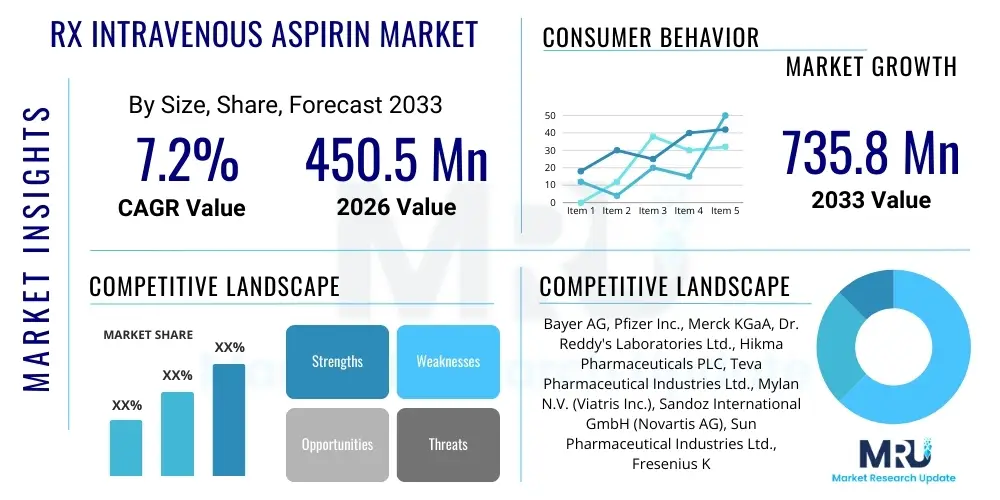

The Rx Intravenous Aspirin Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.2% between 2026 and 2033. The market is estimated at USD 450.5 Million in 2026 and is projected to reach USD 735.8 Million by the end of the forecast period in 2033.

Rx Intravenous Aspirin Market introduction

The Rx Intravenous Aspirin Market encompasses the highly specialized segment of prescription-only acetylsalicylic acid formulations designed for intravenous administration. This route of delivery is critical in acute care settings where rapid onset of action is essential, particularly for conditions demanding immediate antiplatelet, analgesic, or anti-inflammatory effects. Intravenous (IV) aspirin bypasses the limitations associated with oral administration, such as variability in gastrointestinal absorption, delayed peak plasma concentration, and the need for patient cooperation, making it indispensable in critical care, emergency medicine, and perioperative management. The market growth is primarily driven by the increasing global incidence of acute thrombotic events, including myocardial infarction and acute ischemic stroke, where immediate platelet inhibition significantly impacts patient outcomes and reduces mortality and morbidity rates. Furthermore, the rising prevalence of conditions requiring fast and potent non-opioid pain management in hospitalized settings contributes substantially to the expanding demand for IV aspirin products.

Rx Intravenous Aspirin, chemically acetylsalicylic acid (ASA), functions primarily through the irreversible inhibition of cyclooxygenase (COX) enzymes, particularly COX-1, which leads to reduced production of thromboxane A2 (TXA2) in platelets, thereby exerting its potent antiplatelet effects. While historically aspirin was predominantly available in oral forms, the development of high-purity, stable IV formulations has revolutionized its use in acute settings. Major applications include the initial management of acute coronary syndromes (ACS), rapid pain relief post-surgery or in acute headache crises, and fever reduction in patients unable to take oral medication. These applications highlight its dual role as a critical cardiovascular intervention and a valuable component of multimodal analgesia protocols. The product's inherent benefits, such as established efficacy, relatively low cost compared to some novel antiplatelet agents, and flexibility in dosing, cement its position in hospital formularies worldwide.

Driving factors for this market are multifaceted, anchored by continuous advancements in emergency medical services and critical care infrastructure, especially in developing economies. The established guidelines from major cardiology and neurology associations strongly recommend the immediate administration of aspirin, often intravenously, upon suspicion of acute thrombotic events. Technological innovations aimed at improving the stability, solubility, and shelf life of IV aspirin formulations are also crucial market drivers. Furthermore, the growing awareness among healthcare professionals regarding the benefits of immediate, reliable antiplatelet therapy over traditional oral dosing in high-risk patients fuels adoption. However, market expansion is subtly constrained by the potential for bleeding complications and the availability of alternative parenteral non-steroidal anti-inflammatory drugs (NSAIDs) or antiplatelet agents, requiring pharmaceutical companies to focus on improved safety profiles and formulation differentiation to maintain competitive advantages and market trajectory.

Rx Intravenous Aspirin Market Executive Summary

The Rx Intravenous Aspirin Market is poised for significant expansion, characterized by robust growth in acute care settings driven by demographic shifts towards an aging population and the corresponding increase in cardiovascular disease incidence globally. Business trends indicate a focus on strategic partnerships between pharmaceutical manufacturers and hospital group purchasing organizations (GPOs) to streamline procurement and ensure availability in high-volume critical care units. Furthermore, manufacturers are investing in specialized drug delivery systems and buffered formulations to minimize administration risks and enhance product appeal. Competition is intensifying, particularly through generic market entrants following patent expirations, pushing established players to focus on proprietary manufacturing processes and clinical differentiation studies highlighting superior bioavailability and quicker therapeutic onset compared to competing parenteral NSAIDs. Supply chain resilience and quality control remain paramount due to the critical nature of these life-saving acute medications, necessitating stringent regulatory compliance and robust logistical networks across diverse geographical regions.

Regional trends reveal North America and Europe as the dominant revenue contributors, primarily due to well-established healthcare infrastructure, comprehensive acute coronary syndrome treatment protocols, and high levels of healthcare expenditure per capita. However, the Asia Pacific (APAC) region is projected to exhibit the fastest Compound Annual Growth Rate (CAGR). This acceleration is attributed to rapidly improving healthcare access, increasing awareness regarding immediate antiplatelet therapy, and the substantial rise in the patient pool suffering from acute cardiovascular and cerebrovascular events in populous nations like China and India. Government initiatives in these emerging markets aimed at upgrading emergency medical services and establishing specialized cardiac centers are key drivers for increased IV aspirin consumption. The Middle East and Africa (MEA) and Latin America (LATAM) markets are showing steady, albeit slower, growth, dependent heavily on regulatory approvals and the pace of modernization in critical care units.

Segment trends underscore the dominance of acute coronary syndromes (ACS) as the primary application segment, reflecting the established clinical utility and necessity of immediate antiplatelet loading doses. Simultaneously, the pain management segment, particularly post-operative and trauma pain, is gaining traction as hospitals seek non-opioid alternatives for moderate-to-severe pain relief, leveraging the potent analgesic and anti-inflammatory properties of IV aspirin. By end-user, hospitals and critical care centers remain the largest consumers, demanding high volumes for use in intensive care units (ICUs), cardiac catheterization labs, and emergency departments. Ambulatory surgical centers (ASCs) represent an emerging high-growth segment, driven by the increasing trend towards outpatient procedures requiring effective perioperative pain management and prophylactic antiplatelet measures for selected high-risk patients transitioning to post-acute care environments.

AI Impact Analysis on Rx Intravenous Aspirin Market

Common user inquiries regarding the impact of Artificial Intelligence (AI) on the Rx Intravenous Aspirin market center around optimizing patient selection for IV therapy, predicting bleeding risks associated with immediate administration, and improving supply chain forecasting for acute medications. Users frequently question how AI algorithms can personalize dosing regimens based on real-time physiological data, potentially moving beyond standard loading doses to minimize adverse events while maximizing efficacy. Another key theme involves AI-driven clinical decision support systems (CDSS) assisting emergency physicians in rapidly diagnosing acute thrombotic events and immediately triggering the administration of appropriate IV medications, including aspirin, thereby reducing critical treatment delays. The general consensus expectation is that AI will primarily enhance precision medicine in acute cardiology and improve the efficiency and safety profile of IV drug administration across critical care settings.

The integration of AI technologies is set to revolutionize several facets of the Rx Intravenous Aspirin market, beginning with enhanced drug discovery and formulation stability. AI can model molecular interactions to design more stable and soluble IV formulations of aspirin, addressing current challenges related to reconstitution and shelf stability under diverse environmental conditions. In the clinical domain, machine learning algorithms can analyze vast datasets of patient characteristics, comorbidities, concurrent medications, and genetic profiles to accurately predict the individualized risk-benefit ratio of administering IV aspirin, particularly concerning major bleeding risk. This predictive capability ensures that IV aspirin is preferentially administered to patients who stand to benefit most, thereby improving overall treatment safety and cost-effectiveness. Furthermore, AI-powered predictive maintenance models for hospital inventory management will ensure optimal stock levels of this time-sensitive medication, preventing critical shortages during peak incidence periods for myocardial infarction and stroke, ensuring seamless patient care delivery.

- AI-driven clinical decision support systems (CDSS) for rapid diagnosis and IV administration protocol activation in emergency settings.

- Machine learning algorithms predicting individualized patient risk profiles for gastrointestinal or intracranial hemorrhage following IV aspirin.

- Optimization of supply chain and inventory management using AI forecasting to prevent critical shortages in hospitals and trauma centers.

- Accelerated discovery and refinement of novel, highly stable IV aspirin formulations using computational chemistry and molecular modeling.

- Personalization of initial IV aspirin loading doses based on real-time hemodynamic monitoring and patient physiological responses analyzed by AI.

DRO & Impact Forces Of Rx Intravenous Aspirin Market

The dynamics of the Rx Intravenous Aspirin Market are significantly shaped by a confluence of accelerating drivers, structural restraints, and compelling opportunities, all contributing to influential impact forces. The primary driver is the universally established clinical guideline requiring immediate antiplatelet therapy upon the suspicion of acute coronary syndromes (ACS) or acute ischemic stroke, positioning IV aspirin as a foundational, life-saving intervention. Coupled with this is the escalating global prevalence of non-communicable diseases, especially cardiovascular conditions, fueled by lifestyle factors and aging demographics across major economies. Opportunities abound in expanding the application scope into perioperative pain management as part of multimodal opioid-sparing protocols and developing enhanced formulations tailored for pediatric or high-risk populations. These forces necessitate continuous pharmaceutical innovation and regulatory harmonization to ensure broad market access and clinical adoption.

Key drivers strongly influencing market growth include the increasing emphasis on speed and efficiency in acute care, where the rapid onset provided by the intravenous route is non-negotiable for maximizing therapeutic benefit and minimizing irreversible tissue damage. Furthermore, the rising investment in advanced hospital infrastructure, particularly specialized cardiac and stroke centers equipped to handle complex interventions, inherently boosts the consumption of critical acute medications like IV aspirin. Conversely, significant restraints temper the market's trajectory, notably the inherent risk of bleeding complications associated with high-dose intravenous antiplatelet agents, which necessitates careful patient screening and intensive monitoring. Regulatory hurdles, especially in securing approvals for new drug indications or reformulations across disparate international jurisdictions, also act as a constraint, slowing down market entry and adoption rates for novel products. The high cost associated with manufacturing and maintaining the stability of sterile parenteral formulations further contributes to market limitations in resource-constrained settings.

Impact forces arising from these DRO factors create a competitive landscape focused on safety and efficacy differentiation. The opportunity to leverage growing demand for non-opioid pain relief is a strong pull factor, encouraging market players to emphasize the potent analgesic properties of IV aspirin in their commercialization strategies. The expiration of key patents has introduced generic competition, acting as a force that drives down average selling prices but simultaneously increases overall market volume and accessibility. The imperative for safer administration methods and formulations—such as buffered solutions that mitigate local irritation—is a core impact force compelling manufacturers to invest heavily in R&D. Ultimately, the market is driven by clinical urgency but constrained by safety concerns and competition, leading to a strategic focus on clinical data generation and supply chain excellence to secure dominant market positions and ensure the critical availability of this essential acute medication.

- Drivers:

- Mandatory inclusion in established international guidelines for acute coronary syndrome (ACS) and stroke management.

- Superior bioavailability and ultra-rapid onset of action compared to oral aspirin in critical care.

- Global increase in cardiovascular disease incidence driven by aging populations.

- Growing clinical adoption of multimodal, non-opioid pain management protocols in hospital settings.

- Restraints:

- Risk of bleeding complications (gastrointestinal or intracranial hemorrhage) requiring intensive patient monitoring.

- Availability of competing intravenous antiplatelet agents (e.g., P2Y12 inhibitors) and alternative NSAIDs.

- Challenges in maintaining the stability and solubility of IV acetylsalicylic acid formulations.

- Pricing pressure exerted by generic competition and hospital budget constraints.

- Opportunities:

- Expansion of indications to specialized areas like pre-hospital emergency care and acute headache treatment.

- Development of proprietary, ready-to-use liquid formulations eliminating the need for reconstitution.

- Tapping into emerging markets (APAC, LATAM) with rapidly developing critical care infrastructure.

- Integrating IV aspirin into enhanced recovery after surgery (ERAS) protocols for optimized perioperative care.

- Impact Forces:

- Intense regulatory scrutiny on product safety and manufacturing standards for sterile injectables.

- Shift towards outcomes-based purchasing, favoring products demonstrating superior clinical results and lower complication rates.

- Consolidation of purchasing power within large hospital groups and GPOs affecting pricing negotiations.

Segmentation Analysis

The Rx Intravenous Aspirin market segmentation provides a granular view of market dynamics based on formulation, application, and end-user, illustrating where demand concentration and growth potential are strongest. Segmentation by formulation, specifically distinguishing between lyophilized powder for reconstitution and ready-to-use liquid solution, reflects technological progress aimed at enhancing ease of use and reducing medication preparation errors in fast-paced clinical environments. The lyophilized format, historically dominant, offers extended shelf life, but the emerging ready-to-use formats are increasingly favored by emergency departments and operating rooms due to their immediate applicability. Understanding these formulation preferences is crucial for manufacturers tailoring their supply chain and commercial strategies to meet the operational needs of diverse healthcare facilities.

Segmentation by application is critical, as it directly correlates market size with specific clinical pathways. Acute Coronary Syndrome (ACS) treatment remains the foundational segment, driven by robust clinical trial data and unwavering guideline recommendations for immediate antiplatelet therapy. However, the rapidly expanding pain and inflammation management segment is expected to be a key growth driver, capitalizing on the worldwide movement to minimize opioid dependence and utilize non-narcotic alternatives for acute pain relief, such as in post-surgical settings or acute migraine management. Furthermore, the segmentation by end-user—dominated by large hospitals but increasingly including specialized clinics and ambulatory centers—reflects the broadening utilization scope beyond traditional critical care, highlighting market diffusion into outpatient and procedural settings that require effective, rapid-acting parenteral medications.

The analysis of these segments reveals distinct growth trajectories. While cardiovascular indications provide stability, the therapeutic expansion into general pain and inflammation management offers higher marginal growth potential, appealing to a wider range of clinicians outside cardiology and critical care. In terms of geography, sales channels are highly centralized, revolving around direct sales to institutional purchasers, but the rise of specialized pharmacy distributors focusing on sterile injectables indicates an evolving distribution landscape. Strategic pricing, driven by competition within specific dosage forms and application areas, varies significantly; for instance, premium pricing may be sustained for novel, highly stable ready-to-use solutions, while standard lyophilized products face greater generic price erosion, necessitating efficiency improvements in manufacturing processes to maintain profitability margins.

- By Formulation Type:

- Lyophilized Powder for Reconstitution

- Ready-to-Use (RTU) Liquid Solutions

- By Application:

- Acute Coronary Syndrome (ACS) Treatment (including Myocardial Infarction and Unstable Angina)

- Acute Ischemic Stroke

- Pain and Inflammation Management (Post-operative pain, Acute headache)

- Antipyresis (Fever reduction)

- By End-User:

- Hospitals and Critical Care Centers

- Ambulatory Surgical Centers (ASCs)

- Specialized Cardiac and Neurology Clinics

- Emergency Medical Services (EMS)

- By Distribution Channel:

- Direct Sales (to Hospitals/GPOs)

- Hospital Pharmacies

- Retail Pharmacies (Limited)

- Third-Party Distributors

Value Chain Analysis For Rx Intravenous Aspirin Market

The value chain for the Rx Intravenous Aspirin Market is intricate, starting from the sourcing of high-purity acetylsalicylic acid (ASA) raw materials and extending through specialized manufacturing, sterile filling, regulated distribution, and final clinical administration. Upstream activities involve the procurement of pharmaceutical-grade chemical precursors and excipients necessary for producing the stable injectable formulation. Given the stringent requirements for sterility and pyrogen-free status, raw material quality control is paramount and often involves long-term supplier relationships with audited chemical manufacturers. Midstream operations focus on complex synthesis, purification, and sterile formulation processes, which are capital-intensive and subject to strict Good Manufacturing Practice (GMP) regulations, particularly for lyophilization or high-speed sterile liquid filling, distinguishing established players from new market entrants.

Downstream analysis focuses on logistics, distribution, and hospital procurement. Due to the acute nature of the drug, the distribution channel demands reliability and speed. Direct distribution to major hospital systems and Group Purchasing Organizations (GPOs) is the primary channel, allowing manufacturers greater control over inventory management and temperature sensitivity. Indirect distribution involves specialized pharmaceutical wholesalers and distributors who manage regional supply chains and reach smaller hospitals or ambulatory surgical centers. The transition from distribution to the point of care involves hospital pharmacies and critical care unit logistics, where efficient inventory rotation and preparedness for emergency use are non-negotiable operational requirements, highlighting the need for efficient product traceability and rapid delivery mechanisms.

The distribution network relies heavily on both direct and indirect models. Direct sales teams engage with formulary committees, key opinion leaders (KOLs), and hospital procurement managers to secure contracts, focusing on volume discounts and clinical support packages. Indirect channels utilize specialized third-party logistics providers proficient in handling high-value, time-critical sterile injectables, ensuring product integrity up to the point of administration. The efficiency of the value chain is consistently challenged by the need for regulatory compliance across numerous markets, the high cost of maintaining sterile manufacturing facilities, and the constant pressure to optimize production scale while maintaining impeccable quality standards essential for acute care parenteral products, ultimately impacting pricing and market accessibility across different economic zones.

Rx Intravenous Aspirin Market Potential Customers

The primary consumers and end-users of Rx Intravenous Aspirin are institutional buyers deeply embedded within the acute healthcare delivery system, where immediate therapeutic intervention is a prerequisite for patient survival and optimal outcome. These customers primarily include tertiary care hospitals, which house the most intensive critical care centers, coronary care units (CCUs), and emergency departments (EDs), driving the largest volume demand due to the high throughput of patients experiencing acute coronary syndromes, strokes, and trauma. The demand profile of these major hospitals is characterized by bulk purchasing through GPOs, necessitating competitive contract pricing, robust supply chain guarantees, and comprehensive clinical education support from the supplying pharmaceutical companies to ensure correct and standardized usage protocols.

A rapidly growing segment of potential customers includes specialized cardiac centers and designated stroke units that prioritize speed and efficiency in treating thrombotic events. These centers are often early adopters of the newest, most convenient formulations, such as ready-to-use liquid solutions, to minimize preparation time during life-threatening emergencies. Furthermore, ambulatory surgical centers (ASCs) represent an increasingly relevant customer base, particularly as complex surgeries shift to outpatient settings. ASCs require IV aspirin primarily for post-operative pain management as part of enhanced recovery protocols, emphasizing non-opioid options to facilitate quicker patient discharge while managing antiplatelet therapy risks in selected high-risk patients undergoing minor procedures.

Finally, governmental and private Emergency Medical Services (EMS) organizations are emerging customers, especially where protocols allow paramedics to administer critical medications, including IV aspirin, pre-hospital. This pre-hospital administration capability, driven by regional health system policies and technological advancements in mobile critical care, significantly expands the customer base beyond traditional hospital walls. The purchasing decisions across all these customer groups are heavily influenced by evidence-based medicine, inclusion in hospital formularies, favorable total cost of ownership (considering preparation time and error reduction), and, fundamentally, the drug's established efficacy and safety profile in acute, life-critical situations. Addressing the specific logistical needs of EMS (e.g., small, stable packaging) and ASCs (e.g., dose-specific packaging) is crucial for market penetration into these distinct customer segments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Million |

| Market Forecast in 2033 | USD 735.8 Million |

| Growth Rate | 7.2% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bayer AG, Pfizer Inc., Merck KGaA, Dr. Reddy's Laboratories Ltd., Hikma Pharmaceuticals PLC, Teva Pharmaceutical Industries Ltd., Mylan N.V. (Viatris Inc.), Sandoz International GmbH (Novartis AG), Sun Pharmaceutical Industries Ltd., Fresenius Kabi AG, Aurobindo Pharma, Wockhardt Ltd., Aspen Pharmacare, Cipla Limited, Zydus Lifesciences Ltd., Glenmark Pharmaceuticals Ltd., Baxter International Inc., Daiichi Sankyo Company Limited. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Rx Intravenous Aspirin Market Key Technology Landscape

The technology landscape for the Rx Intravenous Aspirin market is defined by advanced pharmaceutical formulation science focused on overcoming stability, solubility, and administration challenges inherent to acetylsalicylic acid in aqueous solutions. A key technology is lyophilization (freeze-drying), which converts the injectable solution into a stable powder, dramatically extending shelf life and preventing hydrolysis until the point of reconstitution. While standard, continuous improvements in lyophilization cycles and excipient selection aim to reduce reconstitution time and ensure complete solubility without particle formation. This technology remains vital for long-term storage and distribution across varied climates, ensuring product integrity and efficacy when needed urgently in critical care scenarios.

Another pivotal technological advancement involves the development of proprietary buffer systems and novel solubilizing agents that facilitate the creation of ready-to-use (RTU) liquid IV aspirin solutions. The objective of RTU technology is to eliminate the need for manual reconstitution, significantly reducing preparation time in high-stress emergency environments and mitigating the risk of dosing errors associated with preparation steps. These RTU formulations demand highly sophisticated manufacturing capabilities, including aseptic processing and terminal sterilization techniques, to ensure both sterility and chemical stability over the product's lifespan. Companies investing in these advanced sterile liquid filling technologies gain a competitive edge by offering products that improve workflow efficiency and enhance patient safety within the hospital setting, addressing a major unmet need in acute medication administration.

Furthermore, packaging and drug delivery systems are integral technological components. The shift towards pre-filled syringes or specialized auto-injector systems, though currently limited for IV aspirin, represents a future trend aimed at increasing portability and simplifying administration, particularly for EMS use. Barrier packaging technologies (e.g., specialized vials or ampoules) are also crucial for protecting the chemically sensitive drug from oxygen and moisture, which can accelerate degradation. Overall, the market's technological focus is not just on the drug molecule itself, but on optimizing its presentation—making it faster to prepare, safer to administer, and compliant with the highest standards of sterile manufacturing, ensuring its reliability as a front-line treatment for acute thrombotic events globally.

Regional Highlights

North America: North America, comprising the United States and Canada, holds the largest market share in terms of revenue, primarily driven by high per capita healthcare spending, the sophisticated infrastructure of critical care centers, and well-defined clinical guidelines that mandate the immediate use of antiplatelet therapy upon hospital presentation for ACS. The high prevalence of cardiovascular diseases, coupled with aggressive utilization of advanced medical technologies and comprehensive insurance coverage, ensures sustained demand for Rx Intravenous Aspirin. The U.S. market, in particular, benefits from a competitive landscape of both branded and generic IV aspirin products, fueling innovation in drug delivery systems and resulting in optimized supply chain efficiency geared towards emergency response. Furthermore, stringent regulatory standards maintained by the FDA necessitate high-quality manufacturing, solidifying the region's position as a leader in terms of market value and adoption of the latest formulation technologies.

Europe: The European market demonstrates robust and steady growth, facilitated by established healthcare systems, national guidelines promoting effective acute cardiology care (aligned with ESC guidelines), and a strong presence of major pharmaceutical innovators and generic manufacturers. Countries like Germany, France, and the UK are key contributors, characterized by high adoption rates in acute settings and increasing use in perioperative pain management protocols. However, the market in Europe is also characterized by significant price pressure, especially within publicly funded healthcare systems, where generic substitution is favored. This pricing environment drives manufacturers to focus on cost-effective manufacturing and differentiation through specialized services or enhanced formulation stability. Eastern European countries are gradually increasing their market contribution as healthcare infrastructure modernizes and access to advanced critical care interventions expands, signaling potential for future volume growth.

Asia Pacific (APAC): The Asia Pacific region is projected to be the fastest-growing market globally, presenting immense untapped potential. This exponential growth is fueled by massive patient populations, rapidly improving healthcare infrastructure, and rising disposable incomes leading to increased access to specialized medical care in countries like China, India, Japan, and South Korea. The accelerating urbanization and shift towards Western lifestyles contribute directly to a dramatic increase in the incidence of cardiovascular and cerebrovascular diseases, creating an acute demand for life-saving injectable medications. While price sensitivity remains a factor, particularly in developing economies, government investments in public health programs aimed at combating non-communicable diseases are instrumental in driving market penetration and ensuring the necessary supply of essential medicines, including IV aspirin, across regional healthcare facilities.

Latin America (LATAM): The LATAM market, including Brazil, Mexico, and Argentina, is marked by moderate but consistent growth. Market dynamics here are influenced by economic stability, government healthcare priorities, and varied levels of development in emergency medical services. Brazil and Mexico, possessing larger and more centralized healthcare systems, are the primary revenue generators. Adoption rates are improving as international clinical standards are increasingly integrated into local hospital protocols, boosting the need for reliably supplied, high-quality injectable antiplatelets. Challenges include complex regulatory environments and logistical hurdles in reaching remote areas, necessitating a decentralized distribution strategy and strong local partnership agreements to effectively serve the diverse geographic landscape and disparate levels of critical care resource availability across the region.

Middle East and Africa (MEA): The MEA market is exhibiting foundational growth, primarily concentrated in the Gulf Cooperation Council (GCC) countries (e.g., UAE, Saudi Arabia) and South Africa, which benefit from significant investments in state-of-the-art medical facilities and high-standard critical care infrastructure. Demand is steady in these areas, driven by high prevalence rates of metabolic syndrome and associated cardiovascular risks. However, growth remains highly segmented; large parts of Sub-Saharan Africa face substantial barriers to adoption due to limited healthcare budgets, underdeveloped infrastructure, and logistical challenges related to the cold chain or high-quality sterile storage requirements. Future growth is contingent upon sustained public and private investment into healthcare capacity building and improving access to specialized cardiovascular treatment centers, which are essential prerequisites for increased IV aspirin utilization.

- North America: Market dominance due to established critical care infrastructure and high cardiovascular disease burden; stringent regulatory environment ensures high quality standards.

- Europe: Stable growth driven by standardized clinical protocols and strong generic presence; focus on cost-effectiveness and efficiency in public healthcare systems.

- Asia Pacific (APAC): Highest CAGR anticipated, fueled by rapidly improving healthcare access, large patient pool, and increasing public spending on cardiovascular health initiatives.

- Latin America (LATAM): Moderate growth, highly reliant on economic stability and modernization of critical care services in key economies like Brazil and Mexico.

- Middle East and Africa (MEA): Growth concentrated in GCC nations due to substantial health infrastructure investment; market fragmented by severe resource limitations in lower-income countries.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Rx Intravenous Aspirin Market.- Bayer AG

- Pfizer Inc.

- Merck KGaA

- Dr. Reddy's Laboratories Ltd.

- Hikma Pharmaceuticals PLC

- Teva Pharmaceutical Industries Ltd.

- Mylan N.V. (Viatris Inc.)

- Sandoz International GmbH (Novartis AG)

- Sun Pharmaceutical Industries Ltd.

- Fresenius Kabi AG

- Aurobindo Pharma

- Wockhardt Ltd.

- Aspen Pharmacare

- Cipla Limited

- Zydus Lifesciences Ltd.

- Glenmark Pharmaceuticals Ltd.

- Baxter International Inc.

- Daiichi Sankyo Company Limited

- Accord Healthcare Ltd.

- Amneal Pharmaceuticals Inc.

Frequently Asked Questions

Analyze common user questions about the Rx Intravenous Aspirin market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Rx Intravenous Aspirin primarily used for in a critical care setting?

Rx Intravenous Aspirin is primarily used for the rapid antiplatelet loading dose required in the immediate treatment of acute coronary syndromes (ACS), such as myocardial infarction or unstable angina, to quickly inhibit platelet aggregation and prevent further clot formation. Its intravenous route ensures maximal bioavailability and the fastest possible onset of action, which is critical for reducing patient mortality in these time-sensitive emergencies.

How does the ready-to-use (RTU) formulation affect hospital workflow compared to lyophilized powder?

The ready-to-use (RTU) liquid formulation significantly streamlines hospital workflow by eliminating the critical steps of reconstituting the lyophilized powder, which saves valuable time in emergency situations and minimizes the risk of preparation errors or contamination. This efficiency enhancement is highly valued in high-stress environments like emergency departments and catheterization laboratories, leading to faster patient intervention times.

What are the main risks associated with administering Intravenous Aspirin?

The main risk associated with administering Intravenous Aspirin, consistent with all systemic antiplatelet agents, is the potential for significant bleeding events, most critically gastrointestinal hemorrhage or intracranial bleeding, particularly in high-risk patients. Therefore, careful patient selection, timely administration, and intensive monitoring of coagulation parameters are essential safety protocols when using this medication in acute settings.

Which geographical region is anticipated to experience the fastest growth in the Rx Intravenous Aspirin Market?

The Asia Pacific (APAC) region is anticipated to experience the fastest market growth, driven by massive investments in healthcare infrastructure, the escalating prevalence of cardiovascular diseases due to changing lifestyles, and the increasing access to advanced critical care and emergency medical services across populous nations like China and India.

Are there non-cardiac applications contributing significantly to the demand for Rx Intravenous Aspirin?

Yes, non-cardiac applications, particularly acute pain and inflammation management, are significantly contributing to demand. IV Aspirin is increasingly used in perioperative settings and emergency pain protocols as a highly potent, non-opioid analgesic and anti-inflammatory agent, supporting the global clinical trend towards enhanced recovery after surgery (ERAS) and minimizing reliance on traditional narcotic pain relief.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager