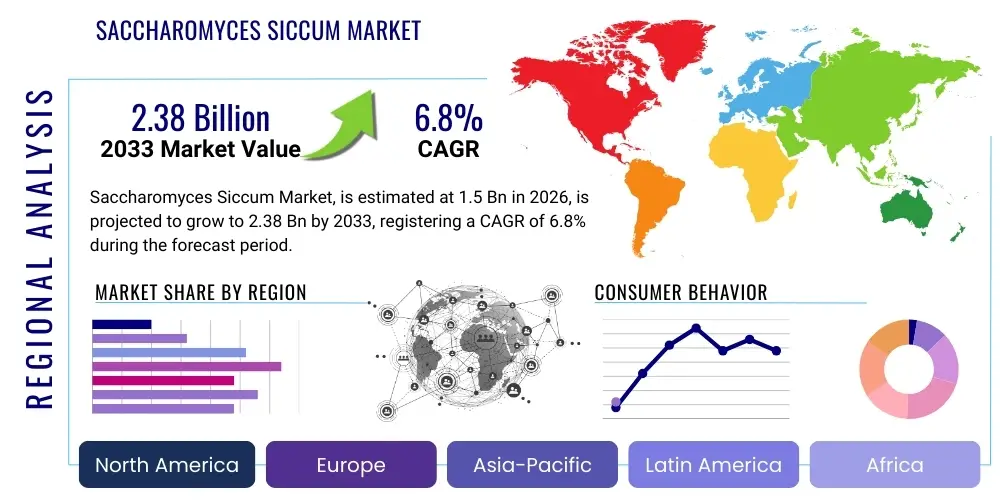

Saccharomyces Siccum Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442736 | Date : Feb, 2026 | Pages : 257 | Region : Global | Publisher : MRU

Saccharomyces Siccum Market Size

The Saccharomyces Siccum Market, fundamentally driven by pervasive applications across the food and beverage industry, nutritional supplements, and advanced biotechnological processes, is experiencing robust expansion. This growth is underpinned by rising global demand for processed foods, alcoholic beverages, and high-efficacy probiotic solutions. Furthermore, the efficiency and shelf stability intrinsic to dry yeast forms make Saccharomyces Siccum a preferred ingredient in large-scale industrial operations compared to liquid forms, driving commercial adoption. The market’s sustained performance is closely tied to consumer trends emphasizing natural ingredients and fermentation-derived products, positioning it for continued upward momentum across diverse geographical regions, particularly in emerging economies where industrial food production is rapidly scaling. Technological advancements in drying processes, such as fluid bed drying and vacuum drying, have further improved viability and purity, contributing significantly to market value and operational efficiency across the supply chain.

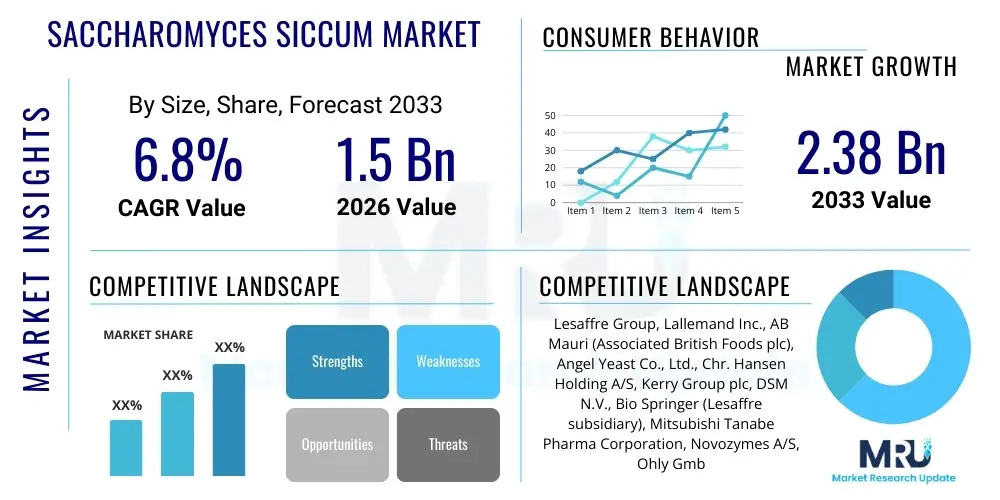

The global market for Saccharomyces Siccum is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $1.5 Billion in 2026 and is projected to reach $2.38 Billion by the end of the forecast period in 2033. This substantial increase reflects not only traditional usage but also the increasing penetration into non-traditional sectors like sustainable biofuel production and specialized therapeutic formulations. The volatility in raw material costs, primarily molasses, presents minor headwinds; however, ongoing innovations in strain optimization and fermentation efficiency are expected to mitigate these external economic pressures, maintaining a steady, positive trajectory for market valuation. Strategic investments by key players in expanding production capacity in high-demand regions, particularly Asia Pacific, are crucial determinants of the forecasted market size increase.

Saccharomyces Siccum Market introduction

The Saccharomyces Siccum market encompasses the industrial production, distribution, and utilization of dried yeast biomass derived primarily from Saccharomyces cerevisiae strains. This product, commonly known as dry yeast, is characterized by its low moisture content, extended shelf life, and high concentration of viable cells, making it essential for various fermentation processes. Key applications span core industries, including baking (leavening agent), brewing (alcohol production), and nutraceuticals (probiotics and nutritional supplements), leveraging its enzymatic activity and rich nutritional profile. Major benefits include ease of storage, cost-effectiveness in transport, and consistent performance compared to fresh yeast. The market growth is fundamentally driven by the escalating demand for bakery products globally, the expansion of the craft brewing industry, and the increasing consumer focus on digestive health, thereby boosting the usage of yeast-based probiotics and functional foods. Furthermore, its role in sustainable biochemical production and animal feed supplementation diversifies its market portfolio and ensures sustained relevance in the bio-economy.

Product Description: Saccharomyces Siccum refers to yeast cells that have undergone controlled drying processes, such as air or vacuum drying, reducing the moisture content typically to below 8%. This stabilization process allows the yeast to remain dormant but highly viable upon rehydration, offering significant logistical advantages. The primary types include active dry yeast (requiring rehydration before use, commonly for baking) and instant dry yeast (can be mixed directly with dry ingredients, highly popular in industrial settings). Major Applications: Baking, which utilizes yeast for leavening dough through CO2 production; Brewing, where it converts sugars into ethanol and CO2; Animal Nutrition, serving as a rich source of protein and B vitamins; and Pharmaceuticals/Nutraceuticals, where specific strains are employed as probiotics to support gut health. Benefits: Enhanced stability, reduced refrigeration requirements, ease of dosing, high cell concentration, and improved logistical footprint compared to traditional compressed yeast forms. Driving factors include globalization of the food supply chain, technological advancements improving yeast viability, and robust consumer health trends favoring fermentation-derived ingredients, all contributing to accelerated market adoption worldwide.

The market is further segmented by types, including Active Dry Yeast (ADY) and Instant Dry Yeast (IDY), which cater to specific industrial scale requirements. ADY requires careful temperature control during rehydration but is robust, making it suitable for high-stress fermentation environments. Conversely, IDY offers unparalleled convenience and speed, dominating modern high-throughput baking facilities. The inherent stability of Saccharomyces Siccum has also made it indispensable in remote and developing markets where cold chain logistics are challenging or non-existent, broadening its global accessibility. The ongoing trend toward clean label ingredients is also favorable, as yeast is widely recognized as a natural and accepted component in food processing. Furthermore, advancements in genetic engineering are enabling the creation of specialized yeast strains optimized for specific tasks, such as high-alcohol tolerance in brewing or enhanced nutritional content for dietary supplements, promising future diversification of the product portfolio and strengthening its market position against alternative fermentation agents.

Saccharomyces Siccum Market Executive Summary

The Saccharomyces Siccum market is poised for significant expansion, driven primarily by favorable macro-economic factors such as population growth, urbanization, and a corresponding increase in demand for standardized, convenient food products globally. Business Trends indicate a strong pivot towards specialized strains and premium products, including non-GMO and organic certified yeasts, appealing to discerning consumer bases and specialty processors. Large industry players are strategically focusing on vertical integration, managing raw material sourcing (molasses/sugar) and investing heavily in research and development to optimize fermentation yields and product characteristics, ensuring competitive advantages in purity and performance. Mergers and acquisitions are also prominent, consolidating market share and enabling technology transfer, particularly in the probiotic and pharmaceutical yeast sectors, thus shaping a dynamic, oligopolistic landscape with continuous pressure for innovation.

Regional Trends show that the Asia Pacific (APAC) region is emerging as the fastest-growing market, fuelled by massive expansion in its food processing sector, rising middle-class disposable income, and increasing Westernization of dietary habits, boosting demand for baked goods and packaged foods. North America and Europe, while mature, maintain strong market shares driven by sophisticated consumer demands for high-quality craft beer, functional foods, and advanced animal nutrition supplements. Regulatory environments, particularly those concerning food safety and labeling transparency in the EU and US, heavily influence product development and certification requirements, encouraging producers to adhere to stringent quality benchmarks. Latin America and the Middle East & Africa (MEA) represent high-potential growth pockets, benefiting from infrastructure improvements and increasing self-sufficiency in food production, providing ample opportunity for export and localized manufacturing investments.

Segment Trends highlight that the food and beverage application segment remains the largest revenue contributor, specifically driven by baking and brewing. However, the fastest growth is observed in the nutraceutical and animal feed segments. In nutraceuticals, specific strains of Saccharomyces Siccum are marketed as highly effective probiotics, benefiting from growing awareness about the gut-microbiome axis. Within animal feed, yeast products are utilized as prebiotics and functional additives to improve livestock health and feed conversion ratios, reducing reliance on antibiotics. Furthermore, there is a burgeoning segment dedicated to industrial biotechnology, particularly in producing bioethanol and other biochemicals, leveraging the efficiency of optimized yeast strains. The distribution segment is witnessing a shift towards specialized B2B direct sales and robust e-commerce platforms, ensuring faster delivery and better technical support for industrial clients, moving away from traditional fragmented distribution networks.

AI Impact Analysis on Saccharomyces Siccum Market

Common user questions regarding AI’s impact on the Saccharomyces Siccum market center on how AI can optimize fermentation parameters, enhance strain selection and modification, and streamline complex supply chain logistics. Users are keen to understand if AI-driven predictive modeling can mitigate risks associated with raw material price volatility (e.g., molasses) and improve the consistency of the final dried product. The primary expectation is that AI will introduce unprecedented efficiency in R&D, moving from trial-and-error strain development to computational modeling for optimizing industrial characteristics such as stress tolerance, yield, and flavor profile specificity. Concerns often revolve around the high initial investment required for sophisticated AI integration and the necessity of highly specialized bio-informatics personnel to manage and interpret the generated data, posing a potential barrier to entry for smaller manufacturers.

The integration of Artificial Intelligence and Machine Learning (AI/ML) is transforming the upstream processes of the Saccharomyces Siccum industry, particularly in strain optimization and fermentation management. AI algorithms are being employed to analyze vast genomic and proteomic datasets of yeast strains, rapidly identifying optimal candidates for specific applications, such as high-temperature tolerance for tropical brewing or enhanced ergosterol production for nutritional supplements. This accelerates the R&D cycle significantly, reducing the time and cost associated with conventional microbial screening. Furthermore, predictive maintenance models utilizing machine learning analyze sensor data from bioreactors—monitoring variables like pH, temperature, dissolved oxygen, and metabolite concentration—to anticipate process deviations and adjust parameters in real-time, thereby maximizing batch consistency and minimizing contamination risks.

Downstream, AI is crucial for enhancing supply chain resilience and market forecasting. Predictive analytics help manufacturers forecast demand fluctuations based on seasonal trends, regional economic indicators, and consumer behavior shifts, allowing for precise production scheduling and inventory management, thereby minimizing waste and optimizing warehousing costs for the shelf-stable product. In quality control, machine vision systems powered by AI are being deployed to inspect the dried yeast granules for size, uniformity, and moisture content with far greater precision and speed than manual or traditional automated systems. This commitment to leveraging sophisticated data science methodologies ensures higher quality standards, crucial for maintaining regulatory compliance and customer trust in high-stakes applications such as pharmaceutical-grade probiotics or sensitive baking ingredients.

- AI-driven optimization of fermentation parameters (pH, temperature, dissolved oxygen) for yield maximization.

- Machine Learning algorithms accelerate novel yeast strain discovery and genetic engineering for specific industrial traits.

- Predictive modeling enhances supply chain visibility, optimizing inventory and mitigating raw material cost volatility.

- AI-powered sensor data analysis enables real-time, automated quality control and process adjustment in bioreactors.

- Advanced analytics support precise demand forecasting, aiding strategic capacity planning for manufacturers.

- AI facilitates the development of digital twins for entire production facilities, enabling risk-free process simulations and optimization.

DRO & Impact Forces Of Saccharomyces Siccum Market

The market dynamics for Saccharomyces Siccum are defined by a strong set of Drivers, moderated by specific Restraints, and continuously shaped by emerging Opportunities, collectively generating significant Impact Forces. Key Drivers include the exponential growth in the global packaged food and ready-to-eat bakery sectors, especially in developing nations, coupled with the increasing consumer adoption of functional foods and dietary supplements containing yeast derivatives like beta-glucans and probiotics. The stability, consistency, and long shelf life of dry yeast make it the preferred choice over fresh or liquid forms for global trade and large-scale industrial operations. However, Restraints encompass the volatile pricing and supply chain unpredictability of key feedstocks, primarily molasses (a sugar cane byproduct), which can compress profit margins. Additionally, stringent regulatory hurdles associated with novel or genetically modified yeast strains in certain high-value markets present technical and financial obstacles to rapid innovation and market entry.

Opportunities are predominantly found in the diversification of applications beyond traditional food processing. Significant potential exists in advanced biotechnology, notably the use of specialized Saccharomyces strains for producing sustainable biofuels (bioethanol), high-value proteins, and complex biochemicals. Furthermore, the rising awareness of animal gut health drives the demand for yeast-based feed additives that enhance nutrient absorption and immune response in livestock, offering a lucrative, specialized market niche. Technological advances in microbial encapsulation and coating techniques offer opportunities to further enhance the viability and targeted delivery of probiotic dry yeast, expanding its efficacy and appeal in the nutraceutical sector. Strategic regional expansion into underserved markets in Africa and Latin America, paired with localized production facilities, also presents substantial growth avenues for global manufacturers.

The Impact Forces, therefore, exert a powerful influence across the value chain. The primary positive force is the pervasive shift toward fermentation as a natural and sustainable production method across multiple industries, securing the central role of Saccharomyces Siccum. Countering this is the competitive pressure from emerging alternative leavening or fermentation agents and the necessity for continuous capital investment to comply with evolving food safety standards and traceability requirements. The consolidated structure of the global market, dominated by a few large producers, means that strategic actions (e.g., pricing, technology adoption, or capacity expansion) by these leaders significantly impact the competitive landscape, dictating raw material procurement strategies and market entry barriers for smaller innovative firms. Overall, the market remains fundamentally strong, with demand outpacing minor supply chain fluctuations, projecting a stable and expansive future.

Segmentation Analysis

The Saccharomyces Siccum market is primarily segmented based on the Type of yeast, its end-use Application, and the Distribution Channel employed for sales. Segmentation by Type distinguishes between Active Dry Yeast (ADY), Instant Dry Yeast (IDY), and Inactive Dry Yeast, each serving specialized functions. Active dry yeast, requiring pre-hydration, is foundational for traditional baking, while instant dry yeast, known for its high convenience and rapid action, dominates high-volume industrial baking processes. Inactive dry yeast, which lacks leavening power but is rich in protein and B vitamins, is crucial in food flavoring, animal feed, and specific nutritional supplement formulations. This differentiation in functional properties allows manufacturers to target various customer needs effectively.

The segmentation by Application reveals the breadth of the market, with Food & Beverages (dominated by Baking and Brewing) being the largest segment. This segment benefits from urbanization and the increasing global consumption of packaged and convenience foods. However, the fastest growth is anticipated in the Feed segment, driven by global efforts to improve livestock health and reduce antibiotic usage, positioning yeast derivatives as essential functional ingredients. The Nutraceuticals and Pharmaceuticals segment, focusing on specialized probiotic strains, commands premium pricing and is expanding rapidly due to rising health consciousness regarding digestive wellness. The industrial segment, encompassing bioethanol production and biochemical manufacturing, represents a long-term strategic growth area, capitalizing on global sustainability initiatives.

Finally, segmentation by Distribution Channel highlights the mechanisms through which the product reaches its end-users. Direct Sales are predominant for large industrial clients (e.g., major breweries, large-scale bakeries, and feed manufacturers), involving customized product specifications and bulk contracts. Indirect Sales channels, involving distributors, wholesalers, and specialized retailers, cater to smaller commercial operations, artisanal producers, and the retail consumer market. The increasing digitalization of the B2B supply chain is driving growth through specialized e-commerce portals, allowing for better inventory management and faster delivery across fragmented geographical markets, enhancing overall market efficiency and penetration, especially for niche and high-value specialized strains.

- By Type:

- Active Dry Yeast (ADY)

- Instant Dry Yeast (IDY)

- Inactive Dry Yeast

- By Application:

- Food & Beverages (Baking, Brewing, Wine/Spirits)

- Animal Feed & Nutrition (Livestock, Poultry, Aquaculture)

- Nutraceuticals & Pharmaceuticals (Probiotics, Dietary Supplements)

- Industrial (Bioethanol, Biochemical Production)

- By Distribution Channel:

- Direct Sales (B2B Industrial Contracts)

- Indirect Sales (Distributors, Wholesalers, Retailers)

Value Chain Analysis For Saccharomyces Siccum Market

The value chain for the Saccharomyces Siccum market begins with upstream activities focused on securing high-quality, consistent raw materials, primarily fermentable sugar sources such as molasses (from sugarcane or sugar beet) and corn steep liquor, alongside essential inorganic nutrients. Upstream analysis highlights that the cost and availability of molasses are critical determinants of profitability, making strategic sourcing and long-term contracts essential risk mitigation strategies. This phase also includes the intensive R&D dedicated to the selection, propagation, and optimization of proprietary yeast strains, which determines the final product's performance characteristics (e.g., leavening power, stress tolerance, nutritional profile). Investment in sterile and highly efficient fermentation and propagation facilities is substantial at this stage, setting the technological base for the entire value chain.

Midstream activities involve the core manufacturing processes: large-scale fermentation, separation, washing, and critically, the drying process (e.g., spray drying or fluid bed drying) which transforms wet yeast into the stable Saccharomyces Siccum form. Strict quality control and assurance protocols are implemented during drying and packaging to ensure cell viability, moisture content, and particle size uniformity, which are paramount for industrial application performance. Packaging, often involving vacuum sealing or nitrogen flushing, is crucial for preserving stability and extending shelf life, directly impacting distribution logistics. Downstream activities involve reaching the diverse end-users through specialized Distribution Channels, which can be Direct or Indirect, tailored to the customer's size and geographic location.

Direct Distribution Channels are favored for large-volume industrial clients (major food manufacturers, large breweries), ensuring streamlined logistics, technical support, and customized bulk orders. This approach minimizes intermediation costs and allows for greater control over service quality. Indirect Distribution Channels rely on regional distributors and specialized wholesalers to penetrate fragmented markets, serving smaller bakeries, artisanal brewers, feed mills, and retail consumers. The proliferation of e-commerce platforms is transforming this indirect route, offering specialized logistics for sensitive ingredients. Ultimately, the effectiveness of the value chain is measured by its ability to deliver high-viability, consistent, and specialized yeast products efficiently and reliably to end-users across geographically dispersed applications, emphasizing logistical expertise and robust technical service as key differentiating factors.

Saccharomyces Siccum Market Potential Customers

Potential customers for Saccharomyces Siccum are highly diversified, reflecting its wide range of applications across several core industries. The largest category of buyers comprises industrial and commercial bakeries, ranging from high-throughput mass production facilities to artisanal specialty bakeries, all relying on dry yeast for consistent leavening, texture, and flavor development in bread, rolls, and pastry items. Following closely are the brewing and alcoholic beverage industries, including major beer manufacturers, craft breweries, and distillers, who require specific yeast strains optimized for ethanol yield, flavor profile, and fermentation speed. The preference here is driven by the consistency and ease of rehydration offered by dry yeast compared to traditionally used liquid cultures, especially in regions with logistical complexities.

A rapidly expanding customer base resides in the animal nutrition and feed manufacturing sector. Feed mills and large integrated livestock operations purchase large volumes of inactive dry yeast and specific live yeast strains (probiotics) to enhance the gut health, immune response, and overall productivity of poultry, swine, and cattle. These ingredients are viewed as valuable alternatives or complements to traditional antibiotics and growth promoters. Furthermore, nutraceutical and functional food companies represent a premium segment of buyers, utilizing pharmaceutical-grade Saccharomyces boulardii and other high-purity strains for encapsulation into probiotic supplements and incorporation into functional dairy and health drink products, catering to the health-conscious consumer market and demonstrating high growth potential.

Finally, the industrial biotechnology sector represents specialized, large-volume consumers, particularly manufacturers of bioethanol used as fuel or fuel additive, as well as companies involved in the production of bio-based chemicals and advanced fermentation-derived ingredients. These customers prioritize yeast strains that exhibit high tolerance to inhibitory substances, high fermentation efficiency, and robustness under extreme industrial conditions. The end-users or buyers are typically procurement managers or R&D directors within these industrial entities, prioritizing consistent quality, certification (e.g., Kosher, Halal, Non-GMO), competitive pricing, and reliable long-term supply agreements. The complexity of the product means technical expertise and specialized support are often as crucial as the product quality itself when securing large, long-term contracts with these potential customers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.5 Billion |

| Market Forecast in 2033 | $2.38 Billion |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Lesaffre Group, Lallemand Inc., AB Mauri (Associated British Foods plc), Angel Yeast Co., Ltd., Chr. Hansen Holding A/S, Kerry Group plc, DSM N.V., Bio Springer (Lesaffre subsidiary), Mitsubishi Tanabe Pharma Corporation, Novozymes A/S, Ohly GmbH (Associated British Foods plc), Leiber GmbH, Algist Bruggeman, Alltech Inc., Oriental Yeast Co., Ltd., Pakmaya, Kothari Fermentation & Biochem Ltd., VEDAN International (Holdings) Limited, Renaissance BioScience Corp., UNITEK BIO. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Saccharomyces Siccum Market Key Technology Landscape

The technological landscape of the Saccharomyces Siccum market is characterized by continuous advancements aimed at improving cell viability, reducing production costs, and tailoring strains for specific functional outcomes. A core technological focus involves optimizing the drying process. Techniques such as high-efficiency fluid bed drying, vacuum drying, and spray drying are continually refined to minimize heat stress on the yeast cells, ensuring maximum viability upon rehydration. Innovations in encapsulation technologies, particularly microencapsulation using protective matrices (e.g., hydrocolloids or specialized fats), are crucial for probiotic strains, shielding them from harsh processing environments and the acidic conditions of the stomach, thereby guaranteeing targeted delivery and efficacy, which is a key differentiator in the high-value nutraceutical segment. Furthermore, advanced monitoring systems utilizing Spectroscopic sensors and real-time gas analysis are employed during fermentation to maintain optimal growth conditions, ensuring batch consistency and purity.

Another significant technological area is Strain Engineering and Genomics. The industry increasingly utilizes modern biotechnological tools, including CRISPR-Cas9 genome editing, to precisely modify Saccharomyces strains. This allows researchers to enhance characteristics vital for industrial success, such as increased tolerance to high ethanol concentrations (for biofuel or high-gravity brewing), improved resistance to osmotic stress, or enhanced production of specific metabolites like vitamins or proteins. Computational biology and high-throughput screening methods, often augmented by AI, allow for the rapid identification and selection of superior natural or engineered strains, significantly shortening the development cycle for commercial launch. This technological sophistication is essential for maintaining competitiveness and addressing specific customer requirements in specialized applications like low-calorie brewing or high-yield protein production.

The manufacturing process itself is continuously being upgraded through Industrial Automation and digitalization, which form the backbone of modern large-scale dry yeast production. Fully automated bioreactors and mixing systems minimize human error and contamination risk while maximizing throughput. Integration with IoT sensors and centralized data management systems enables end-to-end traceability, essential for meeting stringent global food safety and pharmaceutical regulations. The focus on energy efficiency in the high-energy-consuming drying phase is also a major technological driver, pushing manufacturers toward energy recovery systems and optimized heat exchangers to reduce operational expenditure and environmental impact. Overall, the technology landscape is shifting towards personalized, highly functional, and sustainably produced yeast derivatives, moving beyond basic leavening agents toward highly specialized bio-manufacturing tools, ensuring Saccharomyces Siccum remains central to the bio-economy.

Regional Highlights

The global Saccharomyces Siccum market exhibits varied growth patterns influenced by regional economic development, consumer preferences, and regulatory frameworks. North America and Europe currently represent the largest and most mature markets, respectively. North America is characterized by robust demand from the craft brewing industry and a highly advanced nutraceutical sector, which drives demand for premium, specialized probiotic strains and functional yeast ingredients. Regulatory clarity regarding yeast-based supplements supports continuous innovation and market penetration. Europe, meanwhile, benefits from a long tradition of high-quality baking and brewing, coupled with rigorous food safety standards that favor certified, high-purity dry yeast products. The European market is also a leader in sustainable fermentation practices and the adoption of yeast in advanced animal feed formulations, maintaining steady, albeit slower, growth compared to APAC.

Asia Pacific (APAC) stands out as the highest-growth region globally. This explosive expansion is fueled by several factors: rapid urbanization, burgeoning middle-class populations adopting Western dietary habits (driving demand for packaged baked goods), and massive expansion in industrial food processing and feed production across countries like China, India, and Southeast Asian nations. The sheer scale of population and industrialization in APAC necessitates bulk quantities of stable, easily transportable dry yeast, making it a pivotal region for manufacturers seeking high-volume sales and capacity expansion. Local players are rapidly scaling up production capabilities, often leveraging international partnerships for technology transfer, intensely competing on both price and localized product specifications.

Latin America and the Middle East & Africa (MEA) are emerging markets offering substantial future potential. Latin America's market is primarily driven by large-scale commercial baking and increasing investment in bioethanol production, utilizing yeast for fermentation processes. Economic stabilization and rising consumer spending in several countries enhance the accessibility of packaged foods. The MEA region is witnessing growing demand due to population growth and increasing self-sufficiency in food production, particularly in agriculture and associated animal husbandry. Challenges in cold chain logistics in MEA make the shelf-stable nature of Saccharomyces Siccum highly advantageous, positioning dry yeast as the dominant format for both food and feed applications in this geographically complex region, paving the way for targeted market entry strategies focused on infrastructure development.

- North America: High demand in craft brewing and advanced probiotic nutraceuticals; focus on specialized, premium strains and regulatory compliance.

- Europe: Mature market driven by traditional baking, stringent food safety standards, and leadership in sustainable feed applications.

- Asia Pacific (APAC): Fastest-growing market due to rapid urbanization, massive industrial food production expansion, and increasing middle-class consumption.

- Latin America: Growth spurred by commercial baking and significant investments in bioethanol production utilizing yeast fermentation technology.

- Middle East & Africa (MEA): Potential market growth supported by population expansion, agricultural development, and preference for shelf-stable ingredients due to logistical challenges.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Saccharomyces Siccum Market, characterized by their global presence, extensive R&D investments, and broad product portfolios across baking, brewing, and health applications. These companies leverage specialized strain libraries and advanced drying technologies to maintain market dominance.- Lesaffre Group

- Lallemand Inc.

- AB Mauri (Associated British Foods plc)

- Angel Yeast Co., Ltd.

- Chr. Hansen Holding A/S

- Kerry Group plc

- DSM N.V.

- Bio Springer (Lesaffre subsidiary)

- Mitsubishi Tanabe Pharma Corporation

- Novozymes A/S

- Ohly GmbH (Associated British Foods plc)

- Leiber GmbH

- Algist Bruggeman

- Alltech Inc.

- Oriental Yeast Co., Ltd.

- Pakmaya

- Kothari Fermentation & Biochem Ltd.

- VEDAN International (Holdings) Limited

- Renaissance BioScience Corp.

- UNITEK BIO

Frequently Asked Questions

Analyze common user questions about the Saccharomyces Siccum market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Saccharomyces Siccum market?

Market growth is primarily driven by the increasing global demand for processed and packaged foods, particularly industrial bakery products, coupled with significant expansion in the nutraceutical sector due to rising consumer interest in yeast-based probiotics and functional ingredients for gut health. The inherent shelf-stability of dry yeast also facilitates global distribution, boosting demand.

How does Instant Dry Yeast (IDY) differ from Active Dry Yeast (ADY) in commercial applications?

IDY is finely granulated and contains emulsifiers, allowing it to be mixed directly with dry ingredients, providing convenience and speed suitable for high-volume industrial baking. ADY, conversely, requires rehydration in warm liquid before use to maintain viability but is generally more robust, making it preferable for specific traditional or high-stress fermentation methods.

What role do specialized Saccharomyces Siccum strains play in the animal feed industry?

In animal feed, specialized strains of dry yeast are used as functional additives, often referred to as live yeast or prebiotics. They significantly improve gut flora balance, enhance nutrient absorption, and bolster the immune systems of livestock, consequently improving feed conversion efficiency and reducing the reliance on prophylactic antibiotics in animal husbandry.

Which geographical region is expected to demonstrate the fastest growth rate for dry yeast?

The Asia Pacific (APAC) region is forecasted to exhibit the fastest Compound Annual Growth Rate (CAGR). This acceleration is attributed to rapid industrialization in food processing, substantial population growth, increasing urbanization, and expanding middle-class disposable income leading to higher consumption of convenience food products requiring large-scale yeast utilization.

What technological advancements are influencing the quality and cost-effectiveness of Saccharomyces Siccum production?

Key technological advancements include the optimization of drying techniques (fluid bed, vacuum drying) to maximize cell viability, the utilization of sophisticated AI/ML for real-time fermentation parameter control, and the application of genomic editing tools (CRISPR) to create highly efficient, specialized yeast strains tailored for specific industrial performance requirements or high-value biochemical production.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager