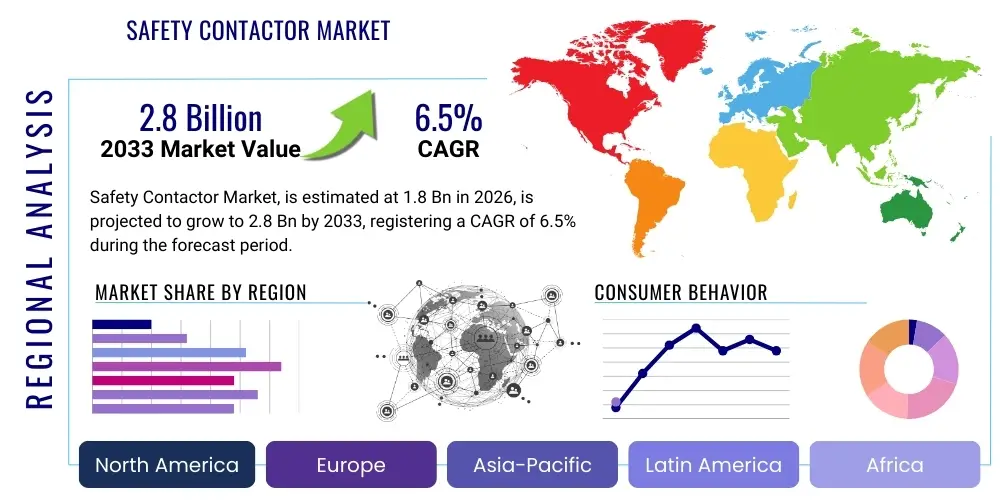

Safety Contactor Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443464 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Safety Contactor Market Size

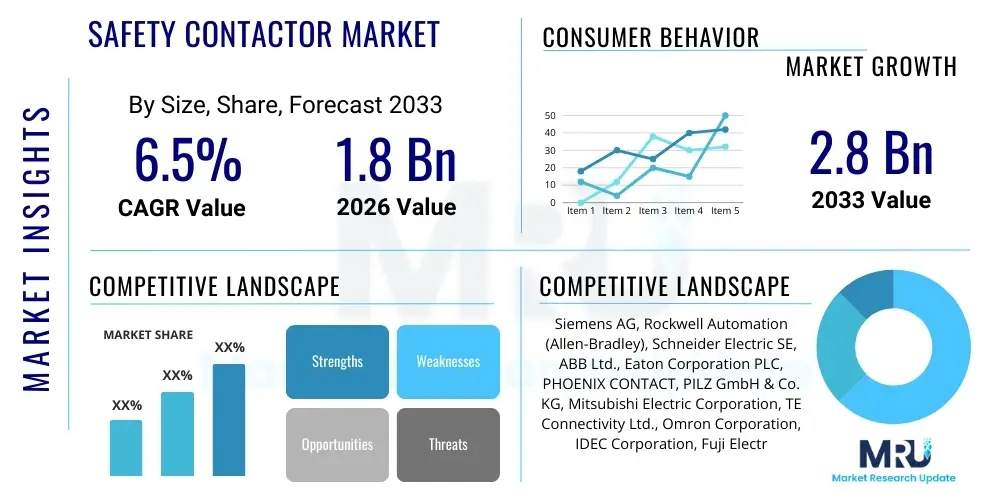

The Safety Contactor Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 1.8 Billion in 2026 and is projected to reach USD 2.8 Billion by the end of the forecast period in 2033.

Safety Contactor Market introduction

The Safety Contactor Market encompasses specialized electromechanical switching devices essential for implementing functional safety within industrial automation and machinery. These contactors are fundamentally different from standard industrial contactors due to their forced-guided or mirror contact design, mandated by international safety standards such as ISO 13849 and IEC 62061. This design prevents the simultaneous closure of normally open (NO) and normally closed (NC) contacts, a critical feature for applications where machinery must reliably stop or isolate power immediately upon detection of a fault or activation of an emergency stop. The primary function is to achieve high safety integrity levels (SIL) or performance levels (PL) in critical control circuits.

Product descriptions typically emphasize features such as tamper-proof mechanisms, auxiliary contact reliability, and compliance with stringent safety categories (e.g., Category 4, PL e). Major applications span diverse industrial sectors, including discrete manufacturing (automotive, packaging, and electronics assembly), process industries, and specialized machinery manufacturing. The integration of safety contactors is non-negotiable in environments utilizing light curtains, safety mats, emergency stop pushbuttons, and two-hand control devices, serving as the final power switching element to ensure machinery cessation, thereby protecting operational personnel from severe injury.

The core benefits driving market adoption include enhanced operational safety, strict regulatory adherence, minimization of catastrophic equipment failures, and reduced downtime associated with safety incidents. Key driving factors involve the accelerating pace of industrial automation, particularly the proliferation of complex robotic systems and high-speed machinery requiring sophisticated safety infrastructure. Furthermore, increasing global regulatory pressure from bodies like OSHA in North America and various European agencies compels manufacturers to upgrade older equipment and incorporate certified safety components, significantly boosting the demand for high-reliability safety contactors across mature and emerging industrial economies.

Safety Contactor Market Executive Summary

The global Safety Contactor Market is poised for significant expansion, largely driven by mandatory safety regulations and the sustained global increase in automated manufacturing processes, particularly within highly regulated sectors such as automotive manufacturing and complex material handling systems. Business trends indicate a strong focus on developing compact, modular safety contactors that offer superior diagnostics capabilities, enabling predictive maintenance and easier integration into modern networked safety control systems utilizing protocols like PROFINET or EtherCAT Safety. Competitive strategies emphasize robust supply chain management, rapid compliance adaptation to evolving standards (e.g., harmonization efforts between regional safety codes), and expansion into emerging markets where industrial safety infrastructure is rapidly maturing. Leading vendors are also investing in hybrid solutions that blend traditional electromechanical switching with solid-state components for ultra-fast response times and enhanced longevity in demanding applications.

Regional trends reveal that Europe, specifically Germany and Italy, remains a dominant market due to its early adoption of stringent machine safety directives (Machinery Directive 2006/42/EC) and a mature automation sector. However, the Asia Pacific (APAC) region is projected to exhibit the highest CAGR, fueled by massive government investments in smart manufacturing initiatives (e.g., China’s Made in China 2025, India’s Make in India) and the subsequent rapid establishment of advanced manufacturing facilities, particularly in automotive and electronics production hubs. North America maintains a stable growth trajectory, underpinned by strict OSHA enforcement and substantial capital expenditure in modernizing aging industrial infrastructure, particularly in heavy industry and logistics automation.

Segment trends underscore the rising preference for high-current rating safety contactors, driven by the increasing size and power requirements of modern industrial machinery and large motor control centers. In terms of technology, contactors integrated with monitoring functionalities and self-testing features are gaining traction, aligning with the industry shift toward Safety Instrumented Systems (SIS). The market is seeing a steady shift from general-purpose contactors utilized non-optimally in safety circuits to certified, specialized safety contactors designed exclusively for functional safety applications, reflecting an increased awareness and adherence to specific performance level requirements among end-users and Original Equipment Manufacturers (OEMs).

AI Impact Analysis on Safety Contactor Market

User queries regarding AI's influence on the Safety Contactor Market primarily revolve around whether predictive maintenance powered by machine learning algorithms will render traditional electromechanical switching obsolete, and how AI-driven safety monitoring systems might integrate with or bypass physical contactor reliability checks. Users are keen to understand if AI can predict contactor failure with high certainty, thereby extending operational lifespan or enabling just-in-time replacement, moving beyond standard cyclic maintenance schedules. Key themes emerging include concerns over data security in networked safety components, expectations for AI enhancing fault diagnostics beyond basic status reporting, and the necessity of maintaining robust, certified hardware—like safety contactors—as the fail-safe physical layer, irrespective of software intelligence. The consensus expectation is that AI will enhance the management and predictive reliability of safety infrastructure, rather than replacing the fundamental mechanical isolation function provided by safety contactors.

- AI enables highly accurate predictive maintenance models for monitoring safety contactor wear and tear, optimizing replacement cycles.

- Integration of machine learning in safety controllers enhances diagnostic capabilities, rapidly identifying subtle anomalies in contactor switching timing or resistance.

- AI-driven optimization of machine startup and shutdown sequences, reducing stress and extending the operational life of electromechanical components.

- Enhanced security protocols utilizing AI anomaly detection to protect networked safety components, including smart contactors, from cyber threats affecting operation integrity.

- Development of smart safety contactors that transmit detailed operational telemetry, facilitating real-time health monitoring and performance assessment through AI platforms.

- Facilitation of digital twinning of entire safety systems, allowing AI simulation of failure modes and verifying the effectiveness of contactor-based isolation procedures.

DRO & Impact Forces Of Safety Contactor Market

The Safety Contactor Market is fundamentally shaped by stringent regulatory mandates, technological advancements in machinery automation, and global industrialization trends, which together form a powerful set of impact forces. The primary drivers include the universally recognized need to comply with international safety standards (such as ISO 13849, IEC 61508) and the increasing complexity of industrial machinery requiring high-integrity safety functions. These regulatory pressures minimize the use of non-certified components, creating a dedicated market for certified safety contactors. The continued investment in factory automation, particularly the widespread adoption of collaborative robots and high-speed packaging lines, further necessitates reliable safety isolation components. These driving forces ensure sustained demand, often independent of short-term economic fluctuations, as safety compliance is non-negotiable.

Restraints, however, temper this growth. A significant barrier remains the high initial cost associated with specialized safety components compared to standard industrial contactors, leading some smaller OEMs or manufacturers in less-regulated regions to opt for cost-effective, though less compliant, alternatives. Complexity in system integration also poses a restraint; designing and wiring high-performance safety circuits requires specialized engineering expertise, often necessitating extensive training or reliance on external consultants. Furthermore, the lengthy certification and compliance testing process for new safety contactor models can slow down product innovation and market penetration, requiring substantial time and investment from manufacturers before commercial viability is achieved. Another restraint involves the potential confusion regarding component obsolescence as users transition from traditional hard-wired safety circuits to modern, bus-based safety systems.

Opportunities in the market primarily stem from the rapid digitalization of factories, leading to the development of smart safety contactors that integrate seamlessly into Industrial IoT (IIoT) platforms, offering enhanced diagnostic data and remote monitoring capabilities. The strong push towards functional safety in emerging markets, especially Southeast Asia and Latin America, presents untapped geographical opportunities for major vendors. Furthermore, the increasing demand for high-reliability safety components in renewable energy infrastructure (e.g., wind turbine pitch control systems) and critical infrastructure applications offers lucrative diversification avenues. The impact forces overwhelmingly favor growth, as regulatory mandates act as a constant baseline driver, pushing technological innovation toward higher safety integrity levels and more integrated solutions.

Segmentation Analysis

The Safety Contactor Market is rigorously segmented based on product design characteristics, current ratings, application methods, and end-user industries, reflecting the diverse requirements of modern industrial environments. Segmentation provides clarity on specific growth areas, with critical distinctions made between IEC and NEMA standards, which dictate design philosophy based on regional acceptance. The product type segmentation typically separates dedicated safety contactors from safety relays that utilize contractor functionality, recognizing the specialized internal mechanisms of true safety contactors designed for forced-guided operation. Analyzing these segments helps stakeholders tailor their product development to meet the precise technical specifications demanded by various high-performance safety applications.

Further analysis focuses on the Current Rating segmentation, which is crucial as safety contactors must reliably interrupt power across a wide range, from low-amperage control circuits to high-amperage motor loads. The high-current segment, typically above 100 Amps, is experiencing rapid growth due to the increased use of large, powerful machinery in heavy industries. Conversely, the low-to-medium current segment remains essential for controlling auxiliary safety devices and smaller machinery components. End-user segmentation highlights the dominance of the discrete manufacturing sector (particularly automotive and semiconductor manufacturing) due to high automation density and strict production line safety protocols, making it the most profitable and fastest-growing application area globally.

The market also differentiates based on technology, evaluating traditional hard-wired electromechanical contactors against hybrid or solid-state solutions. While electromechanical models remain the staple due to their proven reliability and isolation capability, hybrid models are gaining ground for specific applications requiring higher switching frequency and minimized mechanical wear. Understanding these segmentation nuances is critical for market players to develop targeted sales strategies, focusing on compliance features for highly regulated industries and on cost-efficiency and integration ease for general machinery manufacturers.

- By Product Type:

- Standard Safety Contactor

- Miniature Safety Contactor

- Vacuum Safety Contactor

- Solid-State Safety Contactor/Hybrid Contactor

- By Current Rating:

- Up to 20 A

- 20 A to 100 A

- Above 100 A

- By Application:

- Emergency Stop Control

- Safety Gates and Interlocks

- Light Curtains and Scanners

- Motor Safety Disconnect

- Two-Hand Control Systems

- By End-User Industry:

- Automotive

- Packaging and Material Handling

- Food and Beverage

- Semiconductor and Electronics

- Pharmaceutical

- Heavy Industry (Metals, Mining, Cement)

Value Chain Analysis For Safety Contactor Market

The value chain for the Safety Contactor Market begins with upstream activities focused on the sourcing and processing of high-quality raw materials, primarily copper, specialty plastics, silver alloys for contacts, and electromagnetic coil materials. Component manufacturing is a specialized process, requiring precision engineering for the forced-guided contact mechanism, which ensures functional safety integrity. Key challenges in the upstream segment include maintaining stability in commodity prices, ensuring the consistency and purity of silver alloys for contact reliability, and adhering to strict environmental and material composition standards (like RoHS and REACH). Suppliers that can provide certified, high-tolerance components are critical partners in maintaining the quality and safety certification of the final product.

Midstream activities involve the design, assembly, testing, and certification of the safety contactors. Manufacturing processes are highly automated, focusing on achieving zero defects in the critical mirror contact function. Certification by recognized bodies (such as UL, CSA, TUV) is a mandatory step that significantly adds value, validating the device's ability to meet required safety integrity levels (SIL) or performance levels (PL). Marketing and sales activities focus heavily on educating system integrators, OEMs, and end-users about the compliance benefits and technical superiority of safety-rated devices over standard industrial contactors. Manufacturers often provide comprehensive technical documentation and software tools to simplify integration into safety control systems.

Downstream activities involve distribution channels, which are typically robust and multifaceted. Direct distribution is common for large-volume sales to major Original Equipment Manufacturers (OEMs) who integrate the contactors into complex machinery (e.g., robotic cells, CNC machines). Indirect distribution relies heavily on specialized industrial automation distributors and electrical wholesalers who possess the necessary expertise to service Maintenance, Repair, and Operations (MRO) markets and smaller system integrators. These partners play a crucial role in inventory management and local technical support. End-users, such as factory operators, benefit from simplified procurement and readily available replacements, ensuring operational continuity and fast restoration of safety functions after maintenance or failure.

Safety Contactor Market Potential Customers

The primary consumers, or potential customers, of safety contactors are sophisticated industrial entities that prioritize personnel safety, operational reliability, and regulatory compliance within their machinery and plant infrastructure. Original Equipment Manufacturers (OEMs) specializing in automated machinery, such as automotive assembly lines, robotic systems, packaging equipment, and textile machinery, constitute a critical customer base. These OEMs integrate safety contactors directly into their equipment during the manufacturing phase, requiring large volumes and consistent supply of certified components that meet the safety specifications of the target export markets (e.g., European CE marking requirements).

The second major group of customers comprises large end-user organizations engaged in the manufacturing and process industries undergoing modernization or expansion. These include multinational corporations in the Food and Beverage sector, Pharmaceutical manufacturing (where strict validation is required), and the Semiconductor industry, all of which operate high-speed, sensitive equipment requiring robust emergency stop mechanisms. These customers often procure safety contactors for MRO activities or for retrofitting existing machinery to comply with updated local or international safety standards, leading to a steady, high-margin aftermarket demand for replacement parts.

Additionally, specialized customers include third-party System Integrators and Engineering Procurement Construction (EPC) firms that design and implement custom automation projects or Safety Instrumented Systems (SIS). These entities purchase contactors based on specific project requirements, focusing on interoperability with safety PLCs and compatibility with required performance levels. Government and defense entities, particularly those operating heavy machinery or specialized test equipment, also represent a niche but high-value customer segment, often demanding the highest levels of reliability and certification for critical applications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.8 Billion |

| Market Forecast in 2033 | USD 2.8 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Siemens AG, Rockwell Automation (Allen-Bradley), Schneider Electric SE, ABB Ltd., Eaton Corporation PLC, PHOENIX CONTACT, PILZ GmbH & Co. KG, Mitsubishi Electric Corporation, TE Connectivity Ltd., Omron Corporation, IDEC Corporation, Fuji Electric Co. Ltd., Wieland Electric GmbH, Schmersal Group, Dold & Söhne KG, Weidmüller Interface GmbH & Co. KG, Sprecher + Schuh, Lovato Electric S.p.A., IMO Precision Controls Ltd., Danfoss A/S |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Safety Contactor Market Key Technology Landscape

The technological landscape of the Safety Contactor Market is marked by a dual focus on maximizing electromechanical reliability and enhancing digital integration. Core technology remains the forced-guided (mirror) contact structure, which is the defining characteristic ensuring safety integrity. Recent innovations focus on improving the material science of the contacts, moving towards silver-tin oxide and advanced alloys to withstand higher switching frequencies and extended operational cycles, particularly in AC-3 and AC-4 utilization categories. Furthermore, advances in magnetic coil design are leading to more energy-efficient contactors that generate less heat, reducing overall panel space requirements and improving longevity. Miniaturization techniques are also prevalent, driven by the limited control panel space in modern compact machinery.

The rapid adoption of Safety Instrumented Systems (SIS) and functional safety controllers has necessitated technological evolution toward hybrid and smart contactors. Hybrid contactors combine the speed and silent operation of solid-state relays for high-frequency switching tasks with the absolute isolation capability of electromechanical contacts for the final safety disconnection. This blending allows systems to achieve faster reaction times without compromising the required isolation in emergency situations. Furthermore, integrated diagnostics, utilizing microprocessors embedded within the contactor unit, are becoming standard. These diagnostics monitor coil voltage, contact weld detection, and arc suppression performance, transmitting critical health data back to the safety PLC.

Connectivity represents the most significant ongoing technological shift. The implementation of communication interfaces, often leveraging standard industrial Ethernet protocols or dedicated safety buses, allows contactors to become integrated components of the IIoT ecosystem. This smart capability supports remote monitoring, facilitates complex diagnostics, and simplifies compliance record-keeping by automatically logging operational performance and fault history. Future technology development is anticipated to focus on self-testing mechanisms that can periodically verify the integrity of the forced-guided contacts during machine downtime, ensuring continuous adherence to performance level requirements without human intervention, thereby drastically reducing maintenance complexity and enhancing system uptime.

Regional Highlights

- North America (NA): The North American market is characterized by robust demand stemming from compliance with OSHA regulations and the sustained growth of the automotive, aerospace, and general machinery sectors. US manufacturers are heavily focused on modernizing older equipment, driven by liability concerns and the need to achieve higher levels of functional safety (up to PL e). Canada and Mexico are also witnessing growth, tied to expanded manufacturing capacity and cross-border regulatory harmonization efforts. The preference is strong for certified components, often prioritizing UL-listed products, and there is a growing trend toward utilizing modular safety solutions that integrate easily with established safety control architectures prevalent in the region. This market segment is mature but demonstrates consistent growth fueled by automation capital expenditure.

- Europe: Europe represents the most mature and dominant market for safety contactors globally, fundamentally shaped by the EU Machinery Directive and the widespread adoption of ISO 13849 standards across the European Economic Area. Countries like Germany, Italy, and Switzerland, housing major machinery manufacturers (OEMs), demonstrate exceptionally high component quality standards and require advanced safety features. Regulatory enforcement is rigorous, ensuring that new machinery and retrofitted systems strictly adhere to required Performance Levels. The trend here is toward compact, high-density contactors that facilitate integration within increasingly sophisticated and spatially constrained industrial cabinets, alongside a strong emphasis on energy efficiency and sustainable manufacturing practices for control devices.

- Asia Pacific (APAC): APAC is the fastest-growing region, propelled by rapid industrialization, large-scale infrastructure investments, and government initiatives promoting smart factory implementation in China, India, Japan, and South Korea. While historically focusing on cost, the region is rapidly shifting toward safety compliance, especially in export-oriented manufacturing sectors (e.g., consumer electronics and automotive). China is a massive end-user market and a growing manufacturing hub for safety components. Japan and South Korea, with their highly advanced robotic and semiconductor industries, demand high-performance, miniature safety contactors with superior reliability characteristics suitable for complex, high-throughput production environments.

- Latin America (LATAM): The LATAM market, while smaller in absolute terms, is exhibiting steady growth. Brazil and Mexico are the largest consumers, driven by automotive production and mining activities, both requiring robust safety systems. Market adoption is often influenced by foreign direct investment and the safety standards imposed by multinational corporations operating facilities in the region. Regulatory frameworks are evolving, leading to a gradual but definite increase in the mandatory adoption of standardized safety components. Price sensitivity remains a factor, but the long-term trend favors certified, quality safety components as industrial safety awareness improves across key industrial sectors.

- Middle East and Africa (MEA): Growth in the MEA region is concentrated in resource extraction, petrochemicals, and large-scale infrastructure projects (e.g., smart city development in the GCC countries). The petrochemical sector, in particular, requires highly reliable safety contactors compliant with standards suitable for harsh and potentially explosive environments (ATEX/IECEx compliance). Market growth is sporadic and project-dependent, but large-scale industrial investments aimed at economic diversification are gradually establishing a solid base for functional safety component demand, often prioritizing certified solutions from established European and North American vendors.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Safety Contactor Market.- Siemens AG

- Rockwell Automation (Allen-Bradley)

- Schneider Electric SE

- ABB Ltd.

- Eaton Corporation PLC

- PHOENIX CONTACT

- PILZ GmbH & Co. KG

- Mitsubishi Electric Corporation

- TE Connectivity Ltd.

- Omron Corporation

- IDEC Corporation

- Fuji Electric Co. Ltd.

- Wieland Electric GmbH

- Schmersal Group

- Dold & Söhne KG

- Weidmüller Interface GmbH & Co. KG

- Sprecher + Schuh

- Lovato Electric S.p.A.

- IMO Precision Controls Ltd.

- Danfoss A/S

Frequently Asked Questions

Analyze common user questions about the Safety Contactor market and generate a concise list of summarized FAQs reflecting key topics and concerns.What distinguishes a safety contactor from a standard industrial contactor?

The primary distinction is the mandatory forced-guided (mirror) contact principle in safety contactors. This structural design ensures that if a normally open (NO) power contact welds closed, the normally closed (NC) auxiliary monitoring contact cannot simultaneously close. This reliable failure behavior is essential for meeting high Safety Integrity Levels (SIL) and Performance Levels (PL) required by global safety standards like ISO 13849.

Which safety standards primarily govern the use and design of safety contactors?

Safety contactors must comply primarily with functional safety standards, including ISO 13849 (Performance Levels, PL) and IEC 62061 (Safety Integrity Levels, SIL). Additionally, compliance with specific product standards, such as IEC 60947-4-1, is necessary, ensuring the electrical performance characteristics align with industrial control equipment requirements while maintaining the integrity of the forced-guided contacts.

How is the current rating segmentation affecting market demand?

Demand is increasingly shifting toward higher current rating safety contactors (above 100 A) due to the rising power consumption of modern industrial motor control centers and large robotic systems. However, the medium-current segment (20A to 100A) remains robust as it serves the vast majority of standard machinery applications, including smaller motor drives and auxiliary safety circuits in automated factories.

What role do hybrid and smart safety contactors play in future automation?

Hybrid contactors utilize solid-state components for fast, frequent switching cycles while relying on mechanical isolation for definitive safety shutdown, offering enhanced longevity and speed. Smart contactors integrate diagnostics and communication capabilities, enabling predictive maintenance, real-time health monitoring, and seamless integration into Industrial IoT (IIoT) safety control networks, optimizing system reliability and reducing unplanned downtime.

Which geographical region is expected to demonstrate the highest market growth?

The Asia Pacific (APAC) region is forecasted to exhibit the highest Compound Annual Growth Rate (CAGR) during the forecast period. This accelerated growth is primarily attributed to rapid governmental investment in smart manufacturing initiatives, the expansion of the automotive and electronics sectors, and the increasing enforcement of advanced industrial safety regulations across major economies like China, India, and Southeast Asia.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager