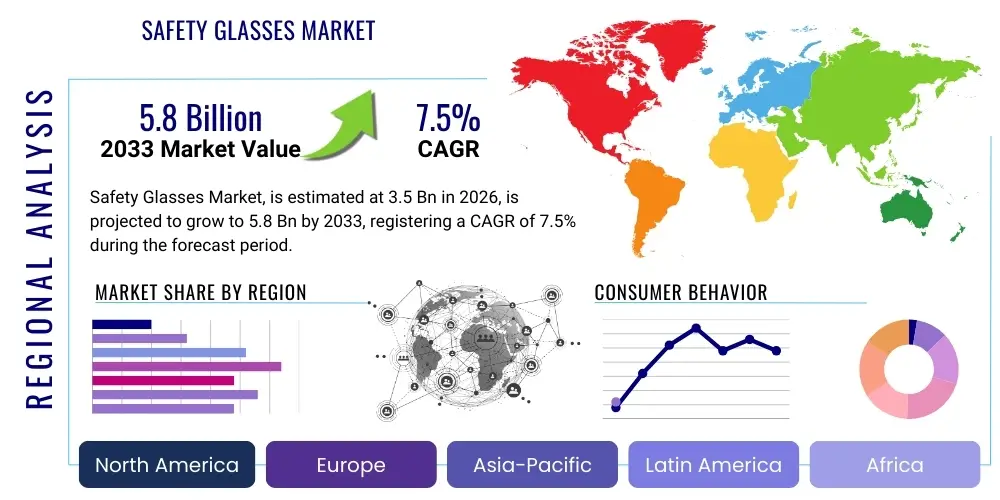

Safety Glasses Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442101 | Date : Feb, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Safety Glasses Market Size

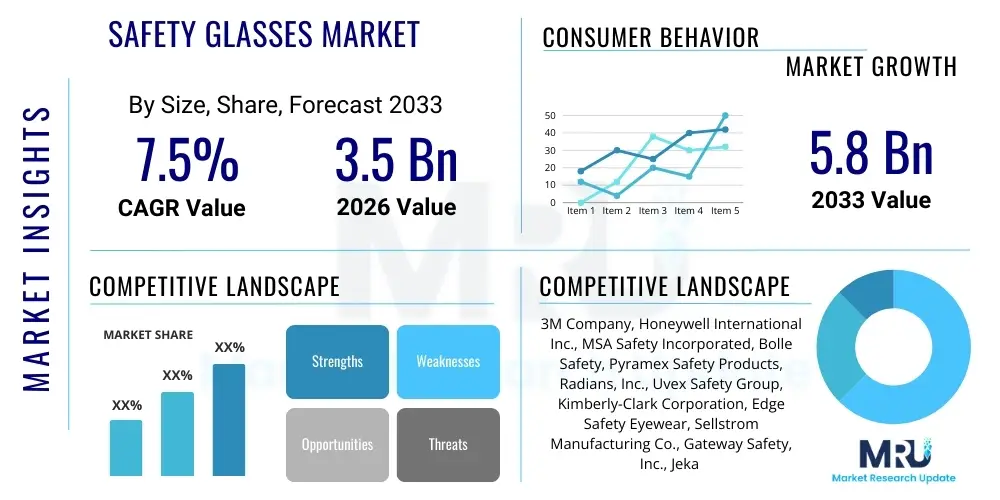

The Safety Glasses Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 5.8 Billion by the end of the forecast period in 2033.

This robust growth trajectory is primarily underpinned by stringent occupational safety regulations enforced globally across developed and developing economies. Governments and regulatory bodies, such as OSHA in the United States and similar agencies in Europe and Asia, are mandating the use of personal protective equipment (PPE), particularly eye protection, in hazardous working environments, including construction, manufacturing, and chemicals. The increasing awareness among employers regarding liability risks associated with workplace injuries further contributes significantly to the steady procurement of high-quality safety glasses, driving market expansion.

Furthermore, technological advancements in material science and design are enhancing the comfort, durability, and aesthetic appeal of safety glasses, encouraging greater compliance among workers. Innovations such as anti-fog coatings, polarized lenses, impact-resistant polycarbonate materials, and ergonomic frame designs are making safety glasses more practical for extended use. The expanding application scope beyond traditional industrial settings—into sectors like healthcare, sports, and DIY home projects—also offers new avenues for market penetration and value growth throughout the forecast period.

Safety Glasses Market introduction

The Safety Glasses Market encompasses the manufacturing, distribution, and sale of specialized eyewear designed to protect the user's eyes from physical, chemical, or biological hazards. These products range from basic spectacle-style protectors to full-coverage goggles, utilizing materials like polycarbonate, Trivex, and specialized plastics engineered for high impact resistance, UV protection, and chemical splash defense. Major applications span industrial manufacturing, construction, mining, oil and gas, healthcare, and laboratory research, all demanding adherence to international safety standards (e.g., ANSI Z87.1, EN 166). The primary benefit of safety glasses is the prevention of severe eye injuries, which translates into reduced medical costs, fewer lost workdays, and improved overall productivity for businesses. Key driving factors include escalating government enforcement of workplace safety laws, rapid industrialization in emerging markets, and continuous innovation in protective materials that offer enhanced clarity and comfort.

The product landscape is highly diversified, catering to specific environmental risks. For instance, welding safety glasses incorporate specialized filtering lenses, while laboratory safety glasses focus on chemical splash protection and sealed designs. Market participants are increasingly focusing on customization and ergonomic factors, recognizing that worker compliance is directly linked to the comfort and fit of the eyewear. This shift towards user-centric design, often incorporating lightweight and adjustable features, is a critical trend influencing purchasing decisions across various end-user industries.

A significant trend reinforcing market growth is the push toward integrated safety solutions. Many industries are now adopting systems where safety glasses are compatible with other PPE, such as helmets and respirators, ensuring comprehensive protection. Furthermore, the rise of specialized industrial environments, particularly in the clean energy and advanced manufacturing sectors, necessitates unique safety glasses equipped with features like specific light filtration or enhanced anti-scratch capabilities, thereby sustaining high demand for premium and specialized segments.

Safety Glasses Market Executive Summary

The Safety Glasses Market demonstrates robust growth driven by mandatory safety protocols and technological evolution, particularly in key sectors such as construction and heavy manufacturing. Business trends highlight a strong emphasis on mergers and acquisitions among major players aiming to consolidate regional market presence and expand specialized product lines, especially those featuring smart technologies like integrated sensors or augmented reality capabilities. Regionally, Asia Pacific is anticipated to be the fastest-growing market due to rapid infrastructure development and subsequent tightening of industrial safety regulations, while North America and Europe maintain leading shares driven by established regulatory frameworks and high safety compliance rates. Segment trends indicate that the permanent side shield segment and polycarbonate material type dominate the market due to their superior impact resistance and cost-effectiveness, though specialized lens coatings (anti-fog, anti-scratch) are experiencing the highest growth in adoption.

The competitive environment is characterized by a balance between global giants offering comprehensive PPE portfolios and niche manufacturers specializing in high-performance or customized eyewear for specific high-risk applications. Pricing strategies vary widely, reflecting product quality, certification standards, and distribution channels. The proliferation of e-commerce platforms has also influenced business strategies, enabling smaller companies to reach global customer bases and driving increased price transparency, requiring established players to focus more intently on value-added features and brand reputation to maintain market share.

Future market momentum will largely depend on the successful integration of digital technologies and sustainable material development. The adoption of biodegradable or recyclable materials in frame construction aligns with increasing corporate sustainability mandates, potentially creating a significant market differentiator. Moreover, the long-term shift toward automated manufacturing processes may alter the types of hazards workers face, requiring adaptive safety eyewear solutions, such as those optimized for dealing with high-intensity light from robotics or laser operations, necessitating continuous R&D investment by market leaders.

AI Impact Analysis on Safety Glasses Market

User queries regarding the impact of Artificial Intelligence on the Safety Glasses Market primarily revolve around how AI can enhance PPE compliance monitoring, predict potential hazards, and improve the manufacturing quality and customization of the eyewear itself. Users are concerned about whether AI integration will lead to smarter, proactive safety features, such as real-time alerts for hazardous gas exposure or fatigue detection, and how this will affect current purchasing patterns. Key expectations center on the development of 'Smart Safety Glasses' capable of collecting and analyzing environmental data, thereby transitioning safety equipment from passive protection to active risk management tools. This shift necessitates detailed consideration of data privacy, interoperability with existing industrial IoT (IIoT) infrastructure, and the cost-effectiveness of these advanced solutions in comparison to traditional passive eyewear.

AI's primary influence is currently manifesting in two major areas: optimizing the design and production process, and developing integrated intelligent monitoring systems. In design, AI algorithms are being utilized to analyze facial metrics across large populations, optimizing ergonomic frame designs to maximize comfort and ensure a secure fit, which directly addresses the historical issue of poor worker compliance due to discomfort. Furthermore, predictive maintenance models can use AI to analyze usage patterns and environmental stress factors, determining the optimal replacement cycle for safety glasses, thereby ensuring continuous adherence to safety standards and reducing unnecessary procurement costs.

The future application of AI lies in its ability to transform safety glasses into crucial components of a connected worker ecosystem. AI-powered software can process data streams from embedded sensors (e.g., UV exposure sensors, proximity detectors) within the safety glasses, alerting supervisors to violations of safety zones or identifying workers entering high-risk areas without adequate protection. This ability to provide actionable, real-time safety insights moves the market towards a preventative safety culture, increasing the perceived value and necessity of high-end, AI-enabled safety eyewear in high-compliance sectors like nuclear energy and advanced pharmaceuticals.

- AI-driven optimization of ergonomic design and customized fit, improving worker compliance.

- Integration into Smart Safety Glasses for real-time hazard detection (e.g., proximity alerts, chemical vapor sensing).

- Predictive analytics for determining optimal PPE replacement schedules based on wear and environmental exposure data.

- Enhanced quality control during manufacturing using computer vision systems for defect detection.

- Development of personalized prescription safety lenses through AI-analyzed optical mapping.

- Implementation of AI algorithms for analyzing and interpreting data collected from integrated eye-tracking sensors to monitor worker fatigue.

DRO & Impact Forces Of Safety Glasses Market

The dynamics of the Safety Glasses Market are primarily influenced by stringent regulatory mandates (Drivers) promoting adoption, coupled with significant price sensitivity and compliance issues (Restraints) that hinder widespread uptake of premium products. Opportunities arise from technological convergence, specifically the integration of smart features and the expanding application scope into non-traditional industries like renewable energy and robotics. The primary impact forces shaping the market include the threat of substitutes, particularly cheaper, non-certified imports, and the bargaining power of buyers, especially large industrial conglomerates that negotiate high-volume discounts. The collective impact of these forces ensures continuous innovation remains critical for market differentiation, while regulatory adherence acts as a baseline requirement for participation.

Key drivers include rapidly industrializing economies, particularly in Asia Pacific, where massive infrastructure and manufacturing investments necessitate basic and advanced PPE. Further, continuous media attention and legal repercussions associated with workplace injuries compel companies to adopt robust safety programs. Restraints predominantly center on the lack of awareness in smaller enterprises regarding the specific standards required, often leading to the purchase of inadequate or uncertified products. Moreover, the cultural resistance to wearing safety eyewear, often cited as uncomfortable or inconvenient, remains a perennial challenge that manufacturers actively address through improved ergonomic design.

The opportunity landscape is defined by the growing demand for specialized and high-performance safety glasses tailored for extreme or unique environments, such as those exposed to intense heat, specific laser wavelengths, or biohazards. Furthermore, sustainability initiatives offer an avenue for growth; companies that develop safety glasses using sustainable and ethically sourced materials will gain a competitive edge. The five forces analysis underscores a moderate rivalry level, driven by intense competition in the standardized product segment, while specialized segments offer higher profitability. The high cost of obtaining global certifications (e.g., CE, ANSI) acts as a moderate barrier to entry for new players, ensuring established manufacturers retain market dominance through quality assurance and regulatory compliance.

Segmentation Analysis

The Safety Glasses Market is comprehensively segmented based on various criteria including product type, material, application, and distribution channel, providing a granular view of market dynamics and end-user preferences. Product type segmentation distinguishes between basic spectacles, full goggles, and specialized face shields, reflecting the required level of protection across different industrial tasks. Material analysis focuses primarily on polycarbonate, renowned for its superior impact resistance, which dictates the performance characteristics and cost structure of the final product. Application segmentation clearly highlights the dominance of the manufacturing and construction sectors, although the healthcare segment has seen exponential, albeit volatile, growth due to global health crises. Understanding these segments is crucial for manufacturers to tailor their production, marketing, and distribution strategies effectively.

- By Product Type:

- Safety Spectacles (Standard, Over-the-glasses)

- Safety Goggles (Vented, Non-vented, Sealed)

- Face Shields and Visors (Often used in conjunction with primary eyewear)

- By Material:

- Polycarbonate (Dominant due to high impact resistance)

- Propionate/Cellulose Acetate (Preferred for chemical resistance)

- Trivex

- Glass (For specific optical clarity or scratch resistance needs)

- By Application/End-Use Industry:

- Construction

- Manufacturing (Heavy and Light)

- Oil & Gas

- Mining

- Healthcare & Pharmaceuticals

- Chemicals & Materials

- Automotive

- Others (e.g., Sports, Military, DIY)

- By Lens Coating/Feature:

- Anti-Scratch

- Anti-Fog

- UV Protection

- Anti-Reflective

- Polarized

- Mirrored

Value Chain Analysis For Safety Glasses Market

The value chain for the Safety Glasses Market begins with the Upstream activities, which involve the procurement and processing of raw materials, primarily specialized resins (polycarbonate, cellulose acetate) and various coatings (silicones, fluoropolymers). High capital investment is required in this stage to ensure material purity and conformity to optical and impact standards. Midstream activities encompass manufacturing processes, including injection molding, lens cutting, coating application, assembly, and rigorous quality testing and certification. This stage adds significant value through precision engineering and adherence to mandated standards like ANSI Z87.1 or EN 166. Manufacturers often face pressure to optimize production efficiency while maintaining superior quality, as product failure can result in severe legal liability.

The Downstream analysis focuses on distribution and end-user engagement. Distribution channels are highly fragmented, involving direct sales to large industrial buyers, indirect sales through specialized industrial safety distributors (the dominant channel), and increasingly, online retail platforms. Specialized distributors provide inventory management, technical support, and regional accessibility, acting as a crucial link between manufacturers and diverse end-users. The choice of channel depends on the volume, complexity, and specific regulatory requirements of the purchasing entity; large entities prefer direct procurement for better cost control, while small and medium enterprises rely heavily on distributors.

Direct channels are preferred by major multinational corporations for bulk purchases, allowing for customization and long-term contract pricing. Indirect channels, primarily driven by industrial supply houses and wholesale safety equipment providers, leverage broad logistical networks to serve fragmented markets effectively. This intricate value chain structure ensures market penetration across all industrial sizes, but also introduces challenges related to traceability and potential grey market proliferation, necessitating strict brand protection and distribution agreements by leading manufacturers to maintain price integrity and quality assurance.

Safety Glasses Market Potential Customers

Potential customers for safety glasses span virtually all sectors where workplace hazards pose a risk to vision, encompassing a wide array of industrial, commercial, and governmental entities. The primary buyers (end-users) are large-scale industrial operators in construction, infrastructure development, automotive manufacturing, and chemical processing, where mandatory compliance with high-impact resistance standards is non-negotiable. Procurement decisions in these sectors are highly centralized, focusing on certified products, supplier reliability, and the total cost of ownership, including the durability and lifespan of the eyewear.

Secondary, yet rapidly expanding, customer segments include healthcare providers, particularly hospitals and research laboratories, which require specialized chemical and splash protection, a demand significantly amplified by global focus on biological safety. Furthermore, the defense and aerospace industries represent high-value customers, requiring extremely specialized, often prescription-grade, anti-ballistic or laser-filtering safety glasses. The increasing prominence of DIY home improvement projects and hobbyist workshops also contributes to a growing consumer-grade safety glasses market, driven by convenience and affordable pricing through retail channels.

In essence, the market serves anyone requiring enhanced eye protection against projectiles, dust, chemicals, radiation, or intense light. The customer base is segregated into high-compliance, high-volume industrial buyers who prioritize standards and bulk pricing, and specialized buyers (e.g., medical, research) who prioritize specific features like anti-fog capabilities and specialized material composition. Successful market penetration requires tailoring product features and distribution strategies to meet the distinct risk profiles and procurement mandates of each key customer segment, emphasizing certifications and ergonomic comfort to maximize employee acceptance.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 5.8 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | 3M Company, Honeywell International Inc., MSA Safety Incorporated, Bolle Safety, Pyramex Safety Products, Radians, Inc., Uvex Safety Group, Kimberly-Clark Corporation, Edge Safety Eyewear, Sellstrom Manufacturing Co., Gateway Safety, Inc., Jeka Group, Safetec (India) Pvt. Ltd., Lincoln Electric Holdings, Inc., MCR Safety, Ergodyne, Hellberg Safety, Shalon Chemical Industries Ltd., Teng Tools, Stanley Black & Decker. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Safety Glasses Market Key Technology Landscape

The technology landscape of the Safety Glasses Market is predominantly defined by advancements in polymer science and surface treatment techniques, aimed at maximizing protection without compromising optical clarity or comfort. Key technologies include high-velocity impact resistance materials, particularly advanced polycarbonate formulations and lightweight Trivex, which offer superior durability and optical quality compared to traditional acrylics. Significant R&D focus is dedicated to specialized lens coatings; for instance, premium anti-fog technologies employ hydrophilic or hydrophobic surface treatments to prevent condensation, a critical requirement for workers in humid or rapidly changing temperature environments. Anti-scratch hard coatings, often based on proprietary silicone or ceramic formulations, extend the product lifespan and maintain visual integrity.

A burgeoning technological segment involves the integration of Smart PPE features. This includes embedded micro-sensors that monitor environmental conditions (e.g., air quality, UV index, noise levels) and transmit real-time data via Bluetooth or Wi-Fi to a central safety management system. Furthermore, some high-end industrial safety glasses are incorporating augmented reality (AR) technology, overlaying critical information, instructions, or maintenance checklists directly onto the user's field of vision, enhancing operational efficiency and reducing human error in complex assembly or repair tasks. This integration elevates safety glasses from mere protective items to sophisticated data input/output devices within the Industrial Internet of Things (IIoT) framework.

Further technological innovations are focused on prescription compatibility and customized optics. Manufacturers are utilizing digital surfacing technology to produce highly individualized prescription safety lenses that minimize distortion and improve peripheral vision, ensuring that corrective vision needs do not compromise safety. This shift is vital for sectors with an aging workforce. Moreover, laser safety glasses, utilizing specialized absorption dyes or reflective coatings, represent a highly niche but critical technological segment, essential for industries employing high-power lasers (e.g., military, manufacturing, medical surgery), driving continuous, focused investment in highly specialized optical engineering and certification processes.

Regional Highlights

- North America: North America, particularly the United States and Canada, holds a substantial share of the global Safety Glasses Market, driven by strict enforcement of occupational safety standards mandated by agencies like OSHA. The market here is characterized by high demand for certified, premium products and a rapid adoption rate of technological innovations, including AR-enabled smart glasses, especially in the automotive, aerospace, and energy sectors. Companies prioritize compliance, durability, and brand reputation, often leading to procurement contracts favoring established global PPE providers. The mature industrial base and high labor costs make investment in preventative safety measures economically viable, ensuring sustained demand for high-quality protective eyewear throughout the forecast period.

- Europe: The European market is highly regulated under the European Union's PPE Regulation (EU) 2016/425, requiring CE marking and adherence to EN standards, fostering a strong emphasis on product quality and traceability. Germany, the UK, and France are key contributors, driven by advanced manufacturing and a robust chemicals industry. Environmental sustainability is a growing concern, pushing manufacturers to develop recyclable frames and sustainable packaging. Furthermore, the aging infrastructure across some regions necessitates significant construction and maintenance activity, ensuring steady demand for standard and specialized safety eyewear, particularly models designed for comfortable long-term use.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, fueled by massive government investments in infrastructure, rapid industrialization, and expansion of the manufacturing base, notably in China, India, and Southeast Asian nations. Although price sensitivity remains high, increasing regulatory scrutiny from local governments attempting to align with international safety benchmarks is gradually shifting demand towards certified, higher-quality products. The vast number of construction workers and factory employees provides an expansive customer base, presenting significant opportunities for volume sales, necessitating localized manufacturing and distribution strategies by global vendors.

- Latin America (LATAM): The LATAM market, while smaller, exhibits substantial growth potential, particularly in Brazil and Mexico, driven by burgeoning mining, oil and gas extraction, and heavy manufacturing sectors. Market growth is often volatile, influenced by economic stability and the varying degrees of local regulatory enforcement. There is a noticeable split in demand, with multinational companies operating in the region favoring globally certified premium brands, while local SMEs often prioritize affordability, driving demand for cost-effective, basic safety spectacles.

- Middle East and Africa (MEA): The MEA market is heavily influenced by large-scale infrastructural projects and the dominant oil and gas sector. Countries like Saudi Arabia, UAE, and Qatar show high demand for durable, heat-resistant, and high-performance safety glasses suitable for extreme desert conditions. The reliance on expatriate labor in construction and energy sectors requires standardized PPE distribution. Africa's market growth is concentrated in mining and emerging industrial zones, facing challenges related to distribution logistics and awareness, though safety standards are slowly rising due to international corporate presence.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Safety Glasses Market.- 3M Company

- Honeywell International Inc.

- MSA Safety Incorporated

- Bolle Safety

- Pyramex Safety Products

- Radians, Inc.

- Uvex Safety Group

- Kimberly-Clark Corporation

- Edge Safety Eyewear

- Sellstrom Manufacturing Co.

- Gateway Safety, Inc.

- Jeka Group

- Safetec (India) Pvt. Ltd.

- Lincoln Electric Holdings, Inc.

- MCR Safety

- Ergodyne

- Hellberg Safety

- Shalon Chemical Industries Ltd.

- Teng Tools

- Stanley Black & Decker

Frequently Asked Questions

Analyze common user questions about the Safety Glasses market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Safety Glasses Market?

The primary driver is the increasing stringency and enforcement of governmental and occupational safety regulations (such as OSHA and EN standards) across industrialized and developing nations, making the use of certified Personal Protective Equipment (PPE) mandatory in hazardous work environments, thereby guaranteeing consistent market demand.

Which material dominates the safety glasses market and why?

Polycarbonate dominates the safety glasses market due to its exceptional combination of high impact resistance, lightweight nature, and inherent ability to block 99.9% of harmful UV radiation, making it the preferred standard for high-risk industrial and construction applications requiring ANSI Z87.1 compliance.

How is technology impacting modern safety glasses design?

Technology is impacting design primarily through enhanced comfort and "smart" integration. Key advances include specialized anti-fog and anti-scratch lens coatings, ergonomic designs optimized via computational analysis, and the incorporation of micro-sensors and augmented reality (AR) features for real-time hazard detection and data display in high-end industrial models.

Which geographical region exhibits the fastest growth rate for safety glasses adoption?

The Asia Pacific (APAC) region is projected to register the fastest growth rate, driven by massive investments in infrastructure development, rapid industrial expansion, and the subsequent implementation of stricter local safety compliance standards in countries like China and India, creating substantial new market opportunities.

What are the main challenges faced by manufacturers in this market?

Manufacturers primarily face challenges related to maintaining a balance between high production quality standards required for global certifications (e.g., ANSI, CE) and managing cost pressures due to high price sensitivity, especially in emerging markets. Additionally, ensuring worker compliance through improved ergonomic comfort remains a persistent hurdle.

This comprehensive report provides an exhaustive analysis of the Safety Glasses Market, detailing growth metrics, segmentation characteristics, technological shifts, and the competitive landscape, ensuring stakeholders have the necessary insights for strategic decision-making in this critical PPE sector.

The market for safety glasses is continually evolving, moving beyond simple protection to integrated safety solutions that leverage advanced optics and digital connectivity. Manufacturers are increasingly focusing on sustainable material sourcing and minimizing the environmental footprint of their products, aligning with global corporate social responsibility (CSR) goals, which is expected to influence procurement policies in major corporate organizations. Furthermore, the persistent threat of supply chain disruptions, highlighted by recent global events, has led to a strategic shift towards regionalizing manufacturing and securing diverse sourcing channels for specialized raw materials, ensuring resilience in production capacity to meet sustained global demand.

In the coming years, customized protective solutions, specifically tailored to the unique hazard matrix of an industry (e.g., specific chemical resistance for pharmaceutical labs, high-intensity flash protection for welding operations), will command a premium. This specialization requires significant R&D investment but offers higher margins and stronger defensibility against generic, low-cost competitors. The long-term viability of market players will hinge on their ability to consistently innovate in both material science and digital integration, turning safety glasses into indispensable tools for modern, data-driven workplace safety management.

The dynamic regulatory environment means continuous investment in certification and testing facilities is paramount. As new hazards emerge, particularly those associated with advanced manufacturing techniques like 3D printing or high-power laser etching, the standards themselves are constantly being updated, requiring manufacturers to rapidly adapt product specifications. This high barrier to regulatory entry solidifies the position of established companies that possess the infrastructure and expertise to navigate complex global compliance requirements effectively, ensuring the market remains dominated by certified, high-quality offerings.

The strategic expansion into related markets, such as industrial head protection or integrated safety systems, also represents a growth vector. Companies offering full-suite PPE solutions often leverage their existing safety glasses clientele to cross-sell other protective gear, enhancing customer lifetime value and establishing deeper relationships with large industrial purchasers. This integrated approach simplifies procurement for end-users and promotes standardization of safety equipment across large operational facilities, thereby supporting market growth through convenience and consolidation of purchasing power.

Future market intelligence indicates a strong focus on enhancing the anti-scratch performance of lenses. While polycarbonate is highly impact-resistant, its inherent softness makes it susceptible to scratching, which compromises optical clarity and requires frequent replacement. Innovations in nanocoatings that offer durable, transparent surface hardening without affecting the lens's primary impact rating are crucial. Achieving cost-effective application of these advanced coatings will be a key technological battleground for competitive advantage in the mid-to-high price segment over the next five years, directly influencing customer satisfaction and repeat business rates.

Sustainability mandates are pushing the development of frame materials derived from recycled plastics or bio-based polymers. While the lens material (polycarbonate) remains highly technical and essential for protection, the frame accounts for a significant portion of the material volume. Companies pioneering the use of eco-friendly, yet durable, frame materials are strategically positioning themselves to capture environmentally conscious industrial buyers in Europe and North America. This focus on green manufacturing not only serves CSR objectives but also opens pathways to tender processes where environmental impact scores are increasingly considered alongside technical specifications and pricing.

Finally, the growing concern over digital eye strain and blue light exposure, even in industrial settings where LED lighting and screens are ubiquitous, is creating a demand for specialized protective eyewear that filters specific high-energy visible (HEV) light wavelengths. This trend merges general eye wellness concerns with industrial safety requirements, prompting manufacturers to develop dual-purpose safety glasses that offer high impact protection alongside advanced blue light filtration, broadening the product's appeal beyond traditional hazard zones to encompass general work areas and office environments within industrial complexes.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager