Salicylic Acid and Alpha Hydroxy Acid for Cosmetic Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443432 | Date : Feb, 2026 | Pages : 241 | Region : Global | Publisher : MRU

Salicylic Acid and Alpha Hydroxy Acid for Cosmetic Market Size

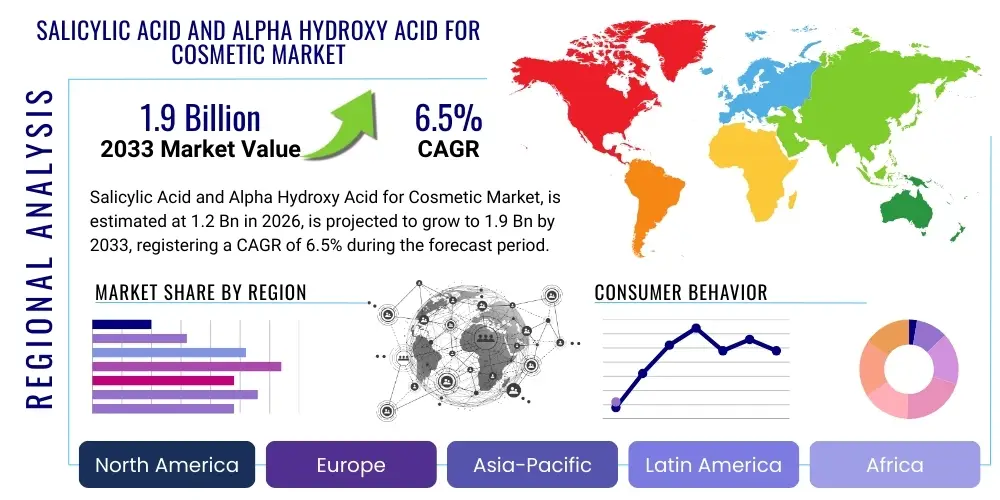

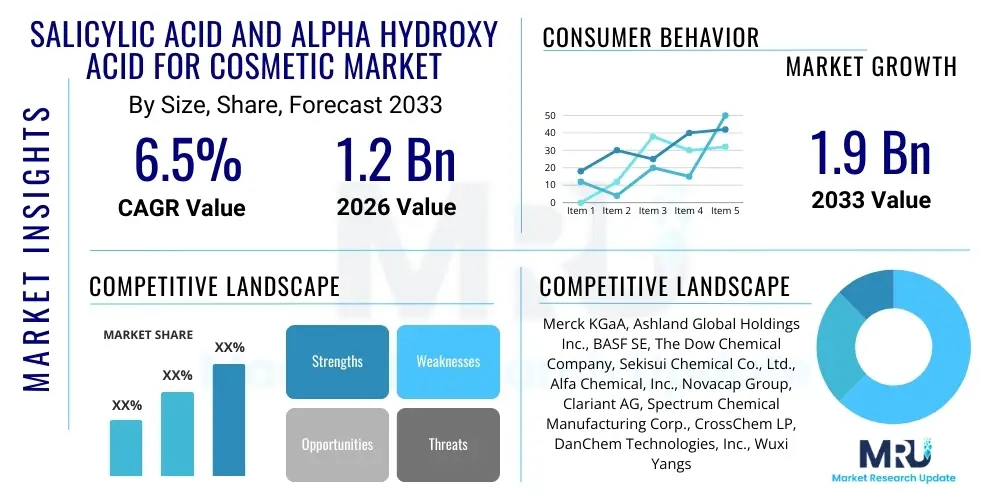

The Salicylic Acid and Alpha Hydroxy Acid for Cosmetic Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 1.9 Billion by the end of the forecast period in 2033.

Salicylic Acid and Alpha Hydroxy Acid for Cosmetic Market introduction

The Salicylic Acid and Alpha Hydroxy Acid (AHA) for Cosmetic Market encompasses the global trade and utilization of these key exfoliating and skin conditioning ingredients within the beauty and personal care industry. Salicylic acid, a Beta Hydroxy Acid (BHA), is widely celebrated for its oil-solubility and unique ability to penetrate pores, making it indispensable in acne treatments, blackhead removal, and overall skin clarification. AHAs, including glycolic acid, lactic acid, and mandelic acid, are water-soluble acids primarily used for surface exfoliation, improving skin texture, reducing fine lines, and enhancing product absorption. The synergistic application of these ingredients across various cosmetic formulations drives substantial market demand.

These ingredients are foundational in professional-grade chemical peels as well as consumer-facing daily skincare products such as cleansers, toners, serums, and masks. Major applications span anti-aging treatments aimed at cellular renewal, hyperpigmentation correction, and intensive therapeutic care for sensitive or acne-prone skin. The primary benefits include accelerated cell turnover, improved collagen production, reduced inflammation, and enhanced overall skin luminosity and evenness. The versatility and proven efficacy of both BHAs and AHAs position them as staples in dermatological and cosmetic science, continually spurring innovation in delivery systems and formulation stability.

The market growth is primarily driven by escalating consumer awareness regarding the benefits of chemical exfoliation over physical scrubs, coupled with a rising global prevalence of skin issues like acne, sun damage, and premature aging. Furthermore, the strong shift toward 'active' and 'clinical' skincare, often promoted through social media and influencer marketing, significantly boosts demand for products containing high concentrations of AHAs and Salicylic Acid. Regulatory clarity in major markets regarding safe usage concentrations also provides a stable framework for manufacturers to expand product lines, ensuring continued market expansion throughout the forecast period.

Salicylic Acid and Alpha Hydroxy Acid for Cosmetic Market Executive Summary

The Salicylic Acid and Alpha Hydroxy Acid for Cosmetic Market demonstrates robust growth, propelled by strong consumer preference for clinically proven active ingredients and the rapid expansion of the professional skincare segment globally. Business trends indicate a focus on sustainable sourcing, particularly for AHAs derived through fermentation processes, and the integration of microencapsulation technologies to minimize irritation while maximizing ingredient efficacy. Leading market players are strategically investing in R&D to develop novel combination therapies that pair AHAs/BHAs with complementary ingredients like ceramides and hyaluronic acid to address comprehensive skin health needs. The competitive landscape is characterized by intense innovation among both established chemical manufacturers and emerging specialty cosmetic ingredient suppliers.

Regionally, North America and Europe maintain dominance, attributed to high disposable incomes, mature cosmetic regulatory environments, and a deep-seated culture of proactive anti-aging and preventative skincare. However, the Asia Pacific (APAC) region is forecasted to exhibit the fastest growth, primarily driven by expanding middle-class populations, increased urbanization, and the growing influence of Korean and Japanese beauty standards which emphasize clear, luminous skin, heavily relying on gentle exfoliation. Regulatory compliance and regional variances in approved concentration levels pose slight challenges, necessitating tailored market entry strategies for multinational corporations.

Segmental trends highlight the Glycolic Acid segment as the market leader among AHAs due to its small molecular structure providing deep penetration, especially favored in anti-aging applications. Salicylic Acid remains critical, dominating the acne treatment segment globally. The end-user market sees cleansers and serums experiencing particularly rapid growth, as consumers prioritize products offering daily, mild exfoliation. The trend toward personalized skincare diagnostics is further segmenting the market, allowing niche players to capture specific consumer profiles requiring customized acid combinations.

AI Impact Analysis on Salicylic Acid and Alpha Hydroxy Acid for Cosmetic Market

User questions related to AI's impact frequently revolve around personalized product recommendation systems, AI-driven formulation optimization, and automated quality control in manufacturing. Key themes include how AI can refine ingredient efficacy for individual skin types, ensuring optimal concentration levels while minimizing side effects. Users also express interest in AI's role in predicting regulatory changes or consumer reaction to new ingredient combinations (like novel AHA blends). The primary expectation is that AI will enhance speed-to-market for effective, safer cosmetic products, moving away from generalized formulations toward highly specific, customized treatments utilizing precise quantities of Salicylic Acid and AHAs based on digital skin analysis.

- AI-driven personalized formulation: Optimizing acid concentration (e.g., glycolic acid levels) based on individual skin hydration, sensitivity, and oil production data captured via digital diagnostics.

- Predictive R&D: Utilizing machine learning models to simulate the chemical stability and biological efficacy of new AHA/BHA combinations before costly laboratory synthesis.

- Automated quality control: Implementing AI vision systems for high-throughput screening of raw ingredient purity and consistency, crucial for maintaining potency of Salicylic Acid derivatives.

- Supply chain optimization: Using predictive analytics to forecast demand fluctuations for key acid intermediates, ensuring timely sourcing and minimizing inventory costs.

- Enhanced consumer engagement: AI chatbots and virtual dermatologists recommending appropriate acid-based products and usage protocols to reduce consumer confusion and misuse.

DRO & Impact Forces Of Salicylic Acid and Alpha Hydroxy Acid for Cosmetic Market

The market dynamics are governed by a complex interplay of strong consumer drivers rooted in efficacy and wellness, countered by regulatory constraints and the inherent irritation potential of high-concentration acids. Driving factors include the global shift towards sophisticated anti-aging and acne solutions, alongside validated dermatological endorsement of these active ingredients. Opportunities lie significantly in developing advanced delivery systems, such as slow-release encapsulation technologies, which address the primary restraint—skin irritation and photosensitivity—thereby widening the addressable consumer base, particularly those with sensitive skin types. The overall impact forces are strongly positive, suggesting sustained innovation will mitigate restrictive factors.

Drivers: Growing consumer focus on active skincare ingredients with scientifically proven results is the core driver. The high success rates of Salicylic Acid in treating comedonal acne and the superior exfoliating properties of Glycolic and Lactic acids for textural refinement continuously reinforce their market position. The professional sector, including medispas and dermatologists, consistently utilizes high-concentration acid peels, creating a trickle-down effect where consumers seek similar efficacy in over-the-counter products, pushing manufacturers to innovate within regulated limits. Furthermore, rising incomes in emerging economies increase access to premium cosmetic products containing these ingredients.

Restraints: The primary restraint remains the potential for skin irritation, dryness, and increased UV sensitivity associated with the use of high-concentration AHAs and BHAs, leading to cautionary consumer behavior and strict regulatory oversight regarding permissible concentration limits. Specific ingredients, such as certain AHA isomers, may face complex registration processes in different geopolitical zones. Additionally, market saturation in basic formulation categories (e.g., simple salicylic acid washes) leads to intense price competition, potentially compressing profit margins for standard products.

Opportunities: Significant market opportunities exist in the development of sophisticated, stabilized formulations that minimize side effects while maximizing bioavailability. This includes encapsulation technology tailored for specific acids, or the formulation of milder, yet effective, AHAs like Mandelic and Gluconolactone (a poly-hydroxy acid often grouped with AHAs in application). Further opportunities arise from expanding their application beyond facial care into scalp treatments (anti-dandruff solutions utilizing Salicylic Acid) and comprehensive body care products addressing conditions like keratosis pilaris, leveraging the full potential of these dermatological actives.

Segmentation Analysis

The Salicylic Acid and Alpha Hydroxy Acid for Cosmetic Market is segmented primarily based on the type of acid, the specific cosmetic application, and the end-user product type. This granular segmentation allows manufacturers to target specific skin concerns, ranging from deep-seated acne to superficial textural improvements and anti-aging regimens. Understanding these segments is crucial for strategic resource allocation, as the growth rates and maturity levels vary significantly between categories; for example, Glycolic Acid dominates the anti-aging segment while Salicylic Acid is indispensable for oil control. The complex interplay of consumer demands for specialized products necessitates a focused approach to segment development and marketing.

The Type segmentation, covering the chemical structure, is vital as each acid offers distinct penetration depth and function; Glycolic Acid, with the smallest molecular weight, penetrates deepest but carries the highest irritation risk, contrasting with larger molecules like Mandelic Acid, which is suitable for sensitive skin. Application segmentation reflects the ultimate consumer need, such as exfoliation or pigmentation correction, guiding product development. The structure of the market is trending toward cross-segment innovation, where acids are combined not only with each other but also with advanced carriers to optimize performance across all application types.

- By Type:

- Salicylic Acid (BHA)

- Glycolic Acid (AHA)

- Lactic Acid (AHA)

- Mandelic Acid (AHA)

- Citric Acid (AHA)

- Tartaric Acid (AHA)

- Other AHAs (e.g., Malic Acid)

- By Application:

- Acne Treatment

- Anti-aging and Wrinkle Reduction

- Exfoliation and Skin Resurfacing

- Pigmentation Correction and Brightening

- Moisturizing and Conditioning

- Sun Damage Repair

- By End-User Product:

- Cleansers and Face Washes

- Toners and Astringents

- Serums and Essences

- Masks and Chemical Peels (Professional and Home Use)

- Moisturizers and Lotions

- Haircare Products (e.g., Scalp Exfoliation)

Value Chain Analysis For Salicylic Acid and Alpha Hydroxy Acid for Cosmetic Market

The value chain for the Salicylic Acid and Alpha Hydroxy Acid market begins with the procurement and synthesis of raw chemical inputs. Upstream activities involve the specialized chemical manufacturing of high-purity cosmetic-grade acids. Salicylic acid is typically synthesized from methyl salicylate or related compounds, while many AHAs, such as lactic acid and glycolic acid, are increasingly produced through sustainable fermentation processes leveraging biotechnology, driven by consumer demand for 'natural' origin ingredients. Quality control at this stage is paramount, focusing on impurity levels and consistency to ensure product safety and efficacy, which directly influences the final cosmetic product's performance and regulatory compliance.

The midstream involves cosmetic formulators and contract manufacturers who integrate these active ingredients into marketable products. This stage involves complex R&D regarding stability, pH balance, and delivery system technology (like liposomal encapsulation) to ensure the acids maintain potency while remaining gentle on the skin. The choice of ancillary ingredients (solvents, stabilizers, preservatives) is critical for commercial success. Innovation in formulation processing is a major competitive differentiator, often allowing premium pricing for proprietary delivery matrices that minimize irritation.

Downstream activities include packaging, branding, and distribution. The distribution channel is multifaceted, comprising both direct-to-consumer (DTC) e-commerce platforms and indirect channels such as specialty retail stores (Sephora, Ulta), pharmacies, and professional channels (dermatology clinics and medispas). The professional channel often distributes higher-concentration products, necessitating specialized training. E-commerce platforms are increasingly vital, enabling brands to educate consumers directly on the use of active ingredients, driving transparency and demand. Marketing efforts heavily leverage clinical claims and scientific endorsements, crucial for gaining consumer trust in products containing potent acids.

Salicylic Acid and Alpha Hydroxy Acid for Cosmetic Market Potential Customers

Potential customers for Salicylic Acid and Alpha Hydroxy Acid ingredients are multifaceted, primarily consisting of large-scale multinational cosmetic corporations, niche skincare brands focused on active ingredients, and contract manufacturing organizations serving the beauty industry. These customers require high-purity, scalable supply of various acid types to meet diverse product formulation needs, ranging from entry-level cleansers to luxury anti-aging serums. The increasing demand for private label manufacturing further expands the customer base among contract manufacturers seeking reliable sourcing partners for raw materials.

End-users and buyers of the final cosmetic products can be broadly categorized into several key demographic segments. The largest segment includes individuals aged 16 to 35 seeking treatments for acne and oily skin, where Salicylic Acid-based products are indispensable. A second, highly lucrative segment comprises consumers aged 30 and above who are focused on preventative and corrective anti-aging skincare, relying heavily on AHAs like Glycolic and Lactic Acid for fine line reduction, sunspot correction, and overall radiance enhancement. These consumers are typically willing to invest in premium products that demonstrate proven clinical outcomes.

Furthermore, professional service providers represent a specialized but high-value customer segment. Dermatologists, aestheticians, and medispas constitute institutional buyers who require concentrated acid solutions for in-office chemical peels and specialized treatments. Their consumption patterns are driven by clinical protocols and patient outcomes. The rise of at-home beauty devices and semi-professional peels also broadens the potential customer base to highly informed consumers who seek near-clinical results through advanced, regulated retail products.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 1.9 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Merck KGaA, Ashland Global Holdings Inc., BASF SE, The Dow Chemical Company, Sekisui Chemical Co., Ltd., Alfa Chemical, Inc., Novacap Group, Clariant AG, Spectrum Chemical Manufacturing Corp., CrossChem LP, DanChem Technologies, Inc., Wuxi Yangshuo Chemical Co., Ltd., Shandong Xinhua Pharmaceutical Co., Ltd., Hunan Chemicalb Co., Ltd., Corbion N.V., Purac (Carrington Labs), Jungbunzlauer Suisse AG, Eastman Chemical Company, Galactic S.A., Res Pharma Industriale Srl. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Salicylic Acid and Alpha Hydroxy Acid for Cosmetic Market Key Technology Landscape

The technology landscape for Salicylic Acid and Alpha Hydroxy Acid is characterized by significant advances in formulation science aimed at enhancing performance and minimizing adverse effects. A critical area of technological focus is the development of sustained-release mechanisms. Traditional acid formulations often result in a rapid burst of activity followed by increased irritation. Microencapsulation and liposomal delivery systems are key technologies used to encase the acid molecules, ensuring gradual release into the stratum corneum over several hours. This targeted delivery significantly reduces peak irritation levels, making these potent ingredients accessible to consumers with sensitive skin, thereby expanding the market's demographic reach.

Another vital technological trend involves chirality and isomer separation, particularly for lactic acid. Manufacturers are increasingly utilizing advanced separation techniques to isolate specific isomers (e.g., L-Lactic Acid) that are recognized as being more bio-compatible and effective for skin cell renewal, moving away from racemic mixtures. This precision in ingredient refinement allows cosmetic brands to market superior, clinical-grade products. Furthermore, the synthesis of novel, hybrid acid derivatives is being explored, designed to offer multi-functional benefits, combining, for instance, the oil solubility of a BHA with the exfoliating power of an AHA, optimized for stable formulation within complex cosmetic matrices.

Biotechnology also plays a substantial role, driving the shift toward fermentative production of AHAs (bio-based Glycolic Acid and Lactic Acid) as an alternative to synthetic chemical routes. This aligns with broader consumer preferences for sustainable, natural-origin ingredients, bolstering the market appeal of these acids. Quality control technologies, including High-Performance Liquid Chromatography (HPLC) and advanced spectroscopies, are fundamental in ensuring the purity, stability, and precise concentration of the active ingredients, which is critical for regulatory adherence and maintaining consumer trust in the efficacy of the final cosmetic products.

Regional Highlights

Regional dynamics are diverse, reflecting varying consumer habits, regulatory frameworks, and economic development levels, all of which influence the consumption and formulation of Salicylic Acid and AHAs in cosmetics.

- North America: Dominates the market, driven by high consumer spending on professional and high-end skincare, early adoption of active ingredient trends, and a mature regulatory environment that supports clear labeling and consumer education. The region exhibits high demand for both acne treatments (Salicylic Acid) and anti-aging serums (Glycolic Acid).

- Europe: Characterized by stringent cosmetic regulations (EU Cosmetics Regulation), necessitating careful formulation and concentration limits. The demand is strong, particularly in Western European markets, emphasizing natural and sustainably sourced AHAs. Innovation is focused on combining AHAs with soothing botanical extracts to counteract potential irritation.

- Asia Pacific (APAC): Expected to be the fastest-growing region. Growth is fueled by rapid urbanization, rising disposable incomes, and the pervasive influence of the K-Beauty and J-Beauty industries, which prioritize bright, smooth, and clear skin achieved through gentle, daily chemical exfoliation (often using Lactic and Mandelic Acids). China and India are major contributors to this growth trajectory.

- Latin America (LATAM): Showing steady growth, particularly in Brazil and Mexico, driven by increasing awareness of sun damage repair and preventative anti-aging treatments. The professional peel market maintains a significant presence, supporting demand for concentrated raw materials.

- Middle East and Africa (MEA): Emerging markets with moderate growth. Demand is primarily centered in urban centers and high-income populations, driven by Western cosmetic trends and a growing need for products addressing pigmentation issues common in these regions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Salicylic Acid and Alpha Hydroxy Acid for Cosmetic Market.- Merck KGaA

- Ashland Global Holdings Inc.

- BASF SE

- The Dow Chemical Company

- Sekisui Chemical Co., Ltd.

- Alfa Chemical, Inc.

- Novacap Group

- Clariant AG

- Spectrum Chemical Manufacturing Corp.

- CrossChem LP

- DanChem Technologies, Inc.

- Wuxi Yangshuo Chemical Co., Ltd.

- Shandong Xinhua Pharmaceutical Co., Ltd.

- Hunan Chemicalb Co., Ltd.

- Corbion N.V.

- Purac (Carrington Labs)

- Jungbunzlauer Suisse AG

- Eastman Chemical Company

- Galactic S.A.

- Res Pharma Industriale Srl

Frequently Asked Questions

Analyze common user questions about the Salicylic Acid and Alpha Hydroxy Acid for Cosmetic market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between Salicylic Acid (BHA) and Alpha Hydroxy Acids (AHAs) in cosmetic applications?

Salicylic Acid (a BHA) is oil-soluble, allowing it to penetrate deep into pores to dissolve sebum and address acne directly. AHAs (like Glycolic Acid) are water-soluble, functioning mainly on the skin's surface to exfoliate dead cells, improve texture, and enhance moisture retention for anti-aging benefits.

Which acid type currently holds the largest market share in the cosmetic segment?

Glycolic Acid, an AHA, generally holds a significant market share due to its superior efficacy in anti-aging, wrinkle reduction, and overall skin resurfacing across both professional and consumer-grade product lines. Salicylic Acid dominates the specific segment of acne treatment.

What are the major growth drivers influencing the Salicylic Acid and AHA market forecast?

Key drivers include rising consumer demand for active, results-driven skincare ingredients, increasing awareness of the benefits of chemical exfoliation over physical methods, and the expanding market for specialized anti-aging and anti-acne formulations globally, particularly in the Asia Pacific region.

How are manufacturers addressing the issue of skin irritation associated with high acid concentrations?

Manufacturers are leveraging advanced delivery technologies such as microencapsulation and liposomal systems. These innovations ensure the acids are released gradually into the skin, maximizing efficacy while significantly reducing the peak concentration at the surface, thereby minimizing potential irritation and adverse reactions.

What role does biotechnology play in the production of cosmetic acids?

Biotechnology is crucial for the sustainable production of AHAs, notably Lactic and Glycolic Acids, through fermentation processes. This method meets the increasing consumer and regulatory demand for bio-based, natural-origin ingredients, offering an environmentally friendly alternative to traditional synthetic chemical routes.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager