Salt and Sand Spreaders Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441036 | Date : Feb, 2026 | Pages : 242 | Region : Global | Publisher : MRU

Salt and Sand Spreaders Market Size

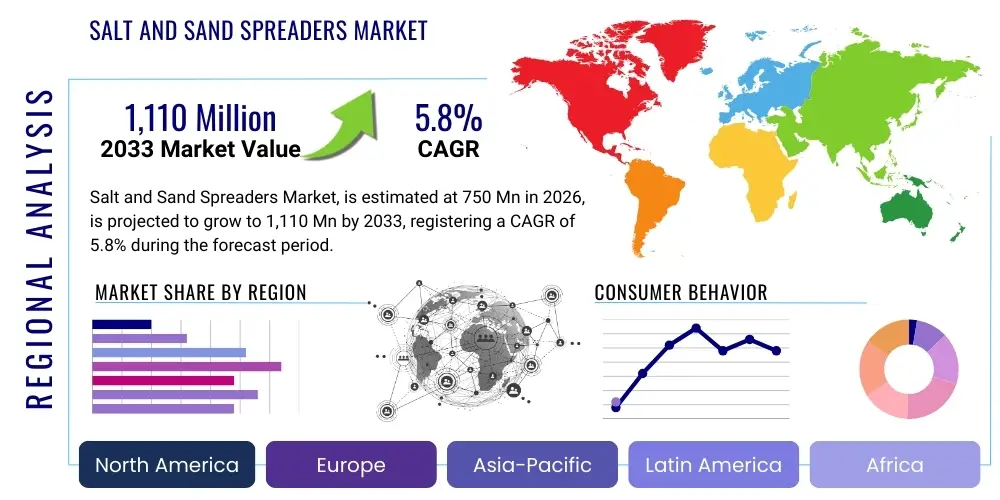

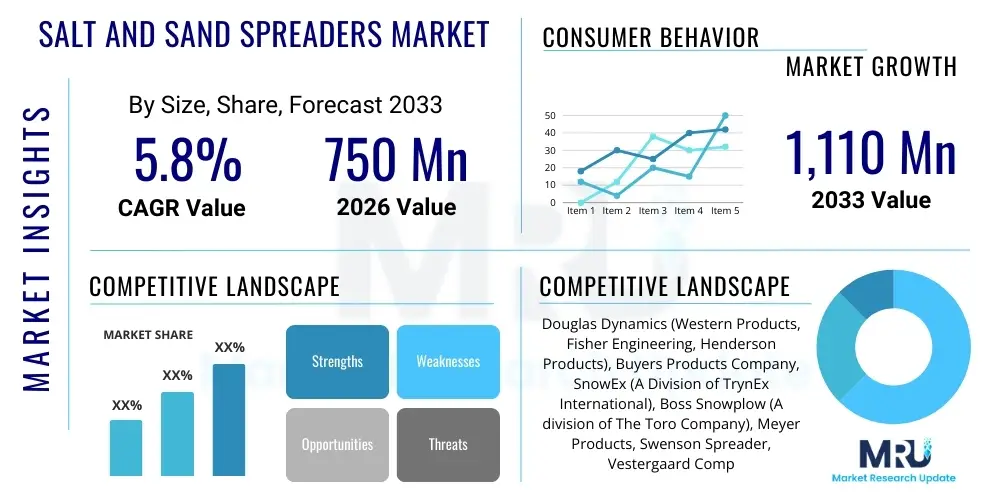

The Salt and Sand Spreaders Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $750 Million in 2026 and is projected to reach $1,110 Million by the end of the forecast period in 2033.

Salt and Sand Spreaders Market introduction

The Salt and Sand Spreaders Market encompasses the global trade and utilization of mechanical devices designed to disperse de-icing agents, primarily rock salt, specialized granular de-icers, or abrasive materials like sand, onto roads, parking lots, sidewalks, and private premises during winter weather events. These devices are critical components of winter maintenance infrastructure, ensuring public safety and maintaining operational continuity across municipal, commercial, and private sectors. The market is characterized by a diverse product portfolio, ranging from small, push-style spreaders for residential or light commercial use to large, truck-mounted or tow-behind hydraulic spreaders capable of covering extensive highway networks. Demand is inherently seasonal and geographically concentrated in regions experiencing significant snowfall and freezing temperatures, making climatic variability a primary external factor influencing market performance. The continuous need for specialized equipment capable of handling both dry and pre-wetting materials dictates continuous innovation in material handling systems and corrosion protection.

The core product in this market includes various spreading mechanisms such as spinner disc spreaders, which rely on centrifugal force to broadcast material over a wide swath, making them ideal for high-speed highway application. Conversely, gravity-fed drop spreaders are preferred for controlled, precise application in confined or environmentally sensitive areas, such as sidewalks or airport taxiways, ensuring material stays within designated boundaries. Major applications span municipal snow removal fleets, departments of transportation (DOTs) requiring rigorous coverage tracking, airports demanding zero-tolerance surface conditions, educational campuses, large retail chains, and property management companies that offer specialized, contractual snow and ice control services. The mechanical robustness and technological integration of these spreaders are key purchasing criteria for professional users. The efficacy of these spreaders is crucial not only for safety but also for optimized cost management, as precise material usage reduces overall operational expenditures and minimizes the substantial environmental impact associated with excessive salt application, including infrastructure corrosion and ecological harm.

Key driving factors supporting the market expansion include increasingly stringent governmental regulations concerning road safety and liability during winter operations, coupled with rapid urbanization that increases the density and area of paved surfaces requiring timely maintenance. Furthermore, the rising adoption of sophisticated, variable-rate technology (VRT) allows operators to precisely control spread width and density based on GPS coordinates and real-time conditions, significantly improving material efficiency and compliance with environmental standards. The benefits derived from using specialized spreaders include enhanced public safety by reducing the risk of slip-and-fall incidents and traffic accidents, reduced liability risks for property owners and municipalities, significant labor cost savings compared to manual application methods, and long-term environmental advantages through optimized material deployment, preventing excessive runoff and accelerating corrosion of critical infrastructure elements like bridges and overpasses. The shift towards multi-season use, where spreaders can also handle fertilizer or sand in other months, adds to their economic justification.

Salt and Sand Spreaders Market Executive Summary

The Salt and Sand Spreaders Market demonstrates robust growth driven primarily by climate unpredictability leading to enhanced investment in winter resilience infrastructure across key markets like North America and Europe. Business trends highlight a strong shift toward automation and precision spreading technology. Manufacturers are focusing intensely on developing spreaders integrated with GPS and sophisticated telematics systems, which facilitate real-time monitoring of application rates, verify coverage maps, and provide comprehensive data logging essential for contractual accountability and governmental reporting. There is a marked trend towards multi-purpose units capable of handling both traditional dry granular materials (rock salt, proprietary blends, sand) and increasingly utilized liquid de-icers (calcium chloride or sodium chloride brine solutions). This versatility offers significant operational flexibility and efficiency gains to end-users operating in varied climatic zones and operational scales. Maintaining supply chain robustness for specialized components, particularly high-performance hydraulic systems, advanced electronic controllers, and highly corrosion-resistant materials (e.g., specialized plastics and coated metals), remains a critical strategic priority for established market stakeholders to ensure inventory availability during peak demand periods.

Regional trends consistently show North America maintaining a definitive market leadership position, largely due to its vast network of public roads and highways, substantial financial allocations in state and local government snow removal budgets, and a high reliance on large, powerful spreading equipment for rapid deployment over wide areas. Europe follows as a major market, characterized by dense population and strong regulatory pressures emphasizing safe, environmentally conscious winter travel, especially prevalent in the Nordic regions, the Alps, and Central European industrial corridors. The demand here often leans toward highly efficient, smaller capacity units suitable for compact urban environments and a pioneering adoption of liquid anti-icing strategies. Asia Pacific, while currently possessing a smaller overall market footprint, is experiencing the highest relative growth rate, primarily fueled by infrastructural improvements and rising urbanization in cold-weather regions of countries such as China, South Korea, and Japan, necessitating modern fleet upgrades.

Segment-wise analysis reveals that the Truck-Mounted segment remains the dominant category in terms of overall revenue generation due to its immense capacity and suitability for large-scale infrastructural maintenance tasks. However, the Electric Powered segment is exhibiting rapid penetration, gaining significant market share within the commercial property management and small-to-medium municipal sectors, owing to its operational simplicity, lower fuel reliance, and reduced maintenance profile compared to complex hydraulic systems. The competitive landscape is intensely focused on technological differentiation, especially concerning material dispersion accuracy and user interface design. Leading manufacturers are actively pursuing strategic alliances and acquisitions focused on expanding their geographical distribution reach and integrating cutting-edge technological capabilities, such as advanced sensor technology and sophisticated cloud-based control systems. The long-term market outlook is overwhelmingly positive, contingent on sustained governmental and private sector investment in modernizing winter fleets and adapting to the continuous and critical requirement for reliable de-icing solutions amidst ongoing climate change challenges that intensify the frequency and severity of winter events.

AI Impact Analysis on Salt and Sand Spreaders Market

User queries regarding the complex influence of Artificial Intelligence (AI) on the Salt and Sand Spreaders Market primarily center on how advanced predictive analytics and machine learning can dramatically optimize resource deployment, enhance operational safety, and revolutionize overall logistical efficiency. End-users, particularly municipal and large commercial fleet managers, are keenly interested in understanding AI's multifaceted role in superior weather pattern forecasting (micro-forecasting), analyzing road surface conditions in near real-time via continuous sensor data streams (e.g., pavement temperature, moisture content, residual salt concentration), and dynamically determining the minimal effective dosage of de-icing materials required to achieve safety targets. A significant portion of user concern revolves around the substantial initial capital investment required for implementing sophisticated, AI-driven control systems and the logistical challenges associated with the necessary specialized training and upskilling of existing fleet operators to effectively manage these advanced tools. Expectations are exceptionally high concerning the development of fully autonomous spreading routes, dynamic, real-time route optimization factoring in live traffic conditions and unexpected weather changes, and comprehensive preventative maintenance scheduling accurately predicted by machine learning algorithms that analyze deep usage patterns and sensor inputs related to mechanical wear and impending component failure. The overarching consensus among market participants is that the integration of AI capabilities will fundamentally transform the entire winter maintenance industry from a traditionally reactive operation into a highly proactive, data-driven, and hyper-efficient logistical challenge, setting new benchmarks for efficiency and accountability.

The implementation of AI will directly address the crucial industry challenge of environmental impact mitigation. By leveraging machine learning models to synthesize vast datasets—including hyper-local weather reports, historical application data, and real-time sensor readings—AI can fine-tune Variable Rate Technology (VRT) systems far beyond current human capabilities. This precision allows fleets to apply only the necessary amount of salt or sand, resulting in massive material cost savings and significantly reducing the negative environmental externalities associated with excessive salt runoff into waterways and soil. AI algorithms can also determine optimal pre-wetting ratios for granular salt, maximizing its efficacy and reducing the total quantity needed. This shift elevates the role of the spreader from a simple dispersal tool to a sophisticated environmental and logistical management system.

Furthermore, AI facilitates integration with broader Smart City frameworks. For municipal customers, AI-powered spreaders become connected assets that communicate with central command centers, reporting road conditions and treatment statuses instantaneously. This connectivity enables dynamic response strategies, such as quickly rerouting spreaders based on real-time accident data or prioritizing areas based on sudden temperature drops detected by vehicle-mounted sensors. This sophisticated orchestration of assets, driven by AI, moves the industry towards a highly automated model, addressing chronic labor shortages in many regions. The long-term vision includes using AI for fleet lifecycle management, predicting which spreaders should be retired or overhauled based on wear patterns observed across an entire fleet, moving procurement away from arbitrary schedules towards data-driven necessity.

- Autonomous route generation based on precise micro-weather models and predictive road surface temperature readings, minimizing unproductive travel time.

- Predictive maintenance scheduling for spreaders utilizing machine learning models to analyze sensor data, thereby minimizing unexpected downtime during critical snow events.

- Optimized material usage through complex AI algorithms that dynamically determine Variable Application Rates (VRT) based on real-time environmental inputs and vehicle speed.

- Real-time performance monitoring and sophisticated anomaly detection in spreading patterns, ensuring regulatory compliance and maximizing coverage effectiveness.

- Seamless integration with wider Smart City infrastructure for holistic, coordinated winter operation management and resource allocation across public services.

- Enhanced operator safety through AI-assisted driving features and workload reduction via automation of routine material calibration tasks.

DRO & Impact Forces Of Salt and Sand Spreaders Market

The dynamics of the Salt and Sand Spreaders Market are shaped by a complex and often conflicting interplay of market drivers, operational restraints, and technological opportunities. The principal market driver remains the unwavering imperative for public safety across global cold-weather jurisdictions, coupled with the immense socio-economic cost associated with road closures, traffic congestion, and accidents resulting from inadequate winter road maintenance. This critical requirement prompts substantial, consistent municipal and governmental investment in the continuous upgrading and expansion of winter fleet assets. Furthermore, the long-term, statistically validated trend of increased frequency and severity of localized, unpredictable winter weather events, often attributed to climate change, forces preparedness and investment throughout the year, stabilizing demand. The driver of infrastructure modernization in emerging markets, especially the expansion of high-speed road networks in APAC, also contributes significantly to demand for high-capacity spreading solutions.

Conversely, the market faces several significant operational and economic restraints. The primary barrier to entry and fleet modernization is the substantially high initial capital expenditure required for specialized, large-capacity spreading equipment, particularly advanced truck-mounted units featuring integrated GPS and VRT capabilities. This high cost often puts budgetary strain on smaller municipalities or private contractors. Furthermore, the volatility and fluctuating costs of key raw materials—notably high-grade steel, specialized polymers for hoppers, and essential hydraulic components—introduce significant manufacturing cost uncertainties. A crucial restraint exerting high pressure on manufacturers is the rising tide of environmental concerns regarding the long-term ecological damage caused by excessive chloride (salt) runoff, which pushes the industry towards more expensive, higher-precision spreading technologies like liquid brine systems and sophisticated VRT, constraining traditional, simpler market segments.

Significant opportunities for future growth are rooted in technological advancements and geographical expansion. The convergence of precision agriculture techniques with de-icing operations presents an immense opportunity for innovation in VRT, high-definition GPS mapping, and automated application systems. The rapid growth in demand for integrated liquid application systems, specifically for brine preparation and specialized pre-wetting equipment, allows manufacturers to capture new revenue streams as end-users move away from reliance solely on dry rock salt. Geographically, opportunities lie in market expansion into developing regions, particularly high-altitude and rapidly urbanizing cold-weather areas in Asia, which are increasingly prioritizing infrastructure maintenance standards. Impact forces currently reflect a market environment dominated by Technological Innovation (driving adoption of VRT and telematics) and Regulatory Compliance (mandating safe and environmentally sensitive application rates), which together exert strong influence over product design, procurement specifications, and competitive advantage.

Segmentation Analysis

The Salt and Sand Spreaders Market is comprehensively segmented based on several critical factors designed to delineate distinct operational needs and market dynamics across various end-user profiles. Analyzing these segments provides a granular view of market performance, revealing specific growth pockets driven by technological preference, capacity requirements, and geographical constraints. The segmentation by Product Type distinguishes the mechanism of dispersal—Centrifugal (Spinner) spreaders are optimized for speed and width, dominating highway applications, while Drop Spreaders offer superior control and precision, essential for pathways and sensitive areas. This foundational distinction reflects the inherent trade-off between speed/coverage and application accuracy demanded by different operational settings. Furthermore, understanding the capacity segmentation is vital, as it directly mirrors the scale of the operation, with high-capacity units (over 15 cubic feet) exclusively serving major municipal and governmental contracts, contrasting sharply with low-capacity units targeting the residential and small commercial maintenance sectors.

Segmentation based on Mounting Type is arguably the most critical operational differentiator, influencing purchasing decisions significantly. Truck-Mounted spreaders, including both in-bed hopper units and smaller tailgate models, represent the bulk of municipal and large contractor spending due to their robust nature and high throughput capabilities. Tow-Behind units offer flexibility for users who lack dedicated fleet vehicles but require significant capacity, often utilized by mid-sized commercial maintenance firms. Conversely, Walk-Behind and Skid-Steer/Tractor Mounted units address highly specialized niche needs: walk-behinds for pedestrian areas and pathways, and skid-steer units providing maneuverability and integration with existing construction equipment fleets. The Power Source segmentation—Hydraulic, Electric, or Engine-driven—is equally crucial, reflecting the technical complexity and energy demands. Hydraulic power, linked directly to the vehicle's engine, is necessary for the powerful, continuous operation required by large capacity VRT systems, whereas electric spreaders appeal to users prioritizing ease of installation and simplicity for lighter tasks.

The application-based segmentation (End-User) clarifies demand profiles. Municipal and Governmental users prioritize durability, service contracts, and telematics integration, focusing on long-term value and compliance. Commercial users, encompassing airport operators, property managers, and retail chains, prioritize versatility, rapid deployment capability, and efficient material consumption to manage operational costs. The residential sector remains highly price-sensitive, focusing on ease of storage and basic functionality. The competitive strategies of manufacturers often pivot on successfully addressing the unique needs defined by this multi-faceted segmentation structure, developing distinct product lines that cater to the specific demands of highway clearance versus sidewalk management, or large-scale brine application versus small-scale rock salt distribution, ensuring comprehensive market coverage.

- By Product Type:

- Spinner Spreaders (Centrifugal) - High speed, wide coverage, dominant for highways.

- Drop Spreaders (Gravity Feed) - High precision, controlled application, preferred for sidewalks/pathways.

- Vibrating Spreaders - Primarily for fine materials or specialized chemical blends.

- Liquid/Brine Spreaders - Focus on pre-wetting or anti-icing applications.

- By Mounting Type:

- Truck-Mounted (In-bed Hopper Spreaders) - High capacity, professional municipal use.

- Tailgate Spreaders (Truck/SUV) - Medium capacity, commercial and light municipal use.

- Tow-Behind (Trailer Spreaders) - Flexible, used when dedicated trucks are unavailable.

- Walk-Behind (Push-Type) - Low capacity, residential and sidewalk management.

- Tractor/Skid-Steer Mounted - Used for versatile site maintenance and existing equipment integration.

- By Power Source:

- Hydraulic Powered - Highest power output, essential for large VRT systems and high torque.

- Electric Powered (12V/24V) - Simple installation, low maintenance, suitable for light-to-medium use.

- Gasoline/Diesel Engine Powered - Self-contained power for non-standard vehicles or tow-behind units.

- By Capacity (Cubic Feet):

- Low Capacity (Under 5 cu ft) - Residential and small commercial.

- Medium Capacity (5 to 15 cu ft) - Mid-size commercial and lighter municipal tasks.

- High Capacity (Over 15 cu ft) - Heavy-duty municipal, state DOT, and airport applications.

- By Application/End-User:

- Municipal & Government (DOTs, Public Works) - Focus on high-capacity, VRT integration.

- Commercial (Property Management, Retail, Logistics Centers) - Focus on flexibility and efficiency.

- Aviation (Airports & Military Bases) - Specialized, high-speed, zero-tolerance equipment.

- Residential & Private Use - Focus on affordability and ease of storage.

- Industrial Facilities (Ports, Mines) - Heavy-duty, robust spreaders for harsh environments.

Value Chain Analysis For Salt and Sand Spreaders Market

The intricate value chain of the Salt and Sand Spreaders Market initiates with a highly specialized upstream segment focused on material procurement and component manufacturing. Raw material sourcing demands include securing continuous supplies of high-grade, cold-rolled steel and aluminum alloys necessary for the chassis and internal mechanical components of heavy-duty spreaders, alongside specialized, UV-resistant, high-density polyethylene (HDPE) resins for the increasingly popular poly-hopper designs that offer superior corrosion resistance. This stage also encompasses the procurement of advanced electronic and hydraulic sub-assemblies. Component manufacturers supply critical parts such as precision gearboxes, high-flow hydraulic pumps, electronic control units (ECUs), and GPS/telematics hardware. The resilience and reliability of this upstream supply network are paramount, as any disruption in the delivery of corrosion-resistant components or specialized control systems can severely bottleneck production, particularly preceding peak winter demand seasons. Effective upstream risk management involves strategic long-term contracts and dual-sourcing strategies for critical, highly specialized components.

The manufacturing and assembly phase represents the core transformation stage where manufacturers leverage efficient fabrication techniques, including robotic welding and advanced polymer molding processes. A critical value-add in this phase is the application of highly protective, multi-layer powder coatings or specialized rust inhibitors to metal components, essential for equipment survival in the intensely corrosive environment created by de-icing salts. Downstream distribution is characterized by its bifurcated structure. Direct sales channels are reserved primarily for large-scale governmental procurement—municipal and state-level tenders—where manufacturers engage directly with procurement officers, often providing extensive customization, installation, and long-term service agreements. This channel emphasizes relationship management and compliance with detailed technical specifications. Indirect distribution relies heavily on a robust network of specialized local equipment dealers, agricultural machinery outlets, and authorized regional distributors who possess the necessary logistical capabilities and expertise to manage local inventory, facilitate financing, and provide expert installation onto various vehicle types.

The value capture post-sale is substantially vested in the after-market segment. Given the harsh operating conditions, spreaders require continuous maintenance, frequent replacement of wear parts (e.g., spinner discs, feed gates, motors), and technical servicing of complex VRT and hydraulic systems. The profitability and long-term customer satisfaction for manufacturers are significantly linked to the efficiency and reliability of their spare parts supply chain and the technical competency of their authorized service network. Furthermore, the installation and initial calibration of advanced spreaders, especially those integrating with vehicle telematics and governmental reporting systems, add significant value at the point of sale, demanding specialized training for dealer technicians. The shift towards liquid de-icing systems is also creating new value streams in the downstream through the sale and maintenance of associated brine preparation equipment, specialized tanks, and complex pump assemblies.

Salt and Sand Spreaders Market Potential Customers

The primary customers for salt and sand spreaders are organizations responsible for maintaining the safety and accessibility of paved surfaces during winter conditions. This broad group can be categorized into institutional, commercial, and private buyers, each having distinct needs concerning capacity, mounting type, and material compatibility. Municipalities and government agencies, including state Departments of Transportation (DOTs) and local Public Works departments, represent the largest customer base, demanding high-capacity, durable, truck-mounted or chassis-mounted hydraulic spreaders for highways and major roads. These contracts are often large-scale, influenced by budgetary cycles and public bidding processes, demanding reliability and often advanced features like VRT and telematics.

Commercial customers constitute a highly dynamic segment, encompassing private snow removal contractors, large property management firms, and businesses such as large retail centers, hospitals, and corporate campuses that manage their own grounds. These users typically favor medium-to-high capacity tailgate spreaders or tow-behind units that offer versatility across various types of property sizes and can be easily moved between different vehicles. For specialized environments like airports, customers require highly precise, often large-scale liquid or granular spreaders to ensure operational safety on runways, prioritizing speed and accurate coverage over cost efficiency.

The residential and small commercial segment targets customers requiring lighter-duty equipment, such as walk-behind (push) spreaders or small tailgate-mounted electric units. This customer base includes individual homeowners, small business owners, and maintenance staff for smaller apartment complexes. Purchasing decisions in this segment are highly influenced by ease of use, storage convenience, and initial purchase price. The overall customer base is unified by the non-negotiable need for operational reliability when weather strikes, making brand reputation for durability a key determinant in procurement decisions across all segments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $750 Million |

| Market Forecast in 2033 | $1,110 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Douglas Dynamics (Western Products, Fisher Engineering, Henderson Products), Buyers Products Company, SnowEx (A Division of TrynEx International), Boss Snowplow (A division of The Toro Company), Meyer Products, Swenson Spreader, Vestergaard Company, EPOKE A/S, Kahlbacher Machinery GmbH, Hiniker Company, Arctic Snow and Ice Products, Cirus Controls, SnowDogg, Aebi Schmidt Group (Through subsidiary brands), Zaugg AG Eggiwil, Hill Tip Oy, Spreader Pro, F.P. Smith Equipment Co., Tellefsdal AS, Curti Spa. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Salt and Sand Spreaders Market Key Technology Landscape

The technological landscape of the Salt and Sand Spreaders Market is undergoing a rapid transition, shifting significantly from purely mechanical dispersal towards highly sophisticated, digitally controlled systems focused on optimizing precision, maximizing resource efficiency, and minimizing environmental externalities. The most impactful innovation currently permeating the professional market is the advanced adoption of Variable Rate Technology (VRT). VRT systems represent a massive technological leap, utilizing high-accuracy GPS coordinates, integrated fleet management software, and continuous input from real-time environmental sensors (such as road surface temperature probes, residual salt level detectors, and ambient air sensors) to instantaneously and automatically adjust the flow rate and spread width of de-icing materials. This crucial technology effectively eliminates unnecessary application, leading to substantial material cost reductions (sometimes up to 30%) and drastically mitigating the significant environmental damage associated with excessive chloride runoff, positioning VRT compliance as a mandatory feature for major governmental procurement tenders.

A second major technological advancement involves the deep integration of advanced telematics and Internet of Things (IoT) connectivity into spreader units. Contemporary professional spreaders are now equipped standard with robust cellular connectivity modules, allowing fleet managers and municipal command centers to remotely monitor essential operational status metrics, precisely track material usage rates per route segment, verify complete coverage maps through GIS overlays, and proactively manage preventative maintenance schedules in real-time. This level of connectivity provides enhanced operational accountability, critical for governmental transparency, and dramatically improves logistical planning, guaranteeing timely material replenishment and efficient resource allocation during multi-day severe weather events. Furthermore, there is an accelerating industry-wide movement towards specialized liquid application technology (brine preparation and spreading systems), which necessitates the development of sophisticated, high-pressure pump systems, extremely durable corrosion-resistant storage tanks, and precision-engineered nozzle arrays designed for uniform distribution, minimal atmospheric drift, and optimized adhesion to the road surface, presenting a distinct and complex technological challenge compared to traditional granular material handling.

Finally, continuous material science engineering constitutes a critical technological pillar, ensuring equipment longevity in highly corrosive operating environments. Manufacturers are relentlessly investing in research and development to create advanced corrosion-resistant materials for all exposure surfaces, including specialized grades of stainless steel, innovative composite materials, and high-density polyethylene (HDPE) plastics specifically formulated for superior chemical and impact resistance. These material innovations are vital as they directly extend the functional lifespan of the equipment, reducing total cost of ownership for end-users. The latest engineering efforts are focused on the development of multi-material handling systems, capable of managing dry granular materials, pre-wet granular materials, and pure liquid brine sequentially or simultaneously, maximizing the spreader’s utility across varying weather conditions and maximizing the effectiveness of the chosen de-icing strategy through multi-functional capability and advanced control interfaces.

Regional Highlights

The Salt and Sand Spreaders Market exhibits profound geographical variation, with market size and growth highly dependent on regional climatic profiles, infrastructure density, and prevailing governmental regulations concerning winter safety. North America (NA) remains the global market powerhouse, holding the majority share due to its vast network of federal and state highways, substantial financial commitment via dedicated municipal and DOT budgets for continuous snow removal, and the non-negotiable public expectation of immediate road accessibility during winter events. Demand in this region is strongly biased towards high-capacity (over 10 cubic yards), highly durable, truck-mounted hydraulic systems, with stringent requirements for integrated VRT, comprehensive telematics integration, and specialized configurations for anti-icing operations on interstates and major arterial roads. Major manufacturers maintain extensive distribution and service networks across the cold-weather states of the US and the provinces of Canada, making competition intense and focused on reliability and service agreements.

Europe constitutes the second largest and arguably the most technologically advanced market, driven by the strong influence of EU directives promoting sustainable maintenance practices and the high density of urban areas requiring precise application control. Market performance is exceptionally strong in the Nordic countries (Sweden, Norway, Finland), Central Europe (Germany, Switzerland, Austria), and Eastern European industrial zones. The European market displays a higher adoption rate of highly efficient, smaller capacity units suitable for compact, sensitive urban environments and is pioneering the widespread use of liquid anti-icing strategies, requiring specialized brine spreaders and pre-wetting attachments. Regulatory focus on minimizing environmental impact has compelled manufacturers serving this region to prioritize extremely accurate dosage control and material conservation, leading to high specification demands even for smaller, city-focused equipment.

The Asia Pacific (APAC) region is forecasted to exhibit the highest Compound Annual Growth Rate (CAGR) over the projection period, although starting from a comparatively lower base. Growth is substantially concentrated in the northern provinces of China, key industrial zones in South Korea, and high-altitude areas of Japan and India, where rapid economic development is increasing the expectation for sophisticated, reliable winter infrastructure maintenance. As these regions modernize their road networks and expand urban areas, local governments are bypassing older mechanical technologies and investing directly in advanced, precision-focused spreading equipment. Latin America and the Middle East and Africa (MEA) currently maintain minimal overall market share, with demand restricted primarily to high-altitude urban centers (e.g., in the Andes) or geographically specific regions prone to frost and occasional freezing events. However, increasing development of mining and large industrial sites in colder zones within these regions is slowly creating niche, high-specification B2B opportunities for reliable, industrial-grade spreading equipment.

- North America (Market Leader): Dominates revenue; characterized by large-scale municipal and DOT procurement; mandatory integration of VRT and robust telematics; preference for high-capacity hydraulic truck-mounted spreaders (US and Canada).

- Europe (Technology Innovator): High adoption of liquid de-icing (brine) systems; market driven by stringent environmental and safety regulations; strong demand for multi-functional, precision-controlled equipment suitable for dense urban environments (Nordic, Central Europe).

- Asia Pacific (High Growth Potential): Fastest growing segment due to infrastructural modernization and urbanization in cold regions; rapid adoption of contemporary precision technology and high-quality equipment in countries like China, Japan, and South Korea.

- Latin America & MEA (Developing Niche Markets): Limited penetration concentrated in geographically specific high-altitude or sporadically cold industrialized zones; demand focused on essential, robust, and often self-powered spreading solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Salt and Sand Spreaders Market.- Douglas Dynamics (Western Products, Fisher Engineering, Henderson Products)

- Buyers Products Company

- SnowEx (A Division of TrynEx International)

- Boss Snowplow (A division of The Toro Company)

- Meyer Products

- Swenson Spreader

- Vestergaard Company (Specialized Airport Equipment)

- EPOKE A/S

- Kahlbacher Machinery GmbH

- Hiniker Company

- Arctic Snow and Ice Products

- Cirus Controls

- SnowDogg

- Aebi Schmidt Group (Through subsidiary brands)

- Zaugg AG Eggiwil

- Hill Tip Oy

- Spreader Pro

- F.P. Smith Equipment Co.

- Tellefsdal AS

- Curti Spa

Frequently Asked Questions

Analyze common user questions about the Salt and Sand Spreaders market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Variable Rate Technology (VRT) in salt spreaders and why is it essential?

VRT is a precision spreading system that uses GPS mapping and real-time road condition sensors (e.g., pavement temperature) to automatically and continuously adjust the flow rate and spread width of de-icing material. It is essential because it ensures the optimal, minimal effective dosage is applied, dramatically reducing material waste, lowering operational costs, and significantly mitigating the negative environmental impact of chloride runoff.

How do municipalities decide between hydraulic and electric powered spreaders?

Municipalities typically choose hydraulic spreaders for their primary, high-capacity fleet vehicles (e.g., highway trucks) due to their superior power, robust continuous operation capability, and seamless integration with heavy-duty engine systems. Electric spreaders are increasingly selected for utility vehicles, park maintenance, or light municipal duties because of their lower installation complexity, ease of use, and reduced maintenance costs, making them ideal for versatility.

What is the future outlook for liquid de-icing (brine) systems?

The future outlook for liquid de-icing systems is exceptionally positive. Driven by environmental regulations and the proven efficacy of anti-icing (pre-treatment) strategies, the demand for specialized brine preparation and high-precision liquid spreaders is growing rapidly, particularly in Europe and across large commercial and airport applications, indicating a significant market segment shift.

What are the primary maintenance challenges for salt spreading equipment?

The primary maintenance challenge is severe corrosion caused by the abrasive and chemical nature of de-icing materials. This necessitates frequent washing, lubrication, and inspection of critical components (motors, chains, hydraulics). Modern poly hopper materials and corrosion-resistant coatings are being adopted to increase equipment lifespan and reduce premature failure during peak season.

Which geographical market segment is projected to grow the fastest?

The Asia Pacific (APAC) market is projected to grow the fastest, fueled by major governmental investments in infrastructure modernization and urbanization in cold-weather zones, particularly in China and South Korea. These regions are rapidly adopting high-specification spreading technology to meet evolving road safety standards.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager