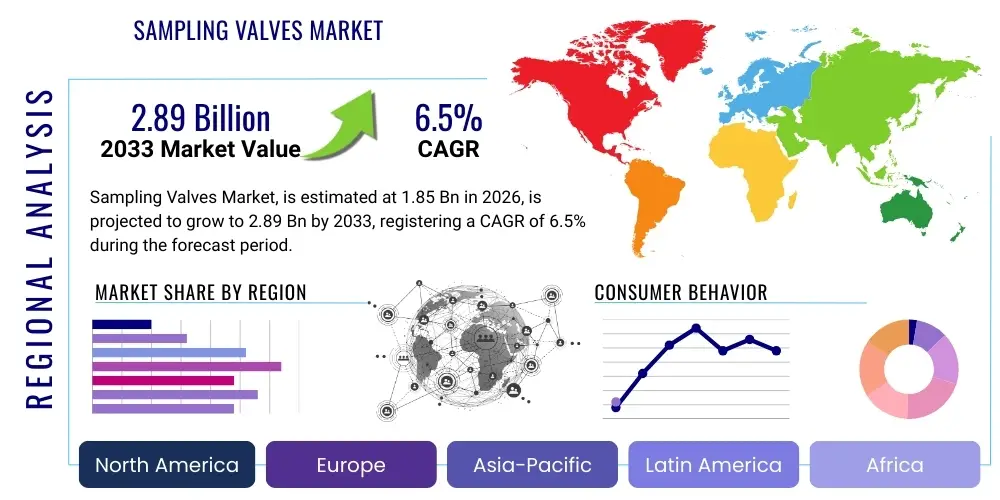

Sampling Valves Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443424 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Sampling Valves Market Size

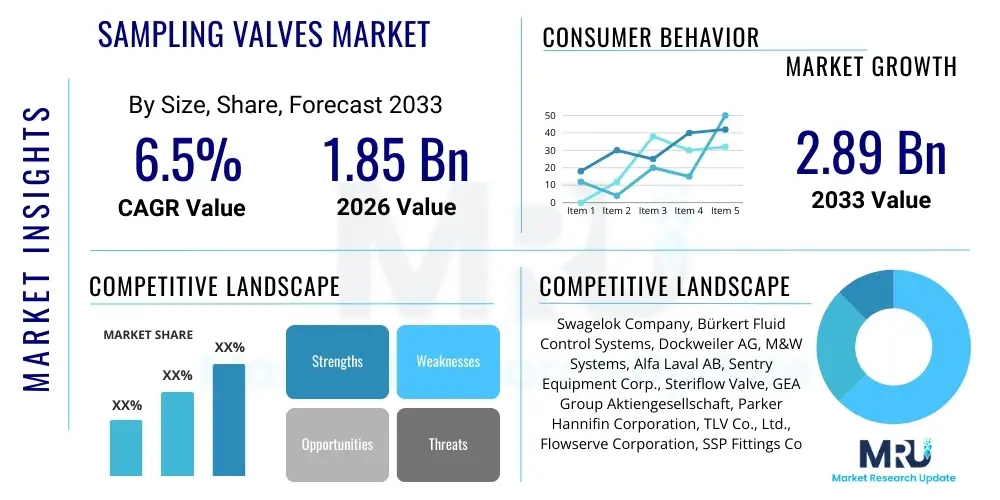

The Sampling Valves Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 1.85 Billion in 2026 and is projected to reach USD 2.89 Billion by the end of the forecast period in 2033.

Sampling Valves Market introduction

The Sampling Valves Market encompasses the global industry dedicated to the design, manufacturing, and distribution of specialized valves used to safely extract representative samples of liquids, gases, or slurries from process lines without disrupting the main flow or exposing the operator or environment to hazardous materials. These critical components ensure process integrity, quality control, and compliance across highly regulated industries. Sampling valves range from basic manual designs to complex automated aseptic systems, tailored specifically to maintain sample purity and operational safety under varied pressure, temperature, and chemical conditions. The fundamental role of these valves is bridging the gap between real-time process control and laboratory analysis, ensuring that the collected sample accurately reflects the materials within the production system at the time of extraction.

Product descriptions within this market vary widely based on the intended application and required level of sterility. Aseptic sampling valves, crucial in pharmaceutical and biotechnology sectors, feature unique diaphragm or piston mechanisms designed to sterilize the valve before and after sampling, completely isolating the process media from the external environment and preventing cross-contamination. Conversely, standard closed-loop sampling systems are predominant in the oil and gas or chemical processing industries, focusing on safely containing volatile or toxic substances during extraction. Major applications span stringent quality assurance in beverage manufacturing, monitoring chemical reactions in petrochemical plants, and ensuring batch consistency in API (Active Pharmaceutical Ingredient) production. The increasing complexity of industrial processes and the heightened focus on regulatory compliance are central factors solidifying the necessity of reliable and certified sampling equipment.

Key benefits derived from utilizing advanced sampling valves include enhanced operator safety by eliminating manual exposure risks, improved data accuracy through representative sample extraction, and significant reduction in product contamination risk, which is paramount in sanitary environments. Driving factors accelerating market growth include stringent global regulatory standards, particularly from bodies like the FDA and EMA, mandating rigorous quality checks and traceability in drug and food production. Furthermore, the expansion of the biopharmaceutical industry, characterized by high-value, sensitive biological products requiring ultra-clean sampling techniques, along with continuous technological innovations focused on automation and integration with digital process monitoring systems, are propelling the adoption of advanced sampling solutions globally.

Sampling Valves Market Executive Summary

The global Sampling Valves Market is currently experiencing robust growth, primarily propelled by the relentless focus on process optimization and regulatory adherence across major industrialized sectors. Business trends highlight a strong shift toward automation, with end-users increasingly demanding integrated sampling systems that offer remote operation, data logging capabilities, and connectivity with central control systems (SCADA/DCS). This demand for smart sampling solutions is transforming the competitive landscape, emphasizing innovation in material science, particularly specialized alloys and polymer seals capable of withstanding extreme chemical resistance and temperature fluctuations found in demanding industries such as specialty chemicals and refining. Furthermore, mergers and acquisitions remain a strategic tool for key market players to acquire niche technologies, expand their geographical footprint, and consolidate market share in specialized segments like aseptic sampling.

Regional trends indicate that Asia Pacific (APAC) is emerging as the fastest-growing market, driven by massive investments in new pharmaceutical manufacturing facilities, rapid expansion of the food and beverage processing industry, and infrastructure development in the chemical sector, particularly in countries like China and India. North America and Europe, while mature, maintain leading market shares due to stringent regulatory frameworks and the early adoption of advanced, high-cost aseptic sampling technologies critical for biologics and advanced therapy medicinal products (ATMPs) production. The Middle East and Africa (MEA) are also showing promising growth, primarily catalyzed by the revitalization and expansion of the region's vast oil and gas infrastructure, necessitating high-pressure, corrosion-resistant sampling solutions for upstream and downstream operations.

Segment trends reveal that the Aseptic Sampling Valves segment, driven by the biopharma boom, is exhibiting the highest growth trajectory, commanding premium pricing due to complex design and certification requirements. Concurrently, based on material, stainless steel remains the dominant choice due to its robustness and hygienic properties, although specialized alloys are gaining traction for harsh chemical applications. The trend toward modular design is simplifying installation and maintenance, appealing to facilities prioritizing operational uptime. The market is witnessing increased utilization of closed-loop sampling systems across industries handling hazardous or environmentally sensitive media, demonstrating a fundamental commitment to environmental protection and worker safety as a core segment driver.

AI Impact Analysis on Sampling Valves Market

User queries regarding AI's impact on the Sampling Valves Market generally revolve around how artificial intelligence and machine learning (ML) can enhance the sampling process, moving beyond simple automation to predictive and prescriptive quality control. Key themes include the integration of AI-driven analytics with sampling data to predict batch quality deviations before they occur, optimizing sampling frequency based on real-time process variability, and leveraging computer vision systems for automated sample integrity verification. Concerns center on the cost of integrating these advanced technologies into existing infrastructure and the need for standardized protocols to ensure AI-generated insights are compliant with highly regulated standards like FDA validation requirements. Expectations are high regarding the capability of AI to transform routine, labor-intensive sampling into a highly optimized, continuous quality monitoring process, dramatically reducing human error and resource expenditure.

The direct integration of AI models, particularly machine learning algorithms, into the control architecture surrounding sampling valves enables the creation of 'smart sampling schedules.' Instead of fixed time intervals, the system uses predictive models based on historical batch data, sensor readings (e.g., pH, temperature, pressure), and input material variability to determine the optimal moment for sample extraction. This optimization maximizes the representativeness of the sample while minimizing waste and unnecessary laboratory effort. For instance, in fermentation processes, AI can identify precursor conditions signaling potential contamination or yield reduction, automatically triggering an immediate, targeted sample extraction for deep analysis, thereby ensuring proactive intervention rather than reactive quality failure management.

Furthermore, AI significantly enhances the post-sampling analysis and traceability chain. Data generated by automated sampling systems—including time stamps, valve cycle counts, and differential pressure readings—are fed into ML models to predict valve failure or maintenance needs (predictive maintenance). In quality control laboratories, AI-powered image recognition systems can analyze microscopic sample images or spectroscopic data much faster and more accurately than human technicians, ensuring compliance and rapid release. This shift moves sampling from a necessary compliance step to an integral, data-generating component of a fully digitalized manufacturing environment, boosting operational efficiency and adherence to Pharma 4.0 principles, thereby demanding valves with higher sensor integration and communication capabilities.

- AI optimizes sampling frequency based on real-time process parameters, reducing unnecessary samples.

- Predictive analytics driven by ML forecasts valve maintenance needs, minimizing unexpected operational downtime.

- Integration with computer vision systems enables automated verification of sample integrity and purity.

- AI enhances data traceability and audit trails, crucial for regulatory compliance in highly sensitive industries.

- Machine learning models process real-time sensor data from valves, improving overall process stability assessment.

- Prescriptive quality control using AI identifies process deviations, automatically triggering specialized sampling protocols.

DRO & Impact Forces Of Sampling Valves Market

The Sampling Valves Market is fundamentally shaped by a powerful interplay of Drivers, Restraints, and Opportunities, which collectively determine its trajectory and impact the operational strategies of market participants. The primary Driver is the escalating need for stringent process safety and quality control standards across globally regulated industries, especially pharmaceuticals, where Good Manufacturing Practices (GMP) require highly reliable, verifiable, and aseptic sampling methods to prevent costly batch failures. Coupled with this is the continuous expansion of complex manufacturing environments, such as those producing high-potency active pharmaceutical ingredients (HPAPIs) or biofuels, which demand specialized, corrosion-resistant, and high-pressure sampling solutions, consequently driving premium valve demand. Additionally, the industrial trend toward digitalization and automation necessitates sampling valves that are easily integrated into Industrial Internet of Things (IIoT) frameworks and distributed control systems (DCS), increasing demand for intelligent, electronically actuated valves.

However, the market faces significant Restraints that temper growth and challenge profitability. The high initial investment costs associated with advanced, custom-engineered aseptic sampling systems often deter small and medium-sized enterprises (SMEs) in emerging economies, forcing reliance on older, less safe, or non-compliant methods. Furthermore, the specialized nature of valve manufacturing requires high precision, certified materials, and lengthy validation processes, leading to complex supply chains and extended lead times, which can slow project execution for end-users. Regulatory complexity presents another hurdle; while regulation drives demand, the rapidly evolving standards—particularly concerning material compatibility, cleaning in place (CIP), and sterilization in place (SIP) validation—require continuous redesign and re-certification of valve products, increasing R&D overheads.

Opportunities for growth are vast, largely centered on technological advancement and geographical expansion. The growing prominence of the biotechnology sector, focusing on personalized medicine and cell and gene therapies, creates a niche, high-value opportunity for ultra-sterile, miniaturized sampling valves capable of handling small, critical volumes. Another significant opportunity lies in the retrofitting and modernization of aging industrial infrastructure, particularly in the oil and gas sectors of North America and Europe, where obsolete manual sampling points are being replaced with safer, closed-loop automated systems to meet updated emission and safety standards. The final crucial opportunity is market penetration into nascent but rapidly industrializing regions like Southeast Asia and specific parts of Latin America, where rapid infrastructure development translates directly into new installations requiring certified sampling components.

- Drivers: Stringent regulatory mandates (GMP, FDA), growth of the biopharmaceutical industry, increased focus on operator safety, and demand for automated process monitoring.

- Restraints: High capital expenditure required for advanced aseptic systems, complexity of regulatory compliance and validation, and competitive pressure from established manufacturers offering conventional solutions.

- Opportunities: Expansion into high-growth sectors (Cell & Gene Therapy), technological advancements in intelligent and sensor-equipped valves, and modernization projects in traditional heavy industries.

- Impact Forces: Regulatory compliance is the strongest impact force, mandating the adoption of high-integrity valves regardless of cost, followed by technological innovation leading to safer, representative sampling methods.

Segmentation Analysis

The Sampling Valves Market is systematically segmented based on Type, Mechanism, End-User Industry, and Application, reflecting the diverse and often highly specialized requirements across various industrial landscapes. Understanding these segmentations is critical for market participants to tailor their product development and marketing strategies. The core differentiation often lies in the valve's capability to maintain sterility and the operational safety features it incorporates. For instance, segments catering to the pharmaceutical sector prioritize aseptic design, while those serving the chemical or oil and gas industries focus on pressure ratings, material compatibility, and leak prevention under hazardous conditions. This granular analysis provides actionable insights into demand patterns and competitive intensity within niche markets, highlighting areas of accelerated investment and technological requirement.

The segmentation by End-User Industry is particularly influential, with Pharmaceuticals & Biotechnology driving the innovation curve for aseptic technologies, demanding specialized materials and zero dead-leg designs. Conversely, the Chemical Processing segment focuses on high-durability materials and advanced sealing technologies to manage corrosive and high-temperature media. Application-wise, quality control remains the largest segment, as regulatory bodies increasingly demand verifiable proof that samples accurately represent the entire batch. The trend towards continuous manufacturing in biopharma, however, is significantly boosting the Process Monitoring segment, requiring valves capable of frequent, low-volume sampling integrated directly into automated process analytical technology (PAT) frameworks.

Furthermore, segmentation by Mechanism distinguishes between conventional valve types like ball and piston valves (suited for non-sterile, high-flow applications) and specialized diaphragm or bellows-sealed valves (essential for aseptic or zero-emission requirements). The increasing adoption of automated sampling valves over manual ones across all segments underscores the market's trajectory towards minimizing human interference and enhancing repeatability. Manufacturers are strategically focusing on developing modular product lines that can be easily customized across these segments, offering different materials, actuator types, and surface finishes to meet the highly heterogeneous demands of global industrial customers, thereby optimizing manufacturing efficiency.

- By Type: Sterile Sampling Valves, Non-Sterile Sampling Valves, Aseptic Sampling Valves, Manual Sampling Valves, Automated Sampling Valves.

- By Mechanism: Diaphragm Valves, Ball Valves, Piston Valves, Needle Valves, Bellows-Sealed Valves.

- By End-User Industry: Pharmaceuticals & Biotechnology, Food & Beverage, Chemical Processing, Oil & Gas, Water Treatment, Petrochemicals.

- By Application: Process Monitoring, Quality Control (QC), Research & Development (R&D), Regulatory Compliance, Environmental Monitoring.

Value Chain Analysis For Sampling Valves Market

The Value Chain for the Sampling Valves Market begins with upstream activities centered on raw material procurement and precision engineering. Upstream suppliers are critical and focus predominantly on high-grade stainless steel (316L being common), specialized alloys (like Hastelloy or Monel for corrosive media), and high-performance sealing materials (PTFE, PEEK, or various elastomers). The core competitive advantage at this stage lies in securing consistent quality and traceability of materials, especially for components destined for aseptic applications where surface finish and chemical resistance are non-negotiable requirements. Manufacturers invest heavily in sophisticated CNC machining and cleanroom assembly facilities to maintain the required standards of precision and hygiene before the valve body and internal components are integrated.

The manufacturing stage involves rigorous design, prototyping, testing, and certification, often requiring compliance with multiple international standards (e.g., ASME BPE, EHEDG). Sampling valve manufacturers strategically position themselves either as comprehensive system providers, offering fully integrated automated skids including controls and analysis preparation, or as niche component specialists focusing solely on specific valve types, such as patented zero dead-leg designs. Distribution channels play a pivotal role in linking the manufacturer to the highly diverse end-user base. Direct channels are commonly used for large, custom-engineered projects, particularly those involving advanced aseptic systems in the biopharma sector, where technical consultation, installation supervision, and validation support are essential components of the sale.

Conversely, indirect distribution, utilizing specialized industrial distributors, regional agents, and integrated channel partners, is prevalent for standard, high-volume valves sold to general chemical or water treatment plants. These indirect channels provide necessary inventory management, local technical support, and rapid delivery services. Downstream activities involve installation, commissioning, validation (a major cost driver in pharma), and extensive after-sales services, including calibration, spare parts supply, and maintenance contracts. The longevity and reliability of a sampling valve heavily depend on the effectiveness of these downstream support services, creating a significant point of differentiation and customer loyalty for manufacturers offering comprehensive life-cycle support.

Sampling Valves Market Potential Customers

The primary end-users and buyers of sampling valves are organizations operating in highly regulated process industries where accurate, repeatable, and safe extraction of process media is mandatory for quality assurance, regulatory reporting, and environmental protection. The largest cluster of potential customers resides within the Pharmaceutical and Biotechnology sectors, encompassing large multinational drug manufacturers, contract manufacturing organizations (CMOs), and research institutes involved in the production of biologics, vaccines, and small molecule APIs. For these customers, the critical requirement is the aseptic and sterile transfer of samples, necessitating high-specification diaphragm and bellows valves with robust material certifications and complete traceability of components and surface finishes to meet strict FDA and EMA guidelines for current Good Manufacturing Practices (cGMP).

Another substantial customer segment includes the Food and Beverage industry, ranging from large brewing companies and dairies to producers of specialized food ingredients. Here, potential buyers require hygienic sampling valves that ensure product safety and prevent microbial contamination, focusing on ease of cleaning (CIP/SIP capability) and compliance with sanitary design standards (e.g., 3-A Sanitary Standards). Although the pressure and temperature requirements might be less extreme than in the chemical sector, the emphasis on sanitary design and rapid turnaround for quality checks makes them a high-volume consumer of moderately complex sampling equipment.

Finally, the heavy industry cluster—including Oil & Gas (upstream, midstream, and downstream), Petrochemicals, and Chemical Processing—represents a crucial market segment. Buyers in these sectors are driven by process safety and environmental regulations (Zero Emission goals), demanding high-pressure, corrosion-resistant, and robust closed-loop sampling systems capable of handling volatile organic compounds (VOCs) and highly toxic fluids safely. These customers typically require heavy-duty valves manufactured from specialized alloys, often bundled with sophisticated instrumentation for automated pressure and flow control during the sampling process. The procurement cycle for these buyers is typically longer, focusing heavily on proven reliability and vendor certifications for hazardous area operations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.85 Billion |

| Market Forecast in 2033 | USD 2.89 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Swagelok Company, Bürkert Fluid Control Systems, Dockweiler AG, M&W Systems, Alfa Laval AB, Sentry Equipment Corp., Steriflow Valve, GEA Group Aktiengesellschaft, Parker Hannifin Corporation, TLV Co., Ltd., Flowserve Corporation, SSP Fittings Corp., Keofitt A/S, SchuF Fetterolf, SampleSafe Systems |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Sampling Valves Market Key Technology Landscape

The technological landscape of the Sampling Valves Market is characterized by continuous innovation focused on enhancing sample integrity, operational safety, and system automation, driven largely by the demands of the biopharmaceutical industry. A major development is the evolution of aseptic diaphragm valves utilizing radial seal technology and zero dead-leg designs, minimizing internal crevices where microbial contamination could proliferate. These advanced valves often feature specialized polishing techniques, achieving internal surface roughness (Ra values) below 0.4 µm, mandatory for highly sensitive media. Furthermore, material innovation includes the introduction of specialized composite diaphragm materials that offer extended operational life and superior chemical compatibility compared to traditional PTFE, crucial for handling aggressive cleaning agents and sterilization media.

Another significant technological shift is the widespread adoption of closed-loop sampling systems, particularly in the chemical and petrochemical industries. These systems utilize hermetically sealed containers and complex valve manifold configurations to extract samples without releasing process media into the atmosphere, directly addressing stricter environmental and worker safety regulations concerning fugitive emissions and exposure to hazardous volatile organic compounds (VOCs). Integration of sophisticated flow control mechanisms, often utilizing proportional control valves and integrated pressure sensors, ensures that the sample velocity and volume are perfectly controlled, thereby guaranteeing a representative sample even from high-pressure lines, leading to higher accuracy in laboratory analysis.

The most forward-looking trend involves the integration of smart technology and automation. Modern sampling valves are increasingly equipped with built-in sensors (e.g., temperature, pressure, valve position indicators) and actuators that allow for remote operation and seamless communication via protocols like Ethernet/IP or PROFIBUS with centralized control systems. This enables automated sampling sequences, real-time logging of operational data, and sophisticated diagnostics, facilitating predictive maintenance strategies. The convergence of sampling technology with Process Analytical Technology (PAT) tools, such as inline spectroscopy or chromatography pre-treatment systems, is transforming the market, allowing for continuous, near-real-time quality measurement, thus accelerating batch release and moving manufacturing closer to the goal of Pharma 4.0 fully integrated digital operations.

Regional Highlights

- North America (USA and Canada): North America holds a dominant position in the Sampling Valves Market, primarily driven by the colossal size and strict regulatory oversight of the pharmaceutical and biotechnology sectors, especially in the United States. High demand exists for custom-engineered, validated aseptic sampling systems necessary for biologics and advanced therapeutics manufacturing. Furthermore, the region’s mature oil and gas infrastructure is undergoing modernization, creating strong demand for closed-loop, automated sampling systems that comply with stringent OSHA and EPA safety standards regarding emissions and worker exposure. Technological adoption rates, including sensor integration and automated controls, are among the highest globally.

- Europe (Germany, UK, France, Italy): Europe is characterized by a strong manufacturing base and robust regulatory environments (EMA, EHEDG standards), ensuring continuous demand for high-quality, hygienic, and certified sampling equipment. Germany leads the demand, driven by its sophisticated chemical industry and precision engineering heritage. The UK and Ireland show high demand due to significant investment in biotechnology hubs. European regulations regarding environmental protection and food safety mandate the use of high-integrity valves, positioning the region as a critical market for premium, specialized sampling solutions, particularly in brewery and dairy processing.

- Asia Pacific (APAC) (China, India, Japan, South Korea): APAC is projected to be the fastest-growing market over the forecast period. This rapid growth is fueled by massive government and private investments in expanding pharmaceutical production capacity, the burgeoning food and beverage industry catering to rapidly growing middle-class populations, and significant infrastructure build-out in chemical processing. While Japan and South Korea lead in adopting advanced, automated technologies, China and India represent massive volume markets, increasingly shifting from conventional manual systems to more sophisticated, safe, and efficient automated sampling methods to meet rising domestic quality standards and export requirements.

- Latin America (Brazil, Mexico): This region represents a developing market segment, primarily driven by investments in the oil and gas sector (particularly Brazil's pre-salt reserves and Mexico's petrochemical revitalization) and local pharmaceutical production aimed at import substitution. The market is characterized by a mix of mature and older facilities, creating demand both for new installations requiring basic, robust sampling valves and modernization projects adopting international safety standards, particularly concerning high-pressure applications.

- Middle East and Africa (MEA): Growth in MEA is highly concentrated within the Gulf Cooperation Council (GCC) nations, driven almost entirely by the massive oil, gas, and petrochemical complexes. Demand is focused on heavy-duty, corrosion-resistant, high-pressure sampling valves suitable for harsh operating environments and high-sulfur content crude oil processing. Infrastructure projects related to water treatment and desalination are also contributing factors, requiring reliable, certified valves for process water quality monitoring.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Sampling Valves Market.- Swagelok Company

- Bürkert Fluid Control Systems

- Dockweiler AG

- M&W Systems

- Alfa Laval AB

- Sentry Equipment Corp.

- Steriflow Valve

- GEA Group Aktiengesellschaft

- Parker Hannifin Corporation

- TLV Co., Ltd.

- Flowserve Corporation

- SSP Fittings Corp.

- Keofitt A/S

- SchuF Fetterolf

- SampleSafe Systems

- Richter Chemie-Technik GmbH

- Watson-Marlow Fluid Technology Solutions

- Saint-Gobain S.A.

- Valmet Corporation

- Perlick Corporation

Frequently Asked Questions

Analyze common user questions about the Sampling Valves market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Sampling Valves Market?

The primary factor is the increasing stringency of global regulatory standards, particularly Good Manufacturing Practices (GMP) and safety regulations, which necessitate highly reliable, verifiable, and aseptic sampling methods across the pharmaceutical, food and beverage, and chemical processing industries to ensure product quality and operational safety.

How do aseptic sampling valves differ from standard sampling valves?

Aseptic sampling valves are specifically designed with zero dead-leg geometry and utilizing sterile barriers (like diaphragms or bellows seals) to ensure the valve chamber is sterilized before and after sample extraction, completely preventing process media contamination, a critical requirement for biopharma manufacturing.

Which end-user segment utilizes the most advanced sampling valve technology?

The Pharmaceutical and Biotechnology segment utilizes the most advanced technology, driven by the need for ultra-high purity and traceability in biologics manufacturing, leading to the adoption of fully automated, orbital-weldable, zero dead-leg valves integrated with cleanroom standards and validation protocols.

What role does automation play in the Sampling Valves Market?

Automation is crucial for enhancing safety and accuracy; automated sampling valves offer repeatable, remote operation, reducing human exposure to hazardous materials, optimizing sampling frequency, and seamlessly integrating data collection into centralized process control and quality assurance systems (IIoT).

What are the key technological trends affecting sampling valve design?

Key trends include the development of closed-loop systems for zero-emission sampling, advanced material science for superior chemical and temperature resistance, and integration of smart sensors and actuators to enable predictive maintenance and real-time operational diagnostics.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager