SAP S-4HANA Application Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442894 | Date : Feb, 2026 | Pages : 241 | Region : Global | Publisher : MRU

SAP S-4HANA Application Market Size

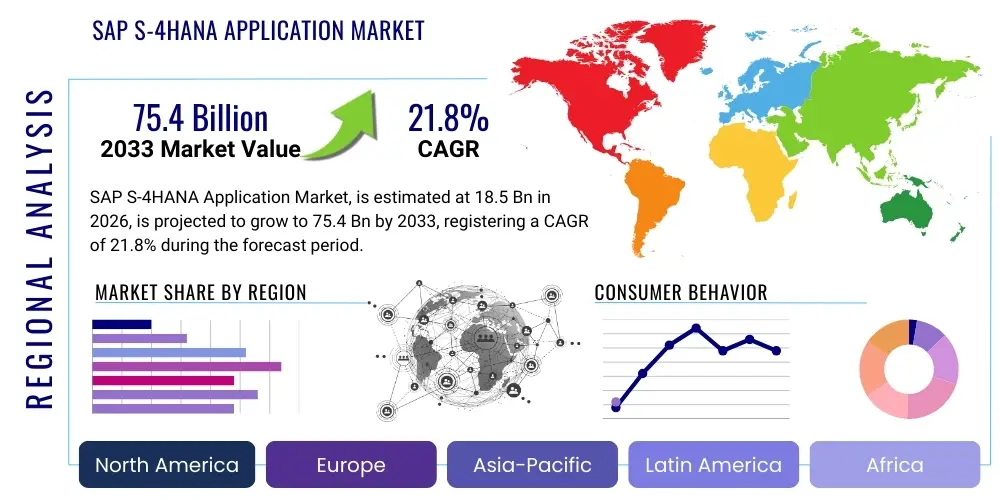

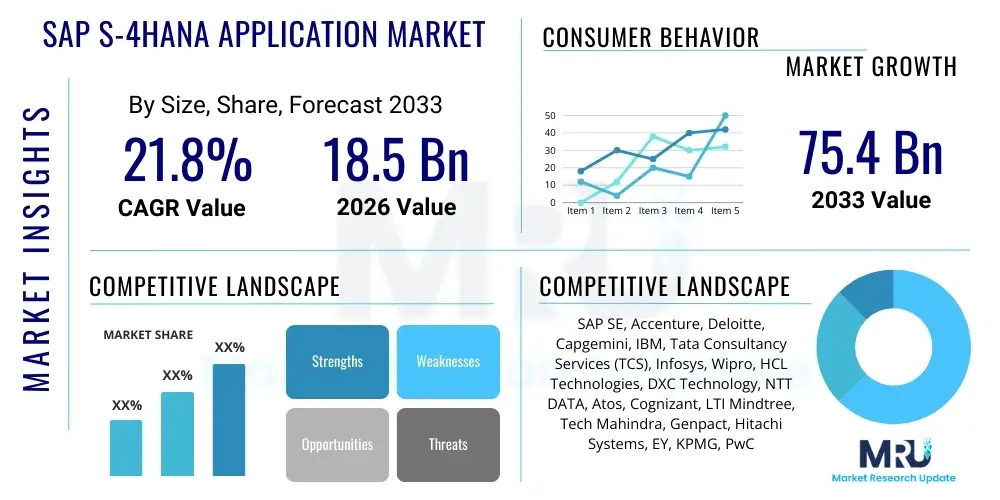

The SAP S-4HANA Application Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 21.8% between 2026 and 2033. The market is estimated at USD 18.5 Billion in 2026 and is projected to reach USD 75.4 Billion by the end of the forecast period in 2033.

SAP S-4HANA Application Market introduction

The SAP S-4HANA Application Market encompasses the deployment, management, and ongoing optimization services related to SAP’s flagship next-generation ERP suite, S-4HANA. This enterprise resource planning system is designed to run exclusively on the SAP HANA in-memory database, offering substantial performance gains, simplified data models, and real-time analytics capabilities previously unattainable with legacy systems. The primary product offerings within this market include implementation services (greenfield, brownfield, selective data migration), system integration, application management services (AMS), cloud hosting services, and specialized functional consulting across key modules such as finance (FI), logistics (MM/SD), manufacturing (PP), and supply chain management (SCM). Major applications span nearly every industry requiring robust, integrated business process management, including discrete and process manufacturing, retail, utilities, and financial services.

The core benefits driving adoption revolve around digital transformation initiatives, enabling enterprises to move away from complex, fragmented IT landscapes toward a unified, intelligent enterprise architecture. S-4HANA facilitates faster financial closing, optimized inventory management, predictive resource planning, and enhanced customer experiences through integrated solutions like SAP Customer Experience (CX). Furthermore, the shift to S-4HANA is often mandated by the approaching end-of-life for technical support for older SAP ECC systems, compelling organizations to migrate to maintain compliance, security, and access to modern innovations.

Key driving factors include the escalating demand for real-time data processing to support strategic decision-making, the global push toward cloud-based ERP deployments (particularly S-4HANA Cloud and RISE with SAP), and the integration of emerging technologies such as Artificial Intelligence (AI), Machine Learning (ML), and Internet of Things (IoT) directly into core business processes. Regulatory compliance requirements, especially in highly regulated sectors like pharmaceuticals and finance, also necessitate the adoption of modern, adaptable ERP systems like S-4HANA.

SAP S-4HANA Application Market Executive Summary

The SAP S-4HANA application market is characterized by robust expansion driven primarily by mandated legacy system upgrades and accelerated cloud migration strategies, particularly those leveraging the RISE with SAP program. Business trends indicate a strong pivot toward industry-specific cloud solutions (Cloud ERP), with organizations prioritizing implementation partners who offer deep vertical expertise and rapid deployment capabilities through standardized templates. The primary expenditure shift is observed from traditional on-premise licensing to subscription-based models for managed services and cloud infrastructure, ensuring predictable operational expenses and enhanced scalability. Key growth segments include selective data transition (SDT) approaches, favored by large enterprises seeking phased migration, and rapid implementation models (RIM) targeting mid-market entities seeking faster time-to-value.

Regionally, North America and Europe continue to dominate the market share due to the high concentration of multinational corporations, mature IT infrastructures, and earlier adoption rates of complex ERP systems. However, the Asia Pacific (APAC) region is demonstrating the highest growth velocity, fueled by digital transformation mandates in developing economies like India and China, alongside significant manufacturing sector investments seeking process optimization. Latin America and the Middle East & Africa (MEA) are also exhibiting steady growth, often driven by large government and energy sector projects that necessitate comprehensive, modern financial and supply chain management capabilities inherent in S-4HANA.

Segment trends reveal that the Services segment, encompassing consulting, implementation, and Application Management Services (AMS), constitutes the largest market share, reflecting the complexity and scale of S-4HANA transformations. Within the deployment type, the Public Cloud and Private Cloud segments are rapidly outpacing traditional on-premise deployments, aligning with global enterprise trends favoring agility and operational resilience. Furthermore, the functional segment of Supply Chain Management (SCM) and Finance (FI/CO) remains pivotal, as real-time insights into logistics and financial performance are critical differentiators in the current competitive landscape.

AI Impact Analysis on SAP S-4HANA Application Market

Users frequently inquire about how Artificial Intelligence (AI) and Machine Learning (ML) capabilities embedded within SAP S-4HANA, particularly through SAP Joule and BTP (Business Technology Platform), fundamentally alter business processes, deployment timelines, and necessary consulting skill sets. Common themes center on the expected ROI from intelligent automation (e.g., automated invoice processing, predictive maintenance), the complexity of integrating external AI models with S-4HANA core, and the security implications of deploying these intelligent features. There is high expectation that AI will streamline migration processes (e.g., using AI to analyze custom code compatibility), reduce post-go-live support requirements, and crucially, transform the role of the end-user from transactional input to strategic analysis, thereby raising the demand for consultants skilled in functional AI implementation and data governance within the S-4HANA environment.

- Accelerated Process Automation: AI embedded in S-4HANA automates routine tasks in finance (e.g., financial closing, reconciliation) and logistics, boosting operational efficiency.

- Predictive Analytics & Forecasting: ML models leverage S-4HANA's real-time data core to improve demand forecasting, inventory optimization, and preventative maintenance schedules.

- Custom Code Remediation: AI tools assist in analyzing and adapting legacy custom code during the transition from ECC to S-4HANA, reducing migration time and costs.

- Enhanced User Experience (UX): Intelligent assistants like SAP Joule and conversational AI improve navigation and accessibility, simplifying complex ERP interactions.

- Integration via BTP: AI/ML capabilities are predominantly accessed and extended through the SAP Business Technology Platform (BTP), positioning it as a mandatory skill area for implementation partners.

- Skill Set Transformation: Increased demand for specialized consultants combining functional SAP knowledge with expertise in data science, Python, and BTP development.

- Data Quality and Governance: AI adoption necessitates stricter data quality frameworks and governance policies to ensure the integrity of the data fueling ML algorithms.

DRO & Impact Forces Of SAP S-4HANA Application Market

The SAP S-4HANA application market is propelled by significant Drivers (D) such as the urgent need for digital core modernization and the end of mainstream maintenance for SAP ECC, forcing mandatory migration. Opportunities (O) are vast, particularly in leveraging the SAP Business Technology Platform (BTP) for hyperscaler integrations (AWS, Azure, GCP) and developing specialized, vertical-specific extensions that enhance core S-4HANA functionality. However, the market faces considerable Restraints (R), including the high initial cost of implementation, the scarcity of highly experienced S-4HANA technical and functional consultants, and the perceived complexity and risk associated with large-scale brownfield migrations. These dynamics collectively create strong Impact Forces, where the regulatory and technology obsolescence pressures outweigh the cost hesitations for most large enterprises, leading to sustained, high-growth demand for implementation services and managed application support.

The primary driver remains the technical necessity to migrate away from SAP ECC before 2027 (or extended deadlines), coupled with the undeniable competitive advantage derived from operating on a real-time data platform. Companies that delay migration risk falling behind competitors who can leverage predictive analytics for superior supply chain resilience and optimized financial performance. The opportunity landscape is continuously expanding, shifting beyond just ERP replacement to complete business transformation, integrating advanced modules like Extended Warehouse Management (EWM), Transportation Management (TM), and utilizing embedded analytics (SAC – SAP Analytics Cloud) for comprehensive reporting directly within the system.

Conversely, one major restraint involves organizational change management; S-4HANA often requires redesigning established business processes (e.g., financial period closing simplification), leading to internal resistance and a steep learning curve for end-users. Additionally, the market is subject to intense competition among consulting firms, resulting in significant pricing pressures for standardized services, though specialized, highly technical consulting remains premium priced. The interplay between these factors determines the pace of adoption, with macroeconomic uncertainty sometimes causing temporary delays in transformation projects, although the long-term strategic necessity ensures continuous market buoyancy.

Segmentation Analysis

The SAP S-4HANA Application Market is broadly segmented based on Deployment Type, Component, Enterprise Size, Functional Area, and Industry Vertical. Analyzing these segments provides a granular view of market dynamics, revealing that the Services component consistently holds the dominant market share due to the highly complex and resource-intensive nature of implementation and ongoing maintenance tasks. Cloud deployment models (specifically Private and Public Cloud options facilitated by RISE with SAP) are showing exponential growth, signaling a definitive industry shift away from traditional on-premise infrastructure. This segmentation highlights the diversity of client needs, ranging from large enterprises requiring extensive customization and brownfield migration expertise to Small and Medium-sized Enterprises (SMEs) opting for streamlined, template-based cloud deployments to achieve faster ROI.

- By Component:

- Software/Platform (License Fees, Subscription)

- Services (Consulting, Implementation, Migration, Application Management Services (AMS), Training, and Support)

- By Deployment Type:

- On-Premise

- Cloud (Public Cloud, Private Cloud, Hybrid Cloud)

- By Enterprise Size:

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

- By Functional Area:

- Finance and Controlling (FI/CO)

- Supply Chain Management (SCM)

- Manufacturing and Production Planning (PP)

- Sales and Distribution (SD)

- Human Capital Management (HCM) - often integrated via SuccessFactors

- Sourcing and Procurement (Ariba Integration)

- By Industry Vertical:

- Manufacturing (Discrete and Process)

- Retail and Consumer Goods (CPG)

- Utilities and Energy

- Financial Services and Insurance

- Public Sector and Government

- Healthcare and Pharmaceuticals

- Telecommunications and IT

- By Migration Strategy:

- Greenfield Implementation (New implementation)

- Brownfield Conversion (System conversion)

- Selective Data Transition (Phased migration)

Value Chain Analysis For SAP S-4HANA Application Market

The value chain for the SAP S-4HANA Application Market is complex, involving multiple layers from core platform development to end-user support. The upstream activities are dominated by SAP SE, which provides the core S-4HANA software platform and the underlying HANA database technology, alongside key partners like hyperscalers (AWS, Azure, Google Cloud) that provide the necessary cloud infrastructure for private and public cloud deployments. The differentiation at this stage lies in continuous innovation, maintaining compatibility with emerging technologies, and providing robust technical support for the platform itself. Crucially, the SAP Business Technology Platform (BTP) forms a midstream layer, enabling system integrators and customers to extend, integrate, and develop specialized applications.

The midstream is centered on system integration and implementation, dominated by global consulting giants and specialized regional partners. This phase includes project planning, scoping, data migration, customization (via BTP), quality assurance, and user training. Downstream activities involve ongoing Application Management Services (AMS), post-go-live support, continuous system optimization, and managing cloud infrastructure security and scaling. The quality of AMS is a major factor in customer satisfaction and long-term contract renewal.

Distribution channels are categorized into Direct and Indirect. Direct distribution occurs when SAP SE licenses the core software directly to large enterprise customers, often bundled with its own consulting services for hyperscalers via programs like RISE with SAP. However, the majority of application implementation and ongoing support is handled through the Indirect channel, relying heavily on the vast ecosystem of certified SAP partners (system integrators, VARs, and specialized consultants) who act as the primary interface between the technology and the end customer. This partner network is crucial for localized support and industry-specific expertise.

SAP S-4HANA Application Market Potential Customers

Potential customers for the SAP S-4HANA Application Market are broadly defined as any enterprise currently running mission-critical operations on legacy ERP systems, especially those using older versions of SAP ECC or competing platforms approaching mandatory modernization. The primary buyer segments are large global corporations mandated to migrate by the SAP 2027 deadline (extended support scenarios notwithstanding) seeking to consolidate their global business processes onto a single, standardized platform. Mid-market companies also represent a rapidly growing segment, particularly those in high-growth industries that require scalable, integrated systems to support rapid expansion and complex international operations. These customers are motivated by the need for better operational visibility, simplified financial reporting, and the necessity to future-proof their IT infrastructure against impending technological obsolescence.

Sector-wise, the Discrete Manufacturing industry, particularly automotive and high-tech electronics, remains a foundational customer base due to the complex supply chain and production planning capabilities offered by S-4HANA. Financial services institutions are also high-value targets, driven by stringent regulatory reporting requirements (e.g., IFRS) that necessitate real-time data access and simplified accounting models. Moreover, organizations adopting aggressive cloud-first strategies are prime candidates for S-4HANA Public or Private Cloud deployments through the RISE framework, viewing the transition as a foundational element of their wider digital transformation agenda, integrating components like Ariba, Concur, and SuccessFactors into the digital core.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 18.5 Billion |

| Market Forecast in 2033 | USD 75.4 Billion |

| Growth Rate | 21.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SAP SE, Accenture, Deloitte, Capgemini, IBM, Tata Consultancy Services (TCS), Infosys, Wipro, HCL Technologies, DXC Technology, NTT DATA, Atos, Cognizant, LTI Mindtree, Tech Mahindra, Genpact, Hitachi Systems, EY, KPMG, PwC |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

SAP S-4HANA Application Market Key Technology Landscape

The core technology underpinning the SAP S-4HANA Application Market is the SAP HANA in-memory database, which fundamentally allows for the merging of transactional (OLTP) and analytical (OLAP) processing onto a single data structure, eliminating the need for separate data warehouses and offering real-time reporting capabilities. This technological shift enables massive performance improvements for complex queries and simplified data models. Beyond the core database, the landscape is defined by the migration pathway technologies, such as the SAP Readiness Check tool, which assesses the preparedness of a legacy ECC system for conversion, and the Custom Code Management tools, essential for handling the adaptation of bespoke customizations during a brownfield migration. Furthermore, Fiori, SAP's modern user interface (UI/UX) technology, is integral, providing role-based, personalized user experiences accessible across various devices, moving away from the complex legacy GUI.

A crucial accelerator in the modern S-4HANA landscape is the SAP Business Technology Platform (BTP). BTP serves as the innovation layer, a Platform-as-a-Service (PaaS) offering that allows organizations to extend S-4HANA functionality without modifying the core system (clean core architecture). Technologies deployed via BTP include advanced AI/ML services (leveraging frameworks like TensorFlow or native SAP solutions), integration services (leveraging APIs and middleware), and automation capabilities (RPA). This platform is essential for connecting S-4HANA to the hyperscaler environment, utilizing services from AWS, Azure, or Google Cloud for infrastructure management, scalability, and specialized services like data lakes or advanced machine learning models, ensuring a hybrid environment that meets specific geographical or regulatory demands.

The market's technology landscape is also heavily influenced by the adoption of modern cloud infrastructure and virtualization. Technologies such as Docker and Kubernetes are increasingly used by implementation partners to manage and orchestrate non-production S-4HANA environments rapidly, streamlining testing and development lifecycles. Security technologies, including advanced identity and access management (IAM) solutions integrated through SAP Cloud Identity Services, are critical given the sensitive nature of ERP data. Ultimately, the successful deployment of S-4HANA depends on proficiency not only in the SAP stack itself but also in adjacent cloud technologies, integration frameworks (like CPI - Cloud Platform Integration), and data modernization tools that facilitate the transition to a real-time, digital core.

Regional Highlights

- North America (NA): North America holds the largest market share, driven by rapid cloud adoption, high IT spending maturity, and a large presence of multinational corporations undergoing mandatory ECC sunset initiatives. The focus here is heavily on complex brownfield conversions and selective data migration strategies. The market is defined by strong demand for specialized financial transformation consulting (especially for organizations moving to centralized global financial systems) and leveraging the full integration potential of RISE with SAP, coupled with advanced BTP customizations. Key countries include the United States and Canada, where competitive pressures necessitate high levels of operational efficiency provided by S-4HANA.

- Europe: Europe represents a significant, highly mature market, characterized by stringent data privacy regulations (e.g., GDPR), which influence deployment decisions toward Private Cloud or hybrid models. Western European nations, particularly Germany (SAP’s home base), the UK, and France, exhibit strong demand across manufacturing, automotive, and pharmaceuticals. The regional growth is fueled by strategic investments in supply chain resilience (post-Brexit and pandemic effects), driving the adoption of S-4HANA’s advanced planning and logistics modules (APO replacement). Implementation partners specializing in localized regulatory compliance hold a distinct advantage.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region globally, primarily due to explosive growth in manufacturing sectors (China, India, Southeast Asia) and accelerating digital maturity. Market dynamics vary significantly by country; while Japan and Australia show high maturity similar to the West, emerging economies are focusing on Greenfield implementations to leapfrog legacy systems, adopting Public Cloud S-4HANA for scalability. The focus is on core ERP functionality to manage rapid scale, complex multi-country logistics, and integrating S-4HANA with regional e-commerce platforms.

- Latin America (LATAM): The LATAM market is growing steadily, driven by the need for simplified compliance with highly complex and variable regional tax and regulatory structures (Nota Fiscal, etc.). Large enterprises in Brazil and Mexico are leading the adoption, primarily focusing on S-4HANA Finance and localized logistical solutions. Economic volatility often necessitates careful, phased implementation strategies and strong regional partner support that understands local business requirements and fiscal reporting nuances.

- Middle East and Africa (MEA): Growth in MEA is concentrated in the Gulf Cooperation Council (GCC) countries, heavily influenced by large-scale government digitization mandates (e.g., Saudi Vision 2030, UAE initiatives) and significant investment in the oil and gas, utilities, and public sector industries. These projects often involve massive, new implementations (Greenfield) or significant system overhauls, requiring deep expertise in asset management (EAM) and large-scale public finance integration.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the SAP S-4HANA Application Market.- SAP SE (The core technology provider)

- Accenture (Leading global system integrator and consulting partner)

- Deloitte Consulting LLP (Major player in strategic consulting and implementation)

- Capgemini SE (Strong focus on cloud services and industry-specific solutions)

- IBM Corporation (Offering comprehensive S-4HANA services and infrastructure)

- Tata Consultancy Services (TCS) (Large Indian IT firm with massive delivery capacity)

- Infosys Limited (Known for technical excellence and cloud migration expertise)

- Wipro Limited (Extensive portfolio across implementation and AMS)

- HCL Technologies Limited (Strong focus on modernization and digital engineering)

- DXC Technology (Provides extensive enterprise application services)

- NTT DATA Corporation (Strong presence in APAC and global system integration)

- Atos SE (European leader in digital transformation and managed services)

- Cognizant Technology Solutions Corporation (Specializing in digital strategy and execution)

- Larsen & Toubro Infotech (LTI Mindtree) (Expertise in niche industry solutions)

- Tech Mahindra Limited (Focus on telecommunications and manufacturing verticals)

- Genpact (Specializing in process transformation and intelligent automation)

- Hitachi Systems (Strong capabilities in the Japanese and industrial markets)

- EY (Ernst & Young Global Limited) (Focused on large-scale business transformation)

- KPMG International Limited (Provides advisory and implementation services)

- PricewaterhouseCoopers (PwC) (Specializing in financial transformation and compliance)

Frequently Asked Questions

Analyze common user questions about the SAP S-4HANA Application market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the most recommended SAP S-4HANA deployment approach for large enterprises?

For large enterprises with extensive customizations, the Selective Data Transition (SDT) or Brownfield Conversion is often recommended. SDT allows for phased migration and data harmonization while preserving historical transactions, minimizing disruption compared to a full Greenfield implementation, although Greenfield is preferred for maximizing process standardization and adopting a clean core architecture.

How does the RISE with SAP offering impact the S-4HANA Application Market?

RISE with SAP acts as a major market accelerator, bundling S-4HANA Cloud, BTP, embedded intelligence, and expert services into a single subscription contract. It simplifies the migration process, shifts the burden of infrastructure management to SAP/Hyperscalers, and dramatically boosts the adoption of the Public and Private Cloud deployment models across the market.

What are the primary factors driving the high cost of S-4HANA implementation?

The high cost is primarily driven by three factors: expensive software licensing (especially for the HANA database), the extensive effort required for data migration and harmonization, and the premium cost associated with securing highly specialized technical and functional consultants needed for complex conversions and customizations.

Which functional modules within S-4HANA are seeing the highest demand for consulting services?

Consulting services are in highest demand for the Finance and Controlling (FI/CO) module due to the significant simplification and restructuring of the financial data model (ACDOCA table), followed closely by Supply Chain Management (SCM), which integrates advanced features like Extended Warehouse Management (EWM) and Transportation Management (TM).

How important is the SAP Business Technology Platform (BTP) for S-4HANA strategies?

BTP is critically important; it enables the "clean core" strategy by facilitating custom development, integration, and innovation (AI/ML, IoT) outside the core ERP system. It is essential for future-proofing the S-4HANA investment, ensuring that the core system remains standardized while allowing for necessary differentiation and extension through cloud-native services.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager