Satellite Communication Services Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441064 | Date : Feb, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Satellite Communication Services Market Size

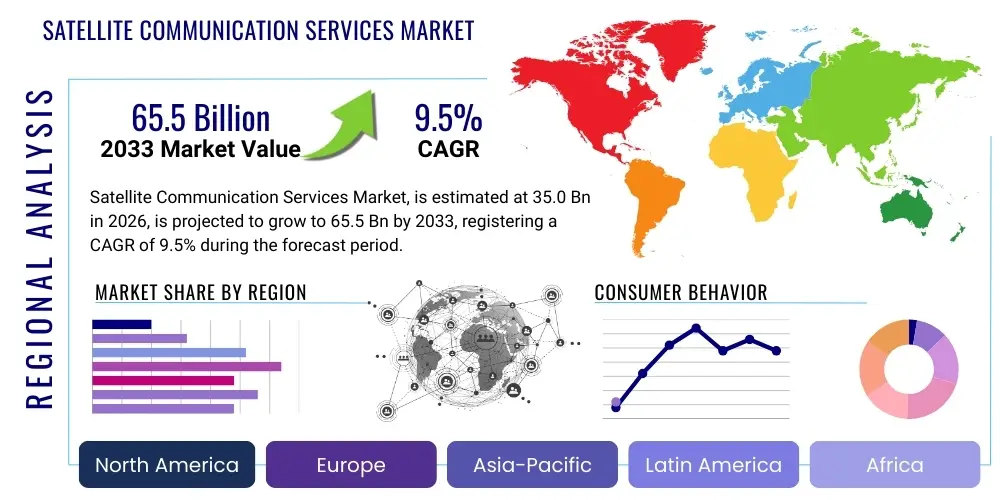

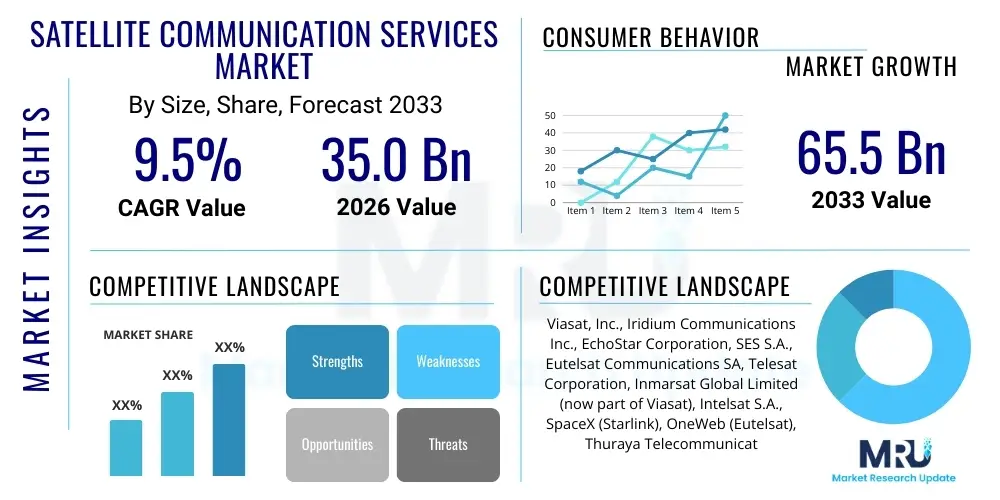

The Satellite Communication Services Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at USD 35.0 Billion in 2026 and is projected to reach USD 65.5 Billion by the end of the forecast period in 2033. This substantial expansion is primarily driven by the increasing demand for high-throughput connectivity in remote and underserved areas, coupled with the rapid deployment of Low Earth Orbit (LEO) and Medium Earth Orbit (MEO) satellite constellations, which offer lower latency and higher capacity services compared to traditional Geosynchronous Equatorial Orbit (GEO) systems. The market dynamics are being reshaped by technological advancements in phased array antennas and software-defined satellites, enhancing flexibility and service scalability across various end-user industries.

Satellite Communication Services Market introduction

The Satellite Communication Services Market encompasses the provision of voice, video, data, and Internet connectivity solutions utilizing orbiting satellites as transmission relays. These services are crucial for bridging the digital divide, offering reliable communication infrastructure where terrestrial networks are insufficient or unavailable, such as maritime, aerospace, military, and remote enterprise operations. Major applications span from broadcasting and direct-to-home (DTH) television to sophisticated backhaul for 5G networks, disaster recovery, and critical asset tracking. Key benefits include global coverage, high reliability, and scalability to support massive connectivity requirements. The market's robust growth is fundamentally driven by the escalating demand for mobile broadband, the expansion of the Internet of Things (IoT) ecosystem requiring ubiquitous connectivity, and government initiatives prioritizing secure and resilient communication infrastructure, particularly for defense and national security purposes. Furthermore, the commercialization of space and the entry of private enterprises deploying mega-constellations are intensifying competition and driving down the cost of bandwidth, making satellite communication increasingly attractive to a broader commercial consumer base.

Satellite Communication Services Market Executive Summary

The Satellite Communication Services Market is undergoing a rapid paradigm shift, characterized by significant business trends focused on vertical integration and the widespread adoption of non-geostationary orbit (NGSO) constellations. Operators are moving beyond traditional capacity leasing to offer managed services, integrating cloud computing and AI capabilities to optimize network performance and customer experience. Segment trends indicate robust growth in mobile satellite services (MSS) driven by maritime and aviation sectors, while fixed satellite services (FSS) are pivoting toward high-throughput satellite (HTS) technology for cellular backhaul and enterprise networking. Regionally, North America maintains market leadership due to substantial defense spending and the presence of major satellite manufacturers and service providers. However, the Asia Pacific (APAC) region is poised for the highest growth rate, fueled by massive infrastructure development needs in developing economies and rising consumer demand for DTH and broadband connectivity in geographically challenging territories. Strategic partnerships between ground segment developers and LEO operators are defining the current competitive landscape, aiming to establish seamless, low-latency connectivity as a viable alternative to fiber optics in many global locales.

AI Impact Analysis on Satellite Communication Services Market

Common user questions regarding AI’s influence on the Satellite Communication Services Market center around operational efficiency, security, and the optimization of dynamic network resources. Users frequently inquire about how AI can autonomously manage complex LEO/MEO satellite handover procedures, predict satellite hardware failures, and enhance cybersecurity measures against sophisticated jamming and spoofing attacks. There is strong user expectation that AI algorithms will revolutionize spectrum allocation, dynamically assigning capacity based on real-time traffic demand across geographically dispersed users, thereby maximizing the utilization and profitability of expensive orbital assets. Furthermore, interest exists in AI's role in processing the massive volumes of telemetry and remote sensing data generated by satellite fleets, converting raw input into actionable insights for diverse end-users, from agricultural monitoring to disaster relief coordination. This collective analysis reveals a core need for intelligent automation to manage the unprecedented complexity introduced by mega-constellations and high-speed data delivery.

- AI enables predictive maintenance, minimizing satellite downtime by analyzing telemetry data and forecasting component failures.

- Dynamic resource allocation utilizes machine learning to optimize spectrum usage and power distribution across multi-beam satellites based on demand fluctuations.

- Enhanced ground segment automation through AI-driven Network Function Virtualization (NFV) and Software-Defined Networking (SDN) protocols.

- AI algorithms significantly improve cybersecurity by identifying anomalous network behavior indicative of cyber threats or unauthorized access attempts.

- Optimization of satellite orbits and maneuver planning using reinforcement learning for fuel efficiency and extended service life.

DRO & Impact Forces Of Satellite Communication Services Market

The Satellite Communication Services Market is primarily driven by the proliferation of LEO satellite constellations offering high-speed, low-latency broadband globally, coupled with escalating government and defense spending on resilient communication systems for intelligence, surveillance, and reconnaissance (ISR). Significant restraints include the high capital expenditure required for satellite manufacturing and launch, regulatory hurdles regarding spectrum allocation and orbital debris mitigation, and the increasing competitive pressure from terrestrial fiber and 5G networks in urbanized areas. However, substantial opportunities exist in the underserved maritime, aviation, and remote enterprise sectors, alongside the burgeoning demand for IoT backhaul solutions across agriculture and logistics. The impact forces are strongly characterized by technological advancement, specifically in HTS technology and the maturation of electronically steerable antennas (ESAs) necessary for tracking NGSO satellites, which together significantly enhance service quality and accessibility, thereby driving overall market adoption and technological disruption across established GEO operators.

Segmentation Analysis

The Satellite Communication Services Market is rigorously segmented based on the type of service offered, the orbital altitude of the satellite utilized, the end-user application, and the network component used for connectivity. This multifaceted segmentation helps operators tailor solutions precisely to specific user requirements, such as optimizing low-latency paths for financial trading or guaranteeing high-availability links for remote military operations. The transition from monolithic, singular GEO payloads to distributed, mesh-network architectures involving thousands of LEO satellites necessitates a continuous refinement of service categorization, ensuring that pricing models and service level agreements (SLAs) accurately reflect the delivered performance metrics, particularly regarding throughput and latency guarantees. Understanding these segments is critical for forecasting investment in manufacturing, launch services, and ground infrastructure development, guiding strategic mergers and acquisitions within the highly competitive satellite ecosystem.

- By Service Type:

- Fixed Satellite Services (FSS)

- Mobile Satellite Services (MSS)

- Broadcasting Satellite Services (BSS)

- Remote Sensing and Earth Observation

- Navigation and Mappin Services

- By Orbital Altitude:

- Geosynchronous Earth Orbit (GEO)

- Medium Earth Orbit (MEO)

- Low Earth Orbit (LEO)

- By End-User:

- Maritime

- Aviation

- Government and Defense

- Enterprise (Oil & Gas, Energy, Retail)

- Consumer (Residential Broadband, DTH)

- Telecom Operators and Service Providers (Backhaul)

- By Component:

- Space Segment (Satellites, Payloads)

- Ground Segment (Gateways, Earth Stations, VSAT Terminals, Antennas)

- Launch Services

Value Chain Analysis For Satellite Communication Services Market

The value chain for Satellite Communication Services is highly complex and capital-intensive, starting with the upstream segment involving satellite manufacturers (design, construction, component sourcing), followed by launch service providers responsible for orbital injection. This upstream segment is characterized by high technical barriers to entry and long development cycles, necessitating significant capital investment and adherence to stringent reliability standards, especially for high-value HTS and GEO assets. Key activities here include the design of advanced payloads, production of reliable power systems, and procurement of highly specialized communication hardware, often governed by international trade regulations and export controls due to dual-use potential, especially concerning defense applications. The competitive environment in the upstream segment is consolidating, with major primes dominating manufacturing capabilities while simultaneously seeing disruption from smaller, agile companies specializing in standardized, mass-produced LEO satellite bus designs.

The midstream operations are dominated by the satellite operators who own and manage the orbiting assets (Space Segment) and the network of gateway earth stations (Ground Segment). Operators monetize these assets by leasing capacity or providing end-to-end managed services. Critical activities in this stage include orbital slot management, spectrum management, active payload monitoring, and ensuring satellite control and anomaly resolution. The transition towards NGSO constellations necessitates complex network operations, integrating vast numbers of satellites, managing inter-satellite links, and dynamically routing traffic to maintain quality of service (QoS) across a moving network. This operational complexity drives the adoption of advanced automation tools and Software-Defined Network (SDN) concepts to ensure scalability and operational efficiency, reducing reliance on manual configuration and management processes across globally distributed ground infrastructure.

The downstream segment involves service providers and distributors responsible for marketing the final communication services directly to end-users or through various channels, including direct sales teams, value-added resellers (VARs), and system integrators. These entities are tasked with installing and maintaining customer premises equipment (CPE), which increasingly includes sophisticated, electronically steerable antennas (ESAs) tailored for LEO connectivity. Distribution channels are diversifying rapidly; traditionally, services flowed through large telecom carriers, but new entrants like Starlink are adopting a direct-to-consumer model. Indirect channels, particularly VARs, remain crucial for highly specialized sectors like maritime, defense, and enterprise, where system integration and bespoke solutions are necessary to combine satellite connectivity seamlessly with existing terrestrial IT infrastructure and security protocols.

- Upstream Analysis: Focuses on satellite manufacturing, payload design, component supply (transponders, solar arrays), and launch vehicle production. High R&D intensity and capital outlay.

- Midstream Analysis: Satellite operation (GEO, MEO, LEO constellation management), teleport and gateway operation, network management systems (NMS), and capacity provisioning.

- Downstream Analysis: Service provision (managed services, bandwidth leasing, DTH), system integration, installation of customer premises equipment (CPE) like VSAT and ESA terminals.

- Distribution Channel: Direct sales (e.g., Starlink residential), Value-Added Resellers (VARs for enterprise/maritime), Telecom carriers (backhaul and mobility), and Government contracts.

Satellite Communication Services Market Potential Customers

The primary potential customers for Satellite Communication Services are segmented across various vertical industries, each possessing unique connectivity requirements determined by geography, mobility needs, and data security demands. The Government and Defense sector represents a consistently high-value customer base, prioritizing highly resilient, secure, and globally available communication links for tactical missions, remote surveillance, and uninterrupted command and control (C2) operations, often leveraging dedicated military satellite systems or hardened commercial capacity. These customers often require customized, high-assurance services with strict geopolitical zoning and assured access capabilities, leading to substantial, long-term contractual agreements and investment in proprietary ground segment technologies. The demand here is less price-sensitive and more focused on performance, redundancy, and cryptographic security standards, driving innovation in advanced waveforms and anti-jamming technologies.

The Enterprise segment, particularly in geographically dispersed industries such as Oil & Gas, Mining, and Construction, constitutes another crucial customer group. These users require reliable connectivity for remote site operations, telemetry data transmission, pipeline monitoring, and employee welfare in locations far beyond the reach of terrestrial infrastructure. The increasing deployment of industrial IoT devices further amplifies this demand, requiring satellite systems capable of supporting massive machine-to-machine (M2M) connectivity for real-time asset tracking and operational efficiency improvements. These enterprise customers prioritize high uptime, scalable bandwidth, and integrated service solutions that can be easily managed and scaled across a global footprint, often preferring managed service offerings over raw bandwidth leasing to simplify complex network deployment.

Furthermore, the consumer and mobility sectors (Aviation and Maritime) are experiencing explosive growth as key end-users. Commercial airlines and cruise ship operators are rapidly adopting high-throughput satellite services to offer high-speed in-flight/on-vessel Wi-Fi and entertainment, viewing it as a critical competitive differentiator. Residential consumers, particularly those located in rural or suburban areas suffering from poor terrestrial broadband access, are increasingly turning to LEO-based satellite broadband solutions due to their comparable latency and significantly higher speeds compared to previous-generation GEO services. The consumer market is highly price-sensitive and driven by ease of installation, monthly subscription costs, and guaranteed minimum data rates, pushing operators to optimize network efficiency and terminal costs through mass production and standardized terminal designs.

- Government & Defense Agencies: Requiring resilient, secure, and redundant communication for tactical, strategic, and disaster response operations.

- Maritime & Aviation Industries: Demanding global mobile broadband for passenger experience, operational efficiency, and critical safety communications.

- Energy, Mining, and Construction (Remote Enterprise): Needing reliable connectivity for remote site monitoring, data backhaul, and Industrial IoT applications.

- Telecom Operators: Utilizing satellite services for cellular backhaul, especially for 5G expansion into rural or difficult-to-reach areas, and network resilience.

- Residential Consumers: Seeking high-speed broadband alternatives in areas with limited or non-existent fiber or DSL infrastructure.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 35.0 Billion |

| Market Forecast in 2033 | USD 65.5 Billion |

| Growth Rate | CAGR 9.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Viasat, Inc., Iridium Communications Inc., EchoStar Corporation, SES S.A., Eutelsat Communications SA, Telesat Corporation, Inmarsat Global Limited (now part of Viasat), Intelsat S.A., SpaceX (Starlink), OneWeb (Eutelsat), Thuraya Telecommunications Company, Gilat Satellite Networks, Hughes Network Systems, Globalstar, Speedcast, OmniAccess, Avanti Communications, ST Engineering iDirect, Maxar Technologies, Lockheed Martin. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Satellite Communication Services Market Key Technology Landscape

The technology landscape in the Satellite Communication Services Market is rapidly evolving, driven primarily by the shift towards Non-Geostationary Orbit (NGSO) systems, necessitating significant innovation in both the space and ground segments. A foundational technological advancement is the deployment of High-Throughput Satellites (HTS), which utilize frequency reuse, spot beam technology, and complex on-board processing to deliver significantly higher capacity (measured in Gbps) compared to traditional wide-beam satellites. This HTS architecture is now standard across both GEO and NGSO systems, fundamentally altering the economics of satellite broadband delivery and making it competitive with terrestrial solutions in high-demand areas. Furthermore, the integration of 5G Non-Terrestrial Networks (NTN) standards is crucial, ensuring seamless interoperability between satellite networks and global 5G infrastructure, allowing mobile operators to leverage satellite backhaul efficiently for ubiquitous service coverage, which requires highly advanced waveform modulation techniques and standardized interfaces.

Another transformative technology is the development and mass production of Electronically Steerable Antennas (ESAs), also known as flat-panel antennas. Traditional parabolic dish antennas are poorly suited for tracking fast-moving LEO satellites. ESAs, utilizing phased array technology, can instantly and electronically steer their beams without physical movement, enabling reliable, seamless handover between satellites moving across the sky. This technological leap is essential for commercializing LEO broadband services for mobility markets (maritime, aviation, and vehicular), reducing the size, weight, and power (SWaP) requirements of terminals. Concurrently, Software-Defined Satellites (SDS) and Software-Defined Networking (SDN) are gaining prominence. SDS allows operators to dynamically reconfigure satellite payloads post-launch, adapting coverage, power distribution, and frequency usage in response to changing market demands or unforeseen events, greatly extending the operational flexibility and lifespan of orbital assets and maximizing return on investment.

The ground segment is also seeing disruption through virtualization and cloud integration. Many satellite operators are migrating their ground station operations and network core functions into cloud environments, leveraging hyperscale cloud providers for computing power, data processing, and distribution capabilities. This move facilitates faster deployment of new services, reduces proprietary hardware dependence, and improves scalability for managing thousands of simultaneous connections inherent in mega-constellations. Key technological focus areas also include advanced digital signal processing (DSP) for minimizing interference, implementing robust inter-satellite links (ISL) using optical or laser technology for high-speed connectivity within the constellation, and developing highly secure, quantum-resistant encryption methods to meet growing security demands from defense and governmental clients, pushing the boundaries of satellite system resilience.

- High-Throughput Satellites (HTS): Employing spot beams and frequency reuse to deliver significantly increased capacity across all orbital regimes (GEO, MEO, LEO).

- Electronically Steerable Antennas (ESAs): Crucial ground technology enabling seamless tracking and connectivity with fast-moving NGSO constellations for mobility applications.

- LEO/MEO Constellations: Utilizing large fleets of satellites in lower orbits to offer low-latency, high-speed global broadband services, reshaping market competition.

- Software-Defined Networking (SDN) & Virtualization: Enabling dynamic network management, automated traffic routing, and cloud integration of ground segment functions for scalability.

- Inter-Satellite Links (ISL): Utilizing laser communication technology to reduce reliance on ground stations and decrease overall network latency.

Regional Highlights

North America dominates the Satellite Communication Services Market, primarily driven by substantial investments from the U.S. Department of Defense and other government agencies requiring secure, resilient global communication. The region is home to major industry players, including SpaceX (Starlink), Viasat, and Hughes Network Systems, which are leading the charge in LEO and HTS technology deployment. The highly competitive and well-established commercial market sees strong demand from aviation and enterprise sectors (especially energy and logistics), driving innovation in both ground terminal development and managed service offerings. Furthermore, the early and large-scale consumer adoption of satellite broadband in rural areas, accelerated by government subsidies aimed at closing the digital divide, cements North America's leadership position in technological advancement and revenue generation within the SatCom sector. The regulatory environment generally supports commercial space activity, encouraging rapid deployment and testing of new technologies.

- The U.S. leads global defense satellite expenditure, acting as a consistent anchor for FSS and MSS contracts.

- High adoption rate of LEO broadband services (e.g., Starlink) in suburban and rural areas due to accessible technology and competitive pricing.

- Strong concentration of satellite manufacturing and launch capabilities, fostering continuous innovation in the space segment.

Europe represents a mature yet dynamic market, characterized by significant governmental space programs (e.g., the European Space Agency) and leading GEO operators such as SES and Eutelsat. The region is focusing on strategic initiatives, including the development of sovereign European LEO connectivity projects, aiming to establish independent satellite infrastructure for government services and secure connectivity, reducing reliance on non-European providers. Demand is particularly strong in the maritime sector, driven by extensive commercial shipping lanes and cruise tourism, requiring robust MSS solutions. While terrestrial fiber coverage is high in Western Europe, satellite services remain crucial for Eastern and Southern European regions, as well as for specialized backhaul needs across densely populated metropolitan areas, where regulatory coordination across diverse national bodies remains a key challenge for pan-European service deployment.

- High demand for maritime connectivity due to extensive coastal lines and shipping activity across the Atlantic and Mediterranean.

- Government-backed initiatives focusing on developing sovereign European satellite constellations and securing critical infrastructure communications.

- Strong existing presence of established GEO operators (SES, Eutelsat) driving modernization of HTS fleet capabilities.

Asia Pacific (APAC) is projected to witness the fastest growth rate, fueled by massive, unmet demand for internet access across populous yet geographically diverse nations like India, China, Indonesia, and Australia. Satellite communication is vital for expanding telecommunication infrastructure (cellular backhaul) into remote and island communities where fiber deployment is economically unviable or physically impossible. Governments in the region are heavily investing in satellite systems for national broadcasting (BSS), disaster management, and educational purposes. The competitive landscape is intensifying with the entry of national and regional satellite operators, often supported by state funding, aiming to capture the huge consumer broadband market. This rapid expansion demands affordable terminal technology and scalable managed services to cater to the diverse economic strata and technical capabilities of the region.

- Fastest growth driven by high population density and the need to connect geographically challenging or underserved regions.

- Massive potential for cellular backhaul (4G/5G) using satellite links to support rapidly expanding terrestrial mobile networks.

- Significant government investment in BSS (Broadcasting Satellite Services) and disaster recovery communication systems.

Latin America is characterized by challenging terrains, including the Amazon rainforest and the Andes mountain range, making satellite services indispensable for reliable connectivity across large geographical areas. Key demand centers include the Oil & Gas sector, which utilizes satellite for exploration and remote pipeline monitoring, and the enterprise sector seeking connectivity in areas where civil infrastructure is nascent. The consumer market in rural areas is increasingly adopting satellite solutions as an alternative to poorly serviced terrestrial networks, though price sensitivity remains a significant factor influencing consumer uptake. Regulatory fragmentation across multiple countries, coupled with currency volatility, introduces unique business challenges, yet the necessity of satellite for essential infrastructure development ensures sustained, stable demand across various vertical markets within the region.

- High reliance on satellite communications for resource extraction industries (Mining, Oil & Gas) operating in remote locations.

- Crucial reliance on FSS and MSS for supporting educational and healthcare connectivity in geographically isolated communities.

- Growing consumer segment seeking reliable connectivity where terrestrial infrastructure penetration is low.

Middle East and Africa (MEA) presents a unique market dynamic, marked by robust growth driven by two distinct factors: high-value government/military contracts and the critical necessity for basic connectivity expansion. The Middle East, with its wealth, invests heavily in secure communication for defense and broadcasting (DTH). In Africa, satellite communication is foundational for bridging the connectivity gap, providing cellular backhaul, and offering primary internet access in vast, underserved territories. The demand for MSS is significant in the Gulf region due to maritime trade routes. Furthermore, the region often bypasses legacy infrastructure, making LEO solutions particularly appealing for rapidly establishing high-speed internet access without the time and cost associated with laying extensive fiber optic cable networks across challenging environmental conditions.

- Critical role of satellite in extending mobile coverage (cellular backhaul) across Africa, particularly in remote regions.

- Significant defense and secure communication expenditure in the Middle East region.

- High demand for MSS and DTH services driven by expansive desert territories and global maritime trade routes.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Satellite Communication Services Market.- Viasat, Inc.

- Iridium Communications Inc.

- EchoStar Corporation

- SES S.A.

- Eutelsat Communications SA

- Telesat Corporation

- Intelsat S.A.

- SpaceX (Starlink)

- OneWeb (Eutelsat)

- Thuraya Telecommunications Company

- Gilat Satellite Networks

- Hughes Network Systems

- Globalstar

- Speedcast

- OmniAccess

- Avanti Communications

- ST Engineering iDirect

- Maxar Technologies

- Airbus SE

- Lockheed Martin

Frequently Asked Questions

Analyze common user questions about the Satellite Communication Services market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between GEO, MEO, and LEO satellite communication services?

GEO (Geostationary Earth Orbit) satellites operate at high altitudes (35,786 km), offering wide coverage but high latency (~600ms). MEO (Medium Earth Orbit) and LEO (Low Earth Orbit) satellites operate much closer to Earth (below 2,000 km), providing significantly lower latency (under 50ms) and higher throughput, making them ideal for latency-sensitive applications like video conferencing and gaming.

How is the proliferation of 5G networks impacting the demand for satellite communication services?

5G networks are increasing the demand for satellite communication, primarily through cellular backhaul. Satellites are crucial for extending 5G coverage to rural, remote, or oceanic areas where fiber optic or terrestrial microwave links are impractical, ensuring ubiquitous coverage and network resilience through Non-Terrestrial Networks (NTN) integration.

What role do Electronically Steerable Antennas (ESAs) play in the SatCom market expansion?

ESAs are critical for the rapid expansion of MEO and LEO services, especially in mobility markets (aviation and maritime). ESAs can electronically track fast-moving satellites without physical movement, allowing for seamless, high-speed, low-latency connectivity, simplifying installation, and reducing terminal size and weight.

Which end-user segment is driving the highest revenue growth in the Satellite Communication Services Market?

While Government and Defense remain high-value customers, the fastest revenue growth is currently being driven by the Consumer and Mobility segments (Aviation and Maritime). The rapid adoption of LEO broadband services by residential users and the increasing integration of high-speed Wi-Fi on commercial aircraft and vessels are expanding the market significantly.

What are the main regulatory challenges facing LEO mega-constellation operators?

The primary regulatory challenges involve securing spectrum allocation across various international jurisdictions, mitigating orbital debris and collision risks due to the sheer number of deployed satellites, and navigating country-specific licensing requirements for ground station deployment and service provision, which varies widely globally.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager