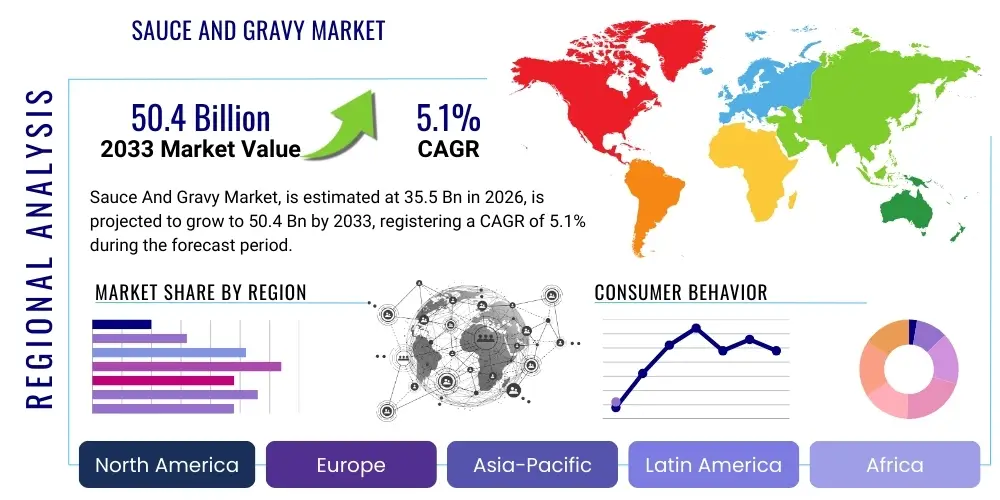

Sauce And Gravy Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441537 | Date : Feb, 2026 | Pages : 241 | Region : Global | Publisher : MRU

Sauce And Gravy Market Size

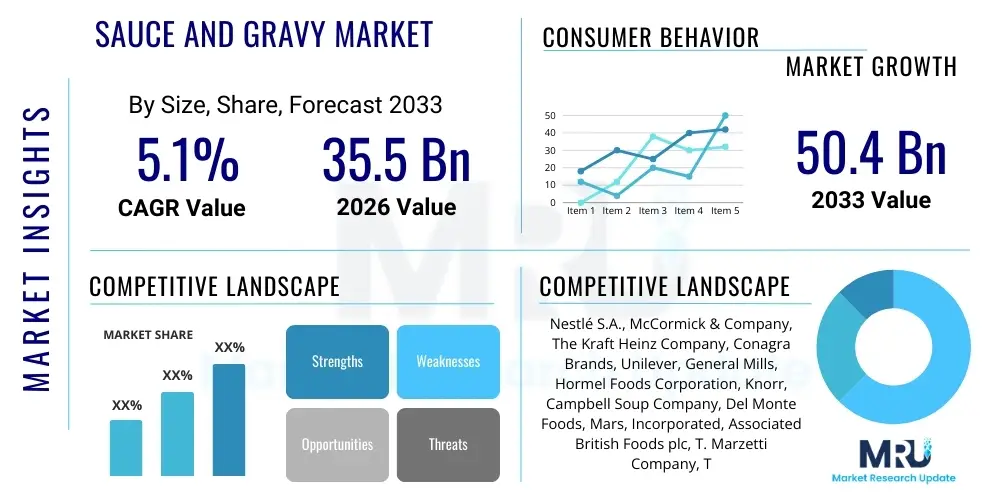

The Sauce And Gravy Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.1% between 2026 and 2033. The market is estimated at USD 35.5 Billion in 2026 and is projected to reach USD 50.4 Billion by the end of the forecast period in 2033.

Sauce And Gravy Market introduction

The global Sauce and Gravy Market encompasses a wide array of products designed to enhance the flavor, moisture, and texture of various cuisines. These culinary components are essential in both household cooking and commercial foodservice sectors, providing convenience and consistency in meal preparation. The market spans numerous categories, including cooking sauces, table sauces (condiments), gravies, marinades, and dressings, catering to diverse global palates and dietary requirements. Product descriptions range from traditional, thick brown gravies used in Western cuisine to complex Asian stir-fry sauces and spicy Latin American moles. Key applications include direct consumption with prepared foods, use as ingredients in processed meals, and integration into restaurant dishes to maintain signature flavors.

Major applications of sauces and gravies are pervasive across the food industry. In the retail segment, consumers utilize these products to quickly assemble or upgrade home-cooked meals, reflecting a growing need for convenient solutions amidst busy lifestyles. The foodservice sector, encompassing restaurants, quick-service chains, and institutional catering, relies heavily on bulk sauces and gravies to ensure efficiency, standardization, and cost control across thousands of operations. Furthermore, the industrial sector incorporates high volumes of specialized sauces and flavor bases into frozen entrees, ready-to-eat meals, and snack food formulations, acting as fundamental building blocks for complex flavor profiles and extending product shelf life.

The primary benefits driving market expansion include unparalleled convenience, flavor complexity, and cost-effectiveness compared to preparing sauces from scratch. Consumers are increasingly seeking global and authentic flavors, and manufacturers respond by offering exotic sauces that introduce culinary diversity without requiring extensive preparation time or specialized ingredients. Driving factors for growth include rapid urbanization, which increases reliance on packaged foods, the expansion of the global fast-food industry, and continuous product innovation focused on health attributes such as low sugar, low sodium, and plant-based formulations, successfully mitigating traditional concerns associated with high preservative content.

Sauce And Gravy Market Executive Summary

The Sauce and Gravy Market demonstrates robust growth, propelled primarily by shifts in consumer dining habits toward convenience and experiential eating. Business trends highlight a strong focus on strategic acquisitions and partnerships aimed at expanding geographic reach and diversifying product portfolios, especially in specialized segments like organic, ethnic, and free-from sauces. Manufacturers are heavily investing in R&D to utilize advanced flavor encapsulation technologies and natural preservation methods, ensuring product quality and extending shelf life while meeting demands for clean labels. Digital marketing and e-commerce penetration are also key commercial trends, allowing niche brands to access broader markets and engage directly with consumers seeking artisanal or specialty products, thereby fragmenting the market slightly but adding dynamic competition.

Regionally, the market exhibits varied maturity levels. North America and Europe, representing mature markets, are characterized by high consumption rates and sophisticated consumer demands, emphasizing premiumization, transparency, and sustainable sourcing. Growth in these regions is primarily volume-driven, coupled with significant innovation in health-focused alternatives. Conversely, the Asia Pacific (APAC) region stands out as the highest growth potential area, fueled by rapidly rising disposable incomes, westernization of diets, and expanding foodservice infrastructure, particularly in developing economies like China and India. The Middle East and Africa (MEA) and Latin America show steady potential, largely driven by population growth and increasing consumption of processed and packaged foods, though distribution logistics remain a persistent challenge in these territories.

Segmentation trends reveal substantial momentum in the cooking sauces category, particularly those facilitating quick, complete meals, such as pasta sauces and curry bases. Ingredient preferences are shifting; the demand for natural and non-GMO ingredients is rising, pressuring suppliers to reformulate existing products. Furthermore, the distribution channel analysis indicates that supermarkets and hypermarkets maintain dominance due to convenience and variety, but the institutional/foodservice segment is recovering sharply post-pandemic, driving large-volume sales. The fastest-growing segment is expected to be plant-based and vegan sauces, mirroring broader dietary shifts towards sustainable and animal-free options, forcing even traditional gravy manufacturers to introduce alternative formulations based on mushrooms or vegetable broths.

AI Impact Analysis on Sauce And Gravy Market

Analysis of common user questions regarding AI's influence in the Sauce and Gravy Market reveals significant interest in flavor innovation, supply chain resilience, and personalized consumer experiences. Users frequently inquire about how AI can predict successful flavor combinations before costly R&D trials and how machine learning algorithms can optimize complex, multi-ingredient supply chains to mitigate volatility in spice or vegetable commodity prices. A recurring theme is the expectation that AI will lead to the 'hyper-personalization' of sauces, allowing consumers to specify nutritional profiles or flavor intensities, which manufacturers could theoretically meet through highly flexible, AI-managed production lines. Key concerns often revolve around the initial capital investment required for AI implementation and ensuring that automation does not diminish the artisanal or traditional quality associated with premium sauces.

AI is fundamentally transforming manufacturing processes within the sauce and gravy industry by enhancing predictive maintenance and optimizing batch consistency. Machine vision systems, powered by AI, are deployed on production lines to perform real-time quality control checks, instantly identifying inconsistencies in color, viscosity, or particle size, thereby reducing waste and improving product uniformity far beyond human capability. Furthermore, AI-driven predictive maintenance schedules reduce unplanned downtime by analyzing sensor data from mixers, fillers, and sterilizers, ensuring continuous operation, which is critical for high-volume, low-margin food production. This shift towards data-driven manufacturing optimizes energy use and raw material consumption, offering tangible cost savings.

Beyond the factory floor, Artificial Intelligence plays a crucial role in strategic market planning and consumer outreach. AI-powered tools analyze massive datasets of social media trends, sales data, and competitive offerings to pinpoint emerging flavor preferences and unmet market needs, enabling faster, data-informed product development cycles. This strategic application reduces the time-to-market for innovative sauces, ensuring that products align precisely with fleeting consumer trends, such as the sudden surge in demand for fermented or regional African flavors. Moreover, AI assists in optimizing logistics and inventory management by accurately forecasting demand fluctuations based on seasonal changes, promotional activities, and external economic factors, minimizing spoilage and ensuring optimal stock levels across disparate distribution points.

- Enhanced Flavor Formulation: AI algorithms predict the stability and consumer acceptance of novel ingredient pairings, accelerating R&D.

- Supply Chain Optimization: Machine learning predicts commodity price volatility (e.g., tomatoes, chili) and optimizes sourcing strategies, ensuring cost stability.

- Automated Quality Control: Vision systems ensure consistent color, texture, and viscosity in real-time on production lines, minimizing defects.

- Personalized Product Recommendations: AI analyzes individual purchasing history and dietary needs to recommend tailored sauce products and recipes.

- Predictive Maintenance: Reduces equipment downtime and operational costs by forecasting mechanical failures in high-throughput blending and filling machinery.

- Demand Forecasting Accuracy: Improves inventory management and reduces food waste by generating highly accurate forecasts based on multiple external variables.

- Optimized Shelf Placement: AI analyzes retail data to recommend optimal product placement strategies in physical and virtual stores to maximize visibility and sales conversion.

DRO & Impact Forces Of Sauce And Gravy Market

The Sauce and Gravy Market is significantly influenced by a combination of key drivers, fundamental restraints, and emerging opportunities, collectively shaping its trajectory. A primary driver is the accelerating consumer desire for culinary convenience; packaged sauces drastically cut down meal preparation time, aligning perfectly with modern, fast-paced lifestyles. Additionally, the globalization of food culture acts as a powerful catalyst, as consumers seek and incorporate international flavors—like authentic Thai curry pastes or Peruvian aji sauces—into their daily cooking, expanding the overall flavor repertoire demanded from manufacturers. The robust growth of the global foodservice industry, particularly quick-service restaurants (QSRs) and specialized food delivery services, further necessitates standardized, high-quality bulk sauces, sustaining continuous demand.

Despite strong driving forces, the market faces distinct restraints that temper growth rates. The volatility in the prices of key raw materials, such as specific spices, sweeteners, and primary agricultural commodities (e.g., tomatoes, soybeans), presents ongoing financial challenges, forcing manufacturers to either absorb costs or raise consumer prices. Furthermore, increasing consumer scrutiny regarding health and wellness is a substantial restraint; the negative perception often associated with packaged sauces—high in sodium, sugar, or artificial preservatives—pushes demand towards niche, often more expensive, ‘clean label’ alternatives. Regulatory hurdles, particularly cross-border food safety and labeling standards, also increase operational complexity and limit the ease of global market expansion.

Opportunities for expansion are abundant, particularly in addressing specific demographic and dietary needs. The demand for clean label, non-GMO, organic, and plant-based sauces represents a major growth opportunity, allowing premium pricing and targeting health-conscious segments. Technological advancements in natural preservation techniques, such as high-pressure processing (HPP), offer a route to reducing artificial additives without compromising shelf stability, attracting discerning consumers. Moreover, engaging with emerging markets in APAC and Latin America, where consumer brand loyalty is forming and distribution networks are rapidly maturing, provides significant long-term potential for mass-market product penetration and volume sales. These impact forces necessitate adaptive supply chain strategies and continuous product innovation to maintain competitive advantage.

Segmentation Analysis

The Sauce and Gravy Market is complexly segmented based on type, raw material, distribution channel, and application, reflecting the vast diversity of consumer uses and preferences globally. This granular segmentation allows manufacturers to tailor their product offerings and marketing strategies to specific consumer niches, addressing everything from dietary restrictions to geographic flavor mandates. Segmentation by type, for example, differentiates between table sauces (used post-cooking, like ketchup or mustard), cooking sauces (used during preparation, like pasta sauce or marinade), and gravies, each serving a distinct culinary purpose and having separate market dynamics related to packaging, shelf life, and ingredient profile. Understanding these segments is paramount for effective resource allocation and market positioning.

Segmentation by raw material reveals the underlying trends in ingredient sourcing and consumer health focus. The shift away from artificial additives towards natural and organic ingredients has created a distinct sub-segment of 'clean label' products, which command higher prices. Furthermore, the rise of plant-based diets has spurred the development of specialized vegan sauces and gravies, substituting traditional meat stocks with vegetable broths or mushroom bases. Meanwhile, the distribution channel segmentation underscores the importance of accessibility; while the general grocery channel (supermarkets/hypermarkets) captures the largest volume due to household purchasing, the foodservice segment is crucial for bulk sales and maintaining brand presence in commercial kitchens, highlighting a dual strategy requirement for market leaders.

The most telling segmentation, arguably, is by application—household versus commercial/industrial use. Household consumption is driven by flavor novelty, convenience, and smaller package sizes, making it sensitive to retail trends and direct consumer marketing. Conversely, commercial applications, used by restaurants and food processors, prioritize large-volume efficiency, consistency, and stringent safety standards, necessitating bulk packaging and specialized formulation stability under high-heat or freezing conditions. Identifying the growth pockets within these application areas—for instance, the accelerating demand for high-quality, pre-portioned sauces in meal kit services—is vital for future investment and capacity planning within the Sauce and Gravy Market.

- By Type:

- Cooking Sauces (e.g., Pasta Sauces, Curry Bases, Stir-Fry Sauces)

- Table Sauces/Condiments (e.g., Ketchup, Mustard, Mayonnaise, Hot Sauce)

- Gravies

- Dressings and Marinades

- Dips and Spreads

- By Raw Material/Ingredient:

- Tomato-Based

- Soy-Based

- Dairy-Based

- Fruit/Vegetable-Based

- Spicy/Chili-Based

- By Distribution Channel:

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Retail (E-commerce)

- Foodservice/Institutional (HORECA)

- By Packaging Type:

- Bottles and Jars (Glass, Plastic)

- Pouches and Sachets

- Cans

- Bulk Containers

- By Application:

- Household/Retail

- Commercial/Foodservice

Value Chain Analysis For Sauce And Gravy Market

The value chain for the Sauce and Gravy Market commences with upstream activities, primarily involving the sourcing and procurement of diverse raw materials, including agricultural products (tomatoes, chili peppers, soybeans, herbs), essential oils, spices, and specialized functional ingredients (stabilizers, emulsifiers, natural preservatives). Upstream analysis reveals that the fragmented nature of agricultural supply chains, coupled with susceptibility to climate change and geopolitical instability, introduces significant cost volatility and quality control challenges. Successful manufacturers implement robust supplier management systems, often involving vertical integration or long-term contracts, to ensure a stable supply of high-quality, consistently flavored ingredients, which are the fundamental determinants of final product quality and consumer acceptance.

Midstream processes center on sophisticated manufacturing, blending, and packaging operations. This stage involves complex flavor development, industrial-scale processing (cooking, homogenization, pasteurization, and sterilization), and ensuring adherence to stringent global food safety standards (HACCP, ISO 22000). Direct distribution often involves large bulk orders for the foodservice industry, utilizing refrigerated or ambient transport tailored to the product’s shelf stability requirements. Indirect distribution, which dominates the retail segment, moves products through national and regional distributors, central warehouses, and third-party logistics (3PL) providers before reaching the final retail shelf. Efficiency in the midstream, particularly optimizing sterilization techniques, directly impacts both production cost and the critical shelf life of the final product.

Downstream analysis focuses on market access, sales, and consumption. The distribution channel is bifurcated: direct channels typically serve high-volume institutional clients (e.g., national restaurant chains) where relationship management and consistent supply are key. Indirect channels dominate the consumer segment, relying on the extensive reach of supermarkets, hypermarkets, and increasingly, specialized e-commerce platforms. Successful downstream strategy involves aggressive brand positioning, data-driven promotional activities, and strong retail partnerships to secure favorable shelf placement (AEO for physical retail). Consumer feedback loops, often facilitated through digital platforms, complete the chain, influencing future R&D by providing crucial data on flavor trends and packaging preferences, ensuring the continuous relevance and market appeal of sauce and gravy offerings.

Sauce And Gravy Market Potential Customers

The primary potential customers for the Sauce and Gravy Market are broadly categorized into three distinct groups: individual households (retail consumers), commercial food service operators, and industrial food manufacturers. Individual households represent the largest and most fragmented customer base, driven by desires for convenience, culinary exploration, and health-focused options. These consumers are seeking easy-to-use flavor enhancers to elevate everyday meals, often influenced by marketing, price sensitivity, and the availability of specialty ethnic or dietary-specific products (e.g., gluten-free pasta sauce or low-sodium soy sauce). Manufacturers target this group through attractive retail packaging, promotional bundling, and high visibility in grocery aisles and online marketplaces.

Commercial food service operators—including restaurants, hotels, cafes (HORECA), catering services, and institutional facilities (hospitals, schools)—constitute the second critical customer segment. These customers require sauces and gravies in bulk, prioritizing consistency, cost-efficiency, and versatility, as these products form the flavor foundation for their menus. For QSRs and chain restaurants, the absolute consistency of a signature sauce or dressing across all outlets is paramount to maintaining brand identity. Sales strategies targeting this segment emphasize reliable supply, tailored industrial formulations (often highly concentrated or heat-stable), and competitive pricing structures based on high-volume commitment.

The industrial food manufacturing sector represents the third, highly specialized customer segment. These customers are typically large-scale producers of frozen meals, ready-to-eat entrees, snack foods, and prepared packaged foods. Their needs are highly technical, demanding specific sauce bases that can withstand complex manufacturing processes like freezing, thawing, retort sterilization, and long-term shelf storage without degradation of flavor, color, or texture. The relationship here is often B2B, involving custom formulation and rigorous specification adherence, making technical support and R&D collaboration essential elements of the vendor offering. These industrial applications drive demand for highly stable, specialized flavor components and concentrates.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 35.5 Billion |

| Market Forecast in 2033 | USD 50.4 Billion |

| Growth Rate | 5.1% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Nestlé S.A., McCormick & Company, The Kraft Heinz Company, Conagra Brands, Unilever, General Mills, Hormel Foods Corporation, Knorr, Campbell Soup Company, Del Monte Foods, Mars, Incorporated, Associated British Foods plc, T. Marzetti Company, TreeHouse Foods, Inc., Mizkan Holdings Co., Ltd., Kewpie Corporation, Premier Foods plc, Frito-Lay, B&G Foods, Inc., Lee Kum Kee. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Sauce And Gravy Market Key Technology Landscape

The Sauce and Gravy Market is increasingly reliant on advanced food processing and preservation technologies to meet consumer demands for both fresh taste and extended shelf life, while minimizing artificial additives. A critical technology is High-Pressure Processing (HPP), a non-thermal pasteurization technique. HPP subjects packaged products to intense pressure, effectively inactivating pathogens and spoilage microorganisms while retaining the natural flavor, color, and nutritional integrity of the sauce. This technology is particularly favored for premium, fresh-prepared sauces and dressings where maintaining a clean label and 'fresh' profile is essential, contrasting sharply with traditional heat sterilization which can often degrade volatile flavor compounds and nutrients, representing a significant technical shift in product quality.

Beyond preservation, automation and digitalization are fundamentally transforming the manufacturing floor. State-of-the-art manufacturing facilities utilize automated blending systems that ensure absolute ingredient consistency across large batches, monitored by sophisticated sensor technology. These systems leverage IoT (Internet of Things) devices to collect real-time data on parameters such as temperature, viscosity, and pH level, feeding into centralized control systems. Advanced filling and packaging machinery are designed for high throughput and rapid switching between various container types (jars, pouches, bottles), significantly enhancing operational flexibility. Furthermore, specialized aseptic packaging technologies are crucial for long-shelf-life liquid products, ensuring sterility without the use of excessive preservatives, thus supporting the clean label trend.

In the realm of flavor development and ingredient management, encapsulation technology is gaining prominence. Flavor encapsulation involves trapping volatile flavor compounds, spices, or nutrients within a protective matrix, preventing their degradation during processing or storage, and ensuring a burst of flavor upon consumption. This is vital for complex sauces that require long shelf stability but must deliver authentic, fresh taste. Additionally, technologies related to waste reduction and sustainable manufacturing, such as efficient water recycling systems and energy-optimized cooking kettles, are becoming standard practice, driven by corporate social responsibility goals and regulatory pressure. The adoption of AI and machine learning for predictive quality control further solidifies the role of data-driven technology in maintaining product excellence and optimizing resource utilization in the modern sauce kitchen.

Regional Highlights

Regional dynamics play a significant role in shaping the Sauce and Gravy Market, driven by local culinary traditions, economic development, and varying consumer health consciousness. North America and Europe, as mature markets, exhibit stable demand with a heavy emphasis on innovation centered around premiumization. North American consumers drive demand for ethnic sauces, low-sugar condiments, and gourmet gravies. European market growth is robust, particularly in the UK and Germany, focused on convenience and organic certifications, with strong growth observed in ready-to-use pasta sauces and dipping sauces, reflecting increasingly diverse and convenience-oriented meal preparation habits.

The Asia Pacific (APAC) region is forecasted to be the engine of market expansion, showing the highest growth rates globally. This is largely attributable to rapid urbanization, rising disposable income, and the extensive adoption of Western dietary patterns which integrate packaged sauces and gravies into traditional meals. Countries like China, India, and Southeast Asian nations are witnessing an explosion in both domestic and international QSR chains, driving massive demand for bulk sauces (e.g., soy sauce, chili sauce, oyster sauce). Local manufacturers are also capitalizing on the domestic popularity of authentic, region-specific sauces, necessitating localized flavor formulations and effective cold chain logistics.

Latin America and the Middle East & Africa (MEA) represent emerging opportunities. Latin America, particularly Brazil and Mexico, shows potential driven by population growth and the cultural importance of specific regional sauces, such as various forms of salsa and chili preparations. The MEA market is characterized by increasing foreign investment in foodservice infrastructure and rising consumer preference for hygienic, packaged food alternatives over unpackaged options, though the growth trajectory is constrained in some areas by complex import tariffs and challenging cold chain requirements. Overall, market success across these regions requires deep cultural insight and the ability to adapt products to specific local taste profiles and regulatory environments.

- North America: Market maturity, focus on premium, organic, and ethnic flavors. High adoption of condiments and dressings.

- Europe: Strong demand for clean label and health-conscious sauces; major consumers of prepared pasta sauces and gourmet gravy mixes.

- Asia Pacific (APAC): Highest growth region, driven by urbanization, QSR expansion, and high consumption of indigenous sauces like soy, oyster, and chili sauces.

- Latin America: Emerging growth, dominated by regional spice preferences and increasing demand for shelf-stable packaged goods, particularly in Brazil and Mexico.

- Middle East and Africa (MEA): Growth driven by population expansion and reliance on packaged foods for hygiene and convenience, particularly in Gulf Cooperation Council (GCC) countries.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Sauce And Gravy Market.- Nestlé S.A.

- McCormick & Company

- The Kraft Heinz Company

- Conagra Brands

- Unilever

- General Mills

- Hormel Foods Corporation

- Knorr (Owned by Unilever)

- Campbell Soup Company

- Del Monte Foods

- Mars, Incorporated

- Associated British Foods plc

- T. Marzetti Company

- TreeHouse Foods, Inc.

- Mizkan Holdings Co., Ltd.

- Kewpie Corporation

- Premier Foods plc

- B&G Foods, Inc.

- Lee Kum Kee

- Frito-Lay (PepsiCo)

Frequently Asked Questions

Analyze common user questions about the Sauce And Gravy market and generate a concise list of summarized FAQs reflecting key topics and concerns.What primary trends are influencing the growth of the Sauce and Gravy Market?

The market is primarily driven by three core trends: increasing consumer demand for culinary convenience and ready-to-use meal solutions; the exploration and adoption of global, authentic ethnic flavors in daily cooking; and a significant shift towards health-focused products, specifically clean label, low sodium, low sugar, and plant-based sauce alternatives that address modern dietary concerns.

How is the concept of 'clean label' impacting product development in the Sauce and Gravy sector?

The clean label trend is forcing widespread product reformulation, requiring manufacturers to eliminate artificial colors, flavors, preservatives, and high-fructose corn syrup (HFCS). This shift necessitates the adoption of natural ingredients, shorter ingredient lists, and advanced natural preservation techniques like High-Pressure Processing (HPP) to meet consumer expectations for transparency and healthier food options.

Which geographic region presents the most significant growth opportunities for sauce and gravy manufacturers?

The Asia Pacific (APAC) region, specifically emerging economies like China and India, offers the highest growth potential. This is fueled by rising middle-class disposable incomes, rapid expansion of the foodservice sector (QSRs), and increasing urbanization, which collectively drives massive adoption of packaged and prepared cooking sauces, both domestic and international variants.

What role does e-commerce and digital distribution play in the market?

E-commerce is increasingly vital, allowing smaller, specialized, or artisanal sauce brands to bypass traditional retail barriers and achieve national or global reach. Digital platforms also provide powerful channels for personalized marketing, direct consumer engagement, and the efficient distribution of high-value, niche products that benefit from targeted online marketing campaigns and subscription models.

What are the main differences in demand between the household and foodservice segments?

The household segment demands smaller package sizes, variety, and flavor novelty, focusing on daily cooking convenience. Conversely, the foodservice segment requires high-volume, cost-effective bulk containers, absolute product consistency for branding, and technical stability (e.g., heat stability for buffets) to ensure standardized quality across commercial kitchen operations and reduce preparation time and labor costs.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager