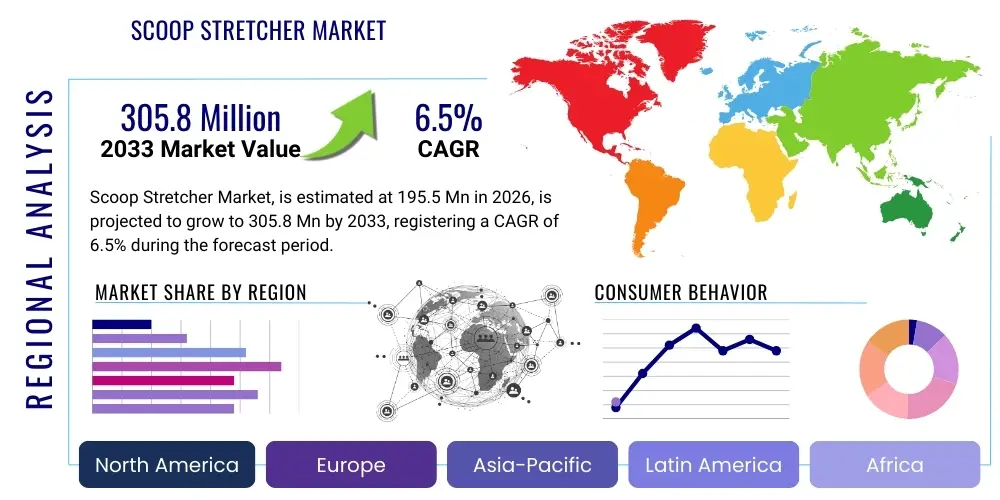

Scoop Stretcher Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443219 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Scoop Stretcher Market Size

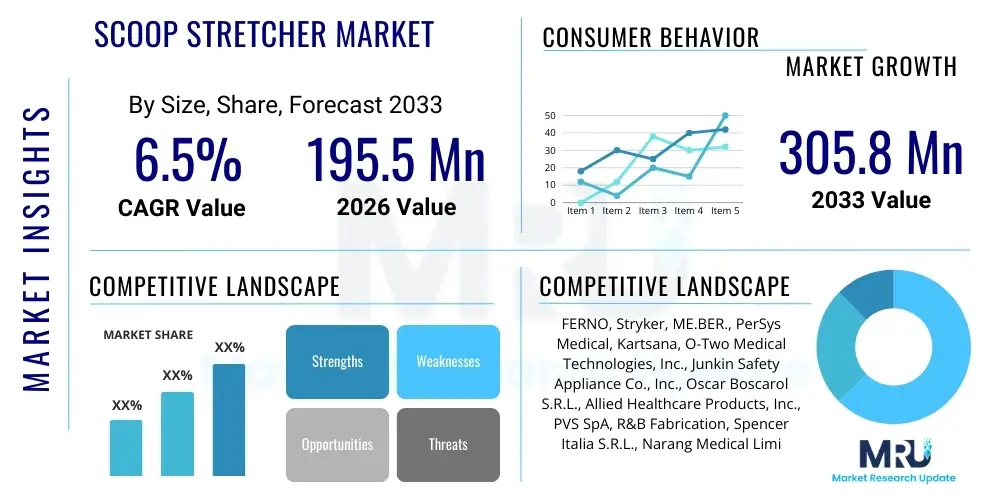

The Scoop Stretcher Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at $195.5 Million in 2026 and is projected to reach $305.8 Million by the end of the forecast period in 2033. This growth trajectory is fundamentally driven by the increasing global prevalence of road traffic accidents and sports injuries requiring spinal immobilization, coupled with enhanced investment in pre-hospital emergency medical services (EMS) infrastructure, particularly in developing economies.

Scoop Stretcher Market introduction

The Scoop Stretcher Market encompasses specialized medical devices designed for lifting and transferring patients, particularly those sustaining suspected spinal injuries, without the need for excessive manipulation, thereby minimizing the risk of further trauma. These devices, often constructed from durable materials like aluminum alloys or high-density polyethylene, split longitudinally into two halves, which are then placed symmetrically beneath the patient and subsequently clipped together. Major applications include trauma centers, ambulance services, military field operations, and sports medicine. The primary benefit of using a scoop stretcher is superior patient immobilization and enhanced safety during transport, especially crucial in trauma scenarios. Key driving factors include stringent regulatory guidelines emphasizing patient safety in emergency transport, the continuous expansion of global emergency response networks, and ongoing technological advancements focused on ergonomic design and lightweight materials to improve operational efficiency for paramedics.

Scoop stretchers, also known as orthopedic stretchers, represent a critical component of initial trauma management protocol. Unlike traditional rigid stretchers or spine boards, the articulating design allows EMS personnel to "scoop" the patient, integrating the stretcher halves seamlessly around the individual without rolling or excessive repositioning. This mechanism is paramount in scenarios involving multi-system trauma or instances where moving the patient could aggravate existing neck or spinal cord injuries. The efficacy of scoop stretchers in reducing lateral movement and ensuring neutral alignment during extrication positions them as indispensable tools in modern emergency medical kits globally.

The market landscape is characterized by constant innovation focusing on material science and operational features. Manufacturers are increasingly integrating features such as telescopic adjustment capabilities to accommodate varying patient heights, thermal insulation properties for extreme weather conditions, and improved locking mechanisms for enhanced security. Furthermore, the push for radiolucent materials, which allow X-rays to be taken without removing the patient from the device, is boosting adoption rates in hospital settings and advanced trauma units, cementing the scoop stretcher's role beyond just pre-hospital care and into initial diagnostic phases.

Scoop Stretcher Market Executive Summary

The Scoop Stretcher Market is witnessing robust business expansion driven by mandatory safety standards in global EMS protocols and rising healthcare expenditure aimed at modernizing trauma care infrastructure. Regional trends show North America and Europe maintaining market dominance due to established emergency response systems and high awareness regarding spinal injury protocols, while the Asia Pacific region is demonstrating the fastest growth propelled by rapid urbanization, infrastructure development, and increased motor vehicle ownership leading to higher incident rates requiring sophisticated extrication equipment. Segment trends indicate a strong preference for durable, lightweight composite material stretchers over traditional aluminum, owing to improved portability and ease of disinfection. Furthermore, the adoption of specialized variants, such as those designed for bariatric patients or hazardous environments, is expanding the market utility, suggesting a continued focus on specialized product differentiation to capture niche emergency response requirements across various end-user settings.

A key observation in market dynamics involves the regulatory harmonization efforts across major economic blocs, such as the EU Medical Device Regulation (MDR) and FDA guidelines in the US, which are compelling manufacturers to adhere to higher quality and safety standards. This regulatory push inadvertently favors established, compliant manufacturers, potentially leading to market consolidation. Simultaneously, business trends highlight increased investment in automated manufacturing processes to reduce production costs and improve consistency, addressing the price sensitivity observed in high-volume public sector procurement across various geographies. The shift towards procurement models emphasizing long-term durability and ease of maintenance is also influencing tender specifications globally.

Segmentation analysis reveals that the End-User segment, specifically the Hospital and Trauma Center category, is poised for significant revenue growth, driven by institutional purchasing cycles and the need to replace aging equipment. Conversely, the growth of private ambulance services and specialized rescue teams is contributing substantially to the expansion of the Pre-Hospital Emergency Services segment. Material-wise, while polymer-based stretchers offer cost-effectiveness and weight advantages, high-grade aluminum stretchers maintain a steady demand in military and extreme environment applications due to their exceptional resilience and structural integrity, ensuring that both material types maintain relevance based on specific operational requirements.

AI Impact Analysis on Scoop Stretcher Market

Common user questions regarding AI's impact on the Scoop Stretcher Market primarily revolve around how artificial intelligence can enhance extrication protocols, improve logistics management of EMS equipment, and integrate with patient monitoring systems during transfer. Key themes emerging from this analysis include expectations for AI-driven risk assessment during accident scenarios, optimizing the deployment of specialized equipment like scoop stretchers based on real-time injury severity data, and using machine learning for predictive maintenance schedules of high-value equipment. Users are particularly keen on understanding whether AI can aid in standardizing the application technique, ensuring optimal spinal alignment regardless of the responder's experience level, thereby reducing potential human error during critical phases of patient handling.

- AI-Enhanced Extrication Protocols: Utilizing machine vision and real-time situational analysis to guide paramedics on the safest and fastest sequence for applying the scoop stretcher, especially in confined spaces.

- Predictive Equipment Maintenance: Implementing machine learning algorithms to forecast the lifespan and potential failure points of stretcher components, minimizing downtime and ensuring equipment readiness.

- Logistics Optimization: AI systems managing the inventory and location tracking of scoop stretchers across ambulance fleets and hospital stores, ensuring rapid availability during mass casualty incidents (MCIs).

- Training and Simulation: Using AI and virtual reality (VR) environments to simulate complex trauma scenarios, providing realistic training for applying scoop stretchers and assessing performance metrics against standardized safe handling procedures.

- Integration with Patient Data: Future connectivity allowing the scoop stretcher to transmit telemetry data (e.g., impact forces, movement) wirelessly to electronic patient care records (ePCRs) via AI-driven processing units.

DRO & Impact Forces Of Scoop Stretcher Market

The dynamics of the Scoop Stretcher Market are heavily influenced by a confluence of impactful forces, categorized as Drivers, Restraints, and Opportunities (DRO). A primary Driver is the increasing global incidence of trauma cases requiring immediate and safe patient extrication, coupled with evolving international guidelines mandating spinal immobilization. These factors create persistent demand. However, the market faces Restraints such as the high initial cost associated with specialized, durable medical equipment and the limited replacement cycles in many public health systems burdened by budgetary constraints. Opportunities primarily lie in developing regions where EMS infrastructure is rapidly being established, providing scope for large-scale adoption, alongside product innovation focusing on lightweight, modular, and sustainable designs that meet varied operational needs while reducing environmental impact.

Impact forces in the market are prominently shaped by regulatory scrutiny and technological obsolescence risk. Regulatory bodies like the FDA and European Medicines Agency exert significant force, ensuring high standards for patient safety and device efficacy, which influences material choice and design validation processes. Furthermore, the inherent competition among key manufacturers drives innovation in areas such as composite materials and integration of diagnostic capabilities, aiming to differentiate products in a functionally standardized market. Economic impact forces, specifically healthcare budgets and public sector procurement policies, dictate the volume and frequency of purchases, often favoring robust, long-lasting products over cheaper, less durable alternatives.

The market equilibrium is maintained by balancing the essential need for rapid and safe patient handling (Driver) against the specialized training required for optimal use and the competition from alternative, though less effective, immobilization methods (Restraint). Strategic opportunities include penetrating specialized sectors like tactical EMS (TEMS) and military medicine, where demand for extreme durability and multi-functionality commands premium pricing. Furthermore, manufacturer efforts to standardize training modules and provide comprehensive service contracts act as secondary drivers, enhancing customer lifetime value and reducing perceived complexity associated with implementing new equipment.

Segmentation Analysis

The Scoop Stretcher Market is meticulously segmented based on material type, product design, end-user application, and regional geography, allowing for targeted strategic planning and accurate market assessment. Material segmentation, covering aluminum, plastics/composites, and alloys, is critical as it dictates the stretcher's weight, durability, and radiolucency. Product design variations include standard adjustable stretchers, bariatric models, and specialized collapsible units for confined space rescue. End-user applications are segmented between pre-hospital care (ambulances, rescue teams), hospital settings (emergency departments, orthopedics), and military/field operations. This structured approach helps stakeholders understand specific demand patterns, procurement processes, and regulatory requirements that vary significantly across different segments and end-user environments.

- Material Type:

- Aluminum Alloy Scoop Stretchers

- Plastic/Composite Scoop Stretchers (Polyethylene, Carbon Fiber)

- Hybrid Material Scoop Stretchers

- Product Design:

- Standard Adjustable Scoop Stretchers

- Bariatric Scoop Stretchers

- Collapsible/Foldable Scoop Stretchers

- Radiolucent Scoop Stretchers

- End-User:

- Pre-Hospital Emergency Services (Ambulance Services, Rescue Teams)

- Hospitals and Trauma Centers (Emergency Departments, Operating Theatres)

- Military and Defense Services

- Sports Medicine and Recreation Centers

- Industrial Safety and Occupational Health Services

- Regional Analysis:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Scoop Stretcher Market

The value chain for the Scoop Stretcher Market begins with upstream activities focused on raw material sourcing, predominantly high-grade aluminum, advanced polymers, and specialized composite fibers. This stage involves stringent quality checks to ensure materials meet medical device standards for strength, weight, and biocompatibility. Key upstream players include specialized metal refiners and chemical companies providing medical-grade plastics. The manufacturing process involves precision engineering, molding, and assembly, requiring ISO 13485 certification and compliance with regional medical device regulations. Efficient inventory management and lean manufacturing techniques are crucial at this stage to optimize production costs and respond flexibly to market demand variations across different product specifications (e.g., radiolucency requirements).

Downstream activities center on distribution, sales, and post-sales services. Due to the critical nature of the product, distribution channels must ensure temperature-controlled and timely delivery, especially to remote or high-demand areas. Direct sales often characterize large governmental tenders (military, public EMS), where manufacturers engage directly with procurement bodies to provide customized packages, training, and long-term maintenance contracts. Indirect sales rely heavily on specialized medical equipment distributors and wholesalers who maintain relationships with private hospitals, smaller ambulance services, and regional retailers, providing necessary local logistical support and immediate availability.

The choice between direct and indirect channels is often dictated by regional market maturity and end-user scale. In North America and Western Europe, a mix of direct large-scale tenders and indirect distributor networks is common. In contrast, emerging markets often rely predominantly on established regional medical supply chain partners who handle regulatory clearance and localized marketing. Post-sales service, including repairs, replacements, and mandatory certification checks, forms a vital part of the value chain, ensuring equipment longevity and patient safety, which in turn influences future procurement decisions and strengthens brand reputation among critical end-users like professional paramedics and trauma surgeons.

Scoop Stretcher Market Potential Customers

The primary potential customers and end-users of scoop stretchers are organizations and facilities that specialize in acute care, emergency response, and patient transport where spinal immobilization is a paramount safety requirement. Pre-Hospital Emergency Services, including municipal and private ambulance services globally, form the largest buying segment due to the routine requirement for extricating victims of accidents or medical emergencies. Hospitals and Trauma Centers, specifically their emergency departments and operating room recovery units, represent a crucial customer base for maintaining inventory for intra-hospital transfers of high-risk patients. These institutional buyers focus heavily on durability, ease of cleaning, and seamless integration with existing hospital transport systems, often favoring radiolucent models to speed up diagnostic procedures upon arrival.

Beyond traditional healthcare entities, specialized segments constitute significant potential customers. Military and Defense Services frequently procure ruggedized, high-specification scoop stretchers capable of operating in extreme conditions and meeting stringent defense logistical standards. Their demand is driven by field operations, tactical casualty care, and disaster relief preparedness. Furthermore, major industrial sites, mining operations, and large public venues (stadiums, amusement parks) invest in scoop stretchers as part of their mandatory occupational safety and first aid provisions, requiring robust, easy-to-use equipment readily available for on-site medical response teams.

Lastly, organizations involved in high-risk recreational or competitive sports, such as professional athletic associations and ski patrols, represent a growing niche customer base. These groups prioritize lightweight, quickly deployable stretchers that can be easily transported over challenging terrain while ensuring immediate and secure immobilization of injured athletes. The purchasing decisions in these niche areas are often influenced by recommendations from specialized athletic trainers and regulatory compliance related to sports injury management protocols.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $195.5 Million |

| Market Forecast in 2033 | $305.8 Million |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | FERNO, Stryker, ME.BER., PerSys Medical, Kartsana, O-Two Medical Technologies, Inc., Junkin Safety Appliance Co., Inc., Oscar Boscarol S.R.L., Allied Healthcare Products, Inc., PVS SpA, R&B Fabrication, Spencer Italia S.R.L., Narang Medical Limited, Shanghai Pinxing Medical Equipment Co., Ltd., Jiangsu Rongtai Medical Equipment Co., Ltd., Jiangsu Aosheng Medical Equipment Co., Ltd., Medi-Plinth, Royax, Jiangsu Ruidong Medical Technology Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Scoop Stretcher Market Key Technology Landscape

The technological landscape of the Scoop Stretcher Market is characterized by continuous refinement in material science and ergonomic design focused on enhancing patient comfort, responder safety, and operational efficiency. The shift from traditional heavy aluminum to advanced composite materials, such as high-strength carbon fiber and specialized polymers like high-density polyethylene (HDPE), is a key technological trend. These lighter materials significantly reduce the physical burden on EMS personnel while offering excellent resistance to corrosion, temperature extremes, and chemical disinfectants, crucial for maintaining hygiene standards in emergency environments. Furthermore, the development of radiolucent composites allows for uninterrupted diagnostic imaging, integrating the stretcher seamlessly into hospital workflow. Innovations in interlocking mechanisms are also prominent, ensuring rapid and secure assembly and disassembly, minimizing extrication time.

Another crucial technological advancement is the integration of telescopic adjustment systems. Modern scoop stretchers feature sophisticated, user-friendly mechanisms that allow length adjustments to accurately fit patients of varying statures quickly and securely while maintaining perfect spinal alignment. This technological detail is vital for compliance with best practice trauma care guidelines. Moreover, manufacturers are incorporating advanced surface textures and anti-slip grips to ensure secure handling, even in wet or demanding field conditions. The focus is increasingly on modular design, where different components (e.g., head immobilizers, specialized straps) can be attached or detached easily, enhancing the versatility of the core device for diverse rescue scenarios.

In the context of connectivity, although scoop stretchers are inherently non-electronic devices, emerging technologies focus on linking the physical equipment to digital systems. This includes the implementation of RFID or NFC tags for automated inventory management, tracking sterilization cycles, and facilitating integration with digital EMS fleet management software. This digital linkage aids in ensuring compliance and operational readiness. Furthermore, the design process utilizes advanced computer-aided design (CAD) and stress analysis software to optimize the structural integrity and weight distribution of the stretcher, ensuring that the devices meet stringent load-bearing requirements without sacrificing portability or ease of use.

Regional Highlights

- North America: Dominates the global market share, driven by a highly structured and well-funded emergency medical services (EMS) system. The region exhibits high adoption rates of advanced, often premium-priced, composite and radiolucent scoop stretchers. Strict regulatory environment (FDA approval) ensures product quality and standardization in trauma management protocols.

- Europe: Represents a mature market characterized by stringent safety regulations (CE marking) and public investment in national health services. Germany, the UK, and France are key contributors. There is a strong focus on ergonomic design and cross-border compatibility of rescue equipment, often favoring European manufacturers who adhere to high quality control standards.

- Asia Pacific (APAC): The fastest-growing regional market, fueled by massive infrastructure development, increasing urbanization, and subsequent rise in road traffic accidents. Countries like China and India are expanding their public and private ambulance fleets, driving significant procurement volumes. Demand often leans towards cost-effective, high-durability plastic/composite models.

- Latin America (LATAM): Shows steady growth driven by modernization initiatives in public health systems and increased international funding for disaster preparedness. Brazil and Mexico are primary markets, where procurement focuses on balancing cost efficiency with essential international safety certifications.

- Middle East & Africa (MEA): A burgeoning market characterized by significant investments in specialized rescue equipment, particularly in GCC nations (UAE, Saudi Arabia) and for military/field operations. The demand is often for high-specification, ruggedized aluminum scoop stretchers capable of enduring desert or volatile operational environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Scoop Stretcher Market.- FERNO

- Stryker

- ME.BER.

- PerSys Medical

- Kartsana

- O-Two Medical Technologies, Inc.

- Junkin Safety Appliance Co., Inc.

- Oscar Boscarol S.R.L.

- Allied Healthcare Products, Inc.

- PVS SpA

- R&B Fabrication

- Spencer Italia S.R.L.

- Narang Medical Limited

- Shanghai Pinxing Medical Equipment Co., Ltd.

- Jiangsu Rongtai Medical Equipment Co., Ltd.

- Jiangsu Aosheng Medical Equipment Co., Ltd.

- Medi-Plinth

- Royax

- Jiangsu Ruidong Medical Technology Co., Ltd.

- Reha-Bed

Frequently Asked Questions

Analyze common user questions about the Scoop Stretcher market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary benefit of using a scoop stretcher over a traditional spine board?

The primary benefit is minimization of patient movement during extrication and transfer. Scoop stretchers allow paramedics to effectively 'scoop' the patient from the ground without necessitating the potentially harmful rolling maneuver required for placement onto a rigid spine board, which is crucial for suspected spinal injuries.

Which material type dominates the Scoop Stretcher Market?

While traditional aluminum alloy scoop stretchers remain popular due to their durability and load capacity, the fastest-growing segment is high-density plastic and composite materials. Composites offer advantages in weight reduction, radiolucency (allowing X-rays), and resistance to biological contamination, meeting modern healthcare hygiene standards.

How are strict medical regulations influencing scoop stretcher design?

Strict medical regulations, such as FDA and EU MDR standards, mandate enhanced device structural integrity, biocompatibility of materials, and ease of sterilization. This drives manufacturers to invest heavily in advanced locking mechanisms, durable materials, and radiolucent designs to ensure maximum patient safety and regulatory compliance.

Which end-user segment drives the highest demand for scoop stretchers?

The Pre-Hospital Emergency Services segment, encompassing municipal and private ambulance services globally, constitutes the largest demand driver. This is due to their critical and routine role in emergency response and trauma stabilization, requiring constant replacement and upgrading of their primary extrication tools.

What role does technology play in the future development of scoop stretchers?

Future technological developments focus on integrating connectivity (e.g., RFID tracking for logistics), optimizing ergonomics through advanced CAD simulations, and employing lightweight, high-performance materials like carbon fiber to improve portability and operational ease for first responders in diverse operational theaters.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager