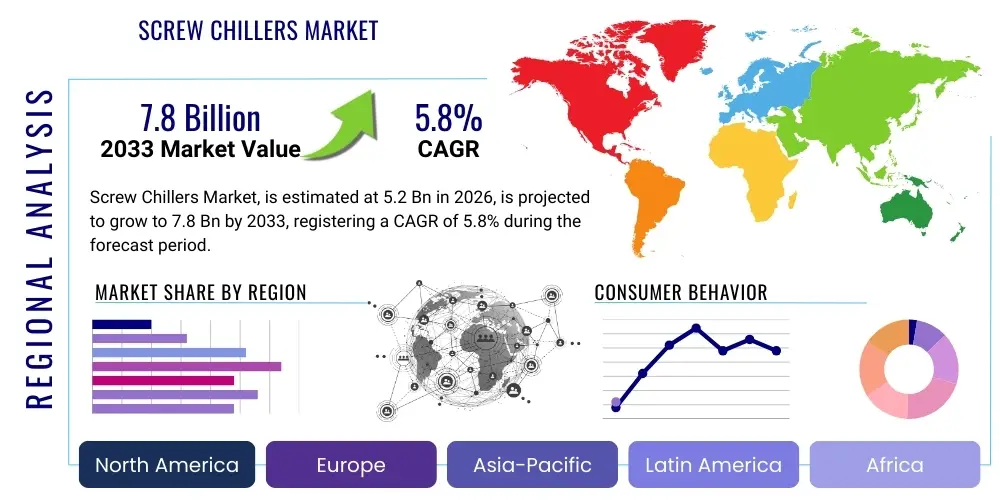

Screw Chillers Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441392 | Date : Feb, 2026 | Pages : 257 | Region : Global | Publisher : MRU

Screw Chillers Market Size

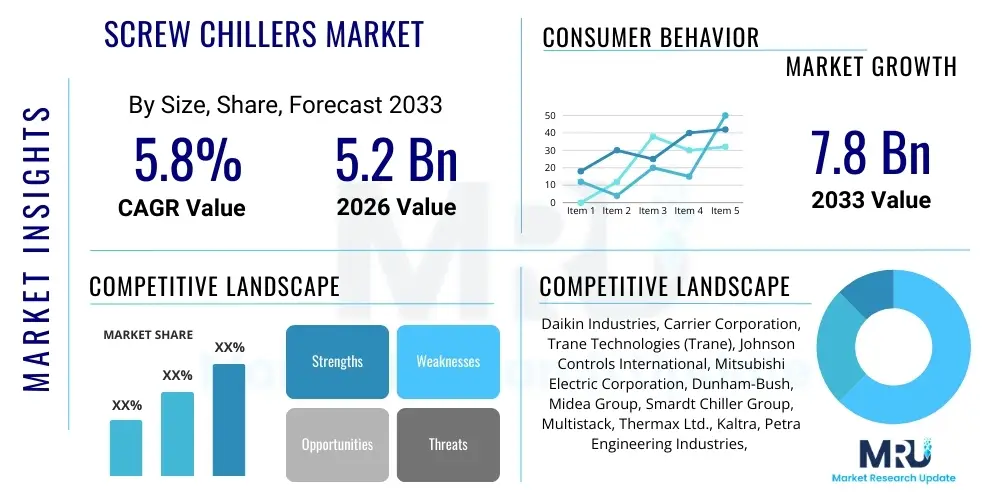

The Screw Chillers Market is projected to grow at a Compound AThe Screw Chillers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $5.2 Billion in 2026 and is projected to reach $7.8 Billion by the end of the forecast period in 2033. This substantial growth is fundamentally driven by the accelerating demand for energy-efficient, high-capacity cooling solutions across massive commercial infrastructures, specialized industrial processes, and large-scale district cooling networks. The increasing global focus on reducing carbon footprints, coupled with stringent governmental regulations concerning HVAC system efficiency (such as minimum efficiency performance standards, or MEPS), compels end-users to upgrade legacy equipment with modern screw chillers, which offer superior part-load efficiency compared to traditional centrifugal or reciprocating units, thereby defining the financial viability of long-term investments in cooling infrastructure. Furthermore, the rapid expansion of data center construction globally, particularly in emerging economies with volatile climates, necessitates reliable and robust cooling systems capable of managing significant thermal loads 24/7, positioning screw chillers as the preferred choice due to their proven reliability, reduced maintenance requirements, and scalability in tandem configurations.

Market expansion is also intricately linked to advancements in compressor technology, specifically the integration of Variable Speed Drive (VSD) systems and oil-free magnetic bearing technology within twin-screw configurations, which significantly enhance operational flexibility and seasonal energy efficiency (SEER/IPLV ratings). Geographically, the Asia Pacific region, led by China and India, represents the primary growth engine, fueled by unprecedented urbanization rates, massive infrastructure projects (including smart cities and large commercial complexes), and booming manufacturing sectors (pharmaceuticals, automotive, chemicals) requiring precise process cooling control. Conversely, matured markets in North America and Europe are characterized more by replacement demand and stringent regulatory mandates driving the adoption of chillers utilizing low Global Warming Potential (GWP) refrigerants, such as HFOs (hydrofluoroolefins), ensuring sustained technological innovation remains a core market dynamic throughout the forecast period. The competitive landscape is intensely focused on leveraging IoT and predictive maintenance capabilities to optimize chiller performance and reduce overall lifecycle costs for end-users.

Screw Chillers Market introduction

Screw Chillers are robust, vapor-compression refrigeration systems that utilize positive displacement rotary screw compressors to provide chilled water for commercial, industrial, and institutional HVAC and process cooling applications. The fundamental mechanism involves the continuous rotation of twin helical rotors (or a single rotor engaging a gate rotor) which compress the refrigerant vapor, significantly increasing its pressure and temperature before it moves through the condenser, expansion valve, and evaporator stages. These chillers are widely favored in mid-to-large capacity installations—typically ranging from 50 tons to over 1,000 tons—where reliability, high capacity, and efficiency, especially under varying load conditions, are paramount requirements. Their design inherently allows for fewer moving parts compared to reciprocating compressors, translating into lower vibration, reduced noise levels, and extended operational life, making them ideal for mission-critical cooling environments like hospitals, data centers, and advanced manufacturing facilities. The product category includes both air-cooled and water-cooled variants, offering flexibility based on site constraints and required energy efficiency profiles, with water-cooled systems generally offering higher coefficient of performance (COP) ratings due to more efficient heat rejection capabilities.

Major applications of screw chillers span across comfort cooling in high-rise buildings, educational institutions, airports, and shopping malls, where consistent temperature management for occupants is essential for productivity and customer experience. Crucially, in industrial settings, they are indispensable for process cooling, maintaining precise temperatures required for chemical reactors, plastic injection molding, metal finishing, and food and beverage production, where minute temperature deviations can compromise product quality or manufacturing throughput. Benefits driving their adoption include their excellent performance under part-load conditions (often utilizing variable speed drives to match cooling output precisely to demand), superior longevity compared to alternatives, and suitability for handling demanding operational cycles. Key driving factors encompass global infrastructure development, the escalating need for efficient cooling in rapidly expanding urban centers, and technological breakthroughs that continuously improve their energy efficiency ratios (EER) and enable the use of environmentally conscious refrigerants as regulations tighten worldwide.

Screw Chillers Market Executive Summary

The Screw Chillers Market is positioned for robust expansion, underscored by transformative business trends focusing heavily on digitalization and sustainability. Business trends indicate a strong industry pivot toward integrated energy management systems (EMS) and IoT capabilities, allowing for real-time performance monitoring, remote diagnostics, and predictive maintenance schedules, thereby maximizing uptime and optimizing energy usage for large commercial and industrial entities. Manufacturers are prioritizing the development of modular and compact designs, facilitating easier installation and integration into existing building management systems (BMS), while competition is intensified by advancements in oil-free screw technology, offering quieter operation and higher efficiency standards. Regionally, the market dynamics are highly differentiated; the Asia Pacific region is the primary driver of new installations due to massive infrastructure investments and rapid industrialization, especially within South East Asian nations and India. In contrast, North America and Europe emphasize retrofit and replacement markets, driven strictly by regulatory mandates promoting the phase-out of high GWP refrigerants and demanding compliance with stringent efficiency benchmarks like SEER and IPLV standards, thus favoring highly efficient Variable Speed Drive (VSD) units.

Segment trends reveal that the twin-screw chiller category maintains dominance due to its superior efficiency and higher capacity range compared to single-screw units, making them the default choice for large industrial process cooling and district cooling applications. Furthermore, the capacity segment exceeding 350 tons is experiencing the fastest growth, directly correlating with the increasing size and thermal density requirements of modern data centers and mega-factories. The end-use segmentation is led by the commercial sector, primarily driven by office buildings, hospitality, and retail, yet the industrial sector, particularly the pharmaceuticals and chemicals sub-segments, exhibits accelerating growth due to the critical nature of maintaining specific process temperatures. Overall market health is contingent upon continued technological innovation in refrigerant choices (shifting towards R-1234ze and R-513A) and the successful integration of advanced controls, ensuring chillers contribute positively to the overall energy performance of smart buildings and complex industrial operations, mitigating operational risks associated with traditional cooling methodologies.

AI Impact Analysis on Screw Chillers Market

User inquiries regarding AI's impact on the Screw Chillers Market frequently center on predictive maintenance capabilities, energy consumption optimization, and integrating chiller performance into broader smart building ecosystems. Users are keenly interested in how AI algorithms can leverage vast amounts of operational data (pressure, temperature, flow rates, ambient conditions) to predict component failure (e.g., compressor bearing wear, refrigerant leaks) long before actual breakdown occurs, thereby minimizing costly downtime and extending asset life. Another major theme is the expectation that AI can dynamically adjust chiller setpoints and optimize staging across multiple units in a plant based on forecasted thermal load, occupancy patterns, and real-time utility pricing, achieving energy savings far beyond what traditional PID controllers or supervisory controls can manage. The core concern revolves around the security and proprietary nature of the data collected and the necessary investment in sensors and communication infrastructure required to effectively utilize AI, pushing manufacturers to develop secure, cloud-based analytical platforms accessible to facility managers for enhanced operational visibility and strategic decision-making regarding cooling system asset management and capital expenditure planning.

- AI-driven Predictive Maintenance: Utilizing machine learning algorithms to analyze vibration, lubrication, and temperature data to forecast potential compressor or motor failures, significantly reducing unplanned outages.

- Dynamic Energy Optimization: Real-time adjustment of compressor speed, condenser water temperature, and fan operation based on AI modeling of building load profiles and external weather data, maximizing IPLV efficiency.

- Fault Detection and Diagnostics (FDD): Automated identification of subtle system inefficiencies (fouling, sensor drift, valve leaks) that typically go unnoticed, restoring peak performance quickly.

- Intelligent Plant Staging: AI orchestration of multiple chiller units within a complex plant, ensuring optimal sequencing and load balancing to maintain high efficiency across varying system demands.

- Enhanced Commissioning and Tuning: Using AI to rapidly calibrate and fine-tune chiller controls during initial commissioning, reducing startup time and ensuring immediate performance alignment with design specifications.

DRO & Impact Forces Of Screw Chillers Market

The Screw Chillers Market is profoundly influenced by a complex interplay of Drivers, Restraints, and Opportunities, resulting in critical Impact Forces shaping its trajectory. The primary Driver is the overwhelming global demand for energy-efficient cooling solutions in response to escalating electricity costs and legislative pressures targeting energy consumption in commercial buildings and industrial processes. This is amplified by rapid urbanization and infrastructure modernization, particularly the construction boom across Asia, requiring high-capacity, reliable HVAC systems for large complexes and data centers. Conversely, the market faces significant Restraints, predominantly high initial capital investment costs associated with screw chillers compared to smaller reciprocating units, which can deter adoption by smaller entities or in projects with restricted budgets. Furthermore, the ongoing regulatory transition concerning refrigerants (phasing out HFCs like R-410A) introduces complexity and higher costs related to the adoption and integration of newer, low GWP alternatives, requiring substantial R&D expenditure from manufacturers and potential retrofit challenges for existing installations.

Opportunities for growth are abundant, notably stemming from the burgeoning district cooling segment, where massive centralized plants leverage high-efficiency screw chillers to supply cooling to entire urban grids, offering economies of scale and significantly higher energy savings potential than decentralized systems. The increasing integration of smart technology—IoT, VSDs, and AI-driven control systems—presents a major opportunity to enhance the operational value proposition, moving screw chillers from simple assets to smart, integrated energy components within a facility's infrastructure. These factors culminate in several significant Impact Forces: first, the pressure to achieve higher Seasonal Energy Efficiency Ratios (SEER) and Integrated Part-Load Value (IPLV) is intensifying competition, making technological innovation in compressor design and heat exchange fundamental. Second, the regulatory shift towards natural and low-GWP refrigerants (e.g., R-290, R-1234ze) is forcing rapid product cycles and supply chain adjustments. Third, the reliability factor remains paramount, particularly in sensitive industrial and data center environments, making robust design and predictive maintenance features essential differentiators in purchasing decisions, influencing long-term customer loyalty and market share consolidation among key players offering comprehensive service packages.

Segmentation Analysis

The Screw Chillers Market is fundamentally segmented based on factors such as compressor type, chiller capacity, cooling method, and primary end-use application, providing a granular view of demand patterns and technological preferences across diverse industrial and commercial landscapes. Analyzing these segments is crucial for understanding where growth opportunities are concentrated and how market participants are tailoring their product portfolios to meet specific functional requirements. For instance, compressor type segmentation delineates the performance boundaries; while single-screw chillers offer simplicity and robustness, the twin-screw segment typically commands the largest market share due to its superior capacity handling, higher efficiency at full load, and reliability in critical cooling applications. This distinction impacts manufacturing complexity and pricing strategies. Similarly, the segmentation by cooling method (air-cooled vs. water-cooled) often dictates regional market performance, with water-cooled systems dominating installations in regions where high efficiency is prioritized and water resources are readily available, whereas air-cooled units are favored in space-constrained or water-scarce environments due to simpler installation requirements and lower ongoing maintenance complexities associated with cooling towers.

Further analysis of the end-use segments highlights the accelerating importance of specialized sectors; while commercial buildings remain the foundational consumer, the demand from specialized industrial sectors such as data centers and pharmaceuticals is exhibiting disproportionate growth rates, driven by the critical need for non-stop, precise temperature control. The capacity segmentation reinforces the trend towards centralization and scale, with high-tonnage units (above 350 tons) showing the most rapid adoption, reflecting the construction of larger facilities globally, demanding centralized cooling systems for operational efficiency. This comprehensive segmentation structure allows stakeholders to strategically target product development and marketing efforts, focusing on VSD technology in the higher capacity, water-cooled twin-screw segments, which align most closely with current global sustainability goals and efficiency mandates, ensuring market relevance and long-term competitive advantage. Understanding these intricate demand dynamics is critical for navigating the competitive landscape and anticipating future technological shifts, particularly concerning refrigerant adoption and integration with advanced building management systems.

- By Compressor Type:

- Single Screw

- Twin Screw

- By Capacity:

- Up to 150 Tons (Small)

- 150 to 350 Tons (Medium)

- Above 350 Tons (Large)

- By Cooling Method:

- Air-Cooled Screw Chillers

- Water-Cooled Screw Chillers

- By End-Use Application:

- Commercial (Offices, Retail, Hospitality)

- Industrial (Chemicals, Pharmaceuticals, Plastics, Automotive)

- Data Centers

- District Cooling

- By Refrigerant Type:

- HFCs (e.g., R-410A)

- HFOs (e.g., R-1234ze, R-1233zd)

- Other Low GWP Refrigerants

Value Chain Analysis For Screw Chillers Market

The Value Chain for the Screw Chillers Market commences with Upstream Analysis, dominated by the procurement and supply of specialized raw materials and core components. Key inputs include high-grade steel and copper for heat exchangers (evaporators and condensers), advanced polymers and lubricants, and, crucially, sophisticated electronic components for control panels, sensors, and Variable Speed Drives (VSDs). The most critical upstream element is the sourcing and precision manufacturing of the screw compressor itself, typically a highly proprietary process involving specialized metallurgy and machining to ensure tight tolerances and reliable performance. This stage is characterized by a limited number of specialized global component suppliers, granting them considerable negotiation power, thus necessitating strategic long-term relationships between chiller manufacturers and these component specialists to ensure stable supply and quality control. Volatility in commodity prices, particularly for copper and steel, directly impacts manufacturing costs and, consequently, the final price point of the chiller units delivered to the market, requiring manufacturers to employ complex hedging and inventory management strategies to mitigate these financial risks across global operations and maintain competitive pricing structures for the end product.

Moving through the midstream, the focus shifts to manufacturing, assembly, and quality assurance, where leading chiller companies leverage advanced assembly lines and rigorous testing protocols to ensure high Coefficient of Performance (COP) and Integrated Part-Load Value (IPLV) ratings, alongside compliance with international safety and environmental standards (such as AHRI certification). The Downstream Analysis focuses critically on Distribution Channels, which are highly specialized due to the technical nature of the product. Direct distribution is common for large, custom-engineered projects, such as district cooling plants or highly specialized industrial applications, where manufacturers maintain in-house engineering teams to consult, design, and commission the system directly with the end-user or consulting engineer. Indirect distribution, however, represents the volume-driving segment, relying on a robust network of authorized distributors, licensed mechanical contractors, and specialized HVAC engineering firms who handle sales, installation, startup, and essential post-sales service. The maintenance and service segment, forming the tail-end of the value chain, is highly profitable and crucial for customer retention, involving scheduled maintenance, parts supply, and emergency repairs, often leveraging proprietary diagnostic tools and certified technicians to ensure optimal long-term system performance and efficiency management.

Screw Chillers Market Potential Customers

The potential customers and primary End-User/Buyers of screw chillers are concentrated within entities requiring high-capacity, reliable, and energy-efficient temperature management for either comfort or critical process stabilization. These customers possess specific requirements concerning cooling capacity, footprint limitations, noise reduction standards, and, increasingly, adherence to stringent energy efficiency mandates and low GWP refrigerant usage. The largest segment remains the institutional and commercial property owners and developers, encompassing entities that manage or construct large infrastructure projects such as international airports, university campuses, large hospital networks, and massive commercial retail complexes, all of whom prioritize longevity, low lifecycle costs, and seamless integration with sophisticated Building Management Systems (BMS) to handle fluctuating occupancy loads efficiently. These buyers typically engage consulting engineers or facility management organizations to conduct detailed analyses of life cycle costs versus initial capital expenditure, making purchasing decisions highly technical and long-term focused, often favoring brands with proven service reliability and extensive warranties that ensure operational continuity.

A second, rapidly growing cohort of potential customers resides in the specialized Industrial and Technology sectors, most notably Data Center operators and pharmaceutical manufacturers. Data centers, whether hyperscale or co-location facilities, require enormous, reliable cooling capacity, making water-cooled twin-screw chillers with advanced redundancy features mandatory to prevent catastrophic server failure and uphold Service Level Agreements (SLAs). Similarly, the pharmaceutical industry requires precise temperature control for manufacturing critical biologics, fermentation processes, and storage, where process cooling stability is non-negotiable for product quality and regulatory compliance, thereby demanding highly customized, redundant chiller solutions. These industrial buyers are characterized by high technical expertise, strict validation protocols, and a strong preference for chillers optimized for specific temperature setpoints and fluid types, placing a premium on vendor expertise in process integration and regulatory documentation, further solidifying the necessity for high-quality, dependable, and meticulously engineered screw chiller installations that can operate efficiently under continuous peak load conditions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $5.2 Billion |

| Market Forecast in 2033 | $7.8 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Daikin Industries, Carrier Corporation, Trane Technologies (Trane), Johnson Controls International, Mitsubishi Electric Corporation, Dunham-Bush, Midea Group, Smardt Chiller Group, Multistack, Thermax Ltd., Kaltra, Petra Engineering Industries, Broad Group, GREE Electric Appliances, Clivet S.p.A., Hitachi Industrial Equipment Systems Co., Ltd., Lennox International, LG Electronics, Eurovent, CIMCO Refrigeration. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Screw Chillers Market Key Technology Landscape

The technological landscape of the Screw Chillers Market is rapidly evolving, driven primarily by the twin mandates of enhanced energy efficiency and environmental compliance regarding refrigerant selection. The most transformative technology remains the widespread integration of Variable Speed Drive (VSD) technology, specifically in high-capacity twin-screw units. VSDs allow the compressor motor speed to be precisely modulated in response to actual cooling load demand, which is highly effective since chillers typically operate at partial loads for the majority of their lifespan. This modulation drastically improves the Integrated Part-Load Value (IPLV), sometimes by over 30%, making VSD-equipped chillers significantly more cost-effective over their operational life. Furthermore, there is a distinct trend towards oil-free magnetic bearing screw compressors, which eliminate mechanical contact and the need for lubricating oil, reducing maintenance complexity, increasing reliability, and allowing the chillers to operate with far higher energy efficiency coefficients, though this technology currently represents a higher initial investment threshold, limiting its immediate mass market adoption but securing its position as a high-performance niche solution for mission-critical applications where minimizing friction and maximizing longevity are paramount design requirements for optimal operational stability.

In addition to compressor innovations, the market is defined by advancements in heat exchanger design and control system intelligence. Manufacturers are increasingly utilizing flooded evaporators and microchannel condensers to improve heat transfer efficiency, leading to more compact unit designs that achieve the same capacity with a smaller footprint and reduced refrigerant charge. Simultaneously, the control systems are transitioning from simple localized controllers to sophisticated, networked Building Management Systems (BMS) integrators, often incorporating IoT connectivity. These advanced controls facilitate remote monitoring, enable real-time diagnostics, and support predictive maintenance schedules using embedded algorithms. This integration is crucial for maintaining compliance with smart building standards and maximizing seasonal operational efficiency across complex cooling plants that may utilize multiple chillers and cooling towers, providing facility managers with unprecedented granular control over energy consumption and thermal performance, ultimately reducing operational expenditure and extending the service life of the highly optimized equipment.

Finally, the technological shift related to refrigerant use is reshaping the market. The Montreal Protocol and subsequent amendments (especially Kigali) necessitate a rapid transition away from high Global Warming Potential (GWP) refrigerants like R-410A towards low GWP alternatives, predominantly HFOs (Hydrofluoroolefins) such as R-1234ze and R-1233zd. This transition requires significant redesigns of compressor internals, seals, and heat exchangers, as HFOs often have different thermodynamic properties and operating pressures than their predecessors. Research is also intensifying into natural refrigerants like CO2 and Ammonia (R-717), particularly for industrial process cooling, although these substances present higher safety and regulatory barriers for commercial HVAC applications. The successful development and commercialization of chiller units specifically optimized for these future-proof refrigerants are essential for long-term market competitiveness and ensuring manufacturers meet increasingly stringent global environmental legislation while maintaining or improving overall chiller performance metrics.

Regional Highlights

- Asia Pacific (APAC): The APAC region is the undisputed leader in market growth, driven by unprecedented levels of urbanization, massive industrial expansion, and significant investments in infrastructure, including smart city projects and high-speed rail networks. Countries like China, India, and Indonesia are experiencing a boom in commercial and residential construction, demanding high-capacity, centralized cooling solutions. Furthermore, APAC is the epicenter of global manufacturing and data center growth, necessitating reliable, heavy-duty screw chillers for process cooling and mission-critical IT cooling applications. While initial cost sensitivity exists, the rapid adoption of VSD technology is accelerating due to governmental mandates prioritizing energy conservation and green building certifications, making efficiency a crucial procurement criterion, thereby favoring sophisticated, high-performance screw chillers over simpler alternatives. This region is projected to consume the highest volume of new screw chiller installations throughout the forecast period due to the scale of its construction and industrial pipeline.

- North America: The North American market is mature but highly sophisticated, characterized predominantly by replacement and retrofit demand rather than new construction volume, with a strong focus on energy efficiency (IPLV/SEER) and the rapid adoption of low GWP refrigerants. Regulatory compliance, particularly related to stricter standards set by organizations like the AHRI and local energy codes (e.g., California’s Title 24), drives purchasing decisions. Data center cooling represents the most dynamic sub-segment, where screw chillers with VSDs and advanced controls are preferred for redundancy and maximizing efficiency. The prevalence of robust service contracts and smart diagnostic integration is also higher here, reflecting a greater emphasis on minimizing lifecycle costs and maximizing operational uptime in critical environments such as hospitals and large corporate campuses, where energy management is a major operational expense.

- Europe: The European market is highly regulated and innovation-driven, placing a strong emphasis on sustainability, decarbonization, and compliance with the F-Gas Regulation. This focus has spurred rapid adoption of HFO refrigerants and advanced controls. The market is segmented, with Central and Western Europe prioritizing premium, high-efficiency water-cooled screw chillers for district cooling networks and large commercial complexes. Eastern Europe exhibits faster growth rates in new installations driven by infrastructure modernization funds. European buyers prioritize low noise levels, minimal footprint, and stringent energy performance indicators, often leading the world in the adoption of natural refrigerants and heat recovery systems integrated with chiller operations, ensuring that technological excellence and environmental compliance are non-negotiable purchasing prerequisites in the highly competitive market landscape.

- Middle East and Africa (MEA): The MEA region, particularly the GCC countries (Saudi Arabia, UAE, Qatar), represents a significant growth area, fueled by massive government investments in infrastructure, tourism (mega-hotels and resorts), and economic diversification projects, alongside the critical need for robust, high-performance cooling systems due to extreme ambient temperatures. District cooling projects are exceptionally common here, driving demand for very large capacity water-cooled screw chillers designed to operate efficiently under high condenser temperatures. Reliability and local service support are critical due to the challenging operating environment. While energy costs are often subsidized, the drive for efficiency is increasing due to long-term government visions (like Saudi Vision 2030) aiming for sustainable resource management and reducing the environmental impact of electricity generation, ensuring a sustained demand for highly specialized chiller units capable of withstanding the harsh climate conditions prevalent across the region.

- Latin America: This region presents a mixed market, with Brazil and Mexico leading the demand due to expanding industrial sectors (automotive, oil and gas, manufacturing) and commercial construction in major metropolitan areas. Market growth is stable but often constrained by economic volatility and higher financing costs compared to mature markets. The focus is often on balancing performance and affordability. Air-cooled screw chillers are popular in some areas due to easier installation and lower reliance on water resources, though the overall trajectory points toward increased adoption of medium-to-large capacity water-cooled units as energy efficiency mandates gradually tighten and industrialization continues to accelerate across key economic hubs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Screw Chillers Market.- Daikin Industries, Ltd.

- Carrier Corporation

- Trane Technologies (Trane)

- Johnson Controls International plc

- Mitsubishi Electric Corporation

- Dunham-Bush

- Midea Group Co., Ltd.

- Smardt Chiller Group Inc.

- Multistack, LLC

- Thermax Ltd.

- Kaltra Innovativtechnik GmbH

- Petra Engineering Industries Co.

- Broad Group

- GREE Electric Appliances Inc.

- Clivet S.p.A.

- Hitachi Industrial Equipment Systems Co., Ltd.

- Lennox International Inc.

- LG Electronics Inc.

- Eurovent Certita Certification

- CIMCO Refrigeration Inc.

Frequently Asked Questions

Analyze common user questions about the Screw Chillers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary advantage of a screw chiller over a centrifugal chiller?

Screw chillers, particularly twin-screw units, offer superior efficiency and stability in medium-to-low cooling capacity ranges and excel under part-load conditions, making them ideal for facilities with fluctuating thermal demands, whereas centrifugal chillers are highly efficient only at very high capacity and near full load.

How does the Variable Speed Drive (VSD) technology impact the efficiency of screw chillers?

VSD technology significantly enhances screw chiller efficiency by allowing the compressor speed to modulate precisely according to the actual cooling load, drastically improving the Integrated Part-Load Value (IPLV) and reducing energy consumption by optimizing operation during the majority of time the chiller runs below peak capacity.

Which refrigerant types are currently mandated or preferred for new screw chiller installations?

Due to global environmental regulations like the F-Gas Regulation, the market is shifting away from high GWP HFCs (like R-410A) toward low GWP HFO refrigerants such as R-1234ze and R-1233zd, which are compliant with long-term climate targets and maintain high efficiency standards.

In which end-use sector is the demand for high-capacity screw chillers growing the fastest?

The Data Center sector is exhibiting the fastest growth in demand for high-capacity (350+ tons), highly reliable water-cooled screw chillers, driven by the need for continuous, redundant cooling solutions to manage intense heat loads generated by hyperscale and edge computing facilities globally.

What role does IoT and AI play in the modern screw chiller market?

IoT and AI are crucial for enabling advanced functionalities such as predictive maintenance, remote diagnostics, and dynamic optimization of chiller staging and setpoints, thereby maximizing operational uptime, minimizing lifecycle costs, and ensuring the chiller operates at peak energy performance relative to real-time conditions and utility pricing.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager