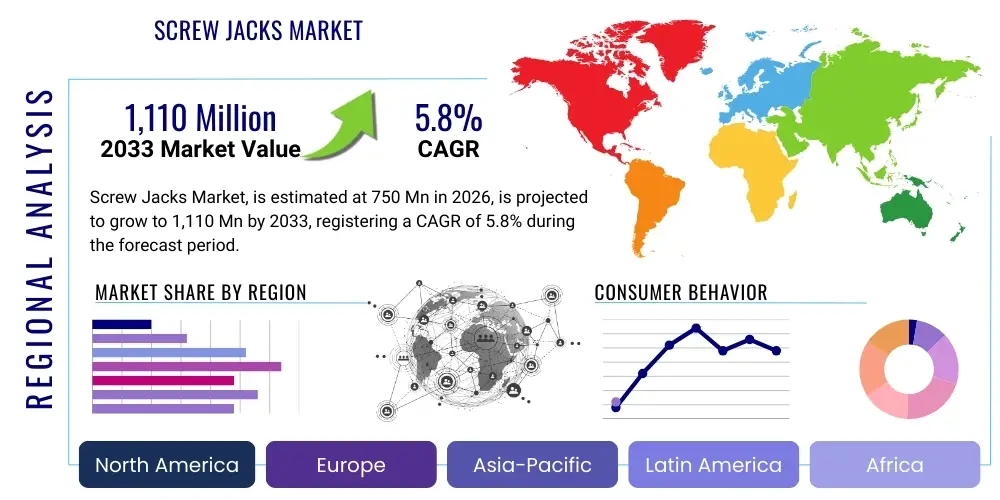

Screw Jacks Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443031 | Date : Feb, 2026 | Pages : 253 | Region : Global | Publisher : MRU

Screw Jacks Market Size

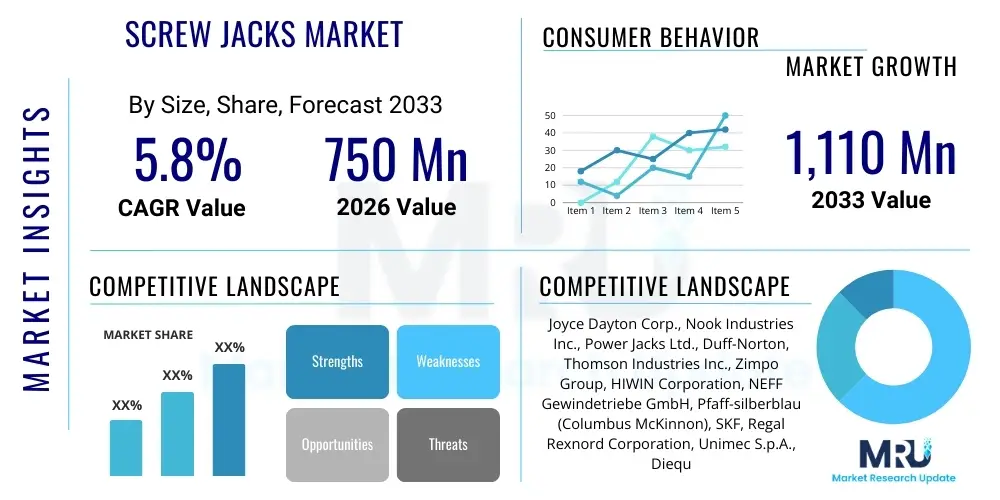

The Screw Jacks Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 750 million in 2026 and is projected to reach USD 1,110 million by the end of the forecast period in 2033.

Screw Jacks Market introduction

Screw jacks represent a crucial component within mechanical power transmission systems, primarily designed for lifting, lowering, pushing, pulling, and applying force. These devices convert rotary motion into linear motion, offering precise positioning capabilities and heavy-duty load support across diverse industrial landscapes. The fundamental design involves an input worm gear or bevel gear driving an internal screw, which translates the rotational movement. This reliability, combined with inherent self-locking features in many designs, makes screw jacks indispensable in applications requiring consistent vertical or horizontal motion under high load conditions. Key performance indicators driving product differentiation include lift capacity, travel speed, duty cycle rating, and the precision of positioning achieved. The evolution of the market is heavily influenced by advancements in material science, leading to lighter, corrosion-resistant, and higher-efficiency models, particularly in harsh operating environments.

The product description spans several primary types, notably Machine Screw Jacks (trapezoidal thread), Ball Screw Jacks (recirculating ball system), and Stainless Steel Screw Jacks, each tailored for specific operational demands. Machine screw jacks are favored for static holding applications and intermittent duty cycles due to their inherent braking capability and cost-effectiveness. Conversely, ball screw jacks excel in applications demanding higher speeds, continuous duty cycles, and superior efficiency due to significantly reduced internal friction, making them critical in modern industrial automation. Major applications are widespread, encompassing precise satellite dish positioning, large-scale stage and platform lifting (entertainment industry), complex assembly lines in automotive manufacturing, and critical valve actuation in energy sectors. The increasing complexity of automated manufacturing processes mandates sophisticated lifting solutions that offer repeatability and synchronization, driving the demand for advanced screw jack systems integrated with sophisticated control mechanisms.

The primary benefits of utilizing screw jacks include their exceptional load handling capacity, the inherent mechanical advantage they provide, and their ability to synchronize motion across multiple units, essential for handling large, unwieldy loads such as aircraft assembly jigs or press bed adjustments. They offer superior rigidity compared to hydraulic or pneumatic systems in static holding positions, requiring minimal energy input to maintain lift once the movement is complete. Driving factors fueling market growth include the global push toward industrial automation (Industry 4.0), significant infrastructure investment in emerging economies, and the increasing complexity of machinery across sectors like aerospace and heavy construction, where extreme precision in positioning massive loads is non-negotiable. Furthermore, stringent safety regulations governing heavy lifting equipment compel end-users to upgrade to certified and reliable screw jack systems, contributing substantially to market expansion.

Screw Jacks Market Executive Summary

The Screw Jacks Market is characterized by robust growth underpinned by significant global business trends focusing on high-precision engineering and the integration of smart factory technologies. Key business trends include the increasing adoption of Ball Screw Jacks over traditional Machine Screw Jacks, driven by the requirement for higher efficiency and longer service life, particularly in continuous-operation environments such as automated warehouses and packaging lines. Manufacturers are increasingly prioritizing modular designs and standardized interfaces, which simplify installation and maintenance, reducing total cost of ownership (TCO) for end-users. Mergers, acquisitions, and strategic partnerships, especially between mechanical component manufacturers and industrial control systems providers, are reshaping the competitive landscape, aiming to offer integrated motion control solutions rather than standalone mechanical products. Furthermore, sustainability initiatives are influencing product development, encouraging the use of lubricants with longer service intervals and materials that enhance overall operational efficiency, minimizing energy wastage associated with mechanical friction.

Regional trends indicate that the Asia Pacific (APAC) region remains the dominant growth engine, fueled primarily by massive expansion in manufacturing capabilities, particularly in China, India, and Southeast Asia. Rapid urbanization and subsequent investment in infrastructure and construction projects necessitate heavy-duty lifting and positioning equipment, solidifying APAC’s market share. North America and Europe, while representing mature markets, exhibit steady demand driven by the replacement cycle of aging industrial equipment and significant investment in aerospace, defense, and specialized medical device manufacturing, sectors demanding the highest levels of precision and reliability. These regions are also leading the adoption of 'smart' screw jack systems equipped with sensors for condition monitoring, predictive maintenance, and remote diagnostics, aligning with advanced digital manufacturing paradigms. Regulatory environments governing occupational safety in these regions also strongly influence the procurement of certified, high-quality screw jack mechanisms.

Segmentation trends highlight the increasing prominence of high-capacity screw jacks (5 Ton to 25 Ton and above) due to the scaling up of industrial machinery and the requirement to handle larger modules in construction and shipbuilding. From a product perspective, the market is shifting toward Stainless Steel Screw Jacks in niche areas like food and beverage processing, pharmaceuticals, and marine applications, where corrosion resistance and stringent hygiene standards are paramount. The application segment analysis reveals that Industrial Automation and Material Handling remain the largest consumers, rapidly integrating screw jacks into automated guided vehicles (AGVs), gantry systems, and automated storage and retrieval systems (AS/RS). The customization segment is also witnessing substantial growth, as specialized industrial processes often require bespoke stroke lengths, mounting configurations, and gear ratios tailored to unique operational demands, allowing smaller, agile manufacturers to compete effectively by focusing on specialized engineering solutions.

AI Impact Analysis on Screw Jacks Market

The integration of Artificial Intelligence (AI) and Machine Learning (ML) primarily impacts the operational efficiency and maintenance lifecycle of screw jack systems rather than the core mechanical function itself. User inquiries predominantly revolve around how AI can enhance uptime, predict failures, optimize duty cycles, and integrate screw jacks into broader Industry 4.0 ecosystems. Common user questions include: "Can AI predict when my screw jack will fail?", "How does condition monitoring using AI improve maintenance schedules?", and "What role do smart sensors play in automating screw jack operations?". Users are concerned about the cost and complexity of retrofitting existing mechanical systems with AI-enabled sensors and software, seeking solutions that provide a tangible Return on Investment (ROI) through reduced unplanned downtime. The underlying expectation is that AI-driven diagnostics will transform the traditional reactive maintenance approach into a highly proactive and predictive model, thereby extending the operational lifespan and ensuring synchronization accuracy in complex multi-unit configurations.

The key themes emerging from this analysis focus on predictive maintenance, optimized motion control, and enhanced system integration. AI algorithms analyze vibration data, temperature fluctuations, current consumption, and noise profiles collected from integrated smart sensors (e.g., accelerometers, thermocouples) to identify subtle anomalies indicative of wear, misalignment, or lubrication degradation well before catastrophic failure occurs. This capability allows operators to schedule precise, condition-based maintenance activities, significantly minimizing costly production halts. Furthermore, AI contributes to optimizing the motion profile of complex systems, such as synchronizing several jacks operating a massive platform, by continuously learning optimal movement trajectories based on load variations and external environmental factors. This dynamic optimization ensures smooth operation, reduces mechanical stress, and maximizes energy efficiency, which is critical in large-scale applications like steel production and telescope positioning.

While AI does not replace the robust mechanical engineering of the screw jack, its influence is profound in enhancing reliability and precision, fundamentally changing how these components are managed and utilized in advanced manufacturing environments. The adoption curve is accelerating, particularly in highly automated industries like semiconductors and precision electronics manufacturing, where even minor errors in positioning or unexpected downtime can result in massive financial losses. The transition toward smart screw jacks involves significant investment in edge computing capabilities to process sensor data locally before transmitting actionable insights to cloud platforms, ensuring low latency and high security. This convergence of mechanical reliability with digital intelligence is positioning screw jacks not merely as lifting devices, but as intelligent nodes within a larger automated network.

- AI-driven Predictive Maintenance: Utilizing ML models to analyze sensor data (vibration, temperature) to forecast mechanical failures, significantly reducing unplanned downtime.

- Optimized Load Management: Algorithms dynamically adjust operational parameters (speed, torque) based on real-time load feedback, preventing overloading and excessive wear.

- Enhanced Synchronization Accuracy: AI control systems maintain perfect alignment and speed parity across multiple linked screw jacks, crucial for handling large, unstable loads.

- Remote Diagnostics and Monitoring: Enabling manufacturers and end-users to monitor the health and performance of screw jacks globally via secure IoT platforms.

- Automated Lubrication Scheduling: AI determines the optimal timing and quantity for lubrication based on usage patterns and environmental conditions, extending bearing and screw life.

- Integration with Digital Twins: Creating virtual replicas of screw jack systems to simulate operational scenarios and test control adjustments before physical deployment.

DRO & Impact Forces Of Screw Jacks Market

The dynamics of the Screw Jacks Market are shaped by a complex interplay of Drivers, Restraints, and Opportunities, resulting in significant impact forces across the industrial landscape. A primary driver is the accelerating pace of global industrial automation, encapsulated by the Industry 4.0 paradigm, which mandates robust, reliable, and precise linear actuation components in automated assembly lines, packaging machinery, and material handling systems. The requirement for higher throughput and reduced manual intervention in production processes across diverse sectors—from automotive stamping presses to solar panel positioning systems—creates sustained demand for high-duty-cycle ball screw jacks. Furthermore, governmental and private sector investments in critical infrastructure projects, including bridge construction, dam maintenance, and large-scale architectural projects, rely heavily on screw jacks for temporary support and permanent positioning systems. The shift towards electrification and energy transition, specifically in the development of large offshore wind turbines requiring precise blade pitch control mechanisms, also acts as a powerful driver, demanding specialized, highly durable screw jack solutions.

Conversely, several restraints impede the market's trajectory. The significant initial capital investment required for high-precision, heavy-duty screw jack systems, particularly those incorporating advanced materials and smart sensors, can be prohibitive for Small and Medium-sized Enterprises (SMEs). Moreover, the mechanical nature of screw jacks necessitates regular, precise maintenance, including lubrication and inspection of wear components, which, if neglected, can lead to rapid deterioration and costly operational failures—a significant operational restraint. Competition from alternative linear actuation technologies, primarily hydraulic and pneumatic cylinders, also poses a constraint. Although screw jacks offer superior positional accuracy and mechanical holding power, hydraulic systems often provide faster operational speeds and higher peak forces over short duty cycles, making them preferred in certain heavy industrial applications like metal forming presses, thereby capturing a segment of the potential screw jack market share. Overcoming these restraints requires manufacturers to focus on improving serviceability and demonstrating clear Total Cost of Ownership (TCO) advantages over the product lifecycle.

Opportunities for market expansion are substantial, especially in emerging high-growth industries and specialized applications. The increasing complexity of medical imaging equipment (e.g., MRI machines, CT scanners) and surgical robotics, which require extremely fine, repeatable adjustments for patient positioning and tool manipulation, opens lucrative avenues for miniature and stainless steel precision screw jacks. Additionally, the push toward ergonomic workplace solutions and lifting aids in manufacturing environments presents opportunities for lower-capacity, user-friendly systems. The most compelling opportunity, however, lies in the continuous enhancement and integration of smart technologies (IoT, AI) into screw jack systems, allowing manufacturers to move beyond component sales into offering comprehensive, predictive motion control solutions. Focusing on developing highly modular designs that can be quickly adapted to diverse application requirements and offering robust after-sales support and maintenance contracts tailored to specific end-user needs will be crucial for capitalizing on these future opportunities and mitigating the impact of competitive forces.

Segmentation Analysis

The Screw Jacks Market is segmented comprehensively based on core attributes, including the mechanical design (Product Type), operational metrics (Lifting Capacity), and the specific industrial environment in which they are deployed (Application and End-User Industry). This multi-faceted segmentation allows for a granular understanding of demand drivers and technological preferences across the global industrial economy. Analyzing these segments is critical for manufacturers to tailor their product offerings, marketing strategies, and distribution networks effectively. For instance, segments focused on precision automation prioritize the high efficiency and speed of Ball Screw Jacks, whereas heavy construction and static holding applications rely on the durability and self-locking features of Machine Screw Jacks. The increasing demand for customization further drives differentiation within these segments, necessitating a flexible manufacturing approach that can accommodate varied stroke lengths, environmental sealing, and specialized mounting configurations required by specific end-users like aerospace tooling or specialized theatrical stage rigging.

Segmentation by Lifting Capacity directly correlates with the scale and weight of industrial loads being handled, providing crucial insight into the target clientele—from small workshops using sub-5-ton units for bench adjustments to heavy engineering firms requiring multi-jack systems capable of lifting over 50 tons for major infrastructure projects. The transition of global manufacturing towards larger component handling, particularly in shipbuilding, renewable energy, and automotive stamping, is continually increasing the demand for high-capacity systems, driving innovation in material strength and gear design. Moreover, geographical factors significantly influence the segment mix; regions with high levels of industrial automation penetration, such as Western Europe and North America, demonstrate higher demand for efficient Ball Screw Jacks, while rapidly industrializing economies in Asia Pacific often show substantial volume demand for economical Machine Screw Jacks, although this trend is gradually shifting towards high-efficiency solutions as manufacturing standards rise.

The Application and End-User segmentation reveals the vertical market penetration, highlighting the critical role screw jacks play across seemingly disparate industries. While Material Handling and General Manufacturing remain the foundational segments, high-growth sectors like Aerospace & Defense demand products certified to stringent quality standards, often requiring exotic materials for weight reduction and high corrosion resistance. The Entertainment industry, focusing on stage automation and rigging, requires highly reliable, quiet, and fast-acting systems synchronized across numerous points. Understanding the unique regulatory requirements, duty cycles, and environmental constraints of each application segment is paramount for successful market entry and sustained growth. The detailed analysis of these segments helps stakeholders prioritize research and development efforts toward addressing specific industry pain points, such as developing specialized sealing for corrosive chemical environments or incorporating integrated safety features for manned platform lifting systems.

- By Product Type: Machine Screw Jacks, Ball Screw Jacks, Stainless Steel Screw Jacks, Bevel Gear Screw Jacks, Customized Systems.

- By Lifting Capacity: Less than 5 Ton, 5 Ton to 25 Ton, More than 25 Ton.

- By Application: Material Handling, Aerospace & Defense, Automotive Manufacturing, General Industrial Automation, Food & Beverage Processing, Energy & Utilities, Medical and Healthcare Equipment, Stage and Platform Automation.

- By End-User Industry: Construction, Metals & Mining, Transportation & Logistics, General Manufacturing, Shipbuilding, Entertainment Industry.

Value Chain Analysis For Screw Jacks Market

The Value Chain for the Screw Jacks Market begins with Upstream Analysis, focusing on the procurement of critical raw materials and specialized components. This phase includes the sourcing of high-grade steel alloys (such as carbon steel, stainless steel, and aluminum) required for the jack housing, lead screws, worm gears, and ball bearings. The quality and availability of these materials directly impact the manufacturing cost, final product performance (especially load capacity and fatigue life), and resilience to operational environments. Key upstream suppliers include specialized steel mills, bearing manufacturers, and precision forging/casting companies. Maintaining a resilient supply chain in this segment is vital, as volatility in global commodity prices, especially steel and specialty lubricants, can significantly influence the final pricing structure of the screw jack unit. Furthermore, the sourcing of precision gearing and high-quality ball screws, often outsourced to specialists, demands strict quality control to meet the stringent positional accuracy requirements of modern industrial applications.

The core manufacturing and assembly stage involves precision machining of components, heat treatment processes to enhance durability, and meticulous final assembly and testing. This is the stage where value is primarily added through proprietary design, engineering expertise, and quality control certifications. Downstream analysis focuses on the distribution channels and the ultimate delivery of the product to the end-user. Distribution is typically bifurcated into direct sales and indirect channels. Direct sales are prevalent for highly customized, high-value, or complex engineered systems, such as large press jacks or aerospace tooling, where close collaboration between the manufacturer's engineering team and the end-user is necessary for successful integration. Indirect channels utilize a network of industrial distributors, specialized mechanical component resellers, and system integrators who stock standard screw jack models and offer localized technical support and installation services, effectively reaching smaller or geographically dispersed customers across the general manufacturing segment.

System integrators play an increasingly crucial role in the value chain, particularly with the rise of automated and networked systems. They take the screw jack components and integrate them with motors, gearboxes, drives, control systems (PLCs), and safety mechanisms to deliver a complete motion solution. This indirect route provides added value through customized programming and commissioning. The choice of distribution channel—direct versus indirect—is heavily influenced by the complexity and volume of the order. While standard, lower-capacity machine screw jacks are typically moved efficiently through indirect distributors (often online platforms or large industrial supply houses), high-end, complex Ball Screw Jack systems destined for continuous duty in specialized machinery necessitate the manufacturer's direct involvement. The final stage involves after-sales support, including spare parts supply, maintenance services, and technical training, which are critical for maximizing the lifetime value of the product and establishing long-term customer relationships.

Screw Jacks Market Potential Customers

Potential customers for the Screw Jacks Market are highly diverse, spanning virtually every sector that requires precise, controlled linear motion and significant load lifting or holding capacity. The primary end-users or buyers are categorized by the nature of their industrial operations and the necessity for specific performance characteristics. Heavy manufacturing industries, including automotive assembly, steel mills, and aerospace tooling facilities, represent core customer groups that utilize screw jacks for tasks such as mold adjustment, press bed leveling, and large component positioning. These customers prioritize high load capacity, long operational lifespan, and the ability to maintain position without continuous power input (self-locking features, especially in machine screw designs). Their purchasing decisions are often driven by stringent safety standards and the need for components that can withstand high duty cycles and harsh environmental conditions common in heavy industrial settings.

Another major segment of potential customers includes specialized equipment builders and Original Equipment Manufacturers (OEMs) who integrate screw jacks as critical subsystems into their machinery. This includes manufacturers of packaging equipment, automated storage and retrieval systems (AS/RS), specialized testing rigs, printing presses, and medical diagnostic equipment. These OEMs typically require high volumes of standardized or semi-customized units and prioritize consistency, compact design, and ease of integration into their proprietary control systems. For example, OEMs producing solar tracking systems require screw jacks with exceptional weather resistance and reliable long-term performance to precisely adjust photovoltaic panel angles throughout the day, representing a rapidly growing customer segment driven by global renewable energy targets.

Furthermore, the infrastructure, construction, and entertainment sectors constitute vital customer bases. Construction companies use heavy-duty screw jacks for temporary support, alignment of bridge sections, and formwork positioning. The entertainment industry, particularly modern theatrical venues and touring companies, relies on synchronized, quiet, and reliable screw jacks for automated stage lifts, scenic element movement, and safety-critical rigging applications. These diverse groups share a common requirement for reliability and precision, but their specific demands vary greatly—construction customers focus on robustness and sheer lifting power, while entertainment buyers emphasize synchronization, minimal noise, and aesthetic integration, illustrating the wide range of engineering requirements the screw jack industry must meet to satisfy its broad customer base.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 750 Million |

| Market Forecast in 2033 | USD 1,110 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Joyce Dayton Corp., Nook Industries Inc., Power Jacks Ltd., Duff-Norton, Thomson Industries Inc., Zimpo Group, HIWIN Corporation, NEFF Gewindetriebe GmbH, Pfaff-silberblau (Columbus McKinnon), SKF, Regal Rexnord Corporation, Unimec S.p.A., Diequa Corporation, Helix Linear Technologies, Roton Products Inc., Beaver Aerospace & Defense, ActionJac, Grob GMBH, ATLANTA Antriebssysteme, Nozag AG |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Screw Jacks Market Key Technology Landscape

The technological landscape of the Screw Jacks Market is undergoing a transformation driven by efficiency, precision, and digitalization. A pivotal area of innovation is the refinement of Ball Screw Jack technology, focusing on achieving higher dynamic load ratings, reduced friction losses, and enhanced travel speeds, essential for modern high-cycle automation tasks. Manufacturers are employing advanced computer-aided design (CAD) and finite element analysis (FEA) to optimize thread geometry and bearing arrangements, thereby maximizing efficiency and minimizing heat generation, which is a major limiting factor in high-speed operations. Furthermore, the use of specialized materials, including aerospace-grade stainless steels and unique surface treatments (e.g., nitride coatings, proprietary anti-corrosion finishes), extends the lifespan and operating envelope of screw jacks, allowing their deployment in increasingly hostile environments, such as marine platforms or chemical processing facilities, demanding greater resilience against wear and contamination.

Another crucial technological development involves the integration of smart components and connectivity solutions, firmly positioning screw jacks within the Industrial Internet of Things (IIoT). Modern screw jack systems are increasingly being fitted with embedded sensors—including linear encoders for highly accurate positional feedback, temperature and vibration sensors for thermal monitoring, and current measurement devices to detect increased friction or impending mechanical stress. These smart jacks transmit data wirelessly via industrial protocols (like EtherCAT or PROFINET) to cloud-based monitoring platforms or edge devices. This data enables real-time condition monitoring, facilitates predictive maintenance schedules, and allows for dynamic adjustment of operational parameters through closed-loop control systems. This digital integration maximizes uptime and allows manufacturers to offer performance guarantees based on continuous operational data analysis, fundamentally changing the traditional service model.

The trend towards modularity and customization also dictates technological advancements in manufacturing processes. Sophisticated manufacturing techniques, such as automated lubrication systems integrated directly into the jack housing and the use of robotic assembly, ensure higher levels of repeatable quality and reduced manufacturing tolerances. Customization technology focuses on rapid prototyping and design scalability, enabling quick turnaround for specialized stroke lengths, non-standard mounting configurations, and integrated safety features like limit switches or specialized braking mechanisms. The incorporation of advanced sealing technologies, particularly bellows and specialized wipers, is also key to preventing the ingress of dust, moisture, and chemical contaminants, thereby protecting the precision internal components and ensuring the long-term reliability required by end-users in sectors like food processing and pharmaceuticals.

Regional Highlights

- Asia Pacific (APAC): APAC dominates the global Screw Jacks Market, primarily due to the rapid industrialization and massive government and private sector investment in manufacturing hubs across China, India, and Southeast Asian nations. The region is characterized by substantial demand from the automotive assembly, construction, and general manufacturing sectors. China, as the world's factory, drives high volume demand, transitioning gradually towards higher efficiency Ball Screw Jacks and automated systems in line with its 'Made in China 2025' initiative, focusing on advanced manufacturing upgrades. India’s growing infrastructure projects and burgeoning logistics sector are creating significant market opportunities for both standard and high-capacity lifting systems.

- North America: North America represents a mature, high-value market driven by demand for high-precision, automated, and specialized screw jack solutions, particularly in the aerospace, defense, and high-tech manufacturing sectors. The focus here is heavily on quality, reliability, and the integration of IoT and predictive maintenance technologies into legacy and new systems. The U.S. remains the largest consumer, with significant requirements for custom-engineered systems used in robotics, medical equipment, and large-scale observatory and radar positioning applications.

- Europe: Europe maintains a strong market presence, characterized by stringent quality standards and a significant focus on advanced automation and energy efficiency, particularly in Germany, Italy, and the UK. The European market prioritizes high-quality, long-life, and energy-efficient Ball Screw Jacks compliant with European directives (e.g., ATEX for hazardous environments). Key demand segments include machine tool manufacturing, advanced automotive production (e.g., luxury and specialized vehicles), and high-tech stage automation, where precision and safety are paramount.

- Latin America (LATAM): The LATAM market is experiencing steady growth, driven mainly by mining, infrastructure development, and energy projects, particularly in Brazil and Mexico. Demand is generally skewed toward robust, cost-effective Machine Screw Jacks capable of handling heavy loads under sometimes challenging environmental conditions. Market growth is closely tied to commodity price volatility and political stability influencing major industrial investments.

- Middle East and Africa (MEA): The MEA region shows potential growth linked to significant investment in oil and gas infrastructure, large-scale construction (e.g., mega-projects in the GCC countries), and renewable energy initiatives. The specific demands in this region often involve resistance to extreme temperatures, dust, and corrosion, necessitating the use of specialized sealing and stainless steel components for long-term operational integrity in harsh desert or offshore environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Screw Jacks Market.- Joyce Dayton Corp.

- Nook Industries Inc.

- Power Jacks Ltd.

- Duff-Norton

- Thomson Industries Inc.

- Zimpo Group

- HIWIN Corporation

- NEFF Gewindetriebe GmbH

- Pfaff-silberblau (Columbus McKinnon)

- SKF

- Regal Rexnord Corporation

- Unimec S.p.A.

- Diequa Corporation

- Helix Linear Technologies

- Roton Products Inc.

- Beaver Aerospace & Defense

- ActionJac

- Grob GMBH

- ATLANTA Antriebssysteme

- Nozag AG

- Kerk Motion Products (Haydon Kerk Pittman)

- Bosch Rexroth AG

- Rollon S.p.A.

- Tsubakimoto Chain Co.

- Altra Industrial Motion Corp. (now part of Regal Rexnord)

- Spiroflow Ltd.

- KML Linear Motion Technology

- Eichenberger Gewinde AG

- Warner Linear (a division of Thomson)

- RK Rose+Krieger GmbH

Frequently Asked Questions

Analyze common user questions about the Screw Jacks market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between Ball Screw Jacks and Machine Screw Jacks?

Ball Screw Jacks utilize a ball recirculation mechanism to convert rotary to linear motion, offering significantly higher mechanical efficiency (up to 90%), faster operation, and requiring less input power. Machine Screw Jacks use sliding friction (trapezoidal threads), leading to lower efficiency but providing an inherent self-locking capability, making them ideal for static holding and intermittent duty applications where the load must be held securely without power.

Which application segments are driving the most significant growth in the Screw Jacks Market?

The most significant growth is primarily driven by industrial automation, material handling (including automated storage and retrieval systems), and specialized fields like aerospace tooling and renewable energy (solar tracking). These sectors demand high reliability, precision synchronization, and increased speed, fueling demand for advanced Ball Screw and specialized Stainless Steel Jack systems.

How is Industry 4.0 influencing the design and functionality of modern screw jacks?

Industry 4.0 necessitates the integration of smart components. Modern screw jacks are equipped with IoT sensors for condition monitoring, temperature measurement, and positional feedback, enabling predictive maintenance, real-time diagnostics, and seamless integration into interconnected industrial control systems (PLCs and SCADA), thereby maximizing system uptime and operational accuracy.

What factors should be considered when selecting the appropriate screw jack for a heavy-duty application?

Key factors include the maximum static and dynamic load capacity, the required travel speed and stroke length, the operational duty cycle (intermittent vs. continuous), the necessary positional accuracy, environmental conditions (temperature, moisture, contaminants), and whether a self-locking feature is required. Proper thermal management and lubrication selection are also critical for sustained heavy-duty performance.

Which geographical region holds the largest market share for screw jacks?

The Asia Pacific (APAC) region currently holds the largest market share, driven by rapid, large-scale industrialization, massive investments in infrastructure development, and the expansion of manufacturing capabilities, particularly in China and India. The demand in APAC encompasses a wide range of capacities, from standard to customized heavy-duty systems.

The extensive analysis of the Screw Jacks Market reveals a highly specialized sector undergoing rapid technological evolution, particularly in response to the global adoption of Industry 4.0 and the increasing demand for high-precision motion control across heavy industry, aerospace, and advanced manufacturing. Market growth is sustained by the inherent reliability and mechanical advantage offered by these devices, making them irreplaceable in applications requiring safe, precise, and synchronized linear movement under high load. The shift towards ball screw technology underscores the market's trajectory towards energy efficiency and high-speed operation, while the integration of AI and IoT sensors is transforming screw jacks from mere mechanical components into intelligent nodes within sophisticated automated systems. Regional dynamism, with APAC leading consumption and Europe/North America driving high-value technological innovation, ensures sustained investment in R&D focusing on material science, thermal management, and digital connectivity. Future success in this market will depend on manufacturers' ability to offer highly customized solutions, integrate seamlessly with digital enterprise ecosystems, and provide comprehensive lifecycle support services, thereby moving beyond component supply to becoming critical partners in motion control engineering for the world’s most demanding industries.

The competitive landscape remains moderately fragmented, featuring both large global power transmission corporations and specialized niche players focusing on custom high-precision engineering. Key strategies employed by market leaders include geographical expansion into high-growth regions like Southeast Asia, strategic acquisitions to consolidate technological expertise (especially in advanced ball screw manufacturing), and heavy investment in proprietary software platforms that enable condition monitoring and remote diagnostic capabilities. The increasing complexity of safety regulations, especially those governing lifting equipment in construction and entertainment, provides an impetus for highly certified products, favoring established manufacturers with robust quality assurance processes. Furthermore, sustainability is becoming a strategic differentiator, with companies developing systems that require less lubrication, minimize energy consumption, and utilize more durable, recyclable materials, aligning with global environmental governance trends and attracting environmentally conscious industrial buyers. This comprehensive report confirms that the Screw Jacks Market is poised for stable and technologically informed growth throughout the forecast period.

In summary, the robustness of the Screw Jacks Market is inextricably linked to the global capital expenditure cycle across manufacturing, infrastructure, and defense. The demand structure suggests a bifurcated market: a high-volume segment focused on traditional, cost-effective machine screw jacks for basic lifting, and a rapidly expanding high-value segment demanding advanced, smart, high-efficiency ball screw jacks integrated into complex automated machinery. Addressing the challenge of high initial investment and the need for specialized maintenance training through improved modularity and user-friendly diagnostic interfaces will be paramount for unlocking the full market potential, particularly among mid-sized industrial operators. The sustained focus on developing solutions tailored for extreme environments, such as cryogenic or high-radiation applications, will further solidify the market's niche and specialized value proposition. Ultimately, the screw jack remains a cornerstone of mechanical power transmission, adapting proactively through digital transformation to meet the evolving precision requirements of the modern industrial world.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Screw Jacks Market Size Report By Type (Ball Screw Jacks, Machine Screw Jacks, Stainless Screw Jacks, Others), By Application (General Industry, Material Handling Industry, Aerospace and Aircraft, Automotive, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Screw Jacks Market Statistics 2025 Analysis By Application (General Industry, Material Handling Industry, Aerospace and Aircraft, Automotive, Others), By Type (Ball Screw Jacks, Machine Screw Jacks, Stainless Screw Jacks, Others), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Screw Jacks Market Statistics 2025 Analysis By Application (General Industry, Material Handling Industry, Aerospace and Aircraft, Automotive), By Type (Ball Screw Jack, Worm Gear Screw Jack), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager