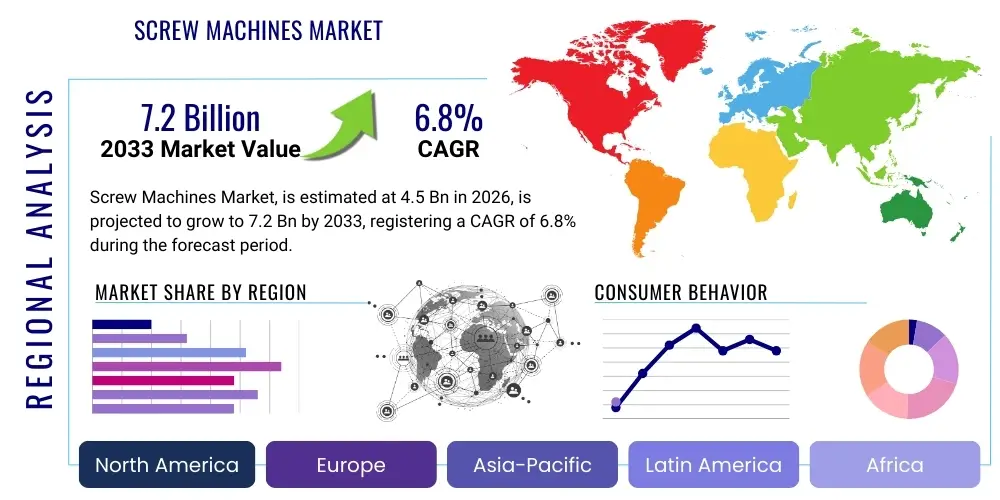

Screw Machines Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442089 | Date : Feb, 2026 | Pages : 245 | Region : Global | Publisher : MRU

Screw Machines Market Size

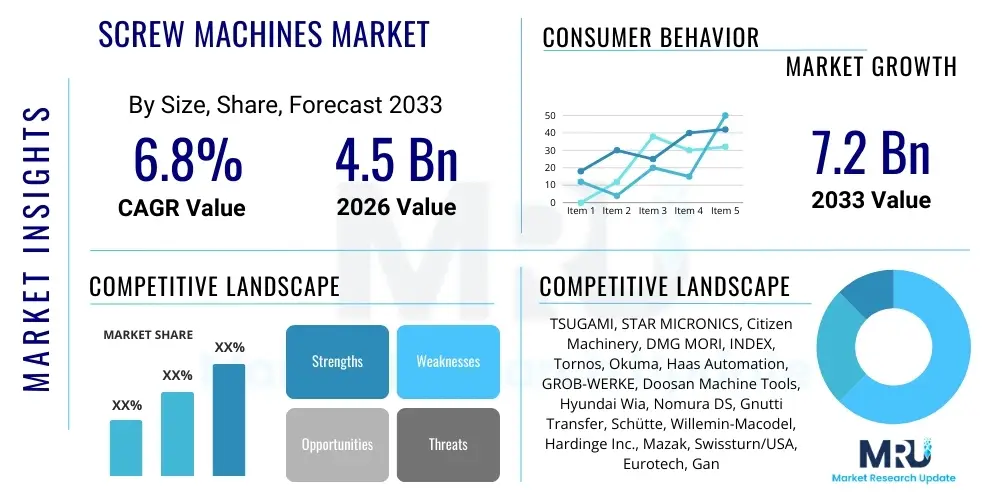

The Screw Machines Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 7.2 Billion by the end of the forecast period in 2033.

Screw Machines Market introduction

The global Screw Machines Market encompasses advanced manufacturing equipment designed for the high-volume, precision production of complex metal components, predominantly fasteners, shafts, bushings, and fittings, crucial across various high-stakes industries. These machines, often categorized as automatic lathes or specialized CNC turning centers, utilize cutting tools to shape raw material (typically bar stock) into finished parts with extremely tight tolerances and high repeatability. The foundational technology has evolved significantly from cam-operated automatic screw machines to sophisticated Computer Numerical Control (CNC) Swiss-type machines and multi-spindle variants, which offer unmatched speed and efficiency in mass production environments, minimizing cycle times and optimizing material usage, which is paramount for competitive advantage in sectors like aerospace and medical device manufacturing.

Product descriptions within this market focus heavily on capabilities such as simultaneous machining operations, live tooling, sub-spindles, and high-pressure coolant systems that enable complex operations like milling, drilling, and tapping alongside standard turning. Major applications span the automotive industry, where screw machines produce engine components, transmission parts, and sensor housings; the electronics sector, generating micro-precision connectors and pins; and the defense industry, fabricating specialized munitions components and critical machinery parts. The transition toward electric vehicles (EVs) and smart manufacturing continues to propel demand for complex, lightweight components that only high-precision screw machines can reliably deliver at scale, ensuring the reliability and performance of modern industrial and consumer products.

Key benefits derived from the adoption of modern screw machines include dramatic reductions in part cycle times, enhanced surface finish quality, and the ability to handle highly specialized, difficult-to-machine materials such as titanium, stainless steel, and high-nickel alloys with exceptional accuracy. Driving factors for market expansion include the continuous global push for miniaturization, particularly in consumer electronics and medical implants, which necessitates machining equipment capable of micromachining capabilities. Furthermore, rising labor costs and the increasing demand for automation across developed and rapidly industrializing economies solidify the imperative for highly automated, minimal-intervention screw machine technology to maintain manufacturing competitiveness and capacity utilization.

Screw Machines Market Executive Summary

The Screw Machines Market is experiencing robust expansion, driven primarily by globalization of precision manufacturing and accelerated industrial automation mandates across key economies. Current business trends indicate a significant shift toward CNC Swiss-type machines, valued for their ability to produce small, complex parts with unparalleled precision in a single setup, thereby reducing handling errors and overall production costs. Strategic mergers and acquisitions among major machine tool builders, focusing on integrating software and advanced robotics for automated loading and unloading, define the competitive landscape. Furthermore, sustainable manufacturing practices are influencing product development, with manufacturers focusing on energy-efficient drives and dry machining capabilities to reduce environmental impact and operational expenditure, making the capital investment in new machines more appealing for end-users seeking long-term operational efficiency gains.

Regional trends reveal Asia Pacific (APAC) as the dominant and fastest-growing region, fueled by massive investment in automotive manufacturing, consumer electronics assembly, and general industrial expansion, particularly in China, Japan, and India. North America and Europe maintain strong market positions characterized by demand for high-end, customized solutions focused on aerospace, defense, and stringent medical device regulations, emphasizing multi-axis capability and rigorous quality control integration. The concentration of advanced manufacturing capabilities, coupled with government incentives supporting domestic production and reshoring initiatives, ensures sustained demand for sophisticated, high-throughput screw machine installations in these mature markets, focusing less on volume and more on technical complexity and material expertise.

Segment trends highlight the dominance of the CNC Screw Machines segment due to their superior flexibility, programming ease, and capacity for complex geometries compared to traditional cam-driven automatic machines. Within end-use segments, the Medical Devices sector exhibits the highest growth rate, necessitated by the need for smaller, biocompatible components such as bone screws, dental implants, and surgical instrument parts, all requiring micro-level precision. The increased integration of Internet of Things (IoT) sensors and predictive maintenance features into new machine models represents a crucial technological segment trend, enhancing machine uptime and providing valuable real-time data for manufacturing optimization and quality assurance, thereby maximizing the return on investment for capital equipment buyers.

AI Impact Analysis on Screw Machines Market

User inquiries regarding the integration of Artificial Intelligence (AI) and Machine Learning (ML) into the Screw Machines Market primarily revolve around optimizing machining processes, achieving predictive maintenance, and enhancing quality control. Common questions include: "How can AI reduce tool wear and breakages in complex turning operations?", "What is the feasibility of using ML algorithms for automatic compensation of thermal drift?", and "Can AI systems ensure zero-defect output in high-volume screw machine production?" The core expectation is that AI will transform these machines from highly precise mechanical tools into intelligent manufacturing systems capable of self-optimization, drastically reducing human intervention and minimizing material scrap. Users are actively seeking solutions that leverage AI for real-time data interpretation from sensors (vibration, temperature, current load) to preemptively address potential failures, thereby maximizing spindle utilization and operational reliability, which is critical in competitive, high-margin manufacturing environments where downtime is prohibitively expensive.

The integration of AI models offers unprecedented opportunities for closed-loop manufacturing, allowing screw machines to adapt cutting parameters dynamically based on chip formation analysis, tool condition monitoring, and material variations. This level of self-adjustment moves beyond traditional adaptive control, employing deep learning to understand subtle patterns indicative of quality degradation long before they become visible defects. Manufacturers expect AI to democratize complex machining knowledge, enabling less experienced operators to achieve the throughput and quality levels previously reserved for highly specialized master machinists. Furthermore, AI facilitates complex scheduling and resource allocation in facilities running hundreds of machines, optimizing batch sizes and minimizing setup changeover times through sophisticated planning algorithms.

Concerns often center on data security, the cost of retrofitting existing machine fleets with necessary sensors and edge computing capabilities, and the need for standardized data protocols across disparate machine brands. Despite these challenges, the prevailing sentiment is that AI is an unavoidable evolutionary step. Its immediate impact is seen in automating the decision-making process for optimizing cycle efficiency, ensuring that the machine operates at the highest possible material removal rate while strictly adhering to quality requirements and maximizing tool life, directly translating to substantial long-term cost savings and improved production consistency across various demanding applications.

- Enhanced Predictive Maintenance: AI algorithms analyze vibration and temperature data to forecast component failure, drastically reducing unplanned downtime.

- Real-Time Process Optimization: Machine Learning adjusts feed rates, spindle speed, and coolant delivery dynamically to minimize cycle time and tool wear.

- Automated Quality Control: Vision systems and AI analyze surface finish and dimensional measurements instantly, enabling in-process defect detection and compensation.

- Adaptive Thermal Compensation: AI models predict and compensate for thermal expansion effects on machine components, ensuring continuous dimensional accuracy.

- Optimized Scheduling and Load Balancing: ML determines the most efficient job scheduling across multiple machines, maximizing overall factory throughput.

DRO & Impact Forces Of Screw Machines Market

The dynamics of the Screw Machines Market are governed by a complex interplay of Drivers (D), Restraints (R), Opportunities (O), and potent Impact Forces. A primary driver is the accelerating demand for miniaturized and complex precision components across booming sectors, including medical devices (e.g., orthopedic implants, endoscopic tools) and advanced electronics (e.g., 5G connectors, sensor components). This miniaturization trend necessitates the high speed and precision capabilities inherent in modern CNC Swiss-type screw machines, which are uniquely suited to machining small-diameter parts with high length-to-diameter ratios. Furthermore, the global trend toward factory automation, driven by increasing labor costs and the necessity for scalable, consistent manufacturing processes, continually pushes manufacturers to invest in highly automated, multi-axis screw machines equipped with robotic handling and integrated inspection systems, thereby ensuring sustained market growth.

However, significant restraints temper this expansion. The substantial initial capital investment required for high-precision CNC screw machines poses a barrier to entry, particularly for smaller manufacturing enterprises and those in developing economies, restricting rapid market penetration. Coupled with this, the shortage of highly skilled technicians and specialized programmers capable of operating, maintaining, and optimally setting up complex multi-spindle and Swiss-type machines creates operational bottlenecks. Economic volatility and the fluctuating cost of raw materials, particularly specialty alloys like titanium and nickel-based superalloys often machined on these systems, introduce uncertainty into manufacturing planning and profitability, leading to cautious capital expenditure decisions by potential buyers. These restraints necessitate sophisticated financing options and robust training programs to mitigate their market-dampening effects.

Opportunities for growth are concentrated in the rapidly expanding aerospace sector's adoption of lighter, high-performance materials (such as composites and specialized alloys) that require sophisticated machining strategies only available on advanced screw machines. The shift toward Electric Vehicle (EV) manufacturing presents a major new application area, requiring high volumes of specialized, precision-machined electrical connectors, bushings, and motor components. Furthermore, the retrofitting and integration of Industry 4.0 technologies—specifically IoT connectivity, cloud analytics, and AI-driven monitoring—into existing machine infrastructure opens up significant revenue streams for technology providers and system integrators. These opportunities focus on enhancing machine utilization and data-driven operational transparency, positioning screw machines as key assets in the smart factory ecosystem.

The impact forces within the market are primarily regulatory and technological. Stringent quality standards, particularly in the medical and aerospace industries (like ISO 13485 and AS9100), act as powerful forces demanding higher machine precision and robust documentation capabilities, favoring advanced machine tools capable of superior repeatability and integrated inspection. Technologically, the ongoing miniaturization trend acts as a disruptive force, constantly pushing machine builders to increase axis count, refine spindle speeds, and improve vibration dampening to achieve sub-micron tolerances, effectively accelerating the obsolescence cycle for older machine generations and ensuring a continuous demand for cutting-edge equipment capable of accommodating increasingly stringent design requirements.

Segmentation Analysis

The Screw Machines Market is meticulously segmented based on machine type, operational capability, and the primary end-use industries served, reflecting the diverse applications and technical requirements inherent in precision component manufacturing. Analyzing these segments provides strategic insights into areas of highest current value and future growth potential. The Type segmentation is particularly crucial, differentiating between traditional, cam-operated automatics (declining share) and advanced CNC variants, which dominate due to their programming flexibility and rapid changeover capabilities, essential for modern, high-mix, low-volume production strategies increasingly adopted across mature economies seeking agile manufacturing solutions.

Further granularity is achieved through the Operational classification, which distinguishes between single-spindle and multi-spindle architectures. While single-spindle CNC machines offer superior flexibility for complex parts and lower initial investment, multi-spindle machines excel in extremely high-volume production of simpler components, dramatically minimizing cycle times by performing multiple operations simultaneously across several stations. The End-Use Industry segmentation highlights the dependence of critical sectors like automotive and medical devices on these precision tools, making market dynamics highly susceptible to capital expenditure cycles within these vital application areas and reflecting the technical specialization required for producing industry-specific components under rigorous regulatory scrutiny.

This segmented view allows market players—from machine tool manufacturers to software providers and material suppliers—to tailor their product development and marketing efforts. For instance, focusing on the Medical Devices segment requires adherence to specific material handling and surface finish standards, favoring high-end Swiss-type CNC machines. Conversely, targeting general engineering focuses on machines offering robustness and versatility for a wide range of materials and part sizes. Geographic segmentation remains pivotal, showing differential growth rates driven by regional industrialization pace and technological adoption rates, with APAC leading the charge in new installations due to massive manufacturing capacity expansion.

- By Type:

- Single-Spindle Screw Machines

- Multi-Spindle Screw Machines

- CNC Swiss-Type Screw Machines

- CNC Turret-Type Lathes

- By Operation:

- Automatic Screw Machines (Cam-Driven)

- Semi-Automatic Screw Machines

- Fully Computer Numerical Control (CNC) Machines

- By End-Use Industry:

- Automotive & Transportation

- Aerospace & Defense

- Medical Devices & Healthcare

- Electronics & Telecommunications

- General Engineering & Industrial Equipment

- By Application:

- Fasteners (Screws, Bolts, Nuts)

- Shafts and Pins

- Bushings and Spacers

- Fittings and Connectors

Value Chain Analysis For Screw Machines Market

The Value Chain for the Screw Machines Market begins with Upstream Analysis, dominated by raw material suppliers (steel, cast iron, and high-performance alloys) and specialized component manufacturers, including providers of CNC controls (Fanuc, Siemens), high-precision linear guides, spindles, and specialized tool holders. The cost and quality of raw materials and control systems significantly influence the final machine price and performance capabilities. Key competitive advantages at this stage are derived from establishing long-term supply agreements for proprietary or critical mechanical and electrical components, ensuring both reliability and cost efficiency in the complex assembly process, which requires specialized handling and testing for precision equipment.

The central manufacturing stage involves machine tool builders (OEMs) who design, assemble, and rigorously test the screw machines. This stage incorporates high-precision engineering, software integration, and application-specific customization (e.g., specialized tooling packages for titanium machining). OEMs differentiate themselves through technological innovation, such as developing proprietary machine architectures (e.g., sliding headstock designs for Swiss-type machines) and integrating advanced automation features. Post-manufacturing, the Distribution Channel plays a critical role. Direct sales channels are often employed for major, custom-configured installations, allowing OEMs to provide extensive pre-sale consultation and post-installation support. Indirect distribution, leveraging local distributors and specialized agents, is common for standardized, smaller machines, relying on the distributor’s regional presence and ability to offer immediate service and localized support to minimize machine downtime.

The Downstream Analysis focuses on the end-users and auxiliary services. End-users are primarily precision component manufacturers who rely on these machines for their core production capabilities. Maintenance, repair, and operations (MRO) services, often provided by the OEM or certified third parties, form a crucial part of the downstream value, ensuring the machine's longevity and performance. The value chain concludes with the application of the machined components in sectors like automotive or medical, where strict quality validation is performed. Efficiency in the distribution channel, coupled with robust technical support, is paramount because screw machines are high-value capital assets whose ROI is directly tied to maximized uptime and sustained machining accuracy across their operational lifecycle.

Screw Machines Market Potential Customers

Potential customers and end-users of screw machines are defined by their stringent requirements for high volume, high precision, and complex component geometry manufacturing across diversified industries globally. The largest segment of potential buyers includes major Tier 1 and Tier 2 suppliers within the Automotive and Transportation sectors, who require continuous, high-speed production of millions of components, such as fuel injection parts, brake system elements, and sensor housing components. These customers prioritize machine robustness, long-term reliability, and the ability to integrate seamlessly into highly automated assembly lines, often demanding multi-spindle machines for maximal throughput and efficiency in large-scale operations requiring minimal human oversight.

The second major group comprises highly specialized contract manufacturers focused on the Medical Devices and Aerospace & Defense industries. These buyers are characterized by their demand for extremely high-tolerance machining, often involving difficult materials (e.g., titanium alloys, stainless steel 316L, PEEK plastic) and strict compliance with regulatory standards (FDA, FAA). Their purchasing decisions are heavily weighted by the machine's capability to achieve microscopic surface finishes, maintain repeatability over extended production runs, and handle complex five- to nine-axis simultaneous machining operations typical of bone screws, turbine blades, or specialized connectors where failure is not an option, making Swiss-type CNC machines the preferred tool of choice.

Additionally, Electronics and Telecommunications companies, along with the General Engineering sector, represent substantial purchasing power. Electronics manufacturers require high-speed production of tiny, intricate components like micro-pins, contact springs, and fiber optic connectors, driving demand for the smallest, fastest CNC Swiss machines. General engineering, covering fluid power, hydraulics, and general machine shops, seeks versatile CNC turning centers capable of handling a broad spectrum of job sizes and materials with quick changeovers, valuing flexibility and comprehensive technical support over ultra-specialization, ensuring a wide, stable base for market demand across diverse economic conditions and manufacturing needs.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.2 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | TSUGAMI, STAR MICRONICS, Citizen Machinery, DMG MORI, INDEX, Tornos, Okuma, Haas Automation, GROB-WERKE, Doosan Machine Tools, Hyundai Wia, Nomura DS, Gnutti Transfer, Schütte, Willemin-Macodel, Hardinge Inc., Mazak, Swissturn/USA, Eurotech, Ganesh Machinery |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Screw Machines Market Key Technology Landscape

The technological landscape of the Screw Machines Market is defined by continuous innovation aimed at enhancing precision, speed, and versatility, moving far beyond the capabilities of legacy automatic lathes. A crucial technology is the widespread adoption of high-performance Computer Numerical Control (CNC) systems, particularly those offering advanced features like conversational programming, integrated collision avoidance, and predictive maintenance algorithms powered by edge computing. Modern CNC Swiss-type machines utilize guide bushings that provide rigid support close to the cutting point, enabling the stable machining of slender parts with high length-to-diameter ratios—a fundamental requirement in medical and electronic component manufacturing—and are often equipped with nine or more axes, allowing for highly complex, simultaneous front and back-end machining to complete parts in a single pass.

Furthermore, the incorporation of advanced tooling systems, such as live tooling (powered tools for secondary operations like drilling and milling) and modular quick-change tooling, has drastically reduced setup times and expanded the complexity of parts producible on screw machines, making them highly efficient manufacturing cells. High-pressure coolant delivery systems (upwards of 2000 PSI) are standard technology, essential for breaking chips when machining difficult materials like superalloys, ensuring effective heat dissipation, and maximizing tool life in high-speed applications. The utilization of robotic automation for bar feeding, finished part handling, and integrated quality inspection via in-machine probing or laser measurement systems represents the core of factory automation integration within this sector.

The market is also witnessing a strong trend toward software-defined machine capabilities, where simulation software (Digital Twins) allows for comprehensive program verification before physical execution, minimizing costly material scrap and machine damage during the setup of new jobs. Energy efficiency technologies, including high-efficiency spindle motors and regenerative braking systems, are becoming standard features, responding to the need for sustainable manufacturing practices. Finally, advanced sensor technology—monitoring vibration, thermal signatures, and acoustic emissions—is fundamental to enabling the AI/ML-driven predictive capabilities now expected by high-end users, ensuring machine longevity and optimal operational parameters in a demanding, 24/7 production environment, reinforcing the machine as a key node in the broader Industry 4.0 infrastructure.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest and fastest-growing market for screw machines, driven by the massive concentration of consumer electronics manufacturing, robust automotive production, and escalating government investment in infrastructure and defense sectors, particularly in China, South Korea, and India. Demand is focused on high-throughput, multi-spindle machines for volume production and advanced CNC Swiss-type machines to support the rapidly growing medical device and semiconductor supply chains within the region, necessitating substantial capital equipment procurement to maintain global cost competitiveness and expand domestic production capacities.

- North America: This region is characterized by high demand for complex, high-margin, and highly customized machining solutions, primarily serving the aerospace, defense, and high-end medical implant manufacturing industries. North American buyers prioritize advanced automation, stringent quality verification integration, and localized technical support. The shift towards reshoring and the strategic investment in domestic supply chains, bolstered by government initiatives, is driving the adoption of the latest generation of flexible, multi-axis CNC screw machines capable of handling specialty materials and tight regulatory compliance requirements.

- Europe: Europe represents a mature market focusing on technological leadership, specializing in high-precision, environmentally compliant machine tools. Demand is strong in the German automotive sector (especially precision components for next-generation propulsion systems), Swiss watchmaking (micromachining), and general high-value engineering across Italy and France. European manufacturers often lead in the development of multi-spindle technology and advanced CNC controls, aiming for superior energy efficiency and lower total cost of ownership (TCO) to maintain competitiveness in global export markets.

- Latin America (LATAM): The LATAM market, while smaller, exhibits steady growth driven by industrialization in Brazil and Mexico, particularly within the automotive component supply base supporting North American and European OEMs. Investment is often targeted at reliable, medium-complexity CNC screw machines offering a balance between cost and performance, supporting local content requirements and expanding domestic manufacturing capabilities for general industrial applications and agricultural machinery components.

- Middle East and Africa (MEA): Growth in MEA is highly concentrated around infrastructure projects, oil and gas field equipment manufacturing (requiring heavy-duty fittings and complex parts), and nascent defense industry expansion. The market generally seeks robust, easy-to-maintain machines capable of operating in challenging environments, with purchasing decisions heavily influenced by long-term service contracts and reliable parts availability from established global machine tool builders.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Screw Machines Market.- TSUGAMI CORPORATION

- STAR MICRONICS CO., LTD.

- Citizen Machinery Co., Ltd.

- DMG MORI CO., LTD.

- INDEX-Werke GmbH & Co. KG

- Tornos SA

- Okuma Corporation

- Haas Automation, Inc.

- GROB-WERKE GmbH & Co. KG

- Doosan Machine Tools (now DN Solutions)

- Hyundai Wia Corporation

- Nomura DS Co., Ltd.

- Gnutti Transfer S.p.A.

- Schütte GmbH

- Willemin-Macodel SA

- Hardinge Inc.

- Mazak Corporation

- Swissturn/USA

- Eurotech/BIGLIA

- Ganesh Machinery

Frequently Asked Questions

Analyze common user questions about the Screw Machines market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between CNC Swiss-type and traditional CNC screw machines?

CNC Swiss-type machines utilize a sliding headstock and guide bushing, which provides support close to the cutting tool, enabling the precise machining of long, slender parts with extremely tight tolerances in a single setup, whereas traditional CNC turning centers rely on a fixed headstock, making them less suitable for high length-to-diameter ratio components.

Which end-use industry drives the highest growth in demand for screw machines?

The Medical Devices and Healthcare sector is currently experiencing the highest proportional growth in screw machine demand globally. This growth is fueled by the continuous need for micro-precision, high-complexity components such as orthopedic implants, dental screws, and minimally invasive surgical parts that require specialized material processing and exacting quality standards.

How is Industry 4.0 influencing the competitive landscape of the screw machines market?

Industry 4.0, via IoT and AI integration, is transforming screw machines into smart manufacturing assets. This allows for real-time performance monitoring, predictive maintenance scheduling, automated process optimization, and centralized data analytics, significantly reducing unplanned downtime and improving overall equipment effectiveness (OEE) for competitive advantage.

What are the key restraint factors limiting the full adoption of advanced screw machine technology?

The primary restraints are the high initial capital expenditure associated with purchasing advanced, multi-axis CNC machines and the persistent global shortage of highly skilled CNC programmers and maintenance technicians necessary to operate and maintain these complex, sophisticated manufacturing systems effectively.

What role does multi-spindle technology play in modern screw machine manufacturing?

Multi-spindle screw machines are utilized for ultra-high-volume production, performing multiple machining operations simultaneously on several workpieces at different stations. This drastically reduces the cycle time per part, making them essential for mass production environments, such as Tier 1 automotive component suppliers, where speed and minimal cost per unit are paramount.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager