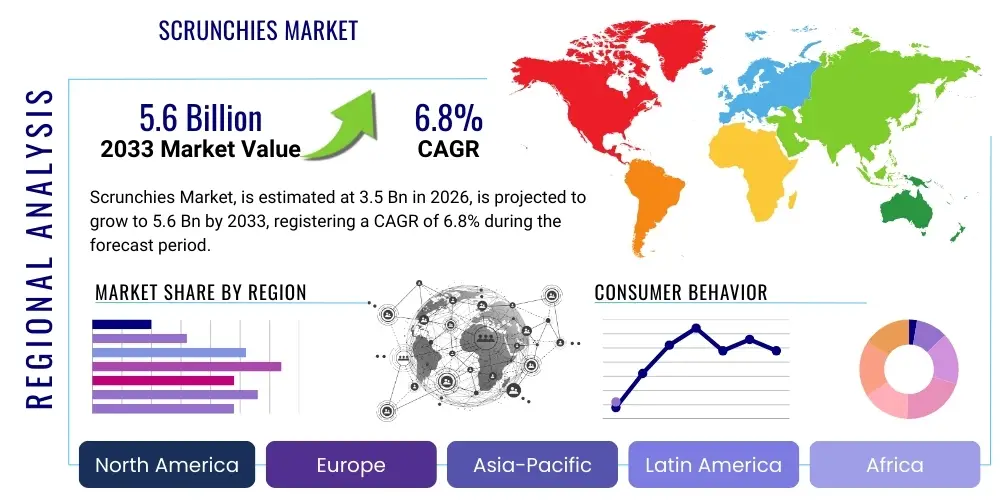

Scrunchies Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441732 | Date : Feb, 2026 | Pages : 241 | Region : Global | Publisher : MRU

Scrunchies Market Size

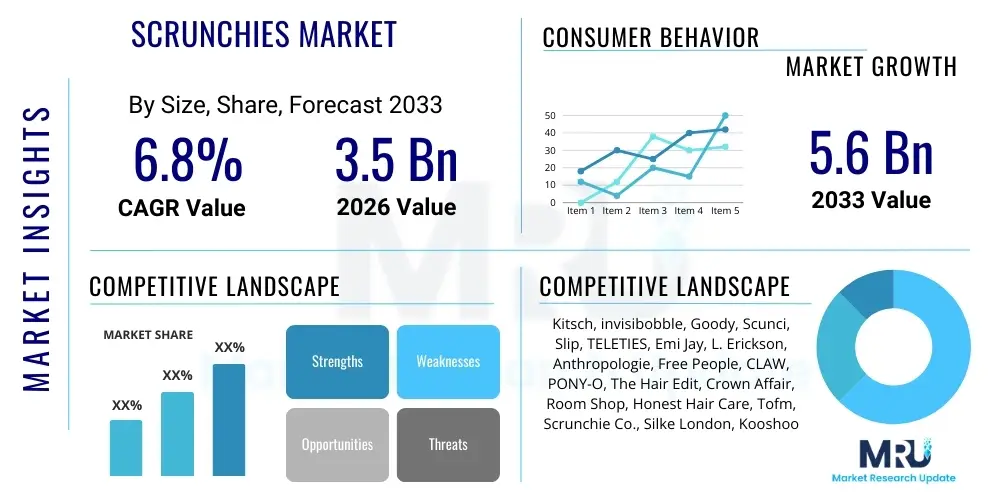

The Scrunchies Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 5.6 Billion by the end of the forecast period in 2033. This robust expansion is primarily fueled by the sustained revival of 1990s and early 2000s fashion trends, particularly among Generation Z and younger Millennials, who value both aesthetic appeal and comfort in hair accessories. The market trajectory is further bolstered by product innovation, encompassing materials such as silk, velvet, organic cotton, and specialized athletic fabrics designed for moisture-wicking properties, expanding the application beyond casual wear into professional and fitness domains. The shift towards sustainable and ethically sourced fashion accessories also significantly influences purchasing decisions, compelling manufacturers to adopt eco-friendly production methods and transparent supply chains. The demand for customizable and personalized scrunchies, facilitated by both large-scale manufacturers and artisan sellers on platforms like Etsy, contributes significantly to market diversity and revenue generation. The low barrier to entry for manufacturing ensures constant competition, driving innovation in material science and design aesthetics, thereby maintaining consumer interest and purchase frequency across global markets.

Scrunchies Market introduction

The Scrunchies Market encompasses the global trade and consumption of fabric-covered elastic hair ties, a product category that has successfully transitioned from a cyclic fashion item into a ubiquitous, everyday accessory. Scrunchies are fundamentally defined by an elastic core encased in gathered fabric, which provides a cushioning effect that minimizes friction, reduces hair breakage, and prevents the harsh indentations often associated with traditional rubber bands. This functional superiority, combined with the immense aesthetic versatility offered by myriad fabrics, colors, and patterns, positions the scrunchie as a critical component of the personal grooming and fashion accessory sector. The market's dynamism is rooted in its ability to adapt to macro trends, such as the increasing focus on hair health and the persistent popularity of voluminous hairstyles that require gentle yet secure fastening mechanisms. The product’s relatively low price point and high accessibility across diverse retail channels further support its expansive market penetration globally.

Major applications of scrunchies span daily wear, athletic activities, and formal occasions. In daily use, they serve as a comfortable method for securing ponytails and buns. The athletic segment demands materials with high resilience, moisture-wicking capabilities, and strong grip, leading to specialized product development utilizing technical textiles. For formal applications, high-end materials like pure silk, designer velvet, or scrunchies embellished with rhinestones or pearls cater to consumers seeking elegance and luxury. Beyond functional use, the scrunchie has cemented its place as a visible fashion accessory, frequently worn around the wrist, transforming it into a statement piece that complements apparel and signals current stylistic alignment. The driving factors include the powerful influence of social media influencers showcasing nostalgic trends, the increasing consumer awareness regarding sustainable and organic material choices, and the growing urbanization leading to higher spending on personal care and appearance-related items.

The core benefits delivered to consumers are multidimensional: enhanced comfort during prolonged wear, significant reduction in hair damage and breakage compared to standard elastics, and unparalleled versatility in expressing personal style through color and texture synchronization with outfits. The market is also driven by seasonal variations, with fabrics like velvet and flannel peaking in demand during winter months, while lighter cotton and linen blends dominate the summer season. Furthermore, collaborations between scrunchie brands and major fashion houses or influencers generate significant media attention and spike purchasing activity. The cumulative effect of these consumer-centric benefits and continuous style refresh cycles ensures sustained market vitality and upward revenue growth projections throughout the forecast period.

Scrunchies Market Executive Summary

The Scrunchies Market is characterized by vigorous growth driven primarily by a powerful convergence of nostalgic fashion revival and intrinsic product benefits related to hair health and comfort. Current business trends indicate a significant polarization of the competitive landscape, with large, established accessory manufacturers focusing on cost-effective mass production and streamlined global distribution, while smaller, artisan brands heavily leverage e-commerce platforms and social media marketing to specialize in premium materials (e.g., silk, organic textiles) and customized, limited-edition designs. A critical shift is observed in supply chain strategies, with increasing demand for traceability and ethical sourcing, pushing manufacturers towards certifications verifying sustainable material acquisition and fair labor practices. This duality in the market—mass-market availability meeting boutique specialization—ensures broad coverage of consumer needs across various price points and lifestyle segments.

Regionally, North America and Europe currently represent the most substantial revenue bases, primarily due to high consumer spending on fashion accessories, early adoption of cyclic trends, and robust presence of both high-street retailers and specialized online accessory stores. However, the Asia Pacific (APAC) region is projected to register the fastest growth rate, propelled by massive youth populations, rising disposable incomes in economies like China and India, and the accelerating penetration of Western beauty standards and accessory consumption habits. Latin America and the Middle East and Africa (MEA) present emerging market opportunities, particularly as global fast-fashion retailers expand their physical and digital footprints, introducing culturally relevant and seasonally appropriate scrunchie designs to new consumer bases. Effective localization of material choices and color palettes is key to unlocking growth in these varied regional markets.

Segment trends underscore the dominance of the Fabric Type segment, where silk/satin scrunchies command a premium due to their perceived anti-frizz and hair-protecting qualities, particularly among consumers focusing on premium haircare regimes. In terms of end-user segmentation, the Adult segment (Aged 25+) represents the highest spend due to greater purchasing power and preference for quality materials, while the Teenage segment drives volume due to high frequency of trend adoption and accessory matching. Distribution channel analysis highlights the increasing importance of the E-commerce segment, which offers unparalleled access to niche brands, personalized products, and direct-to-consumer relationships, challenging the traditional dominance of offline retail channels like supermarkets and specialty stores. Successful market penetration necessitates a multichannel distribution approach integrating both digital responsiveness and physical accessibility.

AI Impact Analysis on Scrunchies Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Scrunchies Market primarily revolve around how technology can influence trend prediction, personalized manufacturing, inventory optimization, and consumer purchasing behavior. Users frequently ask: "Can AI predict the next trending scrunchie color or pattern?", "How does AI affect the textile supply chain used for scrunchies?", and "Will AI-driven customization make mass production obsolete?". The key themes emerging from this analysis are optimization, personalization, and efficiency. Consumers expect AI to facilitate highly specific product recommendations, while manufacturers are keen on leveraging predictive analytics to minimize overstocking of slow-moving inventory and ensure prompt deployment of rapidly emerging stylistic trends, thereby maximizing profitability in this highly trend-sensitive accessory category.

AI's primary influence is expected in the design and retail phases. For design, generative AI algorithms can process vast amounts of social media data, historical sales figures, and cultural signals (e.g., film trends, celebrity endorsements) to identify potential color palettes, material combinations, and dimensional ratios that are statistically likely to become popular within the next six to twelve months. This predictive capability significantly reduces the risk associated with product development cycles. Furthermore, AI-powered virtual try-on features integrated into e-commerce platforms enhance the online shopping experience, allowing consumers to digitally visualize how different scrunchie styles complement their hair color and outfit, reducing return rates and increasing conversion effectiveness.

In manufacturing and supply chain management, AI-driven predictive maintenance optimizes the operation of fabric cutting and sewing machinery, reducing downtime and waste, a crucial factor given the slim margins in accessory production. More sophisticated applications include algorithmic demand forecasting, which dynamically adjusts production volumes based on real-time geographical sales data and localized social media sentiment analysis. This ensures that regions showing high affinity for specific scrunchie types (e.g., velvet in colder climates) receive priority allocation, significantly enhancing logistical efficiency and cash flow management for retailers and wholesalers operating globally. AI thus acts as a catalyst for hyper-responsive and risk-mitigated operations across the value chain.

- AI-driven trend forecasting minimizes inventory risk associated with cyclic fashion changes.

- Generative AI assists designers in creating novel patterns and color combinations based on aggregated social sentiment.

- Predictive demand modeling optimizes raw material procurement (elastic, fabric) and production schedules.

- AI-powered visual recognition tools enhance quality control during high-volume manufacturing processes.

- Personalized e-commerce recommendations utilize machine learning to match scrunchie styles to individual consumer profile data.

- Automated logistics planning shortens lead times from factory floor to global retail shelves, crucial for timely trend capitalization.

DRO & Impact Forces Of Scrunchies Market

The Scrunchies Market is highly influenced by a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively exerting significant impact forces on market dynamics and strategic direction. The core driver is the sustained cultural relevance of nostalgic fashion, particularly the 90s aesthetic embraced by younger generations, coupled with the recognized superior comfort and hair health benefits of scrunchies over traditional elastics. Opportunities are predominantly centered on sustainability—the shift towards organic, recycled, and biodegradable materials presents a significant avenue for premium market differentiation and attracting environmentally conscious consumers. However, the market faces strong restraints, primarily the high commoditization leading to intense price competition, the saturation of basic product offerings, and the inherent volatility stemming from dependence on fickle fashion trends that can shift rapidly and unpredictably, requiring businesses to maintain high agility in design and production cycles.

A primary driver is the widespread digital influence exerted by social media platforms, which rapidly transforms localized micro-trends into global consumer desires almost instantaneously. Influencers demonstrating intricate hairstyles using specific scrunchie types drive immediate purchasing volume, validating the efficacy of digital marketing strategies over traditional advertising. Concurrently, the increasing awareness among consumers about minimizing hair damage fuels the demand for high-quality fabrics like silk and satin, creating lucrative sub-segments within the broader market. Restraints are primarily focused on maintaining intellectual property—the simple design makes scrunchies highly susceptible to replication and counterfeiting, particularly by low-cost manufacturers in emerging economies, eroding potential profit margins for original designers and premium brands. Furthermore, the reliance on textile supply chains, which are susceptible to geopolitical disruptions and volatile raw material pricing (cotton, polyester), presents operational challenges that constrain stable growth and margin maintenance.

The opportunity landscape is expansive, extending beyond materials into functional innovation. This includes developing scrunchies with hidden pockets (utility scrunchies), integrated technology (e.g., small LEDs for novelty or reflective material for athletic safety), or those designed specifically for very thick or thin hair types, addressing underserved niche requirements. The impact forces are generally high, manifesting as intense competitive rivalry fueled by product indistinguishability and high threat of substitutes (other hair accessories like clips, headbands, and elastic bands). Success in this market demands continuous portfolio refreshment, robust brand storytelling focused on quality and ethics, and operational efficiencies to navigate the low-cost manufacturing pressures, ensuring that brands remain top-of-mind within a highly saturated accessory space. The collective forces necessitate strategic planning that balances mass-market volume with premium niche specialization.

Segmentation Analysis

The Scrunchies Market segmentation provides a critical framework for understanding consumer behavior, identifying high-growth sub-markets, and tailoring product development and marketing strategies. The market is typically segmented based on material type, distribution channel, end-user age group, and functional design, each revealing distinct consumer preferences and purchasing power dynamics. Material segmentation is crucial as it directly correlates with price point and functional benefit, separating mass-market polyester from premium silk offerings. The stratification across distribution channels reflects the shift in consumer buying habits towards digital platforms for variety and physical stores for immediate, impulse purchases. Effective segmentation analysis allows stakeholders to accurately gauge demand elasticity and allocate resources efficiently towards the most profitable consumer cohorts and geographical regions, optimizing inventory placement and marketing expenditure for maximum return on investment.

Analysis of the End-User segment shows that teenagers and young adults (13-25) are the primary volume drivers, frequently purchasing multi-packs and inexpensive, trend-driven designs to match numerous outfits. Conversely, the adult segment (26+) often demonstrates a higher Average Transaction Value (ATV), prioritizing durable quality, material sophistication (like PURE silk), and subtle, professional designs suitable for corporate environments. This difference necessitates dual product strategies: high-volume, trend-sensitive lines for younger consumers and premium, quality-focused lines for older demographics. Furthermore, functional segmentation—separating standard daily wear from specialized athletic or swim scrunchies—is gaining importance as consumers demand accessories tailored precisely to specific activities, requiring materials with specific properties such as UV resistance or chlorine tolerance, which opens up new, specialized manufacturing processes and marketing narratives.

The importance of segmentation is further amplified by globalization, where regional preferences influence material choices (e.g., climate-appropriate fabrics) and color palettes (e.g., culturally significant colors). Brands that utilize granular segmentation data—combining material preference with regional climate data and socio-economic indicators—can achieve superior market penetration and minimize operational waste. For instance, focusing promotional efforts for moisture-wicking scrunchies in regions with high participation in outdoor sports, or positioning luxury velvet scrunchies in high-income urban centers before seasonal peaks. The continuous evolution of consumer lifestyles, driven by factors like increased remote work (favoring comfort) and renewed focus on self-care (favoring non-damaging materials), requires continuous reassessment and refinement of these segmentation criteria to ensure product relevance and sustained competitive advantage within the accessory landscape.

- By Material Type:

- Silk/Satin

- Velvet

- Cotton/Organic Cotton

- Polyester/Synthetic Blends

- Other (Linen, Wool Blends, Technical Fabrics)

- By Size:

- Mini/Skinny

- Standard

- Jumbo/Oversized

- By End-User:

- Teenagers (Aged 13-19)

- Young Adults (Aged 20-35)

- Children (Aged 5-12)

- Adults (Aged 36+)

- By Distribution Channel:

- Offline Retail (Supermarkets, Hypermarkets, Specialty Stores, Pharmacies)

- Online Retail (E-commerce Websites, Direct-to-Consumer Channels, Third-Party Marketplaces)

Value Chain Analysis For Scrunchies Market

The Value Chain for the Scrunchies Market begins with upstream activities focused on raw material sourcing, predominantly textiles (silk, cotton, synthetic fibers) and elastic materials (rubber or spandex core). Upstream efficiency is dictated by the ability to secure high-quality, ethically sourced fabrics at competitive prices. Manufacturers dedicated to premium scrunchies must invest heavily in supply chain transparency, often establishing direct relationships with certified textile mills to ensure material integrity and sustainability claims. The subsequent manufacturing process involves fabric cutting, specialized sewing (often utilizing automated machinery for high volume), and final assembly, where labor costs and speed of production are critical competitive differentiators, often favoring facilities located in Asia Pacific regions due to economies of scale and expertise in textile manufacturing.

Downstream analysis focuses on bringing the finished product to the end consumer. This phase is characterized by intense marketing and branding activities designed to capture consumer attention in a crowded accessory market. Distribution channels are highly diversified, ranging from direct sales through branded e-commerce platforms to indirect distribution via large mass retailers, specialty beauty supply stores, and fast-fashion outlets. Direct channels offer brands higher control over pricing, inventory, and customer data, fostering strong brand loyalty and facilitating personalized marketing campaigns. Conversely, reliance on indirect channels provides immediate market reach and high visibility, capitalizing on the foot traffic and established logistics networks of major retailers.

The choice between direct and indirect distribution channels significantly impacts margin structure and brand perception. Small, luxury-focused scrunchie brands often thrive on the direct-to-consumer (D2C) model, emphasizing brand narrative, material quality, and exclusive product drops, maintaining premium pricing. Conversely, mass-market players rely heavily on indirect distribution through hypermarkets and convenience stores, prioritizing volume and accessibility, accepting lower per-unit margins. Effective logistics management, including inventory allocation based on geographic trend data, is paramount to prevent stockouts of trending colors and overstocking of slow-moving items. The final layer of the value chain involves post-purchase activities, including customer service and managing returns, where a positive experience is crucial for encouraging repeat purchases in this high-frequency product category.

Scrunchies Market Potential Customers

Potential customers for the Scrunchies Market are broadly classified based on age, lifestyle, and purchasing motivation, encompassing a vast demographic primarily focused on individuals requiring hair management solutions that prioritize comfort and style integration. The core purchasing demographic consists of teenage girls and young adult women (13-35) who are highly attuned to current fashion cycles and social media trends. These buyers view scrunchies not just as a functional item but as a key element of their daily aesthetic expression, driving demand for variety in color, texture, and size to match diverse outfits and occasions. Their buying decisions are frequently influenced by peer endorsement and influencer marketing, emphasizing affordability and trend relevance.

A significant secondary customer segment includes health-conscious consumers and individuals with delicate or textured hair (such as curly or coily hair types). This group specifically seeks out scrunchies made from specialized materials like pure mulberry silk, satin, or organic cotton, valuing the proven benefits of reduced friction, minimized hair damage, and prevention of unsightly crease marks. For these buyers, price sensitivity is lower, and the motivation centers entirely on long-term hair health and investment in quality accessories, creating a stable, high-value niche market segment focused on premium goods. This cohort actively avoids synthetic or cheap elastic materials that could potentially strip hair moisture or cause breakage over time.

Furthermore, the athletic community and professional workers constitute increasingly important end-users. Athletes require highly functional scrunchies made of durable, non-slip, and moisture-wicking technical fabrics designed to withstand strenuous activity and frequent washing. Professionals (e.g., healthcare workers, office staff) often require accessories that adhere to workplace dress codes, favoring neutral colors and refined materials that provide a secure, polished look throughout a long workday. Marketing efforts tailored to these specific functional needs, emphasizing durability and performance metrics, are essential for expanding market reach beyond the traditional fashion-driven consumer base and securing demand stability.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 5.6 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Kitsch, invisibobble, Goody, Scunci, Slip, TELETIES, Emi Jay, L. Erickson, Anthropologie, Free People, CLAW, PONY-O, The Hair Edit, Crown Affair, Room Shop, Honest Hair Care, Tofm, Scrunchie Co., Silke London, Kooshoo |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Scrunchies Market Key Technology Landscape

The technology landscape within the Scrunchies Market is not defined by revolutionary electronic components, but rather by advanced manufacturing processes and material science innovations designed to enhance durability, comfort, and sustainability. Key technological advancements center on specialized textile production, including the development of high-performance technical fabrics engineered for specific uses, such such as fabrics that offer four-way stretch, superior elasticity retention after repeated use and washing, and moisture-wicking capabilities crucial for athletic scrunchies. The utilization of OEKO-TEX certified fabrics and advanced dyeing technologies that ensure colorfastness and minimize water waste during production represent crucial non-electronic technological shifts impacting product quality and environmental footprint, enabling brands to substantiate premium pricing claims based on verifiable material science. Furthermore, seamless welding techniques for the elastic core are being adopted to increase the lifespan and strength of the product, reducing the common consumer frustration of elastic snapping.

In the production phase, the adoption of sophisticated Computer-Aided Manufacturing (CAM) systems for precision fabric cutting ensures minimal waste generation and maximizes material utilization, a critical cost-saving measure in high-volume production. Automated sewing lines utilizing programmable logic controllers (PLCs) allow manufacturers to rapidly switch between different scrunchie sizes and material requirements with minimal downtime, improving operational agility necessary for reacting quickly to fast-changing fashion demands. Though often overlooked, the technology applied to the elastic itself is paramount; the development of synthetic rubber alternatives with enhanced memory retention properties ensures the scrunchie maintains its gripping power over extended periods, addressing a major consumer pain point often associated with low-quality accessories that quickly lose tension.

Furthermore, technology plays a vital role in consumer engagement and supply chain transparency. QR code integration on product packaging, linking consumers directly to sourcing information, sustainability reports, or virtual try-on tools, represents a crucial application of technology to build brand trust and enhance the customer journey. On the e-commerce front, advanced personalization algorithms powered by data analytics and machine learning are utilized to recommend specific scrunchie styles and materials tailored to a user's purchase history and stated hair type, significantly improving conversion rates. While the end product remains simple, the technological backbone supporting its production, quality assurance, and distribution is increasingly sophisticated, focusing on speed, efficiency, and meeting rigorous sustainability standards demanded by modern consumers globally.

Regional Highlights

The global Scrunchies Market exhibits varied growth trajectories and consumption patterns across major geographical regions, influenced by cultural affinity for accessories, prevailing fashion trends, and economic development levels. North America currently holds the largest market share, driven by strong consumer purchasing power, the sustained strength of the nostalgic 90s aesthetic across all fashion accessories, and the high penetration of major retail chains and specialized accessory brands like Kitsch and Goody. The market here is highly competitive, characterized by frequent product launches and strong investment in digital marketing and influencer collaborations. Consumers in the US and Canada demonstrate a high willingness to pay a premium for scrunchies marketed for their hair-health benefits, particularly those made from silk or high-grade satin, cementing this region as the primary incubator for premiumization trends within the accessory sector.

Europe, particularly Western European nations such as the UK, Germany, and France, represents another mature market segment, showing steady demand fueled by the blend of high-street fashion trends and a significant focus on sustainable and ethical sourcing. European consumers are increasingly scrutinizing the origin and environmental impact of textile products, creating strong demand for scrunchies made from certified organic cotton, recycled polyester, or biodegradable materials. This preference pushes manufacturers to adopt stringent European Union regulatory standards regarding textile chemical usage and supply chain transparency. The market dynamic in Europe favors boutique brands and D2C models that can clearly communicate their commitment to sustainability and ethical labor practices, often commanding higher retail prices than their purely synthetic counterparts.

Asia Pacific (APAC) is anticipated to be the fastest-growing region during the forecast period. This explosive growth is underpinned by rapidly expanding middle-class populations, increasing urbanization leading to greater exposure to global fashion and beauty standards, and massive youth demographics in populous countries like India and China. While the APAC market is currently dominated by lower-cost, high-volume synthetic scrunchies distributed through local markets and massive e-commerce platforms, there is a burgeoning luxury segment targeting high-net-worth individuals in cities like Shanghai and Tokyo, driving demand for imported designer silk scrunchies. Market penetration requires adaptation to diverse hair types (e.g., thicker elastics for dense Asian hair) and sensitivity to regional fashion nuances and color preferences, making localized production and marketing strategies essential for long-term success. Latin America and MEA, while currently smaller, are emerging due to increased access to global fashion via e-commerce and rising disposable incomes, presenting significant untapped potential for affordable, trend-driven scrunchie variants.

- North America: Market leader due to high disposable income, strong brand presence, and cultural affinity for 90s fashion revival.

- Europe: High demand for sustainable, ethically sourced, and premium fabric options; growth driven by strict environmental consciousness.

- Asia Pacific (APAC): Expected fastest growth; characterized by high volume, low cost, and increasing adoption of Western beauty trends among youth populations.

- Latin America: Emerging market potential driven by expanding e-commerce access and rising interest in trendy, affordable accessories.

- Middle East & Africa (MEA): Growth catalyzed by increasing globalization of fashion retail and urbanization, focusing on culturally relevant colors and luxurious materials like satin.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Scrunchies Market.- Kitsch

- invisibobble

- Goody

- Scunci

- Slip

- TELETIES

- Emi Jay

- L. Erickson

- Anthropologie

- Free People

- CLAW

- PONY-O

- The Hair Edit

- Crown Affair

- Room Shop

- Honest Hair Care

- Tofm

- Scrunchie Co.

- Silke London

- Kooshoo

Frequently Asked Questions

Analyze common user questions about the Scrunchies market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the current growth of the Scrunchies Market?

The primary driver is the pervasive resurgence of nostalgic 1990s and early 2000s fashion trends, coupled with the functional benefit of scrunchies reducing hair damage and breakage compared to traditional elastic hair ties. Social media influence accelerates the adoption and high-frequency purchasing of new styles.

How are sustainable practices influencing the Scrunchies Market?

Sustainability is a major opportunity, driving demand for premium scrunchies made from organic cotton, recycled polyester, bamboo, and biodegradable materials. Consumers, particularly in North America and Europe, are willing to pay more for ethically sourced products with transparent supply chains, pushing manufacturers toward eco-friendly certifications like OEKO-TEX.

Which material segment holds the highest value share in the market?

The Silk/Satin material segment holds the highest value share per unit, driven by consumer focus on hair health and anti-frizz properties. Although synthetic blends dominate volume, premium fabrics like pure mulberry silk command significantly higher price points, catering to the luxury haircare segment.

What are the main distribution channels used for selling scrunchies globally?

The main distribution channels are Offline Retail (supermarkets, hypermarkets, specialty beauty stores) and Online Retail (e-commerce platforms, brand D2C websites). Online channels are increasingly dominant, offering access to niche artisan brands and specialized product variants, driving personalized customer experiences.

How does the Scrunchies Market manage rapid shifts in fashion trends?

The market manages trend volatility through agile manufacturing, leveraging AI-driven trend forecasting, and maintaining diversified inventory across different materials and price points. Fast-fashion retailers emphasize rapid prototyping and production cycles to quickly capitalize on short-lived micro-trends identified via social media monitoring.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager