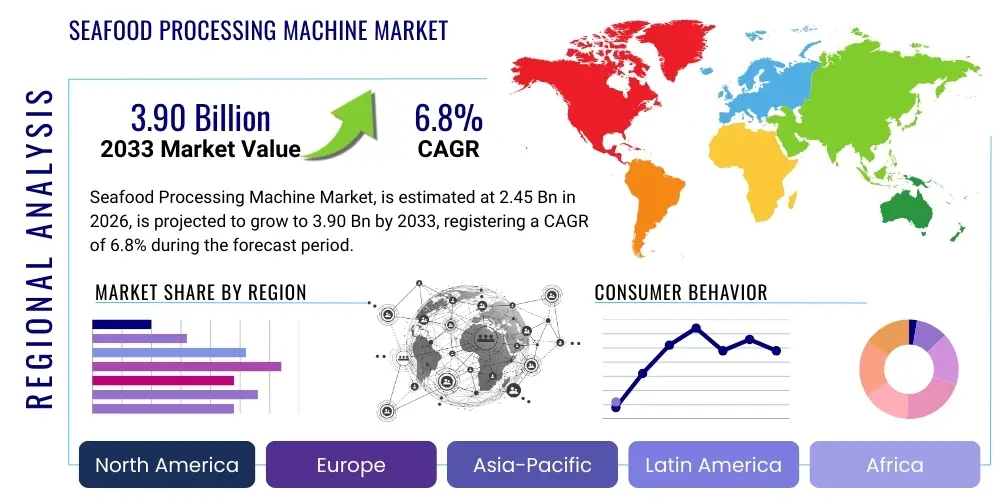

Seafood Processing Machine Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442216 | Date : Feb, 2026 | Pages : 255 | Region : Global | Publisher : MRU

Seafood Processing Machine Market Size

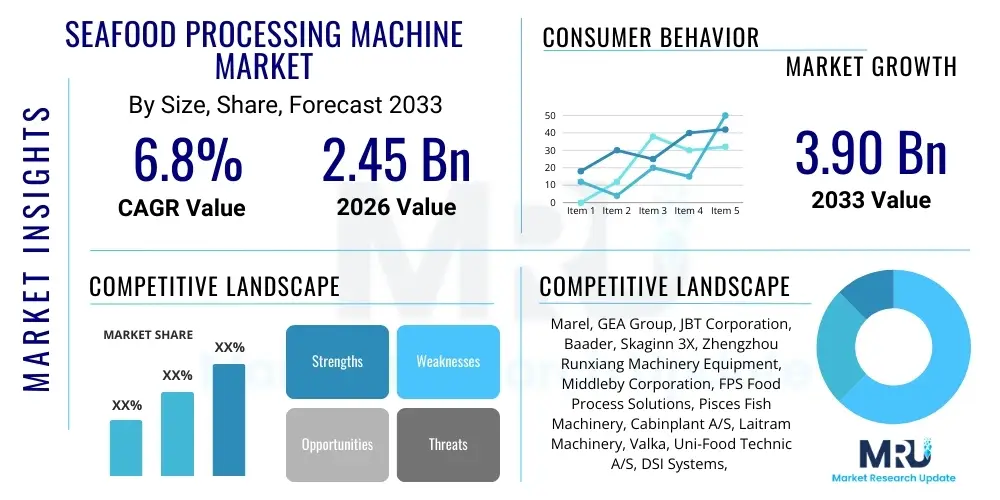

The Seafood Processing Machine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $2.45 Billion in 2026 and is projected to reach $3.90 Billion by the end of the forecast period in 2033.

Seafood Processing Machine Market introduction

The Seafood Processing Machine Market encompasses specialized industrial equipment designed for efficient and hygienic preparation, handling, and preservation of various aquatic species, including fish, crustaceans, and mollusks. These sophisticated machines perform tasks ranging from initial cleaning and grading to filleting, skinning, freezing, and packaging, ensuring product consistency and safety in high-volume operations. The primary product portfolio includes automated filleting lines, precision cutting systems, grading machinery utilizing computer vision, and advanced freezing technologies like cryogenic and IQF (Individual Quick Freezing) systems. These innovations are critical for mitigating labor costs, enhancing yield, and adhering to increasingly stringent global food safety standards.

Major applications for seafood processing machinery span primary processing facilities, secondary value-added processing plants, large commercial fishing vessels equipped for onboard processing, and aquaculture farms that require rapid post-harvest handling. The implementation of this technology is crucial for maximizing the shelf life of highly perishable seafood and meeting the escalating global demand for ready-to-eat and pre-portioned seafood products. The continuous refinement of machinery to handle diverse species with varying anatomical structures represents a key driver of market development.

The core benefits derived from the adoption of modern seafood processing equipment include substantial reductions in manual labor dependency, significant improvements in operational throughput, and minimized product waste due to precision cutting and optimized yield recovery. Driving factors for market expansion include the global shift towards protein-rich diets, the necessity for high-capacity production in developing economies, and technological advancements that integrate automation and real-time monitoring capabilities, often linked to Industry 4.0 paradigms. Furthermore, the increasing focus on sustainability and traceability within the supply chain necessitates the use of high-tech processing solutions that can accurately track and manage batches.

Seafood Processing Machine Market Executive Summary

The Seafood Processing Machine Market is experiencing robust growth, primarily driven by the escalating worldwide consumption of seafood and the imperative for process automation to counter rising labor costs and ensure compliance with stringent hygiene regulations. Current business trends indicate a strong pivot toward integrated, end-to-end processing solutions that utilize robotics and advanced sensor technologies for tasks like grading and defect detection. Manufacturers are focusing heavily on developing modular systems that can be easily customized to handle the diverse requirements of different species and processing volumes, providing operational flexibility to processors globally. Sustainability is also a key commercial driver, pushing innovation towards zero-waste processing techniques and energy-efficient machinery designs, which impacts purchasing decisions across the industry.

Regional trends reveal Asia Pacific (APAC) as the dominant force in both consumption and production capacity expansion, particularly due to the massive scale of fishing and aquaculture operations in China, India, and Southeast Asian countries. North America and Europe, characterized by high regulatory standards and labor costs, demonstrate the highest adoption rates of fully automatic and high-precision machinery, emphasizing value-added processing capabilities. The rapid development of aquaculture infrastructure in Latin America and MEA is creating new demand pockets for specialized machinery, especially feed processing and initial harvest handling equipment. These regional dynamics highlight a heterogeneous market where technology adoption correlates strongly with economic maturity and regulatory environment.

Segment trends emphasize the rapid proliferation of automated filleting and skinning machines, which directly address efficiency bottlenecks in traditional processing lines. The automatic operation segment is projected to exhibit the fastest growth, benefiting from increased investment in high-throughput production facilities. Application-wise, the machinery tailored for fish processing, especially pelagic and whitefish, maintains the largest market share, but the crustacean segment (driven by shrimp and prawn processing) is showing accelerating demand for peeling and sorting automation. Furthermore, there is a distinct trend towards sophisticated grading and sorting machines that use AI-powered vision systems, enhancing accuracy and maximizing yield recovery, thereby cementing the market's trajectory towards digitalization and enhanced operational intelligence.

AI Impact Analysis on Seafood Processing Machine Market

User inquiries regarding the integration of Artificial Intelligence (AI) in the Seafood Processing Machine Market overwhelmingly focus on improving operational efficiency, enhancing product quality control, and ensuring complete traceability. Common questions revolve around the effectiveness of AI vision systems in grading fish by size, quality, and species; the potential for predictive maintenance to minimize costly downtime; and how machine learning algorithms can optimize cutting and filleting patterns to maximize yield from irregularly shaped raw materials. Concerns often surface regarding the initial high investment costs, the need for skilled personnel to manage complex AI systems, and the accuracy of algorithms when processing highly variable biological materials. The consensus expectation is that AI will fundamentally transform processing, shifting it from a labor-intensive, yield-loss environment to a data-driven, precision-controlled industry.

The deployment of AI is moving beyond simple robotics into complex decision-making processes on the factory floor. Machine learning models are now being trained on vast datasets of raw seafood input parameters—such as texture, internal structure (via X-ray or ultrasound), and external defects—to instantly adjust machinery settings. This allows for unparalleled precision in high-speed operations like bone detection, impurity removal, and customized portioning according to specific customer requirements. For instance, AI algorithms can dynamically adjust the cutting angle of a water-jet cutter in real-time based on the measured shape and density of each individual fish, something traditional programmed machinery cannot achieve effectively.

This deep integration promises significant gains in profitability and sustainability. By optimizing yield, reducing human error in quality inspection, and anticipating mechanical failures, AI-enabled seafood processing machines offer a clear competitive advantage. Furthermore, AI contributes significantly to sustainability efforts by monitoring and optimizing water and energy usage within the processing line and enabling accurate material handling for by-product utilization, moving the industry closer to a circular economy model. The strategic adoption of these technologies is becoming a non-negotiable requirement for large processors aiming for global market dominance and adherence to high environmental and ethical standards.

- Enhanced precision cutting and filleting through real-time machine learning optimization, maximizing raw material yield.

- Implementation of advanced computer vision and sensor fusion for instantaneous, highly accurate quality grading, defect detection, and species identification.

- Deployment of predictive maintenance algorithms to monitor machinery health, anticipate component failure, and minimize unscheduled downtime.

- Automated process control and energy optimization, using AI to dynamically manage equipment settings based on throughput and environmental conditions.

- Improved traceability and regulatory compliance by linking processed output data points (quality, yield, origin) directly to blockchain or digital ledger systems.

DRO & Impact Forces Of Seafood Processing Machine Market

The Seafood Processing Machine Market is profoundly influenced by a complex interaction of driving forces, inherent restraints, and lucrative opportunities, collectively shaping its development trajectory. Key drivers include the ever-increasing global protein demand, particularly for healthy seafood, which necessitates scaling up processing capacity. Simultaneously, stringent governmental regulations related to food safety, hygiene (like HACCP and FDA standards), and worker safety mandate the replacement of outdated manual processes with automated, sanitized machinery. The escalating cost and shortage of manual labor, particularly in developed markets, further compel processors toward high levels of automation. These drivers establish a foundational need for consistent technological upgrading.

However, the market faces several significant restraints. The primary impediment is the high initial capital investment required for sophisticated automated systems, which can be prohibitive for small and medium-sized enterprises (SMEs), especially in developing regions. Furthermore, the inherent biological variability of the raw material—fish and crustaceans of different sizes, shapes, and textures—presents ongoing technological challenges for developing universally effective processing algorithms and machinery adaptable across diverse species. Economic volatility, particularly fluctuating raw material prices and international trade barriers, can also delay large-scale machinery investment decisions.

Opportunities for growth are abundant, primarily rooted in the burgeoning aquaculture sector, which provides a stable, uniform raw material supply conducive to automation. The increasing consumer demand for value-added seafood products, such as ready-to-cook meals, fillets, and specialized portions, opens new avenues for advanced secondary processing equipment like precision slicers and packaging robots. Geographically, untapped potential lies in expanding advanced machinery sales within emerging markets, coupled with the development of affordable, scalable modular systems specifically designed for SME adoption. The integration of advanced technologies like AI, IoT, and robotics represents a continuous, high-potential opportunity to redefine operational benchmarks and enhance sustainability metrics throughout the seafood supply chain.

Segmentation Analysis

The Seafood Processing Machine Market is systematically segmented based on Type, Operation, and Application, providing a structured view of technological specialization and end-user demand patterns. Segmentation by Type reflects the core functions performed by the machinery, with filleting and grading machines being the most impactful due to their direct influence on product yield and quality. The segmentation by Operation clearly distinguishes between highly precise, resource-intensive Automatic systems, preferred in high-cost labor regions, and more flexible Semi-Automatic installations prevalent in markets prioritizing affordability and adaptability. This multi-dimensional segmentation allows market participants to tailor their offerings to specific operational needs and regulatory environments globally.

Segmentation by Application is crucial as the anatomy and processing requirements differ drastically between fish (e.g., salmon, whitefish), crustaceans (e.g., shrimp, crab), and mollusks (e.g., clams, oysters). Machines designed for automated fish filleting require different kinematics and precision tools compared to high-speed peeling systems used for shrimp. The functional complexity associated with processing varied species drives specialization within the manufacturing sector. Consequently, market growth is often concentrated in machinery segments dedicated to high-volume, globally traded species, such as salmon and shrimp, due to the rapid return on investment facilitated by automation.

Overall market dynamics suggest that while the traditional segments like gutting and washing machines maintain steady demand, the high-growth potential resides within advanced segments like optical grading, AI-enabled portioning, and freezing technology (e.g., advanced spiral freezers and cryogenic systems) that maximize value retention. The shift towards sustainable practices also favors equipment that maximizes utilization of by-products, such as machinery for fishmeal or fish oil production, further diversifying the application landscape and driving specialized market opportunities across the value chain.

- By Type:

- Filleting Machines

- Skinning Machines

- Deboning Machines

- Grading and Sorting Machines

- Gutting Machines

- Washing and Peeling Machines

- Slicing and Dicing Machines

- Freezing and Refrigeration Equipment

- By Operation:

- Automatic

- Semi-Automatic

- By Application:

- Fish (Pelagic, Whitefish, Salmonids)

- Crustaceans (Shrimp, Crab, Lobster)

- Mollusks (Squid, Clams, Oysters)

- Others (Echinoderms, etc.)

Value Chain Analysis For Seafood Processing Machine Market

The value chain for the Seafood Processing Machine Market begins with the upstream suppliers who provide critical components, including high-grade stainless steel for corrosion resistance, advanced sensors, pneumatic and hydraulic systems, and sophisticated software and control electronics (PLCs, HMIs). These suppliers form the foundational technology base, ensuring the durability, hygiene, and precision of the final machinery. Integration and strong relationships with component suppliers are paramount for manufacturers to control costs, ensure quality compliance, and rapidly integrate new technologies, such as advanced machine vision cameras and specialized robotic arms capable of handling delicate seafood products without damage. Component quality directly impacts the operational lifespan and maintenance requirements of the processing equipment.

The core of the value chain involves the machinery manufacturers (OEMs) who design, assemble, and test the specialized processing lines. This stage is characterized by intense R&D investment focused on automation, yield maximization, and compliance with global food safety standards (e.g., IP69K ratings for washdown environments). The distribution channel plays a vital role, operating through a mix of direct sales channels for major accounts requiring custom integrated solutions, and indirect distribution networks utilizing authorized distributors or regional agents, especially for standardized, mid-range equipment. Direct sales ensure deep technical support and customized integration, crucial for complex projects, while indirect channels provide market penetration and localized service support in diverse geographical areas.

Downstream activities involve installation, commissioning, technical training, and crucial after-sales support, including spare parts supply and preventative maintenance contracts. The ultimate consumers—seafood processors, aquaculture farms, and large industrial kitchens—rely heavily on these services to maximize equipment uptime and processing efficiency. The increasing complexity of automated machinery necessitates advanced technical training for end-users, creating opportunities for manufacturers to offer value-added services and long-term service agreements. This downstream service provision acts as a significant revenue stream and a key differentiator in a competitive landscape, reinforcing customer loyalty and extending the machinery's lifecycle.

Seafood Processing Machine Market Potential Customers

Potential customers, or end-users, of seafood processing machinery primarily consist of large-scale industrial seafood processing plants that handle high volumes of raw material, often operating 24/7. These customers require fully automatic, high-throughput systems capable of performing multiple functions seamlessly, from de-heading and gutting to precision filleting and packaging. Their purchasing decisions are driven by ROI metrics focused on maximizing yield, minimizing labor dependence, and adhering to strict international export standards, making them the most significant buyers of premium, integrated processing lines and advanced freezing technologies.

Another rapidly expanding segment includes aquaculture facilities and large fish farms. As aquaculture production grows globally, these facilities are increasingly adopting automated post-harvest machinery to handle large, often uniformly sized batches of farmed fish (like salmon and tilapia) efficiently immediately after harvesting. Their focus is often on rapid chilling, initial grading, and primary processing before shipment to secondary processing centers. The demand here is specific, favoring robust, compact, and often water-resistant machinery suitable for integration near the source of production.

Furthermore, smaller, specialized processors focusing on high-value, niche species (like gourmet crustaceans or specific regional mollusks) represent a segment for semi-automatic and modular equipment. While they may lack the capital for full automation, they require precise processing tools to maintain the premium quality and presentation of their specialized products. Lastly, large industrial catering services, institutional buyers, and large commercial fishing vessels equipped with onboard processing capabilities also constitute a significant end-user base, particularly for compact, high-performance freezing and grading solutions designed for marine environments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $2.45 Billion |

| Market Forecast in 2033 | $3.90 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Marel, GEA Group, JBT Corporation, Baader, Skaginn 3X, Zhengzhou Runxiang Machinery Equipment, Middleby Corporation, FPS Food Process Solutions, Pisces Fish Machinery, Cabinplant A/S, Laitram Machinery, Valka, Uni-Food Technic A/S, DSI Systems, Stein S.r.l., Ryco Equipment, TENAG S.A., SFT Japan, HPP Solutions, Seafood Tech Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Seafood Processing Machine Market Key Technology Landscape

The technological landscape of the Seafood Processing Machine Market is rapidly evolving, driven by the need for high throughput, minimal human intervention, and enhanced food safety compliance. A primary technological focus is on high-precision processing tools, including advanced water-jet cutting systems and blade technology, which utilize laser or sonic guidance to maximize yield by calculating the optimal cut based on the geometry of each individual fish. Furthermore, X-ray bone detection technology and advanced ultrasound imaging are becoming standard integrated features, ensuring the removal of hazardous materials and guaranteeing premium product quality, particularly crucial for export markets requiring bone-free fillets.

Automation and digitalization are central to the current technology paradigm. This includes the widespread implementation of robotic handling systems that minimize physical product contact, thereby enhancing hygiene and reducing cross-contamination risks. Sophisticated sensor technology, often combined with IoT (Internet of Things) platforms, provides real-time data on machine performance, yield rate, and product temperature, allowing processors to optimize parameters instantaneously. This data integration supports predictive maintenance protocols, drastically reducing unexpected operational downtime—a critical factor in handling highly perishable seafood inventory. The shift towards modular and customizable processing lines, allowing processors to quickly reconfigure systems for different species or product formats, is also a key technological trend.

Crucially, cryogenic and advanced freezing technologies, such as spiral freezers and impingement freezers, are integral to the modern seafood processing landscape, focusing on rapid, high-quality freezing to preserve texture, flavor, and nutritional value. Packaging technology is also advancing rapidly, with modified atmosphere packaging (MAP) and vacuum skin packaging (VSP) machinery ensuring extended shelf life and attractive product presentation. The fusion of these mechanical advancements with digital intelligence—specifically AI for grading and portion control—represents the forefront of innovation, where machines not only execute tasks but also learn and optimize complex biological processing challenges autonomously.

Regional Highlights

Regional dynamics significantly influence the adoption and type of seafood processing machinery deployed globally, reflecting differences in consumption patterns, labor costs, and regulatory stringency.

- Asia Pacific (APAC): This region dominates the market due to the sheer volume of global seafood production, encompassing massive wild catch operations and the largest aquaculture sector globally (especially China, India, and Southeast Asia). Demand is escalating rapidly for medium-speed, robust machinery that can scale operations affordably. However, there is a growing trend among leading exporters in Vietnam and Thailand towards adopting high-end automatic processing lines, particularly for shrimp and pangasius, driven by strict requirements from Western importing nations.

- Europe: Characterized by high labor costs and extremely rigorous food safety and traceability standards (e.g., EU regulations), Europe exhibits the highest penetration of fully automated, technologically advanced equipment. Scandinavian countries (Norway, Iceland) are global leaders in processing technology deployment, focusing on maximizing the value of key species like salmon and cod through advanced filleting, grading, and onboard processing systems. Innovation here centers heavily on sustainability and zero-waste processing.

- North America (USA and Canada): High-volume processors in North America prioritize labor-saving automation and large-capacity machines to handle major wild-catch species (e.g., Alaska Pollock, specific whitefish, crustaceans). The region sees continuous investment in sophisticated inspection, sorting (using vision systems), and high-speed packaging equipment to meet demanding retail and food service supply chains, emphasizing efficiency and guaranteed food safety.

- Latin America (LATAM): Growth in LATAM is tied to expanding aquaculture, particularly in shrimp (Ecuador) and salmon (Chile). The market is developing, showing strong demand for entry-level and semi-automatic processing equipment, but key exporters are rapidly upgrading to automated freezing and primary processing lines to facilitate profitable international trade.

- Middle East and Africa (MEA): This region is characterized by nascent but fast-growing aquaculture projects and traditional fisheries. Demand is currently focused on essential chilling, basic processing (gutting/washing), and basic refrigeration machinery, driven by local consumption needs and increasing government focus on developing sustainable domestic seafood sources.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Seafood Processing Machine Market.- Marel

- GEA Group

- JBT Corporation

- Baader

- Skaginn 3X

- Zhengzhou Runxiang Machinery Equipment

- Middleby Corporation

- FPS Food Process Solutions

- Pisces Fish Machinery

- Cabinplant A/S

- Laitram Machinery

- Valka

- Uni-Food Technic A/S

- DSI Systems

- Stein S.r.l.

- Ryco Equipment

- TENAG S.A.

- SFT Japan

- HPP Solutions

- Seafood Tech Inc.

Frequently Asked Questions

Analyze common user questions about the Seafood Processing Machine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the shift from manual labor to automated seafood processing?

The shift is primarily driven by escalating labor costs, severe shortages of specialized manual labor, and the imperative to meet extremely stringent global food safety and hygiene regulations, which automated, stainless steel machinery is better equipped to satisfy consistently.

How does AI impact the yield and efficiency of processing machinery?

AI significantly boosts yield by utilizing computer vision and machine learning algorithms to measure the precise dimensions and quality of each raw product, optimizing cutting, filleting, and portioning angles in real-time to minimize waste and maximize the recovery of high-value meat.

Which geographical region represents the largest market for seafood processing equipment?

The Asia Pacific (APAC) region currently holds the largest market share due to its massive scale in both capture fisheries and aquaculture production, driven by increasing investment in modernization across countries like China, India, and key Southeast Asian processing hubs.

What are the key technological advancements shaping the future of this market?

Key advancements include the integration of advanced robotics, sophisticated X-ray and ultrasound inspection systems, IoT connectivity for data-driven process optimization and predictive maintenance, and the continued development of high-speed cryogenic and IQF freezing technologies.

What are the main challenges faced by small and medium-sized enterprises (SMEs) in adopting modern processing machinery?

The primary challenge for SMEs is the high initial capital expenditure required for fully automated processing lines. This constraint is driving demand for more affordable, modular, and semi-automatic systems that offer improved efficiency without requiring massive upfront investment.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager