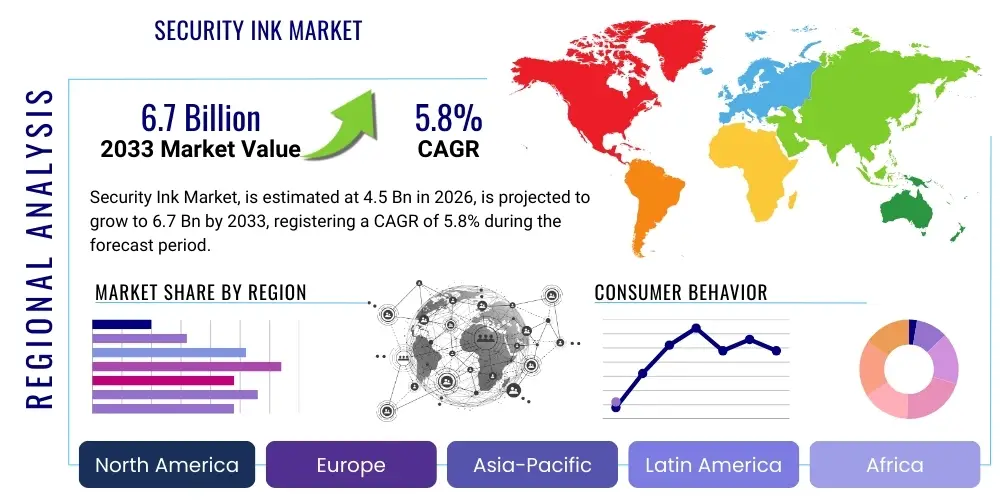

Security Ink Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441745 | Date : Feb, 2026 | Pages : 245 | Region : Global | Publisher : MRU

Security Ink Market Size

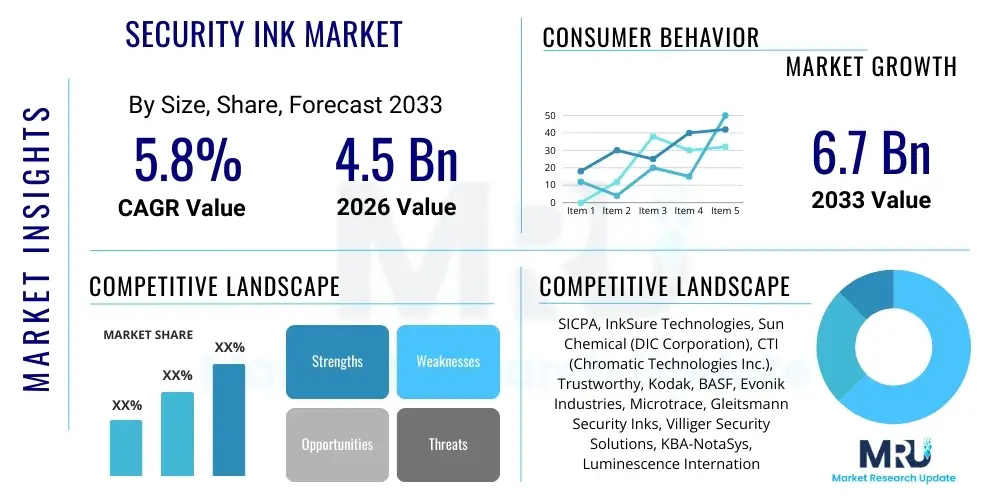

The Security Ink Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.5 billion in 2026 and is projected to reach USD 6.7 billion by the end of the forecast period in 2033. This consistent expansion is primarily fueled by the escalating threat of counterfeiting across high-value sectors such as pharmaceuticals, consumer electronics, and currency production, necessitating robust and sophisticated anti-counterfeiting measures. The inherent need for governments and corporations to protect brand integrity and ensure regulatory compliance drives sustained investment in advanced security printing solutions, where specialized inks play a critical and foundational role.

Security Ink Market introduction

The Security Ink Market encompasses specialized chemical formulations designed to provide unique, difficult-to-replicate features on high-security documents, banknotes, product packaging, and valuable items. These inks utilize unique pigments, dyes, and chemical compounds that exhibit specific properties—such as fluorescence under UV light, color shifting based on viewing angle (OVI), or thermal responsiveness—making them essential components in authentication and brand protection strategies globally. Security inks serve as the first line of defense against forgery, offering overt, covert, and forensic security features that can be verified visually, using simple devices, or through sophisticated laboratory analysis. The widespread adoption of these solutions is driven by the mandate to safeguard intellectual property and assure product authenticity across complex global supply chains.

Major applications of security inks span across governmental identification documents, including passports and visas, pharmaceutical packaging for traceability and anti-diversion purposes, and high-denomination currency production, where optical variability and magnetic properties are paramount for machine verification. Furthermore, these inks are increasingly integrated into luxury goods and consumer electronics to certify originality and combat gray market activities. The core benefit derived from utilizing security inks is the provision of multilayered protection, which complicates the counterfeiter's process and significantly raises the barrier to entry for fraudulent operations. By combining multiple ink types—such as magnetic, thermochromic, and infrared-readable inks—security providers create highly resistant features that are virtually impossible to reproduce using standard commercial printing methods.

Key driving factors supporting the market expansion include stringent regulatory frameworks mandating serialization and traceability, particularly in the healthcare and tobacco industries, alongside the pervasive growth of e-commerce, which unfortunately provides broader avenues for distribution of counterfeit goods. As global trade intensifies, the necessity for cross-border authentication standards and reliable supply chain security protocols has never been higher. Technological advancements in ink chemistry, focusing on greater durability, enhanced resistance to chemical tampering, and improved spectral performance for automated reading, further accelerate the market's growth trajectory and adoption rates across various end-user sectors.

Security Ink Market Executive Summary

The Security Ink Market demonstrates resilient growth driven by global efforts to curb economic losses stemming from counterfeiting and fraud, positioning advanced chemical formulations as essential tools for brand integrity and governmental security. Current business trends indicate a strong shift towards highly complex, multi-layered security features, combining traditional overt inks like Optical Variable Inks (OVI) with advanced covert and forensic marking solutions such as taggants and specialized spectral absorbers. This move is supported by strategic investments in digitalization, where physical security features are increasingly linked to digital authentication platforms, enhancing traceability across the supply chain. Key market participants are focusing on developing eco-friendly ink formulations that maintain high security standards while aligning with global sustainability mandates, offering products that are volatile organic compound (VOC)-free and non-toxic, which represents a significant competitive differentiator in regulated markets like Europe and North America.

Regional trends reveal the Asia Pacific (APAC) region emerging as the fastest-growing market, largely due to rapid industrialization, burgeoning pharmaceutical manufacturing sectors, and increasing regulatory pressure in countries like China and India to protect domestic and international supply chains from fake goods. North America and Europe, while mature markets, continue to dominate in terms of adoption of cutting-edge technology, particularly in high-security document printing and luxury brand protection, driven by advanced regulatory requirements such as the EU Falsified Medicines Directive (FMD). Latin America and the Middle East and Africa (MEA) are also experiencing accelerated growth, fueled by government initiatives to modernize currency printing and secure national identification systems, often adopting proven technology developed in Western markets to rapidly upgrade their security infrastructure.

Segment trends underscore the dominance of the Currency & Banknotes application segment, which demands the highest volume and most sophisticated ink technologies, including magnetic and electroconductive inks crucial for automated banking processes. However, the fastest growth is observed within the Product Security segment, particularly in pharmaceuticals and FMCG, where the proliferation of advanced packaging technologies necessitates flexible and highly durable security features. By type, UV-Fluorescent Inks remain the most adopted due to their cost-effectiveness and ease of verification, while Infrared (IR) and Thermochromic Inks are gaining traction due to their enhanced covertness and integration into machine-readable authentication systems. Strategic partnerships between security ink manufacturers and major printing equipment suppliers are defining the competitive landscape, ensuring that new ink innovations are readily integrated into industrial printing processes.

AI Impact Analysis on Security Ink Market

Common user questions regarding AI’s influence on the Security Ink Market often revolve around how artificial intelligence can enhance the detection speed and accuracy of counterfeit goods, whether AI can design more complex, harder-to-replicate security features, and if machine learning algorithms can predict future counterfeiting trends based on current supply chain data. The consensus theme centers on AI serving as a potent accelerant for verification technology, shifting the focus from manual or simple machine-based inspection to highly automated, data-driven authentication systems. Users are keenly interested in the integration of AI with spectral imaging and sensor technology to analyze the nuanced optical and chemical fingerprints of security inks, distinguishing genuine marks from highly similar forgeries with minimal human intervention. This technological convergence promises to drastically reduce false positives and streamline rapid, high-volume verification processes, especially in logistics and customs environments where speed is critical.

AI's primary transformative impact is the optimization of the authentication workflow through sophisticated pattern recognition and deep learning models. These models are trained on massive datasets of genuine security ink applications, incorporating variables such as printing pressure variations, substrate interaction, and minute chemical inconsistencies inherent to genuine production processes. When a questionable item is scanned, AI algorithms instantaneously compare the acquired spectral data, optical variability, or magnetic signature against the learned 'genuine' profile. This capability allows for the detection of subtle deviations that might be invisible to the human eye or rudimentary scanners. Furthermore, AI contributes significantly to the forensic phase of security, enabling faster analysis of seized counterfeit materials to identify common production characteristics, thereby assisting law enforcement in tracking down the source of fraudulent operations.

In the domain of ink development, AI and machine learning are increasingly used to simulate the performance and durability of new chemical formulations before costly physical synthesis is undertaken. AI models can predict the optimal concentration of taggants or the ideal pigment structure needed to achieve a specific spectral response, accelerating the research and development cycle for next-generation covert inks. Moreover, predictive analytics, powered by AI, helps brand owners understand geographical hot spots for counterfeiting and anticipate which security features are most likely to be targeted, allowing for proactive adjustment of supply chain security protocols and layered ink strategies, thereby ensuring that security investments are targeted effectively against emerging threats.

- AI optimizes spectral analysis, enabling instant, high-accuracy detection of minute ink variations.

- Machine learning models enhance covert feature authentication, minimizing verification errors in high-volume scanning environments.

- Predictive analytics driven by AI identifies high-risk supply chain segments and predicts future counterfeiting methodologies.

- AI accelerates R&D by simulating chemical formulations, optimizing pigment structure, and testing ink durability digitally.

- Automation of verification processes using AI-integrated readers reduces reliance on human inspection and decreases operational verification costs.

- AI facilitates the linkage between physical security features and digital blockchain or database records, enhancing end-to-end traceability.

DRO & Impact Forces Of Security Ink Market

The dynamics of the Security Ink Market are characterized by powerful impact forces centered around increasing global regulatory mandates for anti-counterfeiting measures and the continuous advancement of digital printing technologies. The primary drivers include the exponential growth in global counterfeit goods trade, estimated to exceed billions of dollars annually, which puts immense pressure on governments and corporations to adopt sophisticated protection mechanisms. Simultaneously, technological opportunities are opening up through the convergence of chemical engineering and digital authentication platforms, allowing security inks to be integrated with NFC and IoT sensors, creating 'smart packaging' solutions. However, the market faces significant restraints, notably the high initial investment cost associated with specialized printing equipment required for applying complex security inks, and the continuous struggle to maintain a technological lead over highly skilled, adaptive counterfeiters who rapidly reverse-engineer current security features. These forces collectively shape the market, requiring manufacturers to continuously innovate, offering cost-effective, multi-layered security solutions that are both easy for consumers to authenticate and virtually impossible for criminals to reproduce accurately.

Drivers: The dominant market driver is the proliferation of organized crime syndicates leveraging global supply chains to distribute fake products, particularly in high-profit sectors like pharmaceuticals and automotive parts, posing serious safety risks. Government mandates, such as those requiring tax stamps on tobacco and alcohol, and strict anti-diversion regulations in pharma, further necessitate the use of authenticated security inks. Furthermore, increased consumer awareness regarding product authenticity, particularly regarding high-end brands and consumables, drives brand owners to visibly demonstrate their commitment to quality assurance through overt security features. The expansion of digital printing technologies also creates opportunities to integrate personalized, serialized security features, making each product unique and trackable throughout its lifecycle.

Restraints: Key restraints include the substantial research and development expenditure required to consistently produce novel, uncompromised ink formulations, which translates to high product costs. Furthermore, the limited availability of high-security printing infrastructure, particularly in developing economies, restricts the widespread adoption of the most advanced security features. A critical ongoing restraint is the 'security fatigue' where end-users, including retailers and consumers, often fail to properly inspect complex security features, allowing sophisticated counterfeits to pass through unverified. Complexity in application and the need for specialized training for verification personnel also slow down market adoption compared to simpler, albeit less secure, anti-counterfeiting methods.

Opportunities: Significant market opportunities exist in the development of environmentally sustainable and non-toxic security inks, appealing to regulated Western markets prioritizing green chemistry. The rapid expansion of the food and beverage industry requiring anti-tampering and traceability solutions presents a growing application area beyond traditional high-security documents. Moreover, the integration of advanced forensic markers (taggants) that require lab-grade equipment for detection, coupled with digital verification platforms using smartphones and cloud connectivity, provides a robust, future-proof layer of security. Developing countries, undergoing rapid modernization of identity documents and currency, represent substantial untapped markets for proven security ink technology transfers.

Segmentation Analysis

The Security Ink Market segmentation provides a granular view of the industry structure, differentiating growth potential based on ink type, application sector, and the level of security required. Primary segmentation is based on the type of technology used, categorizing inks into fluorescent, thermochromic, optical variable (OVI), and magnetic inks, each serving distinct authentication roles ranging from simple visual checks to complex machine verification. The application segmentation focuses on the end-use environment, predominantly divided among Currency and Banknotes, High-Security Documents (passports, visas), and Product Security/Brand Protection (pharmaceuticals, luxury goods, tax stamps). This structural diversity allows market players to tailor specialized ink formulations and integrated security solutions to meet the varying regulatory and operational demands of specific sectors, driving specialized market growth in high-value, high-risk areas.

- By Type:

- UV-Fluorescent Inks (Overt and Covert)

- Infrared (IR) Activated Inks (Absorption and Emission)

- Optical Variable Inks (OVI) / Color-Shifting Inks

- Thermochromic Inks

- Magnetic Inks

- Biometric/DNA Inks (Forensic)

- Taggant Inks (Microscopic markers)

- By Application:

- Currency and Banknotes

- High-Security Documents (Passports, Identity Cards, Visas)

- Product Security and Brand Protection

- Tax Stamps and Revenue Collection

- Packaging and Labels (Pharmaceuticals, FMCG, Electronics)

- By Printing Technology:

- Intaglio Printing

- Offset Printing

- Flexography

- Gravure Printing

- Screen Printing

- Digital Printing/Inkjet

- By Level of Security:

- Overt Security Features (Visible to the naked eye)

- Covert Security Features (Requires simple readers/UV light)

- Forensic Security Features (Requires lab analysis)

Value Chain Analysis For Security Ink Market

The security ink value chain is characterized by highly specialized stages, beginning with rigorous upstream research and raw material sourcing, moving through proprietary formulation and production, and culminating in secure distribution and application at high-security printing facilities. Upstream activities are dominated by specialized chemical suppliers providing unique pigments, dyes, solvents, and micro-taggants, often governed by strict intellectual property rights and non-disclosure agreements due to the sensitive nature of the final product. The core competitive advantage is often rooted in the proprietary synthesis of these unique materials, ensuring that the specific spectral or magnetic properties are impossible to reproduce by commercial chemical companies. This initial phase demands significant investment in R&D to maintain technological supremacy over counterfeiters, ensuring novel features are continuously introduced to the market.

The midstream phase involves the security ink manufacturer, who combines these specialized raw materials under highly controlled security protocols to create the final ink product. This stage requires advanced chemical engineering expertise to ensure the ink is compatible with specific high-security printing technologies, such as intaglio, offset, or gravure, while also maintaining the desired security attributes (e.g., color shift persistence, magnetic signal strength). Quality assurance and stringent security clearances for personnel and facilities are critical differentiators in this stage. Downstream activities involve the distribution channel, which is inherently restrictive; direct sales are preferred to high-security printers (often government-owned central banks or certified private security printing houses) to maintain chain of custody integrity, minimizing the risk of unauthorized diversion of sensitive ink materials. Indirect channels, though less common, involve specialized secure logistics partners for international delivery to approved clients.

The final element of the value chain is the application and end-user verification. Ink manufacturers often provide substantial technical support and training to printing houses to ensure correct application and optimal performance of the security features. The distribution channel is heavily scrutinized, relying predominantly on secure, direct-to-client models due to the classification of security inks as controlled substances in many jurisdictions. Manufacturers must manage logistical complexity and regulatory compliance to ensure that the products are delivered securely. The relationship between the ink producer and the high-security printer is often a long-term strategic partnership, involving co-development to integrate the ink flawlessly into specific printing machinery and subsequent post-sale support for verification technology implementation, thereby closing the loop on the robust security system required by sovereign and commercial clients.

Security Ink Market Potential Customers

Potential customers for security inks are predominantly institutions requiring absolute certainty in document and product authentication, placing high value on preventing financial fraud, intellectual property theft, and ensuring public safety. The largest and most demanding customer segment consists of national governmental bodies, specifically central banks responsible for currency issuance, mints, and security document agencies tasked with producing passports, national ID cards, and official governmental certificates. These entities require the highest levels of covert and overt security, often relying on multi-layered ink strategies involving OVI, magnetic, and forensic taggants that comply with international standards set by organizations like the International Civil Aviation Organization (ICAO) and specialized security printing associations. These clients prioritize proven track records, global compliance, and long-term supply stability over minor cost variations.

Another major segment comprises multinational corporations and brand owners in high-risk sectors susceptible to counterfeiting, including pharmaceuticals, luxury goods, consumer electronics, and automotive parts. Pharmaceutical companies are driven by rigorous patient safety mandates and regulatory requirements (like serialization), making them significant consumers of specialized security inks for tamper-evident packaging and unit-level traceability. Luxury brands utilize security inks as a fundamental component of their brand integrity strategy, employing subtle, aesthetically compatible covert inks to certify authenticity and combat gray market sales. These commercial clients typically seek robust, easily verifiable features that can be integrated seamlessly into mass production packaging lines without compromising brand design aesthetics.

Finally, revenue collection agencies, customs authorities, and tax departments represent a growing customer base, utilizing security inks embedded in tax stamps, excise labels, and authentication seals for tobacco, alcohol, and refined fuel products. The objective here is to prevent illicit trade, ensure accurate tax collection, and combat product diversion, often requiring thermochromic or chemically reactive inks that indicate tampering or unauthorized removal. These customers increasingly look for solutions that integrate physical security ink features with digital verification tools, allowing field officers to rapidly confirm authenticity using standard mobile devices or specialized readers, ensuring the integrity of high-value goods subject to government taxation and regulation.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 billion |

| Market Forecast in 2033 | USD 6.7 billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SICPA, InkSure Technologies, Sun Chemical (DIC Corporation), CTI (Chromatic Technologies Inc.), Trustworthy, Kodak, BASF, Evonik Industries, Microtrace, Gleitsmann Security Inks, Villiger Security Solutions, KBA-NotaSys, Luminescence International, Collins Ink, Wifag-Polytype Security. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Security Ink Market Key Technology Landscape

The security ink technology landscape is defined by continuous innovation across multiple chemical and physical modalities designed to create robust, layered defense mechanisms against forgery. The foundational technology remains the integration of specialized pigments and chemical compounds that respond predictably to external stimuli such as UV light, heat, or magnetic fields. Optical Variable Ink (OVI), for instance, utilizes multilayered micro-flakes that change color dramatically based on the viewing angle, making reproduction by standard digital scanners or photocopiers virtually impossible. OVI technology is critical in high-security applications like currency due to its immediate visual impact and high resistance to replication. Further advancements include proprietary formulations that enhance the durability of these shifting properties, ensuring they withstand harsh environmental conditions and long-term use, especially on flexible substrates like polymer banknotes.

Beyond visual authentication, the market heavily relies on covert technologies such as Infrared (IR) absorbing and emitting inks, which are invisible under normal light but exhibit distinct spectral signatures under IR illumination. These covert features are crucial for machine verification in high-speed sorting and authentication equipment used by central banks and large logistics centers. Infrared technology is constantly evolving, with manufacturers introducing dual-band or multi-spectral IR properties to increase complexity and frustrate spectral analysis attempts by counterfeiters. Similarly, forensic inks, incorporating microscopic taggants or synthetic DNA markers, represent the ultimate level of covert security. These markers are invisible even under high magnification and require specialized, proprietary reading equipment or laboratory chemical analysis, providing legally defensible evidence of authenticity in complex legal disputes concerning intellectual property and counterfeiting.

The integration of security inks with digital technologies is the fastest growing trend within the landscape. This includes electroconductive inks used to print functional circuits or antennas that can interact with Near Field Communication (NFC) readers or smartphones, turning packaging into a verifiable digital node. This convergence links the physical product security (provided by the ink) to a digital ledger (such as blockchain or secure databases), enabling real-time supply chain tracking and consumer-facing verification via mobile apps. Innovations in digital security printing are also expanding, allowing for the on-demand production of serialized security features, making each printed item unique. This ensures that the technological advantage of the security feature remains high, even as standard printing costs decrease, by focusing the security value on the complexity and proprietary nature of the specialized ink chemistry rather than just the printing process itself.

Regional Highlights

Geographical analysis reveals distinct adoption patterns and growth drivers across major global regions, reflecting varying levels of governmental security requirements, industrial maturity, and exposure to counterfeiting risks. North America, driven by the United States and Canada, represents a mature market characterized by stringent intellectual property protection laws and high consumer spending on luxury and pharmaceutical goods. The demand here is focused on advanced, integrated security solutions, particularly forensic and digital-linked inks, used extensively in high-value packaging and advanced identity documents. The region benefits from significant investments in security infrastructure and a mature ecosystem of high-security printers, leading to a focus on technological superiority and rapid adoption of the latest OVI and multi-spectral covert inks to stay ahead of highly sophisticated domestic and international counterfeiting rings.

Europe stands out due to comprehensive regulatory mandates, notably the EU Falsified Medicines Directive (FMD) and strict tax stamp regulations for products like tobacco, which necessitate mandatory use of track-and-trace security features, heavily relying on specialized covert and overt security inks. The region emphasizes sustainability, driving demand for eco-friendly, low-VOC security ink formulations. Germany, France, and the UK are key centers for security printing innovation and deployment, especially in the banknote and identity document sectors, maintaining the highest standards globally. The European market exhibits strong growth in the application of thermochromic and chemical indicator inks for anti-tampering measures, ensuring product integrity throughout the complex intra-European supply chain.

Asia Pacific (APAC) is projected to experience the fastest growth, propelled by the sheer scale of manufacturing across China, India, and Southeast Asia, coupled with rapidly increasing domestic consumption and rising concerns over product safety. The region is both a major producer and a major victim of counterfeit goods, leading governments to invest heavily in modernizing their currency and identity document security. Demand is high for cost-effective, high-volume security solutions such as UV-fluorescent inks, but also rapidly transitioning to higher security features like OVI and IR inks as governments upgrade their authentication infrastructure. Regulatory developments in China and India focusing on mandatory serialization in the pharmaceutical sector are prime drivers of ink adoption for brand protection, making APAC the key volume growth engine for the global market.

Latin America (LATAM) and the Middle East and Africa (MEA) are emerging markets focusing on enhancing governmental revenue security and modernizing national identification systems. LATAM countries, notably Brazil and Mexico, are significant users of tax stamp solutions requiring sophisticated security inks to combat high rates of illicit trade in alcohol and tobacco. In MEA, high-security ink adoption is primarily driven by national security initiatives, including the production of secure passports and visas, and large-scale currency modernization projects. While the overall market size is smaller than in North America or Europe, the growth rate is substantial, fueled by international partnerships providing technical assistance and technology transfer from established global security ink providers, resulting in rapid deployment of proven security features like magnetic and bi-fluorescent inks.

- North America: Focuses on advanced forensic and digital-linked security inks for high-value goods and identity documents, driven by stringent IP protection laws and high R&D investment.

- Europe: High adoption rates driven by the EU Falsified Medicines Directive (FMD) and tax stamp regulations; strong emphasis on sustainable and low-VOC ink formulations.

- Asia Pacific (APAC): Fastest growth region due to massive manufacturing scale, rising counterfeiting risks, and governmental mandates for currency and document modernization (e.g., China and India).

- Latin America and MEA: Emerging markets with high growth potential, driven primarily by government initiatives to secure revenue collection (tax stamps) and upgrade national security documents using imported, advanced security technology.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Security Ink Market.- SICPA

- InkSure Technologies

- Sun Chemical (DIC Corporation)

- CTI (Chromatic Technologies Inc.)

- Trustworthy

- Kodak

- BASF

- Evonik Industries

- Microtrace

- Gleitsmann Security Inks

- Villiger Security Solutions

- KBA-NotaSys

- Luminescence International

- Collins Ink

- Wifag-Polytype Security

- Imaje Group

- Giesecke+Devrient (G+D)

- Hahnemühle FineArt

- Jura Security Printing

- Security Printing and Minting Corporation of India (SPMCIL)

Frequently Asked Questions

Analyze common user questions about the Security Ink market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary types of security ink used in currency and banknotes?

The primary types include Optical Variable Inks (OVI) for color shift effects, Magnetic Inks (for machine reading), and Infrared (IR) fluorescent/absorbing inks, which provide high-level, machine-readable covert security features critical for automated banking verification.

How do security inks contribute to brand protection in the pharmaceutical industry?

Security inks provide overt and covert authentication layers on pharmaceutical packaging and seals, ensuring compliance with global serialization mandates. They verify product origin, deter tampering, and facilitate track-and-trace efforts required to prevent the circulation of counterfeit drugs.

What is the main difference between overt, covert, and forensic security features?

Overt features (like OVI or holograms) are immediately visible for public verification. Covert features (like UV or IR inks) require simple tools (e.g., UV light) for detection. Forensic features (like DNA or micro-taggants) require specialized laboratory equipment and analysis for conclusive authentication, providing the highest level of security.

Is the security ink market affected by the shift towards digital authentication methods?

No, the market is integrating with digital methods. Modern security inks often incorporate features like electroconductive properties or Taggants that link the physical product to digital databases, blockchain systems, or smartphone verification apps, enhancing rather than replacing the physical security provided by the ink.

Which geographical region exhibits the fastest growth rate for security ink adoption?

The Asia Pacific (APAC) region is projected to have the fastest growth rate, driven by the massive scale of manufacturing, increasing domestic consumption, modernization of national identity documents, and regulatory crackdowns on the rampant flow of counterfeit goods, particularly in countries like China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Security Ink Market Statistics 2025 Analysis By Application (Banknotes, Official Identity Documents, Tax Banderoles, Security Labels), By Type (Intaglio Inks, Silkscreen Inks, Letterpress Inks, Offset Inks), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Security Ink Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Invisible, Biometric, Fluorescent), By Application (Banknotes, Official Identity Documents, Tax Banderoles, Consumer Packaging), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager