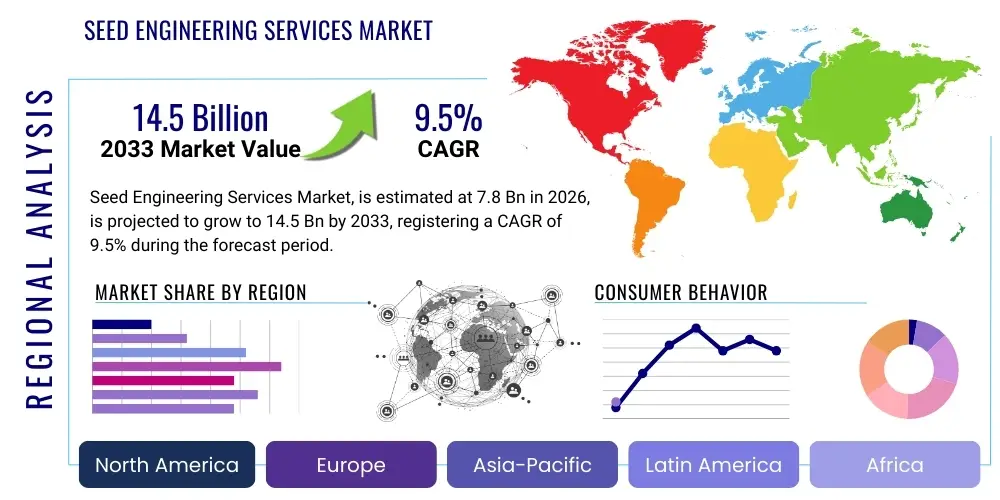

Seed Engineering Services Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443418 | Date : Feb, 2026 | Pages : 241 | Region : Global | Publisher : MRU

Seed Engineering Services Market Size

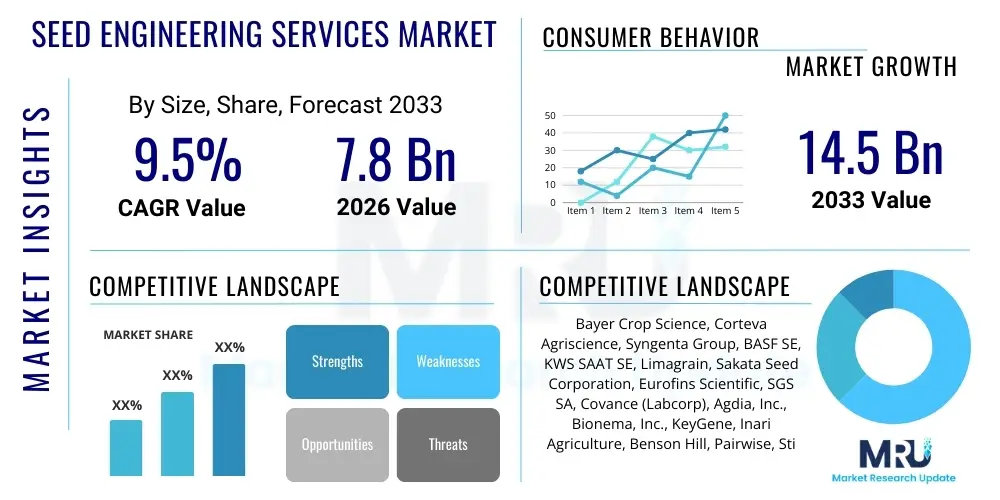

The Seed Engineering Services Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at $7.8 billion in 2026 and is projected to reach $14.5 billion by the end of the forecast period in 2033.

Seed Engineering Services Market introduction

The Seed Engineering Services Market encompasses a wide range of specialized scientific and technical services focused on improving the genetic makeup, quality, and performance of seeds. These services are foundational to modern agriculture, addressing critical global challenges such as increasing food demand, adapting crops to climate change, and enhancing sustainability through reduced chemical inputs. Key services include advanced genetic manipulation techniques, trait stacking, disease resistance development, high-throughput phenotyping, and comprehensive seed testing and treatment procedures designed to maximize yield potential and crop resilience.

The market is defined by the collaborative efforts between agricultural biotechnology firms, large seed producers, and specialized contract research organizations (CROs). The primary applications span major staple crops like maize, soybean, and wheat, as well as high-value specialty crops. The core benefit derived from these services is the acceleration of the breeding cycle and the introduction of superior traits—such as drought tolerance, pest resistance, and improved nutritional content—at a faster rate than conventional breeding methods. This focus on genomic precision is rapidly driving market expansion, supported by significant investments in R&D infrastructure globally.

Driving factors for sustained growth include the global need for food security fueled by population expansion, the rapid advancement and commercialization of gene editing technologies like CRISPR-Cas9, and the increasing adoption of precision agriculture techniques that necessitate highly optimized seed varieties. Furthermore, evolving consumer preferences for sustainable and non-GMO (where applicable) or specifically improved seeds, alongside regulatory support for innovative agricultural practices in various regions, underscore the essential role of seed engineering services in transforming the future of farming.

Seed Engineering Services Market Executive Summary

The Seed Engineering Services Market is currently experiencing robust momentum, primarily driven by rapid advancements in molecular biology and digital agriculture integration. Business trends indicate a shift towards outsourcing complex genomic analysis and trait validation to specialized service providers, mitigating the immense capital expenditure required for in-house R&D, especially among mid-sized seed companies. Strategic collaborations and mergers focusing on combining genomic expertise with proprietary germplasm are shaping the competitive landscape. Furthermore, the commercial adoption of stacked traits, which offer multiple protective benefits in a single seed variety, is a significant growth area, requiring highly sophisticated engineering services for validation and regulatory compliance.

Regionally, North America and Europe remain the core hubs for innovation and high-value service consumption, attributed to strong intellectual property protection and early adoption of biotechnology. However, the Asia Pacific region (APAC) is emerging as the fastest-growing market, propelled by large agricultural economies like China and India investing heavily in domestic food security initiatives and modernizing traditional farming practices. Latin America, particularly Brazil and Argentina, demonstrates strong growth in services related to oilseeds and grains, capitalizing on vast arable land resources and increasing export demand.

Segment trends highlight the dominance of Genetic Engineering and Trait Development services, although the Seed Treatment and Coating segment is gaining rapid traction as companies seek to enhance seed viability and early-stage crop protection without relying solely on systemic pesticides. The application of these services is heavily skewed toward Cereals and Grains, given their global acreage and strategic importance, but specialized services for Fruits and Vegetables are growing quickly due to rising demand for year-round fresh produce and protected cultivation techniques. The integration of AI and machine learning across all segments, particularly in predictive breeding models, is streamlining processes and reducing the time-to-market for new seed varieties, creating efficiencies that further incentivize market participation.

AI Impact Analysis on Seed Engineering Services Market

Common user inquiries regarding the influence of Artificial Intelligence on the Seed Engineering Services Market frequently revolve around its practical application in reducing the breeding cycle duration, optimizing gene editing efficiency, and ensuring high precision in quality assurance. Users are keen to understand how AI-driven predictive analytics can replace or accelerate traditional field trials, which are time-consuming and capital-intensive. Key themes include the feasibility of deploying machine learning for complex trait prediction, the integration of deep learning with high-throughput phenotyping data (HPP) generated from drones and sensors, and the ethical and intellectual property implications of algorithmically designed seed varieties. Expectations are high that AI will democratize sophisticated breeding methodologies, making advanced engineering accessible to a broader range of agricultural firms, thus acting as a major efficiency multiplier across the market value chain.

AI is fundamentally transforming the R&D phase of seed engineering by handling massive, multi-omic datasets (genomics, transcriptomics, proteomics, metabolomics). Machine learning algorithms are crucial for identifying optimal gene targets for editing, predicting the success rate of complex trait combinations (trait stacking), and modeling environmental interactions before seeds are even planted. This computational approach allows service providers to offer precision breeding consultations, dramatically reducing the resources wasted on non-viable genetic crosses and accelerating the selection of superior lines. For instance, proprietary AI platforms can analyze decades of environmental data alongside genomic profiles to recommend the best regional deployment strategies for newly engineered seeds, enhancing the value proposition of engineering services.

Furthermore, AI significantly enhances quality control and seed processing services. Computer vision systems integrated with high-speed sorters use deep learning to analyze seed morphology, detecting minute defects, pathogens, or inconsistencies far beyond human capability. In the field of phenotyping, which is integral to validating engineered traits, AI processes imagery from robotic systems and remote sensing devices to automatically quantify physical characteristics (e.g., height, biomass, disease symptoms) across thousands of plants simultaneously. This integration of sensory data and predictive modeling means seed engineering services can deliver verified, high-performance products with greater confidence and efficiency, positioning AI as an indispensable tool for future market growth and competitive differentiation.

- AI accelerates breeding cycle time by 30-50% through predictive modeling.

- Optimizes CRISPR-Cas9 target selection, increasing gene editing accuracy.

- Enhances High-Throughput Phenotyping (HPP) data analysis using deep learning for trait validation.

- Automates quality assurance in seed processing via computer vision and defect detection.

- Facilitates personalized seed recommendations based on localized climate and soil data.

DRO & Impact Forces Of Seed Engineering Services Market

The Seed Engineering Services Market is shaped by a complex interplay of Drivers (D), Restraints (R), and Opportunities (O), which collectively constitute the Impact Forces influencing investment and market trajectory. Primary drivers include the unrelenting pressure of global population growth necessitating higher crop yields per unit area, coupled with the increasing scientific feasibility and commercial maturity of advanced genetic modification techniques. Restraints are predominantly centered on stringent and often fragmented regulatory approval processes across different geopolitical regions, which dramatically increase the time and cost associated with commercializing new engineered traits. Opportunities arise significantly from the proliferation of gene-editing technologies (like CRISPR), the expansion into under-served crop types (e.g., root crops), and the massive potential inherent in utilizing digital agriculture platforms to enhance service delivery and product performance verification.

Key drivers include the imperative for climate change adaptation, requiring services to engineer seeds capable of surviving severe droughts, floods, and temperature fluctuations, providing essential resiliency. The rising demand for sustainable agricultural practices, particularly the reduction of pesticide and fertilizer use, fuels the need for engineered resistance traits and improved nutrient-use efficiency in seeds. This demand shifts the focus from simple yield enhancement to holistic crop performance and environmental stewardship. Technological advancements, especially in next-generation sequencing and bioinformatics, have lowered the cost and increased the speed of genetic discovery, making sophisticated engineering services more accessible to smaller players and academic institutions, thereby broadening the market base.

However, significant restraints temper growth. Public perception and consumer resistance, particularly in certain developed markets regarding Genetically Modified Organisms (GMOs), necessitate careful navigation and substantial investment in clear communication and non-GMO solutions (like targeted mutagenesis). Furthermore, the high initial investment required for establishing advanced engineering facilities, acquiring necessary intellectual property licenses, and retaining highly specialized scientific talent poses a barrier to entry. Opportunities, conversely, lie in applying seed engineering principles to biologicals (microbiome engineering for soil health), developing smart seeds integrated with sensor technology, and expanding market reach into developing economies where traditional farming methods face immediate challenges requiring rapid technological intervention.

- Drivers: Global food security demands; rapid advancements in gene editing (CRISPR); climate change resilience requirements; rising adoption of precision agriculture.

- Restraints: Complex, time-consuming, and diverse regulatory frameworks globally; high R&D and intellectual property licensing costs; public skepticism regarding biotechnology in food production.

- Opportunities: Expansion into developing markets; commercialization of stacked traits; integration of AI for predictive breeding; engineering of non-traditional or specialty crops.

- Impact Forces: High regulatory scrutiny maintains pricing power for established providers; technological innovation accelerates market disruption; environmental sustainability pressures dictate research priorities.

Segmentation Analysis

The Seed Engineering Services Market is comprehensively segmented based on the type of specialized service delivered, the specific crop type targeted for improvement, and the end-user or client availing these advanced services. This segmentation provides a granular view of market dynamics, revealing where investment and technological focus are concentrated. The Service Type segmentation, which includes everything from initial genetic modification to final seed treatment, represents the core functional division of the market. Crop Type segmentation illustrates the volume and value distribution across staple foods and specialty products, reflecting global consumption patterns and agricultural priorities. Finally, End-User segmentation distinguishes between internal corporate R&D requirements and outsourced service demands from smaller biotech ventures and governmental bodies, highlighting strategic client engagement models crucial for market growth.

- By Service Type: Genetic Engineering, Trait Development & Validation, Seed Testing & Quality Assurance, Seed Treatment & Processing.

- By Crop Type: Cereals & Grains (Maize, Wheat, Rice), Oilseeds & Pulses (Soybean, Canola, Sunflower), Fruits & Vegetables.

- By End-User: Large Seed Companies, Biotech Firms & Startups, Contract Research Organizations (CROs), Academic & Government Research Institutes.

Value Chain Analysis For Seed Engineering Services Market

The value chain for Seed Engineering Services is characterized by high intellectual capital intensity, commencing with the upstream activities centered on fundamental biological research and genomic discovery. Upstream segments involve specialized firms and academic institutions focused on gene synthesis, target identification, bioinformatics analysis, and the development of enabling technologies such as proprietary transformation protocols or novel gene-editing tools. Success at this stage relies heavily on access to extensive germplasm libraries and sophisticated analytical platforms, which are often licensed or collaboratively utilized, emphasizing the importance of strong intellectual property portfolios held by key market players.

The core midstream activities involve the actual execution of engineering services: trait insertion, validation through greenhouse and contained field trials, and quality control. This phase is dominated by large, integrated seed companies and Contract Research Organizations (CROs) that possess the necessary high-throughput screening infrastructure and regulatory expertise. Efficiency here is paramount, as the process involves iterating genetic modification attempts and rigorously testing resulting seed lines for efficacy, stability, and safety. Technological adoption, particularly automated robotics and AI-driven data processing, dictates the speed and cost-effectiveness of these midstream operations, which account for a significant portion of the service value.

Downstream activities include seed processing (cleaning, sizing, coating), distribution channels, and end-user support. Distribution is managed through direct sales to large agricultural producers and complex networks involving regional distributors and local dealers, often coupled with technical advisory services regarding optimal seed deployment and crop management. Indirect channels, such as strategic alliances with agricultural chemical companies offering complementary products, are also critical. The final stage involves feedback loops from farmers and agronomists, which inform upstream R&D cycles, creating a closed-loop system vital for continuous product improvement and market responsiveness.

Seed Engineering Services Market Potential Customers

The primary consumers of Seed Engineering Services are major multinational agricultural corporations, often referred to as large seed companies, which require specialized outsourcing for complex and high-volume tasks such as trait introgression into diverse germplasm and regulatory package preparation. These companies rely on external services to augment their internal R&D capabilities, manage peak testing volumes, and access niche technological expertise (e.g., specialized plant transformation techniques for recalcitrant crops). Their buying decisions are driven by the need for speed-to-market, regulatory compliance assurance, and minimizing proprietary risk.

Another significant customer segment comprises specialized Biotech Firms and agricultural startups. These entities, often focused solely on developing a single, novel trait or utilizing a disruptive technology (like a new gene editor), frequently lack the expansive infrastructure for field trials, large-scale seed production, and comprehensive quality testing. They purchase end-to-end services to take their patented traits from the laboratory bench through to commercial viability. For them, service providers act as essential partners, offering a pathway to regulatory approval and market entry without the burden of building extensive physical assets.

Furthermore, Academic and Government Research Institutions represent a vital customer base, particularly for basic research and non-commercial crop development aimed at public good, such as developing disease resistance in orphan crops crucial for regional food security. These institutions typically purchase specialized services related to genome sequencing, bioinformatics analysis, and small-scale transformation projects. While their volume is lower than commercial entities, they often drive foundational research, leading to new techniques that eventually become commercialized services, ensuring a steady demand for high-level scientific support within the market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $7.8 Billion |

| Market Forecast in 2033 | $14.5 Billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bayer Crop Science, Corteva Agriscience, Syngenta Group, BASF SE, KWS SAAT SE, Limagrain, Sakata Seed Corporation, Eurofins Scientific, SGS SA, Covance (Labcorp), Agdia, Inc., Bionema, Inc., KeyGene, Inari Agriculture, Benson Hill, Pairwise, Stine Seed Company, Advanta Seeds, Bioceres Crop Solutions, Romer Labs. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Seed Engineering Services Market Key Technology Landscape

The technological backbone of the Seed Engineering Services Market is constantly evolving, driven by the shift from traditional transgenic methods to highly precise gene-editing tools. The most impactful technology currently defining the landscape is the CRISPR-Cas system, which offers unprecedented precision, speed, and cost-effectiveness in altering the plant genome compared to older techniques like zinc finger nucleases or TALENs. CRISPR facilitates targeted mutagenesis, enabling the development of desired traits faster and often circumventing some of the stringent regulatory pathways associated with classical GMOs, significantly accelerating the commercialization timeline for new seed varieties and maximizing the utility of outsourced engineering services.

Complementing gene editing, High-Throughput Phenotyping (HPP) technologies are essential for the validation of engineered traits. HPP utilizes a suite of advanced tools, including robotic field systems, unmanned aerial vehicles (UAVs or drones), and advanced imaging sensors (multispectral, hyperspectral, thermal), to rapidly and accurately measure plant characteristics under diverse environmental conditions. The vast volume of data generated by HPP is critical for confirming that an engineered trait performs as expected outside the controlled lab environment, allowing service providers to offer robust performance guarantees to their clients and validating the efficacy of their modification protocols.

Furthermore, bioinformatics and computational biology platforms are indispensable. These platforms manage and analyze the complex datasets derived from next-generation sequencing (NGS), genomics, and HPP. Technologies like Marker-Assisted Selection (MAS) and Genomic Selection (GS), which rely heavily on sophisticated algorithms to correlate genetic markers with desired traits, are foundational services offered by engineering firms. These computational tools allow for "in silico" breeding decisions, dramatically improving efficiency, reducing resource consumption, and providing predictive certainty, which is a core value proposition in the high-stakes seed market.

Regional Highlights

Regional dynamics play a crucial role in shaping the demand and technological orientation of the Seed Engineering Services Market, driven by local agricultural needs, regulatory environments, and research infrastructure.

- North America (NA): Dominates the global market, primarily due to having the largest concentration of major agricultural biotechnology companies, substantial R&D expenditure, and a highly advanced regulatory framework that, while stringent, supports the commercialization of sophisticated engineered products (e.g., stacked traits). NA leads in AI integration and precision breeding service adoption.

- Europe: Characterized by stringent regulations concerning classical GMOs, which has spurred significant investment in non-GMO gene-editing techniques (e.g., targeted mutagenesis viewed as conventional breeding in some contexts). Demand is high for seed treatment services and specialized trait development focused on sustainable and organic farming practices, particularly in Western European nations.

- Asia Pacific (APAC): Expected to register the highest CAGR. Driven by immense population growth, government initiatives promoting high-yield crops (e.g., in China and India), and the urgent need to modernize farming practices. Local service demand focuses on engineering rice, wheat, and cotton for localized pest resistance and climate adaptation, often supported by government-funded research institutions.

- Latin America (LATAM): A rapid-growth market fueled by extensive commercial farming, especially soybean and corn production in Brazil and Argentina. Demand is strong for services that handle high-volume trait introgression, particularly for export markets, requiring robust seed testing and validation against local pathogens.

- Middle East and Africa (MEA): Represents an emerging but high-potential market. Services are critically needed for developing drought-tolerant and heat-resistant varieties tailored to challenging arid and semi-arid environments. Market growth is dependent on improving local R&D capacity and foreign direct investment in localized seed production facilities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Seed Engineering Services Market.- Bayer Crop Science

- Corteva Agriscience

- Syngenta Group

- BASF SE

- KWS SAAT SE

- Limagrain

- Sakata Seed Corporation

- Eurofins Scientific

- SGS SA

- Covance (Labcorp)

- Agdia, Inc.

- Bionema, Inc.

- KeyGene

- Inari Agriculture

- Benson Hill

- Pairwise

- Stine Seed Company

- Advanta Seeds

- Bioceres Crop Solutions

- Romer Labs

- Thermo Fisher Scientific (Life Sciences Division)

- Mérieux NutriSciences

Frequently Asked Questions

Analyze common user questions about the Seed Engineering Services market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between traditional breeding and engineered seed services?

Traditional breeding relies on lengthy, unpredictable cross-pollination and selection over many generations. Engineered seed services use precise molecular tools like CRISPR or gene gun technology to introduce or modify specific traits rapidly and accurately, drastically reducing the time required to develop new varieties.

How do global regulations impact the commercial adoption of engineered seeds?

Regulatory frameworks are highly varied globally. Strict approval processes in regions like the EU often delay market entry and increase R&D costs for GMOs. However, regulatory clarity for newer gene-edited products (non-GMO classification) in North America and parts of Asia is accelerating their commercial adoption and service demand.

Which technology is driving the most significant innovation in the Seed Engineering Market?

CRISPR-Cas gene-editing technology is the most disruptive innovation, allowing service providers to offer unprecedented precision in trait development for drought tolerance, disease resistance, and yield improvement, surpassing older, less targeted modification methods.

What are the key concerns regarding the intellectual property (IP) within seed engineering services?

IP concerns center on patent ownership for proprietary transformation methods, novel gene sequences, and specific trait combinations (stacked traits). Service providers must ensure rigorous licensing agreements and legal compliance to protect both their own and their clients' investments in new seed technologies.

How is the outsourcing trend affecting the structure of the Seed Engineering Services Market?

The increasing complexity and cost of advanced genomic R&D are driving large seed companies to outsource high-throughput testing, bioinformatics, and specialized genetic transformation projects to CROs and expert firms, allowing them to focus internal resources on core germplasm development and market strategy.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager