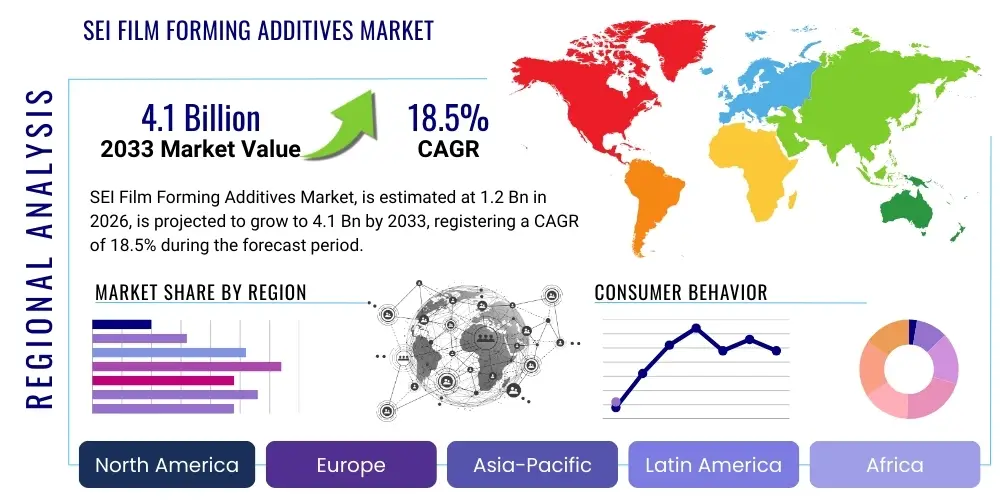

SEI Film Forming Additives Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441784 | Date : Feb, 2026 | Pages : 253 | Region : Global | Publisher : MRU

SEI Film Forming Additives Market Size

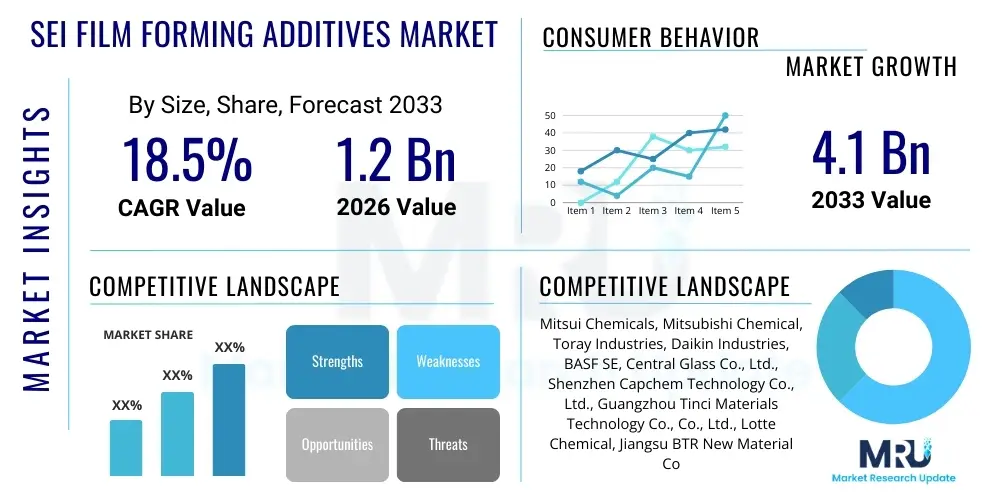

The SEI Film Forming Additives Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at USD 1.2 billion in 2026 and is projected to reach USD 4.1 billion by the end of the forecast period in 2033.

SEI Film Forming Additives Market introduction

The SEI Film Forming Additives Market is integral to the advancement of next-generation lithium-ion battery technology, serving as a fundamental component in enhancing electrochemical stability, extending cycle life, and improving safety parameters within high-energy density cells. These specialized chemical compounds are intentionally incorporated into non-aqueous electrolytes where they undergo reductive decomposition, typically during the initial formation cycle (first charge). This process results in the creation of the Solid Electrolyte Interphase (SEI) layer—a thin, electrically insulating but ionically conductive passivation film formed on the surface of the anode material, predominantly graphite or emerging silicon-based chemistries.

Product descriptions of these additives focus primarily on organic carbonates like Vinylene Carbonate (VC), Fluoroethylene Carbonate (FEC), and various sulfur, phosphate, and borate derivatives, each designed to optimize the composition, flexibility, and ionic permeability of the resultant SEI layer. VC is widely recognized for its effectiveness on standard graphite anodes, offering substantial cycle life improvement, while FEC is critical for stabilizing silicon-rich anodes due to its ability to form a more elastic and robust SEI capable of accommodating the large volume changes inherent to silicon alloying. Major applications span the electric vehicle (EV) sector, portable consumer electronics, and large-scale grid energy storage systems, all demanding superior long-term performance and reliability.

The principal benefits derived from effective SEI film formation include the suppression of continuous electrolyte reduction, which mitigates gas evolution and irreversible capacity loss, leading directly to higher energy retention and longer operational lifecycles for lithium-ion batteries. Key driving factors underpinning market growth include stringent global emissions regulations accelerating EV adoption, relentless consumer demand for longer-lasting and faster-charging electronic devices, and continuous material science innovation aimed at integrating high-capacity anode materials that necessitate sophisticated SEI management for practical use. Furthermore, safety improvements, such as enhanced thermal stability offered by well-formed SEI films, are vital drivers in high-power applications.

SEI Film Forming Additives Market Executive Summary

The SEI Film Forming Additives Market is characterized by robust commercial trends driven by the exponential growth of the electric vehicle industry and significant investment in advanced battery manufacturing capabilities globally. Business trends indicate a strong shift towards developing multi-functional additive packages, moving beyond single-component solutions to synergistic blends that address multiple performance metrics simultaneously, such as high-temperature stability, fast-charging capability, and compatibility with high-voltage cathodes. Innovation is centered on fluorine-containing compounds and novel phosphorus-based materials, which offer superior resistance to oxidative degradation and improve the stability of high-nickel cathode materials through cross-talk mitigation. Strategic collaborations between chemical manufacturers and major battery cell producers are increasing, focusing on customizing additive formulations to meet proprietary cell designs and specific application requirements, ensuring specialized supply chain resilience.

Regional trends highlight the Asia Pacific (APAC) region, particularly China, South Korea, and Japan, as the dominant manufacturing hub and largest consumer market, fueled by massive government support for local EV production and gigafactory expansion. Europe is experiencing the fastest rate of capacity addition, propelled by the European Green Deal and localization mandates requiring sophisticated chemical inputs for domestically produced batteries, leading to increased demand for high-performance additives. North America is also rapidly increasing its footprint, supported by incentives like the US Inflation Reduction Act (IRA), stimulating domestic chemical processing and additive synthesis capabilities to secure critical supply lines away from concentrated Asian sources.

Segmentation trends reveal that the use of Fluoroethylene Carbonate (FEC) and derivatives is forecast to exhibit the highest growth trajectory, primarily due to the increasing commercial viability of silicon-anode batteries and the necessity of forming highly stable SEI layers to manage silicon's expansion/contraction dynamics. By application, the Electric Vehicle (EV) segment maintains the largest market share owing to the high capacity and stringent durability requirements of automotive batteries. In terms of technology, solid-state electrolyte development, while nascent, is beginning to influence additive R&D, requiring specialized interface stabilizers that can bridge the liquid electrolyte/anode interface gap, signaling a future segment shift towards solid-state compatible SEI enhancers.

AI Impact Analysis on SEI Film Forming Additives Market

User inquiries concerning the impact of Artificial Intelligence (AI) on the SEI Film Forming Additives Market commonly revolve around themes of accelerated material discovery, optimization of manufacturing parameters, and predictive battery diagnostics enabled by machine learning. Users seek to understand how AI can rapidly screen millions of potential additive candidates—a historically time-consuming process involving extensive lab testing—to identify novel molecules that possess ideal SEI formation characteristics, such as low impedance, excellent uniformity, and high chemical robustness. Furthermore, there is significant interest in using AI algorithms to analyze complex electrochemical data generated during battery cycling, allowing manufacturers to predict SEI degradation rates and optimize electrolyte formulation in real-time based on usage patterns. This analysis suggests a user expectation that AI will dramatically reduce the time-to-market for next-generation additives, improve quality control in production through automated anomaly detection, and provide crucial insights into the fundamental mechanisms of SEI growth and failure that conventional experimental methods often obscure, thereby shifting R&D from empirical trial-and-error toward predictive material engineering.

- AI accelerates the virtual screening and prediction of novel SEI additive candidates based on molecular structure and quantum chemical properties, reducing physical synthesis requirements.

- Machine learning algorithms optimize additive concentration and processing conditions during battery formation cycles, ensuring optimal SEI layer quality and thickness.

- Predictive maintenance models utilize AI to analyze impedance data and capacity fade curves, forecasting SEI layer failure points and optimizing battery management systems (BMS).

- AI-driven simulation tools model the decomposition mechanisms and stability of SEI components under various thermal and electrical stresses, guiding formulation refinement.

- Automation of high-throughput experimentation (HTE) coupled with AI analysis speeds up the validation and scale-up of promising additive formulations.

DRO & Impact Forces Of SEI Film Forming Additives Market

The market for SEI film forming additives is powerfully influenced by a dynamic interplay of growth drivers and persistent constraints, with substantial opportunities emerging from technological convergence. The primary driver is the global electrification mandate, specifically the proliferation of Electric Vehicles (EVs) which necessitates batteries with increased energy density (requiring high-capacity anodes like silicon) and extended cycle life (demanding resilient SEI layers). Simultaneously, rigorous safety standards imposed by regulatory bodies worldwide compel manufacturers to utilize advanced additives that mitigate thermal runaway risk and stabilize highly reactive components. However, significant restraints include the complex synthesis processes required for high-purity, specialized fluorinated additives, leading to high production costs and supply chain bottlenecks concentrated in specific geographic regions. Furthermore, the inherent trade-off between forming a stable SEI layer (which slightly increases initial cell impedance) and achieving maximum power density presents a continuous technical challenge for optimization.

Opportunities in the market are abundant, primarily stemming from the commercialization of cutting-edge battery chemistries, including silicon-oxide anodes and Lithium Metal Batteries (LMBs). These technologies critically depend on novel, hyper-stable SEI films to achieve their promised performance metrics. The development of multi-functional additives that simultaneously stabilize the anode, scavenge impurities (like water), and protect the cathode surface (known as dual-action or multi-component packages) represents a crucial area for market expansion. Furthermore, significant R&D focus is directed towards electrolyte formulations compatible with next-generation solid-state batteries, where specialized interfacial stabilization additives are essential to bridge the performance gap between solid electrolytes and electrodes.

Impact forces currently shape the competitive landscape through the intensity of rivalry among key chemical manufacturers focusing on proprietary formulations and purity control. The increasing bargaining power of large battery manufacturers (Tier 1 players) dictates price points and demands for stringent quality specifications, putting pressure on smaller suppliers. Technological change is perhaps the most defining impact force, with rapid innovations in additive chemistry rendering older formulations obsolete quickly, necessitating continuous and aggressive investment in R&D. The overall market trajectory is defined by a high-impact force from regulations and technological breakthroughs, slightly moderated by the restraining impact of high material synthesis complexity and purity requirements, ensuring a sustained high growth trajectory focused on performance differentiation.

Segmentation Analysis

The SEI Film Forming Additives Market is systematically segmented based on the type of additive chemistry, the specific application or end-user industry, and the geography of consumption and production. This segmentation provides a granular view of market dynamics, highlighting areas of high growth and technological maturity. Segmentation by type typically includes major commercial families such as Carbonates (e.g., VC, FEC), Phosphates, Borates, and Sulfides, reflecting their distinct chemical structures and performance profiles in stabilizing different electrode materials. The choice of additive is highly dependent on the anode material—graphite, Si/C composites, or pure silicon—and the desired operating conditions, such as high temperatures or fast charge rates, ensuring additive market differentiation based on specialized functionality.

The application segmentation is dominated by the Electric Vehicle (EV) sector, which drives demand for high-volume, performance-critical additives due to the necessity for batteries capable of 10-15 year lifecycles and high energy density for extended range. This segment is followed by Consumer Electronics, which demands smaller volumes but often requires additives optimized for rapid charging and miniaturization, and finally, Energy Storage Systems (ESS), which prioritize long duration and excellent calendar life stability. Geographically, the market analysis is crucial for understanding supply chain concentration and manufacturing trends, with Asia Pacific maintaining global supremacy in both production capacity and consumption due to its established dominance in global battery production.

- By Additive Type:

- Vinylene Carbonate (VC)

- Fluoroethylene Carbonate (FEC)

- Vinyl Ethylene Carbonate (VEC)

- Lithium Bis(oxalate)borate (LiBOB)

- Lithium Difluoro(oxalate)borate (LiDFOB)

- Phosphate Derivatives (e.g., TEP, TMSP)

- Sulfate/Sulfonamide Compounds

- By Application:

- Electric Vehicles (EVs)

- Consumer Electronics (Smartphones, Laptops, Wearables)

- Energy Storage Systems (ESS)

- Industrial Applications

- By End-User Anode Material:

- Graphite Anodes

- Silicon/Silicon-Composite Anodes

- Lithium Metal Anodes (Emerging)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East & Africa (MEA)

Value Chain Analysis For SEI Film Forming Additives Market

The value chain for SEI Film Forming Additives begins with upstream activities focused on the procurement and synthesis of highly purified chemical precursors. This stage involves sourcing commodity chemicals such as ethylene carbonate, ethylene glycol, and various fluorine-containing raw materials, which must meet ultra-high purity standards—often 99.99% or higher—to prevent unwanted side reactions in the sensitive electrochemical environment of a lithium-ion cell. Key upstream players are specialized fine chemical and petrochemical companies, particularly those capable of complex, multi-step organic synthesis, especially fluorination. The synthesis step itself is capital and technology intensive, requiring advanced reactors and strict quality control measures to ensure batch consistency and minimize trace metal contamination, which can severely compromise battery performance. Vertical integration, where electrolyte producers begin to synthesize high-volume additives like VC and FEC internally, is a growing trend to secure supply and manage costs.

Midstream processes involve the formulation and preparation of the electrolyte solution, where SEI additives, alongside conductive salts (e.g., LiPF6) and organic solvents, are meticulously blended under highly controlled, moisture-free conditions (typically in dry rooms with sub-ppm moisture levels). Specialized electrolyte manufacturers dominate this segment, leveraging proprietary blending ratios and purification technologies. Distribution channels are critical, often involving direct supply agreements between major additive producers and large-scale battery cell manufacturers (Gigafactories). Due to the hazardous nature (flammability) and sensitivity of both the additives and the final electrolyte, specialized logistics and warehousing solutions are mandatory, adding complexity and cost to the distribution framework.

Downstream activities center on the integration of the electrolyte and additives into the final battery cell during the manufacturing process, followed by the initial formation cycling where the SEI film is actually created. Direct distribution, involving immediate delivery to Tier 1 battery manufacturers (e.g., CATL, LG Energy Solution, Samsung SDI), is the predominant channel for bulk high-volume orders, ensuring tight integration between chemical input quality and cell production schedules. Indirect distribution plays a minor role, typically involving regional chemical distributors or specialty suppliers serving smaller or niche battery producers. The performance feedback from the downstream application (EVs, consumer devices) directly informs the upstream R&D efforts, creating a closed-loop system driven by the imperative to continuously enhance battery lifespan and safety characteristics.

SEI Film Forming Additives Market Potential Customers

The primary customers and end-users for SEI Film Forming Additives are the globally integrated manufacturers of lithium-ion battery cells, often referred to as Gigafactories or Tier 1 cell producers. These entities require additives in massive volumes and with unparalleled quality consistency, making them the cornerstone of the market demand structure. Their purchasing decisions are driven by stringent criteria related to cycle life extension, impedance reduction, compatibility with specific anode chemistries (especially high-loading silicon), and demonstrated ability to pass critical safety and quality certifications required by the automotive industry. Since the electrolyte formulation is often a closely guarded proprietary aspect of cell design, these major customers engage in long-term, specialized contracts with additive suppliers to ensure a reliable and customized supply of high-purity materials.

Secondary potential customers include smaller, specialized battery manufacturers focused on niche markets such as medical devices, aerospace, or specialized high-power tools, where specific performance requirements (e.g., extreme temperature operation) necessitate unique additive packages. Additionally, academic research institutions and corporate R&D labs engaged in the development of next-generation batteries (e.g., solid-state or Li-metal chemistries) constitute an important customer segment, albeit consuming lower volumes. These R&D customers seek novel, experimental additives to validate new cell designs and explore the fundamental electrochemistry of interface stabilization, driving innovation and future market trends. The overall customer base is highly centralized, with procurement power concentrated among the top 10 global battery producers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 4.1 Billion |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Mitsui Chemicals, Mitsubishi Chemical, Toray Industries, Daikin Industries, BASF SE, Central Glass Co., Ltd., Shenzhen Capchem Technology Co., Ltd., Guangzhou Tinci Materials Technology Co., Co., Ltd., Lotte Chemical, Jiangsu BTR New Material Co., Ltd., Hunan Shanshan Advanced Materials Co., Ltd., Kanto Chemical Co., Inc., UBE Corporation, Stella Chemifa Corporation, Resonac Holdings (Showa Denko), Solvay S.A., Arkema S.A., Fuji Film Wako Pure Chemical Corporation, Sanyo Chemical Industries, Ltd., Guotai Huarong New Chemical Materials Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

SEI Film Forming Additives Market Key Technology Landscape

The technological landscape of the SEI Film Forming Additives Market is defined by the ongoing chemical innovation necessary to overcome the limitations of conventional lithium-ion batteries and enable the transition to higher energy density materials. The core technology centers on molecular design, where chemists synthesize molecules engineered to decompose selectively at the anode potential, forming stable, low-resistance interfaces. Current leading technologies involve highly optimized processes for synthesizing fluorinated organic compounds, such as Fluoroethylene Carbonate (FEC) and derivatives, which are essential for stabilizing next-generation silicon-containing anodes. FEC facilitates the formation of a robust, polymeric SEI rich in LiF and highly elastic components, necessary to endure the significant volumetric expansion (up to 400%) experienced by silicon during lithiation. The manufacturing technology emphasizes purity control, requiring sophisticated distillation, crystallization, and purification techniques to remove impurities like trace metals and moisture that could lead to parasitic reactions and accelerated cell degradation.

A major area of technological focus is the development of multi-functional additive blends. Instead of relying on a single compound, manufacturers are utilizing synergistic mixtures—often involving a film-former (like VC or FEC), an impedance reducer (like LiDFOB), and a gas scavenger—to optimize multiple performance parameters simultaneously, particularly under extreme conditions such as fast charging or elevated temperatures. These blends require advanced formulation technology and extensive electrochemical testing to identify the ideal ratios that provide comprehensive protection without sacrificing ionic conductivity. Furthermore, the industry is increasingly utilizing computational chemistry, including Density Functional Theory (DFT) calculations and machine learning, to predict the reduction potential and decomposition pathways of new molecular candidates, drastically accelerating the R&D cycle compared to purely experimental methods.

Emerging technology trends are heavily influenced by the drive towards solid-state batteries (SSBs). While SSBs eliminate the traditional liquid electrolyte, they introduce a critical need for an interfacial layer stabilizer between the solid electrolyte and the electrode surface to maintain low interfacial resistance and prevent detrimental side reactions. Novel SEI-like stabilizers, often inorganic or polymeric thin films formed in situ or ex situ, are being researched to facilitate stable lithium ion transfer across these solid-solid interfaces. This shift represents a technological convergence, demanding additives or pre-treatment technologies capable of forming highly uniform, dense, and conductive passivation layers under solid-state operating conditions. The transition requires significant investment in specialized coating and deposition technologies, moving beyond simple liquid mixing toward sophisticated surface engineering.

Regional Highlights

- Asia Pacific (APAC): APAC dominates the global SEI Film Forming Additives Market, driven by the massive concentration of lithium-ion battery manufacturing capacity, particularly in China, South Korea, and Japan. China is the largest consumer and producer globally, supported by robust government subsidies and an extensive local supply chain for both chemical synthesis and downstream EV production. The region benefits from established expertise in complex organic synthesis and proprietary additive formulations, essential for maintaining the competitive edge of regional battery giants like CATL, LG Energy Solution, and Samsung SDI. The continuous expansion of gigafactories across Southeast Asia and the sustained demand for high-performance additives compatible with high-nickel cathodes and silicon anodes ensure APAC remains the primary growth engine.

- North America: The North American market is experiencing explosive growth, largely fueled by aggressive investment in domestic battery manufacturing capacity spurred by regulatory incentives such as the Inflation Reduction Act (IRA). This region is actively striving to localize its battery supply chain, creating significant demand for locally sourced, high-purity SEI additives to reduce reliance on Asian suppliers. The focus here is heavily concentrated on the automotive sector, with new joint ventures between major OEMs and battery producers demanding advanced additive chemistries optimized for extreme temperature performance and long-range electric truck applications. R&D efforts are strong, particularly in collaborations between national labs and material science start-ups focusing on lithium metal and solid-state interface stabilization.

- Europe: Europe represents the fastest-growing region in terms of capacity expansion, driven by the continent's ambitious decarbonization goals and the necessity of establishing a localized, sustainable battery value chain (the "Battery Passport" initiative). Countries like Germany, Sweden, and Hungary are becoming major manufacturing hubs. Demand is characterized by a strong preference for high-quality, traceable, and environmentally compliant additives. European battery manufacturers are highly focused on developing specialized formulations that enhance both battery safety and longevity to meet stringent EU automotive standards, pushing significant investment into domestic chemical producers capable of synthesizing complex fluorinated compounds and electrolyte salts essential for advanced SEI formation.

- Latin America (LATAM): The LATAM market, while currently smaller in consumption volume, holds significant strategic importance due to its vast lithium reserves, particularly in the "Lithium Triangle" (Chile, Argentina, Bolivia). Market demand for SEI additives is primarily driven by emerging local EV assembly and small-scale energy storage projects. The region presents long-term opportunities for chemical suppliers looking to establish local processing facilities closer to raw material sources and serve nascent battery manufacturing efforts, although local capacity for synthesizing complex organic additives remains underdeveloped, making it highly import-dependent for high-performance chemical inputs.

- Middle East and Africa (MEA): The MEA region is a nascent but rapidly developing market, driven by two key factors: large-scale renewable energy projects requiring extensive Energy Storage Systems (ESS) and ambitious national diversification strategies (e.g., Saudi Vision 2030) that include establishing local EV manufacturing capabilities. The demand for SEI additives is growing alongside ESS installations, which prioritize excellent calendar life and thermal stability in high-ambient temperature environments. Significant infrastructure investment is expected to stimulate localized demand for battery chemicals, although consumption currently remains concentrated in industrial and grid storage sectors, relying almost entirely on imports from APAC and Europe for specialized additive materials.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the SEI Film Forming Additives Market.- Mitsui Chemicals

- Mitsubishi Chemical

- Toray Industries

- Daikin Industries

- BASF SE

- Central Glass Co., Ltd.

- Shenzhen Capchem Technology Co., Ltd.

- Guangzhou Tinci Materials Technology Co., Co., Ltd.

- Lotte Chemical

- Jiangsu BTR New Material Co., Ltd.

- Hunan Shanshan Advanced Materials Co., Ltd.

- Kanto Chemical Co., Inc.

- UBE Corporation

- Stella Chemifa Corporation

- Resonac Holdings (Showa Denko)

- Solvay S.A.

- Arkema S.A.

- Fuji Film Wako Pure Chemical Corporation

- Sanyo Chemical Industries, Ltd.

- Guotai Huarong New Chemical Materials Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the SEI Film Forming Additives market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of SEI film forming additives in lithium-ion batteries?

The primary function is to chemically decompose during the initial charge cycle, forming a stable Solid Electrolyte Interphase (SEI) passivation layer on the anode surface. This layer prevents continuous decomposition of the bulk electrolyte, minimizes irreversible lithium loss, and significantly extends the battery's cycle life and overall stability.

Why is Fluoroethylene Carbonate (FEC) becoming increasingly critical in the market?

FEC is critical because it is highly effective at stabilizing high-capacity silicon-containing anodes. Silicon undergoes large volume changes during cycling (up to 400%). FEC forms an SEI layer that is more flexible and mechanically robust than those formed by traditional additives, effectively accommodating silicon's expansion and preventing layer pulverization.

How do SEI additives impact the safety profile of lithium-ion batteries?

By forming a highly stable and electrically insulating barrier, SEI additives suppress side reactions that generate heat and gas. A robust SEI layer helps prevent thermal runaway by reducing self-discharge and improving the cell's tolerance to internal short circuits and elevated operational temperatures, thereby enhancing overall battery safety.

Which application segment drives the largest demand for SEI Film Forming Additives?

The Electric Vehicles (EVs) segment drives the largest demand. EV applications require batteries with exceptionally long cycle and calendar life (10-15 years), high energy density, and robust safety features, necessitating large volumes of high-performance SEI additives optimized for automotive-grade battery cells.

What technological challenges are associated with developing next-generation SEI additives?

Key challenges include achieving ultra-high purity during synthesis, designing multi-functional molecules that stabilize both the anode and cathode (cross-talk mitigation), and developing cost-effective additives that are effective in non-traditional electrolytes, such as those intended for high-voltage or solid-state battery chemistries.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager