Seismic Support System Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443623 | Date : Feb, 2026 | Pages : 253 | Region : Global | Publisher : MRU

Seismic Support System Market Size

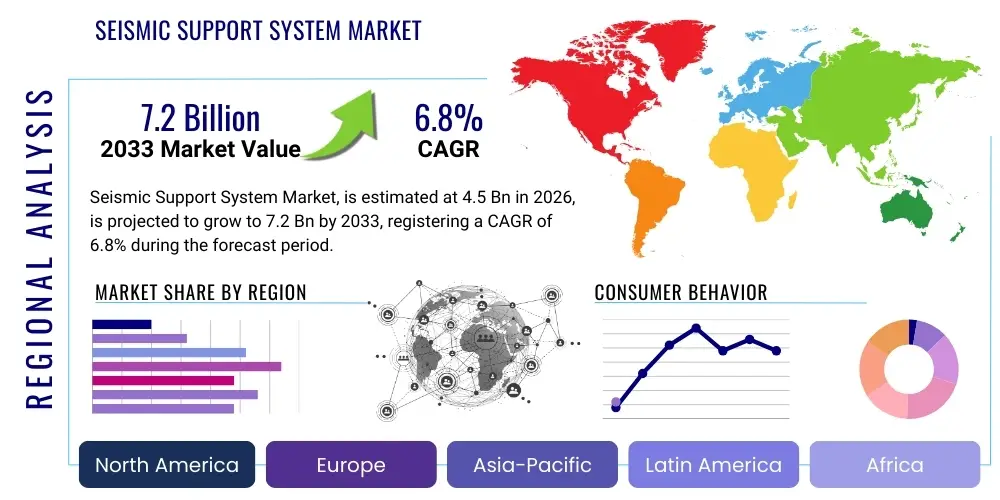

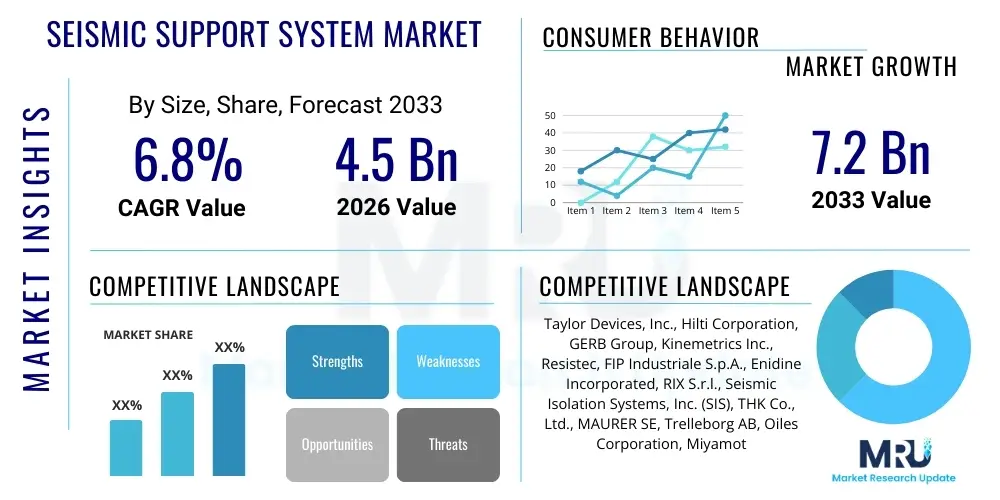

The Seismic Support System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 7.2 Billion by the end of the forecast period in 2033. This growth trajectory is fundamentally driven by increasingly stringent global building codes and regulatory mandates focusing on structural resilience, particularly in high-seismicity zones. Furthermore, the rising investment in critical infrastructure development, including hospitals, data centers, and power generation facilities, where uninterrupted operation during and after a seismic event is paramount, contributes significantly to market expansion. The technological advancements in material science and engineering, leading to more efficient and cost-effective seismic isolation and energy dissipation devices, are enabling broader adoption across diverse construction applications, solidifying the market's robust future prospects.

Seismic Support System Market introduction

The Seismic Support System Market encompasses specialized engineering solutions and components designed to protect buildings, infrastructure, and non-structural elements (like machinery, piping, and utility systems) from damage or collapse during earthquakes. These systems operate on principles of vibration isolation, energy dissipation, or structural bracing to minimize the transfer of seismic forces from the ground to the supported structure or equipment. Key products include base isolation bearings, seismic dampers (viscous, friction, yielding), and robust bracing systems, which are increasingly mandated in regions susceptible to intense seismic activity. The primary objective is not merely preventing total collapse, but ensuring operational continuity and rapid recovery post-event, making these systems essential for critical facilities.

Major applications of seismic support systems span across the commercial sector, including high-rise offices and shopping malls; residential complexes, particularly multi-family dwellings; vital infrastructure suchments as bridges, overpasses, and railway lines; and industrial facilities, such as refineries, nuclear power plants, and large data storage centers. These systems provide numerous benefits, including enhanced life safety by reducing structural displacement, decreased repair costs through minimized damage to both structural and non-structural components, and reduced downtime for critical facilities, which is crucial for maintaining public services following a disaster. The integration of advanced computational modeling and simulation techniques allows engineers to tailor these support systems precisely to the unique dynamic characteristics of a structure and the expected seismic hazard profile of its location, optimizing performance and cost-effectiveness.

Driving factors for this market are multifaceted, anchored by the global rise in urbanization and the subsequent construction boom in earthquake-prone coastal areas, which elevates the risk exposure to seismic hazards. Government initiatives and international collaborations, such as the enforcement of Eurocode 8 or ASCE 7 standards, compel developers to integrate passive or active seismic protection measures into new builds and retrofitting projects. Furthermore, increasing public awareness regarding earthquake risk and the corresponding demand for safer, more resilient buildings, alongside innovations in smart damping technologies utilizing real-time sensor feedback, are propelling the adoption rate of these sophisticated protection systems, driving continuous market innovation and expansion.

Seismic Support System Market Executive Summary

The Seismic Support System Market is characterized by robust growth, propelled by global efforts toward enhancing structural resilience against natural disasters. Business trends highlight a strong shift towards performance-based design methodologies, prioritizing systems that guarantee specific levels of structural functionality post-earthquake, moving beyond mere collapse prevention. Key players are investing heavily in R&D to miniaturize damping devices and integrate smart monitoring capabilities, fostering a competitive environment focused on high-performance, maintenance-free solutions. Furthermore, the increasing complexity of modern architectural designs necessitates bespoke seismic solutions, driving collaboration between seismic engineers, material scientists, and construction firms. The market is also seeing consolidation among specialized manufacturers aiming to offer end-to-end services, from seismic assessment to installation and long-term maintenance, reflecting a trend towards integrated service delivery models that streamline project execution and quality assurance for large-scale infrastructure projects and complex commercial builds.

Regionally, the Asia Pacific (APAC) region dominates the market due to the high frequency of catastrophic seismic events, stringent regulatory environments in countries like Japan and New Zealand, and massive infrastructure spending in developing economies such as China and India, focusing on earthquake-resistant construction standards. North America and Europe, while having established markets, show steady growth driven primarily by the retrofitting of aging critical infrastructure and the increasing adoption of advanced base isolation technologies in high-value commercial and healthcare facilities. Emerging markets in Latin America and the Middle East & Africa (MEA) are poised for rapid growth as governments initiate major urban development projects and concurrently adopt enhanced international building codes, recognizing the long-term economic benefits of seismic resilience. Regulatory harmonization across different jurisdictions continues to influence regional market dynamics, often leading to rapid technology transfer and adoption of proven seismic support techniques globally, though localized seismic hazard mapping remains crucial for design specificities.

In terms of segments, the Base Isolation segment is experiencing the fastest growth, largely due to its superior performance in decoupling the structure from ground motion, thereby protecting sensitive non-structural contents and critical equipment. The application segment sees critical infrastructure and industrial facilities exhibiting the highest demand growth, given the catastrophic economic consequences of operational failure in these sectors. Within product types, Viscous Dampers are gaining traction due to their ability to dissipate large amounts of energy across varying displacement velocities, making them highly versatile for both new construction and retrofitting applications. The demand for lightweight and corrosion-resistant materials, particularly high-strength steel and advanced elastomeric compounds, is also shaping the segmentation landscape, focusing on systems that offer long operational life with minimal required inspection and maintenance cycles, thereby lowering the total cost of ownership over the structure's lifespan.

AI Impact Analysis on Seismic Support System Market

User queries regarding AI in the Seismic Support System Market predominantly revolve around three key themes: the utilization of Machine Learning (ML) for enhanced seismic risk modeling and prediction; the development of 'smart' or adaptive support systems using real-time sensor data and AI algorithms; and the optimization of seismic design processes to reduce costs and time. Users are particularly keen on understanding how AI can move seismic protection from purely passive mechanisms to semi-active or active control systems capable of adjusting their response dynamically during an event. Concerns often center on the reliability, certification standards, and robustness of AI-driven control systems, especially concerning potential failures under extreme, unprecedented seismic conditions. The consensus expectation is that AI will significantly improve the precision of seismic hazard assessments, optimize material use, and facilitate the creation of next-generation, responsive structural safety measures, fundamentally changing how engineers approach earthquake-resistant design.

The deployment of sophisticated Artificial Intelligence (AI) and Machine Learning (ML) algorithms is revolutionizing the seismic support system industry by drastically improving the fidelity of site-specific hazard analysis and structural health monitoring. AI models can process vast datasets, including historical earthquake records, geological surveys, and complex structural dynamics simulations, far exceeding human capacity, allowing for highly refined probabilistic seismic hazard assessments (PSHA). This enhanced accuracy directly translates into optimized design parameters for isolators and dampers, ensuring that support systems are neither over-designed (leading to excessive costs) nor under-designed (leading to inadequate protection). Furthermore, AI facilitates non-linear time-history analyses more rapidly, enabling engineers to explore a broader range of seismic scenarios and structural responses than traditional computational methods allow, substantially accelerating the design cycle for complex or unique structures.

In the operational phase, AI integrated into structural monitoring systems enables predictive maintenance and real-time responsiveness. Smart seismic support systems, equipped with arrays of accelerometers and displacement sensors, utilize ML algorithms to continuously analyze the structure’s dynamic signature. During an earthquake, these algorithms can instantaneously detect initial P-waves and, in semi-active systems, adjust the stiffness or damping coefficients of installed devices (e.g., magnetorheological dampers) to optimally counteract incoming ground motion. This proactive, adaptive response capability represents a significant technological leap over purely passive systems. Post-event, AI can rapidly assess damage levels across the structure, providing engineers with immediate, actionable insights, prioritizing inspections, and accelerating recovery efforts, thereby dramatically reducing downtime and ensuring safety compliance efficiently.

- AI enhances Probabilistic Seismic Hazard Analysis (PSHA) accuracy, optimizing device selection.

- Machine Learning algorithms enable predictive maintenance and structural health monitoring of support systems.

- AI facilitates the development of semi-active and active damping systems for real-time response adjustment.

- Optimization algorithms significantly reduce material usage and overall construction costs through precise design specifications.

- Rapid post-earthquake damage assessment using computer vision and AI minimizes inspection time and speeds up recovery logistics.

DRO & Impact Forces Of Seismic Support System Market

The Seismic Support System Market is primarily driven by rigorous regulatory frameworks and increasing public and private sector recognition of the catastrophic long-term economic costs associated with seismic damage, necessitating proactive mitigation strategies. Restraints largely involve the high initial capital expenditure required for installing advanced seismic isolation systems, particularly in existing structures undergoing retrofitting, coupled with potential resistance from traditional construction methods and skepticism regarding the long-term maintenance requirements of sophisticated devices. Significant opportunities emerge from the expansion of critical infrastructure networks globally, including high-speed rail and large-scale utility projects, which demand the highest level of seismic resilience, alongside the vast, untapped market for seismic retrofitting in high-density urban areas constructed before modern seismic codes were enforced. The market is subjected to powerful impact forces, including competitive rivalry characterized by continuous innovation in proprietary damping technologies, the growing bargaining power of large construction firms demanding integrated and standardized solutions, and the high threat of substitute technologies such as advanced materials (e.g., self-healing concrete) potentially altering demand dynamics for traditional mechanical support systems. Regulatory standards and technological certification processes also exert a strong external influence on market entry and product acceptability, forcing continuous compliance and rigorous testing.

A major driving force is the escalating frequency and intensity of natural disasters worldwide, amplified by climate change effects, compelling governments and insurance bodies to mandate higher standards of structural safety. For instance, the rapid urbanization across the Asia Pacific region, particularly in seismically active areas like the Pacific Ring of Fire, necessitates the construction of millions of new, resilient structures, providing a sustained demand base for seismic support components. Furthermore, the economic imperative to protect high-value assets, such as data centers, which are fundamental to the modern digital economy, and specialized manufacturing facilities where operational disruption is prohibitively expensive, significantly bolsters the demand for high-performance base isolation and damping solutions. The advancement in non-invasive retrofitting technologies, allowing older buildings to be upgraded without extensive structural overhaul, opens up massive potential in mature markets like North America and Europe, where infrastructure assets are often several decades old and require immediate seismic risk mitigation.

Conversely, the primary constraint remains the complexity and associated costs of integrating advanced seismic systems, especially base isolators, which require specialized foundations and structural adjustments, often leading to increased project timelines and upfront investment compared to conventional fixed-base construction. This cost factor often dissuades developers in price-sensitive emerging economies. Another restraint is the fragmented nature of global seismic standards; while harmonization is progressing, variations in local codes and geotechnical conditions necessitate highly customized, non-standardized solutions, complicating manufacturing and global supply chain logistics. However, opportunities abound in developing integrated smart seismic monitoring systems, which utilize IoT and Big Data analytics not only for real-time protection but also for insurance risk mitigation and operational optimization. Additionally, the increasing focus on resilient city planning and green building certifications, which often reward structures with superior disaster resistance, provides a clear pathway for premium seismic support products to gain market share among high-quality, sustainable development projects worldwide.

Segmentation Analysis

The Seismic Support System Market is systematically segmented based on Type, Application, and Material, reflecting the diverse engineering requirements and end-user needs across the construction industry. The Type segmentation distinguishes between passive elements like Base Isolation Systems and Dampers, which offer inherent protection without external power, and potentially emerging active/semi-active systems that require real-time control. Application segmentation highlights the crucial role of these systems across various economic sectors, with infrastructure and critical facilities often requiring the most advanced and rigorous solutions. Material segmentation focuses on the key components used in manufacturing isolators and dampers, where durability, fatigue resistance, and high energy dissipation capacity are essential, guiding product development towards advanced steels, specialized elastomers, and high-performance composite mixtures. Understanding these distinct segments is vital for manufacturers to tailor their R&D investments and marketing strategies to specific high-growth areas within the global resilience market.

The differentiation across these segments reflects not only technical product variations but also the varying risk tolerance and regulatory compliance levels of different end-user industries. For instance, in the critical infrastructure segment, encompassing hospitals, power grids, and data centers, the design requirement shifts from merely preventing collapse to ensuring immediate operational recovery (Immediate Occupancy level), demanding premium performance isolators and viscous dampers. Conversely, in the standard residential sector, cost-effectiveness often drives the adoption of simpler, yet effective, bracing and friction damping systems. The segmentation by material is intrinsically linked to performance; high-damping rubber bearings are favored in moderate seismicity zones for their cost-efficiency and simplicity, whereas complex lead-rubber bearings or friction pendulum systems are mandated for heavy structures in zones of extreme seismic hazard, offering superior energy dissipation and re-centering capabilities. This structural differentiation allows market players to specialize and optimize their offerings to specific, high-demand niches.

- By Type:

- Base Isolation Systems (e.g., Lead Rubber Bearings, High Damping Rubber Bearings, Friction Pendulum Systems)

- Seismic Dampers (e.g., Viscous Fluid Dampers, Metallic Yielding Dampers, Friction Dampers, Viscoelastic Dampers)

- Bracing Systems (e.g., Buckling-Restrained Braces (BRBs), Conventional Steel Braces)

- Anchorage and Restraint Systems

- By Application:

- Critical Infrastructure (Hospitals, Data Centers, Power Plants, Bridges, Tunnels)

- Commercial Buildings (High-Rise Offices, Malls, Hotels)

- Residential Buildings (Multi-Family Housing, Apartments)

- Industrial Facilities (Oil & Gas, Manufacturing Plants)

- By Material:

- Steel (High-Strength Alloys, Stainless Steel for Dampers and Braces)

- Elastomeric Materials (Natural Rubber, Neoprene, High Damping Rubber)

- Composite Materials

Value Chain Analysis For Seismic Support System Market

The value chain for the Seismic Support System Market initiates with the upstream phase, dominated by the sourcing and refinement of specialized raw materials such as high-grade steel alloys, sophisticated elastomeric compounds, and viscous fluids, where quality control and material science innovation are paramount. Manufacturers specializing in these complex components (isolators, dampers, BRBs) form the core of the midstream, requiring high precision engineering, rigorous testing, and compliance with international standards (e.g., ISO, ASTM, CE markings). Downstream activities involve specialized seismic design consultation by structural engineers, procurement by construction companies or infrastructure developers, and installation by highly trained technical crews who ensure the precise integration of these systems into the building structure. The value chain concludes with post-installation monitoring, inspection, and certification, often extending through the entire lifespan of the supported structure, emphasizing long-term performance reliability and maintenance.

Upstream analysis focuses heavily on material innovation, particularly in developing elastomers with superior fatigue resistance and steel alloys that offer high ductility and yield strength, crucial for reliable energy dissipation devices. Suppliers of raw materials operate under strict quality parameters, as the performance of a seismic support system is inherently linked to the chemical and physical integrity of its components. The midstream manufacturing phase is characterized by specialized, high-capital expenditure facilities required for processes like vulcanization for rubber bearings or precision machining for viscous damper components, leading to a relatively high barrier to entry for new market players. Manufacturers often integrate R&D vertically to ensure continuous product improvement and customized solutions tailored to specific project requirements, maintaining high intellectual property value in proprietary designs.

Distribution channels in this market are predominantly indirect, relying heavily on specialized engineering consultants and value-added resellers who possess the technical expertise to integrate these complex systems into project designs. Direct sales are usually reserved for large, flagship infrastructure projects where manufacturers engage directly with government agencies or Tier 1 construction contractors to provide highly customized, often co-developed, solutions. The selection of the distribution channel is often determined by the complexity of the product; standard bracing systems may use broader construction supply networks, while high-performance base isolators require direct involvement from the manufacturer's engineering team throughout the design and installation phases. Effective distribution necessitates not just logistical capability but also comprehensive technical support, training, and certification services to ensure proper application and compliance with stringent seismic regulations worldwide.

Seismic Support System Market Potential Customers

The potential customers and primary buyers of seismic support systems are highly diverse but generally centered around large-scale infrastructure projects and commercial entities that demand exceptional resilience and operational continuity. Key end-users include governmental public works departments responsible for managing and developing critical national assets such as highways, bridges, dams, and utilities (water treatment plants and electrical substations). Healthcare providers, particularly major hospital systems, represent a crucial customer segment, as hospitals must remain fully functional immediately following a disaster to provide emergency services, making advanced seismic isolation a mandatory investment. Furthermore, owners and operators of specialized industrial facilities, notably nuclear power plants, chemical refineries, and liquefied natural gas (LNG) terminals, where system failure could result in catastrophic environmental or safety incidents, are primary consumers of high-performance seismic dampers and restraints for sensitive equipment.

In the private sector, large commercial real estate developers targeting premium markets or constructing high-rise buildings in earthquake-prone metropolitan areas are significant buyers, driven by the need to protect corporate assets, ensure business continuity, and secure favorable insurance premiums. Data center operators, whose facilities house billions of dollars worth of critical IT equipment and whose services rely on zero downtime, are increasingly adopting advanced floor isolation systems and equipment bracing. Institutional customers, such as universities and large research laboratories, also represent a viable market segment, particularly for protecting sensitive, expensive research equipment (e.g., MRI machines, particle accelerators) from vibrational damage during seismic events. The common thread among these potential customers is a low tolerance for operational disruption and a recognition that the lifetime cost savings resulting from avoided disaster damage far outweigh the initial investment in seismic protection.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.2 Billion |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Taylor Devices, Inc., Hilti Corporation, GERB Group, Kinemetrics Inc., Resistec, FIP Industriale S.p.A., Enidine Incorporated, RIX S.r.l., Seismic Isolation Systems, Inc. (SIS), THK Co., Ltd., MAURER SE, Trelleborg AB, Oiles Corporation, Miyamoto International, Earthquake Protection Systems (EPS), Sanwa Tekki Corporation, A&P Engineers, Dynamic Isolation Systems (DIS), Shanghai Tunghsing Industrial Co., Ltd., Ningbo Tiansheng Sealing Material Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Seismic Support System Market Key Technology Landscape

The technological landscape of the Seismic Support System Market is dominated by passive seismic control devices, although significant innovation is occurring in the fields of semi-active and active control. Core technologies center around Base Isolation, which mechanically decouples the structure from ground motion using specialized bearings (e.g., Lead Rubber Bearings, High Damping Rubber Bearings, and Friction Pendulum Systems). These systems require highly specialized material science inputs to ensure long-term stability and specific performance characteristics, such as re-centering capabilities following major displacement. The second primary technology area involves Energy Dissipation, where various types of dampers (viscous, metallic yielding, friction) are strategically placed within the structure to absorb and dissipate seismic energy that would otherwise cause structural strain. The sophistication of viscous fluid dampers, utilizing silicon-based fluids with stable viscosity across wide temperature ranges, represents a major technical achievement, enabling consistent energy absorption performance under diverse environmental conditions.

Advancements are currently focused on two main fronts: improving the efficiency and durability of passive components and integrating smart technologies for adaptive responses. In the passive domain, the development of Buckling-Restrained Braces (BRBs) has provided highly reliable, ductile alternatives to traditional steel bracing, offering symmetric hysteretic behavior under cyclic loading, significantly enhancing structural performance with lower material volume. Simultaneously, the industry is witnessing a gradual shift towards smart seismic control through the incorporation of real-time monitoring and control systems. Sensor networks, utilizing high-resolution accelerometers and displacement transducers, are increasingly common, providing continuous structural health monitoring (SHM). This data feeds into centralized control units, which, in the case of semi-active systems (like magnetorheological dampers), can instantly adjust the damping force based on the perceived seismic intensity and frequency content, moving beyond the limitations of fixed-property passive systems.

Further technological innovation includes the exploration of hybrid seismic protection systems that combine the benefits of isolation and dissipation, offering optimized solutions for complex structures. Furthermore, computational fluid dynamics (CFD) and advanced finite element analysis (FEA) software tools are crucial technological enablers, allowing engineers to accurately simulate the non-linear behavior of these support systems under extreme loading scenarios before physical prototypes are created. This reliance on sophisticated computational modeling accelerates the development cycle and reduces the cost of large-scale testing. Material science research continues to explore composite materials and smart alloys (e.g., shape-memory alloys) for use in dampers, promising devices that can recover their original form and properties after experiencing large seismic displacements, thereby minimizing the need for post-earthquake replacement and maintenance.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest and fastest-growing market segment for seismic support systems, primarily due to its geographical location encompassing the volatile Pacific Ring of Fire, which results in frequent and powerful seismic activity. Countries such as Japan, renowned for its cutting-edge anti-seismic technology and mandatory strict building codes, drive innovation and high-quality demand. Massive infrastructure projects in China, Indonesia, and the Philippines, coupled with urbanization pressures, necessitate substantial investment in earthquake-resistant structures, especially for high-rise residential and commercial developments. Government spending on critical infrastructure resilience, particularly in energy and transportation sectors, sustains robust market growth, making APAC the global hub for both consumption and manufacturing of seismic support devices.

- North America: North America represents a mature market, with growth primarily driven by the mandatory retrofitting of aging infrastructure in high-risk zones, notably California, the Pacific Northwest, and certain areas of the Midwest. The market is characterized by high adoption rates of advanced base isolation and viscous damping technologies in critical facilities such as hospitals, data centers, and advanced manufacturing plants, where business continuity is non-negotiable. Stringent regulatory bodies and high insurance liability costs compel developers to utilize performance-based design, favoring premium, certified seismic support solutions. Retrofitting older bridge and highway structures to withstand higher magnitude earthquakes remains a critical and ongoing area of public investment, sustaining demand for complex, custom-engineered solutions.

- Europe: The European market, particularly Southern and Eastern Europe (Italy, Greece, Turkey), faces significant seismic risk, driving demand for specialized systems. The implementation of harmonized standards like Eurocode 8 provides a consistent regulatory framework, promoting the use of standardized damping and isolation devices. While new construction drives some market activity, a substantial portion of the demand originates from seismic retrofitting projects aimed at preserving historic and culturally significant structures, requiring specialized, low-impact installation techniques. European engineering firms are leaders in innovation concerning smart monitoring and structural health assessment technologies, often integrating these features into seismic support systems provided for international markets.

- Latin America (LATAM): LATAM is an emerging high-growth market, driven by rapidly developing economies and significant seismic risk across the Andean region (Chile, Peru, Ecuador). Governments are increasingly adopting more rigorous building codes, mirroring international standards, spurred by recent devastating earthquakes. Investment in mining infrastructure, energy pipelines, and new urban centers creates substantial demand. The market here is sensitive to cost, leading to a focus on cost-effective yet reliable solutions, such as high-damping rubber bearings and standard bracing systems, although high-value projects are increasingly turning to advanced isolation technologies to mitigate risk and attract foreign investment.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Seismic Support System Market.- Taylor Devices, Inc.

- Hilti Corporation

- GERB Group

- Kinemetrics Inc.

- Resistec

- FIP Industriale S.p.A.

- Enidine Incorporated

- RIX S.r.l.

- Seismic Isolation Systems, Inc. (SIS)

- THK Co., Ltd.

- MAURER SE

- Trelleborg AB

- Oiles Corporation

- Miyamoto International

- Earthquake Protection Systems (EPS)

- Sanwa Tekki Corporation

- A&P Engineers

- Dynamic Isolation Systems (DIS)

- Shanghai Tunghsing Industrial Co., Ltd.

- Ningbo Tiansheng Sealing Material Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Seismic Support System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary differences between seismic isolation and seismic damping systems?

Seismic isolation systems, such as base isolators, function by decoupling the structure from the ground motion, significantly extending the natural period of vibration so the structure moves minimally relative to the ground's rapid movement. This redirection of energy reduces forces transmitted to the building. Conversely, seismic damping systems, like viscous or metallic dampers, remain connected to the structure and function to absorb and dissipate the seismic energy entering the building, converting kinetic energy into heat. While isolation aims to prevent energy entry, damping focuses on efficiently removing energy already inside the structure; often, both are used together in a hybrid approach for optimal protection in critical facilities.

How do global seismic building codes impact market growth and technological adoption?

Global seismic building codes, such as the International Building Code (IBC) and Eurocode 8, are direct drivers of market growth as they legally mandate minimum levels of seismic resistance, especially for new construction and critical infrastructure. Stricter revisions to these codes, often triggered by major earthquake events, necessitate the use of advanced systems like base isolation or Buckling-Restrained Braces (BRBs) to meet higher performance objectives, such as "immediate occupancy." These regulatory requirements compel architects and engineers to adopt certified, technologically sophisticated support systems, ensuring continuous demand for innovative, compliant products and stimulating R&D investment within the industry to meet evolving safety standards.

What is the role of advanced materials in the performance enhancement of seismic support systems?

Advanced materials are fundamental to improving the durability and performance characteristics of seismic support systems. For instance, high-damping rubber and specialized lead-rubber compounds are essential for creating base isolation bearings that offer high vertical stiffness while allowing large horizontal displacement and providing re-centering capabilities. In dampers, the use of high-strength, ductile steel alloys prevents brittle failure in metallic yielding dampers, and stable, wide-temperature-range silicon fluids are critical for consistent energy dissipation in viscous dampers. Material science innovations directly translate to systems that are more reliable, require less maintenance, and deliver predictable performance under extreme, cyclic seismic loading conditions over decades of operational life.

Are seismic support systems cost-effective compared to traditional construction methods?

While the initial installation cost of advanced seismic support systems is generally higher than traditional fixed-base construction, they prove highly cost-effective over the structure's lifetime, especially in high-seismicity regions. The cost-effectiveness stems from two major factors: drastically reduced post-earthquake repair costs (often avoiding structural damage entirely) and minimized operational downtime for critical facilities (hospitals, data centers). Protecting expensive non-structural elements and ensuring business continuity yields substantial economic savings that far outweigh the upfront investment, providing superior insurance risk mitigation and demonstrating a strong commitment to resilience and long-term asset value preservation.

How is the integration of IoT and AI transforming the maintenance and monitoring of seismic systems?

The integration of IoT (Internet of Things) and AI is transforming seismic support systems from passive elements into smart, monitored assets. IoT sensors provide continuous, real-time data on structural health, ambient vibrations, and the operational status of isolators and dampers. AI/Machine Learning algorithms analyze this massive data stream to detect subtle changes indicative of system degradation or impending maintenance needs, enabling proactive, predictive maintenance rather than reactive repairs. This technology ensures the systems perform optimally when needed, extends their service life, and provides detailed performance reports required for regulatory compliance and insurance validation, significantly reducing long-term inspection and maintenance expenditures.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager