Self Propelled Sprayer Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440893 | Date : Feb, 2026 | Pages : 251 | Region : Global | Publisher : MRU

Self Propelled Sprayer Market Size

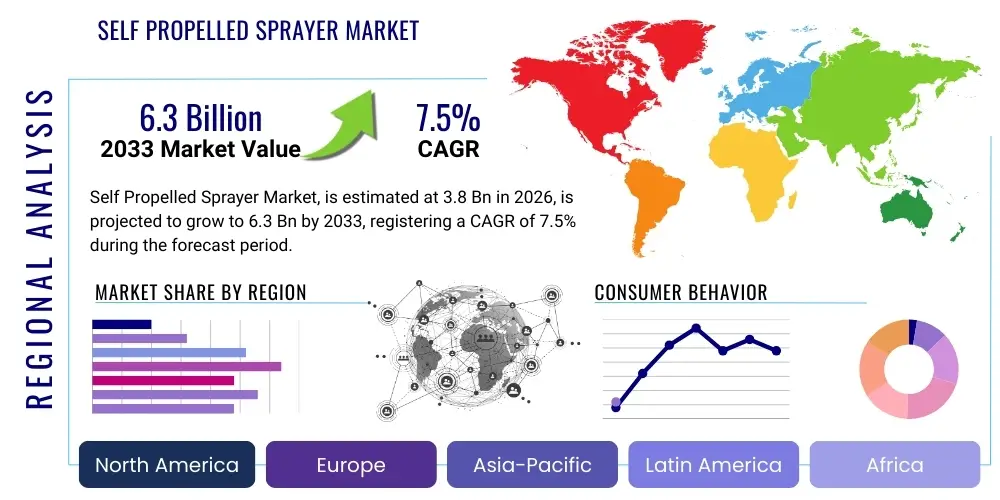

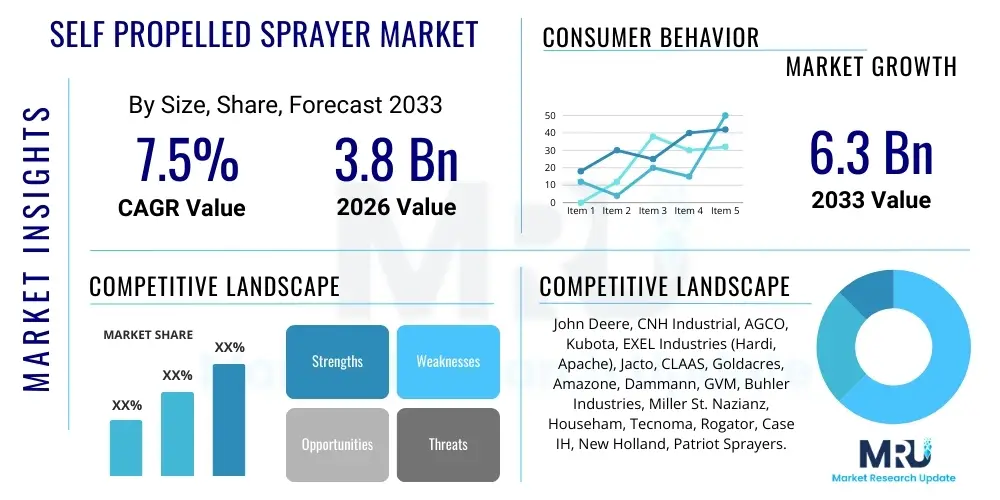

The Self Propelled Sprayer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 3.8 Billion in 2026 and is projected to reach USD 6.3 Billion by the end of the forecast period in 2033.

Self Propelled Sprayer Market introduction

The Self Propelled Sprayer Market encompasses specialized agricultural machinery designed for efficient and timely application of crop protection agents, fertilizers, and other liquid treatments. These high-clearance machines offer significant advantages over tractor-pulled sprayers, primarily due to their superior speed, maneuverability, and integration of advanced precision technologies. The core function of these vehicles is to maximize coverage while minimizing crop damage, thereby increasing overall farm productivity and optimizing input usage. The design emphasizes large capacity tanks, wide boom widths, and robust engine power necessary for covering vast tracts of land rapidly, particularly critical during narrow application windows dictated by weather and crop lifecycle.

Major applications of self propelled sprayers span large-scale commodity cropping operations, including corn, soybeans, wheat, and cotton, as well as specialized high-value crops where precise application is paramount. Key benefits driving adoption include enhanced operational efficiency, reduced labor costs due to higher work rates, and significant improvements in application accuracy through integrated GPS and section control systems. Furthermore, the ergonomic design and stability of modern sprayers contribute to reduced operator fatigue and improved safety standards compared to older machinery types. This machinery category is foundational to modern, intensive farming practices aiming for sustainable yield increases.

Driving factors propelling market growth include the escalating global demand for food, necessitating higher yields per acre, and the increasing focus on adopting precision agriculture techniques to comply with stringent environmental regulations concerning chemical usage. Government subsidies and favorable policies promoting farm mechanization in developing economies also play a pivotal role. The continuous introduction of technologically superior models featuring autonomous capabilities, advanced filtration systems, and enhanced chemical mixing technologies further stimulates replacement and expansion demand across key agricultural regions globally. These factors combine to solidify the self propelled sprayer as an indispensable asset in modern commercial agriculture.

Self Propelled Sprayer Market Executive Summary

The global Self Propelled Sprayer Market is witnessing robust expansion, driven primarily by the global imperative for increased food security and efficiency gains realized through mechanized farming. Business trends indicate a strong shift towards integration, where manufacturers are increasingly incorporating sophisticated telematics, cloud computing, and real-time data analytics into sprayer platforms, moving beyond mere machinery sales to offering integrated precision farming solutions. Consolidation among leading manufacturers and strategic partnerships with technology providers specializing in AI and geospatial data are defining the competitive landscape. Furthermore, heightened scrutiny on sustainability mandates the development of ultra-low drift nozzles and spot-spraying technologies, creating new market opportunities and necessitating significant R&D investment.

Regionally, North America and Europe remain mature but high-value markets, characterized by high adoption rates of advanced, large-capacity machines and immediate uptake of cutting-edge technology such as AI-powered vision systems for weed identification. The Asia Pacific (APAC) region, particularly China and India, presents the highest growth potential, fueled by government initiatives to modernize agriculture, rising farm labor costs, and increasing farm sizes. Latin America, specifically Brazil and Argentina, is critical due to its vast expanse of soybean and corn production, demonstrating high demand for powerful, durable sprayers capable of handling challenging terrains and intensive operational schedules. Market dynamics across all regions are influenced by commodity prices, farmer profitability, and access to financing for large capital equipment purchases.

Segment trends reveal that the market share dominance remains with large capacity sprayers (above 1200 gallons) and models equipped with wide boom widths (over 120 feet), reflecting the growing scale of commercial farming operations. The technological segmentation is heavily favoring Precision Agriculture/GPS-Enabled sprayers, which offer superior return on investment by reducing overlap and optimizing chemical use, thereby mitigating environmental risk. Demand is steadily rising for 4WD drive types due to their enhanced traction and stability, crucial for navigating varied field conditions and slopes. Crop protection remains the primary application, though the incorporation of variable rate technology (VRT) for precise fertilization application is a rapidly emerging segment driving new sales.

AI Impact Analysis on Self Propelled Sprayer Market

User queries regarding the impact of Artificial Intelligence (AI) on the Self Propelled Sprayer Market consistently revolve around four central themes: the feasibility and accuracy of real-time spot spraying, the potential for fully autonomous operation, the economic return on investment (ROI) derived from AI integration, and data privacy/security implications. Farmers and industry stakeholders are eager to understand how AI-driven vision systems can differentiate between crops, weeds, and bare ground instantaneously to reduce herbicide consumption dramatically—a core economic and environmental concern. There is also significant curiosity about the timeline for widespread adoption of level 4 and 5 autonomy in these large machines, addressing labor shortages and optimizing operational planning. Concerns often center on the complexity of maintaining these systems, the necessary infrastructure (connectivity), and the cost threshold for smaller farming operations.

AI technology is transitioning the self propelled sprayer from a simple application tool into an intelligent data collection and decision-making platform. AI algorithms are essential for processing the massive datasets generated by multi-spectral cameras and Lidar sensors mounted on the sprayer boom, enabling highly accurate real-time decisions regarding chemical disbursement. This cognitive capability allows for site-specific treatment on a plant-by-plant basis, a revolutionary shift from broadcast spraying. The integration of machine learning further refines application maps and forecasts optimal spraying windows based on predicted weather patterns and growth stage modeling, thereby maximizing the efficacy of inputs and minimizing waste.

The market anticipates that AI will unlock substantial operational efficiencies, particularly in chemical cost savings, which can represent a significant portion of a farm’s variable expenses. Furthermore, AI contributes significantly to sustainability goals by ensuring that only necessary amounts of chemicals are applied, reducing runoff and environmental exposure. This convergence of high technology, environmental stewardship, and economic viability is fundamentally reshaping the design requirements and market expectations for future generations of self propelled sprayers, positioning AI as the primary technological differentiator in the highly competitive sector.

- AI-driven vision systems enable ultra-precise, real-time spot spraying, reducing herbicide use by up to 80%.

- Machine learning optimizes field mapping and path planning, enhancing operational efficiency and fuel consumption.

- Predictive maintenance algorithms analyze component wear to minimize unexpected downtime during critical application windows.

- Facilitation of fully autonomous spraying operations, addressing farm labor scarcity and extending working hours.

- Enhanced data integration with farm management systems for improved regulatory compliance and documentation.

DRO & Impact Forces Of Self Propelled Sprayer Market

The Self Propelled Sprayer Market is governed by a dynamic interplay of factors that both accelerate and constrain its growth trajectory. Key drivers include the global necessity for higher agricultural productivity and the rapid adoption of precision farming technologies, which necessitate the accuracy and control offered by self propelled units. Restraints primarily involve the high initial capital investment required for these sophisticated machines, which can be prohibitive for small and medium-sized farmers, and the volatility in agricultural commodity prices that directly impacts farmer profitability and willingness to invest in new equipment. Opportunities are abundant, centered around the emerging market demand for autonomous sprayers, the expansion into specialized high-clearance applications (e.g., late-season crop treatments), and significant growth prospects in rapidly modernizing agricultural economies in the APAC region. These forces are collectively shaping investment strategies, R&D priorities, and regional market penetration efforts by key industry players.

Segmentation Analysis

The Self Propelled Sprayer Market is comprehensively segmented based on several critical operational and technological parameters, providing a detailed view of market demand and product specialization. Key segmentation categories include Capacity (reflecting farm size and operational scale), Boom Width (determining field coverage rates), Drive Type (influencing stability and maneuverability), Application (differentiating usage such as crop protection vs. fertilization), and Technology (distinguishing standard machines from those integrated with advanced precision features). Analyzing these segments reveals shifting preferences toward larger, more technologically advanced units that maximize efficiency and resource management, especially in developed agricultural economies. Understanding these segment dynamics is vital for manufacturers planning product development and marketing strategies.

- By Capacity:

- Small Capacity (Under 800 Gallons)

- Medium Capacity (800 – 1200 Gallons)

- Large Capacity (Above 1200 Gallons)

- By Boom Width:

- Narrow (60 – 90 Feet)

- Medium (90 – 120 Feet)

- Wide (Above 120 Feet)

- By Drive Type:

- 2WD (Two-Wheel Drive)

- 4WD (Four-Wheel Drive)

- By Application:

- Crop Protection (Herbicides, Insecticides, Fungicides)

- Fertilization (Liquid NPK)

- Liquid Manure and Slurry Application

- Other Specialized Applications

- By Technology:

- Standard Sprayers

- Precision Agriculture/GPS-Enabled Sprayers (Section Control, Variable Rate Technology, Telematics)

Value Chain Analysis For Self Propelled Sprayer Market

The value chain for the Self Propelled Sprayer Market is complex, beginning with the upstream supply of specialized components and culminating in after-sales support provided to end-users. The upstream segment involves critical suppliers providing high-performance engines (often Tier 4 compliant), advanced hydraulic systems, specialized high-clearance chassis components, and sophisticated electronic control units (ECUs), GPS systems, and proprietary sensors. Global suppliers dominate the engine and transmission markets, necessitating stable and diversified sourcing strategies for sprayer OEMs. Raw materials, primarily high-grade steel and composite materials for booms and tanks, are also a crucial upstream input, subject to commodity price fluctuations and logistical constraints.

The core manufacturing stage involves the assembly, integration of complex electronics, and extensive testing of the final machinery. Downstream activities focus heavily on sales, distribution, financing, and maintenance. Due to the high value and technical complexity of self propelled sprayers, distribution channels are predominantly direct-to-dealer networks, characterized by specialized, authorized dealers capable of offering certified technical support and warranty services. Direct sales from OEM to large corporate farms or farm cooperatives also occur but represent a smaller volume compared to the established dealer model. After-market services, including spare parts supply, software updates, and advanced technical diagnostics, constitute a significant and high-margin component of the downstream value proposition, crucial for ensuring high operational uptime for farmers.

Distribution is predominantly characterized by an indirect approach through established global dealer networks, leveraged by major agricultural machinery conglomerates like John Deere and CNH Industrial. These dealers serve as crucial points of contact for sales, financing, and, most importantly, critical maintenance and technical support. Direct sales are rare but utilized for major fleet sales or governmental tenders. The efficiency of the distribution channel is heavily reliant on inventory management, parts availability, and the technical proficiency of dealer staff. This ensures that farmers receive localized expertise necessary to operate and maintain high-precision, electronically integrated equipment effectively, guaranteeing maximum field performance during peak seasons.

Self Propelled Sprayer Market Potential Customers

The primary consumers, or end-users, of self propelled sprayers are large-scale commercial farming enterprises and high-acreage farm cooperatives, where the machine’s efficiency benefits—high speed, large capacity, and wide coverage—provide the greatest economic advantage. These users typically manage thousands of acres and require equipment that guarantees minimal downtime during critical application windows, making the reliability and advanced technology of self propelled units essential. Secondly, professional custom applicators (contractors) constitute a major customer segment. These businesses purchase fleets of sprayers to provide spraying services to smaller farmers who cannot justify the substantial investment in their own high-end machinery. Custom applicators prioritize versatility, durability, and telematics capabilities for efficient fleet management and precise billing.

Geographically, potential customers are concentrated in regions with extensive arable land, such as the North American Great Plains, the Pampa region of South America, and large agricultural zones in Eastern Europe and Australia. Emerging markets are expanding their customer base to include medium-sized, progressively modernizing farms, particularly those transitioning from traditional or imported, smaller equipment to high-capacity domestic or international self propelled models to boost yields and comply with modern agricultural standards. Investment decisions are heavily influenced by the prevailing farm gate prices for commodity crops (like corn and soybeans), access to subsidized financing, and regulatory pressures demanding more accurate and environmentally sound chemical application methods.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.8 Billion |

| Market Forecast in 2033 | USD 6.3 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | John Deere, CNH Industrial, AGCO, Kubota, EXEL Industries (Hardi, Apache), Jacto, CLAAS, Goldacres, Amazone, Dammann, GVM, Buhler Industries, Miller St. Nazianz, Househam, Tecnoma, Rogator, Case IH, New Holland, Patriot Sprayers. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Self Propelled Sprayer Market Key Technology Landscape

The technological landscape of the Self Propelled Sprayer Market is defined by the pervasive integration of digital agriculture tools aimed at maximizing input efficiency and minimizing environmental impact. Central to this evolution is the deployment of Global Positioning System (GPS) technology, which enables high-precision steering (auto-steer) and automatic boom section control. Auto-steer reduces operator fatigue and ensures precise, repeatable passes, while section control minimizes overlapping application on headlands and irregular fields, achieving significant cost savings on chemicals. The maturity of GPS technology has made it a standard feature, paving the way for more complex, integrated systems.

Variable Rate Technology (VRT) is another foundational element, allowing farmers to adjust the application rate of chemicals or fertilizers dynamically based on pre-loaded prescription maps derived from yield data, soil sensors, or aerial imagery. This level of customization ensures that nutrients and protection agents are only applied where needed, addressing spatial variability within a field. Furthermore, advanced nozzle control systems, such as Pulse Width Modulation (PWM), are gaining traction. PWM systems maintain a consistent droplet size and pressure regardless of travel speed, thereby improving coverage quality and reducing spray drift, a critical factor for regulatory compliance and effectiveness.

The most transformative technologies currently being adopted involve artificial intelligence and machine vision. These AI-powered systems utilize high-resolution cameras and deep learning algorithms to instantaneously identify and differentiate specific weeds from crops. This capability facilitates "See & Spray" or spot spraying technology, which only activates nozzles directly over the targeted weed. This innovation promises drastic reductions in herbicide consumption, pushing the boundaries of chemical efficiency. Finally, telematics and IoT connectivity allow for remote monitoring, diagnostic checks, and real-time data flow to farm management software, enabling superior fleet management and performance tracking across large commercial operations.

Regional Highlights

- North America: This region holds a significant market share, characterized by the adoption of large, high-capacity sprayers (above 1200 gallons) equipped with the latest precision agriculture technologies. The U.S. and Canada benefit from extensive commodity crop acreage, established dealer networks, and high capital availability, fostering rapid uptake of AI-driven spot spraying and autonomous solutions. The emphasis here is on labor efficiency and maximizing cost savings on expensive inputs.

- Europe: The European market is highly mature and driven by stringent environmental regulations, particularly concerning chemical application and drift reduction (e.g., EU Green Deal). This mandates rapid adoption of technologies like PWM and advanced section control. Demand is strong for high-clearance machines and models offering superior stability and lower compaction due to diverse crop types and smaller field sizes compared to North America. Germany, France, and the UK are key markets.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, fueled by agricultural modernization programs in China, India, and Southeast Asia. The transition from manual labor to mechanized spraying, coupled with governmental support for precision farming, drives demand. While smaller to medium capacity sprayers are initially popular, the increasing trend of consolidation and corporate farming is accelerating the demand for larger, more efficient self propelled units.

- Latin America: Dominated by major agricultural powerhouses like Brazil and Argentina, this region is a massive consumer of self propelled sprayers due to vast sugarcane, soybean, and corn production. The market demands robust, powerful machines capable of handling challenging operational conditions and long hours, focusing heavily on durability and high operational speeds. The integration of high-level telematics for remote management across huge farms is critical here.

- Middle East and Africa (MEA): This region represents an emerging market segment, with growth concentrated in technologically advanced agricultural economies like South Africa and parts of the UAE. Market penetration is slower due to fragmented farming structures and economic constraints, but increasing foreign investment in large-scale commercial farming is gradually fueling demand for efficient spraying solutions, focusing initially on standard, durable models.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Self Propelled Sprayer Market.- John Deere

- CNH Industrial (Case IH, New Holland)

- AGCO Corporation (Challenger, RoGator)

- Kubota Corporation

- EXEL Industries (Hardi, Apache)

- Jacto

- CLAAS KGaA mbH

- Goldacres

- Amazone-Werke H. Schöttler GmbH & Co. KG

- Dammann GmbH

- GVM Inc.

- Buhler Industries Inc.

- Miller St. Nazianz, Inc.

- Househam Sprayers Ltd.

- Tecnoma

- Merlo S.p.A.

- TeeJet Technologies

- Raven Industries, Inc.

- Precision Planting (A brand of Agco)

- Capstan Ag Systems, Inc.

Frequently Asked Questions

Analyze common user questions about the Self Propelled Sprayer market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the shift towards high-capacity self propelled sprayers?

The primary driver is the need for increased operational efficiency on large-scale commercial farms. High-capacity sprayers allow farmers to cover more acres per day, especially during narrow weather windows, optimizing labor and ensuring timely chemical application.

How is precision agriculture technology integrated into modern sprayers?

Precision agriculture integration involves GPS for auto-steering and section control, Variable Rate Technology (VRT) for application adjustment, and increasingly, AI-powered camera systems for real-time spot spraying, maximizing input efficiency.

What are the main advantages of a self propelled unit over a trailed sprayer?

Self propelled sprayers offer superior ground clearance, reducing crop damage; better maneuverability and higher operational speeds; and integrated high-level technology platforms essential for advanced precision farming practices.

Which regions exhibit the highest growth potential for this market?

The Asia Pacific (APAC) region, driven by rapid agricultural modernization in countries like China and India, shows the highest compound annual growth rate potential, followed closely by Latin America, due to extensive commodity production.

How does AI technology affect chemical consumption in spraying operations?

AI significantly reduces chemical consumption by enabling spot spraying (See & Spray), where machine vision identifies individual weeds, activating nozzles only directly over the target, leading to substantial savings (often 60% or more) compared to traditional broadcast methods.

The extensive analysis of the global Self Propelled Sprayer Market underscores its vital role in sustaining global food production demands through efficiency and precision. The market’s future is intrinsically linked to the continuous evolution of precision agriculture technologies, especially the maturation and widespread adoption of autonomous and AI-driven systems. Manufacturers are strategically positioning themselves to meet regulatory demands for sustainable farming while delivering equipment that guarantees superior throughput and reduced operational costs for large-scale agricultural enterprises worldwide. The shift towards higher-capacity machines, wider booms, and comprehensive data integration services confirms the trajectory toward fully digitized and automated field operations. Regional dynamics clearly show a dichotomy: established markets prioritize technological sophistication and regulatory compliance, while emerging economies focus on basic mechanization coupled with scalable efficiency improvements. This technological arms race, driven by competitive pressures and farmer demand for measurable ROI, will continue to define the innovation cycle, focusing heavily on minimizing input waste, optimizing labor utilization, and enhancing environmental stewardship across diverse global farming landscapes. The increasing sophistication of telematics and diagnostic capabilities ensures that these complex machines maintain maximum uptime, translating directly into enhanced profitability for the end-user. As connectivity infrastructure improves globally, especially in rural areas, the utility and value proposition of data-driven sprayers will only amplify, cementing their status as cornerstone assets in modern commercial agriculture.

Further examination into the capacity segment reveals distinct purchasing patterns. The Large Capacity segment (Above 1200 Gallons) dominates in North America and Latin America, where immense fields necessitate fewer fills and maximum efficiency per hour. These large units often incorporate advanced hydraulic boom suspension systems and high-horsepower engines to maintain speed and stability over rough terrain. Conversely, in certain parts of Europe and rapidly developing Asian markets, the Medium Capacity segment (800 – 1200 Gallons) offers a better balance between cost, maneuverability, and output, especially in fields constrained by infrastructure or smaller average sizes. The Small Capacity segment (Under 800 Gallons) finds niche applications in specialized farming operations, smaller corporate farms, or as supplementary machines for quick, targeted spraying tasks, though their overall market share is gradually eroding as global farm sizes continue to consolidate. Manufacturers are focusing their R&D budget heavily on improving the efficiency and robustness of components for the large-capacity segment, recognizing the economic value derived from covering extensive acreage efficiently.

In terms of Boom Width, the trend mirrors capacity segmentation. The Wide (Above 120 Feet) and Medium (90 – 120 Feet) categories are experiencing accelerated adoption. Modern composite materials and advanced truss designs allow for these extreme widths without compromising structural integrity or stability during high-speed travel. Wide booms drastically reduce the number of passes required across a field, which directly cuts down on fuel consumption, labor costs, and, critically, wheel traffic damage to crops. Wheel traffic is a major concern for yield reduction, making wider booms highly desirable. Narrow booms (60 – 90 Feet) are becoming increasingly relegated to specialty crops, smaller farms, or regions with significant topographical variations where narrower equipment ensures safety and handling. The focus on wider booms pushes manufacturers to innovate in areas such as auto-leveling mechanisms and independent boom wing control to ensure uniform spray distribution across the entire span, compensating for field undulations and minimizing environmental drift risks.

The segmentation by Drive Type clearly favors the 4WD (Four-Wheel Drive) configuration globally. While 2WD models offer lower initial costs and satisfactory performance in dry, level conditions, the enhanced traction, stability, and superior pulling power of 4WD systems are invaluable across varied field conditions, steep slopes, and particularly wet or soft ground. This resilience ensures that farmers can maintain spraying schedules even when conditions are suboptimal, a critical factor for timely crop protection. Furthermore, 4WD platforms are typically required for the heavier, larger-capacity sprayers that are becoming the industry standard. This technological preference contributes to higher manufacturing complexity and cost but is justified by improved operational flexibility and reduced risk of field delays or equipment immobilization. The continuous improvement in electronic control units managing the 4WD systems further enhances fuel efficiency and minimizes unnecessary wear on the drivetrain.

Analyzing the Application segmentation confirms Crop Protection—which includes the application of herbicides, fungicides, and insecticides—as the dominant usage area for self propelled sprayers. Given the increasing complexity of pest and disease management and the high cost of crop losses, accurate and timely protection is paramount. However, the use of these sprayers for Fertilization, specifically liquid NPK, is a rapidly growing secondary application. VRT, when applied to fertilization, allows farmers to precisely manage nutrient delivery based on soil test results and plant health maps, significantly improving nutrient uptake efficiency and reducing fertilizer waste. This segment’s growth is fueled by rising fertilizer costs and mounting environmental pressure to minimize nutrient runoff. Specialized applications, such as the localized spreading of liquid manure or slurry in certain markets, require specific machine modifications (e.g., heavy-duty pumps and specialized injectors) but represent a smaller, high-value niche.

The Technology segmentation differentiates between Standard Sprayers, which rely on basic rate controllers and manual operation, and Precision Agriculture/GPS-Enabled Sprayers. The latter category, encompassing integrated features like GPS auto-steer, automated section control, advanced telematics, and VRT, is the primary source of market growth and technological differentiation. The clear economic advantages—reduced input costs, less overlap, and higher yields—make the adoption of precision technology an imperative for commercial operations. This demand dictates that manufacturers prioritize software development, sensor integration, and data management capabilities, effectively positioning the sprayer as a complex hardware-software solution. The future trajectory suggests that "Standard Sprayers" will become increasingly obsolete, as even entry-level models incorporate basic GPS functionality to remain competitive.

The strategic dynamics within the Key Technology Landscape are pushing towards comprehensive data ecosystems. Beyond individual machine functionalities, manufacturers are heavily investing in proprietary Farm Management Systems (FMS) that seamlessly communicate with the sprayer’s onboard computer. This allows farmers and agronomists to remotely upload prescription maps, monitor application quality in real-time, and download post-application reports for regulatory documentation and performance analysis. This integration creates a closed-loop system, where data collected by the sprayer (e.g., yield data or sensor readings) informs the next season’s application strategy, maximizing continuous improvement. The reliability and interoperability of these FMS platforms are becoming crucial differentiators in purchasing decisions, influencing which OEM a farmer chooses for their high-value equipment investment.

Furthermore, the development of robust telematics is integral to the value proposition. Telematics systems provide preventative diagnostics, alerting dealer service teams and farmers to potential mechanical failures before they lead to critical downtime—a non-negotiable requirement during short spraying seasons. Remote diagnostics also allow technicians to troubleshoot and potentially resolve software issues without a physical farm visit, significantly improving responsiveness and reducing maintenance costs. The transition to cloud-based data storage and processing is essential for handling the large volumes of geospatial and operational data generated by advanced sprayers. Security protocols protecting this proprietary farm data are also becoming a core focus for OEMs, addressing farmer concerns about data ownership and potential breaches of sensitive agricultural information.

Innovation in boom material science is also significant. To accommodate the demand for wider booms, manufacturers are exploring lightweight yet strong materials, including carbon fiber and high-tensile aluminum alloys, which reduce the overall weight of the machine and minimize soil compaction. Reducing machine weight is a continuous design objective across the industry, balancing the need for large tank capacity with the imperative to limit field damage. Simultaneously, advancements in nozzle technology, specifically the design of air-induction and anti-drift nozzles, are paramount for compliance with environmental mandates. These specialized nozzles ensure that chemical droplets are large enough to resist wind shear, yet small enough for effective target coverage, solving a critical operational dilemma and ensuring regulatory acceptance in highly scrutinized markets like Europe.

The future technology outlook is dominated by autonomy. While current solutions typically involve Level 2 or Level 3 autonomy (requiring operator oversight), the goal of manufacturers is to achieve Level 4 and 5 autonomy, where the sprayer can operate independently across the entire field. This transition requires overcoming significant regulatory hurdles, perfecting sensor fusion technologies (combining radar, LiDAR, and camera inputs for obstacle avoidance), and ensuring robust, uninterrupted connectivity. Companies are beginning trials with smaller, fleet-based autonomous units that work synchronously, potentially revolutionizing the economics of large-scale farming by completely eliminating the need for in-cab operators and extending the operational window beyond traditional labor constraints.

Considering the regional market dynamics in depth, the North American market demonstrates the highest willingness to pay for cutting-edge features. This is supported by high farmer profitability, robust financial markets, and access to specialized dealer financing for large capital purchases. The competitive environment here is intense, dominated by giants like John Deere and CNH Industrial, who continuously push the envelope in integrating digital and hardware solutions. The market trend is leaning towards full connectivity, allowing for instantaneous communication between the sprayer, the farm office, and the agronomist, maximizing prescriptive application accuracy and ensuring regulatory adherence through automated record-keeping.

In Europe, the emphasis on sustainability and traceability is translating directly into purchasing criteria. European farmers demand machines that offer documented evidence of precise application, minimal drift, and adherence to strict EU chemical usage limits. This has led to strong market preference for advanced systems like individual nozzle control and variable rate technology that can be rigorously monitored and audited. Furthermore, the structural heterogeneity of European farms—ranging from large corporate holdings in Eastern Europe to smaller, specialized farms in the West—requires OEMs to offer a broader range of models in terms of capacity and boom width compared to the uniformity often seen in the North American market.

Latin America, particularly Brazil, faces unique challenges due to vast field sizes, high operational temperatures, and often less developed rural infrastructure compared to North America. Sprayers deployed here must be exceptionally durable, capable of long operational cycles, and resistant to harsh environments. Telematics is especially valued for remote monitoring in this region, as farms can be thousands of miles from the nearest dealer support center. The market growth is closely tied to the expansion of commodity crop planting areas and high global prices for soybeans and corn, which underpin farmer confidence and capital investment decisions. Local manufacturing and assembly in Brazil also play a significant role in mitigating import costs and duties.

The high growth trajectory of the Asia Pacific market is primarily driven by government initiatives promoting farm mechanization and addressing rapidly rising rural labor costs. While initial adoption focuses on basic self propelled units replacing tractor-towed models, there is a swift leapfrogging effect toward precision technology. China is heavily investing in domestic production and technology, aiming to close the technological gap with Western competitors quickly. India’s large, though often fragmented, agricultural sector is gradually consolidating, creating a viable market for medium-capacity sprayers that can navigate diverse crop portfolios and infrastructure constraints. The key challenge in APAC remains affordable technology and localized after-sales support networks capable of maintaining sophisticated machinery.

The long-term outlook for the Self Propelled Sprayer Market is one of sustained, moderate growth, increasingly driven by technological necessity rather than purely capacity expansion. The value proposition of future sprayers will pivot from mere high speed and capacity to intelligent resource management, where the machine serves as the primary tool for implementing site-specific, AI-driven agronomic strategies. Investment in R&D focusing on energy efficiency (e.g., hybrid or electric drive trains), lighter materials, and seamless data integration will determine competitive success. Furthermore, manufacturers capable of offering comprehensive financing and long-term service contracts, reducing the total cost of ownership, will gain significant market traction, particularly among price-sensitive emerging market customers and custom application firms focused on maximizing fleet efficiency. The convergence of hardware manufacturing excellence with software intelligence is the defining characteristic of this dynamic market segment.

The competitive landscape among the top key players is characterized by continuous M&A activity and intense focus on internal technology development. Leading companies, such as John Deere and CNH Industrial, leverage their extensive global dealer networks, strong brand loyalty, and significant financial resources to dominate the high-end market segment. Their strategy focuses on creating proprietary, closed-loop ecosystems that encourage the purchase of complementary equipment and software services. Smaller, specialized manufacturers like EXEL Industries (Hardi) and Jacto often compete successfully by specializing in specific niches, such as boom stability, unique chemical handling systems, or by offering high-quality, mid-range equipment tailored for regional operational preferences. Technology providers like Raven Industries and TeeJet, although not primary sprayer manufacturers, play a crucial role by supplying the sophisticated control systems and components that enable precision agriculture features, often partnering closely with the major OEMs. This tiered competitive structure ensures ongoing innovation across all price points and complexity levels within the market.

Market sustainability is increasingly dependent on reducing regulatory friction and meeting global standards for chemical use. The industry is actively responding through the development of recirculating sprayers, which capture and reuse unused chemicals, and sophisticated cleanout systems that minimize cross-contamination and environmental discharge. These features, while adding complexity and cost, are rapidly becoming mandatory requirements in environmentally conscious regions. The market’s resilience through economic cycles is also noteworthy; while commodity price downturns can temporarily suppress new equipment sales, the enduring need for efficient, timely crop protection ensures a baseline demand for both new and used machinery, supported by a strong aftermarket for parts and service necessary to keep existing fleets operational during lean times. This operational criticality underpins the long-term stability and inherent value of the Self Propelled Sprayer Market within the broader agricultural machinery sector.

Furthermore, the long-term impact of regulatory harmonization, particularly concerning autonomous vehicle standards and data interoperability, will shape future market development. As countries establish clearer rules for the deployment of driverless agricultural vehicles, it will unlock significant investment opportunities. Similarly, industry efforts to standardize data formats (e.g., ISOXML) will reduce friction between different equipment brands and farm management software, enhancing the overall utility and value of the precision data generated by self propelled sprayers. Addressing these regulatory and technical standardization challenges is essential for accelerating the next phase of market evolution, ensuring that the benefits of high-precision spraying are accessible and scalable to a wider population of commercial farmers globally, ultimately contributing to more efficient and sustainable food production systems across the world.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager