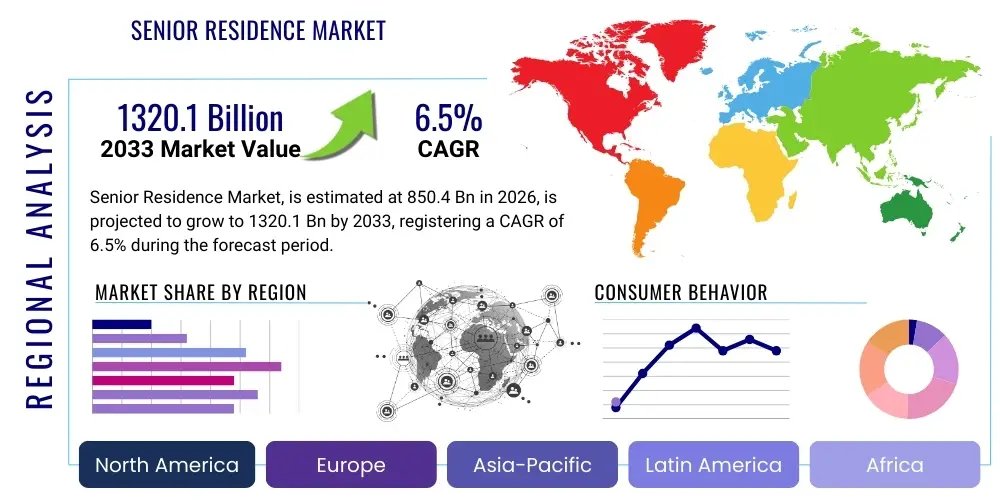

Senior Residence Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441399 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Senior Residence Market Size

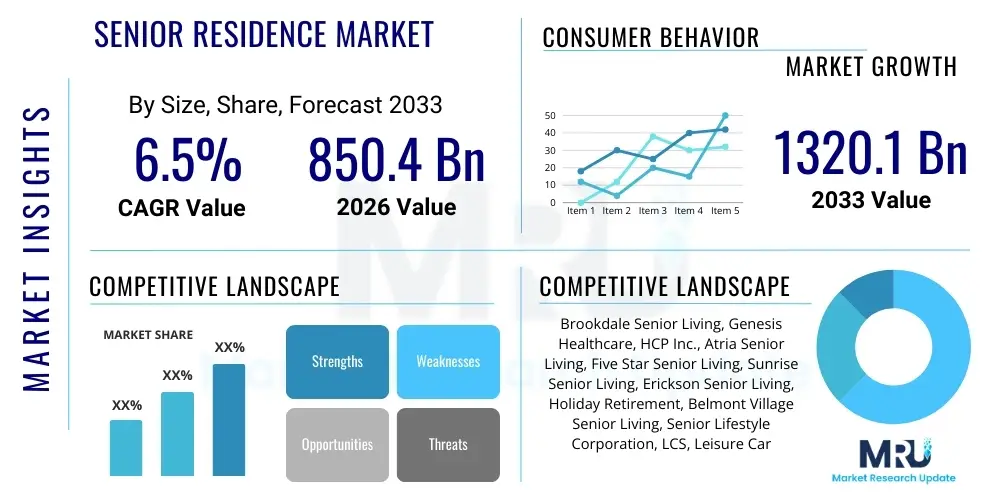

The Senior Residence Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 850.4 Billion in 2026 and is projected to reach USD 1320.1 Billion by the end of the forecast period in 2033.

Senior Residence Market introduction

The Senior Residence Market encompasses a diverse range of long-term care facilities and residential communities specifically designed for the elderly population, addressing varying needs from completely independent living to intensive skilled nursing care. These residences are essential infrastructure components in modern society, providing social engagement, medical oversight, and safety assurances that are often challenging to maintain in private homes as individuals age. Key product types include Independent Living Facilities (ILFs), Assisted Living Facilities (ALFs), Memory Care units, and Continuing Care Retirement Communities (CCRCs), which offer a continuum of care services, minimizing the need for relocation as health needs evolve. The growing emphasis on quality of life, personalized care models, and technological integration is fundamentally reshaping the service offerings within this domain.

Major applications of senior residences span social enrichment, medical management, rehabilitative services, and personal assistance with activities of daily living (ADLs). The primary benefit delivered by this market is the provision of a secure, supportive environment that promotes physical and mental wellness while alleviating the caregiving burden on families. Furthermore, senior residences frequently foster a strong sense of community, combating social isolation—a critical health concern for older adults. The quality of care and the scope of amenities offered, ranging from luxury dining and fitness centers to specialized clinical services, are major differentiators driving consumer preference in high-income regions.

The market expansion is robustly driven by demographic shifts, most notably the rapid aging of the global population, particularly the Baby Boomer generation entering retirement age. Increased life expectancy, coupled with reduced family sizes and greater geographical dispersion of families, amplifies the need for professional, structured senior care solutions. Economic driving factors include rising disposable incomes among the senior demographic and the increasing financial feasibility of long-term care insurance. These factors collectively create sustained demand for high-quality, specialized senior living options that prioritize both comfort and clinical excellence.

Senior Residence Market Executive Summary

The global Senior Residence Market demonstrates significant resilience and consistent growth, primarily fueled by unprecedented demographic tailwinds associated with aging populations across developed and increasingly developing nations. Current business trends indicate a strong move towards specialization and hybridization of services, with Continuing Care Retirement Communities (CCRCs) gaining prominence due to their integrated service model. Investment activity remains high, particularly in the acquisition and development of purpose-built facilities incorporating sophisticated wellness programs and advanced smart home technologies. Furthermore, there is a distinct business focus on improving staff retention and addressing labor shortages through automation and specialized training programs, recognizing that quality human capital is the core competitive advantage in this service-intensive industry.

Regional trends highlight North America and Europe as mature markets, characterized by high penetration rates and strong regulatory frameworks. These regions lead innovation in specialized care (e.g., Alzheimer’s and dementia care) and technological integration, focusing on enhancing resident safety and operational efficiencies. Conversely, the Asia Pacific (APAC) region is emerging as the fastest-growing market, driven by rapidly increasing urbanization, changing traditional family structures, and significant government investments aimed at building geriatric care infrastructure in countries like China, Japan, and India. Investment strategies are currently shifting towards mitigating regulatory risks and adapting service models to cultural expectations regarding elder care in different global regions.

Segment trends reveal that the Assisted Living Facilities (ALFs) segment maintains the largest market share, driven by the balance it strikes between independence and necessary support services. However, the Memory Care segment is projected to experience the highest growth rate, reflecting the rising global prevalence of neurodegenerative diseases. From an ownership perspective, large corporate chains and private equity firms are consolidating market power, leveraging economies of scale to offer specialized services and higher-end amenities, consequently driving up the average quality and cost of premium senior housing globally. Technology integration is no longer optional but essential, defining the next wave of segment differentiation.

AI Impact Analysis on Senior Residence Market

User inquiries concerning the integration of Artificial Intelligence (AI) in the Senior Residence Market predominantly revolve around three critical areas: enhanced safety and predictive health monitoring, optimized operational efficiency, and the maintenance of a personalized, non-intrusive resident experience. Users frequently question how AI can move beyond simple alerts to provide genuine predictive analytics, such as foreseeing falls or rapidly deteriorating health conditions before they become critical events. A major underlying theme is the concern regarding data privacy and the ethical implications of using continuous surveillance technologies (often AI-powered) on vulnerable populations. Users expect AI to automate administrative and routine tasks, thereby allowing human caregivers to spend more quality time directly interacting with residents, enhancing the human element of care rather than replacing it. The expectation is for a seamless, symbiotic relationship between AI tools and human clinical judgment.

The operational impact of AI is profound, allowing senior residence providers to utilize sophisticated algorithms for tasks ranging from dynamic staffing schedule optimization based on predicted resident acuity levels to predictive maintenance of facility infrastructure, reducing unexpected downtime and associated costs. AI-driven systems are increasingly deployed to analyze large volumes of Electronic Health Record (EHR) data to identify complex health patterns indicative of emerging issues, moving the industry toward truly proactive healthcare. Furthermore, AI chatbots and virtual assistants are being adopted to manage resident requests, schedule appointments, and provide routine information, freeing up nursing and administrative staff for more complex duties. This strategic utilization of AI fundamentally shifts the labor dynamics and resource allocation within the facilities.

From a resident perspective, AI integration aims to empower independence. Smart home sensors and AI-driven monitoring systems discreetly track behavioral patterns related to sleep, activity, and nutrition. Deviation from baseline patterns triggers alerts to caregivers, ensuring rapid response without the need for constant physical checks, thereby preserving resident dignity and privacy. Advanced AI is also being used in personalized therapeutic interventions, such as cognitive stimulation programs tailored to individual memory care needs. The adoption of AI is therefore viewed not merely as a cost-saving mechanism, but as a crucial tool for delivering scalable, high-quality, and deeply individualized care in the face of escalating demand and resource constraints.

- AI-driven predictive health analytics to detect early signs of illness or deterioration (e.g., sepsis, UTIs).

- Optimization of staffing ratios and shift management based on real-time resident acuity and facility load.

- Implementation of AI-powered smart monitoring (fall detection, wander management) to enhance resident safety.

- Automation of administrative tasks, documentation, and billing processes to improve operational efficiency.

- Personalized therapeutic and cognitive engagement programs utilizing machine learning algorithms.

- Use of robotic companions and assistants for non-clinical tasks (e.g., fetching, companionship, reminding).

- Predictive maintenance schedules for building infrastructure and medical equipment using sensor data analysis.

DRO & Impact Forces Of Senior Residence Market

The dynamics of the Senior Residence Market are shaped by powerful Drivers, inherent Restraints, and significant Opportunities (DRO), all subject to various internal and external Impact Forces. The primary driver is the undeniable demographic tidal wave of the aging global population, which guarantees continuous demand regardless of short-term economic fluctuations. This is amplified by increased public awareness and acceptance of professional senior care, transitioning away from traditional reliance solely on family caregiving. However, the market faces acute restraints, dominated by severe skilled labor shortages (nurses, specialized aides) and the escalating costs associated with healthcare provision and compliance with increasingly rigorous regulatory standards. The high capital expenditure required for facility construction and maintenance also acts as a barrier to entry for new players, limiting competition and potentially inflating consumer costs.

Opportunities in this market center on technological innovation and market specialization. The successful integration of telehealth, remote patient monitoring (RPM), and sophisticated data analytics presents a major opportunity to enhance care quality while improving staff productivity. Furthermore, there is a rising demand for niche market segments, such as luxury senior housing, age-in-place technologies delivered within CCRC models, and culturally sensitive residences tailored to specific ethnic groups. Strategic partnerships between residence operators, technology firms, and healthcare systems are crucial for unlocking these opportunities, allowing providers to offer comprehensive, preventative wellness packages rather than solely reactive care.

Impact forces affecting the market include governmental policy shifts regarding Medicare/Medicaid reimbursements and long-term care insurance mandates, which directly influence financial viability. Economic volatility impacts consumer affordability and private investment flows into the sector. Social acceptance of AI and robotics in care delivery also acts as a powerful force, determining the speed of technological adoption. Ultimately, the market trajectory is dictated by the industry’s ability to manage escalating operational expenses and labor constraints while maintaining high standards of compassionate, safe, and personalized care, which requires sustained, proactive investment in workforce development and advanced infrastructure.

Segmentation Analysis

The Senior Residence Market is highly heterogeneous, categorized primarily by the level of care provided, the ownership structure, the resident’s payment mechanism, and the physical size and type of the facility. Segmentation by care type is critical as it directly correlates with staffing ratios, regulatory requirements, and pricing models, distinguishing high-acuity facilities like Skilled Nursing Facilities (SNFs) from lower-acuity Independent Living Facilities (ILFs). The market analysis relies heavily on these segmentations to understand differential growth rates and investment attractiveness across the continuum of elder care.

Analyzing the market based on ownership reveals a mix of For-Profit, Non-Profit, and Government-operated facilities, each having distinct financial mandates and service delivery approaches. For-profit residences, often backed by large corporate entities and private equity, prioritize efficiency and scalability, whereas non-profit organizations frequently focus on mission-driven, community-centric care. Geographical segmentation remains paramount, as regulatory environments, cultural preferences for elder care, and demographic profiles vary dramatically, necessitating region-specific operational strategies. The demand profile in North America for CCRCs is very different from the requirements for affordable institutional care in parts of Asia.

Furthermore, segmentation by service model allows for the detailed assessment of market gaps. For instance, the escalating demand for dedicated Memory Care units—a segment offering highly specialized security, environment, and staffing protocols for individuals with dementia—is a major focus area for expansion and specialized investment. The move toward hybrid models, where residences integrate sophisticated wellness centers and rehabilitation services, further highlights the increasing complexity and differentiation within the overall Senior Residence Market structure.

- By Residence Type:

- Independent Living Facilities (ILF)

- Assisted Living Facilities (ALF)

- Memory Care Facilities

- Skilled Nursing Facilities (SNF)

- Continuing Care Retirement Communities (CCRC)

- By Ownership:

- For-Profit Organizations

- Non-Profit Organizations

- Government/Public Entities

- By Payment Source:

- Private Pay

- Medicare/Medicaid

- Long-Term Care Insurance

- Veterans Affairs (VA) Benefits

- By Service Model:

- Standard Residential Care

- Integrated Wellness and Rehabilitation

- Short-Term Stays/Respite Care

Value Chain Analysis For Senior Residence Market

The value chain of the Senior Residence Market begins with upstream activities involving real estate acquisition and development, architectural design tailored for geriatric safety and accessibility, and sophisticated financing structures. Key upstream suppliers include construction companies, medical equipment manufacturers (e.g., mobility aids, patient monitoring systems), and specialized staffing agencies that source clinical and non-clinical personnel. The efficiency and cost-effectiveness of this upstream segment directly influence the initial capital expenditure and the long-term operational viability of the residence. Securing favorable real estate locations—near medical facilities and community amenities—is a critical upstream differentiator.

The core midstream activities involve the daily operations of the residence, which include professional management services, resident intake and assessment, customized care plan execution, food service, housekeeping, and social programming. This segment requires intensive coordination of clinical staff (nurses, therapists), administrative personnel, and support services. Technology platforms, particularly Electronic Health Records (EHRs) and facility management software, are crucial midstream tools that drive service efficiency and compliance adherence. Quality control in this stage is highly regulated and directly impacts resident satisfaction and regulatory ratings.

Downstream activities focus on the distribution channel, which is inherently direct-to-consumer. Senior residences market their services directly to potential residents, their families, and discharge planners from hospitals or rehabilitation centers. Referral networks, including geriatricians, social workers, and financial advisors, play a crucial indirect distribution role. Marketing efforts emphasize the quality of life, safety protocols, and medical services offered. Success in the downstream segment relies heavily on reputation management, transparent pricing, and maintaining high occupancy rates through effective community outreach and seamless resident transitions.

Senior Residence Market Potential Customers

The primary end-users and buyers in the Senior Residence Market are typically individuals aged 65 and older requiring assistance with daily living activities (ADLs) or specialized medical oversight, along with their immediate family members who often act as financial guarantors or decision-makers. The customer base is highly segmented based on the required acuity level, ranging from active retirees seeking social engagement and maintenance-free living (Independent Living) to individuals with severe cognitive decline or complex medical needs (Skilled Nursing and Memory Care). Financial capability is a major determinant, segmenting customers into private-pay residents, who demand higher amenities and luxury, versus those reliant on public funding sources like Medicare and Medicaid.

A significant demographic of potential customers are the 'sandwich generation' adult children who are actively seeking supportive, safe environments for their aging parents, viewing professional care as a necessary alternative to home-based caregiving that might compromise their own careers or well-being. These secondary buyers prioritize location, facility accreditation, staff-to-resident ratios, and emergency response capabilities. The decision-making process is often lengthy, involving emotional, financial, and logistical considerations, necessitating highly compassionate and informative sales and marketing approaches from residence providers.

Furthermore, acute care hospitals and rehabilitation centers serve as key referral sources, essentially functioning as institutional customers, particularly for short-term post-acute care or respite stays. These entities seek residences with strong clinical reputations and efficient discharge processes. The modern potential customer increasingly values technology integration, such as telehealth accessibility, advanced security features, and amenities that promote holistic wellness, indicating a shift toward purchasing high-value, comprehensive lifestyle solutions rather than just basic housing and care.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850.4 Billion |

| Market Forecast in 2033 | USD 1320.1 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Brookdale Senior Living, Genesis Healthcare, HCP Inc., Atria Senior Living, Five Star Senior Living, Sunrise Senior Living, Erickson Senior Living, Holiday Retirement, Belmont Village Senior Living, Senior Lifestyle Corporation, LCS, Leisure Care, Vi Senior Living, Chartwell Retirement Residences, Capital Senior Living, Revera Inc., Trilogy Health Services, SavaSeniorCare, Aegis Living, Prestige Senior Living. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Senior Residence Market Key Technology Landscape

The operational and clinical effectiveness of the Senior Residence Market is increasingly reliant on a sophisticated technology landscape designed to enhance resident safety, improve care delivery, and optimize facility management. Fundamental technologies include comprehensive Electronic Health Record (EHR) systems that centralize medical documentation, medication administration records (MAR), and care plan coordination, ensuring regulatory compliance and seamless information exchange between healthcare providers. Crucially, the deployment of robust Wi-Fi and secure internal communication platforms (e.g., VoIP, secure messaging) is necessary to support the high volume of data generated by monitoring devices and staff communications. These foundational technologies enable the integration of more advanced, specialized systems that differentiate modern senior living facilities.

Advanced patient monitoring technologies are pivotal, particularly passive monitoring systems utilizing ambient sensors, radar, or infrared cameras rather than wearable devices, thereby maintaining resident comfort and adherence. These systems, often bolstered by Artificial Intelligence (AI) and Machine Learning (ML), analyze patterns of movement, sleep, and respiration to detect subtle changes indicative of health distress, such as gait instability preceding a fall or changes in breathing patterns suggesting respiratory infection. Furthermore, telemedicine and virtual care platforms are expanding, allowing residents to consult with specialists remotely, significantly reducing transportation costs and the logistical burden associated with external medical appointments, particularly in skilled nursing settings.

Beyond clinical care, technology significantly impacts facility management. Automated building management systems (BMS) control HVAC, lighting, and security access, optimizing energy consumption and operational costs. Robotics are emerging in non-clinical roles, such as automated floor cleaning and food delivery assistance. Moreover, interactive digital engagement tools, including personalized tablets and specialized cognitive games, are utilized to combat isolation and stimulate cognitive function, directly addressing the holistic wellness mandate of contemporary senior residences. The strategic adoption of these technologies is transforming senior residences into smart, adaptive environments capable of providing high-quality, scalable care.

Regional Highlights

The Senior Residence Market exhibits distinct growth profiles and maturity levels across different geographic regions, heavily influenced by demographic trends, governmental healthcare policies, and cultural attitudes toward institutional elder care. North America, particularly the United States, represents the largest and most developed market, characterized by high penetration rates of Assisted Living and CCRCs. Growth here is driven by advanced clinical services, the presence of major industry players, and a willingness among affluent seniors to utilize private pay options for premium services. Innovations in specialized Memory Care and the integration of sophisticated tech platforms are typically pioneered in this region.

Europe holds the second-largest market share, demonstrating robust demand, particularly in Western European nations like Germany, the UK, and France, which possess highly mature welfare systems and aging populations. The European market tends to emphasize regulatory compliance, non-profit ownership models, and integration with public healthcare services. However, staffing limitations pose a major challenge across the continent, necessitating increased focus on technological solutions for labor efficiency.

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR) during the forecast period. This rapid expansion is primarily driven by the colossal aging populations in China and India, coupled with the erosion of traditional, multi-generational family care structures due to rapid urbanization. Governments in APAC are actively investing in building modern, Western-style senior care infrastructure, though the market remains highly fragmented and often requires models adapted to local cultural preferences regarding communal living and diet. Latin America, the Middle East, and Africa (MEA) remain nascent markets, with demand concentrated primarily in high-income urban centers, characterized by lower overall penetration but strong localized growth potential.

- North America (US and Canada): Market leader in luxury and tech integration; high private pay segment; intense focus on specialized post-acute and memory care services.

- Europe: Stable growth, mature markets in Western Europe; strong influence of public sector funding and stringent quality standards; increasing need for tech-enabled staffing solutions.

- Asia Pacific (APAC): Fastest-growing region; driven by China and India's rapid demographic shift; substantial opportunity for foreign direct investment in new facility development; balancing traditional expectations with modern care models.

- Latin America: Emerging market, concentrated in metropolitan areas (e.g., Brazil, Mexico); growth focused on middle and upper-middle-class segments seeking secure residential options.

- Middle East and Africa (MEA): Limited institutionalization of care; growth tied to high-net-worth individuals and expatriate communities; gradual governmental recognition of the need for specialized elder care infrastructure.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Senior Residence Market.- Brookdale Senior Living

- Genesis Healthcare

- HCP Inc. (now Healthpeak Properties)

- Atria Senior Living

- Five Star Senior Living

- Sunrise Senior Living

- Erickson Senior Living

- Holiday Retirement

- Belmont Village Senior Living

- Senior Lifestyle Corporation

- LCS (Life Care Services)

- Leisure Care

- Vi Senior Living (Classic Residence by Hyatt)

- Chartwell Retirement Residences

- Capital Senior Living

- Revera Inc.

- Trilogy Health Services

- SavaSeniorCare

- Aegis Living

- Prestige Senior Living

Frequently Asked Questions

Analyze common user questions about the Senior Residence market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Senior Residence Market?

The Senior Residence Market is projected to exhibit a steady Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033, driven primarily by favorable global demographic shifts toward an older population profile.

Which segment of the Senior Residence Market is expected to grow the fastest?

The Memory Care segment is anticipated to demonstrate the highest growth rate due to the rising global prevalence of Alzheimer's disease and other forms of dementia, necessitating highly specialized and secured residential care environments.

How is technology, specifically AI, impacting senior residence operations?

AI integration is crucial for enhancing operational efficiency and safety by enabling predictive maintenance, optimizing staff scheduling based on resident needs, and implementing sophisticated passive monitoring systems for early detection of health issues, thus facilitating proactive care.

What are the primary restraints affecting the growth of the Senior Residence Market?

The most significant restraints include persistent critical shortages of skilled clinical labor (nurses and aides), coupled with high capital expenditure requirements for developing and maintaining compliant, high-quality residential facilities.

Which geographical region dominates the Senior Residence Market in terms of revenue?

North America, particularly the United States, currently dominates the Senior Residence Market revenue, characterized by high penetration of various facility types, substantial private pay capacity, and advanced service integration, including Continuing Care Retirement Communities (CCRCs).

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager