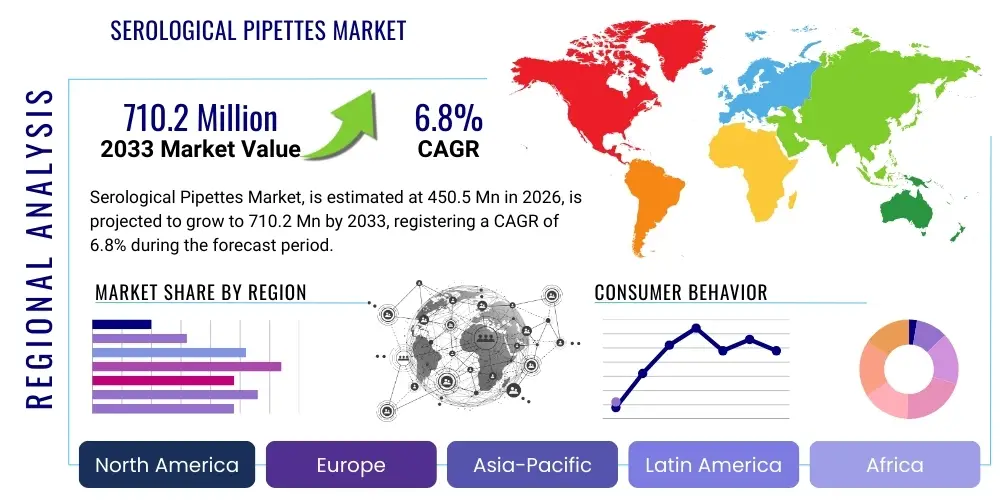

Serological Pipettes Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442371 | Date : Feb, 2026 | Pages : 243 | Region : Global | Publisher : MRU

Serological Pipettes Market Size

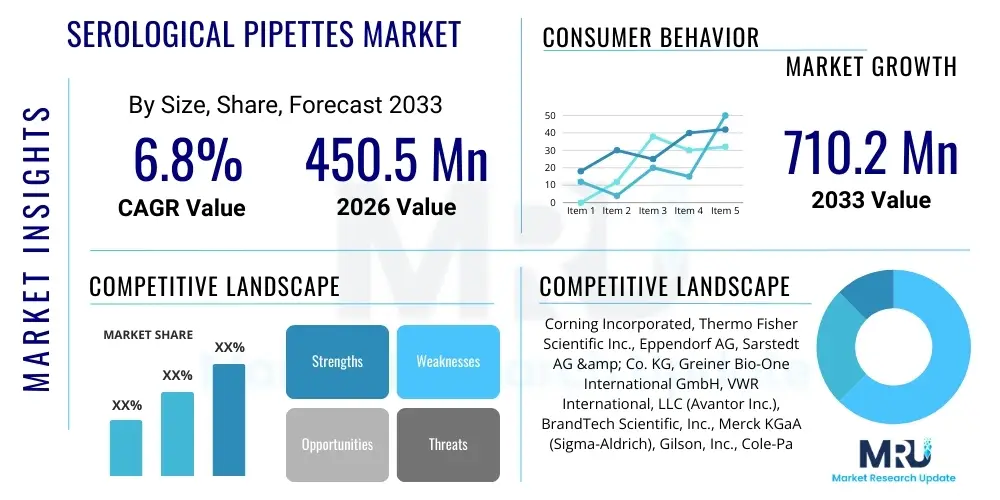

The Serological Pipettes Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 450.5 Million in 2026 and is projected to reach USD 710.2 Million by the end of the forecast period in 2033.

This steady expansion is primarily attributed to the relentless growth in global biological research activities, particularly in fields such as molecular biology, cell culture, and drug discovery and development. Serological pipettes, as indispensable tools for accurate liquid handling in sterile environments, benefit directly from increased funding for life sciences projects across academic, government, and commercial sectors. The rising prevalence of chronic and infectious diseases globally necessitates higher levels of diagnostic testing and pharmaceutical R&D, driving consistent demand for these essential laboratory consumables. Furthermore, advancements in biotechnology and genomics are leading to more complex assays and protocols, requiring precise, disposable liquid transfer instruments to maintain sample integrity and high throughput.

Market valuation reflects the widespread adoption of disposable, sterile polystyrene pipettes, which offer superior contamination control compared to reusable glass alternatives, thereby aligning with stringent regulatory requirements in clinical and pharmaceutical settings. The critical role of these devices in vaccine production and biomanufacturing facilities further solidifies their market trajectory. Manufacturers are focusing on ergonomic designs, improved graduation markings for enhanced accuracy, and specialized filter-plug technology to prevent overflow and cross-contamination, addressing key user requirements for safety and precision. Geographic expansion into emerging economies, where laboratory infrastructure is rapidly modernizing, also contributes significantly to the anticipated revenue growth throughout the forecast period.

Serological Pipettes Market introduction

The Serological Pipettes Market encompasses the manufacturing, distribution, and sale of specialized laboratory instruments designed for accurately transferring measured volumes of liquids, especially in sterile biological and chemical applications. These instruments are predominantly disposable, constructed typically from high-grade polystyrene, and feature clear graduation marks for volumetric accuracy, along with a cotton or synthetic plug barrier to prevent aerosol contamination of the pipetting device or the sample. Serological pipettes are foundational tools in life sciences, biotechnology, and clinical diagnostics, essential for tasks ranging from media addition to cell culture vessels, reagent preparation, solution mixing, and titrating biological samples.

Major applications span cell and tissue culture laboratories, where maintaining aseptic conditions is paramount; pharmaceutical research and manufacturing, especially in Quality Control (QC) and upstream process development; and academic research facilities focusing on genomics and proteomics. The primary benefits of using modern serological pipettes include enhanced sterility assurance (especially disposable, individually wrapped versions), high precision in volume measurement, reduced risk of cross-contamination (due to single-use design), and efficiency in handling large numbers of samples in high-throughput environments. These factors collectively contribute to reliable and reproducible experimental outcomes, which are critical for regulatory compliance and scientific integrity.

The market is primarily driven by the escalating demand for advanced diagnostics, the robust pipeline of biopharmaceutical products requiring stringent aseptic handling during R&D phases, and sustained global investment in healthcare infrastructure and fundamental biological research. Additionally, the increasing automation of laboratory workflows, although sometimes leveraging automated liquid handlers, still necessitates sterile, accurately calibrated consumables like serological pipettes for setting up automated platforms and manual pre-processing steps, ensuring sustained market momentum.

Serological Pipettes Market Executive Summary

The global Serological Pipettes Market exhibits robust growth, propelled by major business trends centered on automation compatibility, sustainability, and quality assurance in biological research. Key business trends include the shift towards bulk packaging and specialized low-retention tips compatible with automated liquid handling systems, catering to the efficiency demands of Contract Research Organizations (CROs) and large pharmaceutical companies. Manufacturers are increasingly focusing on vertical integration and stringent supply chain management to ensure the consistent availability of sterile, certified products, addressing the critical nature of these consumables in clinical and biomanufacturing settings. Strategic partnerships between pipette manufacturers and large laboratory distributors are crucial for penetrating niche markets and ensuring global reach, particularly as regulatory scrutiny on laboratory safety and compliance intensifies.

Regionally, North America remains the dominant market segment, characterized by high R&D spending, the presence of major biotechnology and pharmaceutical hubs, and advanced healthcare infrastructure driving immediate adoption of high-quality disposable consumables. Asia Pacific, however, is projected to record the highest growth rate, fueled by substantial government initiatives to boost domestic pharmaceutical production (e.g., in China and India), increasing foreign investment in APAC life sciences, and rapid expansion of clinical diagnostic capabilities. European markets maintain stability, driven by strict quality standards (ISO certification requirements) and significant investment in academic research centers, with a growing emphasis on green laboratory practices.

Segment-wise, the large volume capacity segment (10ml-25ml) holds a significant market share due to its frequent use in media preparation and bulk reagent transfer in cell culture laboratories. Conversely, the smaller volume segment (1ml-5ml) is experiencing rapid growth driven by specialized applications like PCR setup and micro-volume analytical chemistry. End-user trends show the Pharmaceutical & Biotechnology Companies segment as the largest consumer, reflecting the intensity of drug discovery efforts, while Academic & Research Institutes provide a stable, foundational demand base. Polystyrene remains the material of choice owing to its optical clarity, rigidity, and cost-effectiveness, although niche applications may utilize polypropylene for chemical resistance.

AI Impact Analysis on Serological Pipettes Market

User inquiries regarding AI's influence on the Serological Pipettes Market primarily revolve around two themes: optimization of inventory management and the future of manual liquid handling in automated labs. Users frequently ask if AI-driven forecasting tools can reduce waste by predicting precise pipette consumption rates based on experimental schedules and historical data. Another major concern is whether the integration of AI-powered robotic systems will completely phase out manual serological pipetting, leading to a decline in demand for traditional disposable products. The consensus derived from these questions suggests that while AI may not directly impact the physical design or function of the pipette itself, it profoundly influences the logistical and operational efficiency of labs that rely on them. Specifically, AI and Machine Learning (ML) are expected to enhance supply chain predictability, optimize purchasing decisions, and improve quality control by analyzing image data of pipette manufacturing processes, thereby ensuring consistency and reducing defects that could affect experimental integrity. However, due to the versatility, low cost, and necessity for manual interventions (e.g., setting up specialized culture plates or handling highly viscous liquids), serological pipettes are expected to remain critical, serving as necessary complements to automated systems, particularly in small-scale or rapid setup protocols.

- Enhanced Inventory Prediction: AI algorithms optimize stock levels for various pipette sizes, minimizing obsolescence and preventing critical shortages in high-throughput labs, leading to optimized procurement strategies.

- Manufacturing Quality Control: Machine vision systems utilizing AI detect minute flaws, inconsistencies in graduation markings, or filter plug defects during high-speed production, ensuring higher product quality and reduced batch variability.

- Automation Synergy: AI-driven scheduling optimizes the interplay between manual serological tasks (e.g., reagent staging) and subsequent robotic liquid handling, improving overall laboratory throughput and process flow management.

- Data Logging Integration: Serological pipetting, even when manual, can be integrated with laboratory information management systems (LIMS) using AI-enabled voice or visual recognition interfaces, improving documentation and reducing transcription errors associated with volume transfer records.

- Supply Chain Resilience: ML models forecast demand fluctuations based on global research funding cycles, pandemic responses, and specific drug discovery pipelines, allowing manufacturers to proactively adjust production capacity and distribution networks.

DRO & Impact Forces Of Serological Pipettes Market

The Serological Pipettes Market dynamics are shaped by a complex interplay of growth Drivers (D), constraining Restraints (R), and compelling Opportunities (O), which collectively exert significant Impact Forces. Key drivers include the exponential expansion of global biotechnology research, fueled by personalized medicine and gene therapy initiatives, necessitating continuous and precise sterile liquid transfer. The rising incidence of infectious diseases and chronic illnesses globally directly correlates with the need for expanded diagnostic capabilities, which heavily rely on serological techniques. Opportunities arise primarily from technological advancements, such such as the development of specialized low-binding materials and anti-static treatments to improve yield with sensitive biological samples, and the potential for expansion into emerging markets where research infrastructure is being modernized rapidly. However, these forces are tempered by restraints, particularly the increasing penetration of sophisticated automated liquid handling systems (which reduce the dependence on manual pipetting in extremely high-throughput settings) and concerns over plastic waste generation, pushing labs to seek more sustainable alternatives or reusable options, despite sterility concerns.

Drivers act as the primary engines for market expansion. The substantial increase in venture capital funding directed towards life science startups and the sustained governmental investment in public health infrastructure globally guarantee a robust, long-term demand for fundamental laboratory consumables like serological pipettes. Furthermore, the stringent quality and regulatory environment (e.g., GMP and GLP standards) often favor sterile, disposable, pre-calibrated pipettes over reusable glassware, minimizing the risks associated with cleaning and potential cross-contamination, particularly in highly sensitive clinical trials and biomanufacturing processes. This regulatory requirement for assured sterility is a powerful, non-negotiable factor sustaining market growth.

Restraints and opportunities represent the critical points of strategic focus for market participants. The high volume of plastic waste generated by disposable labware presents a significant environmental challenge, compelling manufacturers to invest in developing products made from recyclable or biodegradable polymers—a major opportunity for differentiation. Additionally, the constant pressure on research budgets, particularly in academic settings, necessitates competitive pricing, potentially impacting profit margins. Conversely, the opportunity to integrate advanced features such as clearer optical properties, error-reducing color-coding systems for volume identification, and compatibility with proprietary electronic pipette controllers provides avenues for premium pricing and market segment leadership, ensuring that specialized, high-accuracy products continue to capture significant value despite competition from generic alternatives.

Segmentation Analysis

The Serological Pipettes Market is comprehensively segmented based on key functional attributes and end-user deployment environments, providing a nuanced view of demand patterns and strategic market focuses. Analyzing the market through segmentation allows stakeholders to target specific niches defined by volume requirements, material performance, sterility demands, and operational context. The primary segmentation dimensions include the nominal volume capacity, the material used in construction, the intended usage environment (sterile vs. non-sterile), and the type of end-user institution. These divisions reveal that while basic polystyrene sterile pipettes for high-volume cell culture dominate the revenue, specialized low-volume, high-precision pipettes used in molecular diagnostics are driving the higher growth rates. Understanding these segment dynamics is crucial for tailored product development and effective market penetration strategies.

- By Volume Capacity:

- 1 ml to 5 ml

- 10 ml to 25 ml

- Greater than 25 ml (e.g., 50 ml, 100 ml)

- By Material:

- Polystyrene (PS)

- Polypropylene (PP)

- Glass (Minor segment, primarily reusable)

- Other Polymers

- By Usage:

- Sterile Serological Pipettes

- Non-Sterile Serological Pipettes

- By End-User:

- Pharmaceutical & Biotechnology Companies

- Academic & Research Institutes

- Hospitals & Diagnostic Laboratories

- Contract Research Organizations (CROs) and Contract Manufacturing Organizations (CMOs)

Value Chain Analysis For Serological Pipettes Market

The value chain for serological pipettes begins with upstream activities, primarily involving the procurement and processing of high-purity raw materials, predominantly medical-grade polystyrene resin. Key upstream dependencies include petrochemical suppliers who provide the feedstock necessary for polymer manufacturing. Quality control at this stage is critical, as the optical clarity, lack of cytotoxic leachables, and mechanical integrity of the plastic directly impact the pipette's performance in sensitive biological assays. Manufacturers invest heavily in securing reliable, certified resin supplies and employing specialized molding techniques (e.g., injection molding) to ensure precise volume calibration and a smooth inner surface, preventing liquid retention and maximizing accuracy, making the material science segment highly influential on downstream product quality and cost.

The midstream process involves the actual manufacturing, assembly (including filter plug insertion), sterilization (typically gamma irradiation or E-beam), and packaging, often performed in certified cleanroom environments (ISO Class 7 or 8). Distribution channels form the crucial link between production and end-users. Direct channels involve large manufacturers selling directly to major pharmaceutical companies or institutional purchasing groups, allowing for better margin control and specialized technical support. Indirect channels, which form the bulk of the market, rely on extensive networks of laboratory supply distributors (e.g., VWR, Avantor, Fisher Scientific) who handle warehousing, logistics, regional inventory management, and smaller volume deliveries to diverse academic and clinical clients globally. Distributors add significant value by consolidating orders for thousands of different laboratory products, offering convenience and regional compliance expertise.

Downstream activities center on end-user application and post-consumption waste management. End-users (e.g., research scientists, clinical technicians) determine product preference based on factors such as ergonomic comfort, volume range availability, and compatibility with their existing pipette controllers. The life cycle concludes with disposal, highlighting the growing pressure on manufacturers and end-users to adopt responsible waste streams, including autoclaving and specialized biohazard disposal protocols. The efficiency of the distribution channel is vital, as these consumables must be available immediately and reliably, particularly during high-demand periods like global health crises or large-scale research project ramp-ups, making logistics a significant competitive factor.

Serological Pipettes Market Potential Customers

The potential customers for serological pipettes are primarily institutions and organizations engaged in sterile liquid handling, biological experimentation, diagnostic testing, and pharmaceutical production. This market is highly diverse but concentrates heavily within the life science ecosystem, demanding single-use, high-precision products essential for maintaining aseptic environments. Key buyers are often laboratory managers, procurement departments within large research organizations, and principal investigators who require validated, certified consumables for their grant-funded projects. The purchasing decisions are usually based on a balance between cost-efficiency for high-volume consumption and the assurance of sterility and calibration accuracy necessary for critical applications like cell therapy manufacturing or virology research.

Pharmaceutical and Biotechnology Companies represent the largest and most commercially valuable customer segment. Their robust R&D pipelines, massive screening initiatives, and large-scale manufacturing operations necessitate millions of sterile pipettes annually for media preparation, dose-response studies, cell line maintenance, and quality control testing. These organizations prioritize long-term supply agreements, comprehensive quality documentation, and compatibility with advanced robotic systems. Academic and Research Institutes constitute the foundational customer base, driving steady demand across all volume segments for education, basic science experiments, and disease modeling. While often more price-sensitive than commercial entities, they require a broad range of specialized products to meet diverse experimental needs.

Hospitals and Diagnostic Laboratories, particularly those running high-throughput molecular or immunology tests (e.g., PCR testing, ELISA assays), are rapidly growing consumers, driven by the increasing volume of patient samples processed and the mandatory requirements for sterile, disposable materials to prevent patient cross-contamination and ensure regulatory compliance. Finally, Contract Research Organizations (CROs) and Contract Manufacturing Organizations (CMOs) represent a high-growth customer segment. As outsourcing in drug development increases, CROs require massive volumes of standardized, globally recognized serological pipettes to support diverse client projects efficiently and cost-effectively, acting as major consolidators of procurement across various therapeutic areas and geographic locations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Million |

| Market Forecast in 2033 | USD 710.2 Million |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Corning Incorporated, Thermo Fisher Scientific Inc., Eppendorf AG, Sarstedt AG & Co. KG, Greiner Bio-One International GmbH, VWR International, LLC (Avantor Inc.), BrandTech Scientific, Inc., Merck KGaA (Sigma-Aldrich), Gilson, Inc., Cole-Parmer Instrument Company, LLC, HiMedia Laboratories Pvt. Ltd., Kartell Labware, Simport Scientific, Argos Technologies, Tarsons Products Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Serological Pipettes Market Key Technology Landscape

The technology landscape for serological pipettes, while seemingly straightforward, is characterized by ongoing refinements focused on enhancing precision, contamination control, and user ergonomics. The primary technological advancements center on the manufacturing process of the pipette body itself, utilizing high-precision injection molding techniques that ensure highly uniform wall thickness and accurate volumetric calibration markings, crucial for reproducible scientific data. A significant technology is the implementation of advanced filter plug materials, typically proprietary synthetic fibers (e.g., polyolefin) treated to be non-cytotoxic and hydrophobic. These plugs act as highly effective aerosol barriers, preventing liquid overflow into the pipetting device or cross-contamination between samples, a vital feature for working with infectious agents or sensitive cell lines. Furthermore, anti-static treatments are increasingly applied to polystyrene surfaces to mitigate electrostatic charge buildup, which can cause erratic liquid dispensing or adherence of minute volumes, thereby improving dispensing accuracy for smaller volume transfers.

Another crucial technological element is the integration of color-coding systems. Standardized color-coding corresponding to specific pipette volumes allows users to quickly identify the correct size, minimizing setup errors, which is particularly beneficial in fast-paced or high-throughput laboratory environments. Packaging technology is also evolving, with multi-packs being increasingly replaced by individually wrapped, peel-pack sterile packaging that maintains the highest level of assurance against contamination until the point of use. This focus on verifiable sterility is supported by advanced sterilization technologies, primarily validated gamma irradiation processes, with clear documentation that meets global regulatory requirements for medical devices and laboratory consumables.

The peripheral technology landscape includes the design and functionality of electronic pipette controllers, which are not the pipettes themselves but are intrinsically linked to their use. Modern controllers feature intuitive interfaces, variable speed settings for handling liquids of differing viscosities, and rechargeable, long-life batteries, enhancing user comfort and reducing strain during extended pipetting sessions. Compatibility between these controllers and various brands of serological pipettes is a key purchasing factor. Moreover, there is an emerging trend toward incorporating IoT and smart laboratory technology, where unique identifiers on pipette packaging could potentially link usage data directly to LIMS, enhancing traceability and compliance documentation without relying solely on manual input, streamlining laboratory auditing processes.

Regional Highlights

- North America (USA, Canada): This region holds the largest market share globally, driven by massive and consistent investments in pharmaceutical R&D, particularly in biotech sectors focusing on cell and gene therapies and oncology. The presence of world-leading universities, a sophisticated clinical diagnostics infrastructure, and supportive governmental policies favoring healthcare innovation ensures sustained demand for high-quality, sterile serological pipettes. Strict FDA regulations and high quality expectations necessitate the use of certified, single-use products, boosting revenue for premium brands. The USA, in particular, acts as a primary hub for technological innovation and early product adoption.

- Europe (Germany, UK, France, Italy, Spain): Europe represents the second-largest market, characterized by stringent EU regulatory standards (e.g., CE marking) and a strong emphasis on academic and public health research. Countries like Germany possess robust biomanufacturing sectors, driving high consumption rates for bulk sterile consumables. The market here is mature, focusing heavily on sustainability initiatives, leading to increased interest in manufacturers offering optimized packaging or viable alternatives to traditional polystyrene, reflecting a broader regional commitment to environmental responsibility in laboratory practices.

- Asia Pacific (APAC) (China, India, Japan, South Korea): APAC is projected to be the fastest-growing region during the forecast period. This rapid growth is underpinned by escalating governmental funding for indigenous pharmaceutical manufacturing, the proliferation of Contract Research Organizations (CROs), and significant expansion of clinical laboratory networks across highly populated nations like China and India. Increasing foreign direct investment into the life sciences ecosystem, coupled with rising awareness of advanced laboratory protocols and quality control standards, drives demand for reliable, internationally compliant serological pipettes, positioning this region as the major future revenue contributor.

- Latin America (Brazil, Mexico, Argentina): The Latin American market exhibits steady growth, primarily fueled by improvements in national healthcare spending and the expansion of domestic pharmaceutical production capacity, aiming to reduce reliance on imports. Market growth is often challenged by economic volatility and complex logistics, but demand remains robust within major metropolitan research centers and centralized hospital laboratories, particularly for basic diagnostic and academic research applications, with procurement often focused on cost-effective bulk supplies.

- Middle East and Africa (MEA) (GCC Countries, South Africa): MEA is an emerging market segment where growth is geographically localized, centered heavily around the GCC countries (UAE, Saudi Arabia) which are strategically investing in developing advanced biomedical research and clinical testing capabilities. South Africa also serves as a key regional research hub. Demand is driven by governmental diversification efforts away from oil economies, focusing on building high-standard healthcare infrastructure and specialized research parks, requiring consistent supply of high-grade laboratory consumables.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Serological Pipettes Market.- Corning Incorporated

- Thermo Fisher Scientific Inc.

- Eppendorf AG

- Sarstedt AG & Co. KG

- Greiner Bio-One International GmbH

- VWR International, LLC (Avantor Inc.)

- BrandTech Scientific, Inc.

- Merck KGaA (Sigma-Aldrich)

- Gilson, Inc.

- Cole-Parmer Instrument Company, LLC

- HiMedia Laboratories Pvt. Ltd.

- Kartell Labware

- Simport Scientific

- Argos Technologies

- Tarsons Products Ltd.

- SPL Life Sciences

- Integra Biosciences AG

- Biotech-IgG

- Starlab International GmbH

- Mettler-Toledo International Inc.

Frequently Asked Questions

Analyze common user questions about the Serological Pipettes market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Serological Pipettes Market?

Market growth is predominantly driven by the surging global investment in biopharmaceutical research and development, particularly in advanced therapies like cell and gene therapy, which require extremely high standards of sterile liquid handling. Additionally, the increasing volume of diagnostic testing worldwide and the rapid expansion of life science infrastructure in emerging economies are critical growth catalysts. Regulatory mandates favoring certified disposable consumables over reusable options further ensure consistent demand across clinical and research settings.

How do automated liquid handling systems impact the demand for traditional serological pipettes?

While automated systems handle highly repetitive, high-throughput tasks, they do not eliminate the need for serological pipettes; rather, they redefine it. Serological pipettes remain essential for preparatory steps, handling unique or viscous media, smaller batch experiments, and tasks where complex manual dexterity is required. Consequently, automated systems restrain the high-volume manual market growth but increase demand for automation-compatible serological products used in feeder workflows, ensuring their sustained relevance.

Which material segment dominates the Serological Pipettes Market, and why?

Polystyrene (PS) dominates the market material segment. PS is favored due to its excellent optical clarity, rigidity for precision handling, cost-effectiveness in mass production, and ability to be easily sterilized (typically via irradiation). Polystyrene pipettes meet the high demands of cell culture and molecular biology for sterile, non-cytotoxic liquid transfer, making them the standard choice across academic, pharmaceutical, and diagnostic laboratories globally.

What key technological advancements are improving the performance of serological pipettes?

Key technological improvements focus on precision and contamination control. These include enhanced high-precision molding for superior volumetric accuracy, the integration of advanced hydrophobic filter plugs to prevent aerosol cross-contamination, and the application of anti-static treatments to improve dispensing consistency, especially for sensitive or low-volume biological solutions. Furthermore, improved ergonomics and standardized color-coding enhance user efficiency and reduce the incidence of pipetting errors.

What is the significance of the Asia Pacific (APAC) region in the Serological Pipettes Market forecast?

APAC is anticipated to be the fastest-growing regional market due to substantial government initiatives promoting domestic biopharma R&D (notably in China and India), significant foreign investment attracting global pharmaceutical companies, and the rapid modernization and expansion of clinical laboratory networks. This surge in high-quality research output and diagnostic volume creates an accelerating demand base for reliable, sterile laboratory consumables.

How are environmental concerns influencing product development in the Serological Pipettes Market?

Growing environmental concerns regarding single-use plastics are pressuring manufacturers to innovate in sustainable practices. This is influencing product development towards optimizing packaging materials to reduce waste volume and exploring biodegradable or bio-based polymer alternatives for pipette construction. While maintaining sterility remains paramount, the industry is increasingly focused on developing products that align with 'green lab' initiatives without compromising performance or regulatory compliance.

What role do Contract Research Organizations (CROs) play in the Serological Pipettes Market demand?

CROs are major drivers of bulk demand due to the increasing trend of pharmaceutical and biotech companies outsourcing drug discovery and clinical trial activities. CROs require vast, consistent volumes of standardized serological pipettes to support diverse client projects simultaneously. Their purchasing volumes often necessitate favorable long-term supply agreements and high logistical efficiency, making them a crucial high-throughput customer segment.

Why is sterile packaging a critical factor for serological pipette adoption in clinical settings?

Sterile packaging, typically individual or multi-pack peel pouches sterilized via gamma irradiation, is critical because clinical and biomanufacturing environments require absolute assurance against microbiological contamination. In applications such as patient diagnostics or cell culture, maintaining asepsis is essential for regulatory compliance, data integrity, and preventing patient harm. Certified sterility provides the necessary quality guarantee, driving adoption in regulated sectors.

What is the typical end-use application for serological pipettes with volumes greater than 25 ml?

Serological pipettes with volumes greater than 25 ml (e.g., 50 ml, 100 ml) are primarily utilized for large-scale liquid handling tasks in biomanufacturing and cell culture laboratories. These applications include preparing large batches of cell culture media and buffers, transferring bulk volumes of reagents into bioreactors, or large-scale titration and solution mixing, where high volume capacity and rapid transfer are prioritized over micro-precision.

How does the quality assurance process for serological pipettes ensure accuracy?

Quality assurance is rigorous, involving multi-stage monitoring. Manufacturers employ high-precision computer-controlled injection molding to ensure accurate internal geometry for volumetric precision. Post-production, random batch testing using sophisticated gravimetric methods verifies calibration accuracy against specified tolerances (e.g., ISO standards). Furthermore, sterility assurance levels (SAL), typically 10^-6, are confirmed through validated sterilization protocols and documentation, ensuring both volume reliability and contamination safety.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Serological Pipettes Market Size Report By Type (1-2 ml, 5 ml, 10 ml, 25 ml, Other ( 50 ml etc.)), By Application (Tissue Culture, Bacterial Culture, Testing Lab, Other), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Serological Pipettes Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (1-2 ml, 5 ml, 10 ml, 25 ml, Other), By Application (Tissue Culture, Bacterial Culture, Testing Lab, Other), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager