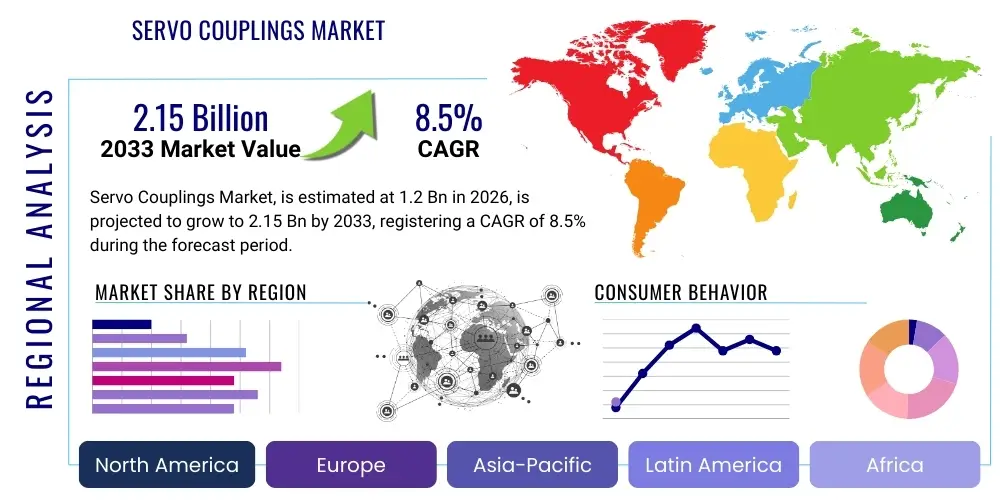

Servo Couplings Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442130 | Date : Feb, 2026 | Pages : 253 | Region : Global | Publisher : MRU

Servo Couplings Market Size

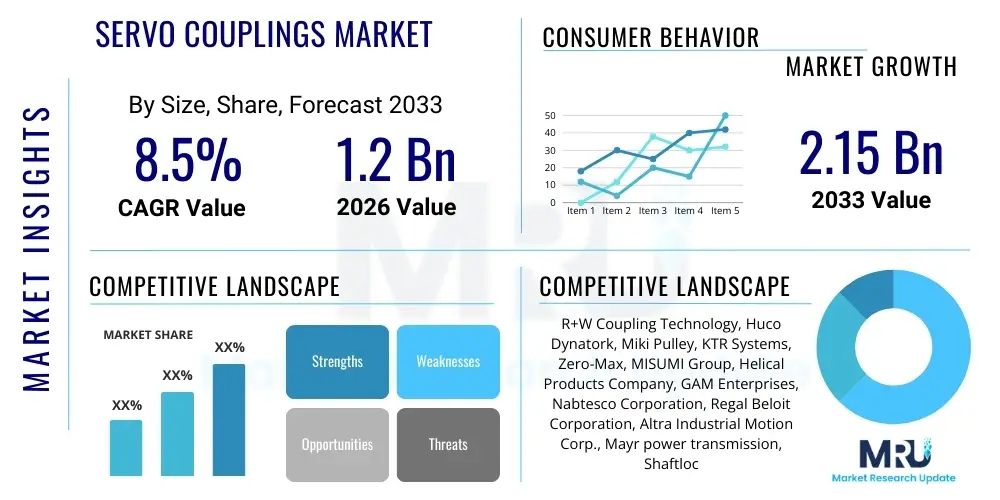

The Servo Couplings Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 2.15 Billion by the end of the forecast period in 2033. This substantial growth trajectory is underpinned by the accelerating global adoption of industrial automation, precision manufacturing techniques, and the continued expansion of the robotics industry, which heavily relies on high-performance torque transmission components.

Servo Couplings Market introduction

The Servo Couplings Market comprises specialized mechanical components designed to transmit torque and motion between two shafts in servo and stepper motor drive systems. Unlike standard industrial couplings, servo couplings are engineered for high-precision motion control, demanding attributes such as zero backlash, high torsional stiffness, low inertia, and the ability to accurately compensate for angular, parallel, and axial misalignments. These characteristics are crucial for maintaining the dynamic accuracy and responsiveness required in sophisticated automated processes, including high-speed pick-and-place robotics and ultra-precise machine tools. The primary function of these couplings is to ensure faithful transmission of rotary input from the motor to the driven machine element, minimizing vibration and resonance that could degrade system performance.

Major applications for servo couplings span across high-tech manufacturing sectors, including semiconductor fabrication, automated medical diagnostic equipment, advanced packaging lines, and complex printing machinery. The inherent benefits derived from utilizing optimized servo couplings include enhanced system rigidity, improved longevity of connected components (such as bearings and seals), reduced settling time in dynamic positioning systems, and overall higher throughput and operational reliability. Furthermore, their lightweight construction and minimal moment of inertia allow for faster acceleration and deceleration profiles, directly contributing to energy efficiency and cycle time reduction in continuous operation environments. The proliferation of Industry 4.0 initiatives, emphasizing interconnected smart manufacturing systems, serves as a significant foundational driver for increased market demand.

Driving factors for this market include the global shift towards lights-out manufacturing where continuous, unattended operation demands components with extremely high reliability and extended Mean Time Between Failures (MTBF). The miniaturization trend in electronics manufacturing, necessitating highly accurate small-scale assembly systems, further fuels the demand for ultra-compact and precision couplings. Additionally, the rapid investment in electric vehicle (EV) production infrastructure globally, which requires extensive use of specialized automated assembly robots and testing rigs, is creating a massive new avenue for the deployment of specialized servo coupling technologies capable of handling stringent operational cycles.

Servo Couplings Market Executive Summary

The global Servo Couplings Market is experiencing robust expansion driven by profound business trends centered on automation adoption across traditionally manual industries and the transition towards high-mix, low-volume manufacturing requiring flexible automation solutions. Segment trends indicate a pronounced shift towards disc couplings and bellows couplings due to their superior zero-backlash characteristics and high torsional stiffness, critical for the latest generation of high-dynamic servo systems. Material innovations, particularly the use of specialized aluminum alloys and carbon fiber composites, are gaining traction as manufacturers prioritize weight reduction and enhanced dynamic performance. Regionally, the Asia Pacific (APAC) market, spearheaded by China, South Korea, and Japan, remains the primary growth engine, fueled by massive government and private sector investment in semiconductor, electronics, and automotive production capabilities. North America and Europe demonstrate steady, quality-driven growth, focusing on high-end specialized applications in aerospace, medical technology, and advanced robotics, driving demand for custom-engineered coupling solutions.

AI Impact Analysis on Servo Couplings Market

User queries regarding the impact of Artificial Intelligence (AI) on the Servo Couplings Market commonly revolve around themes of predictive maintenance, optimization of coupling design parameters, and integration within AI-driven motion control loops. Key concerns often center on whether AI can accurately predict coupling failure modes based on operational data (vibration, temperature, torque fluctuations) and if AI-optimized systems will necessitate even higher performance specifications (e.g., stricter balance tolerances or greater torsional rigidity) than current standards. Users express expectations that AI will transition maintenance strategies from time-based scheduling to genuine condition-based monitoring, maximizing uptime and component lifespan. Furthermore, the integration of AI in advanced machine vision and robotic path planning requires even higher fidelity and lower latency motion control, subtly increasing the performance requirements placed upon the mechanical interface components like servo couplings, pushing manufacturers toward developing smarter, sensor-integrated coupling solutions that feed data directly back into the control system for real-time adjustments.

- AI drives demand for integrated sensor technology within couplings for real-time condition monitoring (Smart Couplings).

- Predictive maintenance algorithms use operational data (vibration, torque ripple) transmitted through the system to forecast coupling wear and prevent catastrophic failure.

- AI-driven simulation tools optimize coupling geometries and material selection during the design phase, reducing prototyping cycles.

- Increased system dynamism and accuracy required by AI-enabled robotics heighten the need for ultra-low backlash and high torsional stiffness couplings.

- AI assists in optimizing inventory management and supply chain logistics for coupling manufacturers and end-users based on predicted industrial production ramp-ups.

- Automated quality control systems utilizing AI vision enhance inspection accuracy during the manufacturing process of precision couplings.

DRO & Impact Forces Of Servo Couplings Market

The Servo Couplings Market is significantly influenced by a delicate balance of Drivers, Restraints, and Opportunities, collectively representing the Impact Forces shaping its trajectory. Key drivers include the overwhelming global trend toward factory automation, the relentless quest for higher precision and speed in manufacturing processes, and the rapid growth of the global robotics sector, especially collaborative robots (cobots). Restraints primarily involve the high initial cost associated with premium, zero-backlash couplings compared to standard industrial counterparts, and the technical complexity involved in correctly sizing and installing specialized servo couplings, which requires specialized engineering expertise. Opportunities abound in the burgeoning fields of electric vehicle battery production lines, advanced medical automation (surgical robotics), and the integration of diagnostic sensors directly into coupling mechanisms (Condition Monitoring integration), leading to the development of 'smart' coupling solutions capable of feeding critical performance data back into control systems, thereby enhancing overall machine intelligence and reliability, further increasing the value proposition of these specialized components.

Impact forces indicate a strong positive momentum due to macroeconomic shifts. The pervasive adoption of Industry 4.0 principles necessitates components that can reliably handle high dynamic loads and complex duty cycles over extended periods, directly favoring high-quality servo couplings. However, the market faces constraints related to supply chain resilience, particularly concerning specialized materials and highly precise manufacturing tolerances. Geopolitical instability and trade restrictions can impact the sourcing of key components, potentially hindering the rapid scale-up required by the automotive and semiconductor industries. Successful companies will capitalize on opportunities by focusing on modular design, simplified installation procedures, and expanding their footprint in emerging markets that are rapidly modernizing their manufacturing infrastructure.

Segmentation Analysis

The Servo Couplings Market segmentation offers a granular view of product diversity and application-specific demands, enabling targeted market strategies. The market is primarily segmented by Type, Material, Application, and End-User Industry. Segmentation by Type, encompassing varieties like beam, bellows, disc, and jaw couplings, is critical as each type offers distinct performance characteristics regarding torsional stiffness, misalignment compensation capabilities, and inertia. Material segmentation highlights the shift from traditional steel alloys to lighter, corrosion-resistant materials such as high-grade aluminum and engineered plastics, driven by the demand for low inertia. Application and End-User Industry segmentation reveal where the highest growth potential resides, specifically identifying highly automated sectors such as robotics and semiconductor manufacturing as dominant revenue streams demanding specialized, custom-engineered solutions for extreme environments or ultra-high precision requirements.

Analyzing these segments reveals that while traditional Jaw couplings remain popular due to their cost-effectiveness and robustness in moderate-precision applications, the growth is disproportionately driven by Bellows and Disc couplings in high-end, demanding applications where zero-backlash and maximum torsional rigidity are non-negotiable prerequisites. Manufacturers are increasingly differentiating their offerings based on certified cleanroom compatibility and resilience to harsh environments (e.g., vacuum compatibility in semiconductor etching machines), ensuring niche specialization provides a sustained competitive advantage over generalized industrial coupling providers. This detailed segmentation aids stakeholders in understanding the nuanced requirements across various industrial ecosystems and adapting product development accordingly to meet evolving technological benchmarks in precision motion control.

- By Type:

- Beam Couplings (Single and Multi-Beam)

- Bellows Couplings (Helical and Welded)

- Jaw Couplings (Standard and Zero-Backlash Inserts)

- Disc Couplings (Single and Double Flexing Disc)

- Oldham Couplings

- Slit Couplings

- Pin and Bush Couplings (Modified for Servo)

- Grid Couplings (High Torque Servo)

- By Material:

- Aluminum Alloys (High-strength 7075, 6061)

- Stainless Steel (Corrosion and temperature resistance)

- Engineered Plastics (Low cost, insulation properties)

- Carbon Fiber Composites (Ultra-low inertia, high stiffness)

- By Application:

- Precision Robotics (Industrial arms, SCARA, Delta robots)

- CNC Machine Tools (Lathes, Mills, Grinders)

- Semiconductor Manufacturing Equipment (Wafer handlers, lithography)

- Medical and Laboratory Automation (Scanners, drug dispensing)

- Printing and Packaging Machinery (High-speed web handling)

- Testing and Measurement Equipment (Dynamometers, test benches)

- By End-User Industry:

- Automotive and Transportation (EV manufacturing, body assembly)

- Electronics and Semiconductor

- Aerospace and Defense

- Food and Beverage Processing

- Pharmaceutical and Biotechnology

- Machine Tool Manufacturing

Value Chain Analysis For Servo Couplings Market

The value chain for the Servo Couplings Market begins with the Upstream Analysis, which encompasses the procurement of specialized raw materials such as high-grade aluminum, stainless steel alloys, and custom elastomers used in jaw inserts. Quality control at this stage is paramount, as the precision performance of the final coupling is directly dependent on the metallurgical properties and dimensional consistency of the raw input. Key upstream suppliers include specialty metal fabricators and precision machining tool providers. High material costs and the necessity for specific material certifications (e.g., aerospace or medical grade) often contribute significantly to the overall product cost, establishing barriers to entry for new coupling manufacturers who lack established supplier relationships guaranteeing material traceability and quality.

The core manufacturing process, involving sophisticated CNC machining, grinding, and specialized assembly (such as welding for bellows couplings or precise bolting for disc couplings), forms the middle segment of the value chain. This stage requires significant capital investment in advanced machinery and highly skilled technicians to achieve the micron-level tolerances and balanced assemblies necessary for zero-backlash performance at high rotational speeds. Following manufacturing, the Downstream Analysis focuses on distribution channels. Sales are typically handled through a combination of Direct Sales (for large OEM clients requiring custom engineering and extensive technical support) and Indirect Channels, utilizing specialized industrial distributors and technical sales representatives who possess the expertise to integrate these high-precision components into complex automated systems. E-commerce platforms are also increasingly relevant for standard, off-the-shelf servo coupling models, catering to smaller machine builders and maintenance, repair, and overhaul (MRO) requirements.

The selection of the appropriate distribution channel significantly affects market reach and customer service levels. Direct channels offer greater control over technical consultation and pricing, crucial for complex custom orders in the robotics and aerospace sectors. Conversely, utilizing an extensive network of indirect distributors allows manufacturers to penetrate diverse geographical markets and serve a broad base of smaller system integrators efficiently. The efficiency and technical competency of the after-sales support structure, particularly concerning inventory management for spares and rapid replacement services, are vital components of the downstream value proposition, ensuring maximum uptime for the end-user’s expensive automated equipment and reinforcing brand loyalty.

Servo Couplings Market Potential Customers

Potential customers and primary end-users for servo couplings are centered within industries requiring extreme accuracy, rapid cycling, and reliable motion control, where system downtime is prohibitively expensive. The primary buying segments include Original Equipment Manufacturers (OEMs) of advanced machinery, suchators and system integrators specializing in automation cells, and large industrial facilities performing MRO activities on existing servo-driven lines. OEMs in the robotics, CNC machinery, and semiconductor equipment sectors are the largest volume buyers, typically requiring customized batch orders tailored to specific motor flanges and driven shaft dimensions. These buyers prioritize technical specifications such as certified backlash levels, torsional stiffness ratings, and inertia profiles, often establishing long-term supply contracts based on performance guarantees and quality adherence.

System integrators act as crucial intermediaries, purchasing couplings alongside other motion control components (motors, drives, linear guides) to assemble bespoke automation solutions for end-users across diverse sectors like packaging, logistics, and medical device manufacturing. Their buying decisions are often guided by ease of installation, availability, and the support provided by the coupling manufacturer's technical sales team. Finally, large-scale industrial end-users (e.g., major automotive plants or large food processing factories) purchase couplings primarily for maintenance and replacement, focusing on compatibility with legacy systems and the availability of quick-ship options to minimize production interruptions. This MRO segment demands high reliability and standardized sizing to facilitate rapid swap-outs during scheduled or unscheduled maintenance cycles.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 2.15 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | R+W Coupling Technology, Huco Dynatork, Miki Pulley, KTR Systems, Zero-Max, MISUMI Group, Helical Products Company, GAM Enterprises, Nabtesco Corporation, Regal Beloit Corporation, Altra Industrial Motion Corp., Mayr power transmission, Shaftloc, Schmidt-Kupplung, Voith Group, Centa Antriebe, Cross Company, Tsubakimoto Chain Co., Renold PLC, KB Electronics |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Servo Couplings Market Key Technology Landscape

The technological landscape of the Servo Couplings Market is characterized by continuous innovation focused on enhancing torsional rigidity, reducing inertia, and improving misalignment capacity without sacrificing zero-backlash performance. A primary area of technological advancement involves the design and material science of flexible elements. For example, welded bellows couplings utilize high-grade, thin-walled stainless steel or nickel alloys, engineered through precise welding processes to achieve exceptionally high torque transmission capacity relative to their mass, crucial for rapid acceleration in servo systems. Similarly, advanced disc couplings employ finely tuned, multiple layered stainless steel disc packs to handle significant parallel and angular misalignment while maintaining virtually infinite life under specified operating conditions, thereby minimizing maintenance requirements and maximizing system reliability in continuous duty applications.

A second major technological trend is the evolution of hub and clamping mechanisms. Traditional set screw attachments are rapidly being replaced by state-of-the-art clamping hub designs, such as tapered locking elements or friction fit mechanisms, which ensure absolute zero-slip and concentricity between the shaft and the coupling hub, critical for highly sensitive positional accuracy. Furthermore, manufacturers are increasingly incorporating Finite Element Analysis (FEA) and dynamic simulation tools during the design phase. These computational methods allow for the precise optimization of geometry to minimize stress concentration points, predict resonance frequencies, and reduce the overall mass moment of inertia, leading to couplings specifically tuned for the demanding acceleration profiles typical of high-performance servo motor systems. This computational approach significantly reduces the time and cost associated with physical prototyping.

The third critical development area is the integration of 'Smart' features. Although not universally adopted, a growing segment of the market is exploring sensor integration, embedding miniature accelerometers or torque transducers directly onto or into the coupling structure. These sensors enable the coupling to become a dynamic data source, providing real-time feedback on vibration levels, torsional loads, and even temperature, which are essential inputs for AI-driven predictive maintenance platforms. This technological convergence elevates the coupling from a passive mechanical component to an active data node within the Industry 4.0 ecosystem, offering enhanced diagnostics and operational insights previously unavailable to machine operators and engineers, significantly enhancing machine overall equipment effectiveness (OEE).

Regional Highlights

- Asia Pacific (APAC): APAC is the epicenter of growth, dominated by massive investment in manufacturing automation, particularly in China (robotics and general automation) and South Korea/Taiwan (semiconductor and high-end electronics). Governments in these regions actively support advanced manufacturing capabilities, leading to rapid scaling of automated production lines. The high volume manufacturing of electric vehicles and associated components, coupled with the need for high-speed packaging solutions, ensures APAC maintains the highest CAGR globally throughout the forecast period.

- North America: This region is characterized by high demand for highly specialized and custom-engineered couplings, driven primarily by the aerospace, defense, and advanced medical device sectors. While volume growth may be lower than APAC, the average selling price (ASP) is significantly higher due to stringent regulatory requirements and the necessity for certified, ultra-high-performance materials and designs. The revitalization of domestic manufacturing and the focus on highly complex, low-volume production contribute to steady, quality-focused growth.

- Europe: Western European countries, particularly Germany and Italy, remain leaders in the machine tool and specialized machinery segments, demanding premium servo coupling solutions. European growth is sustained by innovation in high-end automation, particularly within the automotive sector's transition to EV production and the strong focus on energy efficiency mandates, which favor low-inertia, precision couplings. Stringent quality standards and a preference for local, high-specification suppliers define this mature market.

- Latin America (LATAM): This region exhibits moderate but increasing demand, primarily fueled by modernization efforts in the automotive, mining, and food & beverage processing industries. Market penetration for advanced servo systems is increasing, often driven by international OEMs establishing local production facilities. Cost-sensitivity remains a factor, leading to a balance between high-end bellows/disc couplings and more cost-effective zero-backlash jaw couplings.

- Middle East and Africa (MEA): Growth in MEA is highly localized, driven by infrastructure projects, oil & gas downstream processing automation, and nascent diversification into general manufacturing. Adoption of servo couplings is slower than in other regions but is showing promise, especially in logistics automation and specialized processing plants where reliability under extreme temperature conditions is a critical specification.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Servo Couplings Market.- R+W Coupling Technology

- Huco Dynatork

- Miki Pulley

- KTR Systems

- Zero-Max

- MISUMI Group

- Helical Products Company

- GAM Enterprises

- Nabtesco Corporation

- Regal Beloit Corporation

- Altra Industrial Motion Corp.

- Mayr power transmission

- Shaftloc

- Schmidt-Kupplung

- Voith Group

- Centa Antriebe

- Cross Company

- Tsubakimoto Chain Co.

- Renold PLC

- KB Electronics

- S.S. White Technologies

- Ondrives Ltd.

- Coupling Corp of America

- Guardian Couplings

- Stafford Manufacturing Corp.

Frequently Asked Questions

Analyze common user questions about the Servo Couplings market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary performance criteria differentiating servo couplings from standard industrial couplings?

Servo couplings are distinguished by their absolute zero backlash, exceptionally high torsional stiffness, and low inertia. These characteristics ensure precise positional accuracy and rapid dynamic response necessary for high-performance motion control systems, unlike standard couplings primarily designed for basic torque transmission and vibration dampening in general machinery.

Which type of servo coupling provides the highest torsional rigidity for demanding applications?

Double-disc couplings and welded bellows couplings typically offer the highest torsional rigidity coupled with zero backlash. Double-disc couplings are often preferred in high-speed, high-torque applications where extreme precision is mandatory, such as CNC machine axes and critical robotics joints.

How does the shift towards Industry 4.0 impact the design requirements of servo couplings?

Industry 4.0 demands integrated connectivity and predictive capabilities. This is driving manufacturers to develop 'smart couplings' featuring embedded sensors (for vibration and temperature monitoring) and standardized communication interfaces, enabling real-time data feedback essential for predictive maintenance and enhanced operational efficiency within interconnected manufacturing systems.

What role does material selection play in optimizing servo coupling performance?

Material selection is critical for inertia and environmental resilience. Lightweight aluminum alloys (e.g., 7075) are favored to minimize inertia for high-acceleration systems, while stainless steel is utilized in medical, food processing, or high-humidity environments for corrosion resistance and enhanced torque capacity. Specialized engineered plastics are sometimes used for electrical isolation purposes.

What key factors should engineers consider when sizing a servo coupling for a new automation system?

Engineers must consider peak torque requirements (including acceleration/deceleration torques), maximum operational speed, the required level of torsional stiffness (system rigidity), and the magnitude of expected misalignment (angular, parallel, axial). Selecting a coupling based solely on nominal torque can lead to premature failure due to high dynamic loads inherent in servo operations.

Is there a noticeable trend toward using composite materials in modern servo coupling manufacturing?

Yes, there is a distinct, though niche, trend towards using carbon fiber composites, particularly in the flex element of highly specialized, ultra-high-speed servo couplings. Composites offer the lowest possible inertia and excellent strength-to-weight ratios, crucial for reducing overall system mass and maximizing the responsiveness of dynamic motion control axes, especially in aerospace and high-precision test benches.

How do clamping hubs improve upon older set screw mechanisms in servo coupling mounting?

Clamping hubs, such as single-screw or twin-screw friction clamps, provide 360-degree frictional contact around the shaft, ensuring a true zero-backlash connection and superior concentricity compared to set screws. This eliminates shaft damage and slippage under high dynamic loads, which is essential for maintaining the positional accuracy required by servo systems.

What is the significance of balancing in servo coupling production?

Precision balancing is paramount, especially for couplings operating at high RPMs (above 5,000 RPM). Poorly balanced couplings introduce significant centrifugal forces and vibration, leading to system resonance, premature bearing wear in motors and driven equipment, and reduced overall dynamic accuracy. Manufacturers often balance couplings dynamically to meet strict ISO G standards.

Which end-user industries are currently driving the most innovation in coupling design?

The semiconductor manufacturing and advanced robotics industries are driving the most innovation. Semiconductor equipment demands extremely high precision, vacuum compatibility, and minimal particle generation, leading to the development of specialized cleanroom-certified, low-outgassing coupling designs. Robotics requires continuous improvement in weight reduction and stiffness for collaborative systems (cobots).

What are the typical failure modes observed in servo couplings, and how are they mitigated?

Common failure modes include fatigue fracture of the flex element (disc or bellows) due to excessive misalignment or cyclic stressing, and loss of zero-backlash connection due to hub slippage. Mitigation strategies involve over-sizing the coupling based on application duty cycle, utilizing high-quality clamping hubs, and employing predictive maintenance monitoring to detect pre-failure symptoms like increased vibration.

How important is thermal stability for couplings operating in automated manufacturing environments?

Thermal stability is highly important. Temperature variations, especially those generated by the servo motor itself or ambient factory conditions, can induce thermal expansion, leading to increased misalignment or changes in the coupling's torsional properties. High-performance couplings are designed with materials (like stainless steel or specific aluminum alloys) that maintain dimensional and performance stability across a wide operating temperature range.

Do specialized high-speed servo couplings require lubrication?

The majority of modern, high-performance servo couplings—including disc, bellows, beam, and jaw types (using polyurethane inserts)—are entirely non-lubricated. They are designed for maintenance-free operation over their specified lifespan. Only certain geared or grid couplings, adapted for extremely high torque servo applications, might require periodic lubrication, but these are less common in typical low-inertia servo systems.

What distinguishes bellows couplings from disc couplings in terms of performance trade-offs?

Bellows couplings generally offer superior performance in handling combined angular and parallel misalignment with very low reaction forces on the connected components. Disc couplings typically offer even higher torsional stiffness and torque density relative to their diameter but are often more sensitive to complex misalignments and may exert higher radial reaction forces, requiring robust motor and machine bearings.

In what way is the demand for custom-engineered servo couplings increasing?

The demand is increasing because complex automation systems (such as multi-axis robotic platforms and highly integrated semiconductor equipment) often necessitate non-standard bore sizes, specific material requirements (e.g., non-magnetic), or specialized mounting flange designs. OEMs are increasingly seeking partnerships with coupling manufacturers to co-design components optimized for their unique envelope and dynamic requirements.

How is the growth of the electric vehicle (EV) manufacturing sector affecting the servo couplings market?

The EV sector is a major growth driver, specifically increasing demand for heavy-duty, yet precise, servo couplings used in battery module assembly lines, high-speed winding machines, and end-of-line testing rigs. These applications require couplings capable of reliable performance under sustained high-cycle duty and often higher torque demands than traditional general automation.

What are the key differences between Slit couplings and Beam couplings?

Both are monolithic designs machined from a single piece of material. Beam couplings use helical cuts (single or multiple) to achieve flexibility, suitable for lighter loads and higher misalignments. Slit couplings use multiple radial slits connected by thin sections, offering higher torsional stiffness than beam couplings of similar size, making them better suited for moderately demanding precision systems where rigidity is prioritized over maximum misalignment tolerance.

How does the choice of jaw insert material affect the performance of a zero-backlash jaw coupling?

The elastomer insert (spider) material dictates the coupling's torque capacity, vibration dampening, and temperature resilience. Harder elastomers (e.g., Hytrel or rigid polyurethane) provide higher torsional stiffness and greater torque transmission, leading to higher precision but less vibration dampening. Softer elastomers (e.g., certain polyurethanes) offer greater dampening but result in lower stiffness and suitability for positional accuracy.

Why is low inertia a critical specification for servo couplings?

Low inertia is critical because the servo motor must accelerate and decelerate the coupling mass along with the driven load. A high-inertia coupling increases the total system inertia, requiring larger motors, consuming more energy, and ultimately limiting the system's dynamic performance, speed, and accuracy, especially during rapid indexing movements.

What are the current technological challenges in making servo couplings suitable for vacuum environments?

The main challenges involve material selection to prevent 'outgassing' (releasing gases under vacuum), which contaminates sensitive environments like those in semiconductor processing. This requires using specific, tested stainless steels and avoiding standard lubricants or non-vacuum-rated elastomers, necessitating specialized manufacturing and cleaning protocols.

Beyond torque and speed, what dimensional specification is most crucial for ease of integration?

The most crucial dimensional specification for integration is the overall length (L) or minimum gap required between the two shafts (BSE - distance Between Shaft Ends). System designers must often work within severely constrained machine envelopes, making the coupling's length and outside diameter essential parameters for successful mechanical fitting into compact servo drive trains.

Are magnetic couplings emerging as a viable alternative in the servo market?

Magnetic couplings are emerging, offering complete physical separation, which is beneficial for sealing processes or providing overload protection. However, they generally lack the high torsional stiffness and zero backlash required by high-dynamic, ultra-precision servo systems, limiting their current application primarily to scenarios where fluid separation or maintenance-free soft-start capabilities are paramount.

How are environmental regulations influencing the design and material usage in the coupling industry?

Environmental regulations, particularly those concerning material restriction (like RoHS or REACH in Europe), influence material choices, pushing manufacturers away from certain heavy metals and towards compliant alloys and coatings. Furthermore, the push for energy efficiency encourages the development of lighter, low-inertia couplings that reduce the energy consumption of the overall automated system.

What is the market outlook for Oldham couplings within the servo market segment?

Oldham couplings, while historically cost-effective and capable of handling large parallel misalignments, are generally limited to lower-speed, moderate-precision servo applications. Their reliance on sliding blocks can introduce slight wear-induced backlash over time, making them less favored than disc or bellows types in the most demanding, ultra-precise robotic or machine tool applications.

What is the typical lifespan expectation for a high-quality zero-backlash servo coupling?

When properly sized and operated within the manufacturer's specified misalignment and torque limits, high-quality metallic servo couplings (disc or bellows) are designed for virtually infinite fatigue life. Their lifespan is often limited only by the bearings of the connected components rather than the coupling itself, assuming no excessive shock loads or gross misalignment occurs.

What specialized tooling is required for the proper installation of servo couplings with clamping hubs?

Proper installation of clamping hubs typically requires a calibrated torque wrench. Applying the exact specified clamping torque is crucial. Insufficient torque leads to slippage and backlash, while excessive torque can deform the hub or shaft. Specialized gauges may also be used to verify accurate shaft separation (BSE) during mounting.

How do servo couplings handle machine resonant frequency issues?

Servo couplings contribute to the overall system's natural frequency. High torsional stiffness helps push the fundamental resonant frequency higher, ideally above the system's operational frequencies. Engineers select couplings with stiffness characteristics that decouple the motor's natural frequency from the driven load's frequency, mitigating resonance problems through tailored system analysis.

What recent advancements have been made in coupling visualization and selection software?

Manufacturers are deploying sophisticated online selection tools integrated with 3D CAD modeling and finite element analysis (FEA) modules. These tools allow engineers to input operational parameters (torque, inertia, misalignment) and instantly visualize the coupling's stress profiles and calculate the estimated safety factor, streamlining the selection process and reducing the risk of improper application.

Why is the semiconductor industry a significant driver of demand for specialized servo couplings?

The semiconductor industry requires motion control with atomic-level precision for wafer handling, etching, and lithography processes. This necessitates couplings with ultra-low vibration transmission, zero backlash, extreme torsional rigidity, and often specialized features like high vacuum compatibility and low magnetic permeability, demanding premium, custom-engineered products.

In the context of the Servo Couplings Market, what does 'torque density' refer to?

Torque density refers to the amount of torque a coupling can transmit relative to its physical size or mass. Higher torque density is a continuous design goal, enabling engineers to use smaller, lighter couplings for the same application, which helps reduce system weight, lower inertia, and minimize the overall footprint of the automated machine, particularly important in crowded robotic cells.

How does the increasing adoption of collaborative robots (cobots) influence servo coupling design?

Cobots require lightweight, smooth-running, and often smaller components. Coupling designs must minimize sharp edges for safety, maximize torque density to handle payloads effectively within compact joints, and maintain high rigidity to ensure the precise force-sensing feedback required for human-robot interaction and safety compliance in shared workspaces.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager