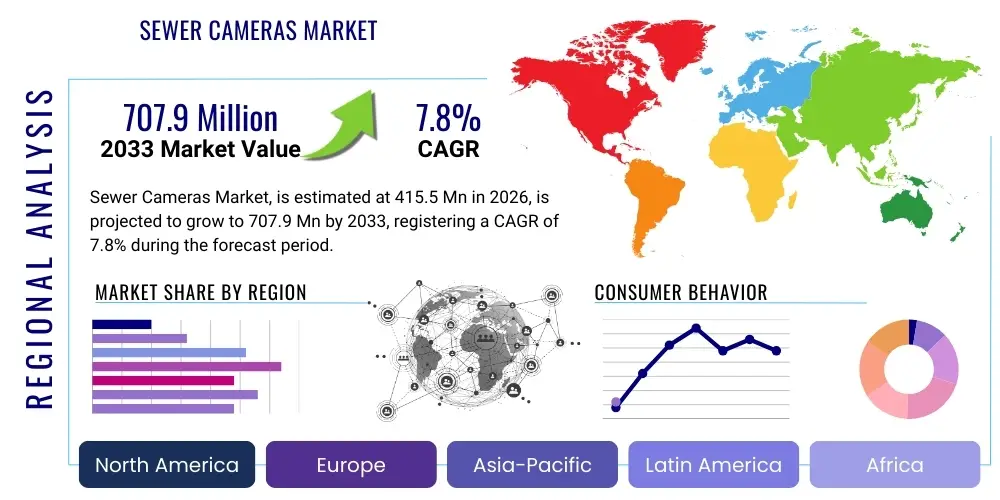

Sewer Cameras Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441428 | Date : Feb, 2026 | Pages : 243 | Region : Global | Publisher : MRU

Sewer Cameras Market Size

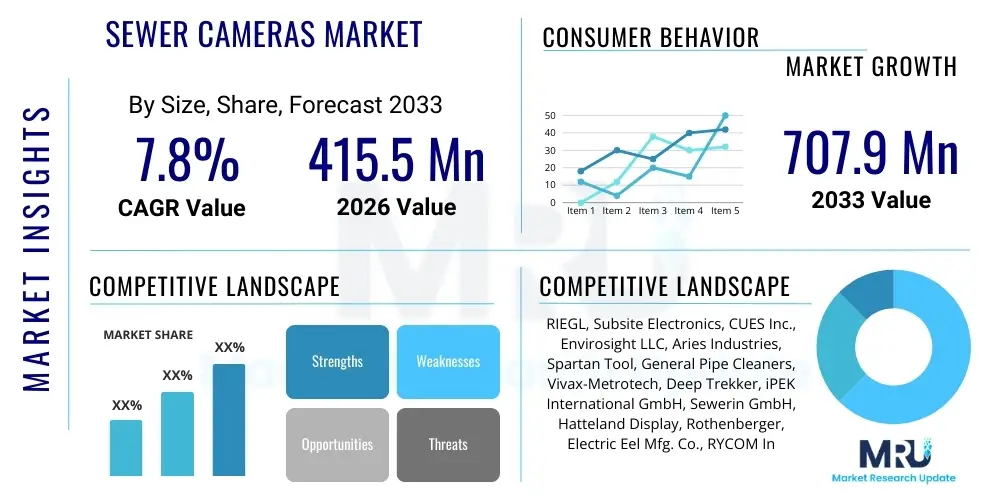

The Sewer Cameras Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 415.5 Million in 2026 and is projected to reach USD 707.9 Million by the end of the forecast period in 2033.

Sewer Cameras Market introduction

The Sewer Cameras Market encompasses specialized remote visual inspection systems designed for diagnosing, monitoring, and locating structural or functional defects within subterranean piping and sewer networks. These sophisticated tools, typically comprising high-resolution cameras, LED illumination, flexible or rigid push cables, and recording monitors, are indispensable for preventive maintenance and emergency response in complex infrastructure systems. The primary function is to provide real-time visual data on pipe conditions, identifying issues such as blockages, cracks, root intrusion, corrosion, and misalignment without requiring destructive excavation.

Major applications of sewer camera systems span municipal infrastructure maintenance, residential plumbing inspection, and industrial pipeline surveying, contributing significantly to the longevity and efficiency of critical utilities. These systems are fundamental in enforcing compliance with regulatory standards pertaining to water quality and environmental protection, as they facilitate accurate documentation of pipe defects before and after repairs. The technology has evolved from rudimentary reel systems to highly advanced robotic crawlers equipped with sonar, laser profiling, and articulated heads, enhancing diagnostic precision and operational depth.

The principal driving factors for market expansion include the increasing age of global municipal water and sewer infrastructure, heightened governmental spending on utility refurbishment, and stringent environmental regulations demanding proactive infrastructure monitoring. Furthermore, the rising awareness among homeowners and industrial entities regarding the long-term cost savings associated with preventative inspection over reactive repairs fuels demand. The inherent benefits, such as non-destructive testing (NDT), reduced operational downtime, and precise localization of faults, position sewer cameras as essential tools in modern utility management practices.

Sewer Cameras Market Executive Summary

The Sewer Cameras Market is experiencing robust growth driven by the global imperative to manage aging underground infrastructure effectively and economically. Key business trends indicate a strong shift towards incorporating high-definition digital imaging, advanced data logging capabilities, and cloud-based reporting platforms to improve operational efficiency. Manufacturers are focusing on developing lighter, more durable materials for push rods and introducing modular designs for robotic crawlers, allowing for greater adaptability across varying pipe diameters and material compositions. The competitive landscape is characterized by innovation in battery technology for extended field operations and the integration of GIS (Geographic Information System) mapping to link inspection data directly with location coordinates, optimizing future maintenance schedules.

Regionally, North America and Europe currently dominate the market due to extensive legacy infrastructure, high adoption rates of advanced trenchless technologies, and significant governmental investment in water utility upgrades. However, the Asia Pacific (APAC) region is projected to register the fastest growth, primarily fueled by rapid urbanization, substantial new infrastructure development in countries like China and India, and the consequential demand for reliable inspection equipment to ensure quality installation and maintenance. This regional dynamic requires market participants to tailor their offerings—such as ruggedized, affordable systems—to meet the varied infrastructural and economic conditions present across developing economies.

Segment trends reveal a pronounced preference for self-propelled crawler cameras in large-diameter municipal applications, owing to their superior range and maneuverability. Conversely, push rod systems remain highly relevant in residential and small-diameter commercial plumbing contexts due to their cost-effectiveness and ease of deployment. The software segment, encompassing data management and reporting tools, is rapidly gaining prominence, transforming raw video footage into actionable, quantified defect assessments, thereby significantly enhancing the value proposition of the hardware systems.

AI Impact Analysis on Sewer Cameras Market

User inquiries regarding the integration of Artificial Intelligence (AI) and Machine Learning (ML) into the Sewer Cameras Market predominantly center on automated defect recognition, data processing efficiency, and predictive maintenance capabilities. Key concerns revolve around the accuracy and reliability of AI algorithms in interpreting ambiguous visual data, the necessity for massive, well-labeled datasets for effective training, and the resultant shift in the necessary skill sets of inspection technicians. Users are actively seeking solutions that minimize human error in assessment, streamline the reporting process, and transition maintenance strategies from reactive scheduling to condition-based prediction. The overarching expectation is that AI will dramatically reduce inspection time, standardize defect classification across different operators, and unlock new levels of efficiency in infrastructure management.

The current application of AI involves integrating computer vision models into the camera system’s firmware or accompanying software. These models are trained to automatically detect, classify, and measure common pipe defects, such as joint offsets, infiltration points, and varying degrees of corrosion, significantly faster than manual review. This automation frees up technicians to focus on complex decision-making and repair planning rather than tedious video analysis. Furthermore, AI-driven analysis of historical inspection data, when combined with GIS mapping and environmental factors, facilitates sophisticated predictive maintenance modeling, allowing utilities to prioritize repairs based on the estimated risk of failure rather than simple age or linear scheduling.

- AI-driven automated defect detection reduces manual review time by up to 60%.

- Machine learning algorithms enhance the standardization and accuracy of defect classification (e.g., NASSCO PACP scoring).

- Predictive maintenance analytics, powered by AI, optimize resource allocation and prevent catastrophic failures.

- Integration of real-time image stabilization and enhancement using neural networks improves video quality in challenging environments.

- Natural Language Processing (NLP) is used to generate concise and standardized inspection reports automatically from analyzed data inputs.

- AI assists in path planning and autonomous navigation for robotic crawler systems in complex sewer geometries.

DRO & Impact Forces Of Sewer Cameras Market

The Sewer Cameras Market trajectory is fundamentally shaped by a complex interplay of Drivers, Restraints, and Opportunities, collectively forming the critical Impact Forces determining market evolution. The dominant driver is the globally increasing average age of subterranean utility infrastructure, which necessitates proactive, non-invasive inspection to mitigate environmental risks and service disruptions. This is synergized by evolving regulatory frameworks, particularly in developed economies, mandating detailed periodic inspections and condition reporting. However, market growth faces limitations from restraints such as the significant initial capital expenditure required for high-end crawler systems and the shortage of certified technicians trained to operate and interpret data from complex inspection technologies. The primary opportunities lie in the adoption of AI-powered analysis tools, the expansion into underserved emerging markets, and the development of cost-effective, wireless, and modular camera platforms accessible to smaller municipalities and independent contractors.

The Drivers fueling demand include advancements in sensor technology (e.g., 4K resolution and laser profiling), which deliver superior diagnostic data, coupled with the rapid integration of Internet of Things (IoT) connectivity for remote monitoring and data transfer. These technological improvements drastically reduce the time spent on field assessments, increasing the return on investment for end-users. Conversely, the market is restrained by the challenging operational environment, where cameras must withstand harsh conditions (high pressure, corrosive substances, variable temperatures), often leading to high maintenance costs and shorter equipment lifecycles. Furthermore, resistance to adopting new technologies among traditionally conservative municipal utilities acts as a frictional force slowing widespread implementation of advanced systems.

The combined impact forces—driven by aging infrastructure and regulation, constrained by high costs and technical complexity, and opened up by AI integration and digitalization—mandate continuous innovation. The market's responsiveness to opportunities, specifically the development of subscription-based inspection services and the refinement of articulated camera heads for greater navigational dexterity, will dictate its pace of expansion. The balance between offering robust, durable hardware and providing sophisticated, intuitive software analytics remains the core tension influencing purchasing decisions globally.

Segmentation Analysis

The Sewer Cameras Market is segmented based on critical operational and technological criteria, predominantly covering Type, Application, and Operating Mechanism. This segmentation provides a granular understanding of the diverse needs within the infrastructure maintenance sector, ranging from detailed residential pipe checks to large-scale municipal sewer evaluations. The Type segmentation distinguishes between portable, manually operated systems (Push Rod) and complex, motorized systems (Crawler), reflecting variations in pipe diameter suitability and required inspection range. Analyzing these segments is essential for strategic market positioning, ensuring products are designed to meet specific functional requirements and budgetary constraints of various end-user groups.

Application analysis highlights the primary sectors driving demand, with Municipal Infrastructure representing the largest and most consistently growing segment due to massive public spending on urban utility maintenance. Industrial Plumbing, encompassing manufacturing and petrochemical plants, requires highly specialized, often explosion-proof or chemically resistant cameras, driving innovation in material science and system durability. Meanwhile, the Residential Inspection segment is highly sensitive to price and portability, favoring lightweight, easy-to-deploy systems used predominantly by independent plumbers and home inspectors.

Furthermore, the segmentation by Operating Mechanism—Manual Push, Self-Propelled, and Articulating Head—reflects the evolution of technology aimed at enhancing maneuverability and data capture quality. The shift towards self-propelled and articulating systems underscores the industry's drive for efficiency and thoroughness, allowing inspectors to navigate difficult bends, measure defect dimensions via laser profiling, and perform comprehensive 360-degree assessments in large pipelines, ultimately leading to more precise and cost-effective rehabilitation decisions.

- By Type

- Push Rod Cameras (Typically for 1.5 to 6-inch pipes, residential/commercial)

- Crawler Cameras (Self-propelled, for 6-inch pipes and larger, municipal/industrial)

- Reel Systems (Hybrid manual/powered systems)

- By Application

- Municipal Infrastructure (Main sewers, storm drains)

- Industrial Plumbing (Processing plants, refineries, utilities)

- Residential Inspection (Lateral lines, internal plumbing)

- Commercial Building Inspection

- By Operating Mechanism

- Manual Push Systems

- Self-Propelled Systems (Robotic crawlers)

- Articulating Head Systems (Pan and Tilt, Zoom capabilities)

- By Camera Resolution

- Standard Definition (SD)

- High Definition (HD)

- 4K Ultra HD

Value Chain Analysis For Sewer Cameras Market

The value chain of the Sewer Cameras Market begins with Upstream Analysis, focusing on the sourcing and manufacturing of highly specialized components. This stage involves suppliers of critical technologies such as high-resolution CMOS sensors, robust LED lighting arrays, specialized ruggedized cables (fiber optic and copper), durable chassis materials (often stainless steel or high-grade polymers), and precision motors for articulation and propulsion systems. Key challenges in the upstream segment include maintaining a consistent supply of advanced sensors and ensuring the quality and environmental resistance of all components used in harsh subterranean environments. Efficiency gains are sought through vertical integration or securing long-term contracts with specialized technology providers for proprietary components like battery packs and sophisticated control boards.

The middle segment involves Original Equipment Manufacturers (OEMs) who design, assemble, and integrate the diverse components into finalized inspection systems. This stage adds value through software development, specifically the integration of intuitive user interfaces, data logging capabilities (WIP, PACP standards), and connectivity features (Wi-Fi, Bluetooth, 5G). Distribution Channel analysis reveals a hybrid model: Direct sales are common for high-value, customized robotic crawler systems sold to large municipal utilities and major industrial clients, requiring specialized training and post-sale support. Indirect sales, utilizing regional distributors, value-added resellers (VARs), and specialized plumbing supply houses, are predominant for standard push rod cameras targeting independent contractors and smaller firms, offering localized inventory and quick accessibility.

Downstream analysis centers on the End-Users, which include municipal public works departments, dedicated pipeline inspection service providers, and residential plumbing professionals. Value is realized at this stage through the application of the technology—reducing excavation costs, minimizing downtime, and providing essential data for trenchless rehabilitation methods (e.g., Cured-In-Place Pipe or CIPP). Post-sale services, including calibration, repair, software updates, and advanced operational training, are critical components of the downstream value chain, establishing long-term customer loyalty and ensuring maximum utilization of the sophisticated equipment.

Sewer Cameras Market Potential Customers

The potential customers and primary end-users of sewer camera systems span a diverse spectrum of infrastructure stakeholders, each with distinct needs regarding system complexity, ruggedness, and data output capabilities. The largest and most influential customer base is Municipal Public Works Departments and Water Utility Agencies, responsible for the vast networks of sanitary and stormwater systems. These entities prioritize high-end, self-propelled crawler systems capable of inspecting large diameter pipes over extensive distances, demanding high precision (often involving laser profiling) and adherence to national standards like NASSCO's Pipeline Assessment Certification Program (PACP) for standardized defect reporting.

A second significant customer group comprises Independent Plumbing Contractors and Specialized Inspection Service Firms. These professional service providers utilize a mixed fleet, primarily relying on portable, durable push rod cameras for residential and small commercial lateral line inspections. Their purchasing criteria emphasize portability, quick setup time, and robust customer support, as their business relies on high-volume, rapid-turnaround inspections. Industrial entities, including oil and gas refineries, chemical manufacturing plants, and food processing facilities, constitute a specialized customer segment requiring intrinsically safe (ATEX-certified) or highly corrosion-resistant cameras to operate in hazardous or hostile environments, prioritizing system safety and material integrity.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 415.5 Million |

| Market Forecast in 2033 | USD 707.9 Million |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | RIEGL, Subsite Electronics, CUES Inc., Envirosight LLC, Aries Industries, Spartan Tool, General Pipe Cleaners, Vivax-Metrotech, Deep Trekker, iPEK International GmbH, Sewerin GmbH, Hatteland Display, Rothenberger, Electric Eel Mfg. Co., RYCOM Instruments, Minicam Ltd., Scanprobe Techniques, RS Technical Services, Wohler USA, PipeEye. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Sewer Cameras Market Key Technology Landscape

The technological landscape of the Sewer Cameras Market is characterized by continuous advancements aimed at improving image clarity, operational longevity, and data integration. High-definition (HD) and increasingly 4K sensor technology is becoming standard across both push rod and crawler systems, providing inspectors with highly detailed imagery necessary for accurate small defect identification and quantification. Alongside improved visual clarity, advanced illumination technology, specifically high-intensity, energy-efficient LED arrays with variable light intensity controls, is essential for maintaining clear video feeds in dark and murky pipe interiors. Furthermore, sophisticated articulation mechanisms, including pan-and-tilt and continuous 360-degree rotation capabilities in camera heads, allow for thorough examination of pipe joints and lateral connections, significantly reducing the chance of missed defects.

A crucial technological development is the integration of auxiliary measurement tools, primarily laser profiling and sonar mapping systems, particularly in municipal crawler cameras. Laser profiling utilizes dual lasers mounted on the camera head to accurately measure the pipe's internal diameter, identify structural deformation (e.g., ovality), and quantify defect dimensions (such as joint gaps or material loss). Sonar technology is employed for inspections in partially or fully submerged pipes where traditional optical cameras lose clarity, providing crucial geometric data about submerged debris or structural integrity. These measurement technologies transform the inspection process from purely visual assessment into precise engineering data collection, essential for modern rehabilitation planning.

Connectivity and data processing form the backbone of modern sewer camera technology. Systems now feature robust data logging hardware compliant with industry standards (PACP), often utilizing solid-state drives for reliable data storage. Wireless transmission capabilities (Wi-Fi, cellular) facilitate immediate uploading of inspection videos and reports to cloud-based platforms for centralized management and stakeholder sharing. Furthermore, the inclusion of integrated location technologies, such as sondes (transmitters) for above-ground locating and sophisticated inertial measurement units (IMUs), ensures precise mapping of the inspected line relative to surface infrastructure, a critical feature for efficient excavation and repair targeting.

Regional Highlights

- North America: This region holds a dominant market share driven by the critical necessity to address aging infrastructure, particularly in the US and Canada. Government mandates, such as the EPA's regulations regarding municipal separate storm sewer systems (MS4s), necessitate regular inspection and remediation, leading to high adoption rates of advanced crawler camera systems and associated software analytics. The region benefits from early technology adopters and established industry standards (NASSCO PACP), fostering a high demand for cutting-edge, integrated inspection solutions. High labor costs also incentivize investment in efficient, automated inspection technology. The U.S. infrastructure investment plans further solidify the long-term demand for pipeline inspection technology.

- Europe: The European market is characterized by stringent environmental protection regulations and a massive network of century-old pipelines, particularly in the UK, Germany, and France. Growth is sustained by continuous investment in urban sanitation and the requirement for preventative maintenance to avoid contamination. European manufacturers, often specializing in high-precision, robust camera systems (like iPEK and Sewerin), drive innovation in articulated and explosion-proof (ATEX) certified equipment required for specialized industrial applications. The focus here is on efficiency through digitalization and integrating inspection data directly into utility asset management systems.

- Asia Pacific (APAC): APAC represents the fastest-growing region, propelled by rapid urbanization, extensive new sewer network construction, particularly in China, India, and Southeast Asian nations, and increasing foreign direct investment in water management infrastructure. While the demand is initially for cost-effective, durable push rod systems for new installations and smaller municipal projects, rising awareness of infrastructure quality mandates is increasing the uptake of advanced crawler technology. The need for quality control in newly laid pipes, combined with managing increasing sewage volumes, mandates comprehensive inspection tools, creating vast market potential.

- Latin America (LATAM): Growth in LATAM is currently moderate but accelerating, primarily driven by improvements in public sanitation access and modernization initiatives in major urban centers like São Paulo and Mexico City. Market penetration remains lower than in developed economies, making it price-sensitive. Demand focuses on robust, mid-range equipment that balances durability and affordability. Infrastructure deficits and the push toward sustainable water management are expected to significantly boost market adoption in the forecast period, especially as financing for utility projects increases.

- Middle East and Africa (MEA): This region exhibits varied market maturity. The Gulf Cooperation Council (GCC) states show high demand for advanced camera systems due to high capital investment in massive infrastructure projects (e.g., smart city developments) and the need for durable equipment to withstand harsh desert conditions. African nations, while facing infrastructure gaps, are starting to invest in essential inspection tools for rapidly growing urban centers, often supported by international development financing. Specific technological requirements include systems capable of handling extremely high temperatures and highly corrosive waste streams.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Sewer Cameras Market.- RIEGL

- Subsite Electronics

- CUES Inc.

- Envirosight LLC

- Aries Industries

- Spartan Tool

- General Pipe Cleaners

- Vivax-Metrotech

- Deep Trekker

- iPEK International GmbH

- Sewerin GmbH

- Hatteland Display

- Rothenberger

- Electric Eel Mfg. Co.

- RYCOM Instruments

- Minicam Ltd.

- Scanprobe Techniques

- RS Technical Services

- Wohler USA

- PipeEye

Frequently Asked Questions

Analyze common user questions about the Sewer Cameras market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary differences between push rod and crawler sewer camera systems?

Push rod systems are highly portable, manually operated, cost-effective, and designed for small-to-medium pipes (1.5 to 6 inches) over shorter distances (up to 200 feet), typically used in residential and commercial plumbing. Crawler systems are self-propelled robotic units, heavier, significantly more expensive, and designed for large-diameter municipal or industrial pipelines (6 inches and up) over long distances, often incorporating advanced features like laser profiling and articulating heads.

How is AI impacting the accuracy and efficiency of sewer camera inspections?

AI significantly enhances inspection efficiency by utilizing computer vision to automatically detect, classify, and quantify common pipe defects (cracks, roots, infiltration) from video feeds in real-time. This automation standardizes reporting, reduces the high labor cost associated with manual video review, and improves overall accuracy by minimizing human interpretation error.

Which regional market is exhibiting the highest growth rate for sewer camera adoption?

The Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR). This acceleration is driven by rapid urbanization, massive government investment in constructing and standardizing new utility networks, and the subsequent high demand for quality control and maintenance inspection equipment across urban centers in countries like China and India.

What are the main technological drivers for crawler camera system innovation?

The main technological drivers include the integration of 4K ultra-high-definition imaging sensors, robust laser and sonar profiling systems for dimensional measurement, increased battery life for extended field operation, and advanced IoT connectivity for real-time, cloud-based data synchronization and remote diagnostics.

What is the typical lifespan of a professional-grade sewer camera system given the harsh operating conditions?

The typical operational lifespan of a professional-grade crawler camera system is between 5 and 8 years, heavily dependent on routine maintenance, the corrosiveness of the environments encountered, and the quality of the system components. Due to continuous technological advancements (especially in software and sensors), systems are often replaced or upgraded before full mechanical failure occurs to leverage new efficiencies.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager