Shaving Lotions and Creams Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442356 | Date : Feb, 2026 | Pages : 255 | Region : Global | Publisher : MRU

Shaving Lotions and Creams Market Size

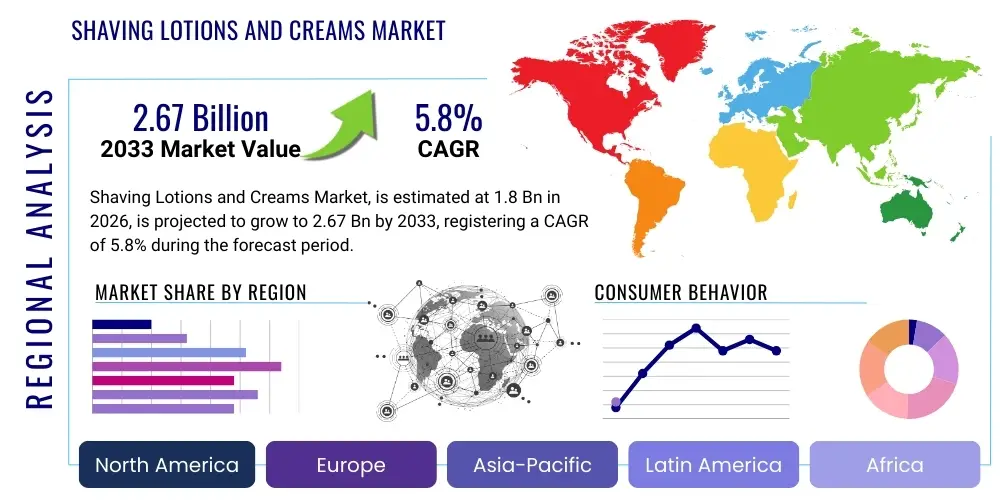

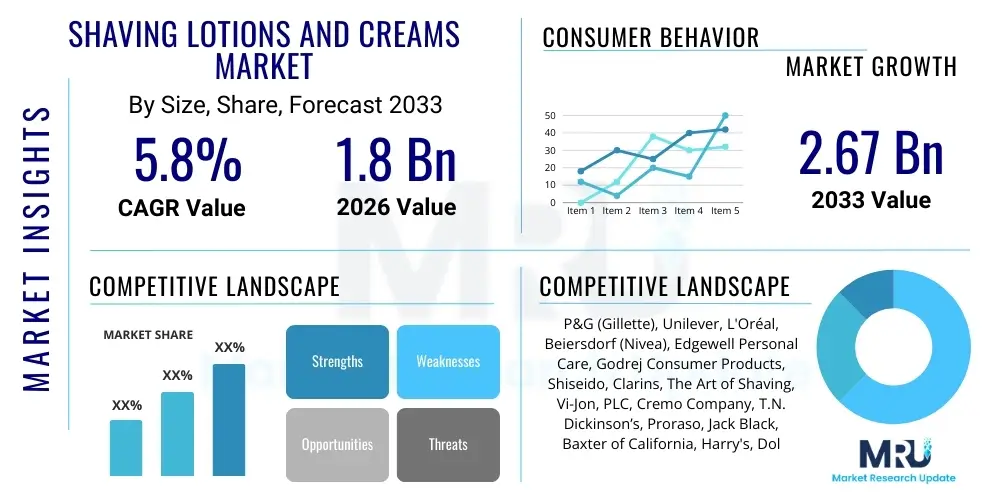

The Shaving Lotions and Creams Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 1.8 Billion in 2026 and is projected to reach USD 2.67 Billion by the end of the forecast period in 2033. This consistent expansion is primarily fueled by the growing consumer focus on personal grooming, coupled with a steady demand for specialized and premium shaving formulations that offer enhanced skincare benefits beyond basic lubrication. The shift toward wet shaving practices, especially in emerging economies, further solidifies the market's trajectory.

Shaving Lotions and Creams Market introduction

The Shaving Lotions and Creams Market encompasses a wide range of topical formulations designed to prepare the skin and hair for shaving, enhance razor glide, and minimize post-shave irritation. These products typically include shaving creams (lathering and non-lathering), gels, foams, and post-shave lotions or balms. Major applications span across both genders, though historically dominated by the male grooming segment, and are essential components of traditional wet shaving routines. Key benefits derived from these products include superior lubrication to reduce friction and nicks, intense moisturization to prevent dryness, and the inclusion of active ingredients like aloe vera, essential oils, and anti-inflammatory compounds that soothe sensitive skin. The market's growth is predominantly driven by increasing consumer awareness regarding skin health, rising disposable incomes leading to the adoption of premium products, and strategic marketing emphasizing sophisticated grooming rituals. Furthermore, innovation focusing on natural, organic, and environmentally friendly ingredients is reshaping consumer preferences and stimulating product development across all geographic regions, necessitating constant adaptation from manufacturers to maintain competitive advantage in this dynamic consumer packaged goods sector. The inherent need for daily or frequent hair removal ensures a stable foundation for demand, irrespective of minor economic fluctuations.

The product portfolio within this market is highly diversified, ranging from traditional canned foams, which offer convenience and speed, to high-end concentrated creams and artisan soaps, which appeal to enthusiasts seeking a luxurious experience. Shaving lotions, particularly those designed for pre-shave application, aim to soften the hair follicle and create a protective barrier, optimizing the subsequent shaving process. Post-shave balms and lotions, crucial for closing the market cycle, focus intensely on replenishing moisture lost during shaving and calming the epidermal layer, reducing redness and razor burn. The functional integrity of these products is tied to their composition, involving surfactants, humectants, emollients, and targeted active ingredients that deliver specific dermatological outcomes. Product differentiation is a critical strategy employed by market players, relying heavily on unique fragrances, therapeutic claims, and specialized formulations catering to specific skin conditions, such as acne-prone or extremely sensitive skin. This ongoing emphasis on specialization ensures that the shaving experience is tailored, moving beyond mere hair removal to become an integral component of daily skincare and wellness routines.

Major market segments include products categorized by formulation type (cream, gel, foam, lotion), application (men, women), and distribution channel (retail, e-commerce, professional salons). Driving factors are deeply rooted in demographic shifts, notably the increasing population of image-conscious millennials and Gen Z consumers who view meticulous grooming as an essential part of personal branding and professional presentation. Simultaneously, marketing efforts focused on sustainability, ethical sourcing, and 'free-from' ingredients (parabens, sulfates) resonate strongly with modern consumers, steering purchasing decisions toward brands demonstrating corporate social responsibility. The proliferation of direct-to-consumer (DTC) subscription models has also fundamentally altered market dynamics, providing easier access to specialized products and fostering brand loyalty among committed users. The continuous push for innovation, particularly in integrating advanced skincare technology into shaving preparations, remains central to sustaining the projected growth rate throughout the forecast period, positioning the market as a significant contributor to the broader personal care industry.

Shaving Lotions and Creams Market Executive Summary

The Shaving Lotions and Creams Market is currently characterized by vigorous competition and a rapid trend toward premiumization, driven largely by shifting consumer perceptions that equate shaving preparation with comprehensive facial skincare. Business trends underscore a significant pivot toward e-commerce and subscription services, which allow niche brands to bypass traditional retail barriers and establish direct, personalized relationships with consumers. This DTC model facilitates rapid feedback loops, enabling quicker product iteration and the introduction of highly specialized formulations, such as vegan, cruelty-free, and hyper-allergenic lines. Furthermore, major market players are heavily investing in mergers and acquisitions of small, innovative brands to quickly assimilate sustainable technologies and gain access to targeted consumer bases. The overall market resilience is also demonstrated by consistent marketing spend focusing on digital platforms, emphasizing the ritualistic and therapeutic aspects of wet shaving, thus transforming a mundane necessity into a self-care experience.

Regional trends highlight dynamic growth acceleration in the Asia Pacific (APAC) region, particularly driven by increasing urbanization, rising middle-class disposable income in China and India, and the adoption of Western grooming standards. While North America and Europe remain established, mature markets, they are experiencing stable growth fueled by premiumization, sophisticated product demands, and the strong performance of specialized men’s grooming categories. Latin America and the Middle East & Africa (MEA) present burgeoning opportunities, characterized by a younger population demographic and expanding retail infrastructure, leading to increased accessibility of internationally branded products. Manufacturers are strategically adapting their product offerings in these emerging regions, balancing affordability with the desire for quality, often launching localized variants that incorporate region-specific scents or traditional ingredients, thereby ensuring market relevance and penetration effectiveness.

Segment trends reveal that the shaving cream and gel segments maintain a dominant share due to their efficacy and widespread availability, but the specialized shaving lotion and balm segment is exhibiting the fastest growth rate, reflecting the consumer priority shift towards post-shave care and skin recovery. In terms of application, the men's segment is still the largest revenue generator, but the women's shaving segment is increasingly recognized as a key growth area, especially with the introduction of tailored products addressing specific female skin and hair needs, moving beyond mere rebranding of male products. Distributionally, online sales channels are exponentially outpacing traditional brick-and-mortar retail, driven by convenience, comprehensive product reviews, and exclusive online offers. The confluence of these business, regional, and segment dynamics necessitates that stakeholders adopt omnichannel strategies, prioritize sustainable sourcing, and leverage data analytics for highly personalized product development and targeted marketing campaigns to maximize market share and capitalize on future growth avenues.

AI Impact Analysis on Shaving Lotions and Creams Market

User queries regarding the impact of Artificial Intelligence (AI) on the Shaving Lotions and Creams Market commonly revolve around themes of personalization, supply chain efficiency, and enhanced customer engagement. Consumers frequently ask how AI can recommend the ideal shaving preparation based on their specific skin type, beard/hair density, and regional climate conditions, demonstrating a strong expectation for hyper-personalized product matching. Manufacturers, on the other hand, focus on leveraging AI for predictive demand forecasting to optimize inventory and reduce waste, and for quality control in manufacturing processes, such as identifying anomalies in product texture or consistency during large-scale production runs. There is also keen interest in how AI-powered chatbots and virtual assistants can provide instant, high-quality advice on wet shaving techniques and product application, significantly elevating the digital customer experience. The key underlying themes synthesized from these queries are the desire for precision in product selection, efficiency in delivery, and authenticity in brand interaction, all facilitated by intelligent algorithms.

The core expectation from AI deployment is the shift from mass-market products to highly individualized solutions, where machine learning algorithms analyze purchasing history, demographic data, and self-reported skin characteristics to formulate or recommend bespoke product kits. AI's role extends into the marketing domain, enabling sophisticated sentiment analysis of online reviews and social media chatter, allowing brands to quickly identify emerging ingredient trends, address product shortcomings in real-time, and refine their marketing messages for maximum impact. By processing vast datasets on ingredient efficacy and consumer preference patterns, AI is expected to accelerate the R&D cycle, pinpointing novel combinations that offer superior performance or sustainability metrics. This analytical capability transforms traditional market research, moving from reactive surveys to proactive predictive modeling, ensuring that new product launches are precisely aligned with latent consumer needs, significantly de-risking the innovation process.

Furthermore, the incorporation of AI facilitates sophisticated supply chain logistics, predicting local spikes in demand caused by weather events or cultural occurrences, ensuring optimal stock levels across disparate regional distribution centers. This reduction in logistical friction translates directly into improved profitability and reduced environmental footprint through minimized waste and optimized transportation routes. In the realm of customer service, AI-driven virtual try-on experiences or skin diagnostic tools help consumers visualize or anticipate product results, lowering the barrier to purchase and increasing confidence in online transactions. Ultimately, AI is positioned not just as a tool for efficiency, but as a transformative force that deepens the relationship between the brand and the consumer through unprecedented levels of relevance and service customization across the entire product lifecycle.

- AI-driven personalization for product recommendations based on skin and hair characteristics.

- Predictive demand forecasting to optimize inventory levels and reduce supply chain waste.

- Enhanced quality control during manufacturing using computer vision and machine learning models.

- AI-powered customer service chatbots providing real-time shaving technique and product usage advice.

- Sentiment analysis of consumer feedback to rapidly inform R&D and marketing strategy adjustments.

- Optimization of logistics and distribution networks through algorithmic routing and efficiency planning.

DRO & Impact Forces Of Shaving Lotions and Creams Market

The dynamics of the Shaving Lotions and Creams Market are shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively form the Impact Forces determining market trajectory. A primary driver is the accelerating consumer adoption of holistic grooming routines, viewing shaving preparations not merely as functional products but as essential elements of comprehensive facial skincare, demanding formulations enriched with active ingredients like hyaluronic acid, peptides, and botanical extracts. This demand for premiumization is strongly supported by rising disposable incomes globally and robust digital marketing campaigns that effectively elevate the perceived value of specialized shaving products. Simultaneously, the proliferation of specialized men’s grooming brands, often fueled by venture capital, introduces product innovation and intensifies competition, compelling traditional players to rapidly modernize their offerings and distribution strategies. The social normalization of meticulous personal appearance, particularly among younger demographics in professional and social settings, ensures sustained consumer engagement and frequent repurchase cycles, underpinning the market's fundamental stability.

Despite these favorable drivers, the market faces significant restraints, most notably the continuous technological advancements and increasing market penetration of electric shavers, which offer convenience and perceived lower long-term cost, potentially displacing wet shaving products. Furthermore, consumer concerns related to skin sensitivity and allergies, often triggered by artificial fragrances, parabens, or harsh chemicals found in some lower-quality formulations, necessitate stringent quality control and substantial investment in hypoallergenic product lines, increasing R&D costs. The prevalence of product proliferation also leads to significant consumer confusion and difficulty in brand loyalty, as the sheer volume of choices can overwhelm buyers. Economically, the market is vulnerable to fluctuating raw material costs, particularly those derived from natural sources or specialized chemicals, which can compress profit margins if not managed through effective long-term procurement strategies. These restraints compel manufacturers to constantly innovate and articulate clear product differentiation based on specific consumer benefits and safety profiles.

Opportunities for growth are concentrated in untapped segments and geographical expansion. The immense potential of the women's shaving segment remains largely unrealized, requiring tailored marketing and product innovation that specifically addresses female skin needs and hair removal practices distinct from men's products. Secondly, the rapid expansion of e-commerce, especially in emerging APAC and MEA markets, offers a low-overhead entry point for brands to reach previously inaccessible consumer bases. A critical opportunity lies in the development of highly sustainable and ethical product lines, including waterless or concentrated formulations and biodegradable packaging, catering to the environmentally conscious consumer base, turning ethical responsibility into a competitive advantage. The convergence of DRO factors indicates that the market is evolving toward specialization and premium, sustainable offerings, where success is determined by the ability to effectively communicate superior skincare benefits and maintain robust, transparent supply chains in the face of ongoing competition from alternative hair removal methods. The high impact forces favor companies that can quickly adapt their portfolio to meet evolving clean beauty standards while optimizing their digital presence.

Segmentation Analysis

Segmentation analysis of the Shaving Lotions and Creams Market is crucial for identifying targeted growth avenues and understanding divergent consumer preferences across various product formats, applications, and purchasing channels. The market is broadly categorized based on product type, application (end-user), and distribution channel, providing a granular view of revenue generation and consumer behavior. Product type segmentation distinguishes between creams, gels, foams, and lotions/balms, with each category serving specific needs relating to lather quality, consistency, and skin feel. Application segmentation differentiates between male and female grooming, acknowledging the fundamental differences in skin anatomy, hair texture, and product marketing required for each demographic. Finally, the distribution channel segmentation separates traditional retail (supermarkets, convenience stores), pharmacy channels, and the rapidly expanding digital landscape of e-commerce and direct-to-consumer platforms, offering insights into logistical optimization and retail strategy planning.

Focusing on the product type segmentation reveals a clear trend toward specialized, high-performing formulations. Shaving creams, particularly concentrated and traditional types, are gaining traction among enthusiasts willing to invest in superior lubrication and skin conditioning benefits, often leveraging exotic or natural ingredients. Conversely, foams and gels maintain high volume sales due to their speed of application and convenience, appealing to time-constrained consumers who prioritize efficiency. The fastest emerging segment, however, remains the pre-shave lotion and post-shave balm category, reflecting the broader industry trend where skin preparation and recovery are viewed as equally important, if not more so, than the actual act of shaving. This indicates a maturing consumer base that values the holistic impact of the grooming ritual on long-term skin health. Understanding these nuances allows manufacturers to allocate resources effectively toward innovation in segments showing exponential demand acceleration.

The interplay between application and distribution is equally vital. While men's shaving continues to dominate the market volume, the women's segment is witnessing targeted expansion, fueled by unique formulations designed for larger body surface areas and enhanced sensitivity. E-commerce platforms, due to their ability to host an infinite catalog of niche brands and provide detailed ingredient transparency, are becoming the preferred purchasing channel for premium and specialized products across both genders. Traditional supermarkets and hypermarkets remain crucial for high-volume, mass-market foam and gel sales, catering to the price-sensitive and convenience-driven consumer base. Strategic marketing must therefore be localized and customized, leveraging digital influence for high-end sales and mass merchandising techniques for accessible, everyday products, ensuring maximum penetration across all consumer strata and maintaining optimized inventory flows through segmented channel management.

- Product Type: Shaving Creams, Shaving Gels, Shaving Foams, Pre-Shave Lotions, Aftershave Balms/Lotions.

- Application/End-User: Men, Women.

- Distribution Channel: Hypermarkets/Supermarkets, Pharmacy Stores, Online Retail (E-commerce & DTC), Convenience Stores, Professional Salons.

- Formulation Type: Conventional, Natural/Organic, Specialty (Sensitive Skin, Medicated).

Value Chain Analysis For Shaving Lotions and Creams Market

The Value Chain for the Shaving Lotions and Creams Market begins with Upstream Analysis, which focuses on the sourcing and processing of core raw materials. These include surfactants (for foaming/lathering), emollients (for lubrication and moisture), humectants, and increasingly, specialized active ingredients such as botanical extracts, essential oils, and synthetic polymers. The cost and quality of these raw materials, many of which are commodity chemicals or agricultural derivatives, are subject to significant global market fluctuations and sustainability scrutiny. Key upstream activities involve stringent quality checks, ethical sourcing certification, and R&D focused on bio-based alternatives to traditional petrochemical derivatives, reflecting consumer demand for clean and green formulations. Suppliers demonstrating transparency and stability in pricing and ethical practices hold considerable leverage, making robust supplier relationship management a critical competitive factor for manufacturers.

Moving through the midstream, the manufacturing and formulation phase involves high-precision blending, packaging, and quality assurance processes. This stage is capital intensive, requiring advanced machinery for homogenization, filling, and sterilization, especially for products utilizing sensitive natural components that demand rigorous preservation methods. Downstream Analysis encompasses distribution and sales, where products move from manufacturers to various retail points. The distribution channel is bifurcated into direct sales (DTC via company websites and specialized subscription boxes) and indirect sales (through mass retailers, pharmacies, and e-commerce giants). Indirect channels require complex logistical frameworks and often involve multiple intermediaries, including national distributors and wholesalers, thereby adding layers of cost but providing maximum market reach and visibility, essential for mass-market penetration.

The Direct Channel offers brands greater control over pricing, inventory, and customer experience, facilitating personalized marketing and fostering brand loyalty, which is particularly vital for premium and niche offerings. The indirect channel, dominated by hypermarkets and large-scale e-commerce platforms, leverages their massive shopper traffic and established logistical infrastructure to move high volumes quickly. Successful value chain optimization hinges on seamlessly integrating these upstream and downstream activities, utilizing technology for inventory visibility, demand planning, and maximizing efficiency from raw material procurement to the final customer touchpoint. Manufacturers must also navigate complex regulatory landscapes concerning cosmetic safety and labeling in multiple jurisdictions, ensuring compliance throughout the entire production and distribution process to mitigate legal and reputational risks.

Shaving Lotions and Creams Market Potential Customers

The primary potential customers and end-users of shaving lotions and creams are individuals engaged in frequent hair removal, spanning across both genders and a wide spectrum of socio-economic groups. The largest segment remains the conventional male grooming consumer, ranging from teenagers starting their shaving journey to mature men who incorporate wet shaving as a daily habit. Within this segment, there is a distinct split between the mass-market consumer, who seeks convenience and affordability (often purchasing foams/gels via supermarkets), and the premium consumer, who invests in high-quality creams, artisan soaps, and specialized balms purchased through specialty stores or DTC channels, valuing the experience and dermatological benefits. This premium segment is particularly interested in products catering to sensitive skin, anti-aging properties, and natural ingredient compositions, representing a high-value customer base for innovation-driven brands.

The secondary but rapidly expanding customer base is the female consumer, who requires specialized products for body shaving (legs, underarms, bikini line). This demographic seeks formulations that provide excellent glide over large areas, intense moisturization, and prevention of ingrown hairs, often preferring milder scents or unscented options. Brands are increasingly launching female-centric lines with sophisticated marketing that acknowledges the distinct physical and psychological aspects of women's body care routines. Furthermore, professional end-users, such as barbershops, spas, and aesthetic clinics, constitute a specialized customer group, demanding high-volume, professional-grade products that offer superior performance for clients and often prioritize large format sizes and potent, therapeutic formulations that minimize irritation during close shaves.

A crucial emerging demographic consists of environmentally and ethically conscious consumers across all age groups. These buyers prioritize products with transparent sourcing, sustainable packaging (recyclable, zero-waste), and clean label ingredients (vegan, cruelty-free, paraben-free). They are often willing to pay a premium for brands demonstrating verifiable commitment to environmental stewardship and social responsibility. Manufacturers targeting future growth must cater explicitly to this segment by achieving relevant certifications and communicating their sustainability efforts effectively. Effective segmentation requires acknowledging these diverse needs—from affordability and convenience in mass markets to luxury experience and ethical alignment in niche markets—to ensure maximal market penetration and sustained customer lifetime value across the diverse array of end-users.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.8 Billion |

| Market Forecast in 2033 | USD 2.67 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | P&G (Gillette), Unilever, L'Oréal, Beiersdorf (Nivea), Edgewell Personal Care, Godrej Consumer Products, Shiseido, Clarins, The Art of Shaving, Vi-Jon, PLC, Cremo Company, T.N. Dickinson’s, Proraso, Jack Black, Baxter of California, Harry's, Dollar Shave Club, Barbasol, Taylor of Old Bond Street, Pacific Shaving Company |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Shaving Lotions and Creams Market Key Technology Landscape

The technological landscape of the Shaving Lotions and Creams Market is characterized by innovation in formulation science, manufacturing processes, and sustainable packaging solutions, all aimed at enhancing product performance, safety, and environmental profile. In formulation technology, there is a significant move towards microemulsion and nanotechnology, which allow for the stable incorporation of oil-soluble active ingredients (like vitamins and antioxidants) into water-based shaving preparations. These advanced delivery systems ensure deeper penetration of skin-conditioning agents, resulting in superior hydration and long-lasting smoothness. Furthermore, specialized foaming agents are being developed to create denser, richer, and more stable lathers that minimize razor drag and friction, particularly critical for consumers with coarse hair or sensitive skin. This continuous refinement of chemical engineering allows manufacturers to produce hybrid products that effectively combine the functional properties of shaving aids with the therapeutic benefits of high-end skincare, blurring the lines between cosmetic and dermatological preparations.

Manufacturing technology is rapidly adopting automation and digitization, primarily driven by the need for consistency and large-scale ethical production. Continuous manufacturing processes, replacing traditional batch processing, are being implemented to improve efficiency, reduce energy consumption, and ensure highly reproducible product quality across millions of units. A key area of technological investment involves advanced quality assurance systems utilizing sophisticated sensors and imaging technology to monitor raw material input and final product consistency in real-time, thereby minimizing waste and ensuring compliance with stringent regulatory standards regarding ingredient concentrations and contamination avoidance. The integration of smart factory principles allows for dynamic adjustments in production parameters based on instantaneous data feedback, optimizing yield and reducing the overall environmental footprint associated with complex chemical mixing and homogenization.

In parallel, packaging technology is undergoing a revolution driven by environmental concerns and AEO requirements related to product longevity and user experience. Innovations include the widespread adoption of airless pump systems for creams and lotions, which prevent oxidation of sensitive natural ingredients, thereby extending shelf life and reducing the need for strong chemical preservatives. More critically, there is a determined shift toward recyclable, post-consumer recycled (PCR) plastics, and biodegradable materials for tubes and containers, addressing consumer demand for sustainability. Advanced engineering of aerosol cans, where relevant, focuses on eliminating volatile organic compounds (VOCs) and ensuring efficient propellant usage, aligning with global environmental protection initiatives. These technological advancements collectively support the market's move toward premium, high-efficacy products that are not only safer for the user but also minimize their impact on the planet, defining the competitive edge for forward-thinking brands in the modern grooming industry.

Regional Highlights

North America: North America, particularly the United States and Canada, represents a mature but highly influential market segment characterized by high disposable incomes and a strong consumer focus on specialized men's grooming and premium products. The market here is driven by innovation in niche segments, such as organic, artisan, and custom-blended shaving preparations, often distributed via DTC channels and subscription boxes. Consumers in this region readily adopt new technologies and prioritize efficacy, resulting in strong demand for products incorporating advanced skincare ingredients like retinol, advanced peptides, and proprietary dermatological complexes. The competitive landscape is intense, necessitating continuous brand differentiation through sophisticated digital marketing and clear articulation of health and wellness benefits, as consumers are generally well-informed and demanding regarding ingredient transparency and ethical sourcing practices. This region also serves as a crucial testing ground for high-end, luxury shaving brands before their global rollout.

Europe: Europe maintains a significant share of the global market, underpinned by established wet shaving traditions, particularly in countries like Italy and the UK, which boast historical artisan shaving brands. The market is rigorously governed by the European Union’s cosmetic regulations (EC 1223/2009), driving manufacturers to prioritize product safety and ingredient transparency. Current growth is fueled by the 'clean beauty' trend, where consumers actively seek products free from known irritants, microplastics, and controversial chemicals, accelerating the shift toward natural and certified organic formulations. Western European nations (Germany, France, UK) show high per capita spending on premium items, while Eastern Europe presents growth opportunities fueled by rising economic status and modernization of retail infrastructure. Sustainable packaging is a major purchasing determinant, compelling brands to invest heavily in recyclable and refillable formats to maintain regional market relevance and compliance with evolving environmental mandates.

Asia Pacific (APAC): The APAC region stands out as the fastest-growing market globally, characterized by vast population size, rapid urbanization, and exponential growth of the middle class, especially in China, India, and Southeast Asia. While traditional grooming habits vary, the increasing adoption of Western beauty standards and the influence of K-Beauty and J-Beauty trends are driving demand for sophisticated products that combine shaving functionality with intensive skin brightening and moisturizing benefits tailored to diverse Asian skin types. The expansion of modern retail chains and the pervasive penetration of e-commerce platforms (like Alibaba and Amazon India) are significantly improving product accessibility across both urban and rural areas. Price sensitivity remains a factor in certain sub-regions, requiring manufacturers to balance quality with affordability, often leading to differentiated product portfolios optimized for local economic conditions and specific consumer preferences related to fragrance and texture.

Latin America (LATAM) and Middle East & Africa (MEA): LATAM is a high-potential market characterized by a young, growing population and increasing urbanization, leading to higher spending on personal care. Brazil and Mexico are the regional powerhouses, demanding accessible yet high-quality products. The market dynamic is heavily influenced by economic stability and exchange rate volatility, which can impact the cost of imported raw materials and finished goods. The MEA region is experiencing substantial growth, particularly in the GCC countries, where high disposable incomes drive demand for luxury and imported international brands. Cultural norms and climate conditions often necessitate specific product attributes, such as highly soothing post-shave balms to counter environmental dryness. E-commerce penetration is rising steadily across both LATAM and MEA, providing a crucial channel for accessing international premium brands and navigating complex local retail landscapes, promising sustained incremental growth in the forecast period.

- North America: Focus on premiumization, specialized men's grooming, and DTC subscription models.

- Europe: Strong emphasis on 'clean beauty,' stringent regulatory compliance, and sustainable packaging solutions.

- Asia Pacific (APAC): Fastest growth market driven by urbanization, rising middle class, and integration of specialized skin care benefits.

- Latin America (LATAM): High potential due to young population; influenced by economic stability and demand for accessible quality.

- Middle East & Africa (MEA): Growth fueled by high disposable incomes in GCC and demand for moisturizing, soothing formulations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Shaving Lotions and Creams Market.- Procter & Gamble (Gillette)

- Unilever PLC

- L'Oréal S.A.

- Beiersdorf AG (Nivea)

- Edgewell Personal Care Company

- Godrej Consumer Products Limited

- Shiseido Company, Limited

- Clarins S.A.

- The Art of Shaving

- Vi-Jon, PLC

- Cremo Company

- T.N. Dickinson’s

- Proraso

- Jack Black

- Baxter of California

- Harry's

- Dollar Shave Club (acquired by Unilever)

- Barbasol

- Taylor of Old Bond Street

- Pacific Shaving Company

Frequently Asked Questions

Analyze common user questions about the Shaving Lotions and Creams market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the demand for premium shaving creams and lotions?

The demand for premium products is driven by consumers viewing shaving as a skin care ritual, prioritizing ingredients that offer enhanced dermatological benefits like anti-aging, intense hydration, and reduced irritation, supported by increased disposable income and sophisticated marketing.

How do shaving creams and shaving gels fundamentally differ in performance?

Shaving creams are generally formulated to produce a richer, denser lather, providing superior cushion and lubrication ideal for traditional wet shaving and coarse hair. Gels typically generate a lighter foam, often requiring less water, and offer convenience and visibility, appealing to speed-conscious users.

Which geographical region exhibits the highest growth potential for shaving preparations?

The Asia Pacific (APAC) region currently holds the highest growth potential, fueled by rapid urbanization, substantial growth in the middle-class population, increasing consumer exposure to global grooming standards, and the expansion of accessible e-commerce distribution channels.

What is the primary impact of e-commerce on the Shaving Lotions and Creams Market?

E-commerce has significantly democratized the market by reducing barriers for niche and DTC brands, enabling greater product customization and ingredient transparency, while offering consumers convenience and access to an extensive, specialized inventory previously unavailable in traditional retail.

Are natural and organic shaving products dominating market trends?

While conventional products still dominate volume sales, natural and organic formulations are the fastest-growing trend, heavily influencing consumer preference due to concerns over chemical irritants, environmental sustainability, and ethical sourcing, pushing mainstream brands toward 'clean label' reformulations.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager