Shellac Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441305 | Date : Feb, 2026 | Pages : 243 | Region : Global | Publisher : MRU

Shellac Market Size

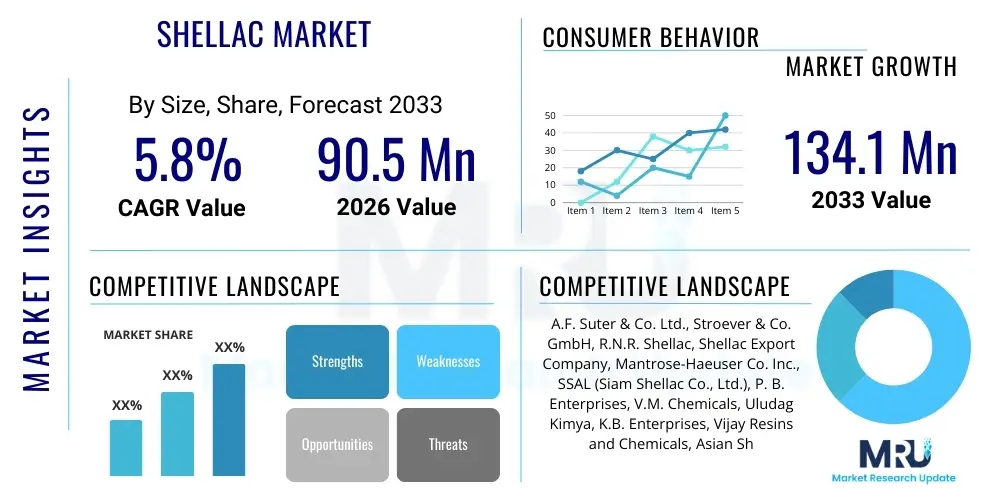

The Shellac Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 90.5 Million in 2026 and is projected to reach USD 134.1 Million by the end of the forecast period in 2033.

Shellac Market introduction

Shellac, a complex natural polyester resin derived from the secretions of the tiny female lac bug, Kerria lacca, serves as a versatile, eco-friendly biopolymer in numerous industrial applications. Its unique chemical structure, comprising a blend of polyhydroxy carboxylic acids, endows it with exceptional film-forming, gloss-enhancing, and adhesion properties, positioning it as a key ingredient in specialty chemicals globally. The market encompasses a range of grades, including crude stick lac, seedlac, buttonlac, and highly refined dewaxed and bleached shellac, each tailored for specific industrial requirements regarding purity, color, and solubility. Major applications span from confectionery and pharmaceuticals, where it functions as a natural glazing and coating agent (E904), to traditional woodworking finishes and modern electronics insulation. The inherent benefits of shellac, such as its natural origin, biodegradability, and recognized safety profile (GRAS status), are the fundamental drivers supporting its sustained market demand against synthetic alternatives.

The core utility of shellac in high-growth sectors, particularly the nutraceutical and controlled-release drug delivery segments, stems from its specific barrier properties. When applied as an enteric coating on tablets or capsules, shellac ensures the active pharmaceutical ingredients remain protected from the low pH environment of the stomach, releasing them only when they reach the higher pH of the small intestine. This controlled-release functionality is indispensable for certain medications and dietary supplements. Furthermore, its ability to impart a durable, non-tacky finish makes it irreplaceable in premium coatings, where traditional French polish is still highly valued for its aesthetic depth and repairability. This dual functionality across highly regulated and traditional consumer markets ensures a stable and diversified consumption base, mitigating sector-specific risks. The versatility of shellac extends into cosmetics, particularly nail polishes and hair sprays, where it acts as a superior natural binding agent and film former, responding directly to the global trend of reducing synthetic chemical exposure in personal care products.

Market expansion is also intrinsically linked to global sustainability initiatives and consumer trends favoring clean-label ingredients. As environmental concerns increase, industries are actively seeking renewable and biodegradable raw materials, aligning perfectly with shellac’s natural sourcing. Moreover, advancements in processing technology, leading to the commercial availability of ultra-pure, standardized grades (e.g., arsenic-free, heavy metal-compliant), have unlocked new, premium-priced applications in highly sensitive electronics and medical devices. These technological improvements address historical concerns regarding purity and batch variability, thereby solidifying shellac's reputation as a high-performance natural resin capable of meeting stringent 21st-century manufacturing specifications. The rising global confectionery and snack industry, coupled with the expansion of the pharmaceutical market in emerging economies, provides a robust structural tailwind for market value growth throughout the forecast period, emphasizing shellac's role as a vital natural excipient and additive.

Shellac Market Executive Summary

The global Shellac market is poised for consistent expansion, driven primarily by favorable consumer migration towards natural and clean-label ingredients across food, cosmetics, and drug formulation sectors. Business trends indicate an intensifying focus on optimizing the historically volatile supply chain through better agricultural practices and increased investment in advanced refining infrastructure, particularly in South Asia and Southeast Asia, the key sourcing regions. Major market players are consolidating their positions through vertical integration to secure stable access to crude lac, mitigating supply risks associated with climatic variability and ensuring better pricing stability. Furthermore, strategic partnerships between large shellac processors and multinational pharmaceutical excipient providers are becoming more common to ensure compliance with global pharmacopeial standards and guarantee high-volume, standardized deliveries, highlighting a maturation of quality control practices.

Regionally, the market presents a dichotomy: high-volume, cost-competitive production centered in the Asia Pacific (APAC), particularly India and Thailand, versus high-value consumption dominated by mature regulatory markets in North America and Europe. APAC not only serves as the global production hub but is also experiencing surging domestic demand fueled by demographic growth and rapid modernization of its food processing sector, utilizing shellac in various traditional and commercial applications. In contrast, North American and European markets exhibit premium pricing for specialized products like bleached and dewaxed shellac, driven by the indispensable requirement for natural enteric coatings in their vast nutraceutical and generic drug markets. This geographical segmentation defines trade flows, with substantial imports of refined grades into Western markets being a key economic feature of the global shellac trade, requiring intricate international logistics and certification protocols.

Segmentation analysis underscores the dominance of the Application segment, with Food and Beverage maintaining the largest share due to widespread use in glazing and protective coatings for candies and processed foods, capitalizing on the aesthetic appeal shellac provides. However, the fastest growth trajectory is anticipated within the Pharmaceutical segment, propelled by the development of complex drug delivery systems and the expanding need for taste masking and acid protection in oral solid dosage forms, demanding the highest purity grades. Trends within the product type segmentation show a clear shift toward high-purity, processed grades (dewaxed and bleached shellac) over conventional seed or button lac, reflecting the increasing technical demands from end-user industries that require consistent performance characteristics, particularly solubility, molecular weight, and low impurity profiles, thereby fueling higher revenue per unit volume for specialized manufacturers focused on value-added processing.

AI Impact Analysis on Shellac Market

User inquiries concerning the impact of Artificial Intelligence (AI) on the Shellac market predominantly revolve around optimizing agricultural yields, predicting raw material price fluctuations, and enhancing quality control in processing. Key themes emerging from these questions include the potential for AI-driven climate modeling to forecast lac bug population health and resin output, thus mitigating supply chain risks associated with unpredictable harvesting cycles. Users are also keen on understanding how machine learning algorithms can analyze global demand signals and environmental factors to provide accurate price forecasts for stakeholders, moving away from traditional, often reactive, pricing mechanisms. Furthermore, there is significant interest in leveraging computer vision and AI for automating the grading and sorting of crude shellac, ensuring consistent purity and reducing human error in the refinement process, which is critical for compliance-heavy sectors like pharmaceuticals.

The direct influence of AI integration is less about replacing shellac itself and more about optimizing the entire value chain, from farm to finished product. Precision agriculture techniques, potentially guided by AI, could monitor host tree health and insect colony proliferation using satellite imagery and environmental sensors, ensuring sustainable and predictable raw material procurement. In the manufacturing phase, AI can manage complex blending ratios for customized shellac formulations (e.g., specific dissolution rates or molecular weight requirements for pharmaceutical coatings), drastically improving batch consistency, reducing material waste, and decreasing energy consumption during refinement processes like bleaching and dewaxing. The primary expectation is that AI tools will stabilize the notoriously volatile supply side of the market, addressing the natural seasonality inherent to lac production, thereby improving margins and reliability for end-users, especially those operating under strict Just-In-Time (JIT) inventory systems.

Another significant area of inquiry focuses on consumer trend analysis and customized formulation development. AI and big data analytics are increasingly used by confectionery and cosmetics manufacturers, the primary end-users, to understand natural ingredient preferences, predict ingredient performance based on physicochemical parameters, and accelerate formulation success rates. While AI doesn't directly influence shellac production yield, its application in consumer-facing industries indirectly drives shellac demand by highlighting clean-label preferences and accelerating product development cycles that favor natural resins over synthetic alternatives. For instance, predictive maintenance driven by AI can monitor equipment used in specialized coating processes, minimizing downtime and ensuring the continuous production of high-specification, standardized shellac grades required by global clients, thus creating efficiencies throughout the downstream market segments.

- AI-driven predictive modeling for lac bug habitat conditions and yield forecasting, stabilizing raw material supply and informing farmer compensation strategies.

- Implementation of Machine Learning (ML) for sophisticated raw material price prediction, minimizing market volatility risks for processors and end-users by identifying external economic factors.

- Enhanced quality control using computer vision systems for automated grading and purity assessment of crude shellac resin flakes, ensuring compliance with global pharmacopeias.

- Optimization of manufacturing processes, including precise temperature and solvent control for producing high-purity, dewaxed shellac grades with improved efficiency and reduced energy expenditure.

- Utilization of big data analytics by end-users to quantify consumer preference for natural coatings, thereby boosting shellac usage in clean-label products and driving product innovation.

- Streamlining inventory management and logistics across the supply chain using AI algorithms to reduce storage costs, minimize spoilage of liquid formulations, and optimize delivery lead times globally.

- Adoption of robotic process automation (RPA) in packaging and final inspection stages to maintain sterile conditions, especially crucial for pharmaceutical-grade shellac processing.

DRO & Impact Forces Of Shellac Market

The Shellac market dynamics are shaped by a complex interplay of inherent natural attributes, evolving regulatory pressures, and shifting market demands for sustainable solutions. The most potent driving forces include the escalating global demand for natural, non-toxic, and edible coatings, particularly within the confectionery and pharmaceutical industries where shellac acts as a direct replacement for synthetic waxes. Shellac's established classification as a Generally Recognized As Safe (GRAS) substance in the United States and its E904 status in the European Union facilitates its extensive use, contrasting favorably with ongoing regulatory scrutiny faced by various synthetic food additives. Additionally, the increasing consumer preference for organic and sustainably sourced products, coupled with the environmental mandate for biodegradable materials, firmly positions shellac as a highly attractive ingredient, especially in specialized coating and binder applications where synthetic polymers pose long-term environmental challenges, creating significant market momentum.

Despite these drivers, the market faces significant structural restraints primarily centered on supply chain instability and competition. As shellac is a natural resin harvested from living organisms in specific geographical areas (monsoon-dependent regions), its production is highly susceptible to unpredictable weather patterns, climate change effects, and seasonal pest infestations, invariably leading to inherent price volatility and periodic supply shortages. This unpredictability hinders long-term strategic planning for large industrial users. Furthermore, competition remains intense from synthetic alternatives such as carnauba wax, candelilla wax, and synthetic polymers like various cellulose derivatives and polymethacrylates. These competitors often offer superior consistency, lower acquisition costs, and specific engineered properties (e.g., higher resistance to solvents or precisely defined melting points), providing a persistent competitive constraint, particularly in non-food applications where natural origin is less critical.

Opportunities for market growth lie significantly in refining technologies to produce ultra-high purity grades (e.g., pharmaceutical-grade bleached, wax-free shellac) suitable for highly sensitive applications like advanced drug delivery systems, specialized cosmetic ingredients, and high-end electronics insulation, which command substantial premium pricing. Another critical opportunity involves the development of new, specialized shellac derivatives, such as highly elastic or fast-dissolving shellac formulations, which could unlock novel applications in cosmetics, specialized inks, and improved food coatings requiring specific texture profiles. Moreover, enhancing supply chain resilience through sustainable sourcing initiatives, coupled with achieving internationally recognized certifications (e.g., fair trade or ecological standards), can act as powerful market differentiators, especially in quality-conscious markets like Europe and North America, positioning shellac as a premium, environmentally responsible ingredient. These dynamic forces collectively shape the investment landscape and strategic decisions governing market participants' future growth.

Segmentation Analysis

The Shellac market is comprehensively segmented based on the product type (grade of refinement), the functional application area, the physical form, and the geographic region of consumption. Analyzing these segmentations provides critical insight into the varying purity requirements, pricing structures, and regulatory landscapes across different end-user industries. The segmentation by product type is paramount, as the degree of refinement—ranging from crude stick lac to highly purified, dewaxed, and bleached shellac—directly correlates with suitability for sensitive applications, such as pharmaceutical enteric coatings, and dictates market price. High-purity grades necessitate specialized, capital-intensive processing and thus command significant premiums over conventional grades used in lower-value industrial coatings, influencing manufacturers' strategic investment decisions.

Segmentation by application highlights the key demand drivers. The Food and Beverage segment historically consumes the largest volume due to the widespread use of shellac as a natural glazing agent, enhancing the appearance and preserving the freshness of items like confectioneries, citrus fruits, and coffee beans. Conversely, the Pharmaceutical segment, while lower in volume, represents the highest value segment due to the strict quality and regulatory requirements imposed on excipients, driving demand for specialized grades with extremely low impurity levels. Understanding the growth trajectory of these application segments—particularly the rapid expansion expected in nutraceuticals and customized drug delivery systems—is essential for market forecasting and capacity planning for processing facilities.

The segmentation by form (solid flakes/buttons versus liquid solutions) affects logistical and end-user handling requirements. Solid forms are advantageous for long-distance international trade and have an extended shelf life, while liquid forms, often alcohol or water-based solutions, offer convenience for direct application in manufacturing processes but require specialized storage and handling due to flammability or shelf-stability issues. Finally, regional segmentation delineates the producer economies (APAC) from the high-value consumer economies (North America and Europe), underscoring the vital role of international trade and compliance with differing regional food and drug administration standards in shaping global market dynamics.

- By Product Type (Grade):

- Seed Shellac (Crude, basic processed form)

- Button Shellac (Intermediate processed grade)

- Wax Shellac (Contains natural wax content)

- Dewaxed Shellac (Refined, wax content reduced for superior clarity and adhesion)

- Bleached Shellac (Decolorized, used in light-colored applications and pharmaceuticals)

- By Application:

- Food and Beverage (Glazing agents, protective coatings for confectionery, chewing gum, and fresh produce)

- Pharmaceuticals (Enteric coating, tablet binding, controlled-release matrix formation, capsule sealing)

- Cosmetics (Nail polish base, hair sprays, mascara, binders in personal care formulations)

- Wood Finishing and Coatings (French polish, sealants, varnishes for high-end furniture and musical instruments)

- Electrical and Electronics (Insulating materials, bonding cements for mica and resistance coils)

- Leather and Textiles (Finishes and stiffeners)

- Inks and Dyes (Binders for printing inks and specialized pigments)

- By Form:

- Solid (Flakes, Buttons, Powder)

- Liquid (Aqueous Solutions, Alcohol Solutions, Specialized Resin Dispersions)

- By End-User Industry:

- Confectionery Industry (Largest volume consumer)

- Drug Manufacturing (Highest value consumer)

- Furniture and Handicraft Manufacturing

- Industrial Coatings and Specialty Chemicals

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Shellac Market

The Shellac market value chain is initiated by the highly specialized and geographically concentrated upstream activities: lac cultivation and harvesting. This phase is predominantly centered in agrarian communities across India and Thailand, involving the labor-intensive process of managing host trees (such as Kusum, Ber, and Palash) and monitoring the lac bug colonies (Kerria lacca) responsible for secreting the stick lac. Upstream analysis highlights significant reliance on traditional, small-scale farming methods, which results in supply fragmentation and inherent susceptibility to weather dependency, a major factor contributing to price volatility. Efficiency improvements at this initial stage—focusing on better pest control, host tree management, and farmer education—are crucial for stabilizing the supply of crude resin and maintaining minimum quality standards before refinement.

The crucial midstream segment involves the industrial processing and refinement of crude lac. This stage transforms the raw stick lac into various commercial grades through steps including washing, crushing, melting, straining, and chemical treatment (bleaching or dewaxing). Refining requires significant capital investment in specialized filtration equipment, solvent recovery systems, and quality control laboratories to meet the purity demands of global markets, particularly for pharmaceutical and food grades. Major processors located in APAC (near the source) and in Europe/North America (near the high-value consumer markets) execute this transformation. The strategic importance of the midstream lies in achieving consistency—producing standardized shellac flakes or solutions with reliable molecular weight and low heavy metal content, which differentiates high-quality suppliers from commodity traders.

The distribution of refined shellac utilizes a sophisticated hybrid channel structure. Direct sales are often mandated for large industrial buyers, especially multinational pharmaceutical companies and major global confectionery corporations, who demand certified, batch-tested, and standardized refined shellac, often negotiated through long-term supply agreements. Indirect channels, involving specialized chemical distributors, regional agents, and international traders, handle the bulk of sales to smaller coating manufacturers, local cosmetic formulators, and the fragmented furniture industry. The downstream segment involves the ultimate end-users, where shellac is incorporated into final products. Effective logistics must manage the different requirements for solid flakes (robust, long shelf-life) and liquid solutions (flammable or time-sensitive), while consistently ensuring that all distributed shellac grades meet the specific legal and quality compliance standards (e.g., FDA, EFSA) of the destination market, underpinning the overall integrity of the value chain.

Shellac Market Potential Customers

Potential customers for high-grade Shellac are predominantly concentrated within the heavily regulated industries of Pharmaceuticals and Food & Beverage, which rely on its unique combination of natural origin and functional performance. The pharmaceutical industry represents the most critical, high-value customer segment, requiring ultra-pure, dewaxed, and often bleached shellac for use in enteric coatings, tablet binding, and microencapsulation for controlled drug release. These buyers, consisting mainly of large generic and branded drug manufacturers and nutraceutical companies, place the highest priority on quality consistency, comprehensive regulatory documentation (such as non-GMO status, low heavy metal content, and Certificate of Analysis for every batch), and demonstrable efficacy as an acid-resistant film former. Their purchasing decisions are necessity-driven, making them highly inelastic consumers who will pay a premium for compliance and reliability.

The confectionery and general food processing industries constitute the largest volume customer segment globally. Manufacturers of premium chocolates, glazed candies, chewing gums, and producers of fresh fruit coatings rely extensively on shellac (E904) to provide superior gloss, protection against moisture ingress, and preservation of product aesthetics, thereby extending shelf life. These high-volume customers are highly sensitive to raw material price fluctuations but are increasingly being influenced by consumer demand for transparency and clean labels. The rapid expansion of organic, natural, and premium food products globally is continuously broadening the scope of this customer base, driving demand for shellac that is ethically sourced and naturally certified, creating niche market opportunities within the broader food sector.

Beyond the food and medical sectors, significant potential customers exist in specialized industrial and consumer markets. The fine woodworking and musical instrument sectors, including professional restorers and high-end manufacturers, remain dedicated users of shellac for traditional French polish, valuing its deep, rich luster and easy repairability. The electrical equipment manufacturing industry utilizes specialized grades for insulating varnishes, particularly in applications involving high temperatures and complex coil windings, leveraging shellac's excellent dielectric properties and thermal resistance. Furthermore, the cosmetics industry, including manufacturers of high-performance nail polishes, sealants, and hair fixatives, actively seeks shellac for its exceptional film-forming and adhesive qualities, appealing to a consumer base increasingly demanding efficacious yet naturally derived ingredients in their personal care regimes.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 90.5 Million |

| Market Forecast in 2033 | USD 134.1 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | A.F. Suter & Co. Ltd., Stroever & Co. GmbH, R.N.R. Shellac, Shellac Export Company, Mantrose-Haeuser Co. Inc., SSAL (Siam Shellac Co., Ltd.), P. B. Enterprises, V.M. Chemicals, Uludag Kimya, K.B. Enterprises, Vijay Resins and Chemicals, Asian Shellac, H. G. Chemicals, N. K. Shellac, S. B. Lac & Chemicals, Kusum Products Ltd., Essen International, Resin Technology, C.P.Shellac Co., Ltd., D.C. Enterprises |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Shellac Market Key Technology Landscape

The key technology landscape in the Shellac market is primarily focused on achieving higher purity and greater consistency, crucial attributes for meeting the strict requirements of pharmaceutical and advanced food-grade applications. Traditional processing methods involving heat and solvent extraction are continuously being optimized through advancements in continuous flow technology and highly efficient, multi-stage filtration systems, often incorporating membrane separation techniques. Modern technological advancements prioritize the production of certified, high-grade shellac by implementing sophisticated bleaching and dewaxing protocols. For instance, processes utilize advanced centrifugation and precise chemical treatments (e.g., using stabilized hydrogen peroxide or optimized alkali washes) to minimize impurities, heavy metals, and residual wax content far below regulatory thresholds, thereby distinguishing premium shellac products from lower-cost commodity grades.

A major area of innovative technological development involves overcoming the inherent solubility limitations of shellac. Traditionally soluble only in alcohol (ethanol), the development of stable, aqueous shellac solutions and dispersions has revolutionized its utility. This technology involves utilizing specialized emulsifiers, surfactants, and pH modifiers to create stable, water-based emulsions that retain shellac’s critical film-forming properties without the need for flammable organic solvents. This shift is critically important for meeting global environmental, health, and safety (EHS) standards, particularly in large-scale food and industrial coating environments where the use of alcohol solvents is restricted or highly regulated. Water-based formulations open new markets for shellac in sustainable packaging, environmentally friendly wood coatings, and novel oral drug delivery systems requiring zero residual solvent content.

Furthermore, robust analytical technology is indispensable for quality assurance and compliance in the modern shellac market. Processors are increasingly utilizing state-of-the-art instruments such as High-Performance Liquid Chromatography (HPLC), Gel Permeation Chromatography (GPC), and Atomic Absorption Spectroscopy (AAS). These tools enable precise monitoring of shellac's complex polymer structure, ensuring reliable batch-to-batch consistency in crucial parameters like molecular weight distribution, dissolution rate, and detection of trace contaminants. Investment in these high-precision analytical and processing technologies allows established industry leaders to consistently deliver standardized, certified products, thus maintaining competitive advantage over suppliers relying on less precise, traditional processing methods, and assuring end-users of dependable performance in critical applications.

Regional Highlights

The Shellac market exhibits strong regional specialization, clearly bifurcating into the dominant production centers and the specialized high-value consumption hubs. Asia Pacific (APAC) stands as the principal geographical segment, controlling both the raw material sourcing and the initial processing phases globally. India, particularly in its central and eastern states, alongside Thailand, are the primary global suppliers of crude stick lac. This regional dominance is underpinned by suitable climatic conditions, established traditional harvesting practices, and competitive labor costs. The APAC region not only serves the global export market but also maintains significant internal consumption, driven by its large, rapidly expanding food and confectionery sectors and the continued use of shellac in local handicrafts and traditional industries, stabilizing demand despite global fluctuations.

North America and Europe constitute the core high-value consumption markets. These regions are characterized by extremely stringent regulatory environments (e.g., FDA, EFSA/E904), leading to a high demand for premium, highly refined grades such as dewaxed and bleached shellac. The growth in these regions is not volume-driven but value-driven, propelled by the robust expansion of the pharmaceutical, nutraceutical, and premium organic food sectors. European markets, in particular, show a strong consumer preference for natural additives, which reinforces shellac's market share against synthetic alternatives. These regions serve as the destination for the highest-specification shellac grades, requiring complex supply chain certification and traceability protocols to ensure compliance with medical and food safety standards upon import.

Latin America (LATAM) and the Middle East & Africa (MEA) represent important emerging markets with rapidly increasing demand for processed shellac. Growth in LATAM is closely linked to the modernization of the region's food and beverage manufacturing sector and the parallel expansion of its pharmaceutical industry, which necessitates importing certified excipients for local drug production. Similarly, the MEA region is witnessing growing consumption in industrial coatings, specialized food glazing, and local cosmetic production. However, market penetration in these regions can be slower due to fragmented distribution infrastructure, fluctuating import tariffs, and reliance on complex international logistics from APAC producers. Strategic focus on improving distribution networks and establishing regional technical support centers will be key to unlocking the full potential of these emerging economies during the forecast period.

- Asia Pacific (APAC): Dominates global supply and primary processing. Key countries are India and Thailand. Driven by large internal consumption in food processing and traditional industries, and serving as the export base for intermediate and final grades.

- Europe: A high-value consumer market focused heavily on pharmaceutical (enteric coating) and natural food glazing applications. Demand is strictly governed by E904 regulation and consumer desire for clean-label ingredients.

- North America: Significant importer of refined, high-purity shellac for specialized food coatings, nutraceutical binders, and high-end wood finishing applications. Market growth is closely tied to the natural and organic products trend.

- Latin America (LATAM): Emerging market showing strong growth in demand for imported refined shellac, driven by the expansion and internationalization of regional food and drug manufacturing sectors.

- Middle East and Africa (MEA): Growth potential in industrial coatings, specialized food preparation, and regional cosmetics manufacturing, although market growth is contingent on overcoming logistical challenges and trade barriers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Shellac Market.- A.F. Suter & Co. Ltd.

- Stroever & Co. GmbH

- R.N.R. Shellac

- Shellac Export Company

- Mantrose-Haeuser Co. Inc.

- SSAL (Siam Shellac Co., Ltd.)

- P. B. Enterprises

- V.M. Chemicals

- Uludag Kimya

- K.B. Enterprises

- Vijay Resins and Chemicals

- Asian Shellac

- H. G. Chemicals

- N. K. Shellac

- S. B. Lac & Chemicals

- Kusum Products Ltd.

- Essen International

- Resin Technology

- C.P.Shellac Co., Ltd.

- D.C. Enterprises

FAQ

Analyze common user questions about the Shellac market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Shellac and why is it preferred over synthetic alternatives in food?

Shellac is a natural resin excreted by the female lac bug, making it a biodegradable, non-toxic, and renewable resource. It is preferred in food and confectionery (E904 in the EU) primarily because it offers excellent moisture barrier properties and high gloss while strictly adhering to global clean-label standards, contrasting favorably with many synthetic waxes or petroleum-derived polymers.

How is the pricing of Shellac determined, and what factors cause volatility?

Shellac pricing is determined by supply-demand dynamics strongly influenced by the agricultural cycle. Price volatility is primarily caused by uncontrollable climate conditions, monsoon rainfall variability, and seasonal pest infestations in the major producing regions (India and Thailand), leading to unpredictable harvest yields and subsequent supply shortages.

What is the primary function of Shellac in the pharmaceutical industry?

In pharmaceuticals, the essential function of shellac is as an enteric coating agent. It ensures the active pharmaceutical ingredients remain chemically stable by resisting dissolution in the stomach's low pH environment, facilitating targeted and controlled drug release only upon reaching the higher pH of the small intestine.

What are the key technological advancements driving market growth for Shellac?

Key technological advancements focus on producing ultra-high purity, standardized grades (dewaxed and bleached shellac) that meet stringent medical specifications. Crucially, the development of stable, water-based shellac dispersions is expanding applications by providing a safe, environmentally compliant, non-alcoholic alternative for industrial and pharmaceutical coatings.

Which geographical regions are the largest consumers and producers of shellac?

Asia Pacific (APAC), specifically India and Thailand, are the dominant global producers of the crude lac resin. Conversely, mature and highly regulated economies in North America and Europe, driven by large pharmaceutical and specialty food sectors, are the largest, highest-value consumers of refined and certified shellac grades.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Liquorice Shellac Market Size Report By Type (Hot Filtration, Solvent Method), By Application (Food Industry, Pharmaceuticals, Cosmetics, Paints & Coatings, Printing Inks, Leather), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Statistics, Trends, Outlook and Forecast 2025-2032

- Shellac Market Size Report By Type (Wax Containing Shellac, Bleached shellac, Dewaxed shellac, Others), By Application (Food Industry, Pharmaceutical Industry, Cosmetic Industry, Industrial applications, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Shellac Market Statistics 2025 Analysis By Application (Food Industry, Pharmaceutical Industry, Cosmetic Industry, Industrial applications), By Type (Wax Containing Shellac, Bleached Shellac, Dewaxed Shellac), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Wood Lacquer Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Stains & varnishes, Shellac coating, Wood preservatives, Water repellents, Others), By Application (Furniture, Cabinets, Siding, Flooring & decking, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager