Ship Engine Turbochargers Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443005 | Date : Feb, 2026 | Pages : 245 | Region : Global | Publisher : MRU

Ship Engine Turbochargers Market Size

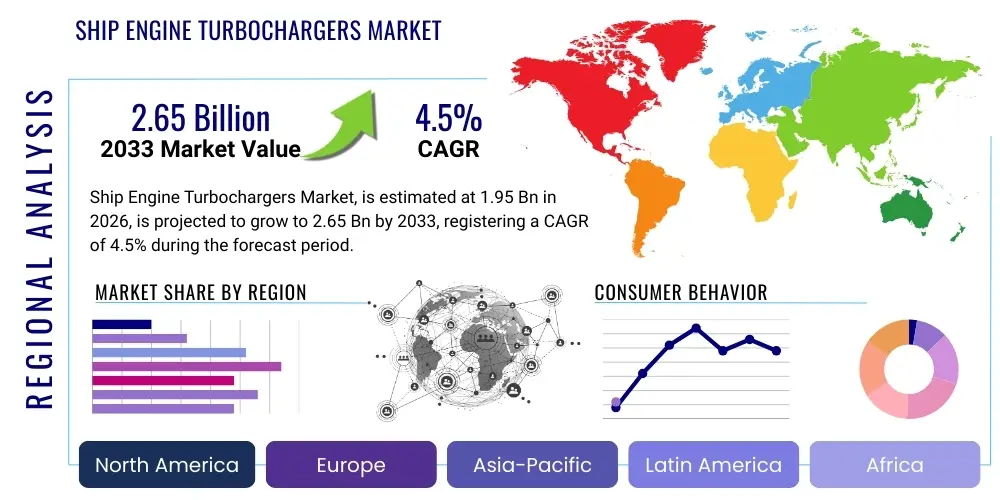

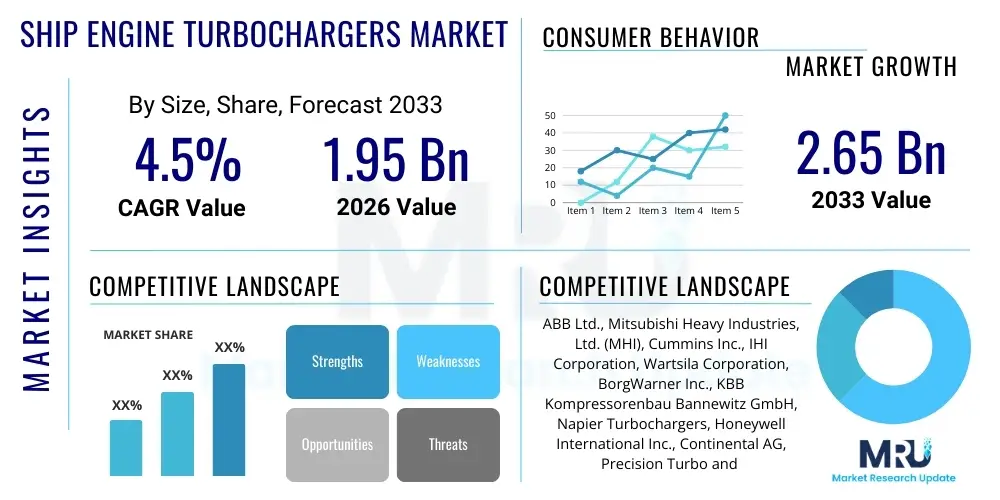

The Ship Engine Turbochargers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at $1.95 Billion in 2026 and is projected to reach $2.65 Billion by the end of the forecast period in 2033.

Ship Engine Turbochargers Market introduction

The Ship Engine Turbochargers Market encompasses the design, manufacturing, distribution, and maintenance of specialized forced-induction devices used primarily in large marine diesel and gas engines. These critical components enhance engine performance and efficiency by compressing intake air, allowing more fuel to be burned and thus increasing power output without significantly increasing engine size or displacement. Turbochargers are essential across various vessel types, including container ships, bulk carriers, oil tankers, cruise ships, and naval vessels, driving both high-speed performance and fuel economy crucial for long-distance maritime transport. The core benefit derived from their application is the substantial reduction in specific fuel consumption (SFC) and, critically, the mitigation of harmful emissions, aligning with increasingly stringent environmental regulations imposed by international bodies such as the International Maritime Organization (IMO).

Product descriptions within this market focus heavily on advanced materials capable of withstanding extreme thermal and mechanical stresses, aerodynamic efficiency of compressor and turbine wheels, and robust bearing systems designed for continuous, heavy-duty operation. Major applications are broadly categorized by engine size and type, ranging from small, high-speed auxiliary engines to massive two-stroke main propulsion engines used in ultra-large container vessels (ULCVs). The sophisticated engineering involved ensures optimal air pressure ratios and flow characteristics, adapting dynamically to varying engine loads and speeds characteristic of maritime operations. This complexity drives continuous investment in R&D, particularly concerning variable geometry turbochargers (VGT) and two-stage turbocharging systems, aiming for enhanced efficiency across the entire engine operating envelope.

Key driving factors accelerating market growth include the robust expansion of global seaborne trade, necessitating larger and more powerful ships, coupled with the mandatory regulatory transition towards cleaner marine fuels and reduced greenhouse gas (GHG) emissions. Ship operators are compelled to upgrade or replace older, less efficient engines and turbocharging systems to comply with IMO Tier III and upcoming EEDI/EEXI regulations. Furthermore, the rising adoption of dual-fuel engines (LNG/Diesel) requires specially adapted turbocharging systems capable of handling the distinct combustion characteristics and operational demands of alternative marine fuels, solidifying the turbocharger as a central technology enabler for the decarbonization of the shipping industry.

Ship Engine Turbochargers Market Executive Summary

The Ship Engine Turbochargers Market is experiencing structural shifts driven by regulatory mandates and technological convergence, particularly in pursuit of maritime decarbonization goals. Business trends indicate a consolidation among key turbocharger manufacturers, focusing on establishing comprehensive after-sales service networks and developing modular, highly efficient systems tailored for retrofitting existing fleets as well as integrating seamlessly into new builds utilizing alternative fuels like LNG, methanol, and ammonia. The imperative for vessel efficiency is shifting purchasing decisions away from purely initial cost towards total cost of ownership (TCO), heavily weighted by fuel savings and compliance assurance. Strategic alliances between turbocharger suppliers and major engine manufacturers (OEMs) are crucial for accelerating product development and market penetration, especially in high-growth segments such as large-bore two-stroke engines for mega-ships.

Regionally, Asia Pacific (APAC), led by major shipbuilding nations such as China, South Korea, and Japan, dominates both the production and consumption landscape due to the concentration of global shipyard activities and the rapid modernization of domestic and regional fleets. Europe maintains a strong position in high-value segments, particularly in R&D for advanced turbocharging technologies, systems for luxury cruise liners, and specialized offshore vessels, often setting the standards for technological innovation and integration of predictive maintenance capabilities. The North American market, while smaller in terms of new vessel construction, drives demand for retrofits and specialized turbochargers for coast guard and inland waterway vessels, emphasizing durability and compliance with strict local emission standards.

Segment trends highlight the increasing importance of the Aftermarket segment, fuelled by the long service life of marine engines and the necessity for periodic overhauls and efficiency upgrades (e.g., swapping older turbochargers for newer, more efficient models compliant with updated regulations). Technically, two-stage turbocharging systems are gaining traction in large container ships and tankers to maximize fuel efficiency and achieve necessary NOx reduction targets. Furthermore, the segmentation by application is seeing disproportionate growth in the segments serving LNG carriers and large bulk carriers, reflecting their central role in global trade dynamics and the ongoing transition toward dual-fuel propulsion systems which inherently rely on optimized turbocharging for combustion stability and power delivery.

AI Impact Analysis on Ship Engine Turbochargers Market

User inquiries concerning the impact of Artificial Intelligence (AI) on the Ship Engine Turbochargers Market overwhelmingly focus on themes related to predictive maintenance, real-time performance optimization, and the integration of AI-driven diagnostics into ship management systems. Key concerns revolve around data security, the reliability of algorithms in high-stress operational environments, and the necessary skill transfer required for marine engineers to effectively utilize these new tools. Users anticipate that AI will primarily enhance operational efficiency (fuel savings) and significantly reduce unplanned downtime by accurately forecasting component failure, particularly concerning turbocharger bearings and wheel degradation. There is also a strong expectation regarding AI's role in fine-tuning turbocharger parameters (like VGT settings) in real-time based on varying weather conditions, engine load profiles, and fuel quality, optimizing combustion across diverse operational scenarios.

- AI enables real-time monitoring and anomaly detection for critical turbocharger parameters (speed, temperature, vibration).

- Predictive maintenance algorithms forecast component wear, reducing unplanned engine downtime and overhaul costs.

- Optimized turbocharger control (e.g., precise VGT adjustment) enhances fuel efficiency and minimizes NOx emissions dynamically.

- AI-driven digital twins simulate turbocharger performance under various operational stress scenarios for design validation and training.

- Automated diagnostics streamline fault identification, accelerating repair times during port calls or sea operations.

- Integration with broader vessel performance management systems maximizes holistic efficiency gains across the propulsion train.

DRO & Impact Forces Of Ship Engine Turbochargers Market

The dynamics of the Ship Engine Turbochargers Market are fundamentally shaped by a confluence of regulatory pressures and technological advancements, creating both significant drivers and substantial restraints. Driving factors, predominantly stringent environmental regulations (IMO Tier III, EEXI, and Carbon Intensity Indicator - CII), necessitate advanced turbocharging solutions capable of maximizing engine efficiency while minimizing harmful emissions, particularly NOx and CO2. This regulatory push forces fleet operators to invest in new, high-efficiency vessels or retrofit existing fleets with sophisticated turbocharger technologies. Simultaneously, continuous technological innovation in materials science and aerodynamics allows manufacturers to offer lighter, more durable, and significantly more efficient turbochargers, meeting the growing demand for superior fuel economy and reliable performance under varying engine loads typical in marine applications.

However, the market faces significant restraints, notably the high initial capital expenditure associated with purchasing and installing sophisticated modern turbochargers, especially advanced systems like two-stage units or electric-assisted variants. This cost burden can deter adoption, particularly among smaller fleet operators or owners of older vessels who might prioritize short-term cost savings over long-term efficiency gains, despite regulatory pressure. Furthermore, the inherent volatility in global shipping cycles and freight rates directly impacts new shipbuilding orders and retrofitting decisions, causing periodic fluctuations in demand for new turbochargers. The complexities involved in the specialized repair and maintenance of these high-precision components, requiring highly skilled technicians and specialized tooling, also pose a logistical restraint, especially in less developed maritime regions.

Opportunities in the market are prominently centered around the rapid global adoption of alternative marine fuels, such as Liquefied Natural Gas (LNG), methanol, and eventually ammonia. These new fuel sources require highly specialized turbocharging systems engineered for stable combustion and specific exhaust gas characteristics, opening up entirely new product lines and revenue streams for manufacturers who can adapt swiftly. Another critical opportunity lies in the expanding Aftermarket segment, driven by the ongoing need for retrofitting older engines to meet current and future efficiency standards, creating long-term service and upgrade contracts. The overall impact forces are strongly weighted toward the drivers, as mandatory environmental compliance outweighs cost concerns in the long term, positioning the market for sustained, technology-led growth despite cyclical restraints.

Segmentation Analysis

The Ship Engine Turbochargers Market is comprehensively segmented based on several key operational and technical characteristics, including Engine Type, Operation Type, Application, and Sales Channel. This structure allows for granular market analysis, revealing specific growth pockets driven by distinct technological requirements or regulatory compliance needs. The Engine Type segmentation, differentiating between two-stroke and four-stroke engines, is critical because these two engine types utilize vastly different turbocharger designs optimized for their respective operational cycles and power outputs; two-stroke engines, used predominantly for main propulsion in large vessels, require large, highly customized turbochargers, while four-stroke engines use medium-sized units for auxiliary power generation or smaller vessel propulsion. Understanding these dynamics is essential for strategic market positioning.

Further segmentation by Operation Type (Single-Stage vs. Multi-Stage) highlights the technological shift towards more complex systems designed to maximize thermal efficiency and meet stringent emission standards. Multi-stage (two-stage) systems are becoming increasingly prevalent in high-power applications where extremely high-pressure ratios are required to meet IMO Tier III NOx limits and improve fuel efficiency significantly. The application segmentation, covering various vessel classes such as container ships, tankers, bulk carriers, and passenger vessels, demonstrates how specific operational profiles (e.g., continuous high-load vs. frequent maneuvering) dictate the choice of turbocharger technology and durability requirements. Finally, the Sales Channel segmentation (OEM vs. Aftermarket) provides insight into the revenue streams, with the Aftermarket representing a substantial and stable source of revenue due to maintenance, repair, and overhaul activities essential for maritime operations.

- By Engine Type:

- Two-Stroke Engines

- Four-Stroke Engines

- By Operation Type:

- Single-Stage Turbochargers

- Multi-Stage Turbochargers (e.g., Two-Stage)

- By Application (Vessel Type):

- Container Ships

- Tankers (Oil, Chemical, Gas)

- Bulk Carriers

- Cruise and Passenger Ships

- Naval and Offshore Vessels

- By Sales Channel:

- Original Equipment Manufacturers (OEM)

- Aftermarket (Service and Retrofit)

Value Chain Analysis For Ship Engine Turbochargers Market

The value chain for the Ship Engine Turbochargers Market is intricate, beginning with the upstream supply chain which involves critical raw material sourcing, predominantly high-grade specialty steels, nickel alloys, and advanced ceramic materials required for the turbine wheels, compressor wheels, and casings due to extreme operating conditions (high temperatures and high rotational speeds). Key activities in the upstream phase include the specialized casting, forging, and precision machining of these components, often outsourced to specialized engineering firms that meet stringent quality and tolerance specifications. Reliability and material integrity are paramount, making supplier relationships highly specialized and characterized by long-term contracts and rigorous quality control protocols. Disruptions in the supply chain for specific high-performance alloys can significantly impact production lead times and costs for turbocharger manufacturers.

The midstream segment involves the core manufacturing and assembly processes carried out by major turbocharger OEMs. This phase encompasses advanced R&D in aerodynamics, bearing technology, and control systems (e.g., electronic control units for VGT). The distribution channel bifurcates significantly here: direct channels are utilized for sales to large engine manufacturers (OEMs) who integrate the turbochargers into new propulsion packages, whereas indirect channels, involving certified distributors, service centers, and maintenance providers, are crucial for aftermarket sales and support. Direct sales emphasize strong technical collaboration and just-in-time delivery to shipyards, while indirect sales focus on inventory management, speed of spare parts delivery, and specialized repair services globally.

Downstream analysis focuses on the end-users—ship operators and owners. The after-sales service and maintenance component forms a hugely significant part of the downstream value chain, often representing higher profit margins than initial equipment sales. This includes scheduled maintenance, provision of genuine spare parts, engine performance monitoring, and efficiency upgrades (retrofits). The quality and global reach of the service network are critical determinants of competitive advantage. The entire value chain is currently being modernized through digitalization, leveraging sensor technology and remote diagnostics to optimize maintenance schedules and minimize operational expenditure for the end-user, thereby strengthening the link between the manufacturer and the vessel operator through long-term service agreements.

Ship Engine Turbochargers Market Potential Customers

The primary customer base for the Ship Engine Turbochargers Market consists of entities involved in the design, construction, ownership, and operation of marine vessels that utilize large internal combustion engines for propulsion or auxiliary power generation. The most significant direct buyers are Original Equipment Manufacturers (OEMs), specifically large marine engine builders (e.g., MAN Energy Solutions, Wartsila, etc.). These OEMs purchase turbochargers in large volumes, integrating them into their engine offerings for new shipbuilding projects. Their purchasing decisions are driven by stringent performance specifications, long-term reliability guarantees, system integration capabilities, and competitive pricing based on large procurement contracts. The health of the new shipbuilding industry directly dictates the demand from this OEM segment.

A second, equally critical customer segment is the global fleet owner and operator community, which drives the high-value aftermarket segment. This includes major container shipping lines, large oil and gas tanker operators, bulk cargo carriers, and cruise ship companies. These buyers procure turbochargers or their spare parts for maintenance, scheduled overhauls, emergency repairs, and efficiency-driven retrofits. Their purchasing behavior is influenced heavily by operational cost optimization, reliability metrics, adherence to regulatory compliance (EEXI/CII), and the need for rapid global service support. For these end-users, minimized downtime and maximal fuel efficiency are the paramount purchasing criteria, often leading them to invest in manufacturer-certified service providers.

Additionally, specialist customers such as navies, coast guards, offshore service vessel operators, and ferry operators constitute niche but high-demand segments. These entities require robust, highly customized turbochargers capable of operating reliably under diverse and often extreme operational profiles. For these specialized applications, factors like shock resistance, rapid transient response, and specific mission requirements often supersede purely commercial fuel efficiency concerns. Finally, independent repair facilities and regional authorized distributors act as intermediaries, servicing localized fleets and providing crucial logistical support to the ultimate end-users, requiring consistent supply of genuine or certified replacement parts.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.95 Billion |

| Market Forecast in 2033 | $2.65 Billion |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ABB Ltd., Mitsubishi Heavy Industries, Ltd. (MHI), Cummins Inc., IHI Corporation, Wartsila Corporation, BorgWarner Inc., KBB Kompressorenbau Bannewitz GmbH, Napier Turbochargers, Honeywell International Inc., Continental AG, Precision Turbo and Engine, Inc., Turbocharger Engineering Company (TCE), Schwitzer DHD, Trelleborg Group, Garrett Motion Inc., Kongsberg Gruppen, Yanmar Holdings Co., Ltd., Hyundai Heavy Industries Co., Ltd. (Engine & Machinery Division), Zekai Turbocharger Co., Ltd., Niigata Power Systems Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ship Engine Turbochargers Market Key Technology Landscape

The Ship Engine Turbochargers Market is characterized by a rapidly evolving technological landscape driven primarily by the need to achieve higher efficiency and comply with mandatory emission standards, notably IMO Tier III regulations requiring substantial reductions in nitrogen oxide (NOx) emissions. A dominant technology trend is the increasing implementation of Variable Geometry Turbochargers (VGT) and advanced two-stage turbocharging systems. VGT technology utilizes adjustable vanes or nozzle rings to optimize the exhaust gas flow area to the turbine wheel, allowing the turbocharger to deliver optimal boost pressure across a much wider range of engine loads and speeds. This is crucial for maximizing efficiency during partial load operations, which are common for vessels in transit, and achieving precise air-fuel ratios necessary for meeting low-emission targets.

Furthermore, the shift towards alternative marine fuels has necessitated specialized turbocharging adaptations. Dual-fuel engines (running on LNG or methanol) require turbochargers with enhanced durability and optimized designs to handle the different exhaust gas temperatures and compositions associated with these fuels. Manufacturers are focusing on developing turbochargers that maintain high efficiency even when fuel switching occurs, ensuring seamless transition between operational modes. The incorporation of auxiliary technologies, such as turbo compounding (recovering energy from the exhaust gas beyond the turbocharger for added mechanical power) and electric-assisted turbocharging (e-turbos), represents the next wave of innovation, offering incremental efficiency gains and greater control over the engine air supply system during transient operation or low-speed maneuvering.

Digitalization forms the third critical pillar of the current technology landscape. Modern turbochargers are routinely equipped with sophisticated sensors and control units that feed real-time performance data back to centralized ship management systems. This data is leveraged for high-precision operational optimization and the integration of predictive maintenance capabilities, moving away from time-based maintenance schedules. Technologies related to advanced bearing systems (e.g., magnetic bearings) and high-performance material coatings are also continuously being refined to enhance component longevity and robustness, minimizing frictional losses and improving resistance to corrosion and erosion in harsh marine environments, ultimately contributing significantly to the overall reliability and efficiency of the marine propulsion package.

Regional Highlights

The global Ship Engine Turbochargers Market demonstrates distinct regional concentration points influenced by shipbuilding activity, maritime trade volume, and regional regulatory frameworks. Asia Pacific (APAC) stands as the undisputed leader in both demand and supply. This dominance is attributed to the presence of the world’s largest shipbuilding nations—China, South Korea, and Japan—which collectively account for the vast majority of new vessel constructions globally. Consequently, the demand for OEM turbochargers is highest here. Furthermore, APAC nations possess expansive maritime fleets that continually drive substantial aftermarket activity, demanding spares and retrofits to comply with increasing regional and international emission standards. Investment in high-tech manufacturing and advanced turbocharger R&D is also rapidly accelerating across this region.

- Asia Pacific (APAC): Dominates the global market share due to concentrated shipbuilding capabilities (China, South Korea) and high volume of regional fleet operations, driving both OEM and aftermarket segments.

- Europe: Characterized by strong technological leadership, focusing on high-efficiency, specialized turbochargers for cruise vessels, high-speed ferries, and niche offshore segments. Significant emphasis on R&D for zero-emission fuel compatibility.

- North America: Market growth primarily driven by aftermarket demand, fleet maintenance, and stringent regional emissions regulations (e.g., EPA requirements for coastal and inland vessels). Focus on reliability and lifecycle support.

- Middle East and Africa (MEA): Growing segment driven by expansion in oil and gas tanker fleets and localized maritime transportation development. Increasingly relevant for service centers due to high transit traffic.

- Latin America: Stable but smaller market, focused predominantly on specialized applications related to resource extraction, fishing, and regional trade, relying heavily on imports for sophisticated turbocharger systems and maintenance.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ship Engine Turbochargers Market.- ABB Ltd.

- Mitsubishi Heavy Industries, Ltd. (MHI)

- IHI Corporation

- Wartsila Corporation

- BorgWarner Inc.

- Cummins Inc.

- KBB Kompressorenbau Bannewitz GmbH

- Napier Turbochargers

- Honeywell International Inc.

- Continental AG

- Garrett Motion Inc.

- Precision Turbo and Engine, Inc.

- Turbocharger Engineering Company (TCE)

- Trelleborg Group

- Kongsberg Gruppen

- Yanmar Holdings Co., Ltd.

- Hyundai Heavy Industries Co., Ltd. (Engine & Machinery Division)

- Zekai Turbocharger Co., Ltd.

- Niigata Power Systems Co., Ltd.

- Weichai Power Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Ship Engine Turbochargers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for advanced ship engine turbochargers?

The primary driver is the stringent enforcement of environmental regulations by the International Maritime Organization (IMO), specifically Tier III NOx limits and upcoming EEXI/CII requirements, which mandate enhanced engine efficiency and reduced emissions through advanced turbocharging systems like two-stage and VGT configurations.

How are alternative marine fuels impacting turbocharger design?

Alternative fuels such as LNG, methanol, and ammonia require highly specialized turbochargers engineered for stability and efficiency during dual-fuel operation. Designs must accommodate differing exhaust gas compositions, pressure dynamics, and temperatures to maintain reliable combustion and meet strict emission controls.

Which segment holds the most promising growth potential in the Ship Engine Turbochargers Market?

The Aftermarket segment (service, spares, and retrofits) is projected to hold the most robust and stable growth potential, driven by the necessary lifespan maintenance of existing global fleets and the growing requirement to retrofit older engines with modern, efficiency-compliant turbocharging technology.

What role does digitalization and AI play in the future of marine turbocharging?

Digitalization and AI are essential for future market growth, primarily by enabling real-time performance monitoring, optimizing turbocharger operations dynamically based on engine load and environmental conditions, and implementing highly accurate predictive maintenance strategies to minimize operational downtime and maximize fuel savings.

Which geographical region dominates the manufacturing and consumption of ship engine turbochargers?

Asia Pacific (APAC), particularly driven by major shipbuilding nations like China, South Korea, and Japan, dominates both the manufacturing output and the consumption of new ship engine turbochargers due to the high volume of global new vessel construction occurring within the region.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager