Ship Repair and Maintenance Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442522 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Ship Repair and Maintenance Market Size

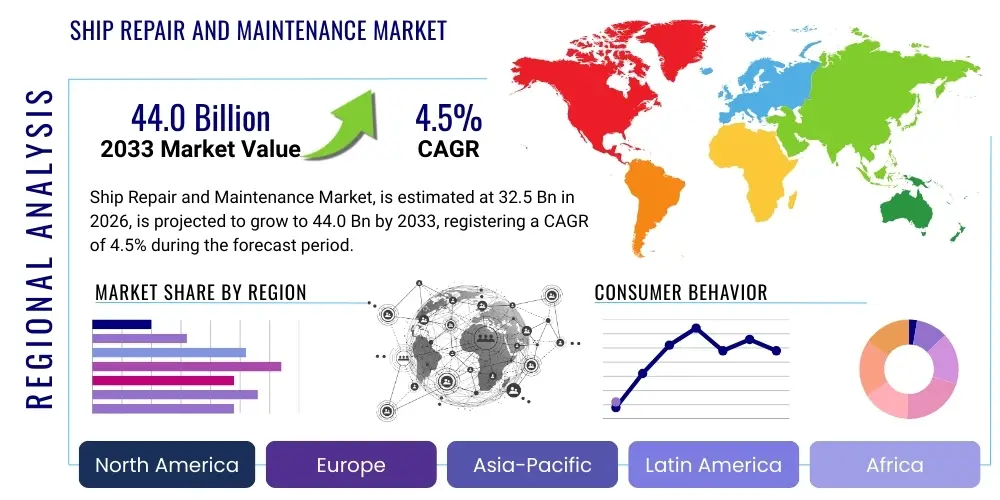

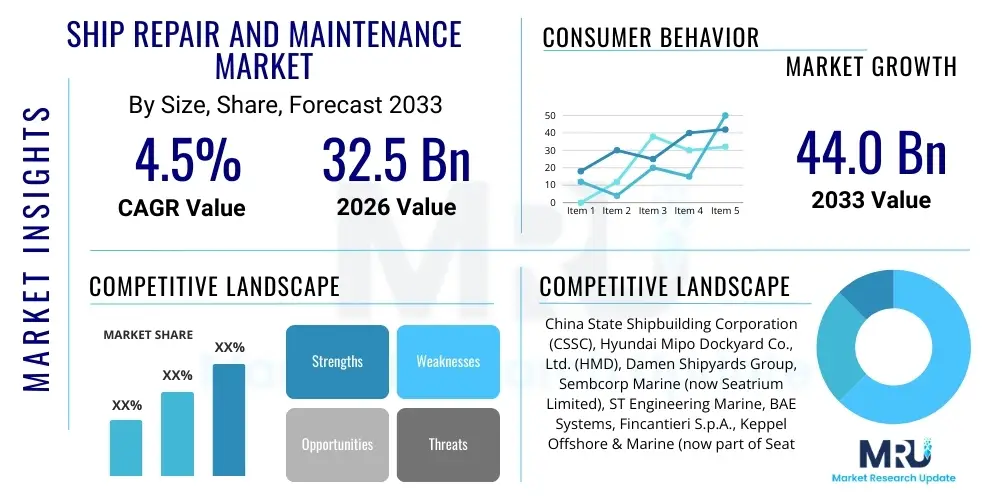

The Ship Repair and Maintenance Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% (CAGR) between 2026 and 2033. The market is estimated at USD 32.5 Billion in 2026 and is projected to reach USD 44.0 Billion by the end of the forecast period in 2033. This substantial expansion is primarily driven by the increasing average age of the global merchant fleet, combined with stringent international maritime regulations mandating periodic surveys, dry-docking, and specialized retrofitting operations. The market’s resilience is bolstered by the non-negotiable requirement for operational safety and environmental compliance, ensuring a steady stream of demand regardless of short-term fluctuations in global trade volumes. Furthermore, the push towards decarbonization necessitates significant investment in retrofitting vessels with energy-efficient technologies and alternative propulsion systems, opening highly lucrative specialized service segments.

The market valuation reflects not just routine maintenance but also large-scale conversion and upgrade projects. As the shipping industry navigates the transition towards low-sulfur fuels and, subsequently, zero-emission fuels, shipyards capable of handling complex conversions, such as LNG bunkering facility installations or the integration of carbon capture systems, will capture premium revenue streams. Geographically, Asia Pacific continues to dominate this sector, benefiting from lower operating costs, vast infrastructure capacity, and proximity to major shipbuilding hubs and global shipping routes. However, specialized European and North American yards maintain a competitive edge in complex, high-technology repairs and naval vessel maintenance.

Ship Repair and Maintenance Market introduction

The Ship Repair and Maintenance (SRM) market encompasses all services required to ensure the operational integrity, longevity, and regulatory compliance of marine vessels, ranging from routine upkeep and classification surveys to emergency repairs, major overhauls, and modernization retrofits. Key products and services include hull cleaning and coating, engine and propulsion system maintenance, electrical and automation system repair, and specialized services like ballast water treatment system (BWTS) and scrubber installation. The major applications span the entire commercial fleet (tankers, bulk carriers, container ships, gas carriers), passenger vessels (cruise ships, ferries), and naval and specialized government vessels. The primary benefits derived from effective SRM include minimized downtime, extended vessel lifespan, reduced operational costs through improved fuel efficiency, and critical adherence to environmental mandates set by organizations such as the International Maritime Organization (IMO).

Driving factors for sustained market growth are multifaceted and systemic. Foremost among these is the regulatory framework, particularly the IMO's initiatives like the Carbon Intensity Indicator (CII) and Energy Efficiency Existing Ship Index (EEXI), which necessitate vessel performance upgrades and fleet optimization. The increasing global maritime trade volume demands a high operational readiness for the existing fleet, while geopolitical tensions occasionally spur demand for emergency repairs. Furthermore, technological advancements, including the adoption of predictive maintenance tools (condition-based monitoring), are slowly reshaping how repairs are scheduled and executed, moving the industry from reactive failure repair to proactive, data-driven maintenance strategies. This shift, while initially requiring capital investment, ultimately enhances shipyard efficiency and improves vessel turnaround times.

Ship Repair and Maintenance Market Executive Summary

The Ship Repair and Maintenance market is currently characterized by intense competition, consolidation among major players, and a structural shift driven by sustainability mandates. Business trends highlight increasing digitalization across shipyard operations, utilizing smart planning and integrated IT systems to optimize dry-dock utilization and supply chain logistics. There is a noticeable trend towards the development of specialized repair clusters focusing exclusively on niche segments, such as mega-container vessel repair or complex LNG carrier maintenance, requiring higher technical expertise and sophisticated docking facilities. Furthermore, market participants are heavily investing in workforce training to handle complex new technologies, including alternative fuel systems like ammonia and methanol, recognizing that human capital expertise is a core differentiator in high-value services. Strategic partnerships between shipyards, technology providers, and marine equipment manufacturers are becoming common to provide integrated, turnkey retrofit solutions for fleet owners facing tight compliance deadlines.

Regional trends indicate that the Asia Pacific (APAC) region remains the epicenter of the global SRM market, spearheaded by countries like China, Singapore, and South Korea, which offer massive docking capacity and competitive pricing for routine repairs. However, European yards, particularly those in the Netherlands and Germany, maintain dominance in high-end, complex conversion projects, especially those related to cruise ship refurbishment and advanced naval vessel support, leveraging proprietary technology and established expertise. Segment trends demonstrate accelerated demand within the specialized repair category. While routine maintenance remains essential, the exponential growth is visible in the retrofit market driven by environmental regulations. Services related to EEXI compliance, engine de-rating, scrubber retrofits, and increasingly, installations for carbon capture technology, are experiencing above-average growth rates. The cargo segment, particularly large container vessels, presents the highest monetary value opportunity due to the scale and complexity of required repairs and conversions.

AI Impact Analysis on Ship Repair and Maintenance Market

User queries regarding AI's influence in the Ship Repair and Maintenance Market predominantly center on efficiency gains, predictive capabilities, and cost reduction. Common concerns revolve around the reliability of AI-driven diagnostics, the initial investment required for sensor integration and data infrastructure, and the potential displacement of skilled labor in routine inspection and welding tasks. Users keenly seek information on how AI facilitates predictive maintenance scheduling, moving away from time-based or reactive maintenance to condition-based strategies, thus minimizing unexpected downtime. Key themes emerging from this user analysis include the adoption of Computer Vision for hull inspection, the use of Machine Learning algorithms to predict component failure in main engines and auxiliary systems, and the application of AI in optimizing logistical operations within the shipyard, such as resource allocation and supply chain management for spare parts. Expectations are high that AI will significantly shorten dry-dock periods and improve the accuracy of damage assessments.

- AI-driven Predictive Maintenance (PdM): Algorithms analyze sensor data (vibration, heat, pressure) to anticipate equipment failure, minimizing unplanned vessel downtime and optimizing repair scheduling.

- Automated Visual Inspection: Drones and underwater remotely operated vehicles (ROVs) equipped with AI-powered computer vision rapidly detect hull defects, corrosion, and coating damage, improving speed and accuracy over manual inspection.

- Resource Optimization: Machine Learning models optimize shipyard scheduling, allocating specialized labor, dry-dock slots, and material logistics to enhance throughput and reduce operating costs.

- Digital Twin Technology Integration: AI enhances the fidelity and utility of vessel digital twins, simulating the impact of repairs or retrofits before physical execution, reducing risk and execution time.

- Enhanced Supply Chain Management: AI systems forecast spare part demand based on historical failure rates and predicted maintenance needs, optimizing inventory levels and reducing procurement lead times.

- Robotics and Automation: AI guides robotic welding, painting, and cleaning operations, improving precision, consistency, and safety in high-risk environments.

- Compliance Monitoring: AI tools analyze operational data to ensure continuous compliance with EEXI/CII and other environmental regulations, identifying areas requiring immediate technical adjustment or repair.

DRO & Impact Forces Of Ship Repair and Maintenance Market

The dynamics of the Ship Repair and Maintenance market are dictated by a confluence of powerful drivers (D), significant restraints (R), compelling opportunities (O), and structural impact forces. Drivers include the rapidly aging global merchant fleet, increasing global seaborne trade volumes, and non-negotiable regulatory pressure from the IMO mandating environmental compliance and periodic special surveys. These factors ensure consistent demand regardless of short-term economic cycles. Conversely, restraints primarily revolve around the severe shortage of specialized labor (welders, marine engineers, technicians) capable of handling modern complex vessel systems, the high cost associated with establishing and maintaining sophisticated dry-dock infrastructure, and the inherent cyclical volatility of global shipping markets which affects capital expenditure decisions by shipowners. Opportunities are largely concentrated in the rapidly expanding green retrofit market (decarbonization, alternative fuel conversions) and the potential for technological leapfrogging through digitalization and automation, which can improve operational efficiency.

Impact forces stemming from geopolitical instability, fluctuating raw material prices (especially steel and coatings), and the ongoing climate transition significantly shape market strategy. The shift toward alternative fuels like LNG, methanol, and potentially ammonia requires massive infrastructure changes in shipyards for safe handling and repair, acting as a high barrier to entry for smaller repair facilities. Moreover, the demand for fast turnaround times—a critical metric for asset-heavy shipping companies—pushes shipyards to adopt advanced planning systems and robotics. The global regulatory timeline for IMO 2030 and IMO 2050 targets creates a sustained, multi-decade impact force, transforming routine repair contracts into complex, high-value engineering projects focused on sustainable operations. These forces mandate continuous innovation in repair methodologies and significant capital outlay by repair service providers to remain competitive and compliant with evolving customer needs.

Segmentation Analysis

The Ship Repair and Maintenance Market is structurally segmented based on the type of service provided, the location where the service is rendered, the type of ship being serviced, and the specific requirement driving the repair action. Understanding these segments is crucial for market stakeholders, allowing for targeted infrastructure investment and specialized service development. Key segments include the classification of services into routine maintenance (e.g., scheduled dry-dockings and hull maintenance), major overhauls (e.g., engine major service and propulsion system replacement), and conversion/retrofit projects (e.g., scrubber installation, ballast water treatment systems, and fuel conversions). The operational environment segmentation differentiates between dry-docking services, which require removing the vessel from the water, and in-situ/afloat repairs, which are conducted while the vessel remains waterborne, often during loading or unloading operations. The complexity and value of the service tend to increase significantly when moving from routine maintenance to structural conversion projects.

Further segmentation by vessel type reveals varied demand profiles. The cargo segment (container ships, bulk carriers, general cargo vessels) drives the highest volume of routine and structural repair demand due to their operational intensity and sheer numbers in the global fleet. The tanker segment (crude, chemical, and product carriers) requires highly specialized repair facilities due to safety and contamination risks, leading to premium pricing for services. Passenger vessels, particularly cruise ships, are characterized by extremely strict turnaround times and high-cost, interior-focused refurbishment contracts, often requiring specialized interior designers and advanced regulatory compliance for passenger safety. Naval vessels represent a distinct niche market, characterized by long-term government contracts, high security requirements, and demand for complex systems integration and classified technological maintenance, often restricting service provision to national or strategically approved shipyards. This segmented demand structure dictates shipyard specialization and geographical competitiveness.

- By Service Type:

- General Maintenance (e.g., Hull cleaning, painting, minor machinery repair)

- Major Overhaul and Refurbishment (e.g., Engine major service, propeller replacement, systems modernization)

- Conversions and Retrofitting (e.g., Ballast Water Treatment Systems (BWTS) installation, Scrubber installation, LNG/Alternative Fuel Conversion)

- Emergency Repairs (e.g., Accident damage, unforeseen structural failure)

- By Ship Type:

- Cargo Vessels (Container Ships, Bulk Carriers, General Cargo)

- Tankers (Crude Tankers, Product Tankers, Chemical Tankers)

- Gas Carriers (LNG, LPG)

- Passenger Vessels (Cruise Ships, Ferries)

- Offshore Vessels (Supply Vessels, PSVs, FPSOs)

- Naval and Specialized Vessels (Warships, Research Vessels)

- By Docking Type:

- Dry Dock

- Floating Dock

- Slipways

- Afloat Repair/Wet Dock

- By End-User:

- Commercial Ship Owners and Operators

- Naval and Defense Forces

- Governmental Agencies (Coast Guard, Research)

Value Chain Analysis For Ship Repair and Maintenance Market

The value chain for the Ship Repair and Maintenance Market is intricate, involving numerous specialized layers from material sourcing to final delivery of the repaired vessel. The upstream segment of the chain is dominated by suppliers of essential industrial materials and components. This includes suppliers of marine-grade steel (for hull repairs), specialized coatings (anti-fouling and protective paints), engine spare parts (OEMs and third-party providers), and critical marine equipment like pumps, valves, and electrical components. The cost and availability of these upstream inputs, particularly steel and specialized marine chemicals, significantly influence the overall repair cost and project timelines. Geopolitical events and global commodity prices have a direct and immediate impact on the profitability and stability of the upstream suppliers, which is then passed down to shipyards and ultimately, ship owners.

The core midstream segment involves the shipyards and repair facilities themselves, which act as the central service providers, coordinating labor, docking facilities, project management, and specialized engineering services. Shipyards often rely on a network of highly specialized subcontractors for niche tasks such as complex engine overhaul, propeller balancing, or advanced electronics integration. The downstream segment is characterized by the direct interaction with the end-users—the commercial ship owners, fleet managers, charterers, and naval commands. Distribution channels in this service-based industry are predominantly direct, meaning the shipowner contracts directly with the selected shipyard. However, indirect channels exist through specialized repair brokers or technical management firms that handle the tendering and project oversight process on behalf of the vessel owner. Effective coordination across all these stages—from the precise delivery of specialty paint to the seamless execution of a dry-dock schedule—is paramount for maintaining competitiveness and maximizing facility utilization.

Ship Repair and Maintenance Market Potential Customers

The primary consumers of ship repair and maintenance services are entities responsible for the operational readiness, financial viability, and regulatory compliance of marine vessels. The largest customer base consists of commercial ship owners and operators, encompassing major global shipping lines for container vessels, independent owners of bulk carriers and oil tankers, and companies managing specialized fleets like chemical and LNG carriers. These customers demand efficiency, short turnaround times (to minimize off-hire periods), and high-quality work that adheres to class society standards (e.g., Lloyd’s Register, DNV, ABS). Their purchasing decisions are heavily influenced by the yard's reputation, proximity to major trading routes, and specialized expertise in handling particular vessel types or complex retrofit projects, particularly those related to decarbonization.

A second major customer category is the naval and defense sector, including national navies, coast guards, and other government maritime agencies. This segment is distinct due to the classified nature of the work, the requirement for robust security protocols, and long-term maintenance contracts often stretching over decades. Naval contracts typically involve advanced weapons systems maintenance, structural modifications for extended operational longevity, and highly specialized systems integration, demanding exclusive access and certification for specific repair facilities. Finally, auxiliary but important customers include cruise line operators, who require extensive, high-cost refurbishment and modernization services on strict schedules, and offshore energy companies, which utilize yards for the repair, maintenance, and conversion of specialized floating structures like FPSOs (Floating Production Storage and Offloading) and drilling rigs, which often involve complex, heavy-duty engineering requirements.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 32.5 Billion |

| Market Forecast in 2033 | USD 44.0 Billion |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | China State Shipbuilding Corporation (CSSC), Hyundai Mipo Dockyard Co., Ltd. (HMD), Damen Shipyards Group, Sembcorp Marine (now Seatrium Limited), ST Engineering Marine, BAE Systems, Fincantieri S.p.A., Keppel Offshore & Marine (now part of Seatrium), Cochin Shipyard Limited (CSL), Dalian Shipbuilding Industry Co., Ltd. (DSIC), Arab Shipbuilding and Repair Yard (ASRY), Drydocks World (Dubai), Tsuneishi Shipbuilding, Navantia, Sanmar Shipyards. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ship Repair and Maintenance Market Key Technology Landscape

The technological landscape of the Ship Repair and Maintenance market is undergoing a fundamental transformation driven by the imperatives of efficiency, speed, and safety. Central to this evolution is the adoption of digitalization and the Industrial Internet of Things (IIoT). Shipyards are increasingly deploying sensors, data analytics platforms, and cloud computing solutions to create a 'Smart Yard' environment. This technology enables real-time monitoring of work progress, accurate inventory tracking, and optimized resource allocation, drastically reducing administrative overhead and turnaround times. Advanced planning software, often integrated with 3D modeling and augmented reality (AR) tools, allows engineers to visualize complex repairs and structural modifications before physical commencement, thereby minimizing errors and rework, which are costly and time-consuming in the dry-dock environment. This digital integration is essential for managing the increasingly complex retrofit projects associated with new regulatory standards.

Automation and robotics represent another critical pillar of the evolving technology ecosystem. Robotic systems are now routinely employed for high-risk, repetitive, or difficult tasks such as grit blasting, paint application on large hull areas, and underwater welding repairs. These robots improve consistency and speed while significantly enhancing worker safety by removing human personnel from hazardous environments. Furthermore, the development of Additive Manufacturing (3D Printing) is gaining traction, particularly for the rapid production of obsolete or customized spare parts. Instead of waiting weeks for specialized components to be shipped, shipyards can print critical parts on demand, dramatically shortening the repair cycle. This is particularly valuable for aging vessels where original equipment manufacturer (OEM) support might be limited or lead times are prohibitively long, contributing directly to the vessel's operational availability and reducing dry-dock costs.

The integration of advanced non-destructive testing (NDT) techniques, often powered by AI, is also reshaping diagnostic and inspection services. Technologies like phased array ultrasonic testing (PAUT), remote visual inspection (RVI) via drones, and thermal imaging allow for highly precise defect detection in hull plating, welds, and machinery components without requiring disassembly. This rapid, accurate diagnosis is foundational to Condition-Based Monitoring (CBM) and Predictive Maintenance (PdM) systems. By leveraging these technologies, shipyards can offer ship owners data-driven, strategic maintenance advice rather than simply executing mandatory scheduled repairs. The future competitive advantage in the SRM sector will increasingly hinge on a yard's ability to efficiently process and act upon real-time operational and diagnostic data, moving the focus from physical repair labor to technical engineering expertise and sophisticated data management.

Regional Highlights

The global distribution of Ship Repair and Maintenance activity is heavily skewed towards regions possessing extensive coastlines, established maritime infrastructure, and high volumes of international trade. Regional market dynamics are influenced by labor costs, technological sophistication, proximity to shipping lanes, and governmental support for the maritime sector.

- Asia Pacific (APAC): APAC is the dominant market globally, driven primarily by China, South Korea, and Singapore. China, with massive shipbuilding capacity, offers highly competitive pricing and scale, especially for routine dry-docking and large-scale hull repairs. Singapore, while smaller in size, serves as a premium maritime hub specializing in complex repairs, high-value retrofits (like BWTS and scrubber installation), and offshore structure maintenance due to its strategic location and skilled workforce. South Korea focuses on specialized high-tech vessel repair, particularly LNG carriers and sophisticated naval vessels. The region benefits from robust government policies supporting maritime infrastructure development and proximity to the world’s busiest trade routes, ensuring continuous high demand.

- Europe: Europe retains a significant, high-value share of the market, characterized by specialization in complex technological repairs, sophisticated naval support, and high-end cruise ship refurbishment. Countries like the Netherlands, Germany, and Italy focus on providing niche expertise and advanced engineering solutions, often involving retrofits for cutting-edge environmental compliance or complex engine conversions. The European market operates on stricter environmental standards and higher labor costs but commands premium pricing for its technical excellence and quick access for European fleets.

- North America: The North American market is highly concentrated in naval and specialized government vessel maintenance (e.g., US Navy, Coast Guard). Commercial repair activities, while present, are often limited by high labor costs, making them less competitive globally for routine repairs. However, the region excels in highly specialized services related to offshore oil and gas platforms and niche vessel classes, primarily served by specialized yards on the Gulf Coast and West Coast.

- Middle East and Africa (MEA): This region is rapidly growing, capitalizing on its strategic location between Asia and Europe, particularly the access provided by the Suez Canal and major oil export routes. The UAE (Dubai, Abu Dhabi) and Bahrain (ASRY) are established centers focusing on tanker and bulk carrier maintenance. Investment in infrastructure expansion and modernization, aimed at capturing more transit traffic and offering competitive repair prices, is a major trend in this region.

- Latin America: This region presents a fragmented market, largely focusing on domestic fleet maintenance, offshore vessel support (especially Brazil for its oil industry), and niche capabilities centered around the Panama Canal. While capacity is expanding, the region often faces challenges related to infrastructure investment and maintaining a consistent supply chain for specialized parts.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ship Repair and Maintenance Market.- China State Shipbuilding Corporation (CSSC)

- Hyundai Mipo Dockyard Co., Ltd. (HMD)

- Damen Shipyards Group

- Sembcorp Marine (now Seatrium Limited)

- ST Engineering Marine

- BAE Systems

- Fincantieri S.p.A.

- Keppel Offshore & Marine (now part of Seatrium)

- Cochin Shipyard Limited (CSL)

- Dalian Shipbuilding Industry Co., Ltd. (DSIC)

- Arab Shipbuilding and Repair Yard (ASRY)

- Drydocks World (Dubai)

- Tsuneishi Shipbuilding

- Navantia

- Sanmar Shipyards

- Shanghai Waigaoqiao Shipbuilding Co., Ltd. (SWS)

- Mitsui E&S Shipbuilding Co., Ltd.

- Harland and Wolff Group Holdings PLC

- Northrop Grumman Shipbuilding

- Hanjin Heavy Industries & Construction Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Ship Repair and Maintenance market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the current high demand for ship repair services globally?

The primary drivers are the aging global fleet, which necessitates more frequent and extensive maintenance, and stringent environmental regulations (e.g., IMO's EEXI and CII) that mandate costly retrofits like Ballast Water Treatment Systems (BWTS) and scrubbers, transforming market demand from routine fixes to specialized engineering projects.

Which region dominates the Ship Repair and Maintenance Market, and why?

The Asia Pacific (APAC) region, led by China, South Korea, and Singapore, dominates the market. This dominance is due to superior docking capacity, competitive labor costs, proximity to major international shipping routes, and extensive government support for maritime industrial development.

How is technology impacting turnaround times in shipyards?

Technology, specifically AI-driven predictive maintenance (PdM) and advanced robotics, is minimizing turnaround times. PdM allows for proactive scheduling and prevents unexpected breakdowns, while robotic systems for hull cleaning and welding execute tasks faster and more consistently than manual labor, optimizing dry-dock utilization.

What are the greatest restraints facing the growth of the ship repair industry?

The most significant restraints include the severe shortage of skilled technical labor capable of servicing increasingly complex, high-tech vessels and alternative fuel systems, coupled with the high capital investment required to modernize dry-dock infrastructure for mega-ships.

What are the key differences between the commercial and naval repair segments?

The commercial segment prioritizes speed and cost-efficiency (minimizing off-hire), focusing on compliance and structural longevity. The naval segment, conversely, demands high security, long-term specialized contracts, and expertise in complex, often classified, weapons and mission systems integration, leading to higher margins and exclusive repair agreements.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Ship Repair and Maintenance Service Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Ship Repairs, Conversions, Routine Maintenance), By Application (Oil And Chemical Tankers, Container Ships, Gas Carriers, Offshore Vessels, Passenger Ships And Ferries, Bulk Carriers, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- Ship Repair and Maintenance Services Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (General Services, Dockage, Hull Part, Engine Parts, Electric Works, Auxiliary Services), By Application (Oil and Chemical Tankers, Bulk Carriers, General Cargo, Container Ships, Gas Carrier, Passenger Ships), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager