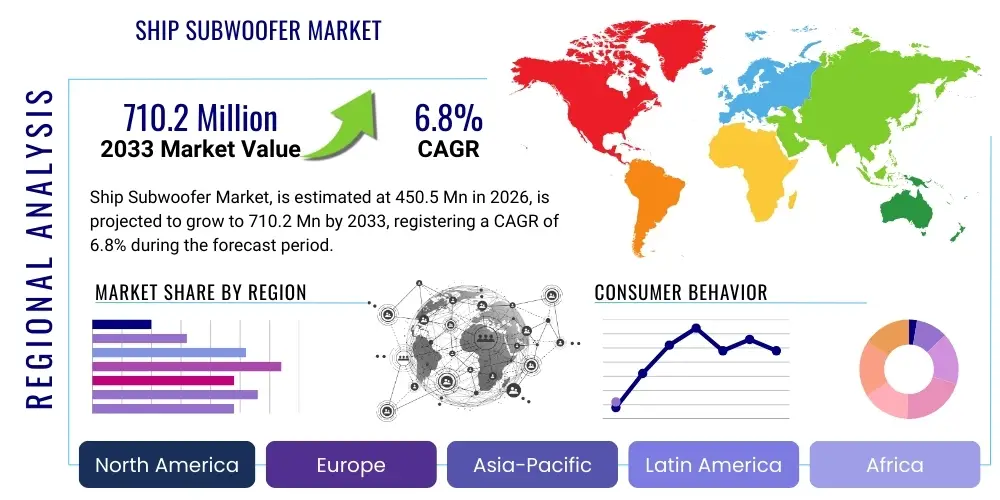

Ship Subwoofer Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441668 | Date : Feb, 2026 | Pages : 251 | Region : Global | Publisher : MRU

Ship Subwoofer Market Size

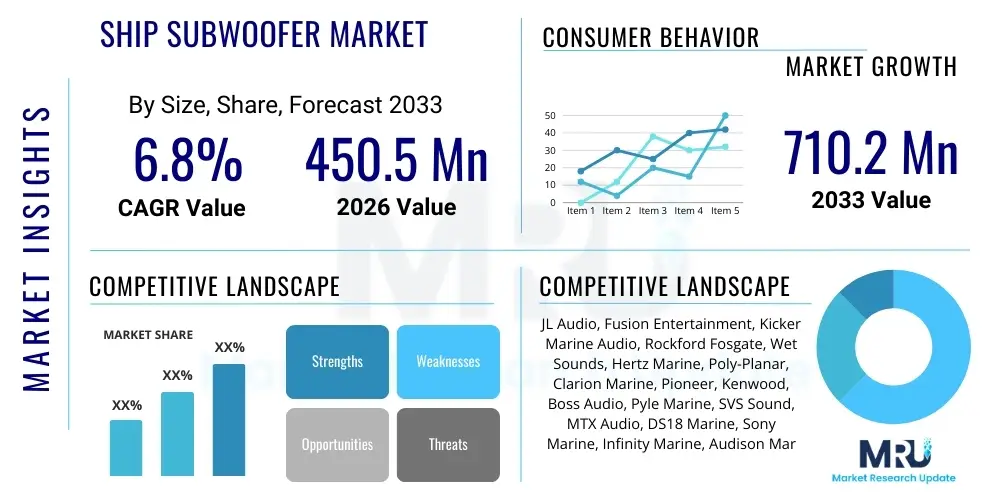

The Ship Subwoofer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 450.5 Million in 2026 and is projected to reach USD 710.2 Million by the end of the forecast period in 2033.

Ship Subwoofer Market introduction

The Ship Subwoofer Market encompasses the design, manufacturing, and distribution of specialized low-frequency audio transducers built specifically for marine and nautical environments. These subwoofers are essential components of high-fidelity marine audio systems, providing deep, rich bass that compensates for the sound dispersion and absorption challenges inherent in open-air and water-adjacent settings. Unlike standard automotive or home audio subwoofers, ship subwoofers require rigorous environmental protection, including UV stabilization, salt fog resistance, and complete waterproofing (IP ratings often exceeding IPX5) to withstand extreme conditions such as constant moisture exposure, fluctuating temperatures, and structural vibrations typical of various vessel types, ranging from small recreational boats to large luxury yachts and commercial ships.

The primary product characteristic driving technological innovation in this sector is durability coupled with acoustic performance. Manufacturers focus on using marine-grade materials such as polypropylene cones, stainless steel hardware, and specialized rubber surrounds to ensure longevity. Major applications include entertainment systems on recreational boats (cruisers, sailboats, fishing vessels), enhancing the guest experience on luxury yachts and cruise ships, and providing communication and alarm system reinforcement on larger commercial or military vessels where clear sound output is critical despite high ambient noise levels. The integration of powerful, efficient Class D amplifiers optimized for 12V DC systems is a recurring technical feature across the product portfolio.

Key benefits derived from utilizing specialized ship subwoofers include vastly improved sound clarity and depth, crucial for providing a premium experience that matches the investment in high-end marine vessels. Driving factors include the sustained growth in global boat sales, particularly in the luxury and recreational segments, where owners increasingly demand home-theater-quality audio integration. Furthermore, technological advancements in digital signal processing (DSP) and compact enclosure design allow for seamless integration into constrained boat architectures, pushing market growth through enhanced product usability and performance metrics, thereby addressing acoustic challenges unique to the marine setting.

Ship Subwoofer Market Executive Summary

The Ship Subwoofer Market demonstrates robust growth driven by escalating demand for premium marine audio equipment and continuous technological improvements focused on weather resistance and acoustic efficiency. Business trends indicate a strong shift towards integrated audio solutions, where manufacturers offer complete ecosystem packages including speakers, amplifiers, and subwoofers optimized for specific vessel sizes and operational environments. Strategic alliances and mergers among specialized marine electronics companies and general consumer electronics giants are common, aiming to consolidate market share and leverage distribution networks. The aftermarket segment remains dominant, driven by refitting and upgrade activities, although Original Equipment Manufacturers (OEMs) are increasingly incorporating higher-quality audio as standard features in new boat models, signalling a premiumization trend in the entry-level and mid-range vessel categories.

Regionally, North America and Europe maintain leading market positions due to high recreational boating penetration and significant disposable income dedicated to leisure activities. However, the Asia Pacific (APAC) region is emerging as the fastest-growing market, propelled by rapid growth in coastal tourism, expansion of private yacht ownership in developing economies, and increasing investments in marine infrastructure. Regulatory stability regarding noise pollution and marine electronics standards influences product development, particularly in established markets. Successful market navigation requires localized product adaptation, especially concerning waterproofing standards and regional consumer preferences regarding sound profiles and aesthetic integration.

Segment trends highlight the increasing preference for active subwoofers (those with integrated amplifiers) due to their simplicity of installation and space efficiency, especially in smaller vessels where space optimization is critical. The 10-inch and 12-inch size segments dominate sales, balancing performance needs with physical installation constraints. Furthermore, demand for advanced features such as LED lighting integration, multi-zone control capabilities, and seamless connectivity with navigation systems is defining product differentiation. Key stakeholders are focusing on sustainable material sourcing and energy-efficient amplification to align with broader environmental compliance expectations within the marine leisure sector.

AI Impact Analysis on Ship Subwoofer Market

User queries regarding AI's influence on the Ship Subwoofer Market primarily revolve around how artificial intelligence can optimize sound performance, manage multi-zone audio systems autonomously, and predict equipment failure in harsh marine conditions. Users are particularly interested in AI-driven digital signal processing (DSP) that can automatically compensate for environmental variables, such as engine noise, hull resonance, and wind interference, ensuring consistent audio quality regardless of vessel speed or sea state. Another major theme is the potential for AI-powered diagnostics to monitor the health of high-investment marine audio systems, including detecting early signs of corrosion or moisture ingress in sensitive electronic components. Expectations also include personalized listening profiles generated by AI based on passenger presence and activity, thus creating a dynamic and optimized user experience.

- AI-Enhanced DSP (Digital Signal Processing) for Acoustic Correction: Algorithms analyze real-time environmental noise (wind, engine) and automatically adjust subwoofer crossover frequencies and phase alignment, delivering optimal bass response.

- Predictive Maintenance and Diagnostics: AI models monitor electrical load, temperature fluctuations, and vibration patterns of subwoofers and amplifiers, predicting component failure before it occurs, crucial for safety and reliability on long voyages.

- Automated Multi-Zone Audio Management: AI systems learn user preferences and autonomously balance volume and sound staging across different zones of the vessel (cabin, deck, bow), optimizing output based on real-time occupancy sensing.

- Smart Power Management: AI optimizes power draw from the vessel’s limited DC supply, ensuring high performance while minimizing battery strain, which is vital for efficient marine operation.

- Voice Command Integration and Interaction: Enhanced natural language processing driven by AI facilitates hands-free control of complex marine audio networks, improving user safety and accessibility while navigating.

- Advanced Manufacturing Quality Control: Machine learning vision systems detect micro-defects in marine-grade coatings and sealing processes during manufacturing, significantly improving the longevity and IP rating consistency of the products.

DRO & Impact Forces Of Ship Subwoofer Market

The Ship Subwoofer Market growth trajectory is fundamentally shaped by the interplay of increasing luxury boating trends and the persistent technical challenges posed by the marine environment. The primary driving forces include the sustained rise in global leisure spending, which directly translates into higher demand for feature-rich, high-performance marine audio systems. Simultaneously, technological leaps in material science, leading to truly marine-grade, highly durable subwoofers capable of enduring years of harsh UV exposure and salt water immersion, remove key barriers to adoption. However, market expansion faces significant restraints, chiefly the inherently high initial cost of specialized marine electronics compared to standard consumer components, which can deter cost-sensitive buyers. Furthermore, installation complexity, requiring skilled technicians to integrate these systems into complex boat electrical and structural layouts, often acts as a bottleneck, particularly in emerging markets.

Opportunities abound in developing smarter, more integrated product ecosystems. The market is ripe for innovation in wireless technology applied to marine audio, simplifying installation and reducing vulnerability to wiring corrosion. The focus on energy efficiency through advanced Class D amplification also presents an opportunity to cater to the growing segment of electric and hybrid marine vessels. Strategic market entry into high-growth regions like Southeast Asia and the Middle East, where yachting culture is rapidly expanding, offers lucrative prospects. Additionally, servicing the significant refit and upgrade market with modular and backward-compatible systems provides sustained revenue streams, capitalizing on existing vessel ownership.

The impact forces within the market are predominantly driven by consumer expectations for uncompromising performance (Acoustic Pressure Level and Frequency Response), which forces continuous engineering optimization, balanced against regulatory pressures regarding electromagnetic compatibility (EMC) and environmental standards (e.g., REACH compliance in Europe). Competitive intensity is high, with established specialist brands leveraging their reputation for durability, while new entrants often compete on price or unique features like multi-color LED synchronization. The supply chain fragility for specialized components (e.g., rare-earth magnets optimized for high output) also dictates pricing and production timelines, making resilience in sourcing a critical impact factor on overall profitability and market responsiveness.

Segmentation Analysis

The Ship Subwoofer Market is meticulously segmented based on product characteristics, application type, physical size, and distribution channels, reflecting the diverse requirements of the marine industry. Segmentation by type differentiates between active (powered) and passive (unpowered) units, addressing different installation complexities and power availability constraints on vessels. Size segmentation (8-inch, 10-inch, 12-inch, and larger) is crucial as it directly correlates with acoustic output capacity and suitability for varying hull sizes and available mounting locations. Application segmentation clearly delineates between the high-volume recreational sector and the more specialized commercial and military requirements, each demanding specific durability and performance metrics. Understanding these segment dynamics is vital for manufacturers to tailor their product offerings and channel strategies effectively.

- By Type

- Active Subwoofers (Integrated Amplifier)

- Passive Subwoofers (External Amplifier Required)

- By Size

- 8-inch Subwoofers

- 10-inch Subwoofers

- 12-inch Subwoofers

- Others (Greater than 12-inch)

- By Application

- Recreational Boats (Yachts, Cruisers, Fishing Vessels)

- Commercial Vessels (Ferries, Workboats)

- Military Vessels

- By Distribution Channel

- Original Equipment Manufacturer (OEM)

- Aftermarket (Retail, Specialized Marine Electronics Dealers)

Value Chain Analysis For Ship Subwoofer Market

The value chain for the Ship Subwoofer Market begins with upstream activities focused heavily on raw material sourcing and specialized component manufacturing. This upstream segment is characterized by the procurement of marine-grade polymers (for cones and enclosures), high-strength magnetic materials (Neodymium or Ferrite), UV-resistant rubber compounds, and stainless steel hardware for corrosion resistance. Given the specialized nature of marine requirements, key suppliers often operate under strict quality control mandates, making vertical integration or strategic long-term sourcing agreements crucial for maintaining supply stability and cost efficiency. The design and engineering phase, particularly concerning enclosure resonance modeling and material longevity testing (salt fog chamber testing), adds significant value here, distinguishing marine components from standard audio products.

The manufacturing stage involves highly specialized assembly processes to ensure the critical IP ratings (Ingress Protection) are met, including precise sealing techniques and quality checks. Downstream activities involve distribution through specialized channels. The OEM channel involves direct supply to boat builders, requiring strict compliance with vessel design specifications and just-in-time delivery. The aftermarket channel is complex, relying on authorized marine electronics distributors, specialized marine audio retailers, and certified installation technicians. Effective logistical support for warranty and repair services is paramount in the aftermarket segment due to the inherent difficulty in servicing components in remote or challenging marine environments. Brand reputation and the perceived durability of the product are heavily influenced by the quality of this downstream support.

Distribution channels for ship subwoofers are bifurcated into direct (OEM) and indirect (Aftermarket). Direct sales involve rigorous qualification processes where subwoofer manufacturers collaborate closely with vessel designers early in the boat construction lifecycle. Indirect channels, which comprise the bulk of sales volume, depend on a network of expert marine audio dealers who provide consultation, integration, and installation services. These dealers act as critical intermediaries, educating end-users about the technical requirements and long-term maintenance of marine systems. Successful market penetration hinges on robust dealer training and inventory support, ensuring that installers are equipped to handle the unique electrical and acoustic environments of different vessel types, thereby guaranteeing optimal product performance and customer satisfaction post-sale.

Ship Subwoofer Market Potential Customers

Potential customers for the Ship Subwoofer Market primarily consist of end-users involved in recreational boating, luxury cruising, and specialized commercial marine operations. The largest segment of buyers comprises private owners of recreational vessels, ranging from weekend fishing boats and wakeboarding boats to high-end cruisers and superyachts. These customers are driven by the desire for superior on-water entertainment and view premium audio as a core aspect of their luxury leisure experience. In this segment, purchasing decisions are highly influenced by brand prestige, acoustic performance, aesthetic integration, and proven long-term reliability in harsh conditions.

A second significant customer base includes Original Equipment Manufacturers (OEMs) of boats and yachts. These buyers integrate subwoofers directly into their vessel designs as part of factory-installed premium audio packages. OEMs prioritize reliability, ease of factory installation, competitive bulk pricing, and compliance with stringent marine industry standards (e.g., ABYC). The trend toward larger, more luxurious yachts has significantly increased the volume and complexity of audio components required per vessel, making these OEMs crucial long-term partners for subwoofer manufacturers.

Furthermore, commercial operators and military bodies represent a specialized but critical customer segment. Commercial applications include audio systems for passenger ferries, specialized workboats, and research vessels where clear, powerful audio is needed for communication and safety systems in high-noise environments. Military customers require subwoofers that meet extreme durability and electromagnetic shielding specifications. These buyers prioritize operational uptime, compliance with military-grade standards, and robust performance under continuous heavy use, often resulting in demand for highly customized, high-specification products that command a premium price point.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Million |

| Market Forecast in 2033 | USD 710.2 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | JL Audio, Fusion Entertainment, Kicker Marine Audio, Rockford Fosgate, Wet Sounds, Hertz Marine, Poly-Planar, Clarion Marine, Pioneer, Kenwood, Boss Audio, Pyle Marine, SVS Sound, MTX Audio, DS18 Marine, Sony Marine, Infinity Marine, Audison Marine, JBL Marine, Skar Audio. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ship Subwoofer Market Key Technology Landscape

The Ship Subwoofer Market is characterized by continuous technical innovation focused on enhancing durability, acoustic performance, and integration capabilities specific to the marine environment. A cornerstone technology is the use of advanced marine-grade materials, including specialized poly-ether-ether-ketone (PEEK) or polypropylene cone materials combined with Santoprene or specialized rubber surrounds. These materials must maintain acoustic integrity and flexibility across wide temperature ranges while offering superior resistance to UV degradation, salt corrosion, and moisture intrusion. Furthermore, sealed enclosure technology, often incorporating robust internal baffling and pressure equalization vents protected by hydrophobic membranes, is essential for achieving high IP ratings (e.g., IPX7 or IPX8), ensuring long-term operational lifespan even when subjected to direct washdown or partial submersion.

Another crucial technological development lies in amplification and signal processing. The widespread adoption of highly efficient Class D amplifier technology has revolutionized marine audio by delivering high power output with minimal heat generation and reduced current draw, which is critical given the limited electrical power capacity on most vessels. Modern ship subwoofers are increasingly bundled with integrated Digital Signal Processors (DSPs) that allow for precise tuning of equalization, crossover points, and phase alignment. This optimization is necessary to counteract the variable acoustic environment of a boat, which lacks the rigid, enclosed spaces typical of home or automotive installations, often requiring frequency response adjustments based on whether the vessel is moored or cruising at high speed.

Integration technologies are also paramount. Subwoofers often incorporate advanced connectivity features, including compatibility with standardized marine network protocols (like NMEA 2000 in complex systems), allowing for centralized control and monitoring via Multi-Function Displays (MFDs). Aesthetic integration is addressed through sophisticated lighting systems, such as customizable RGB/LED illumination that synchronizes with the vessel’s lighting schemes. Furthermore, design flexibility, specifically incorporating shallow-mount and free-air (infinite baffle) subwoofer designs, allows installers to maximize bass performance in geometrically challenging and space-constrained areas, reducing the need for traditional, bulky sealed enclosures which are difficult to fit within standard boat structures.

Regional Highlights

- North America: This region holds the largest market share, driven by a deeply ingrained recreational boating culture, high per capita income, and a large concentration of luxury yacht ownership. The US and Canada are major hubs for both OEM boat manufacturing and extensive aftermarket sales. Demand is highly focused on premium, high-power systems offering extensive features and connectivity.

- Europe: A mature market characterized by strong yachting sectors in coastal nations like Italy, France, Spain, and the UK. European consumers emphasize sound quality, subtle aesthetic integration, and strict adherence to regional environmental regulations (e.g., CE marking and RoHS/REACH compliance). The Mediterranean cruising sector fuels continuous demand for refitting and upgrades.

- Asia Pacific (APAC): Expected to register the highest growth rate (CAGR). This acceleration is due to rising economic prosperity, especially in China, Australia, and Southeast Asia, leading to increased investment in marine tourism and private vessel ownership. Market growth is currently centered around developing robust distribution and installer networks capable of handling technical complexity.

- Latin America: This region presents emerging opportunities, primarily in Brazil and Mexico, linked to localized leisure boating and fishing industries. The market here is sensitive to price, leading to a focus on cost-effective, durable solutions, often imported through specialized trade channels rather than extensive local manufacturing.

- Middle East and Africa (MEA): Growth is concentrated in wealthy Gulf nations (UAE, Qatar) driven by luxury yacht imports and coastal real estate development incorporating marina facilities. Demand is exclusively for high-end, bespoke marine audio systems, often requiring extreme temperature resistance and custom installation solutions for superyachts.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ship Subwoofer Market.- JL Audio

- Fusion Entertainment (A Garmin Brand)

- Kicker Marine Audio

- Rockford Fosgate

- Wet Sounds

- Hertz Marine

- Poly-Planar

- Clarion Marine

- Pioneer

- Kenwood

- Boss Audio

- Pyle Marine

- SVS Sound

- MTX Audio

- DS18 Marine

- Sony Marine

- Infinity Marine

- Audison Marine

- JBL Marine

- Skar Audio

Frequently Asked Questions

Analyze common user questions about the Ship Subwoofer market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the key difference between a marine subwoofer and a standard car subwoofer?

Marine subwoofers are specifically engineered with highly durable, marine-grade materials (UV-resistant polymers, stainless steel hardware) and sealed designs with high Ingress Protection (IP) ratings to withstand constant exposure to moisture, salt fog, temperature extremes, and direct washdown without degradation, which standard car subwoofers cannot reliably endure.

Which subwoofer size is generally recommended for optimizing bass on a mid-sized cruiser?

For mid-sized cruisers (25-45 feet), the 10-inch and 12-inch marine subwoofers are most recommended. These sizes offer the best balance of powerful low-frequency output (necessary to overcome ambient noise) and physical manageability for installation within limited hull space, often utilizing free-air or shallow-mount designs.

Are active or passive ship subwoofers more suitable for OEM boat builders?

Passive subwoofers are often preferred by OEM boat builders as they allow centralized power management using dedicated, high-quality external marine amplifiers integrated into the vessel’s main electrical system, offering greater control, flexibility, and easier maintenance compared to decentralized active units.

What is the Compound Annual Growth Rate (CAGR) projected for the Ship Subwoofer Market?

The Ship Subwoofer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between the forecast years of 2026 and 2033, driven by increasing recreational boating activity and the premiumization of marine audio systems globally.

How does Digital Signal Processing (DSP) enhance the performance of marine subwoofers?

Integrated DSP technology significantly improves marine subwoofer performance by allowing technicians to precisely adjust frequency response, time alignment, and crossover settings in real-time. This counteracts acoustic challenges like boat resonance and open-air dispersion, ensuring deeper, clearer, and more controlled bass regardless of the operating environment or vessel speed.

What are the primary challenges related to the installation of high-power ship subwoofers?

Key installation challenges include securing adequate, stable power supply from the vessel's DC system, managing high-gauge marine wiring pathways to prevent corrosion, optimizing enclosure volume or baffle constraints within the limited hull structure, and acoustically isolating the subwoofer to prevent unwanted vibration or structural damage.

Which geographic region holds the largest market share for ship subwoofers, and why?

North America currently holds the largest market share due to its established and vast recreational boating sector, high consumer spending on luxury marine accessories, and the presence of major global marine electronics manufacturers and boat builders, sustaining robust demand for high-end audio upgrades.

How is environmental compliance influencing material selection in marine subwoofer manufacturing?

Environmental compliance, particularly in Europe (REACH/RoHS), drives manufacturers to select materials free from hazardous substances, focusing on eco-friendly plastics and coatings. This necessitates extensive research into non-toxic, yet highly durable, alternatives for UV protection and waterproofing elements, ensuring product sustainability without compromising longevity.

What role do yacht charter and cruise lines play in the demand dynamics of the market?

Yacht charter and cruise lines contribute significantly to the high-end segment demand. They require reliable, multi-zone, powerful audio systems for guest entertainment, often specifying professional-grade subwoofers capable of continuous high-output operation, thereby driving technological demand for robust and integrated solutions in commercial marine applications.

Define 'Infinite Baffle' or 'Free Air' mounting common in marine subwoofer applications.

Infinite Baffle mounting means the subwoofer uses the hull structure or a large sealed compartment of the boat as its enclosure, eliminating the need for a separate, bulky sealed box. This design is highly common in marine environments as it saves valuable space while separating the front sound waves from the rear, ensuring effective bass reproduction.

What is the significance of the Aftermarket segment in the Ship Subwoofer Market value chain?

The Aftermarket segment is critical as it serves the large population of existing boat owners looking to upgrade, replace, or enhance their audio systems. It is characterized by high service intensity, reliance on specialized marine electronics dealers, and often involves higher complexity due to retrofitting requirements in existing vessel structures.

How does the integration of LED lighting systems affect consumer preference for marine subwoofers?

The integration of customizable RGB/LED lighting systems has become a significant factor in consumer preference, especially in the recreational and wakeboarding segments. It enhances the aesthetic appeal and customization of the vessel, transforming the audio equipment into a visual feature and adding value beyond pure acoustic performance.

What are the current trends in materials used for subwoofer cones in harsh marine settings?

Current material trends lean towards injection-molded polypropylene or mineral-filled polymer blends. These materials offer an optimal balance of rigidity for tight bass response, light weight for efficiency, and crucial resistance to water absorption and chemical deterioration caused by cleaning agents or fuel vapors.

How does the volatility in raw material costs, specifically rare earth magnets, impact subwoofer pricing?

Volatility in the price of rare earth magnets (such as Neodymium, used in high-efficiency drivers) directly impacts the manufacturing cost of high-performance subwoofers. Since premium marine subwoofers require strong magnetic motors for high output, manufacturers often pass these cost fluctuations onto the consumer, affecting final retail pricing.

What security and connectivity features are becoming standard in high-end marine audio systems?

Standard features now include Bluetooth 5.0 for stable wireless streaming, NMEA 2000 compatibility for system control via MFDs, and advanced security protocols like password protection or geo-fencing to prevent unauthorized system usage when the vessel is unoccupied, addressing theft concerns.

In which application segment is durability and failure resistance the absolute highest priority?

Durability and failure resistance are the absolute highest priorities within the Military Vessels application segment. Subwoofers used in these environments must meet stringent military specifications for shock, vibration, electromagnetic compatibility (EMC), and operational reliability under extreme combat or prolonged operational conditions.

Explain the driving factor related to 'premiumization' in the Ship Subwoofer Market.

Premiumization is driven by vessel owners increasingly viewing their boats as luxury extensions of their homes, demanding audio quality and connectivity features comparable to high-end residential systems. This forces OEMs and aftermarket suppliers to incorporate more advanced technology, higher power handling, and superior materials, boosting average selling prices.

What is the role of specialized certifications, such as ASTM B117, in this market?

ASTM B117 (Salt Fog/Salt Spray Resistance) certification is crucial for marine audio manufacturers. It proves that the product can withstand corrosive salt environments over extended periods, providing assurance of longevity and durability to both boat builders (OEMs) and end-users, thereby serving as a key competitive differentiator.

How does AI impact predictive maintenance capabilities for ship subwoofers and amplifiers?

AI analyzes operational data (voltage, current draw, heat profiles) collected from the audio system over time. By recognizing subtle anomalies or deviations from baseline performance, AI algorithms can predict potential component failure (e.g., voice coil stress or amplifier overheating) days or weeks in advance, alerting users for preventative servicing.

What challenges do manufacturers face regarding the 12V DC power systems on boats?

Manufacturers must design subwoofers and amplifiers that efficiently convert and utilize limited 12V DC power, maximizing acoustic output while minimizing current draw to prevent battery depletion or system shutdowns. This requires highly efficient Class D amplifier designs optimized for marine electrical systems that often experience voltage fluctuations.

Which factor contributes most significantly to the high initial cost of marine subwoofers?

The most significant contributor to the high initial cost is the necessity of specialized, corrosion-resistant, and UV-stabilized materials (e.g., stainless steel grilles, marine-grade sealing compounds, and highly resilient cone materials) and the rigorous, complex sealing processes required to achieve guaranteed ingress protection (IP) ratings.

How are advancements in vessel design influencing subwoofer placement and size selection?

Modern vessel designs, often prioritizing interior space, necessitate smaller, shallower, and more flexible subwoofer formats. This drives demand for compact, high-excursion drivers and sophisticated enclosure simulations, allowing manufacturers to fit high-performance bass solutions into previously unusable voids and compartments.

What is the primary function of a subwoofer crossover in a marine audio setup?

The crossover in a marine subwoofer system is essential for filtering out high-frequency signals, ensuring only the low-frequency bass notes are sent to the subwoofer. This prevents distortion, improves overall system clarity, and directs the correct sound frequencies to the specialized drivers (subwoofer, mid-range, tweeter).

Identify a key restraint related to the distribution channel in emerging markets.

A key restraint in emerging markets is the lack of specialized, certified marine audio installers. Proper installation requires specific knowledge of marine electrical systems and acoustic tuning; the shortage of skilled labor complicates high-quality aftermarket integration and limits consumer willingness to purchase complex systems.

How important is acoustic modeling and simulation in the design phase of marine subwoofers?

Acoustic modeling is critically important. Since the boat hull, cabin, and deck are non-standard and highly variable acoustic environments, manufacturers rely on Finite Element Analysis (FEA) and complex simulations to predict how a subwoofer will perform when integrated into specific vessel architectures before physical prototyping, optimizing for power and phase response.

What competitive advantage do specialized brands like JL Audio and Wet Sounds maintain?

Specialized brands maintain a competitive advantage primarily through their reputation for superior acoustic engineering and proven long-term durability in extreme marine conditions. Their concentrated focus on marine-specific R&D allows them to consistently deliver products that outperform general consumer electronic brands in harsh environments.

What potential opportunities exist in servicing the commercial workboat segment?

The commercial workboat segment represents an opportunity for extremely robust, military-spec or heavy-duty subwoofers and communication reinforcement systems. This segment prioritizes unwavering reliability and extremely high SPL (Sound Pressure Level) to cut through industrial noise, often requiring customized, sealed components for harsh use.

How does the trend of electric and hybrid boats influence the market for amplifiers and subwoofers?

Electric and hybrid boats place a premium on energy efficiency. This trend necessitates subwoofers paired with ultra-high-efficiency Class D amplifiers that draw minimal current, ensuring maximum acoustic performance without substantially reducing the vessel’s limited battery range or increasing the load on auxiliary power generation.

What role does the warranty period play in consumer purchasing decisions for marine subwoofers?

The warranty period is highly influential, functioning as a proxy for product confidence in durability. Given the high cost and environmental risks associated with marine electronics, extended or comprehensive warranties offered by manufacturers significantly reduce perceived purchasing risk for end-users and installation risk for dealers.

What are the key upstream components analyzed in the Ship Subwoofer Market value chain?

Key upstream components include specialized permanent magnets (Neodymium), marine-grade copper wiring, high-density polymer materials for cone and surrounds, UV-stable coatings, and corrosion-resistant metal baskets (typically stainless steel or high-grade aluminum alloys) that define the product's ultimate endurance.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager