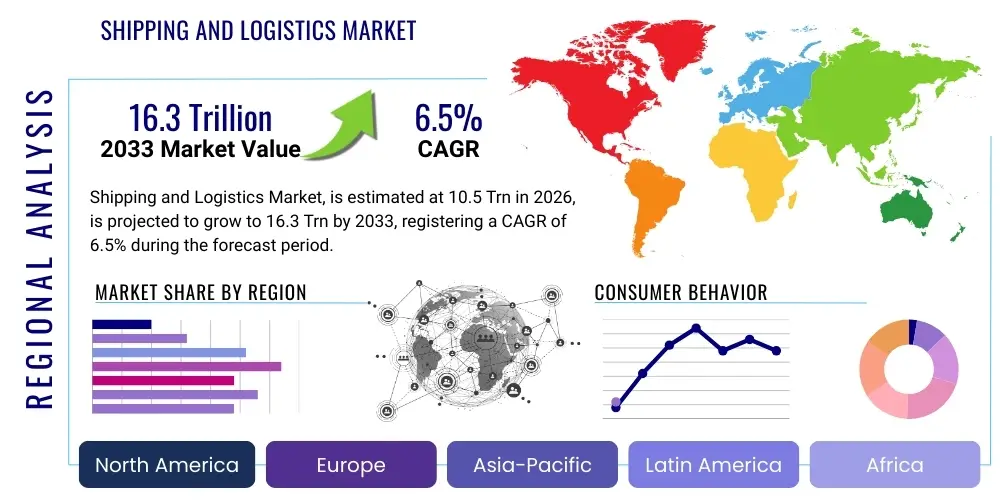

Shipping and Logistics Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441376 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Shipping and Logistics Market Size

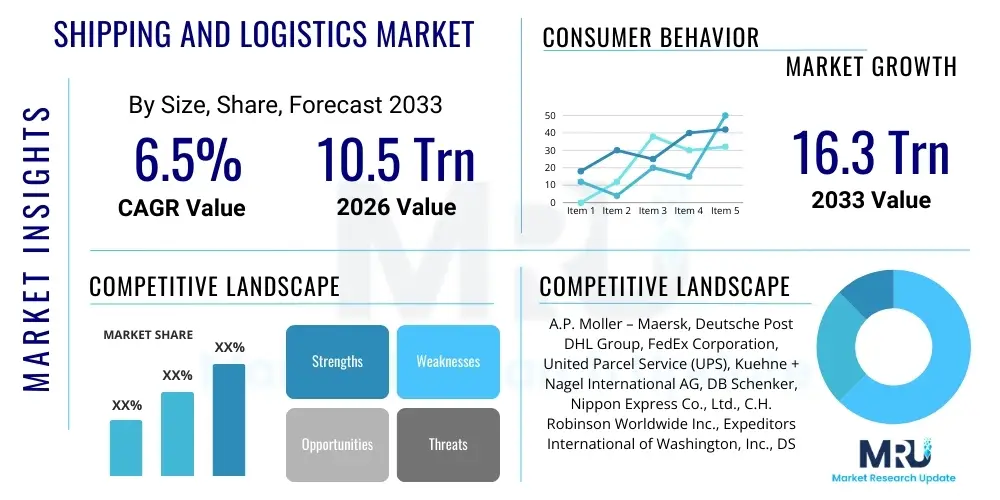

The Shipping and Logistics Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 10.5 Trillion in 2026 and is projected to reach USD 16.3 Trillion by the end of the forecast period in 2033.

Shipping and Logistics Market introduction

The Shipping and Logistics Market encompasses the management of the flow of goods, information, and other resources between the point of origin and the point of consumption, addressing complex supply chain requirements across diverse industries. This sector provides essential services including transportation (freight forwarding, trucking, air freight, maritime shipping), warehousing, inventory management, packaging, and third-party logistics (3PL) services. The product offered by this market is the seamless movement and storage infrastructure necessary for global commerce, ensuring supply chain integrity and efficiency. Major applications span retail, manufacturing, automotive, healthcare, and e-commerce, linking producers with end consumers globally.

The core benefits of a robust logistics market include reduced operational costs for businesses, faster time-to-market for products, enhanced supply chain resilience against disruptions, and optimized inventory levels through sophisticated management systems. Furthermore, modern logistics focuses intensely on visibility and security, offering real-time tracking and minimizing losses due to damage or theft. The complexity of modern trade, driven by shorter product lifecycles and personalized delivery expectations, necessitates highly sophisticated and integrated logistics solutions that leverage digital platforms for execution.

Key driving factors accelerating market expansion include the explosive growth of cross-border e-commerce, which demands faster and more flexible last-mile delivery capabilities. Rapid urbanization and industrialization in emerging economies, particularly across Asia Pacific and Latin America, are also escalating the need for scalable infrastructure development and sophisticated multimodal transport networks. The continued push for supply chain transparency, often mandated by regulatory bodies and consumer demand for sustainability, forces logistics providers to invest heavily in tracking technology and green logistics solutions, further stimulating market growth and technological adoption.

Shipping and Logistics Market Executive Summary

Global logistics trends are heavily influenced by geopolitical shifts and the rapid acceleration of digital transformation, dictating a necessity for greater supply chain diversification and redundancy. Business trends show a strong movement towards integrated 4PL models, where providers manage the entire supply chain, including IT infrastructure, offering deep expertise and scalability. High labor costs and increasing regulatory pressure regarding emissions are pushing providers toward greater automation in warehousing and the adoption of alternative fuels in maritime and road transport. Strategic mergers and acquisitions are consolidating market power among major global players, aiming to achieve end-to-end control over critical trade lanes.

Regionally, Asia Pacific maintains its dominance, fueled by robust manufacturing output, surging domestic consumption, and extensive investment in maritime infrastructure, particularly through initiatives like China's Belt and Road. North America and Europe are focusing intensely on sustainability mandates and technological integration, utilizing advanced robotics and AI for operational efficiency gains, while also grappling with challenges related to labor shortages and port congestion. Emerging regions in the Middle East and Africa are witnessing significant investments in logistics hubs and free trade zones, positioning themselves as critical intermodal transit points connecting East and West, driven by diversification away from oil economies.

Segment trends reveal that the e-commerce fulfillment segment is experiencing the fastest growth, requiring specialized, temperature-controlled, and highly flexible logistics services. Within mode of transport, air freight remains volatile but critical for high-value and time-sensitive goods, while sea freight continues to handle the bulk of global trade, increasingly focusing on container fleet optimization and digitalization of booking processes. The warehousing segment is transforming into highly automated distribution centers, moving beyond simple storage to offering complex value-added services like light assembly, packaging customization, and returns processing, catering directly to complex omnichannel retail strategies.

AI Impact Analysis on Shipping and Logistics Market

Common user inquiries regarding AI's influence in the Shipping and Logistics Market center predominantly on themes of operational efficiency gains, risk mitigation, and job transformation. Users frequently ask how AI can optimize complex routing problems (e.g., last-mile delivery algorithms), how predictive analytics can improve inventory forecasting and minimize 'bullwhip' effect inventory volatility, and what specific cybersecurity risks are introduced by greater reliance on AI-driven systems. A significant concern revolves around the balance between automation displacing human labor in traditionally manual roles (like truck driving and warehouse picking) versus the creation of new, high-skill jobs in maintenance and data science. Users expect AI to deliver measurable improvements in delivery speed, cost reduction, and enhanced customer experience through sophisticated tracking and communication tools.

The implementation of Artificial Intelligence, including Machine Learning (ML) and deep learning, is revolutionizing logistics operations by moving beyond traditional rules-based automation towards cognitive decision-making capabilities. AI systems are increasingly deployed to analyze vast datasets relating to weather patterns, traffic congestion, port capacity, and geopolitical events in real-time, allowing logistics providers to dynamically adjust routes and schedules. This proactive decision-making minimizes delays, optimizes fuel consumption, and significantly enhances the efficiency of resource allocation across large, complex networks. Furthermore, AI-powered computer vision systems are drastically improving safety and security within warehouses and during transport, detecting anomalies and preventing potential accidents or cargo tampering.

Specific applications of AI are profoundly impacting inventory management and demand forecasting. ML algorithms analyze historical sales data alongside external factors like seasonal changes, promotions, and macroeconomic indicators to generate highly accurate demand predictions, leading to optimized inventory stocking levels and reduced holding costs. In warehouse operations, robotics guided by AI pathfinding algorithms ensure faster putaway and retrieval cycles. Crucially, AI is central to enhancing customer service through intelligent chatbots and personalized delivery tracking notifications, significantly reducing the workload on human customer support teams while providing customers with instant, accurate information regarding their shipments and logistics service status.

- Enhanced Route Optimization: AI algorithms dynamically calculate the most fuel-efficient and timely paths, factoring in real-time variables like traffic and weather.

- Predictive Maintenance: AI analyzes sensor data from vehicles and machinery to forecast equipment failure, reducing downtime and maximizing asset utilization.

- Autonomous Warehousing: Robotics and autonomous guided vehicles (AGVs) use AI for efficient movement, sorting, and inventory management within fulfillment centers.

- Demand Forecasting Accuracy: Machine learning improves the precision of inventory planning, minimizing overstocking and stock-outs.

- Fraud and Risk Detection: AI monitors transactions and shipping patterns to identify and flag potential security breaches or fraudulent activities.

- Intelligent Freight Pricing: Algorithms determine optimal pricing strategies based on current market capacity, demand, and transport costs.

DRO & Impact Forces Of Shipping and Logistics Market

The dynamics of the Shipping and Logistics Market are shaped by powerful Drivers, inherent Restraints, and significant Opportunities (DRO), collectively forming the market's Impact Forces. Key drivers include the relentless expansion of globalized trade and the paradigm shift towards direct-to-consumer models accelerated by e-commerce penetration, which fundamentally alters delivery expectations. Conversely, major restraints involve persistent geopolitical volatility leading to supply chain fracturing, the severe infrastructural bottlenecks in developing ports and road networks, and escalating operational costs primarily due to volatile fuel prices and increasing regulatory mandates related to decarbonization. The most potent opportunities lie in leveraging digital technologies such as Blockchain for supply chain transparency and investing in innovative last-mile delivery solutions like drone or autonomous vehicle integration.

The primary drivers are anchored in macro-economic shifts. The proliferation of free trade agreements, coupled with the rising disposable incomes in emerging markets, encourages greater cross-border movement of manufactured goods. The transition to omnichannel retail mandates highly responsive logistics networks capable of fulfilling orders from multiple inventory locations (stores, warehouses, and micro-fulfillment centers), requiring significant investment in flexible IT infrastructure and transportation assets. Furthermore, the increasing need for specialized logistics—such as cold chain for pharmaceuticals and perishable food items—is acting as a powerful niche driver, demanding higher quality, technology-enabled services.

Significant market restraints pose serious challenges to sustained growth. A critical restraint is the acute shortage of skilled labor, particularly truck drivers and logistics planners, impacting operational capacity across North America and Europe. Environmental regulations, such as the IMO 2020 sulfur cap and impending EU carbon border adjustments, impose substantial compliance costs on carriers, often necessitating large capital expenditures for fleet upgrades or alternative fuel adoption. Cybersecurity threats targeting increasingly digitized logistics systems represent a non-physical restraint but carry the potential for catastrophic operational shutdowns, highlighting the vulnerability inherent in highly integrated digital supply chains.

Segmentation Analysis

The Shipping and Logistics Market is segmented based on the mode of transport, the type of service offered, the function or operational model, and the primary end-use industry served. This multi-faceted segmentation allows for detailed analysis of market dynamics, as different segments exhibit varied growth rates and sensitivity to economic cycles and technological adoption. The dominant segments, such as road freight and warehousing, remain the foundation of regional logistics, while niche areas like cold chain logistics and specialized e-commerce fulfillment are experiencing rapid, above-average growth, driven by stringent regulatory requirements and consumer expectations for faster delivery of sensitive goods. Understanding these distinct segments is crucial for strategic resource allocation and identifying high-growth investment pockets across the global market.

Segmentation by Service Type highlights the increasing importance of sophisticated, outsourced solutions. Third-Party Logistics (3PL) and Fourth-Party Logistics (4PL) providers are gaining market share by offering integrated services that go beyond simple transportation or storage, incorporating value-added activities like customs brokerage, supply chain consulting, and reverse logistics management. The shift towards 4PL, where the provider manages and optimizes the entire logistics portfolio, reflects the increasing complexity of global supply chains and the willingness of major manufacturers and retailers to outsource non-core competencies. Conversely, segmentation by End-Use Industry demonstrates the resilience of the manufacturing sector (automotive, machinery) and the transformational impact of the retail/e-commerce sector, which dictates speed and flexibility requirements across the entire logistics chain.

Geographic segmentation is vital, as regulatory environments, infrastructural quality, and labor costs vary significantly by region. For example, North American and European logistics are characterized by high levels of automation and advanced IT integration, while the Asia Pacific market is defined by sheer volume and rapid expansion of physical infrastructure. The ongoing trade route shifts, often due to political mandates or infrastructural improvements (e.g., expansion of the Suez or Panama Canals), continuously alter the dynamics of segmentation by mode, influencing investment decisions favoring either maritime or rail linkages based on cost and reliability projections for specific corridors.

- By Mode of Transport:

- Road Freight

- Sea Freight (Maritime)

- Air Freight

- Rail Freight

- Intermodal Transport

- By Service Type:

- Freight Forwarding (Ocean, Air, Road)

- Warehousing and Distribution

- Value-Added Services (VAS)

- Customs and Border Clearance

- Supply Chain Management and Consulting

- By End-Use Industry:

- Manufacturing (Automotive, Heavy Industry)

- Retail and E-commerce

- Healthcare and Pharmaceutical (Cold Chain)

- Food and Beverages

- Oil, Gas, and Chemicals

- Technology and Electronics

- By Business Model:

- Third-Party Logistics (3PL)

- Fourth-Party Logistics (4PL)

- In-House Logistics

Value Chain Analysis For Shipping and Logistics Market

The Shipping and Logistics Value Chain begins with upstream activities focused on securing and managing core assets and resources, including the procurement of transport equipment (vessels, trucks, aircraft), investment in infrastructure (warehouses, cross-docks), and the hiring of essential labor. This stage is heavily influenced by global capital markets and commodity prices, particularly steel and fuel. Upstream players, such as vessel manufacturers and engine suppliers, dictate the efficiency and sustainability profile of the logistics assets. Continuous technological upgrades in asset quality, especially regarding emission reduction, represent a major cost component in the initial stages of the value chain. Effective relationship management with regulatory bodies and port authorities is also a crucial upstream activity, ensuring smooth operational access and adherence to global standards.

Midstream activities constitute the core service delivery components, encompassing actual transportation planning, execution, and tracking. This involves optimizing routes, managing diverse fleets, coordinating intermodal transfers, and performing consolidation or deconsolidation services at hubs. The distribution channel structure plays a critical role here, often bifurcating into direct channels (e.g., dedicated contract carriage for a large manufacturer) and indirect channels (e.g., using freight brokers or aggregators to match capacity with demand). Direct distribution offers greater control and integration, while indirect channels provide flexibility and access to smaller carriers, balancing cost and speed. The integration of advanced Transportation Management Systems (TMS) and Warehouse Management Systems (WMS) is essential in this phase to maximize operational throughput and minimize empty backhauls.

Downstream analysis focuses on delivering the product to the end-user or buyer, including last-mile delivery, reverse logistics, and customer relationship management. The efficiency of the last mile is increasingly becoming the primary determinant of customer satisfaction, especially in e-commerce, demanding rapid response times and flexible delivery options (e.g., parcel lockers, scheduled deliveries). Reverse logistics—the management of returns, repairs, and recycling—is also a rapidly growing downstream activity, adding complexity but also significant value recovery potential. The continuous loop of data generation, flowing from downstream customer feedback back to upstream procurement planning, ensures that the logistics services are perpetually refined to meet evolving market demands and sustain high service quality.

Shipping and Logistics Market Potential Customers

Potential customers, or End-Users/Buyers, for the Shipping and Logistics Market are diverse, spanning nearly every sector of the global economy that relies on the physical movement of goods. These buyers typically seek services that offer a trifecta of cost-efficiency, reliability, and speed, often customized to the specific requirements of their product type, such as temperature control for pharmaceuticals or specialized handling for high-value electronics. The largest customer segments include massive multinational corporations engaged in global manufacturing (e.g., automotive assembly lines requiring just-in-time delivery) and the burgeoning e-commerce retailers (e.g., fashion and general merchandise requiring rapid, scalable fulfillment networks). The increasing specialization in supply chains means customers often demand deep industry expertise from their logistics partners rather than generic services.

The manufacturing sector represents a foundational customer base, where logistics providers are tasked with managing highly complex, globalized supply chains. Automotive manufacturers, for instance, require meticulous inbound logistics to feed assembly lines across multiple continents, often relying on sophisticated sequencing and milk-run deliveries to maintain efficiency. Similarly, heavy industry and construction sectors need specialized handling for oversized, heavy loads (project cargo), demanding compliance with stringent safety and regulatory standards, making service quality a non-negotiable factor in vendor selection and long-term contract establishment. These customers prioritize long-term contractual stability and proven risk management capabilities.

Conversely, the Retail and E-commerce sector prioritizes speed, flexibility, and scalability, driven by volatile consumer demand and seasonal spikes. E-commerce buyers require highly advanced last-mile capabilities, reverse logistics management for handling high return volumes, and access to sophisticated parcel delivery networks. The pharmaceutical and healthcare sector, characterized by highly regulated and sensitive cargo, demands specialized cold chain logistics services that maintain strict temperature ranges throughout transit, necessitating the use of advanced monitoring technologies and compliant infrastructure, representing a premium segment where reliability outweighs cost concerns.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 10.5 Trillion |

| Market Forecast in 2033 | USD 16.3 Trillion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | A.P. Moller – Maersk, Deutsche Post DHL Group, FedEx Corporation, United Parcel Service (UPS), Kuehne + Nagel International AG, DB Schenker, Nippon Express Co., Ltd., C.H. Robinson Worldwide Inc., Expeditors International of Washington, Inc., DSV Panalpina A/S, CEVA Logistics, XPO Logistics, Inc., Sinotrans Limited, GEODIS, J.B. Hunt Transport Services, Inc., Rhenus Group, Toll Holdings Limited, Agility, Bolloré Logistics, YRC Worldwide Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Shipping and Logistics Market Key Technology Landscape

The Shipping and Logistics Market is undergoing a rapid technological transformation, moving towards highly connected, autonomous, and intelligent operations. The core technological landscape is dominated by the integration of sophisticated supply chain software systems, notably Transportation Management Systems (TMS) and Warehouse Management Systems (WMS). These platforms provide end-to-end visibility and control, optimizing everything from route scheduling and carrier selection to inventory placement and order fulfillment. The ongoing evolution of these systems includes the migration to cloud-based architectures, which facilitates faster deployment, enhanced scalability, and seamless data sharing across multiple stakeholders in the supply chain, moving away from legacy on-premise solutions that often operate in silos.

Connectivity and data generation are paramount, driven by the widespread adoption of the Internet of Things (IoT) and advanced telematics. IoT sensors embedded in containers, vehicles, and warehouse assets generate massive amounts of real-time data regarding location, temperature, humidity, vibration, and security status. This granular data feeds into predictive analytics platforms, allowing for proactive intervention to prevent cargo damage or spoilage, particularly critical in the cold chain segment. Telematics systems in fleet management not only track location but also monitor driver behavior and engine performance, contributing to fuel efficiency optimization and adherence to strict maintenance schedules, significantly reducing operational expenditure and increasing asset lifespan.

Emerging technologies like Blockchain are gaining traction for improving document management and fostering trustless transparency within complex multi-party trade transactions. Blockchain offers a tamper-proof ledger for recording ownership transfers, customs documents, and certifications, thereby drastically reducing the administrative friction and potential for fraud associated with traditional paper-based processes. Furthermore, automation technologies, including robotics, Automated Storage and Retrieval Systems (AS/RS), and high-speed sorting equipment, are redefining warehouse efficiency, reducing dependence on manual labor and enabling the high-throughput necessary to handle the volume peaks of e-commerce fulfillment, representing a critical investment area for market participants focused on long-term cost reduction and competitive advantage.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest and fastest-growing region in the global Shipping and Logistics Market, underpinned by its status as the world's manufacturing hub and the rapidly expanding consumer base in China, India, and Southeast Asia. The region benefits from massive governmental investments in infrastructure, including new deep-sea ports, dedicated freight corridors (especially rail), and highly integrated logistics parks. E-commerce penetration is exceptionally high, driving demand for innovative and localized last-mile delivery solutions. The shift towards regional manufacturing hubs (e.g., Vietnam, Thailand) as part of supply chain diversification strategies further fuels intra-regional trade and logistics complexity, requiring resilient and agile cross-border service capabilities.

- North America: This region is characterized by high operational costs but also a high degree of technological sophistication, particularly in warehouse automation and IT integration. The market is dominated by road freight, facing chronic challenges related to truck driver shortages and aging infrastructure. Focus areas include optimizing intermodal rail usage, implementing advanced predictive analytics for port and rail yard congestion management, and heavy investment in sophisticated parcel delivery networks to serve large, dispersed populations. Sustainability is a growing concern, pushing carriers towards electric and alternative fuel vehicle adoption, driven by state-level regulations like those in California.

- Europe: Europe benefits from excellent cross-border connectivity through the European Union's standardized regulatory environment, promoting efficient road and rail transport across member states. The region is highly advanced in multimodal logistics, particularly leveraging inland waterways and high-speed rail for freight. A key highlight is the strong regulatory push towards green logistics and circular economy principles, forcing companies to adopt stringent emissions standards and focus heavily on reverse logistics capabilities. Digitalization initiatives, often supported by EU funding, focus on creating seamless digital corridors and improving customs processing efficiency to maintain competitive edge against global rivals.

- Latin America: This region presents significant growth potential, though it faces structural challenges related to underdeveloped infrastructure, complex customs regulations, and security concerns. Brazil and Mexico are the largest markets, driven by manufacturing and agricultural exports, respectively. Investments are concentrating on modernizing port infrastructure, enhancing internal road and rail links, and adopting cloud-based supply chain software to improve visibility and reduce lead times. The rising e-commerce sector is particularly focused on overcoming last-mile delivery hurdles in densely populated urban centers and geographically challenging terrains.

- Middle East and Africa (MEA): The MEA region is emerging as a critical global transshipment hub, leveraging its strategic geographic location between Europe, Asia, and Africa. Countries like the UAE (Dubai, Abu Dhabi) and Saudi Arabia are making colossal investments in world-class airport and seaport facilities, coupled with free trade zones, positioning themselves as logistics gateways. While the Middle East focuses on high-tech intermodal connectivity, Africa's logistics market is fragmented but offers huge potential, driven by rapid urbanization and the need for basic infrastructural development, focusing on mobile technology for supply chain coordination in remote areas.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Shipping and Logistics Market.- A.P. Moller – Maersk

- Deutsche Post DHL Group

- FedEx Corporation

- United Parcel Service (UPS)

- Kuehne + Nagel International AG

- DB Schenker

- Nippon Express Co., Ltd.

- C.H. Robinson Worldwide Inc.

- Expeditors International of Washington, Inc.

- DSV Panalpina A/S

- CEVA Logistics

- XPO Logistics, Inc.

- Sinotrans Limited

- GEODIS

- J.B. Hunt Transport Services, Inc.

- Rhenus Group

- Toll Holdings Limited

- Agility

- Bolloré Logistics

- YRC Worldwide Inc.

Frequently Asked Questions

Analyze common user questions about the Shipping and Logistics market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the market growth in global shipping and logistics?

The primary drivers are the exponential expansion of global e-commerce and subsequent demand for expedited last-mile delivery, alongside rising globalization leading to complex international supply chains. Furthermore, technological adoption (IoT, AI) enhancing operational efficiency is a key catalyst for market expansion and value creation.

How is geopolitical instability impacting the logistics sector?

Geopolitical instability, including trade wars, sanctions, and regional conflicts, severely impacts the logistics sector by causing supply chain disruptions, route diversions, and increasing insurance and risk management costs. This instability drives companies to adopt 'China Plus One' strategies, diversifying sourcing and manufacturing locations to build redundancy.

Which technologies are most critical for future logistics operations?

The most critical technologies include Artificial Intelligence (AI) for predictive analytics and route optimization, the Internet of Things (IoT) for real-time asset tracking and monitoring, and Blockchain for enhancing supply chain transparency and secure documentation. Warehouse automation (robotics and AGVs) is also essential for high-throughput fulfillment.

What are the key challenges in last-mile delivery within the logistics market?

Key challenges in last-mile delivery include high operational costs due to inefficient routing in dense urban areas, environmental sustainability pressures (requiring shift to electric vehicles), and the need for flexible, time-definite delivery windows that meet diverse consumer expectations. Traffic congestion and parcel theft also contribute to complexity.

What role does sustainability play in modern shipping and logistics?

Sustainability is a core mandate, driven by regulatory bodies (e.g., IMO, EU) and consumer preference. It compels companies to adopt decarbonization strategies (e.g., alternative fuels, electric fleets), optimize packaging to reduce waste, and implement efficient reverse logistics systems for product recycling and reuse, ensuring long-term operational viability.

How is the shift towards 4PL models redefining the market?

The shift towards Fourth-Party Logistics (4PL) models redefines the market by moving the logistics provider from an asset operator to a neutral supply chain orchestrator. 4PL providers manage all aspects of the client's supply chain, integrating various 3PLs, technology platforms, and carriers to optimize the entire network, offering consulting expertise and strategic oversight rather than just physical movement services.

What is the significance of cold chain logistics growth?

The growth of cold chain logistics is highly significant, primarily driven by the expanding global trade of pharmaceuticals (including vaccines) and perishable food products. It necessitates specialized infrastructure, including temperature-controlled warehouses and refrigerated transport, coupled with stringent monitoring technologies to ensure product integrity and regulatory compliance throughout the supply chain.

What is the impact of labor shortages on warehousing operations?

Labor shortages significantly impact warehousing operations by increasing wage costs and slowing throughput, particularly during peak seasons. This shortage is accelerating the necessity of adopting automation, including advanced robotics and automated storage and retrieval systems (AS/RS), to maintain operational capacity and efficiency despite reduced human workforce availability.

How do tariffs and trade barriers affect maritime shipping volumes?

Tariffs and trade barriers directly reduce maritime shipping volumes on affected trade routes by increasing the cost of goods, thereby discouraging trade flow. This necessitates global carriers to frequently adjust deployment strategies, potentially leading to vessel repositioning costs and increased volatility in freight pricing across major global corridors.

Why is supply chain visibility crucial in the current market environment?

Supply chain visibility is crucial because it enables real-time tracking of goods, identification of potential delays or risks, and accurate prediction of delivery times. Enhanced visibility, often achieved through IoT and advanced telematics, allows businesses to manage inventory effectively, reduce uncertainty, and provide superior customer service, ultimately strengthening supply chain resilience against unforeseen disruptions.

What role does rail freight play in intermodal transport?

Rail freight plays a vital role in intermodal transport by efficiently moving large volumes of goods over long distances, particularly in large landmasses like North America and Eurasia. It acts as the backbone of intermodal systems, linking sea ports and manufacturing hubs to inland distribution centers, providing a cost-effective and increasingly environmentally friendly alternative to long-haul trucking.

How are logistics companies utilizing Big Data analytics?

Logistics companies utilize Big Data analytics to process massive datasets from TMS, WMS, and IoT sensors. This analysis generates actionable insights for predictive maintenance of assets, precise forecasting of demand volatility, optimization of staffing levels, and dynamic pricing strategies, transforming reactive operations into proactive and optimized systems.

What are the primary risks associated with drone delivery expansion?

Primary risks associated with drone delivery expansion include air traffic management complexities, regulatory hurdles regarding beyond visual line of sight (BVLOS) operation, security concerns (theft or hacking), and limitations related to payload capacity and battery life, which currently restrict widespread deployment, especially in densely populated areas.

How does the shift to omnichannel retail affect warehousing requirements?

Omnichannel retail necessitates warehousing facilities that are highly flexible and capable of handling both large bulk orders for stores and individual parcel fulfillment for e-commerce. This drives demand for automated, multi-purpose distribution centers often closer to urban centers, known as micro-fulfillment centers, to meet rapid delivery demands.

What is the current trend regarding insourcing versus outsourcing logistics services?

The current trend leans heavily toward outsourcing specialized and complex logistics functions (3PL and 4PL), particularly among non-core businesses seeking cost reduction and access to specialized technology. However, large retailers and high-volume manufacturers may selectively insource last-mile delivery or core trucking fleets to maintain direct control over customer experience and critical capacity.

What is the significance of the Belt and Road Initiative (BRI) for global logistics?

The Belt and Road Initiative (BRI) is highly significant as it drastically enhances connectivity across Asia, Europe, and Africa through massive infrastructural development, particularly focused on rail and maritime routes. BRI investments create new trade corridors, reduce transit times between Asia and Europe, and fundamentally reshape the geopolitical flow of goods, impacting freight rates and volume distribution globally.

How are ports addressing congestion and increasing throughput?

Ports are addressing congestion by investing in digital twin technologies for optimized berth and yard planning, implementing advanced terminal operating systems (TOS), and utilizing increased automation for container handling (e.g., automated stacking cranes). Collaborative data sharing with carriers and inland transport providers is also key to ensuring smooth cargo flow and faster vessel turnaround times.

What is reverse logistics and why is it becoming crucial?

Reverse logistics is the process of moving goods from their typical final destination back to the producer for value capture or proper disposal (e.g., returns, repairs, recycling). It is becoming crucial due to the immense volume of returns generated by e-commerce and increasing pressure for companies to participate in the circular economy, impacting profitability and consumer satisfaction.

What challenges do logistics providers face regarding cross-border compliance?

Logistics providers face challenges in cross-border compliance due to the complexity of differing national customs regulations, varying sanitary and phytosanitary requirements, and evolving trade agreement rules of origin. This requires sophisticated software solutions and expert customs brokerage services to ensure seamless, penalty-free international movement of goods.

How do autonomous vehicles fit into the future of road freight?

Autonomous vehicles are projected to significantly reduce labor costs and improve safety in long-haul road freight operations by operating continuously with minimal human intervention. While regulatory and ethical challenges remain, phased implementation, starting with platooning technology and closed-route logistics parks, is anticipated to improve capacity utilization and fuel efficiency over major corridors.

What are the primary factors influencing air freight pricing volatility?

Air freight pricing volatility is influenced by factors such as fluctuating global trade demand, the availability of belly capacity on passenger aircraft (which was highly impacted by the pandemic), geopolitical events disrupting air routes, and the rising cost of aviation fuel. High-value and time-critical shipments contribute to peak-season pricing spikes.

How is cybersecurity managed within digitalized logistics networks?

Cybersecurity in digitalized logistics is managed through multi-layered defenses, including network segmentation, robust encryption protocols for sensitive data (e.g., bills of lading), employee training against phishing and social engineering, and continuous monitoring using AI-driven threat detection systems to protect operational technology (OT) systems and intellectual property from sophisticated cyber attacks.

What is the impact of rising fuel prices on operating margins?

Rising fuel prices severely compress the operating margins of logistics providers, particularly those reliant on road and maritime transport, as fuel constitutes a significant portion of total operating expenses. Companies mitigate this by implementing fuel surcharges, optimizing routes through telematics, and investing in newer, more fuel-efficient or alternative-fueled fleets to reduce consumption.

How do inventory management systems contribute to market efficiency?

Inventory Management Systems (IMS), often integrated with WMS, contribute to market efficiency by providing real-time visibility into stock levels, optimizing warehouse layout for faster picking, implementing strategies like Just-in-Time (JIT) or vendor-managed inventory (VMI), and minimizing capital tied up in excess stock, thereby reducing holding costs across the supply chain.

What specialized needs does the healthcare industry require from logistics providers?

The healthcare industry requires specialized logistics focused on cold chain management, strict compliance with pharmaceutical Good Distribution Practices (GDP), high security for controlled substances, and rapid, reliable delivery for medical devices and life-saving drugs. Providers must offer validated, end-to-end temperature monitoring and regulatory expertise.

What distinguishes 3PL from 4PL services?

A 3PL (Third-Party Logistics) typically handles specific outsourced operational tasks like warehousing or transport. A 4PL (Fourth-Party Logistics) goes further by acting as an integrator that manages and optimizes the client's entire supply chain, including coordinating multiple 3PLs, technology, and resources, without necessarily owning physical assets.

Why is sustainable packaging becoming mandatory in logistics?

Sustainable packaging is becoming mandatory due to increased consumer environmental awareness, regulatory pressures (e.g., plastic taxes), and the necessity to reduce waste in reverse logistics streams. It involves using recyclable materials, optimizing dimensions to reduce empty space in containers, and minimizing overall material usage without compromising product protection during transit.

How does the digitalization of documentation (e.g., e-bills of lading) benefit the industry?

Digitalization of documentation, such as using electronic bills of lading (e-B/L), dramatically benefits the industry by reducing administrative delays, eliminating fraud risks, lowering printing and handling costs, and accelerating customs clearance processes. This shift is crucial for realizing the goal of a fully seamless, paperless global trade environment.

What are the main risks of relying too heavily on single-source suppliers or specific trade routes?

Relying heavily on single-source suppliers or narrow trade routes introduces extreme vulnerability to localized disruptions, whether caused by natural disasters, labor strikes, or geopolitical conflicts. This lack of redundancy significantly increases risk exposure, leading to prolonged delays, steep recovery costs, and potential loss of market share during periods of instability.

How are logistics firms attracting and retaining talent in a competitive environment?

Logistics firms are attracting and retaining talent by offering competitive wages, investing heavily in training and professional development (especially in digital skills), providing flexible work arrangements for non-operational staff, and improving working conditions for drivers and warehouse workers through better technology, safety protocols, and automation to reduce strenuous labor.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager