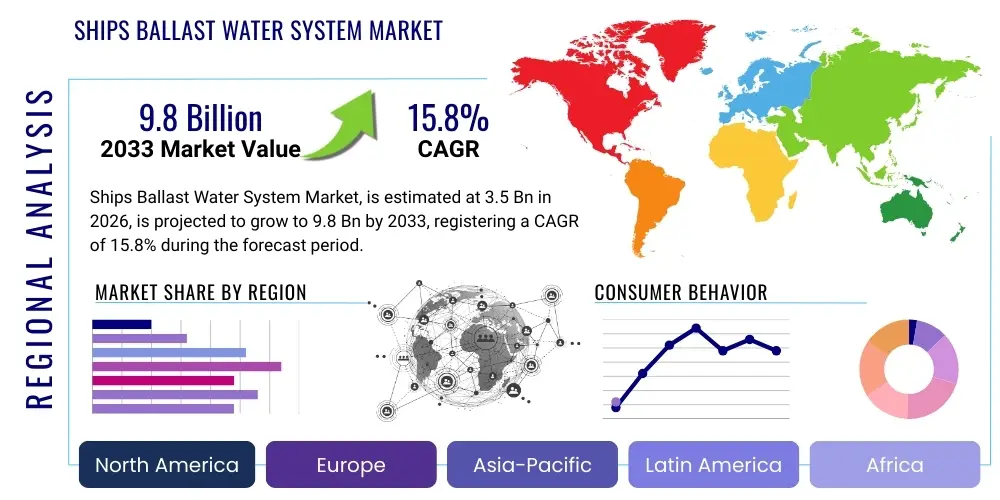

Ships Ballast Water System Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441782 | Date : Feb, 2026 | Pages : 242 | Region : Global | Publisher : MRU

Ships Ballast Water System Market Size

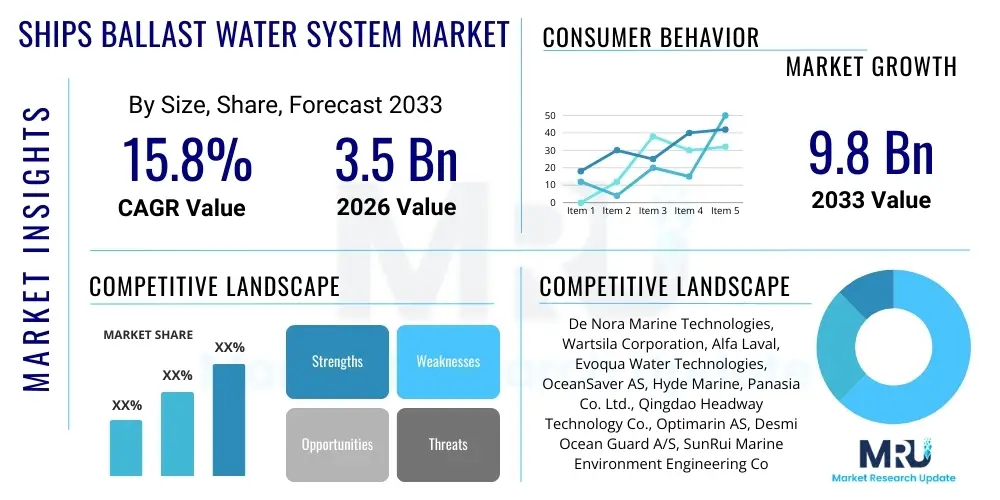

The Ships Ballast Water System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.8% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 9.8 Billion by the end of the forecast period in 2033.

Ships Ballast Water System Market introduction

The Ships Ballast Water System Market encompasses the design, manufacture, installation, and maintenance of specialized equipment crucial for complying with the International Maritime Organization (IMO) Ballast Water Management (BWM) Convention, which entered into force in September 2017. Ballast water, essential for ship stability and structural integrity, poses significant risks when discharged into new environments, carrying non-indigenous aquatic species and pathogens that can severely impact local ecosystems and public health. The core mandate driving this market is the strict requirement for ships to treat ballast water before discharge, ensuring that harmful organisms are neutralized or removed to meet the rigorous D-2 standard set by the IMO.

Ballast Water Treatment Systems (BWTS) are complex installations that integrate various processes, including filtration, followed by a primary disinfection stage utilizing methods such as Ultraviolet (UV) radiation, electro-chlorination, or deoxygenation. These systems are essential for various vessel types, including massive oil tankers, bulk carriers, container ships, and cruise liners, which rely heavily on efficient ballast operations during transit. The product description involves highly specialized equipment capable of handling high flow rates, resisting corrosion in marine environments, and operating effectively across different salinities and water qualities, making integration and maintenance technically challenging aspects of the market.

The primary applications of BWTS are retrofit installations on existing global fleets that predate the convention, and integration into new shipbuilding projects. The market benefits significantly from guaranteed demand created by regulatory deadlines, ensuring sustained revenue streams for manufacturers and service providers. Key driving factors include the mandatory compliance schedules enforced globally, the necessity for preserving marine biodiversity, and the increasing stringency of regional regulations, such as those imposed by the U.S. Coast Guard (USCG), which often exceed IMO standards, thereby promoting the development and adoption of advanced, type-approved systems.

Ships Ballast Water System Market Executive Summary

The Ships Ballast Water System Market is characterized by a definitive shift from mandatory regulatory response to technological optimization, underpinned by a massive global retrofit wave. Business trends highlight accelerated compliance deadlines for the existing global merchant fleet, driving intense competition among system manufacturers focusing on modular designs, energy efficiency, and minimized footprint crucial for installation in restricted engine rooms. A major trend involves strategic partnerships between system suppliers and shipyards, particularly in Asian shipbuilding hubs, to streamline the installation process and manage the significant backlog of vessels requiring treatment systems. Furthermore, the market is maturing with a growing focus on the after-sales service segment, including long-term maintenance contracts, spare parts supply, and digital monitoring solutions to ensure continuous compliance and operational efficiency.

Regionally, the Asia Pacific (APAC) area dominates the market both in terms of demand and supply, largely due to its concentrated shipbuilding industry, housing the majority of major shipyards in South Korea, China, and Japan. These nations are crucial for both new build installation and the majority of global retrofit projects. However, European countries, particularly those with strong maritime heritage and robust environmental policies, are leading in technological innovation and the development of highly advanced treatment methods. North America remains a significant, though distinct, market due to the strict requirements mandated by the USCG, necessitating systems with specific USCG type approval, creating a high barrier to entry for international manufacturers.

Segment-wise, the electro-chlorination technology segment holds the largest revenue share, primarily due to its suitability for handling large volumes of ballast water quickly and effectively, making it the preferred choice for large vessels such as VLCCs (Very Large Crude Carriers) and Capesize bulk carriers. Concurrently, the UV treatment segment is experiencing rapid growth, driven by its appeal to smaller and medium-sized vessels, particularly those sensitive to chemical discharge, such as cruise ships and specialized tankers. The retrofit market continues to overshadow the new build segment in volume terms, although the new build segment ensures stable, forward-looking demand, driven by increasing global trade volumes and fleet renewal initiatives.

AI Impact Analysis on Ships Ballast Water System Market

User inquiries regarding AI's influence in the Ballast Water System market frequently center on how these intelligent systems can enhance operational reliability, reduce maintenance costs, and ensure guaranteed compliance under varying environmental conditions. Key themes emerging from these questions include the potential for AI algorithms to predict equipment failure (e.g., UV lamp efficiency degradation or electrode fouling), optimize chemical dosing (in electro-chlorination systems) based on real-time water quality parameters (temperature, salinity, turbidity), and automate regulatory reporting. Users seek confirmation on whether AI can transform reactive maintenance into proactive scheduling, thereby minimizing vessel downtime and significantly lowering the total cost of ownership (TCO) associated with complex BWTS operations. The consensus expectation is that AI will move BWTS management from a hardware-centric operation to a data-driven, highly efficient, and consistently compliant system.

- AI enables predictive maintenance, forecasting equipment failure (e.g., filter blockage, UV intensity drop) to schedule repairs proactively.

- Optimization of treatment protocols through real-time data analysis, adjusting chemical dosage or UV exposure based on immediate water quality parameters.

- Automated compliance assurance by monitoring system performance against regulatory benchmarks and generating immutable digital compliance records.

- Energy efficiency enhancement by using machine learning models to minimize power consumption during ballast operations without compromising treatment efficacy.

- Intelligent fault diagnosis, allowing remote technical support teams to identify and troubleshoot system malfunctions faster, reducing vessel downtime.

DRO & Impact Forces Of Ships Ballast Water System Market

The dynamics of the Ships Ballast Water System market are dictated by powerful regulatory drivers, operational constraints, and compelling opportunities stemming from technological advancements and global environmental mandates. The primary driver is the absolute necessity for global compliance with the IMO BWM Convention D-2 standard, which is non-negotiable for international shipping operations. This regulatory framework creates a stable, mandated demand curve, forcing vessel owners to invest significant capital regardless of short-term market fluctuations. However, this mandated investment is heavily constrained by the high initial Capital Expenditure (CAPEX) required for purchasing and installing the systems, coupled with substantial Operational Expenditure (OPEX) related to energy consumption, filter replacements, and specialized chemical replenishment.

Restraints are notably complex, focusing on physical and operational challenges. The limited space available for retrofitting complex equipment, especially in older vessels, often necessitates bespoke, space-saving designs, inflating engineering and installation costs. Furthermore, system performance can be highly variable depending on the water quality encountered (e.g., high turbidity water reducing UV efficacy), leading to operational risks and potential non-compliance if not carefully managed. The fragmentation of the technology landscape, with numerous systems holding different type approvals, complicates purchasing decisions for multinational fleet operators, requiring rigorous due diligence.

Opportunities for market expansion are centered on the accelerating demand for after-sales services, digital integration, and the development of modular, multi-redundant systems. The opportunity for leveraging digitalization, including the integration of Internet of Things (IoT) sensors and Artificial Intelligence for system monitoring, represents a significant growth area, transforming maintenance schedules and enhancing long-term operational reliability. Furthermore, as the industry seeks 'green' solutions, the development of non-chemical or low-energy consuming systems offers a competitive edge, appealing to environmentally conscious ship operators looking to demonstrate verifiable sustainability commitment beyond minimum regulatory compliance. The market is subject to intense impact forces, primarily driven by regulatory deadlines (a strong external force) and technological maturity (an internal competitive force), ensuring a continuous, yet challenging, expansion trajectory.

Segmentation Analysis

The Ships Ballast Water System market is highly segmented based on critical operational and technological factors, reflecting the diverse requirements of the global shipping fleet. Segmentation provides crucial insights into adoption rates across vessel sizes, preferred technologies suitable for varying water types, and the dominant installation method (new build versus retrofit). Understanding these segments allows manufacturers and service providers to tailor system designs and service offerings to specific customer bases, maximizing market penetration and regulatory compliance assurance across the heterogeneous maritime industry.

- Technology Type:

- Electro-chlorination

- Ultraviolet (UV)

- Ozone

- Deoxygenation

- Chemical Disinfection (e.g., Peracetic Acid)

- Capacity/Flow Rate:

- Less than 1,500 m3/h

- 1,500 to 5,000 m3/h

- Above 5,000 m3/h

- Application/Vessel Type:

- Container Ships

- Tankers (Crude, Product, Chemical)

- Bulk Carriers

- General Cargo Ships

- Others (Cruise, Ro-Ro, Naval)

- Installation Type:

- New Vessels (New Build)

- Existing Vessels (Retrofit)

Value Chain Analysis For Ships Ballast Water System Market

The value chain for the Ships Ballast Water System market is complex and highly integrated, starting with the specialized supply of raw materials and complex components, flowing through manufacturing and system assembly, culminating in installation, commissioning, and long-term after-sales support. Upstream analysis focuses on the procurement of specialized components such as high-purity UV lamps, sophisticated medium-pressure filters (often automatic back-flushing types), and durable corrosion-resistant materials (like titanium for electrode assemblies in electro-chlorination units). Supply chain stability and quality control are paramount at this stage, as component failure can jeopardize regulatory compliance and result in steep financial penalties for shipowners.

The midstream stage involves the design, engineering, and modular fabrication of the treatment systems. Manufacturers must invest heavily in R&D to ensure their systems meet both IMO and USCG type approval requirements, which often involves extensive and costly testing procedures. Distribution channels are critical in connecting manufacturers with the end-users. Direct channels often involve major system providers selling directly to large fleet owners or partnering with shipyards for new build projects, ensuring customized integration solutions. Indirect channels utilize specialized marine equipment distributors, engineering consultancy firms, and regional agents who handle sales, logistics, and localized installation support, particularly in highly fragmented retrofit markets.

The downstream segment, which is increasingly becoming the most profitable area, involves installation, commissioning, and comprehensive after-sales service. Installation, frequently performed during dry-docking, requires highly skilled labor and specialized integration engineering, as the system must interface seamlessly with existing ship piping and power infrastructure. Furthermore, the mandatory requirement for periodic calibration, maintenance, and compliance verification drives the strong and steady demand for long-term service contracts, constituting a stable, high-margin revenue stream. This service dependency emphasizes the importance of a global network of certified technicians and readily available spare parts to minimize vessel downtime.

Ships Ballast Water System Market Potential Customers

The primary customer base for Ships Ballast Water Systems comprises global shipowners and operators, who bear the ultimate responsibility for regulatory compliance, maintenance, and operational expenditure. This group includes owners of major fleets such as major container lines, national and international oil and gas majors operating tankers, and large mining companies utilizing bulk carriers. Their purchasing decisions are primarily driven by adherence to the IMO D-2 standard and, where applicable, the more stringent USCG regulations, prioritizing systems that offer proven reliability, global service support, and minimal interference with cargo operations.

A secondary, yet crucial, customer group consists of global shipyards—both those specializing in new construction and those focused on repair and maintenance (dry-docking facilities). Shipyards act as crucial intermediaries and direct buyers, especially in the retrofit market. For new builds, the BWTS is specified and integrated into the design phase. For retrofits, shipyards are responsible for the complex engineering work required to install the system in existing vessel spaces. Manufacturers often target these entities with comprehensive package deals, integration support, and long-term warranties to secure volume sales and standardized installation protocols.

Furthermore, marine engineering consultants and naval architecture firms serve as influential potential customers, often making procurement recommendations on behalf of the shipowners. These engineering firms assess the technical suitability of various BWTS technologies based on the specific vessel type, trading routes, flow rates, and operational profile. Consequently, BWTS vendors invest significant resources in securing product approvals and endorsements from these key stakeholders, recognizing their pivotal role in the buyer's decision-making process and specifying the necessary equipment specifications for tender documents.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 9.8 Billion |

| Growth Rate | 15.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | De Nora Marine Technologies, Wartsila Corporation, Alfa Laval, Evoqua Water Technologies, OceanSaver AS, Hyde Marine, Panasia Co. Ltd., Qingdao Headway Technology Co., Optimarin AS, Desmi Ocean Guard A/S, SunRui Marine Environment Engineering Co. Ltd., Hitachi Ltd., Samsung Heavy Industries Co. Ltd., Ecochlor, Techcross Inc., Veolia Water Technologies, Bio-UV Group, Coldharbour Marine, Mitsui Engineering & Shipbuilding, NEI Treatment Systems |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ships Ballast Water System Market Key Technology Landscape

The technological landscape of the Ships Ballast Water System market is predominantly characterized by the rivalry between two major treatment methods: Ultraviolet (UV) radiation and Electro-chlorination (also known as E/C or electrolysis). UV systems operate by physically disinfecting organisms by damaging their DNA using high-intensity UV light, often combined with a filtration stage to remove larger particles that could shield organisms from the light. This technology is highly favored for smaller to medium-sized vessels, particularly those operating in fresh or coastal waters with low turbidity, due to its non-chemical nature and ease of integration. However, its effectiveness can be significantly impaired in highly turbid or sediment-laden water, requiring substantial power input to compensate for reduced light transmission.

In contrast, Electro-chlorination systems generate hypochlorite by passing electric current through the natural salts present in seawater. This chemical oxidant effectively kills harmful organisms, and the system is highly favored for high-volume applications (vessels with flow rates exceeding 5,000 m3/h), such as large tankers and bulk carriers. A key advantage of E/C is its consistent performance across varying water qualities, although it requires precise monitoring and neutralization of residual chemicals (Total Residual Oxidants or TRO) before discharge to meet environmental safety standards. The choice between UV and E/C often dictates the overall system design, footprint, and operational complexity, forming a strategic decision for shipowners based on their specific vessel profile and common trading routes.

Emerging and niche technologies, such as ozone treatment and deoxygenation, also play a role, although they command smaller market shares. Deoxygenation systems, often used on gas carriers, reduce the oxygen content in the ballast tanks, effectively killing aerobic organisms without chemical addition, offering benefits for tank corrosion control. Furthermore, the market is seeing continuous innovation focused on modularity—creating compact, skid-mounted systems that facilitate easier retrofit installation—and enhancing digital control systems. These digital platforms incorporate advanced sensors and automation to optimize the treatment process, minimize power consumption, and provide comprehensive data logging essential for demonstrating continuous regulatory compliance during inspections by port state control authorities.

Regional Highlights

The global distribution of the Ships Ballast Water System market is heavily skewed toward Asia Pacific (APAC), which acts as the epicenter for both demand fulfillment and manufacturing capacity. APAC, dominated by major shipbuilding nations such as China, South Korea, and Japan, commands the largest market share due to the sheer volume of new vessel construction requiring mandatory BWTS installation and the extensive dry-docking capacity facilitating the global retrofit wave. Furthermore, several key BWTS manufacturers are headquartered in this region, benefiting from local supply chains and governmental support for maritime technology development. The region's operational focus is primarily on high-flow electro-chlorination systems suitable for the large tankers and bulk carriers that define Asian shipping traffic. The market maturity in this region means competition is fierce, centering on price, installation turnaround time, and localized service support.

Europe represents a crucial market characterized by high regulatory standards and a strong emphasis on technological innovation and compliance management. European shipowners were generally early adopters of BWTS, driven by stringent national and regional environmental mandates predating the full global enforcement of the IMO Convention. The demand in Europe is bifurcated, with Mediterranean and Baltic Sea operators requiring systems optimized for brackish and low-salinity water conditions. European manufacturers focus heavily on developing low-energy UV systems and advanced filtration technologies, often incorporating sophisticated monitoring and control systems (AEO/GEO focus: optimization, compliance verification, and sustainable shipping). The service segment is particularly strong here, with a high concentration of engineering firms specializing in complex retrofit project management and system commissioning across global routes.

North America maintains a unique regulatory environment due to the U.S. Coast Guard (USCG) regulations, which require all BWTS systems operating in U.S. waters to possess specific USCG Type Approval, often necessitating more rigorous performance standards than the IMO D-2 convention. This creates a high regulatory entry barrier but guarantees sustained demand for approved systems. The North American market is smaller in terms of shipbuilding but critical for the high-value US-flagged fleet and international vessels calling at US ports. Manufacturers targeting this region must invest significantly in type approval testing, which assures highly robust and reliable equipment. The Middle East and Africa (MEA) and Latin America (LATAM) markets are predominantly demand-driven based on compliance timelines for vessels operating to and from key regional ports, with adoption rates often dictated by economic cycles and port state control enforcement efforts, presenting strong opportunities for maintenance and localized technical support as compliance obligations intensify.

- Asia Pacific (APAC): Dominates the market due to concentrated shipbuilding activity and extensive retrofit capabilities in China, South Korea, and Japan. Focus on large-capacity systems.

- Europe: Characterized by early adoption, stringent regional environmental laws, and strong R&D focused on advanced UV and digital compliance monitoring solutions.

- North America: Driven by strict US Coast Guard (USCG) Type Approval requirements, creating a high-specification niche market for approved systems.

- Middle East and Africa (MEA): Growth driven by compliance needs for crude oil tankers and bulk carriers frequenting major regional export terminals.

- Latin America (LATAM): Emerging compliance market with increasing port state control enforcement, driving demand for cost-effective retrofit solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ships Ballast Water System Market.- Alfa Laval

- Wartsila Corporation

- Evoqua Water Technologies

- De Nora Marine Technologies

- OceanSaver AS

- Hyde Marine

- Panasia Co. Ltd.

- Qingdao Headway Technology Co.

- Optimarin AS

- Desmi Ocean Guard A/S

- SunRui Marine Environment Engineering Co. Ltd.

- Hitachi Ltd.

- Samsung Heavy Industries Co. Ltd.

- Ecochlor

- Techcross Inc.

- Veolia Water Technologies

- Bio-UV Group

- Coldharbour Marine

- Mitsui Engineering & Shipbuilding

- NEI Treatment Systems

Frequently Asked Questions

Analyze common user questions about the Ships Ballast Water System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the current growth of the Ballast Water System market?

The primary factor driving market growth is the mandatory enforcement of the International Maritime Organization (IMO) Ballast Water Management (BWM) Convention’s D-2 standard, requiring nearly all international vessels to install type-approved treatment systems for environmental protection.

Which ballast water treatment technology holds the largest market share by installed capacity?

Electro-chlorination technology holds the largest market share by installed capacity, largely due to its high flow rate capability and effective disinfection in high-salinity waters, making it the preferred choice for large crude oil tankers and bulk carriers.

What are the main operational challenges faced by shipowners when adopting BWTS?

Shipowners primarily face challenges related to high installation costs (CAPEX), system performance variability under different water qualities (turbidity, salinity), large system footprint requirements for retrofitting, and high energy consumption (OPEX) during ballast operations.

How do the IMO and USCG requirements differ, impacting system procurement?

While the IMO D-2 standard provides the global baseline, the U.S. Coast Guard (USCG) imposes a stricter regulatory regime, requiring systems to undergo specific USCG Type Approval testing, often necessitating higher performance standards for systems intended to operate in US waters.

Is the retrofit market phase concluding, or will it sustain demand in the coming years?

The retrofit market is past its initial peak but will sustain significant demand through the forecast period (2026-2033) as a substantial number of older vessels reach their compliance deadlines and require system replacement or upgrades, alongside stable demand from new build installations.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager